U.S. Bank Freight Payment Index: Truck freight volume, spend decline at slower pace

31 Outubro 2024 - 9:00AM

Business Wire

Third quarter marked the ninth consecutive

quarterly decrease in shipments, but smallest drop in more than a

year

Truck freight shipments and spending continued to contract in

the third quarter, albeit at a slower pace than earlier this year,

according to the latest U.S. Bank Freight Payment Index. Shipments

were down 1.9% compared to the previous quarter while spending

dropped 1.4%. This was the ninth consecutive quarterly decrease in

volume, but the smallest drop in more than a year.

“The latest data continues to show some positive developments

for the freight market. However, there remain sequential declines

nationwide, and in most regions,” said Bobby Holland, U.S. Bank

director of freight business analytics. “Over the last two

quarters, volume and spend contractions have lessened, but we’re

waiting for clear evidence that the market has reached the

bottom.”

The third quarter again highlighted the value of examining truck

freight conditions by region, where conditions varied greatly. In

the West, spending was up 4.4% over the previous quarter and volume

increased 1.1%. Meanwhile, in the Southeast spending declined 3.3%

and shipments were down 3.0%.

“It’s a positive sign that spending contracted less than

shipments. With diesel fuel prices lower, the fact that pricing

didn’t erode more tells me the market is getting healthier,” said

Bob Costello, senior vice president and chief economist at the

American Trucking Associations.

The U.S. Bank Freight Payment Index measures quantitative

changes in freight shipments and spend activity based on data from

transactions processed through U.S. Bank Freight Payment, which

processes more than $42 billion in freight payments annually for

shippers and carriers across the U.S. The Index insights are

provided to U.S. Bank customers to help them make business

decisions and discover new opportunities.

Data

National Data Shipments Linked quarter: -1.9% Year over

year: -21.2%

Spending Linked quarter: -1.4% Year over year: -21.3%

Regional Data West Shipments Linked quarter: 1.1%

Year over year: -10.9%

Spending Linked quarter: 4.4% Year over year: -18%

Stronger West Coast port volumes boosted truck freight levels.

This marked the first time shipments have risen for two consecutive

quarters in the West since 2021. The West also had by far greatest

increase in truck freight spending during the third quarter.

Southwest Shipments Linked quarter: -7.2% Year over year:

-28.6%

Spending Linked quarter: 0.1% Year over year: -19.8%

Among regions, the Southwest had the largest quarterly decline

in volume (-7.2%). This follows a 13.6% drop in the second quarter.

Weaker economic activity – including the impacts of Hurricane Beryl

– dampened truck freight activity in the region.

Midwest Shipments Linked quarter: 0.3% Year over year:

-19.2%

Spending Linked quarter: -3.0% Year over year: -22%

Positive housing starts in the Midwest helped boost truck

freight shipments modestly during the third quarter. Spending,

meanwhile, dropped for the third consecutive quarter.

Northeast Shipments Linked quarter: -2.8% Year over year:

-25.4%

Spending Linked quarter: -2.5% Year over year: -27.7%

This quarter’s contraction followed a 2.7% increase in shipments

in the second quarter. Economic activity in the region has been

mixed, with increases in residential construction but lower retail

sales.

Southeast Shipments Linked quarter: -3.0% Year over year:

-23.1%

Spending Linked quarter: -3.3% Year over year: -20.8%

Spending on truck freight in the Southeast declined by the most

among regions on a quarterly basis. The drop was due to falling

volumes as well as lower fuel costs.

To see the full report including in-depth regional data, visit

the U.S. Bank Freight Payment Index website. For more than 25

years, organizations have turned to U.S. Bank Freight Payment for

the service, reliability, and security of a full-service, federally

regulated financial institution and payments provider. The U.S.

Bank Freight Payment Index measures quantitative changes in freight

shipments and spend activity based on data from transactions

processed through U.S. Bank Freight Payment.

About U.S. Bank

U.S. Bancorp, with more than 70,000 employees and $686 billion

in assets as of September 30, 2024, is the parent company of U.S.

Bank National Association. Headquartered in Minneapolis, the

company serves millions of customers locally, nationally and

globally through a diversified mix of businesses including consumer

banking, business banking, commercial banking, institutional

banking, payments and wealth management. U.S. Bancorp has been

recognized for its approach to digital innovation, community

partnerships and customer service, including being named one of the

2024 World’s Most Ethical Companies and Fortune’s most admired

superregional bank. Learn more at usbank.com/about

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031601511/en/

Todd Deutsch, U.S. Bank Public Affairs & Communications

todd.deutsch@usbank.com

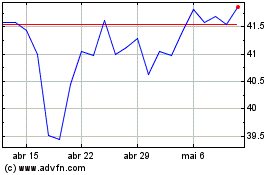

US Bancorp (NYSE:USB)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

US Bancorp (NYSE:USB)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025