Nuveen Preferred and Income Term Fund Announces Preliminary Results of Tender Offer

15 Agosto 2024 - 9:00AM

Business Wire

Nuveen Preferred and Income Term Fund (NYSE: JPI) announced the

preliminary results of a tender offer.

As previously announced, the fund conducted a tender offer

allowing shareholders to offer up to 100% of their common shares

for repurchase for cash at a price per share equal to 100% of the

net asset value per share as of the close of ordinary trading on

the New York Stock Exchange on the expiration date of the tender

offer. The tender offer expired on August 14, 2024 at 5:00 p.m.

Eastern time.

Based on preliminary information, 8,511,627 common shares were

tendered, representing approximately 37% of the fund’s common

shares outstanding. These figures do not include shares tendered

through notice of guaranteed delivery.

The completion of the fund’s tender offer is subject to certain

conditions, including that the aggregate net assets of the fund

attributable to common shares must equal or exceed $70 million as

of the expiration date of the tender offer, taking into account the

amounts that would be paid to shareholders who have properly

tendered their shares. If the fund’s aggregate net assets

attributable to common shares after taking into account shares

properly tendered would be less than $70 million, the tender offer

will not be completed, no common shares will be repurchased, and

the fund will proceed terminate on its scheduled termination

date.

The fund currently anticipates the satisfaction of all tender

offer conditions and a successful completion of the tender offer

and expects to announce the final results of the offer on August

19, 2024. Accordingly, the fund intends to implement the proposal

described in the fund’s proxy statement dated February 26, 2024 and

in the offer to purchase relating to the tender offer. In

particular, anticipated to be effective on August 19, 2024, JPI’s

term structure will be eliminated and the fund’s name will change

to “Nuveen Preferred Securities & Income Opportunities Fund.”

The common shares of the fund will continue to trade on the New

York Stock Exchange under the current ticker symbol. In addition,

Nuveen will waive 50% of its net management fees over the first

year following the elimination of the term.

Nuveen is a leading sponsor of closed-end funds (CEFs) with $54

billion of assets under management across 45 CEFs as of 30 June

2024. The funds offer exposure to a broad range of asset classes

and are designed for income-focused investors seeking regular

distributions. Nuveen has more than 35 years of experience managing

CEFs.

About Nuveen

Nuveen, the investment manager of TIAA, offers a comprehensive

range of outcome-focused investment solutions designed to secure

the long-term financial goals of institutional and individual

investors. Nuveen has $1.2 trillion in assets under management as

of 30 June 2024 and operations in 27 countries. Its investment

specialists offer deep expertise across a comprehensive range of

traditional and alternative investments through a wide array of

vehicles and customized strategies. For more information, please

visit www.nuveen.com.

Nuveen Securities, LLC, member FINRA and SIPC.

The information contained on the Nuveen website is not a part of

this press release.

Certain statements made in this release are forward-looking

statements. Actual future results or occurrences may differ

significantly from those anticipated in any forward-looking

statements due to numerous factors. These include, but are not

limited to:

- market developments;

- legal and regulatory developments;

- the satisfaction of conditions for completing the tender offer;

and

- other additional risks and uncertainties.

You should not place undue reliance on forward-looking

statements, which speak only as of the date they are made. Nuveen

and the closed-end funds managed by Nuveen and its affiliates

undertake no responsibility to update publicly or revise any

forward-looking statements.

The annual and semi-annual reports and other regulatory filings

of Nuveen closed-end funds with the Securities and Exchange

Commission (“SEC”) are accessible on the SEC’s web site at

www.sec.gov and on Nuveen’s web site at www.nuveen.com/cef and may

discuss the above-mentioned or other factors that affect Nuveen

closed-end funds.

EPS-3788971CR-E0824W

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240815673987/en/

For more information, please visit Nuveen’s CEF homepage

www.nuveen.com/closed-end-funds or contact:

Financial Professionals: 800-752-8700

Investors: 800-257-8787

Media: media-inquiries@nuveen.com

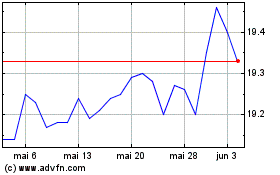

Nuveen Preferred Securit... (NYSE:JPI)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Nuveen Preferred Securit... (NYSE:JPI)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025