Provides clients with more choices to invest in

technology and AI

Today, BlackRock expanded investor access to technology and AI

equities with the launch of the iShares A.I. Innovation and Tech

Active ETF (NYSE: BAI) and the iShares Technology Opportunities

Active ETF (NYSE: TEK). While the AI revolution is still in its

early stages, BlackRock believes its long-term impact will be

profound.

“We are at the dawn of an intelligence revolution,” said Tony

Kim, Head of the Fundamental Equities Technology Group at

BlackRock. “These active ETFs can help investors seize outsized

and overlooked investment opportunities across the full stack of AI

and advanced technologies.”

As an investing theme, BlackRock views AI as a mega force with

broad investing implications both now and in the long term,

offering investors an opportunity to tap into a market that could

be poised for significant growth.

Leverages BlackRock’s alpha-seeking expertise to capture

evolving global AI and technology trends1

Both BAI and TEK provide investors with the best of BlackRock’s

investment insights in a liquid, transparent, and tax-efficient ETF

wrapper. Managed by Tony Kim and Reid Menge, the Funds benefit from

the expertise of BlackRock’s Fundamental Equities Technology Group.

BlackRock manages $32 billion in assets under management across

over 40 active ETFs in the U.S.2

Fund Name

Ticker

Performance Benchmark

Portfolio

Managers

iShares A.I. Innovation and Tech Active

ETF

BAI

S&P 500 Index

Tony Kim

Reid Menge

iShares Technology Opportunities Active

ETF

TEK

MSCI All Country World IT 10/40

“The asset management industry has reached an inflection point

as active ETFs become the next frontier in investment innovation,”

said Rachel Aguirre, Head of U.S. iShares Product at

BlackRock. “Today’s launches expand BlackRock’s active ETF

platform to more investors, enabling our clients to harness the

long-term potential of AI and technology within the convenience of

an ETF."

iShares A.I. Innovation and Tech Active ETF (BAI)

BAI seeks to maximize total return by investing in a

concentrated portfolio of ~20-40 global AI and technology stocks

across all market capitalizations. The ETF targets companies

generating revenue tied to one or more layers of the AI stack,

including AI infrastructure (AI power, accelerated computing, cloud

infrastructure), intelligence (AI models, data), and applications

(data software and tools, AI applications, services and

solutions).

iShares Technology Opportunities Active ETF (TEK)

TEK has a similar investment objective, investment process,

benchmark, and portfolio managers as the BlackRock Technology

Opportunities Fund (BGSIX). The ETF seeks long-term capital

appreciation by investing in a select portfolio of ~50-70 global

technology companies across semiconductors, software, hardware,

internet, services, content and infrastructure, and new

industries.

About BlackRock

BlackRock’s purpose is to help more and more people experience

financial well-being. As a fiduciary to investors and a leading

provider of financial technology, we help millions of people build

savings that serve them throughout their lives by making investing

easier and more affordable. For additional information on

BlackRock, please visit www.blackrock.com/corporate | Twitter:

@blackrock | LinkedIn: www.linkedin.com/company/blackrock

About iShares

iShares unlocks opportunity across markets to meet the evolving

needs of investors. With more than twenty years of experience, a

global line-up of 1400+ exchange traded funds (ETFs) and $4.2

trillion in assets under management as of September 30, 2024,

iShares continues to drive progress for the financial industry.

iShares funds are powered by the expert portfolio and risk

management of BlackRock.

Carefully consider the Funds' investment objectives, risk

factors, and charges and expenses before investing. This and other

information can be found in the Funds' prospectuses or, if

available, the summary prospectuses which may be obtained by

visiting www.iShares.com or www.blackrock.com. Read the prospectus

carefully before investing.

Investing involves risk, including possible loss of

principal.

The Fund is actively managed and does not seek to replicate the

performance of a specified index. The Fund may have a higher

portfolio turnover than funds that seek to replicate the

performance of an index.

Funds that concentrate investments in specific industries,

sectors, markets or asset classes may underperform or be more

volatile than other industries, sectors, markets or asset classes

and than the general securities market.

Technology companies may be subject to severe competition and

product obsolescence.

Convertible securities are subject to the market and issuer

risks that apply to the underlying common stock.

Securities issued in IPOs have no trading history, and

information about the companies may be available for very limited

periods. In addition, the prices of securities sold in IPOs may be

highly volatile or may decline shortly after the IPO.

Preferred stocks are not necessarily correlated with securities

markets generally. Rising interest rates may cause the value of the

Fund’s investments to decline significantly. Removal of stocks from

the index due to maturity, redemption, call features or conversion

may cause a decrease in the yield of the index and the Fund.

International investing involves risks, including risks related

to foreign currency, limited liquidity, less government regulation

and the possibility of substantial volatility due to adverse

political, economic or other developments. These risks often are

heightened for investments in emerging/developing markets or in

concentrations of single countries.

The Fund's use of derivatives may reduce the Fund's returns

and/or increase volatility and subject the Fund to counterparty

risk, which is the risk that the other party in the transaction

will not fulfill its contractual obligation. The Fund could suffer

losses related to its derivative positions because of a possible

lack of liquidity in the secondary market and as a result of

unanticipated market movements, which losses are potentially

unlimited. There can be no assurance that the Fund's hedging

transactions will be effective.

This information should not be relied upon as research,

investment advice, or a recommendation regarding any products,

strategies, or any security in particular. This material is

strictly for illustrative, educational, or informational purposes

and is subject to change. This material does not constitute any

specific legal, tax or accounting advice. Please consult with

qualified professionals for this type of advice.

The iShares Funds are distributed by BlackRock Investments, LLC

(together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc. or its affiliates. All rights reserved.

iSHARES and BLACKROCK are trademarks of BlackRock,

Inc. or its affiliates. All other trademarks are those of their

respective owners.

1 Alpha refers to the excess return of a fund relative to the

return of a benchmark. 2 BlackRock, as of October 21, 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241022669587/en/

Media Contacts Joanna Yau Joanna.Yau@BlackRock.com

646-856-7274

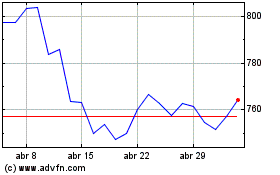

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024