HSBC Global Entrepreneurial Wealth Report: U.S. Entrepreneurs Optimistic Amid Global Market Uncertainty

14 Novembro 2024 - 10:00AM

Business Wire

- 41% of U.S. entrepreneurs actively contribute to charitable

causes—the most philanthropic group among all markets

surveyed.

- 81% agree they feel valued by society, and 80% agree they

actively seek to make a positive impact in their communities.

- 44% of high-net-worth and ultra-high-net-worth (HNW/UHNW) U.S.

entrepreneurs intend to pass their businesses on, either within the

family or to other successors.

- 36% of U.S. entrepreneurs own multiple businesses, aligning

with the global average, while 20% plan an exit within five

years.

HSBC’s Global Entrepreneurial Wealth Report 2024 reveals that an

impressive 94% of U.S. HNW and UHNW entrepreneurs are optimistic

about future business prospects, and 88% believe their wealth will

grow in the next 12 months, even as markets face uncertainties.

The study, conducted by Ipsos UK on behalf of HSBC Global

Private Banking across ten markets—including the U.S., UK,

Switzerland, China, and UAE—surveyed 1,798 HNW and UHNW business

owners who chose to take part in the survey with at least $2

million in investable assets, and included interviews with both

first-generation and multi-generational entrepreneurs. By examining

entrepreneurs’ values, motivations, and ambitions, the research

unveils the factors driving their optimism and the nuanced

approaches to wealth management across borders.

“As a leading global wealth manager, HSBC is committed to

empowering entrepreneurs across the U.S. and internationally,” said

Racquel Oden, HSBC US Head of Wealth, Premier, and Global Private

Banking. “This report gives us valuable insights into how these

leaders view today’s business landscape, which in turn helps us

better serve their evolving financial needs.”

Additional U.S. Highlights:

- A Supportive, Yet Challenging Environment: While 74% of

U.S. entrepreneurs agree they feel government support (in the form

of regulations, laws and policies) —slightly below the global

average—their optimism is underpinned by a long-term vision rather

than short-term political factors. However, inflation remains a top

concern, with 43% selecting it as a major challenge, compared to

31% globally.

- Confidence in Opportunity and Ability: 51% of U.S.

respondents cite the availability of business opportunities as a

core driver of optimism about their business prospects, while 50%

attribute their confidence to personal business acumen, showcasing

faith in both the market and their own abilities.

- Succession and Expansion in Focus: While 55% of

U.S. entrepreneurs are first-generation, only 25% have ventures

outside the U.S. When considering international markets, France

(20%) and the UK (20%) are top expansion destinations. The report

also highlights the advanced succession planning among U.S.

entrepreneurs, with 36% lacking a formal plan, a contrast to the

global average of 52%.

About HSBC

HSBC Holdings plc, the parent company of HSBC, is

headquartered in London. HSBC serves customers worldwide from

offices in 60 countries and territories. With assets of US$3,099bn

at 30 September 2024, HSBC is one of the world’s largest banking

and financial services organizations.

HSBC Bank USA, National Association (HSBC Bank USA, N.A.)

serves customers through Wealth and Personal Banking, Commercial

Banking, Private Banking, Global Banking, and Markets and

Securities Services. Deposit products are offered by HSBC Bank USA,

N.A., Member FDIC. It operates Wealth Centers in: California;

Washington, D.C.; Florida; New Jersey; New York; Virginia; and

Washington. HSBC Bank USA, N.A. is the principal subsidiary of HSBC

USA Inc., a wholly-owned subsidiary of HSBC North America Holdings

Inc.

For more information, visit: HSBC in the USA

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114826584/en/

Media enquiries to: Matt Kozar Vice President, External

Communications matt.kozar@us.hsbc.com

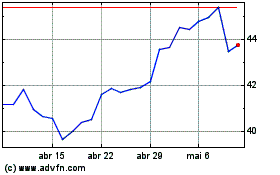

HSBC (NYSE:HSBC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

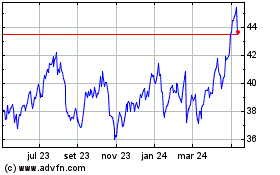

HSBC (NYSE:HSBC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024