- HPS Investment Partners is a leading global credit investment

manager that provides creative capital solutions across $148

billion in client assets

- This combination creates an integrated private credit franchise

with ~$220 billion in client assets

- Expected to increase private markets fee-paying AUM and

management fees by 40% and ~35%, respectively

- Transaction structured for leadership continuity and alignment

with BlackRock’s shareholders, with proceeds paid in BlackRock

equity

- HPS leadership team will lead a new, combined business

unit

BlackRock (NYSE: BLK) and HPS Investment Partners (“HPS”), a

leading global credit investment manager with approximately $148

billion in client assets, have entered into a definitive agreement

for BlackRock to acquire HPS for approximately $12 billion, with

100% of consideration paid in BlackRock equity. The equity is

issued by a wholly-owned subsidiary of BlackRock (“SubCo Units”),

and exchangeable on a one-for-one basis into BlackRock common

stock.

The future of fixed income is building public and private

portfolios to optimize liquidity, yield, and diversification. This

transaction will bring together BlackRock’s strong corporate and

asset owner relationships with HPS’s diversified origination and

capital flexibility. The combined private credit franchise will

work side-by-side with BlackRock’s $3 trillion public fixed income

business to provide both public and private income solutions for

clients across their whole portfolios.

“I am excited by what HPS and BlackRock can do together for our

clients and look forward to welcoming Scott Kapnick, Scot French,

and Michael Patterson, along with the entire HPS team, to

BlackRock. We have always sought to position ourselves ahead of our

clients’ needs. Together with the scale, capabilities, and

expertise of the HPS team, BlackRock will deliver clients solutions

that seamlessly blend public and private,” said Laurence D. Fink,

BlackRock Chairman and CEO.

Durable global growth will require higher volumes of debt

financing and markets are increasingly looking to private capital

as an answer. The addition of HPS will position BlackRock to

connect companies of all sizes, from small and medium-sized

businesses to large corporations, with financing for investments

that support economic growth and job creation.

Market forces, technology, and regulation are consistently

moving financial activity to where it can be done most efficiently,

making private credit a structural growth segment. BlackRock

expects the private debt market will more than double to $4.5

trillion by 2030. The duration, returns, and yield characteristics

of private credit match the needs of clients with long-dated

capital, including insurance companies, pensions, sovereign wealth

funds, wealth managers, and investors saving for retirement.

BlackRock and HPS will form a new private financing solutions

business unit led by Scott Kapnick, Scot French, and Michael

Patterson. This combined platform will have broad capabilities

across senior and junior credit solutions, asset-based finance,

real estate, private placements, and CLOs. To develop a

full-service financing solution for alternative asset managers, the

business will unite direct lending, fund finance, and BlackRock’s

GP and LP solutions (fund of funds, GP/LP secondaries,

co-investments). This combination creates an integrated solution

for clients and borrowers across corporate and asset-based finance,

investment and non-investment grade and private credit. As part of

this transaction, Messrs. Kapnick, French, and Patterson will join

BlackRock’s Global Executive Committee and Mr. Kapnick will be an

observer to the BlackRock Board of Directors.

“Today marks an important milestone in our drive to become the

world's leading provider of private financing solutions. Our

partnership with BlackRock will further strengthen our position in

this fast growing but increasingly competitive market. The

combination of HPS’s proven culture of investment discipline with

BlackRock’s global reach will allow us to seize new opportunities

for our investors and employees and set us up for continued success

for the next decade and beyond. My partners and I are energized to

work with Larry Fink and our new BlackRock colleagues,” said Scott

Kapnick, HPS CEO.

Founded in 2007, HPS is a leading global credit investment

manager with capabilities across the capital structure. HPS has

continually demonstrated its ability to identify, structure, and

execute compelling investments, and its extensive investing

expertise coupled with the firm’s strong track record has fueled

its growth into one of the largest independent private credit

platforms. HPS’s differentiated origination platform, which spans

non-sponsor and sponsor channels, underpinned by a scaled and

flexible capital base, offers companies a wide range of bespoke

financing solutions. The firm continues to be led by its founders

and long-term Governing Partners Scott Kapnick, Michael Patterson,

Scot French, Purnima Puri, Faith Rosenfeld, Paul Knollmeyer, and

Kathy Choi.

Since BlackRock’s founding in 1988, the firm has grown its fixed

income capabilities, and now serves clients through a $3 trillion

platform across Fundamental Fixed Income, led by Rick Rieder, as

well as Financial Institutions, Municipals, Systematic Fixed

Income, Index Fixed Income, and iShares bond ETFs. BlackRock

manages nearly $90 billion in private debt client assets across

sponsor- and non-sponsor-led core middle market direct lending in

U.S., European, and Asian markets, venture lending, investment

grade private placements, and real estate debt, as well as

dedicated private infrastructure debt.

This transaction will deepen BlackRock’s capabilities for

insurance clients. BlackRock is a leading provider of solutions for

insurers, which represent 100 Aladdin technology clients and $700

billion in assets under management at BlackRock. HPS is a leading

independent provider of private credit for insurance clients. The

addition of HPS will position BlackRock to be a full-service,

fiduciary provider of public-private asset management and

technology solutions for insurance clients.

Mr. Fink continued, “For over 35 years, BlackRock has grown and

evolved alongside the capital markets. With GIP, and now HPS, we

are expanding our private markets capabilities across our

comprehensive global platform. Our Aladdin technology, including

eFront, and soon Preqin, will make access to private markets

simpler and more transparent. These capabilities, together with our

global reach, deep relationships, and powerful technology,

differentiate our ability to serve clients.”

Terms of the Transaction

Under the terms of the transaction, BlackRock will acquire 100%

of the business and assets of HPS for total consideration of 12.1

million SubCo Units.

SubCo Units are exchangeable on a one-for-one basis into

BlackRock common stock at the election of the holder, and will have

equivalent dividend rights to BlackRock common stock.

A portion of the transaction consideration will be paid at

closing, and a portion will be deferred approximately five years.

Approximately 9.2 million SubCo Units will be paid at closing.

Approximately 25% of the consideration, or 2.9 million SubCo Units,

will be paid in approximately five years, subject to achievement of

certain post-closing conditions. There is also potential for

additional consideration to be earned of up to 1.6 million SubCo

Units that is based on financial performance milestones measured

and paid in approximately five years. Of the total deal

consideration, up to $675 million in value will be used to fund an

equity retention pool for HPS employees.

In aggregate, inclusive of all SubCo Units paid at closing,

eligible to be paid in approximately five years, and potentially

earned through achievement of financial performance milestones, the

maximum amount of BlackRock common stock issuable upon exchange for

SubCo Units would be approximately 13.7 million shares.

As part of closing the transaction, BlackRock expects to retire

for cash, or refinance, approximately $400 million of existing HPS

debt. The transaction is not expected to meaningfully change

BlackRock’s leverage profile.

BlackRock is committed to being a good steward of shareholders’

capital. Its capital management strategy is to first invest for

growth, and then return excess capital to shareholders through a

combination of dividends and a consistent share repurchase program.

Over the last ten years BlackRock has repurchased 29 million

shares, at an average repurchase price of $498 per share, which

represents a 15% annualized return for shareholders.

The deal is expected to increase private markets fee-paying AUM

and management fees by 40% and approximately 35%, respectively, and

be modestly accretive to BlackRock’s as-adjusted earnings per share

in the first full year post-close.

The transaction is expected to close in mid-2025 subject to

regulatory approvals and customary closing conditions.

Perella Weinberg Partners LP served as lead financial advisor to

BlackRock. Morgan Stanley & Co. LLC also served as financial

advisor, with Skadden, Arps, Slate, Meagher & Flom LLP and

Clifford Chance LLP acting as legal counsel. J.P. Morgan Securities

LLC served as lead financial advisor to HPS, with Goldman Sachs

& Co. LLC, BofA Securities, Inc., Deutsche Bank Securities

Inc., BNP Paribas, and RBC Capital Markets acting as co-financial

advisors and Fried, Frank, Harris, Shriver & Jacobson LLP

serving as legal counsel.

Teleconference and Webcast Details

BlackRock will hold an investor call on Tuesday, December 3,

2024 at 8:00 a.m. ET to discuss the transaction.

Members of the public who are interested in participating in the

teleconference should dial, from the United States, (313) 209-4906,

or from outside the United States, (877) 502-9276, shortly before

8:00 a.m. ET and reference the BlackRock Conference Call (ID Number

6786819). A live, listen-only webcast will also be available via

the investor relations section of www.blackrock.com.

The webcast will be available for replay by 11:00 a.m. ET on

Tuesday, December 3, 2024. To access the replay of the webcast,

please visit the investor relations section of

www.blackrock.com.

An investor presentation with additional details about the

transaction is also available on the “Events & Presentations”

section of the investor relations website:

https://ir.blackrock.com/news-and-events/events-and-presentations/

About BlackRock

BlackRock’s purpose is to help more and more people experience

financial well-being. As a fiduciary to investors and a leading

provider of financial technology, we help millions of people build

savings that serve them throughout their lives by making investing

easier and more affordable. For additional information on

BlackRock, please visit www.blackrock.com/corporate.

About HPS Investment Partners

HPS Investment Partners, LLC is a leading global, credit-focused

alternative investment firm that seeks to provide creative capital

solutions and generate attractive risk-adjusted returns for our

clients. We manage various strategies across the capital structure,

including privately negotiated senior debt; privately negotiated

junior capital solutions in debt, preferred and equity formats;

liquid credit including syndicated leveraged loans, collateralized

loan obligations and high yield bonds; asset-based finance and real

estate. The scale and breadth of our platform offers the

flexibility to invest in companies large and small, through

standard or customized solutions. At our core, we share a common

thread of intellectual rigor and discipline that enables us to

create value for our clients, who have entrusted us with

approximately $148 billion of assets under management as of

September 2024. For more information, please visit

www.hpspartners.com.

Contacts

Forward Looking Statements

This press release, and other statements that BlackRock may

make, may contain forward-looking statements within the meaning of

the Private Securities Litigation Reform Act, with respect to

BlackRock’s future financial or business performance, strategies or

expectations, including the anticipated timing, consummation and

expected benefits of the proposed HPS Investment Partners (“HPS”)

transaction and HPS’s projected financial performance. Forward

looking statements are typically identified by words or phrases

such as “trend,” “potential,” “opportunity,” “pipeline,” “believe,”

“comfortable,” “expect,” “anticipate,” “current,” “intention,”

“estimate,” “position,” “assume,” “outlook,” “continue,” “remain,”

“maintain,” “sustain,” “seek,” “achieve,” and similar expressions,

or future or conditional verbs such as “will,” “would,” “should,”

“could,” “may” and similar expressions.

BlackRock cautions that forward-looking statements are subject

to numerous assumptions, risks and uncertainties, which change over

time and may contain information that is not purely historical in

nature. Such information may include, among other things,

projections and forecasts. There is no guarantee that any forecasts

made will come to pass. Forward-looking statements speak only as of

the date they are made, and BlackRock assumes no duty to and does

not undertake to update forward-looking statements. Actual results

could differ materially from those anticipated in forward-looking

statements and future results could differ materially from

historical performance.

BlackRock has previously disclosed risk factors in its

Securities and Exchange Commission (“SEC”) reports. These risk

factors and those identified elsewhere in this press release, among

others, could cause actual results to differ materially from

forward-looking statements or historical performance and include:

(1) the introduction, withdrawal, success and timing of business

initiatives and strategies; (2) changes and volatility in

political, economic or industry conditions, the interest rate

environment, foreign exchange rates or financial and capital

markets, which could result in changes in demand for products or

services or in the value of assets under management; (3) the

relative and absolute investment performance of BlackRock’s

investment products; (4) BlackRock’s ability to develop new

products and services that address client preferences; (5) the

impact of increased competition; (6) the impact of recent or future

acquisitions or divestitures, including the acquisitions of HPS

(the “HPS Transaction”), Preqin (the “Preqin Transaction”) and

Global Infrastructure Partners (together with the HPS Transaction

and the Preqin Transaction, the “Transactions”); (7) BlackRock’s

ability to integrate acquired businesses successfully, including

the Transactions; (8) risks related to the HPS Transaction and the

Preqin Transaction, including delays in the expected closing date

of the HPS Transaction or the Preqin Transaction, the possibility

that either or both of the HPS Transaction or the Preqin

Transaction does not close, including, but not limited to, due to

the failure to satisfy the closing conditions; the possibility that

expected synergies and value creation from the HPS Transaction or

the Preqin Transaction will not be realized, or will not be

realized within the expected time period; and the risk of impacts

to business and operational relationships related to disruptions

from the HPS Transaction or the Preqin Transaction; (9) the

unfavorable resolution of legal proceedings; (10) the extent and

timing of any share repurchases; (11) the impact, extent and timing

of technological changes and the adequacy of intellectual property,

data, information and cybersecurity protection; (12) the failure to

effectively manage the development and use of artificial

intelligence; (13) attempts to circumvent BlackRock’s operational

control environment or the potential for human error in connection

with BlackRock’s operational systems; (14) the impact of

legislative and regulatory actions and reforms, regulatory,

supervisory or enforcement actions of government agencies and

governmental scrutiny relating to BlackRock; (15) changes in law

and policy and uncertainty pending any such changes; (16) any

failure to effectively manage conflicts of interest; (17) damage to

BlackRock’s reputation; (18) increasing focus from stakeholders

regarding ESG matters; (19) geopolitical unrest, terrorist

activities, civil or international hostilities, and other events

outside BlackRock’s control, including wars, natural disasters and

health crises, which may adversely affect the general economy,

domestic and local financial and capital markets, specific

industries or BlackRock; (20) climate-related risks to BlackRock's

business, products, operations and clients; (21) the ability to

attract, train and retain highly qualified and diverse

professionals; (22) fluctuations in the carrying value of

BlackRock’s economic investments; (23) the impact of changes to tax

legislation, including income, payroll and transaction taxes, and

taxation on products, which could affect the value proposition to

clients and, generally, the tax position of BlackRock; (24)

BlackRock’s success in negotiating distribution arrangements and

maintaining distribution channels for its products; (25) the

failure by key third-party providers of BlackRock to fulfill their

obligations to BlackRock; (26) operational, technological and

regulatory risks associated with BlackRock’s major technology

partnerships; (27) any disruption to the operations of third

parties whose functions are integral to BlackRock’s exchange-traded

funds platform; (28) the impact of BlackRock electing to provide

support to its products from time to time and any potential

liabilities related to securities lending or other indemnification

obligations; and (29) the impact of problems, instability or

failure of other financial institutions or the failure or negative

performance of products offered by other financial institutions.

BlackRock’s Annual Report on Form 10–K, Quarterly Reports on Form

10-Q and BlackRock’s subsequent filings with the SEC, accessible on

the SEC’s website at www.sec.gov and on BlackRock’s website at

www.blackrock.com, discuss these factors in more detail and

identify additional factors that can affect forward–looking

statements. The information contained on BlackRock’s website is not

a part of this press release, and therefore, is not incorporated

herein by reference.

BlackRock reports its financial results in accordance with

accounting principles generally accepted in the United States

(“GAAP”); however, management believes BlackRock’s ongoing

operating results may be enhanced if investors have additional

non–GAAP financial measures. Management reviews non-GAAP financial

measures to assess ongoing operations and considers them to be

helpful, for both management and investors, in evaluating

BlackRock’s financial performance over time. Management also uses

non-GAAP financial measures as a benchmark to compare its

performance with other companies and to enhance the comparability

of this information for the reporting periods presented. Non-GAAP

measures may pose limitations because they do not include all of

BlackRock’s revenue and expense. BlackRock’s management does not

advocate that investors consider such non-GAAP financial measures

in isolation from, or as a substitute for, financial information

prepared in accordance with GAAP. Non-GAAP measures may not be

comparable to other similarly titled measures of other

companies.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241203219893/en/

BlackRock Media Relations Patrick Scanlan 212-810-3622

patrick.scanlan@blackrock.com

BlackRock Investor Relations Caroline Rodda 212-810-3442

caroline.rodda@blackrock.com

HPS Investment Partners Mike Geller / Josh Clarkson

646-818-9018 / 646-818-9259 mgeller@prosek.com /

jclarkson@prosek.com

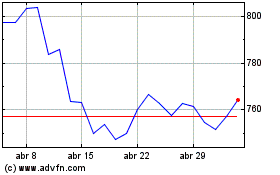

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024