BlackRock Introduces International Country Rotation Strategy to Active ETF Lineup

04 Dezembro 2024 - 10:30AM

Business Wire

Broadens Access to Dynamic International

Exposure with Expertise from the Firm’s Model Portfolio Solutions

Team

Today, BlackRock expanded its active ETF offering with the

launch of the iShares International Country Rotation Active ETF

(CORO). Designed as a model building block, CORO consolidates

insights from the BlackRock Model Portfolio Solutions team (MPS)

and proprietary quantitative models to express changing views on

international developed and emerging market countries in a timely

manner.

Managed by Lisa O’Connor, Michael Gates, Michele Freed, and

Jonathan Adams, CORO benefits from MPS’s asset allocation insights

to capture potential additional alpha. By investing in iShares

country ETFs, CORO’s strategy enables agile allocation across

various international markets in response to changes in their

economic cycles. MPS oversees $178 billion in assets under

management globally and includes over 20 research and portfolio

management professionals dedicated to managing model

portfolios.1

“International equities are a crucial diversifier for U.S.

investors,” said Michele Freed, Head of Research for U.S. Model

Portfolio Solutions. “CORO’s rotation approach offers model

builders a flexible tool to seek alpha by dynamically shifting

towards stronger markets while maintaining balanced exposure to

international markets with a single ticker.”

iShares International Country Rotation

Active ETF

Ticker

CORO

Performance Benchmark

MSCI ACWI ex-US Index

Portfolio Managers

Michele Freed, Michael Gates, CFA, Lisa

O’Connor, CFA, and Jonathan Adams

Enhancing whole portfolio solutions for financial

advisors

“We continue to see more financial advisors leveraging active

ETFs as model building blocks to scale the delivery of consistent,

repeatable outcomes for their clients,” said Rachel Aguirre,

U.S. Head of iShares Products at BlackRock. “CORO adds another

alpha-generating opportunity to our active ETF platform, helping

investors benefit from active investment and risk management in the

ease and efficiency of the ETF wrapper.”

BlackRock manages $34 billion in assets under management across

over 40 active ETFs in the U.S.2

About BlackRock

BlackRock’s purpose is to help more and more people experience

financial well-being. As a fiduciary to investors and a leading

provider of financial technology, we help millions of people build

savings that serve them throughout their lives by making investing

easier and more affordable. For additional information on

BlackRock, please visit www.blackrock.com/corporate | Twitter:

@blackrock | LinkedIn: www.linkedin.com/company/blackrock

About iShares

iShares unlocks opportunity across markets to meet the evolving

needs of investors. With more than twenty years of experience, a

global line-up of 1,400+ exchange traded funds (ETFs) and $4.2

trillion in assets under management as of September 30, 2024,

iShares continues to drive progress for the financial industry.

iShares funds are powered by the expert portfolio and risk

management of BlackRock.

Carefully consider the Funds' investment objectives, risk

factors, and charges and expenses before investing. This and other

information can be found in the Funds' prospectuses or, if

available, the summary prospectuses which may be obtained by

visiting www.iShares.com or www.blackrock.com. Read the prospectus

carefully before investing.

Investing involves risk, including possible loss of

principal.

There is no guarantee that the classification system used to

determine the rotation model or strategy will achieve its intended

results. The fund may engage in active and frequent trading of its

portfolio securities which may result in higher transaction costs

to the fund. The fund is actively managed and does not seek to

replicate the performance of a specified index.

Actively managed funds do not seek to replicate the performance

of a specified index, may have higher portfolio turnover, and may

charge higher fees than index funds due to increased trading and

research expenses.

Diversification and asset allocation may not protect against

market risk or loss of principal. Transactions in shares of ETFs

may result in brokerage commissions and may generate tax

consequences. All regulated investment companies are obliged to

distribute portfolio gains to shareholders.

Alpha is a measure of performance on a risk-adjusted basis.

Alpha takes the volatility (price risk) of a mutual fund and

compares its risk-adjusted performance to a benchmark index. The

excess return of the fund relative to the return of the benchmark

index is a fund's alpha.

This information should not be relied upon as research,

investment advice, or a recommendation regarding any products,

strategies, or any security in particular. This material is

strictly for illustrative, educational, or informational purposes

and is subject to change.

The Funds are distributed by BlackRock Investments, LLC

(together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc. or its affiliates. All Rights Reserved.

BLACKROCK and iSHARES are trademarks of BlackRock,

Inc. or its affiliates. All other trademarks are those of their

respective owners.

1 BlackRock, as of 11/15/2024.

2 BlackRock, as of 12/3/2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241204096839/en/

Media: Joanna Yau Joanna.yau@blackrock.com

646.856.7274

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

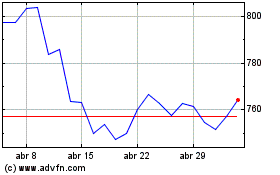

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024