HSBC and National Community Reinvestment Coalition (NCRC) Announce $25 Million Partnership to Advance Economic Opportunities in Low- and Moderate-Income

20 Novembro 2024 - 11:00AM

Business Wire

Initiative to Drive Economic Opportunities

Through Loans, Grants, and Investments with a Strong Focus on

California and Other Key U.S. Markets

HSBC and the National Community Reinvestment Coalition (NCRC)

announced a four-year, $25 million community growth initiative

today, as part of HSBC’s broader strategy to drive responsible

banking practices and promote financial equity across its U.S.

footprint and designed to address concerns raised by NCRC.

The partnership, which begins January 2025, aims to expand

economic opportunities in low and moderate-income, diverse, and

underserved communities through a combination of loan subsidies,

community development grants, and philanthropic donations. HSBC’s

investment will provide essential support to neighborhoods where

financial services have historically been more challenging to

access.

Highlights of this agreement:

- HSBC has committed $10 million in loan subsidies to support

homebuyers, particularly in low- and moderate-income, diverse and

underserved communities.

- $3.5 million of these subsidies will be allocated to certain

California markets to address specific community development

needs.

- HSBC and NCRC will each oversee $4 million in grants to

Community Development Financial Institutions (CDFIs) and

community-based nonprofit organizations that deliver critical

services, such as credit counseling, financial education, and

homeownership support, to residents in majority Black and Hispanic

communities.

- HSBC will make a $6 million donation to NCRC to support its

efforts in building strong, resilient communities across the

nation.

- HSBC also will dedicate $1 million towards community engagement

aimed at expanding economic opportunity and ensuring greater

financial inclusion in HSBC’s current U.S. operating markets.

Unlike typical Community Benefits Agreements (CBAs) attached to

bank merger proposals, this $25 million, four-year partnership

between HSBC and the NCRC represents a distinct approach to

supporting underserved communities. In recent years, NCRC raised

concerns about lending practices, and HSBC responded by engaging in

discussions with NCRC to ensure its community investment strategy

aligns with the needs of the communities it serves. These

collaborative efforts have culminated in the partnership announced

today, which reflects HSBC’s commitment to high-impact initiatives

in diverse, underserved communities.

“As one of the largest financial institutions in the world, HSBC

is proud to play a role in helping advance the communities we serve

around the world,” said Michael Roberts, HSBC US and Americas CEO.

“Our partnership with the NCRC reflects our shared commitment to

fostering economic resilience and opportunity in communities across

the U.S., and we are honored to support these efforts through our

loans, investments and grants.”

“I am glad that we were able to come to an agreement and partner

to deliver real and lasting impact for communities of color,” said

Jesse Van Tol, President and CEO of NCRC. “What began as a dispute

turned into a conversation that will now expand a powerful bank’s

work on behalf of lower-income communities, communities of color

and other places that the whole banking industry has historically

overlooked. I look forward to continuing our collaborative,

accountability-driven partnership as we now implement the ideas we

identified: a combination of loan subsidies, grants, and direct

financial support will help bridge the gap to financial inclusion

for thousands of families.”

About HSBC

HSBC Holdings plc, the parent company of HSBC, is

headquartered in London. HSBC serves customers worldwide from

offices in 60 countries and territories. With assets of US$3,099bn

at 30 September 2024, HSBC is one of the world’s largest banking

and financial services organizations.

HSBC Bank USA, National Association (HSBC Bank USA, N.A.)

serves customers through Wealth and Personal Banking, Commercial

Banking, Private Banking, Global Banking, and Markets and

Securities Services. Deposit products are offered by HSBC Bank USA,

N.A., Member FDIC. It operates Wealth Centers in: California;

Washington, D.C.; Florida; New Jersey; New York; Virginia; and

Washington. HSBC Bank USA, N.A. is the principal subsidiary of HSBC

USA Inc., a wholly-owned subsidiary of HSBC North America Holdings

Inc.

For more information, visit: HSBC in the USA

About NCRC

The National Community Reinvestment Coalition is a network of

organizations and individuals dedicated to creating a nation that

not only promises but delivers opportunities for all Americans to

build wealth and live well. We work with community leaders,

policymakers and institutions to advance solutions and build the

will to solve America’s persistent racial and socio-economic

wealth, income and opportunity divides, and to make a Just Economy

a national priority and a local reality. This vision is the

foundation of the Just Economy Pledge.

NCRC’s unique mix of research, investigations, investments,

media, grant-making, training, advocacy, litigation, lending,

convening and facilitation strengthens communities of historic

disinvestment, expands economic mobility, holds public and private

institutions accountable for their impacts, and informs local and

national leaders, policymakers and the private sector. Learn more

at ncrc.org.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241120987675/en/

Media enquiries to: Matt Kozar HSBC US Communications

Matt.Kozar@us.hsbc.com

Alan Pyke NCRC Director of Communications apyke@ncrc.org

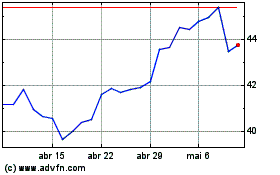

HSBC (NYSE:HSBC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

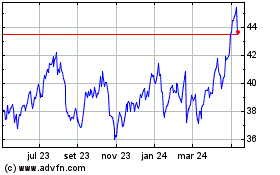

HSBC (NYSE:HSBC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024