Arista Networks, Inc. (NYSE: ANET), an industry leader in

data-driven, client-to-cloud networking for large AI, data center,

campus and routing environments, today announced financial results

for its third quarter ended September 30, 2024.

Third Quarter Financial Highlights

“Arista remains at the forefront of next generation centers of

data across client-to-cloud and AI focused locations,” said

Jayshree Ullal, Chairperson and CEO of Arista Networks. “Our Q3

2024 results once again demonstrate our continued commitment to

customer priorities as well as delivering strong financial

results.”

- Revenue of $1.811 billion, an increase of 7.1% compared to the

second quarter of 2024, and an increase of 20.0% from the third

quarter of 2023.

- GAAP gross margin of 64.2%, compared to GAAP gross margin of

64.9% in the second quarter of 2024 and 62.4% in the third quarter

of 2023.

- Non-GAAP gross margin of 64.6%, compared to non-GAAP gross

margin of 65.4% in the second quarter of 2024 and 63.1% in the

third quarter of 2023.

- GAAP net income of $747.9 million, or $2.33 per diluted share,

compared to GAAP net income of $545.3 million, or $1.72 per diluted

share in the third quarter of 2023.

- Non-GAAP net income of $769.1 million, or $2.40 per diluted

share, compared to non-GAAP net income of $581.4 million, or $1.83

per diluted share in the third quarter of 2023.

Commenting on the company's financial results, Chantelle

Breithaupt, Arista’s CFO said, “We are proud to report another

quarter of strong revenue growth driven by our ability to

consistently deliver innovation and value to customers and

shareholders.”

Company Highlights

- Alabama Fiber Network Selects Arista Networks for Statewide

Middle-Mile Initiative - Arista Networks announced that

Alabama Fiber Network (AFN), a consortium of eight electric

cooperatives, has selected Arista as its provider of routing and

switching equipment for its robust middle-mile network project.

This initiative delivers affordable, high-capacity and reliable

internet access to last-mile providers and large enterprises

throughout underserved rural areas across Alabama.

- CloudVision Delivers Modern Network Operating Model Across

the Enterprise - Arista Networks announced significant

new capabilities in its CloudVision ® platform, enabling a modern

network operating model for customers. Arista’s CloudVision

dramatically simplifies operations with automation, observability

and zero trust security capabilities across all enterprise

networking domains, from campus to data center, WAN, and

cloud.

- Meta and Arista Build AI at Scale - The rise of

the AI center has created greater demands on modern open

networking. The Arista Etherlink portfolio delivers choices in form

factor, scaling from single-chip systems to modular multi-chip,

multi-tier networks that scale out to thousands of XPU ports. The

7700R4 Distributed Etherlink Switch offers simplicity and

scalability with a cost-effective and power-efficient solution for

the AI Center. We are thrilled with the close engineering

collaboration with Meta for the new era of AI.

Stock Split

Arista’s board of directors has approved a four-for-one forward

stock split to make Arista’s common stock more accessible to a

broader base of investors.

The four-for-one forward stock split will be effected through

the filing of an amendment to Arista’s Amended and Restated

Certificate of Incorporation that will proportionately increase the

authorized shares of common stock.

Our stockholders will receive an additional three shares of

common stock for each share held as of the effective time of the

filing of the amendment on December 3, 2024. Prior to market open

on December 4, 2024, trading is expected to commence on a

split-adjusted basis.

Financial Outlook

For the fourth quarter of 2024, we expect:

- Revenue between $1.85 billion to $1.90 billion

- Non-GAAP gross margin of approximately 63% - 64%; and

- Non-GAAP operating margin of approximately 44%.

Guidance for non-GAAP financial measures excludes certain items,

including stock-based compensation expense, intangible asset

amortization, and potential non-recurring charges or benefits. A

reconciliation of non-GAAP guidance measures to corresponding GAAP

measures is not available on a forward-looking basis without

unreasonable effort because these exclusions can be uncertain or

difficult to predict, including stock-based compensation expense

which is impacted by the timing of employee stock transactions, the

company’s future hiring and retention needs and the future fair

market value of the company’s common stock. The actual amount of

these exclusions will have a significant impact on the company’s

GAAP gross margin and GAAP operating margin.

Prepared Materials and Conference Call Information

Arista's executives will discuss the third quarter 2024

financial results on a conference call at 1:30 p.m. Pacific time

today. To listen to the call via telephone, dial (888) 330-2502 in

the United States or +1 (240) 789-2713 from international

locations. The Conference ID is 5655862.

The financial results conference call will also be available via

live webcast on Arista's investor relations website at

https://investors.arista.com/. Shortly after the conclusion of the

conference call, a replay of the audio webcast will be available on

Arista’s investor relations website.

Forward-Looking Statements

This press release contains “forward-looking statements”

regarding our future performance, including quotations from

management, statements in the section entitled “Financial Outlook,”

such as estimates regarding revenue, non-GAAP gross margin and

non-GAAP operating margin for the fourth quarter of 2024,

statements regarding the benefits of Arista's products, statements

about our ability to consistently deliver innovation and value to

customers and shareholders, and statements relating to our planned

forward stock split. Forward-looking statements are subject to

known and unknown risks, uncertainties, assumptions and other

factors that could cause actual results, performance or

achievements to differ materially from those anticipated in or

implied by the forward-looking statements including risks

associated with: large purchases by a limited number of customers

who represent a substantial portion of our revenue; adverse

economic and geopolitical conditions and conflicts, including

inflationary pressures which result in increased component costs

and reduced information technology and network infrastructure

spending, geopolitical pressures and changes in the U.S.

presidential administration; changes in our customers technology

roadmaps and priorities including the need for the deployment of

artificial intelligence (“AI”) and related technologies; the impact

of sole or limited sources of supply, supply shortages and extended

lead times or supply changes; volatility in our revenue growth

rate; variations in our results of operations; the rapid evolution

of the networking market; failure to successfully carry out new

products and service offerings and expand into adjacent markets;

variability in our gross margins; intense competition and industry

consolidation; expansion of our international sales and operations;

investments in or acquisitions of other businesses; seasonality and

industry cyclicality; fluctuations in currency exchange rates;

failure to raise additional capital on favorable terms; our

inability to attract new large customers or sell additional

products and services to our existing customers; sales of our

switches generating most of our product revenue; large customers

requiring more favorable terms; inability to increase market

awareness or acceptance of our new products and services; the

inclusion of any acceptance provisions in our customer contracts

and any delays in acceptance, or rejection, of those products;

decreases in the sales prices of our products and services; long

and unpredictable sales cycles; declines in maintenance renewals by

customers; product quality problems; failure to anticipate

technological shifts; managing the supply of our products and

product components; our dependence on third-party manufacturers to

build our products; assertions by third parties of intellectual

property rights infringement; failure or inability to protect or

assert our intellectual property rights; defects, errors or

vulnerabilities in our products, the failure of our products to

detect security breaches or incidents, the misuse of our products

or the risks or product liability; enhanced U.S. tax, tariff,

import/export restrictions, Chinese regulations or other trade

barriers; failure to comply with government law and regulations;

issues in the development and use of artificial intelligence,

combined with an uncertain regulatory environment; and other future

events. Additional risks and uncertainties that could affect us can

be found in our most recent filings with the Securities and

Exchange Commission including, but not limited to, our annual

report on Form 10-K and quarterly reports on Form 10-Q. You can

locate these reports through our website at

https://investors.arista.com/ and on the SEC’s website at

https://www.sec.gov/. All forward-looking statements in this press

release are based on information available to the company as of the

date hereof and we disclaim any obligation to publicly update or

revise any forward-looking statement to reflect events that occur

or circumstances that exist after the date on which they were

made.

Non-GAAP Financial Measures

This press release and accompanying table contain certain

non-GAAP financial measures including non-GAAP gross profit,

non-GAAP gross margin, non-GAAP income from operations, non-GAAP

operating margin, non-GAAP net income and non-GAAP diluted net

income per share. These non-GAAP financial measures exclude

stock-based compensation expense, intangible asset amortization,

gains/losses on strategic investments, and the income tax effect of

these non-GAAP exclusions. In addition, non-GAAP financial measures

exclude net tax benefits associated with stock-based awards, which

include excess tax benefits, and other discrete indirect effects of

such awards. The company uses these non-GAAP financial measures

internally in analyzing its financial results and believes that

these non-GAAP financial measures are useful to investors as an

additional tool to evaluate ongoing operating results and trends.

In addition, these measures are the primary indicators management

uses as a basis for its planning and forecasting for future

periods.

Non-GAAP financial measures are not meant to be considered in

isolation or as a substitute for the comparable GAAP financial

measures. Non-GAAP financial measures are subject to limitations,

and should be read only in conjunction with the company's

consolidated financial statements prepared in accordance with GAAP.

Non-GAAP financial measures do not have any standardized meaning

and are therefore unlikely to be comparable to similarly titled

measures presented by other companies. A description of these

non-GAAP financial measures and a reconciliation of the company’s

non-GAAP financial measures to their most directly comparable GAAP

measures have been provided in the financial statement tables

included in this press release, and investors are encouraged to

review the reconciliation.

About Arista Networks

Arista Networks is an industry leader in data-driven,

client-to-cloud networking for large AI, data center, campus and

routing environments. Its award-winning platforms deliver

availability, agility, automation, analytics, and security through

an advanced network operating stack. For more information, visit

www.arista.com.

ARISTA, CloudVision and Etherlink are among the registered and

unregistered trademarks of Arista Networks, Inc. in jurisdictions

around the world. Other company names or product names may be

trademarks of their respective owners.

ARISTA NETWORKS, INC.

Condensed Consolidated Income

Statements

(Unaudited, in thousands,

except per share amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenue:

Product

$

1,523,807

$

1,285,548

$

4,275,923

$

3,719,179

Service

287,129

223,908

796,787

600,552

Total revenue

1,810,936

1,509,456

5,072,710

4,319,731

Cost of revenue:

Product

593,343

522,866

1,655,415

1,565,341

Service

55,876

44,171

156,986

123,335

Total cost of revenue

649,219

567,037

1,812,401

1,688,676

Gross profit

1,161,717

942,419

3,260,309

2,631,055

Operating expenses:

Research and development

235,824

212,353

711,701

643,437

Sales and marketing

106,832

102,033

316,315

293,496

General and administrative

33,811

25,338

87,329

76,787

Total operating expenses

376,467

339,724

1,115,345

1,013,720

Income from operations

785,250

602,695

2,144,964

1,617,335

Other income (expense), net

97,660

41,815

231,143

110,300

Income before income taxes

882,910

644,510

2,376,107

1,727,635

Provision for income taxes

134,972

99,183

325,049

253,950

Net income

$

747,938

$

545,327

$

2,051,058

$

1,473,685

Net income per share:

Basic

$

2.38

$

1.76

$

6.54

$

4.78

Diluted

$

2.33

$

1.72

$

6.41

$

4.66

Weighted-average shares used in computing

net income per share:

Basic

314,482

310,185

313,742

308,602

Diluted

320,448

317,631

320,078

316,564

ARISTA NETWORKS, INC.

Reconciliation of Selected

GAAP to Non-GAAP Financial Measures

(Unaudited, in thousands,

except percentages and per share amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

GAAP gross profit

$

1,161,717

$

942,419

$

3,260,309

$

2,631,055

GAAP gross margin

64.2

%

62.4

%

64.3

%

60.9

%

Stock-based compensation expense

4,098

3,717

11,531

9,516

Intangible asset amortization

4,195

5,622

12,585

19,262

Non-GAAP gross profit

$

1,170,010

$

951,758

$

3,284,425

$

2,659,833

Non-GAAP gross margin

64.6

%

63.1

%

64.7

%

61.6

%

GAAP income from operations

$

785,250

$

602,695

$

2,144,964

$

1,617,335

Stock-based compensation expense

98,123

85,390

254,630

215,398

Intangible asset amortization

6,690

8,117

20,070

26,747

Non-GAAP income from operations

$

890,063

$

696,202

$

2,419,664

$

1,859,480

Non-GAAP operating margin

49.1

%

46.1

%

47.7

%

43.0

%

GAAP net income

$

747,938

$

545,327

$

2,051,058

$

1,473,685

Stock-based compensation expense

98,123

85,390

254,630

215,398

Intangible asset amortization

6,690

8,117

20,070

26,747

(Gain)/loss on strategic investments

(12,400

)

473

(12,400

)

(18,699

)

Tax benefits on stock-based awards

(57,698

)

(45,667

)

(193,079

)

(133,561

)

Income tax effect on non-GAAP

exclusions

(13,598

)

(12,253

)

(40,864

)

(28,488

)

Non-GAAP net income

$

769,055

$

581,387

$

2,079,415

$

1,535,082

GAAP diluted net income per share

$

2.33

$

1.72

$

6.41

$

4.66

Non-GAAP adjustments to net income

0.07

0.11

0.09

0.19

Non-GAAP diluted net income per share

$

2.40

$

1.83

$

6.50

$

4.85

Weighted-average shares used in computing

diluted net income per share

320,448

317,631

320,078

316,564

Summary of Stock-Based Compensation

Expense:

Cost of revenue

$

4,098

$

3,717

$

11,531

$

9,516

Research and development

58,340

47,965

152,897

125,671

Sales and marketing

20,960

20,490

56,630

51,461

General and administrative

14,725

13,218

33,572

28,750

Total

$

98,123

$

85,390

$

254,630

$

215,398

ARISTA NETWORKS, INC.

Condensed Consolidated Balance

Sheets

(Unaudited, in

thousands)

September 30, 2024

December 31, 2023

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

3,175,139

$

1,938,606

Marketable securities

4,253,249

3,069,362

Accounts receivable, net

1,130,897

1,034,398

Inventories

1,769,962

1,945,180

Prepaid expenses and other current

assets

548,693

412,518

Total current assets

10,877,940

8,400,064

Property and equipment, net

93,034

101,580

Goodwill and acquisition-related

intangible assets, net

337,230

357,299

Deferred tax assets

1,318,224

945,792

Other assets

220,295

151,900

TOTAL ASSETS

$

12,846,723

$

9,956,635

LIABILITIES AND STOCKHOLDERS’

EQUITY

CURRENT LIABILITIES:

Accounts payable

$

289,161

$

435,059

Accrued liabilities

323,990

407,302

Deferred revenue

1,599,590

915,204

Other current liabilities

221,633

161,870

Total current liabilities

2,434,374

1,919,435

Income taxes payable

116,604

95,751

Deferred revenue, non-current

907,741

591,000

Other long-term liabilities

142,115

131,390

TOTAL LIABILITIES

3,600,834

2,737,576

STOCKHOLDERS’ EQUITY:

Common stock

31

31

Additional paid-in capital

2,371,010

2,108,331

Retained earnings

6,865,260

5,114,025

Accumulated other comprehensive income

(loss)

9,588

(3,328

)

TOTAL STOCKHOLDERS’ EQUITY

9,245,889

7,219,059

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

$

12,846,723

$

9,956,635

ARISTA NETWORKS, INC.

Condensed Consolidated

Statements of Cash Flows

(Unaudited, in

thousands)

Nine Months Ended September

30,

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net income

$

2,051,058

$

1,473,685

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

46,650

56,233

Stock-based compensation

254,630

215,398

Deferred income taxes

(376,726

)

(217,489

)

Amortization (accretion) of investment

premiums (discounts)

(44,609

)

(22,389

)

Other

1,921

(5,084

)

Changes in operating assets and

liabilities:

Accounts receivable, net

(96,499

)

84,379

Inventories

175,218

(603,832

)

Other assets

(173,119

)

(118,622

)

Accounts payable

(142,005

)

33,740

Accrued liabilities

(84,565

)

117,481

Deferred revenue

1,001,127

153,505

Income taxes, net

59,763

346,170

Other liabilities

4,428

(5,625

)

Net cash provided by operating

activities

2,677,272

1,507,550

CASH FLOWS FROM INVESTING

ACTIVITIES:

Proceeds from maturities of marketable

securities

1,427,348

1,564,950

Proceeds from sales of marketable

securities

44,865

49,584

Purchases of marketable securities

(2,593,418

)

(1,934,156

)

Purchases of property and equipment

(19,580

)

(28,424

)

Other investing activities

(6,628

)

(2,451

)

Net cash used in investing activities

(1,147,413

)

(350,497

)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Proceeds from issuance of common stock

under equity plans

55,501

53,797

Tax withholding paid on behalf of

employees for net share settlement

(47,452

)

(23,939

)

Repurchases of common stock

(299,823

)

(112,279

)

Net cash used in financing activities

(291,774

)

(82,421

)

Effect of exchange rate changes

(1,011

)

(934

)

NET INCREASE IN CASH, CASH EQUIVALENTS AND

RESTRICTED CASH

1,237,074

1,073,698

CASH, CASH EQUIVALENTS AND RESTRICTED CASH

—Beginning of period

1,939,464

675,978

CASH, CASH EQUIVALENTS AND RESTRICTED CASH

—End of period

$

3,176,538

$

1,749,676

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107434565/en/

Investor Contacts: Arista Networks, Inc. Liz Stine,

408-547-5885 Investor Relations lRevents@arista.com

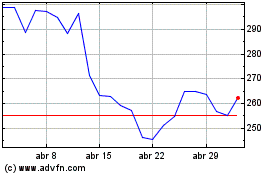

Arista Networks (NYSE:ANET)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Arista Networks (NYSE:ANET)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024