BlackRock, Inc. (NYSE: BLK) and Global Infrastructure Partners

(“GIP”) announce the successful completion of BlackRock’s

acquisition of GIP. The combination creates an industry leader in

infrastructure across equity, debt and solutions – providing a

diverse range of infrastructure sector expertise and exposure

across developed and emerging markets. The combined infrastructure

platform will be branded Global Infrastructure Partners (GIP), a

part of BlackRock. GIP will continue to be led by Bayo Ogunlesi and

the Office of the Chairman. With approximately $170 billion in AUM,

the platform will field a 600-person strong global team that

manages a diversified portfolio of more than 300 active investments

with operations in over 100 countries. With this combination,

BlackRock consolidates over $100 billion of private markets AUM,

and approximately $750 million of run rate management fees,

boosting private markets AUM by approximately 40% and expanding run

rate revenues.

“Infrastructure represents a generational investment

opportunity. Through the combination of BlackRock and GIP, we are

well positioned to capitalize on the long-term structural trends

that will continue to drive the growth of infrastructure and

deliver superior investment opportunities for clients globally,”

said Laurence D. Fink, BlackRock Chairman and CEO. “We are thrilled

to welcome Bayo and the talented GIP team to BlackRock and look

forward to providing our clients this combined depth and bench of

infrastructure investment expertise.”

“We are excited to embark on this new chapter as Global

Infrastructure Partners (GIP), a part of BlackRock, with the goal

of creating the premier global infrastructure investing firm,” said

Bayo Ogunlesi, Global Infrastructure Partners’ Chairman and Chief

Executive Officer. “The combination of our institutional

intellectual capital, investing and business improvement

capabilities, global footprint, corporate and government

relationships will allow us to deliver attractive investments for

our investors and innovative solutions for our customers.”

BlackRock plans to appoint Bayo Ogunlesi to its Board of

Directors at the next regularly scheduled Board meeting.

Perella Weinberg Partners served as lead financial advisor to

BlackRock, with Skadden, Arps, Slate, Meagher & Flom and Fried,

Frank, Harris, Shriver & Jacobsen LLP acting as legal counsel.

Evercore served as lead financial advisor and Kirkland & Ellis

LLP and Debevoise & Plimpton LLP acted as legal counsel to

GIP.

About BlackRock

BlackRock’s purpose is to help more and more people experience

financial well-being. As a fiduciary to investors and a leading

provider of financial technology, we help millions of people build

savings that serve them throughout their lives by making investing

easier and more affordable. For additional information on

BlackRock, please visit www.blackrock.com/corporate.

Special Note Regarding Forward-Looking Statements

This press release, and other statements that BlackRock may

make, may contain forward-looking statements within the meaning of

the Private Securities Litigation Reform Act, with respect to

BlackRock’s future financial or business performance, strategies or

expectations. Forward-looking statements are typically identified

by words or phrases such as “trend,” “potential,” “opportunity,”

“pipeline,” “believe,” “comfortable,” “expect,” “anticipate,”

“current,” “intention,” “estimate,” “position,” “assume,”

“outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,”

“achieve,” and similar expressions, or future or conditional verbs

such as “will,” “would,” “should,” “could,” “may” and similar

expressions.

BlackRock cautions that forward-looking statements are subject

to numerous assumptions, risks and uncertainties, which change over

time and may contain information that is not purely historical in

nature. Such information may include, among other things,

projections and forecasts. There is no guarantee that any forecasts

made will come to pass. Forward-looking statements speak only as of

the date they are made, and BlackRock assumes no duty to and does

not undertake to update forward-looking statements. Actual results

could differ materially from those anticipated in forward-looking

statements and future results could differ materially from

historical performance.

BlackRock has previously disclosed risk factors in its SEC

reports. These risk factors and those identified elsewhere in this

press release, among others, could cause actual results to differ

materially from forward-looking statements or historical

performance and include: (1) the introduction, withdrawal, success

and timing of business initiatives and strategies; (2) changes and

volatility in political, economic or industry conditions, the

interest rate environment, foreign exchange rates or financial and

capital markets, which could result in changes in demand for

products or services or in the value of assets under management;

(3) the relative and absolute investment performance of BlackRock’s

investment products; (4) BlackRock’s ability to develop new

products and services that address client preferences; (5) the

impact of increased competition; (6) the impact of future

acquisitions or divestitures, including BlackRock’s proposed

acquisition of Preqin Holding Limited (“Preqin” and together with

GIP, the “Transactions”); (7) BlackRock’s ability to integrate

acquired businesses successfully, including GIP and Preqin; (8)

risks related to the Transactions, including the expected closing

date of Preqin, the possibility that Preqin does not close,

including, but not limited to, due to the failure to satisfy

closing conditions, the possibility that expected synergies and

value creation from either of the Transactions will not be

realized, or will not be realized within the expected time period,

and impacts to business and operational relationships related to

disruptions, from the Transactions; (9) the unfavorable resolution

of legal proceedings; (10) the extent and timing of any share

repurchases; (11) the impact, extent and timing of technological

changes and the adequacy of intellectual property, data,

information and cybersecurity protection; (12) the failure to

effectively manage the development and use of artificial

intelligence; (13) attempts to circumvent BlackRock’s operational

control environment or the potential for human error in connection

with BlackRock’s operational systems; (14) the impact of

legislative and regulatory actions and reforms, regulatory,

supervisory or enforcement actions of government agencies and

governmental scrutiny relating to BlackRock; (15) changes in law

and policy and uncertainty pending any such changes; (16) any

failure to effectively manage conflicts of interest; (17) damage to

BlackRock’s reputation; (18) increasing focus from stakeholders

regarding environmental, social and governance matters; (19)

geopolitical unrest, terrorist activities, civil or international

hostilities, and other events outside BlackRock’s control,

including wars, natural disasters and health crises, which may

adversely affect the general economy, domestic and local financial

and capital markets, specific industries or BlackRock; (20)

climate-related risks to BlackRock’s business, products, operations

and clients; (21) the ability to attract, train and retain highly

qualified and diverse professionals; (22) fluctuations in the

carrying value of BlackRock’s economic investments; (23) the impact

of changes to tax legislation, including income, payroll and

transaction taxes, and taxation on products, which could affect the

value proposition to clients and, generally, the tax position of

BlackRock; (24) BlackRock’s success in negotiating distribution

arrangements and maintaining distribution channels for its

products; (25) the failure by key third-party providers of

BlackRock to fulfill their obligations to BlackRock; (26)

operational, technological and regulatory risks associated with

BlackRock’s major technology partnerships; (27) any disruption to

the operations of third parties whose functions are integral to

BlackRock’s exchange-traded funds platform; (28) the impact of

BlackRock electing to provide support to its products from time to

time and any potential liabilities related to securities lending or

other indemnification obligations; and (29) the impact of problems,

instability or failure of other financial institutions or the

failure or negative performance of products offered by other

financial institutions.

BlackRock’s Annual Report on Form 10–K and BlackRock’s

subsequent filings with the SEC discuss these factors in more

detail and identify additional factors that can affect

forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240930165403/en/

BlackRock Media Relations Ed Sweeney 646-231-0268

Ed.Sweeney@BlackRock.com

BlackRock Investor Relations Caroline Rodda 212-810-3442

Caroline.Rodda@BlackRock.com

Global Infrastructure Partners (GIP) Media Relations

Mustafa Riffat 646-216-7788 Mustafa.Riffat@global-infra.com

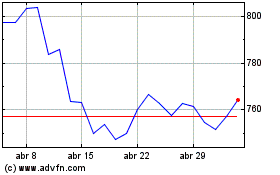

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024