- Revenue of $533.3 million in the third quarter of 2024

increased 8.3% from revenue of $492.5 million for the comparable

prior-year period, representing a backlog conversion rate of

18.2%.

- Net new business awards were $533.7 million in the third

quarter of 2024, representing a decrease of 12.7% from net new

business awards of $611.5 million for the comparable prior-year

period, which resulted in a net book-to-bill ratio of 1.00x.

- Third quarter of 2024 GAAP net income was $96.4 million, or

$3.01 per diluted share, versus GAAP net income of $70.6 million,

or $2.22 per diluted share, for the comparable prior-year period.

Net income margin was 18.1% and 14.3% for the third quarter of 2024

and 2023, respectively.

- EBITDA was $118.8 million for the third quarter of 2024, an

increase of 31.7% from EBITDA of $90.2 million for the comparable

prior-year period, resulting in an EBITDA margin of 22.3%.

Medpace Holdings, Inc. (Nasdaq: MEDP) (“Medpace”) today

announced financial results for the third quarter ended September

30, 2024.

Third Quarter 2024 Financial Results

Revenue for the three months ended September 30, 2024 increased

8.3% to $533.3 million, compared to $492.5 million for the

comparable prior-year period. On a constant currency basis, revenue

for the third quarter of 2024 increased 8.1% compared to the third

quarter of 2023.

Backlog as of September 30, 2024 increased 8.8% to $2,927.4

million from $2,689.5 million as of September 30, 2023. Net new

business awards were $533.7 million, representing a net

book-to-bill ratio of 1.00x for the third quarter of 2024, as

compared to $611.5 million for the comparable prior-year period.

The Company calculates the net book-to-bill ratio by dividing net

new business awards by revenue.

For the third quarter of 2024, total direct costs were $364.3

million, compared to total direct costs of $359.3 million in the

third quarter of 2023. Selling, general and administrative

(SG&A) expenses were $49.2 million in the third quarter of

2024, compared to SG&A expenses of $41.4 million in the third

quarter of 2023.

GAAP net income for the third quarter of 2024 was $96.4 million,

or $3.01 per diluted share, versus GAAP net income of $70.6

million, or $2.22 per diluted share, for the third quarter of 2023.

This resulted in a net income margin of 18.1% and 14.3% for the

third quarter of 2024 and 2023, respectively.

EBITDA for the third quarter of 2024 increased 31.7% to $118.8

million, or 22.3% of revenue, compared to $90.2 million, or 18.3%

of revenue, for the comparable prior-year period. On a constant

currency basis, EBITDA for the third quarter of 2024 increased

32.3% from the third quarter of 2023.

A reconciliation of the Company’s non-GAAP financial measures,

including EBITDA and EBITDA margin to the corresponding GAAP

measures is provided below.

Year-to-Date 2024 Financial Results

Revenue for the nine months ended September 30, 2024 was

$1,572.5 million, and increased 13.3% on a reported basis and

constant currency basis from the comparable prior-year period.

Year-to-date 2024 GAAP net income was $287.4 million, or $8.96 per

diluted share, compared to $204.5 million, or $6.42 per diluted

share, for the comparable prior-year period. Year-to-date 2024

EBITDA was $346.7 million, or 22.0% of revenue, and increased 30.0%

on a reported basis and 29.8% on a constant currency basis from the

comparable prior-year period.

Balance Sheet and Liquidity

The Company’s Cash and cash equivalents were $656.9 million at

September 30, 2024, and the Company generated $149.1 million in

cash flow from operating activities during the third quarter of

2024. There were no share repurchases in the third quarter of 2024.

As of September 30, 2024, the Company had $308.8 million remaining

under its authorized share repurchase program.

2024 Financial Guidance

The Company forecasts 2024 revenue in the range of $2.090

billion to $2.130 billion, representing growth of 10.8% to 12.9%

over 2023 revenue of $1.886 billion. GAAP net income for full year

2024 is forecasted in the range of $376.0 million to $388.0

million. Additionally, full year 2024 EBITDA is expected in the

range of $450.0 million to $470.0 million. Based on forecasted 2024

revenue of $2.090 billion to $2.130 billion and GAAP net income of

$376.0 million to $388.0 million, diluted earnings per share (GAAP)

is forecasted in the range of $11.71 to $12.09. This guidance

assumes a full year 2024 tax rate of 15.5% to 16.5%, interest

income of $24.4 million, and 32.1 million diluted shares

outstanding. This guidance does not include the potential impact of

any share repurchases the Company may make pursuant to the share

repurchase program after September 30, 2024.

Conference Call Details

Medpace will host a conference call at 9:00 a.m. ET, Tuesday,

October 22, 2024, to discuss its third quarter 2024 results.

To participate in the conference call, interested parties must

register in advance by clicking on this link. While it is not

required, it is recommended you join 10 minutes prior to the event

start. Upon registration, all telephone participants will receive a

confirmation email detailing how to join the conference call,

including the dial-in number along with a unique PIN that can be

used to access the call.

To access the conference call via webcast, visit the “Investors”

section of Medpace’s website at medpace.com. The webcast replay of

the call will be available at the same site approximately one hour

after the end of the call. A supplemental slide presentation will

also be available at the “Investors” section of Medpace’s website

prior to the start of the call.

About Medpace

Medpace is a scientifically-driven, global, full-service

clinical contract research organization (CRO) providing Phase I-IV

clinical development services to the biotechnology, pharmaceutical

and medical device industries. Medpace’s mission is to accelerate

the global development of safe and effective medical therapeutics

through its high-science and disciplined operating approach that

leverages regulatory and therapeutic expertise across all major

areas including oncology, cardiology, metabolic disease,

endocrinology, central nervous system and anti-viral and

anti-infective. Headquartered in Cincinnati, Ohio, Medpace employs

approximately 5,900 people across 43 countries as of September 30,

2024.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including without limitation,

statements regarding our forecasted financial results and the

effective tax rate used for non-GAAP adjustment purposes. In this

context, forward-looking statements often address expected future

business and financial performance and financial condition, and

often contain words such as “guidance,” “expect,” “anticipate,”

“intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,”

“target,” “forecast,” “may,” “could,” “likely,” “anticipate,”

“project,” “goal,” “objective,” “potential,” “range,” “estimate,”

“preliminary,” “opportunity,” “outlook,” “trend,” “can,” “might,”

“drives,” “hope,” “predict” and similar expressions, and variations

or negatives of these words. However, the absence of these words

does not mean that a statement is not forward-looking.

These forward-looking statements are largely based on

management’s current expectations and projections about future

events and financial trends that we believe may affect our

financial condition, results of operations, business strategy,

short-term and long-term business operations and objectives, and

financial needs. These statements are neither promises nor

guarantees, but involve known and unknown risks, uncertainties and

other important factors that may cause our financial condition,

actual results, performance (including share price performance), or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements, including, but not limited to, the

following: the potential loss, delay or non-renewal of our

contracts, or the non-payment by customers for services we have

performed; the failure to convert backlog to revenue at our present

or historical conversion rate(s); the failure to maintain or

generate new business awards; fluctuation in our results between

fiscal quarters and years; the risks and uncertainties related to

disruptions to or reductions in business operations or prospects

due to pandemics, epidemics, widespread health emergencies, or

outbreaks of infectious diseases; decreased operating margins due

to increased pricing pressure or other factors; our failure to

perform our services in accordance with contractual requirements,

government regulations and ethical considerations; the impact of

underpricing our contracts, overrunning our cost estimates or

failing to receive approval for or experiencing delays with

documentation of change orders; our failure to increase our market

share, grow our business, successfully execute our growth

strategies or manage our growth effectively; the impact of a

failure to retain key executives or other personnel or recruit

experienced personnel; the risks associated with our information

systems infrastructure, including potential cybersecurity breaches

and other disruptions which could compromise patient information or

our information; adverse results from customer or therapeutic area

concentration; the risks associated with doing business

internationally, including the effects of tariffs and trade wars;

the risks associated with the Foreign Corrupt Practices Act and

other anti-corruption laws; future net losses; the impact of

changes in tax laws and regulations; our failure to attract

suitable investigators and patients to our clinical trials; the

liability risks associated with our research and development

services, including risks of liability resulting from harm to

patients; inadequate insurance coverage for our operations and

indemnification obligations; fluctuations in exchange rates;

general economic conditions, including inflation, in the markets in

which we operate, including financial market conditions; the impact

of unfavorable economic conditions, including conditions caused by

the uncertain international economic environment and current and

future international conflicts; the impact of a natural disaster or

other catastrophic event; negative outsourcing trends in the

biopharmaceutical industry and a reduction in aggregate

expenditures and research and development budgets; our inability to

compete effectively with other CROs; the impact of healthcare

reform; the impact of consolidation in the biopharmaceutical

industry; our failure to comply with federal, state and foreign

healthcare laws; the effect of current and proposed laws and

regulations regarding the protection of personal data; our

potential involvement in costly intellectual property lawsuits;

actions by regulatory authorities or customers to limit the scope

of indications related to or withdraw an approved drug, biologic or

medical device from the market; and the impact of industry-wide

reputational harm to CROs. Moreover, we operate in a very

competitive and rapidly changing environment in which new risks

emerge from time to time. It is not possible for our management to

predict all risks, nor can we assess the impact of all important

factors on our business or the extent to which any factor, or

combination of such factors, may cause actual results to differ

materially from those contained in any forward-looking statements

we may make.

These and other important factors discussed under the caption

“Risk Factors” in Item 1A, Part I of our Annual Report on Form 10-K

filed with the Securities and Exchange Commission, or SEC, and our

other reports filed with the SEC could cause actual results to

differ materially from those indicated by the forward-looking

statements made in this press release. We cannot guarantee that any

forward-looking statement will be realized. Achievement of

anticipated results is subject to substantial risks, uncertainties

and inaccurate assumptions. If known or unknown risks or

uncertainties materialize or if underlying assumptions prove

inaccurate, actual results could vary materially from past results

and those anticipated, estimated or projected. These factors should

not be construed as exhaustive and should be read in conjunction

with the other cautionary statements that are included in this

release and in our filings with the SEC. Any such forward-looking

statements represent management’s estimates as of the date of this

press release. While we may elect to update such forward-looking

statements at some point in the future, we disclaim any obligation

to do so, even if subsequent events, developments or circumstances

cause our views to change. These forward-looking statements should

not be relied upon as representing our views as of any date

subsequent to the date of this press release.

Non-GAAP Financial Measures

Certain financial measures presented in this press release, such

as EBITDA and EBITDA margin, are not recognized under generally

accepted accounting principles in the United States of America, or

U.S. GAAP. Management uses EBITDA and EBITDA margin or comparable

metrics as a measurement used in evaluating our operating

performance on a consistent basis, as a consideration to assess

incentive compensation for our employees, for planning purposes,

including the preparation of our internal annual operating budget,

and to evaluate the performance and effectiveness of our

operational strategies.

EBITDA and EBITDA margin have important limitations as

analytical tools and you should not consider them in isolation, or

as a substitute for, analysis of our results as reported under U.S.

GAAP. See the condensed consolidated financial statements included

elsewhere in this release for our U.S. GAAP results. Additionally,

for reconciliations of EBITDA and EBITDA margin to our closest

reported U.S. GAAP measures, refer to the appendix of this press

release.

We believe that EBITDA and EBITDA margin are useful to provide

additional information to investors about certain material non-cash

and non-recurring items. While we believe these financial measures

are commonly used by investors to evaluate our performance and that

of our competitors, because not all companies use identical

calculations, this presentation of EBITDA and EBITDA margin may not

be comparable to other similarly titled measures of other companies

and should not be considered as an alternative to performance

measures derived in accordance with U.S. GAAP. EBITDA is calculated

as net income attributable to Medpace Holdings, Inc. before income

tax expense, interest expense, net, depreciation and amortization.

EBITDA margin is calculated by dividing EBITDA by Revenue, net for

each period. Our presentation of EBITDA and EBITDA margin should

not be construed as an inference that our future results will be

unaffected by unusual or non-recurring items.

MEDPACE HOLDINGS, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (UNAUDITED)

(Amounts in thousands, except per share

amounts)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Revenue, net

$

533,317

$

492,499

$

1,572,465

$

1,387,441

Operating expenses:

Direct service costs, excluding

depreciation and amortization

171,540

164,364

514,573

473,958

Reimbursed out-of-pocket expenses

192,769

194,942

579,904

525,784

Total direct costs

364,309

359,306

1,094,477

999,742

Selling, general and administrative

49,217

41,407

134,751

118,838

Depreciation

7,158

6,329

20,663

17,707

Amortization

360

549

1,082

1,649

Total operating expenses

421,044

407,591

1,250,973

1,137,936

Income from operations

112,273

84,908

321,492

249,505

Other income (expense), net:

Miscellaneous (expense) income, net

(1,025

)

(1,602

)

3,435

(2,198

)

Interest income (expense), net

7,528

(105

)

17,113

(2,332

)

Total other income (expense), net

6,503

(1,707

)

20,548

(4,530

)

Income before income taxes

118,776

83,201

342,040

244,975

Income tax provision

22,350

12,651

54,672

40,463

Net income

$

96,426

$

70,550

$

287,368

$

204,512

Net income per share attributable to

common shareholders:

Basic

$

3.11

$

2.30

$

9.28

$

6.65

Diluted

$

3.01

$

2.22

$

8.96

$

6.42

Weighted average common shares

outstanding:

Basic

31,047

30,629

30,960

30,723

Diluted

32,088

31,762

32,060

31,839

MEDPACE HOLDINGS, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(Amounts in thousands, except share

amounts)

As of

September 30,

2024

December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

656,900

$

245,449

Accounts receivable and unbilled, net

311,466

298,400

Prepaid expenses and other current

assets

64,229

49,979

Total current assets

1,032,595

593,828

Property and equipment, net

124,058

120,589

Operating lease right-of-use assets

130,547

144,801

Goodwill

662,396

662,396

Intangible assets, net

34,727

35,809

Deferred income taxes

76,683

74,435

Other assets

23,055

24,970

Total assets

$

2,084,061

$

1,656,828

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

26,201

$

31,869

Accrued expenses

306,868

292,961

Advanced billings

670,939

559,860

Other current liabilities

37,346

40,441

Total current liabilities

1,041,354

925,131

Operating lease liabilities

128,277

142,122

Deferred income tax liability

2,289

2,404

Other long-term liabilities

30,702

28,221

Total liabilities

1,202,622

1,097,878

Commitments and contingencies

Shareholders’ equity:

Preferred stock - $0.01 par-value;

5,000,000 shares authorized; no shares issued and outstanding at

September 30, 2024 and December 31, 2023

—

—

Common stock - $0.01 par-value;

250,000,000 shares authorized at September 30, 2024 and December

31, 2023; 31,081,601 and 30,752,292 shares issued and outstanding

at September 30, 2024 and December 31, 2023, respectively

311

308

Treasury stock - 70,073 and 70,573 shares

at September 30, 2024 and December 31, 2023, respectively

(12,235

)

(12,322

)

Additional paid-in capital

836,903

802,681

Retained earnings (Accumulated

deficit)

65,636

(221,645

)

Accumulated other comprehensive loss

(9,176

)

(10,072

)

Total shareholders’ equity

881,439

558,950

Total liabilities and shareholders’

equity

$

2,084,061

$

1,656,828

MEDPACE HOLDINGS, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS (UNAUDITED)

(Amounts in thousands)

Nine Months Ended

September 30,

2024

2023

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income

$

287,368

$

204,512

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation

20,663

17,707

Amortization

1,082

1,649

Stock-based compensation expense

19,625

15,351

Noncash lease expense

17,305

14,579

Deferred income tax benefit

(2,433

)

(11,308

)

Other

(3,836

)

821

Changes in assets and liabilities:

Accounts receivable and unbilled, net

(13,032

)

(39,314

)

Prepaid expenses and other current

assets

(11,108

)

(8,954

)

Accounts payable

(3,029

)

(921

)

Accrued expenses

13,933

54,923

Advanced billings

111,079

56,026

Lease liabilities

(15,417

)

(14,433

)

Other assets and liabilities, net

(4,051

)

(13,659

)

Net cash provided by operating

activities

418,149

276,979

CASH FLOWS FROM INVESTING ACTIVITIES:

Property and equipment expenditures

(28,905

)

(26,662

)

Other

8,159

30

Net cash used in investing activities

(20,746

)

(26,632

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from stock option exercises

14,600

9,855

Repurchases of common stock

—

(144,020

)

Proceeds from revolving loan

—

105,000

Payments on revolving loan

—

(155,000

)

Net cash provided by (used in) financing

activities

14,600

(184,165

)

EFFECT OF EXCHANGE RATES ON CASH, CASH

EQUIVALENTS, AND RESTRICTED CASH

(552

)

760

INCREASE IN CASH, CASH EQUIVALENTS, AND

RESTRICTED CASH

411,451

66,942

CASH, CASH EQUIVALENTS, AND RESTRICTED

CASH — Beginning of period

245,449

28,265

CASH, CASH EQUIVALENTS, AND RESTRICTED

CASH — End of period

$

656,900

$

95,207

MEDPACE HOLDINGS, INC. AND

SUBSIDIARIES

RECONCILIATION OF NON-GAAP MEASURES

(UNAUDITED)

(Amounts in thousands)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

RECONCILIATION OF GAAP NET INCOME TO

EBITDA

Net income (GAAP)

$

96,426

$

70,550

$

287,368

$

204,512

Interest (income) expense, net

(7,528

)

105

(17,113

)

2,332

Income tax provision

22,350

12,651

54,672

40,463

Depreciation

7,158

6,329

20,663

17,707

Amortization

360

549

1,082

1,649

EBITDA (Non-GAAP)

$

118,766

$

90,184

$

346,672

$

266,663

Net income margin (GAAP)

18.1

%

14.3

%

18.3

%

14.7

%

EBITDA margin (Non-GAAP)

22.3

%

18.3

%

22.0

%

19.2

%

FY 2024 GUIDANCE RECONCILIATION

(UNAUDITED)

(Amounts in millions, except per share

amounts)

Forecast 2024

Net Income

Net income per diluted

share

Low

High

Low

High

Net income and net income per diluted

share (GAAP)

$

376.0

$

388.0

$

11.71

$

12.09

Income tax provision

68.6

76.6

Interest income, net

(24.4

)

(24.4

)

Depreciation

28.4

28.4

Amortization

1.4

1.4

EBITDA (Non-GAAP)

$

450.0

$

470.0

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241021984442/en/

Investor Contact: Lauren Morris 513.579.9911 x11994

l.morris@medpace.com Media Contact: Michael Maley 513.579.9911

x12831 m.maley@medpace.com

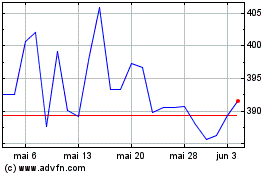

Medpace (NASDAQ:MEDP)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Medpace (NASDAQ:MEDP)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024