Nuveen Preferred and Income Term Fund Announces Final Results of Tender Offer and Increase in Distribution Rate

19 Agosto 2024 - 9:00AM

Business Wire

Nuveen Preferred and Income Term Fund (NYSE: JPI) announced the

final results of a tender offer.

As previously announced, the fund conducted a tender offer

allowing shareholders to offer up to 100% of their common shares

for repurchase for cash at a price per share equal to 100% of the

net asset value (NAV) per share as of the close of ordinary trading

on the New York Stock Exchange on the expiration date of the tender

offer. The tender offer expired on August 14, 2024 at 5:00 p.m.

Eastern time.

In the tender offer, 8,672,542 common shares were tendered,

representing approximately 38% of the fund’s common shares

outstanding. Properly tendered shares will be repurchased as

promptly as practicable at $20.0081 per share, which was the NAV of

the fund as of the close of ordinary trading on the New York Stock

Exchange on the expiration date, August 14, 2024. Shareholders of

the fund who have questions regarding the tender offer should

contact Georgeson, LLC, the information agent for the fund’s tender

offer, at (866) 679-9573.

As a result of the successful completion of the tender offer,

the proposals described in the fund’s proxy statement dated

February 26, 2024 and in the offer to purchase relating to the

tender offer will be implemented. In particular:

- The fund’s declaration of trust will be amended effective

August 19, 2024 to eliminate the term structure of the fund. The

amendment was previously approved by the fund’s shareholders at the

fund’s annual meeting held on April 12, 2024, as adjourned to July

17, 2024.

- The fund’s name will change to “Nuveen Preferred Securities

& Income Opportunities Fund” effective August 19, 2024 (the

fund’s common shares will continue to trade on the New York Stock

Exchange under the ticker JPI).

- Nuveen Fund Advisors, LLC, the investment adviser to the fund,

will waive 50% of the fund’s net management fees beginning August

19, 2024 and continuing over the first year following the

elimination of the term structure.

In addition, the Board of Trustees of the fund has approved an

increase in the fund’s monthly distribution rate as outlined below.

The distribution change is intended to help support secondary

market trading in fund shares and enhance shareholder value. It is

anticipated that to maintain the declared distribution rate, the

fund may make distributions from sources other than net investment

income. In this regard, the source of regular distributions may

include a return of capital.

The following dates apply to today’s monthly distribution

declaration for the fund:

Record Date

September 13, 2024

Ex-Dividend Date

September 13, 2024

Payable Date

October 1, 2024

Monthly

Distribution Per Share

Ticker

Exchange

Fund Name

Amount

Change From

Previous Month

Percentage

Increase

JPI

NYSE

Nuveen Preferred and Income Term Fund

$0.1660

$0.0680

69.4%

The Fund intends to distribute all or substantially all of its

net investment income each year through its regular monthly

distribution and to distribute realized capital gains at least

annually. In addition, in any monthly period, to maintain its

declared per common share distribution amount, the Fund may

distribute more or less than its net investment income during the

period. In the event the Fund distributes more than its net

investment income during any yearly period, such distributions may

also include realized gains and/or a return of capital. To the

extent that a distribution includes a return of capital the NAV per

share may erode. If a distribution includes anything other than net

investment income, the fund provides a notice of the best estimate

of its distribution sources at the time of the distribution which

may be viewed at www.nuveen.com/CEFdistributions. These estimates

may not match the final tax characterization (for the full year’s

distributions) contained in shareholders’ 1099-DIV forms after the

end of the year.

Nuveen is a leading sponsor of closed-end funds (CEFs) with $54

billion of assets under management across 45 CEFs as of 30 June

2024. The funds offer exposure to a broad range of asset classes

and are designed for income-focused investors seeking regular

distributions. Nuveen has more than 35 years of experience managing

CEFs.

About Nuveen

Nuveen, the investment manager of TIAA, offers a comprehensive

range of outcome-focused investment solutions designed to secure

the long-term financial goals of institutional and individual

investors. Nuveen has $1.2 trillion in assets under management as

of 30 June 2024 and operations in 27 countries. Its investment

specialists offer deep expertise across a comprehensive range of

traditional and alternative investments through a wide array of

vehicles and customized strategies. For more information, please

visit www.nuveen.com.

Nuveen Securities, LLC, member FINRA and SIPC.

The information contained on the Nuveen website is not a part of

this press release.

Certain statements made in this release are forward-looking

statements. Actual future results or occurrences may differ

significantly from those anticipated in any forward-looking

statements due to numerous factors. These include, but are not

limited to:

- market developments;

- legal and regulatory developments; and

- other additional risks and uncertainties.

You should not place undue reliance on forward-looking

statements, which speak only as of the date they are made. Nuveen

and the closed-end funds managed by Nuveen and its affiliates

undertake no responsibility to update publicly or revise any

forward-looking statements.

The annual and semi-annual reports and other regulatory filings

of Nuveen closed-end funds with the Securities and Exchange

Commission (“SEC”) are accessible on the SEC’s web site at

www.sec.gov and on Nuveen’s web site at www.nuveen.com/cef and may

discuss the above-mentioned or other factors that affect Nuveen

closed-end funds.

EPS-3796863PR-E0824W

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240819744995/en/

For more information, please visit Nuveen’s CEF homepage

www.nuveen.com/closed-end-funds or contact:

Financial Professionals: 800-752-8700

Investors: 800-257-8787

Media: media-inquiries@nuveen.com

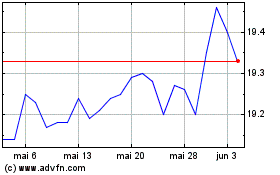

Nuveen Preferred Securit... (NYSE:JPI)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Nuveen Preferred Securit... (NYSE:JPI)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025