Riot Platforms, Inc. (“Riot”) issues this press release

pursuant to Part 3 of Canadian National Instrument 62-103 – The

Early Warning System and Related Take-Over Bid and Insider

Reporting Issues and Part 5 of Canadian National Instrument 62-104

– Take-Over Bids and Issuer Bids in respect of Bitfarms Ltd.

(“Bitfarms” or the “Company”).

Riot announces that on August 13, 2024 it acquired ownership of

1,000,000 common shares (the “Purchased Shares”) of the

Company representing approximately 0.22% of the issued and

outstanding Common Shares (the “Common Shares”) of the

Company (based on the information contained in the Company’s

management’s discussion and analysis for the three and six months

ended June 30, 2024 (the “Company’s Q2 MD&A”)).

The Purchased Shares were acquired through normal course

purchases on the Nasdaq Stock Market and other open market trades

for a weighted average price of approximately US$2.28 per Purchased

Share (equivalent to approximately C$3.13 per Purchased Share based

on the daily exchange rate posted by the Bank of Canada on August

13, 2024 (the “Exchange Rate”)) at a price range per

Purchased Share of approximately US$2.20 to US$2.34 (equivalent to

approximately C$3.02 to C$3.21 based on the Exchange Rate) for an

aggregate amount equal to US$2,280,800.00 (equivalent to

approximately C$3,129,942.84 based on the Exchange Rate).

Immediately prior to the acquisition of Common Shares giving

rise to the issuance of this press release, Riot beneficially owned

84,293,054 Common Shares, representing approximately 18.68% of the

issued and outstanding Common Shares (based on the information

contained in the Company’s Q2 MD&A). Following completion of

the aforementioned acquisition, Riot beneficially owned 85,293,054

Common Shares, representing approximately 18.90% of the issued and

outstanding Common Shares as at the date hereof (based on the

information contained in the Company’s Q2 MD&A).

On June 24, 2024, Riot announced that it has requisitioned a

special meeting of shareholders (the “Special Meeting”) at

which Riot will seek to remove certain directors from the Company’s

Board of Directors (the “Bitfarms Board”) and replace them

with independent director candidates.

Riot intends to review its investment in the Company on a

continuing basis and depending upon various factors, including

without limitation, any discussion between Riot, the Company and/or

the Bitfarms Board and its advisors regarding, among other things,

the requisitioned Special Meeting and/or the composition of the

Bitfarms Board, the Company’s financial position and strategic

direction, overall market conditions, other investment

opportunities available to Riot, and the availability of securities

of the Company at prices that would make the purchase or sale of

such securities desirable, Riot may (i) increase or decrease its

position in the Company through, among other things, the purchase

or sale of securities of the Company, including through

transactions involving the Common Shares and/or other equity, debt,

notes, other securities, or derivative or other instruments that

are based upon or relate to the value of securities of the Company

in the open market or otherwise, (ii) enter into transactions that

increase or hedge its economic exposure to the Common Shares

without affecting its beneficial ownership of the Common Shares or

(iii) consider or propose one or more of the actions described in

subparagraphs (a) - (k) of Item 5 of Riot’s early warning report

filed in accordance with applicable Canadian securities laws,

including submitting a revised proposal to acquire the Company.

This press release is not meant to be, nor should it be

construed as, an offer (or an intention to make an offer) to buy or

the solicitation of an offer to sell any of the Company’s

securities.

Riot will file the Early Warning Report in accordance with

applicable securities laws, which will be available under the

Company’s profile at www.sedarplus.ca. The head office of the

Company is 110 Yonge Street, Suite 1601 Toronto, Ontario M5C 1T4.

The address of Riot is 3855 Ambrosia Street, Suite 301, Castle

Rock, CO 80109.

FOR MORE INFORMATION

For further information and to obtain a copy of the Early

Warning Report, please see the Company’s profile on the SEDAR+

website (www.sedarplus.ca) or contact Phil McPherson, Vice

President, Capital Markets & Investor Relations, at (303)

794-2000 ext. 110.

About Riot Platforms, Inc.

Riot’s (NASDAQ: RIOT) vision is to be the world’s leading

Bitcoin-driven infrastructure platform. Our mission is to

positively impact the sectors, networks, and communities that we

touch. We believe that the combination of an innovative spirit and

strong community partnership allows the Company to achieve

best-in-class execution and create successful outcomes.

Riot, a Nevada corporation, is a Bitcoin mining and digital

infrastructure company focused on a vertically integrated strategy.

Riot has Bitcoin mining operations in central Texas and electrical

switchgear engineering and fabrication operations in Denver,

Colorado.

For more information, visit www.riotplatforms.com.

Cautionary Note Regarding Forward Looking Statements

Statements contained herein that are not historical facts

constitute “forward-looking statements” and “forward-looking

information” (together, “forward-looking statements”) within the

meaning of applicable U.S. and Canadian securities laws that

reflect management’s current expectations, assumptions, and

estimates of future events, performance and economic conditions.

Such forward-looking statements rely on the safe harbor provisions

of Section 27A of the U.S. Securities Act of 1933 and Section 21E

of the U.S. Securities Exchange Act of 1934 and the safe harbor

provisions of applicable Canadian securities laws. Because such

statements are subject to risks and uncertainties, actual results

may differ materially from those expressed or implied by such

forward-looking statements. Words and phrases such as “anticipate,”

“believe,” “combined company,” “create,” “drive,” “expect,”

“forecast,” “future,” “growth,” “intend,” “hope,” “opportunity,”

“plan,” “potential,” “proposal,” “synergies,” “unlock,” “upside,”

“will,” “would,” and similar words and phrases are intended to

identify forward-looking statements. These forward-looking

statements may include, but are not limited to, statements

concerning: uncertainties as to whether the Company will enter into

discussions with Riot regarding a proposed combination of Riot and

the Company; the outcome of any such discussions, including the

terms and conditions of any such potential combination; the future

performance, liquidity and financial position of the combined

company, and its ability to achieve expected synergies; and

uncertainties as to timing of the Special Meeting or the outcome.

Such forward-looking statements are not guarantees of future

performance or actual results, and readers should not place undue

reliance on any forward-looking statement as actual results may

differ materially and adversely from forward-looking statements.

Detailed information regarding the factors identified by the

management of Riot, which they believe may cause actual results to

differ materially from those expressed or implied by such

forward-looking statements in this press release, may be found in

Riot’s filings with the U.S. Securities and Exchange Commission

(the “SEC”), including the risks, uncertainties and other

factors discussed under the sections entitled “Risk Factors” and

“Cautionary Note Regarding Forward-Looking Statements” of Riot’s

Annual Report on Form 10-K for the fiscal year ended December 31,

2023, filed with the SEC on February 23, 2024, and the other

filings Riot has made or will make with the SEC after such date,

copies of which may be obtained from the SEC’s website at

www.sec.gov. All forward-looking statements contained herein are

made only as of the date hereof, and Riot disclaims any intention

or obligation to update or revise any such forward-looking

statements to reflect events or circumstances that subsequently

occur, or of which Riot hereafter becomes aware, except as required

by applicable law.

No Offer to Purchase or Sell Securities

This press release is for informational purposes only and is not

intended to and does not constitute an offer to sell or the

solicitation of an offer, or an intention to offer, to subscribe

for or buy or an invitation to purchase or subscribe for any

securities, nor shall there be any sale, issuance or transfer of

securities in any jurisdiction in contravention of applicable law.

Such an offer to purchase securities would only be made pursuant to

a registration statement, prospectus, tender offer, takeover bid

circular, management information circular or other regulatory

filing filed by Riot with the SEC and available at www.sec.gov or

filed with applicable Canadian securities regulatory authorities on

SEDAR+ and available at www.sedarplus.ca.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240813543528/en/

Investor Contacts: Phil McPherson 303-794-2000 ext. 110

IR@Riot.Inc Okapi Partners Bruce Goldfarb / Chuck Garske, (877)

285-5990 info@okapipartners.com Media Contact: Longacre

Square Partners Joe Germani / Dan Zacchei

jgermani@longacresquare.com / dzacchei@longacresquare.com

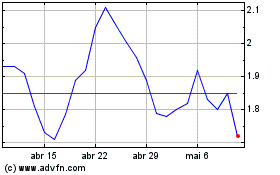

Bitfarms (NASDAQ:BITF)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Bitfarms (NASDAQ:BITF)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024