- Third quarter

- Revenue: Decreased 5% to $2.255 billion compared to the prior

year period (decreased 6% on a constant currency basis), and

exceeded guidance of a decrease of 6% to 7% (decrease of 7% to 8%

on a constant currency basis)

- EPS:

- GAAP basis: $2.34 exceeded guidance of approximately $2.30

- Non-GAAP basis: $3.03 exceeded guidance of approximately

$2.50

- Full year outlook

- Revenue: Reaffirms projected decrease of 6% to 7% (decrease 6%

to 7% on a constant currency basis)

- Operating margin:

- GAAP basis: Projected to be approximately 9.2% compared to

approximately 9.8% previously

- Non-GAAP basis: Reaffirms outlook of approximately flat

compared to 10.1% in 2023

- EPS:

- GAAP basis: Projected to be in a range of $10.55 to $10.70

compared to $11.20 to $11.45 previously

- Non-GAAP basis: Projected to be in a range of $11.55 to $11.70

compared to $11.55 to $11.80 previously

- Updated EPS guidance includes negative impact of approximately

$0.15 per share related to foreign currency translation compared to

approximately $0.05 previously

PVH Corp. [NYSE: PVH] today reported its 2024 third quarter

results and updated its full year EPS outlook.

Stefan Larsson, Chief Executive Officer, commented, “We beat our

top- and bottom-line guidance for the third quarter, fueled by our

relentless execution of the PVH+ Plan. Throughout the quarter, we

drove powerful consumer engagement for both Calvin Klein and TOMMY

HILFIGER, and continued to build momentum in product, with

significantly improved sell-throughs for the Fall 24 season across

all regions and both our iconic brands, and we are coming into the

holiday season with a fresh and strong inventory composition.”

Larsson continued, “We are building systematic and repeatable

progress across the business, where we increasingly connect product

strength, consumer engagement, and marketplace execution to our

data and demand-driven operating model. In North America we

continue to deliver strong profitability, in Europe, we are gaining

great traction with our quality of sales initiative which led to

increased sell-throughs and sequentially improved wholesale orders,

and in Asia Pacific, we are delivering on our plan and drove growth

across all channels. Looking ahead, we are focused on driving next

level execution of the PVH+ Plan to build our brands for

sustainable, profitable growth.”

Zac Coughlin, Chief Financial Officer, said, “For the third

quarter, we drove solid profitability by relentlessly focusing on

next level execution of the PVH+ Plan. We continue to manage our

business prudently by remaining agile and maintaining strong

expense discipline. Across the Company, we are focused on driving

sustainable, profitable growth long-term by unlocking the full

potential of our iconic brands, increasing quality of sales and

generating cost efficiencies to deliver significant cash flow and

attractive returns for our shareholders.”

Non-GAAP Amounts:

Amounts stated to be on a non-GAAP basis exclude the items that

are defined or described in greater detail near the end of this

release under the heading “Non-GAAP Exclusions.” Amounts stated on

a constant currency basis also are deemed to be on a non-GAAP

basis. Reconciliations of amounts on a GAAP basis to amounts on a

non-GAAP basis are presented after the Non-GAAP Exclusions section

and identify and quantify all excluded items.

Third Quarter Review:

- Revenue decreased 5% compared to the prior year period

(decreased 6% on a constant currency basis), including a 2% decline

resulting from the sale of the Heritage Brands women’s intimates

business in November 2023. Overall revenue in the Company’s

international businesses was flat compared to the prior year period

(decreased 2% on a constant currency basis), as growth in the Asia

Pacific region in local currency was more than offset by the

continuation of the Company’s planned strategic reduction of sales

in Europe to drive overall higher quality of sales in the region.

In North America, revenue in the Tommy Hilfiger and Calvin Klein

businesses combined decreased 6% compared to the prior year period.

The prior year period benefited from a shift in the timing of

wholesale shipments from the fourth quarter into the third quarter.

- Direct-to-consumer revenue was flat compared to the

prior year period (decreased 1% on a constant currency basis).

Revenue in the Company’s owned and operated stores increased 1%

compared to the prior year period (decreased 1% on a constant

currency basis). Revenue in the Company’s owned and operated

digital commerce business decreased 1% compared to the prior year

period (decreased 3% on a constant currency basis), primarily due

to the continuation of the Company’s planned strategic reduction of

sales in Europe to drive overall higher quality of sales in the

region.

- Wholesale revenue decreased 8% compared to the prior

year period (decreased 9% on a constant currency basis), including

a 4% reduction resulting from the sale of the Heritage Brands

women's intimates business. The remaining decline reflects the

continued strategic reduction of sales in Europe to drive overall

higher quality of sales in the region and the impact of the timing

of wholesale shipments in North America discussed above.

- Gross margin increased 170 basis points to 58.4%

compared to 56.7% in the prior year period. The increase reflects

benefits from a favorable shift in channel mix and a reduction in

sales to lower margin wholesale accounts.

- Inventory increased 9% compared to the prior year period

primarily due to a combination of early receipts of inventory in

the current quarter and lean inventory levels in the prior year

period.

Third Quarter Consolidated Results:

- Revenue of $2.255 billion decreased 5% compared to

$2.363 billion in the prior year period (decreased 6% on a constant

currency basis), including a 2% decline resulting from the sale of

the Heritage Brands women’s intimates business.

- Tommy Hilfiger revenue decreased 1% compared to the

prior year period (decreased 2% on a constant currency basis).

- Tommy Hilfiger International revenue was flat (decreased

2% on a constant currency basis).

- Tommy Hilfiger North America revenue decreased 3%.

- Calvin Klein revenue decreased 3% compared to the prior

year period (decreased 4% on a constant currency basis).

- Calvin Klein International revenue increased 1%

(decreased 1% on a constant currency basis).

- Calvin Klein North America revenue decreased 9%

primarily driven by the timing of wholesale shipments discussed

above.

- Heritage Brands revenue decreased 54% compared to the

prior year period, which included a 44% decrease resulting from the

sale of the Heritage Brands women's intimates business.

- Earnings before interest and taxes (“EBIT”) on a GAAP

basis was $183 million, inclusive of a $3 million positive impact

attributable to foreign currency translation, compared to $230

million in the prior year period. EBIT on a GAAP basis included net

costs of $53 million in the current quarter and costs of $19

million in the prior year period described under the heading

“Non-GAAP Exclusions” later in this release. EBIT on a non-GAAP

basis for these periods excludes these amounts. EBIT on a non-GAAP

basis was $236 million, inclusive of a $3 million positive impact

attributable to foreign currency translation, compared to $249

million in the prior year period. The gross margin improvement

discussed above was more than offset by the impact of the revenue

decline in the quarter. The Company continues to take a disciplined

approach to managing expenses, driving cost efficiencies while

making targeted investments to drive its strategic

initiatives.

- Earnings per share (“EPS”)

- GAAP basis: $2.34 compared to $2.66 in the prior year

period.

- Non-GAAP basis: $3.03 compared to $2.90 in the prior

year period.

EPS on both a GAAP and a non-GAAP basis for

the third quarter of 2024 includes the positive impact of $0.05 per

share related to foreign currency translation.

EPS on a GAAP basis for these periods also

includes the amounts for the applicable period described under the

heading “Non-GAAP Exclusions” later in this release. EPS on a

non-GAAP basis for these periods excluded these amounts.

- Interest expense decreased to $16 million from $22

million in the prior year period.

- Effective tax rate was 21.0% on a GAAP basis compared to

22.2% in the prior year period. The effective tax rate was 22.6% on

a non-GAAP basis as compared to 22.1% in the prior year

period.

Stock Repurchase Program:

Delivering on its commitment under the PVH+ Plan to return

excess cash to stockholders, the Company repurchased 300,000 shares

of its common stock for $29 million during the third quarter of

2024, bringing total share repurchases for the first nine months of

2024 to 2.4 million shares for $254 million. The Company currently

expects to make common stock repurchases under the stock repurchase

program of approximately $400 million for the full year 2024.

2024 Outlook:

Full Year 2024 Guidance

- Revenue: Reaffirming projected decrease of 6% to 7%

compared to 2023 (decrease 6% to 7% on a constant currency basis),

inclusive of a 2% reduction resulting from the sale of the Heritage

Brands women’s intimates business and a 1% reduction from the 53rd

week in 2023.

- Operating margin

- GAAP basis: Projected to be approximately 9.2% compared

to 10.1% in 2023. Previous guidance was approximately 9.8%.

- Non-GAAP basis: Reaffirming outlook of approximately

flat compared to 10.1% in 2023.

Operating margin on a GAAP basis for these

periods include the amounts described under the heading “Non-GAAP

Exclusions” later in this release. Operating margin on a non-GAAP

basis exclude these amounts.

- EPS

- GAAP basis: Projected to be in a range of $10.55 to

$10.70 compared to $10.76 in 2023. Previous guidance was a range of

$11.20 to $11.45.

- Non-GAAP basis: Projected to be in a range of $11.55 to

$11.70 compared to $10.68 in 2023. Previous guidance was a range of

$11.55 to $11.80.

The 2024 EPS projections include the

estimated negative impact of approximately $0.15 per share related

to foreign currency translation. Previous guidance was a negative

impact of approximately $0.05.

EPS on a GAAP basis for these periods also

include the amounts described under the heading “Non-GAAP

Exclusions” later in this release. EPS on a non-GAAP basis exclude

these amounts.

- Interest expense is projected to decrease to

approximately $68 million compared to $88 million in 2023,

primarily due to the repayment in 2023 of the $100 million 7 3/4%

debentures and an increase in interest income. Previous guidance

was approximately $70 million.

- Effective tax rate is projected to be approximately 15%

on a GAAP basis and approximately 16% on a non-GAAP basis.

Fourth Quarter 2024 Guidance

- Revenue is projected to decrease 6% to 7% compared to

the fourth quarter of 2023 (decrease 4% to 5% on a constant

currency basis), inclusive of a reduction of 1% resulting from the

sale of the Heritage Brands women's intimates business and a 3%

reduction from the 53rd week in 2023.

- EPS

- GAAP basis: Projected to be in a range of $2.83 to $2.98

compared to $4.55 in the prior year period.

- Non-GAAP basis: Projected to be in a range of $3.05 to

$3.20 compared to $3.72 in the prior year period. The fourth

quarter EPS projections include the estimated negative impact of

approximately $0.09 per share related to foreign currency

translation. EPS on a GAAP basis for these periods also include the

amounts described under the heading “Non-GAAP Exclusions” later in

this release. EPS on a non-GAAP basis exclude these amounts.

- Interest expense is projected to decrease to

approximately $15 million compared to $20 million in the fourth

quarter of 2023.

- Effective tax rate is projected to be approximately

20%.

Please see the section entitled “Full Year and Quarterly

Reconciliations of GAAP to Non-GAAP Amounts” at the end of this

release for further detail and reconciliations of GAAP to non-GAAP

amounts discussed in this section.

Non-GAAP Exclusions:

The discussions in this release that refer to non-GAAP amounts

exclude the following:

- Pre-tax net restructuring costs totaling approximately $33

million incurred and expected to be incurred in 2024 consisting

principally of severance and the gain on the sale of a warehouse

and distribution center in the third quarter in connection with the

Company’s multi-year initiative to simplify its operating model by

centralizing processes and improving systems and automation to

drive more efficient, cost-effective ways of working across the

organization, of which $15 million was incurred in the second

quarter, $3 million was incurred in the third quarter, and

approximately $15 million is expected to be incurred in the fourth

quarter.

- Pre-tax costs of $51 million incurred in the third quarter of

2024 in connection with an amendment to Mr. Tommy Hilfiger’s

employment agreement pursuant to which the Company made a cash

buyout of a portion of future payments to Mr. Hilfiger.

- Pre-tax gain of $10 million recorded in the first quarter of

2024 in connection with the Company’s sale of the Heritage Brands

women’s intimates business.

- Pre-tax gain of $46 million recorded in the fourth quarter of

2023 related to the recognized actuarial gain on retirement

plans.

- Pre-tax net gain of $13 million recorded in the fourth quarter

of 2023 in connection with the sale of the Company’s Heritage

Brands women's intimates business, which includes a gain on the

sale, less costs to sell, and severance and other termination

benefits associated with the transaction.

- Pre-tax restructuring costs of $61 million incurred in 2023

consisting principally of severance related to actions taken in the

second and third quarters of 2023 under the plans announced in

August 2022 to reduce people costs in the Company’s global offices

by approximately 10% by the end of 2023, of which $39 million was

incurred in the second quarter, $19 million was incurred in the

third quarter and $4 million was incurred in the fourth

quarter.

- Estimated tax effects associated with the above pre-tax items,

which are based on the Company’s assessment of deductibility. In

making this assessment, the Company evaluated each item that it had

identified above as a non-GAAP exclusion to determine if such item

was (i) taxable or tax deductible, in which case the tax effect was

taken at the applicable income tax rate in the local jurisdiction,

or (ii) non-taxable or non-deductible, in which case the Company

assumed no tax effect.

The Company presents constant currency revenue information,

which is a non-GAAP financial measure, because it is a global

company that transacts business in multiple currencies and reports

financial information in U.S. dollars. Foreign currency exchange

rate fluctuations affect the amounts reported by the Company in

U.S. dollars with respect to its foreign revenues and can have a

significant impact on the Company’s reported revenues. The Company

calculates constant currency revenue information by translating its

foreign revenues for the relevant period into U.S. dollars at the

average exchange rates in effect during the comparable prior year

period (rather than at the actual exchange rates in effect during

the relevant period).

The Company presents non-GAAP financial measures, including

constant currency revenue information, as a supplement to its GAAP

results. The Company believes presenting non-GAAP financial

measures provides useful information to investors, as it provides

information to assess how its businesses performed excluding the

effects of non-recurring and non-operational amounts and the

effects of changes in foreign currency exchange rates, as

applicable, and (i) facilitates comparing the results being

reported against past and future results by eliminating amounts

that it believes are not comparable between periods and (ii)

assists investors in evaluating the effectiveness of the Company’s

operations and underlying business trends in a manner that is

consistent with management’s evaluation of business performance.

The Company believes that investors often look at ongoing

operations of an enterprise as a measure of assessing performance.

The Company uses its results excluding these amounts to evaluate

its operating performance and to discuss its business with

investment institutions, the Company’s Board of Directors and

others. The Company’s results excluding non-recurring and

non-operational amounts are also the basis for certain incentive

compensation calculations. Non-GAAP financial measures should be

viewed in addition to, and not in lieu of or as superior to, the

Company’s operating performance calculated in accordance with GAAP.

The non-GAAP financial measures presented may not be comparable to

similarly described measures reported by other companies.

Please see tables 1 through 5 and the sections entitled

“Reconciliations of Constant Currency Revenue” and “Full Year and

Quarterly Reconciliations of GAAP to Non-GAAP Amounts” later in

this release for reconciliations of GAAP to non-GAAP amounts.

Conference Call Information:

The Company will host a conference call to discuss its third

quarter earnings release on Thursday, December 5 at 9:00 a.m.

EST. Please log on to the Company’s website at

www.PVH.com and go to the Events page in the Investors

section to listen to the live webcast of the conference call. The

webcast will be available for replay for one year after it is held.

Please log on to www.PVH.com as described above to listen to the

replay. The conference call and webcast consist of copyrighted

material. They may not be re-recorded, reproduced, re-transmitted,

rebroadcast or otherwise used without the Company’s express written

permission. Your participation represents your consent to these

terms and conditions, which are governed by New York law.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION

REFORM ACT OF 1995: Forward-looking statements in this press

release and made during the conference call/webcast, including,

without limitation, statements relating to the Company’s future

revenue, earnings, plans, strategies, objectives, expectations and

intentions are made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. Investors are

cautioned that such forward-looking statements are inherently

subject to risks and uncertainties, many of which cannot be

predicted with accuracy, and some of which might not be

anticipated, including, without limitation, (i) the Company’s

plans, strategies, objectives, expectations and intentions are

subject to change at any time at the discretion of the Company;

(ii) the Company’s ability to realize anticipated benefits and

savings from divestitures, restructurings and similar plans, such

as the headcount cost reduction initiative announced in August

2022, the 2021 sale of assets of, and exit from, its Heritage

Brands menswear and retail businesses, the November 2023 sale of

the Heritage Brands women’s intimate apparel business to focus on

its Calvin Klein and Tommy Hilfiger businesses and its current

multi-year initiative to simplify its operating model; (iii) the

ability to realize the intended benefits from the acquisition of

licensees or the reversion of licensed rights (such as the

announced, in-process plan to bring in-house most of the product

categories that are or had been licensed to G-III Apparel Group,

Ltd. upon the expirations over time of the underlying license

agreements) and avoid any disruptions in the businesses during the

transition from operation by the licensee to the direct operation

by us; (iv) the Company has significant levels of outstanding debt

and borrowing capacity and uses a significant portion of its cash

flows to service its indebtedness, as a result of which the Company

might not have sufficient funds to operate its businesses in the

manner it intends or has operated in the past; (v) the levels of

sales of the Company’s apparel, footwear and related products, both

to its wholesale customers and in its retail stores and its

directly operated digital commerce sites, the levels of sales of

the Company’s licensees at wholesale and retail, and the extent of

discounts and promotional pricing in which the Company and its

licensees and other business partners are required to engage, all

of which can be affected by weather conditions, changes in the

economy (including inflationary pressures like those currently

being experienced globally), fuel prices, reductions in travel,

fashion trends, consolidations, repositionings and bankruptcies in

the retail industries, consumer sentiment and other factors; (vi)

the Company’s ability to manage its growth and inventory; (vii)

quota restrictions, the imposition of safeguard controls and the

imposition of new or increased duties or tariffs on goods from the

countries where the Company or its licensees produce goods under

its trademarks, any of which, among other things, could limit the

ability to produce products in cost-effective countries, or in

countries that have the labor and technical expertise needed, or

require the Company to absorb costs or try to pass costs onto

consumers, which could materially impact the Company’s revenue and

profitability; (viii) the availability and cost of raw materials;

(ix) the Company’s ability to adjust timely to changes in trade

regulations and the migration and development of manufacturers

(which can affect where the Company’s products can best be

produced); (x) the regulation or prohibition of the transaction of

business with specific individuals or entities and their affiliates

or goods manufactured in (or containing raw materials or components

from) certain regions, such as the listing of a person or entity as

a Specially Designated National or Blocked Person by the U.S.

Department of the Treasury’s Office of Foreign Assets Control and

the issuance of Withhold Release Orders by the U.S. Customs and

Border Protection; (xi) changes in available factory and shipping

capacity, wage and shipping cost escalation, and store closures in

any of the countries where the Company’s or its licensees’ or

wholesale customers’ or other business partners’ stores are located

or products are sold or produced or are planned to be sold or

produced, as a result of civil conflict, war or terrorist acts, the

threat of any of the foregoing, or political or labor instability,

such as the current war in Ukraine that led to the Company’s exit

from its retail business in Russia and the cessation of its

wholesale operations in Russia and Belarus, and the temporary

cessation of business by many of its business partners in Ukraine;

(xii) disease epidemics and health-related concerns, such as the

recent COVID-19 pandemic, which could result in (and, in the case

of the COVID-19 pandemic, did result in some of the following)

supply-chain disruptions due to closed factories, reduced

workforces and production capacity, shipping delays, container and

trucker shortages, port congestion and other logistics problems,

closed stores, and reduced consumer traffic and purchasing, or

governments implement mandatory business closures, travel

restrictions or the like, and market or other changes that could

result in shortages of inventory available to be delivered to the

Company’s stores and customers, order cancellations and lost sales,

as well as in noncash impairments of the Company’s goodwill and

other intangible assets, operating lease right-of-use assets, and

property, plant and equipment; (xiii) actions taken towards

sustainability and social and environmental responsibility as part

of the Company’s sustainability and social and environmental

strategy may not be achieved or may be perceived to be falsely

claimed, which could diminish consumer trust in the Company’s

brands, as well as the Company’s brands’ values; (xiv) the failure

of the Company’s licensees to market successfully licensed products

or to preserve the value of the Company’s brands, or their misuse

of the Company’s brands; (xv) significant fluctuations of the U.S.

dollar against foreign currencies in which the Company transacts

significant levels of business; (xvi) the Company’s retirement plan

expenses recorded throughout the year are calculated using

actuarial valuations that incorporate assumptions and estimates

about financial market, economic and demographic conditions, and

differences between estimated and actual results give rise to gains

and losses, which can be significant, that are recorded immediately

in earnings, generally in the fourth quarter of the year; (xvii)

the impact of new and revised tax legislation and regulations;

(xviii) the duration and outcome of the investigation of the

Company’s business by China’s Ministry of Commerce (“MOFCOM”) under

the Provisions on the List of Unreliable Entities (“UEL

Provisions”), which could result in fines or restrictions on the

Company’s ability to do business in Mainland China; and (xix) other

risks and uncertainties indicated from time to time in the

Company’s filings with the Securities and Exchange Commission

(“SEC”).

This press release includes, and the conference call/webcast

will include, certain non-GAAP financial measures, as defined under

SEC rules. Reconciliations of these measures are included in the

financial information following this Safe Harbor Statement, as well

as in the Company’s Current Report on Form 8-K furnished to the SEC

in connection with this earnings release, which is available on the

Company’s website at www.PVH.com and on the SEC’s website at

www.sec.gov.

The Company does not undertake any obligation to update publicly

any forward-looking statement, including, without limitation, any

estimate regarding revenue or earnings, whether as a result of the

receipt of new information, future events or otherwise.

PVH CORP. Consolidated GAAP Statements of

Operations (In millions, except per share data)

Quarter Ended

Nine Months Ended

11/3/24

10/29/23

11/3/24

10/29/23

Net sales

$

2,131.0

$

2,225.8

$

5,946.3

$

6,382.1

Royalty revenue

97.9

108.0

266.8

272.8

Advertising and other revenue

26.2

29.1

68.2

72.9

Total revenue

$

2,255.1

$

2,362.9

$

6,281.3

$

6,727.8

Gross profit

$

1,316.6

$

1,339.4

$

3,761.2

$

3,862.0

Selling, general and administrative

expenses

1,154.0

1,123.8

3,254.6

3,326.3

Non-service related pension and

postretirement income

0.4

0.5

1.3

1.4

Other gain

9.5

—

19.5

—

Equity in net income of unconsolidated

affiliates

10.6

13.7

34.7

34.8

Earnings before interest and taxes

183.1

229.8

562.1

571.9

Interest expense, net

16.1

22.2

52.9

67.8

Pre-tax income

167.0

207.6

509.2

504.1

Income tax expense

35.1

46.0

67.9

112.3

Net income

$

131.9

$

161.6

$

441.3

$

391.8

Diluted net income per common share

(1)

$

2.34

$

2.66

$

7.74

$

6.29

Quarter Ended

Nine Months Ended

11/3/24

10/29/23

11/3/24

10/29/23

Depreciation and amortization expense

$

69.7

$

75.2

$

211.6

$

223.0

Please see following pages for information related to non-GAAP

measures discussed in this release.

(1)

Please see Note A in Notes to

Consolidated GAAP Statements of Operations for the reconciliations

of GAAP diluted net income per common share to diluted net income

per common share on a non-GAAP basis.

PVH CORP. Non-GAAP Measures

The Company believes it is useful to investors to present its

results for the periods ended November 3, 2024 and October 29, 2023

on a non-GAAP basis by excluding (i) the net restructuring costs

incurred in the second and third quarters of 2024 related to the

Company's multi-year initiative to simplify its operating model by

centralizing processes and improving systems and automation to

drive more efficient, cost-effective ways of working across the

organization (the "Growth Driver 5 Actions"), consisting

principally of severance and a gain on the sale of a warehouse and

distribution center in the third quarter; (ii) the costs incurred

in the third quarter of 2024 in connection with an amendment to Mr.

Tommy Hilfiger’s employment agreement pursuant to which the Company

made a cash buyout of a portion of future payments to Mr. Hilfiger

(the “Mr. Hilfiger amendment”), (iii) the gain recorded in the

first quarter of 2024 in connection with the sale of the Company’s

Heritage Brands women's intimates business (the "Heritage Brands

intimates transaction"); (iv) the restructuring costs incurred in

the second and third quarters of 2023 related to actions taken

under the plans announced in August 2022 to reduce people costs in

the Company’s global offices by approximately 10% by the end of

2023 (the “2022 cost savings initiative”), consisting principally

of severance; and (v) the tax effects associated with the foregoing

pre-tax items. The Company excludes these amounts because it deems

them to be non-recurring or non-operational and believes that their

exclusion (i) facilitates comparing the results being reported

against past and future results by eliminating amounts that it

believes are not comparable between periods, thereby permitting

management to evaluate performance and investors to make decisions

based on the ongoing operations of the Company, and (ii) assists

investors in evaluating the effectiveness of the Company’s

operations and underlying business trends in a manner that is

consistent with management’s evaluation of business performance.

The Company believes that investors often look at ongoing

operations of an enterprise as a measure of assessing performance.

The Company uses its results excluding these amounts to evaluate

its operating performance and to discuss its business with

investment institutions, the Company’s Board of Directors and

others. The Company’s results excluding the items described above

are also the basis for certain incentive compensation calculations.

The non-GAAP measures should be viewed in addition to, and not in

lieu of or superior to, the Company’s operating performance

measures calculated in accordance with GAAP. The information

presented on a non-GAAP basis may not be comparable to similarly

titled measures reported by other companies.

The following table presents the non-GAAP measures that are

discussed in this release. Please see Tables 1 through 5 for the

reconciliations of the GAAP amounts to amounts on a non-GAAP

basis.

Quarter Ended

Nine Months Ended

11/3/24

10/29/23

11/3/24

10/29/23

Non-GAAP Measures

Selling, general and administrative

expenses (1)

$

1,092.9

$

1,105.0

$

3,178.2

$

3,268.5

Other gain (2)

—

—

Earnings before interest and taxes (3)

236.5

248.6

620.8

629.7

Income tax expense (4)

49.9

50.0

84.3

125.1

Net income (5)

170.5

176.4

483.6

436.8

Diluted net income per common share

(6)

$

3.03

$

2.90

$

8.48

$

7.01

(1)

Please see Table 3 for the

reconciliations of GAAP selling, general and administrative

(“SG&A”) expenses to SG&A expenses on a non-GAAP basis.

(2)

Please see Table 4 for the

reconciliations of GAAP other gain to other gain on a non-GAAP

basis.

(3)

Please see Table 2 for the

reconciliations of GAAP earnings before interest and taxes to

earnings before interest and taxes on a non-GAAP basis.

(4)

Please see Table 5 for the

reconciliations of GAAP income tax expense to income tax expense on

a non-GAAP basis and an explanation of the calculation of the tax

effects associated with the pre-tax items identified as a non-GAAP

exclusions.

(5)

Please see Table 1 for the

reconciliations of GAAP net income to net income on a non-GAAP

basis.

(6)

Please see Note A in Notes to

Consolidated GAAP Statements of Operations for the reconciliations

of GAAP diluted net income per common share to diluted net income

per common share on a non-GAAP basis.

PVH CORP. Reconciliations of GAAP to Non-GAAP

Amounts (In millions, except per share data)

Table 1 -

Reconciliations of GAAP net income to net income on a non-GAAP

basis

Quarter Ended

Nine Months Ended

11/3/24

10/29/23

11/3/24

10/29/23

Net income

$

131.9

$

161.6

$

441.3

$

391.8

Diluted net income per common share

(1)

$

2.34

$

2.66

$

7.74

$

6.29

Pre-tax items excluded:

SG&A expenses associated with the 2022

cost savings initiative

18.8

57.8

SG&A expenses associated with the

Growth Driver 5 Actions

12.2

27.5

SG&A expenses associated with the Mr.

Hilfiger amendment

50.7

50.7

Gain in connection with the Growth Driver

5 Actions (recorded in other gain)

(9.5

)

(9.5

)

Gain in connection with the Heritage

Brands intimates transaction (recorded in other gain)

(10.0

)

Tax effect of the pre-tax items above

(2)

(14.8

)

(4.0

)

(16.4

)

(12.8

)

Net income on a non-GAAP basis

$

170.5

$

176.4

$

483.6

$

436.8

Diluted net income per common share on a

non-GAAP basis (1)

$

3.03

$

2.90

$

8.48

$

7.01

(1)

Please see Note A in Notes to the

Consolidated GAAP Statements of Operations for the reconciliations

of GAAP diluted net income per common share to diluted net income

per common share on a non-GAAP basis.

(2)

Please see Table 5 for an

explanation of the calculation of the tax effects of the above

items.

Table 2 - Reconciliations of GAAP earnings

before interest and taxes to earnings before interest and taxes on

a non-GAAP basis

Quarter Ended

Nine Months Ended

11/3/24

10/29/23

11/3/24

10/29/23

Earnings before interest and taxes

$

183.1

$

229.8

$

562.1

$

571.9

Items excluded:

SG&A expenses associated with the 2022

cost savings initiative

18.8

57.8

SG&A expenses associated with the

Growth Driver 5 Actions

12.2

27.5

SG&A expenses associated with the Mr.

Hilfiger amendment

50.7

50.7

Gain in connection with the Growth Driver

5 Actions (recorded in other gain)

(9.5

)

(9.5

)

Gain in connection with the Heritage

Brands intimates transaction (recorded in other gain)

(10.0

)

Earnings before interest and taxes on a

non-GAAP basis

$

236.5

$

248.6

$

620.8

$

629.7

PVH CORP. Reconciliations of GAAP to Non-GAAP Amounts

(continued) (In millions, except per share data)

Table 3 -

Reconciliations of GAAP SG&A expenses to SG&A expenses on a

non-GAAP basis

Quarter Ended

Nine Months Ended

11/3/24

10/29/23

11/3/24

10/29/23

SG&A expenses

$

1,154.0

$

1,123.8

$

3,254.6

$

3,326.3

Items excluded:

Expenses associated with the 2022 cost

savings initiative

(18.8

)

(57.8

)

Expenses associated with the Growth Driver

5 Actions

(12.2

)

(27.5

)

Expenses associated with the Mr. Hilfiger

amendment

(50.7

)

(50.7

)

SG&A expenses on a non-GAAP basis

$

1,091.1

$

1,105.0

$

3,176.4

$

3,268.5

Table 4 -

Reconciliations of GAAP other gain to other gain on a non-GAAP

basis

Quarter Ended

Nine Months Ended

11/3/24

11/3/24

Other gain

$

9.5

$

19.5

Items excluded:

Gain in connection with the Growth Driver

5 Actions

(9.5

)

(9.5

)

Gain in connection with the Heritage

Brands intimates transaction

(10.0

)

Other gain on a non-GAAP basis

$

—

$

—

Table 5 -

Reconciliations of GAAP income tax expense to income tax expense on

a non-GAAP basis

Quarter Ended

Nine Months Ended

11/3/24

10/29/23

11/3/24

10/29/23

Income tax expense

$

35.1

$

46.0

$

67.9

$

112.3

Item excluded:

Tax effect of pre-tax items identified as

non-GAAP exclusions (1)

14.8

4.0

16.4

12.8

Income tax expense on a non-GAAP basis

$

49.9

$

50.0

$

84.3

$

125.1

(1)

The estimated tax effects

associated with the Company’s exclusions on a non-GAAP basis are

based on the Company’s assessment of deductibility. In making this

assessment, the Company evaluates each pre-tax item that it has

identified as a non-GAAP exclusion to determine if such item is (i)

taxable or tax deductible, in which case the tax effect is taken at

the applicable income tax rate in the local jurisdiction, or (ii)

non-taxable or non-deductible, in which case the Company assumes no

tax effect.

PVH CORP. Notes to Consolidated GAAP Statements of

Operations (In millions, except per share data)

A. The Company computed its diluted net income per common share

as follows:

Quarter Ended

Quarter Ended

11/3/24

10/29/23

GAAP

Non-GAAP

GAAP

Non-GAAP

Results

Adjustments (1)

Results

Results

Adjustments (2)

Results

Net income

$

131.9

$

(38.6

)

$

170.5

$

161.6

$

(14.8

)

$

176.4

Weighted average common shares

55.8

55.8

60.3

60.3

Weighted average dilutive securities

0.5

0.5

0.5

0.5

Total shares

56.3

56.3

60.8

60.8

Diluted net income per common share

$

2.34

$

3.03

$

2.66

$

2.90

Nine Months Ended

Nine Months Ended

11/3/24

10/29/23

GAAP

Non-GAAP

GAAP

Non-GAAP

Results

Adjustments (1)

Results

Results

Adjustments (2)

Results

Net income

$

441.3

$

(42.3

)

$

483.6

$

391.8

$

(45.0

)

$

436.8

Weighted average common shares

56.4

56.4

61.7

61.7

Weighted average dilutive securities

0.7

0.7

0.6

0.6

Total shares

57.1

57.1

62.3

62.3

Diluted net income per common share

$

7.74

$

8.48

$

6.29

$

7.01

(1)

Represents the impact on net

income in the applicable periods ended November 3, 2024 from the

elimination of (i) the net restructuring costs related to the

Growth Driver 5 Actions; (ii) the costs incurred in connection with

the Mr. Hilfiger amendment; (iii) the gain recorded in connection

with the Heritage Brands intimates transaction; and (iv) the tax

effects associated with the foregoing pre-tax items. Please see

Table 1 for the reconciliations of GAAP net income to net income on

a non-GAAP basis.

(2)

Represents the impact on net

income in the periods ended October 29, 2023 from the elimination

of (i) the restructuring costs related to the 2022 cost savings

initiative; and (ii) the tax effects associated with the foregoing

pre-tax item. Please see Table 1 for the reconciliations of GAAP

net income to net income on a non-GAAP basis.

PVH CORP. Consolidated Balance Sheets (In

millions)

11/3/24

10/29/23

ASSETS

Current Assets:

Cash and Cash Equivalents

$

559.6

$

357.6

Receivables

999.0

1,062.6

Inventories

1,608.2

1,476.9

Other Assets

311.4

310.5

Assets Held For Sale (1)

—

139.5

Total Current Assets

3,478.2

3,347.1

Property, Plant and Equipment

787.0

848.0

Operating Lease Right-of-Use Assets

1,199.5

1,234.6

Goodwill and Other Intangible Assets

5,406.3

5,362.6

Other Assets

370.3

374.8

TOTAL ASSETS

$

11,241.3

$

11,167.1

LIABILITIES AND STOCKHOLDERS’ EQUITY

Accounts Payable and Accrued Expenses

$

1,890.2

$

1,842.8

Current Portion of Operating Lease

Liabilities

293.4

319.5

Short-Term Borrowings

—

18.0

Current Portion of Long-Term Debt

511.1

665.2

Other Liabilities

552.6

610.4

Long-Term Portion of Operating Lease

Liabilities

1,051.6

1,085.6

Long-Term Debt

1,654.2

1,571.3

Stockholders’ Equity

5,288.2

5,054.3

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

$

11,241.3

$

11,167.1

Note: Year over year balances are impacted

by changes in foreign currency exchange rates.

(1)

Assets held for sale include the

assets of the Company's Heritage Brands intimate apparel business,

primarily $43 million of inventory and $96 million of intangible

assets. The Company completed the sale of the business on November

27, 2023.

PVH CORP.

Segment Data

(In millions)

REVENUE BY

SEGMENT

Quarter Ended

Quarter Ended

11/3/24

10/29/23

Tommy Hilfiger North

America

Net sales

$

318.1

$

326.9

Royalty revenue

25.5

25.6

Advertising and other revenue

6.2

6.7

Total

349.8

359.2

Tommy Hilfiger

International

Net sales

830.5

831.1

Royalty revenue

16.0

15.6

Advertising and other revenue

4.6

4.0

Total

851.1

850.7

Total Tommy

Hilfiger

Net sales

1,148.6

1,158.0

Royalty revenue

41.5

41.2

Advertising and other revenue

10.8

10.7

Total

1,200.9

1,209.9

Calvin Klein North

America

Net sales

287.7

310.0

Royalty revenue

41.6

51.0

Advertising and other revenue

12.5

14.5

Total

341.8

375.5

Calvin Klein

International

Net sales

634.5

627.4

Royalty revenue

14.7

15.5

Advertising and other revenue

2.9

3.8

Total

652.1

646.7

Total Calvin

Klein

Net sales

922.2

937.4

Royalty revenue

56.3

66.5

Advertising and other revenue

15.4

18.3

Total

993.9

1,022.2

Heritage Brands

Wholesale

Net sales

60.2

130.4

Royalty revenue

0.1

0.3

Advertising and other revenue

—

0.1

Total

60.3

130.8

Total

Revenue

Net sales

2,131.0

2,225.8

Royalty revenue

97.9

108.0

Advertising and other revenue

26.2

29.1

Total

$

2,255.1

$

2,362.9

PVH CORP.

Segment Data (continued)

(In millions)

EARNINGS BEFORE

INTEREST AND TAXES BY SEGMENT

Quarter Ended

Quarter Ended

11/3/24

10/29/23

Results

Results

Under

Non-GAAP

Under

Non-GAAP

GAAP

Adjustments (1)

Results

GAAP

Adjustments (2)

Results

Tommy Hilfiger North America

$

32.6

$

(17.1

)

$

49.7

$

39.5

$

(5.4

)

$

44.9

Tommy Hilfiger International

58.0

(39.1

)

97.1

90.8

(3.6

)

94.4

Total Tommy Hilfiger

90.6

(56.2

)

146.8

130.3

(9.0

)

139.3

Calvin Klein North America

40.1

—

40.1

48.8

(2.6

)

51.4

Calvin Klein International

84.5

(1.9

)

86.4

94.9

(1.7

)

96.6

Total Calvin Klein

124.6

(1.9

)

126.5

143.7

(4.3

)

148.0

Heritage Brands Wholesale

10.3

—

10.3

3.9

(3.2

)

7.1

Corporate

(42.4

)

4.7

(47.1

)

(48.1

)

(2.3

)

(45.8

)

Total earnings before interest and

taxes

$

183.1

$

(53.4

)

$

236.5

$

229.8

$

(18.8

)

$

248.6

(1)

The adjustments for the quarter

ended November 3, 2024 represent the elimination of (i) the net

restructuring costs related to the Growth Driver 5 Actions; and

(ii) the costs incurred in connection with the Mr. Hilfiger

amendment.

(2)

The adjustments for the quarter

ended October 29, 2023 represent the elimination of the

restructuring costs related to the 2022 cost savings

initiative.

PVH CORP.

Segment Data (continued)

(In millions)

REVENUE BY

SEGMENT

Nine Months Ended

Nine Months Ended

11/3/24

10/29/23

Tommy Hilfiger North

America

Net sales

$

885.7

$

891.2

Royalty revenue

69.0

64.4

Advertising and other revenue

15.2

15.5

Total

969.9

971.1

Tommy Hilfiger

International

Net sales

2,281.3

2,444.1

Royalty revenue

43.8

45.2

Advertising and other revenue

12.6

13.0

Total

2,337.7

2,502.3

Total Tommy

Hilfiger

Net sales

3,167.0

3,335.3

Royalty revenue

112.8

109.6

Advertising and other revenue

27.8

28.5

Total

3,307.6

3,473.4

Calvin Klein North

America

Net sales

797.1

807.6

Royalty revenue

116.3

121.1

Advertising and other revenue

32.1

35.9

Total

945.5

964.6

Calvin Klein

International

Net sales

1,819.8

1,836.0

Royalty revenue

37.5

41.3

Advertising and other revenue

8.2

8.2

Total

1,865.5

1,885.5

Total Calvin

Klein

Net sales

2,616.9

2,643.6

Royalty revenue

153.8

162.4

Advertising and other revenue

40.3

44.1

Total

2,811.0

2,850.1

Heritage Brands

Wholesale

Net sales

162.4

403.2

Royalty revenue

0.2

0.8

Advertising and other revenue

0.1

0.3

Total

162.7

404.3

Total

Revenue

Net sales

5,946.3

6,382.1

Royalty revenue

266.8

272.8

Advertising and other revenue

68.2

72.9

Total

$

6,281.3

$

6,727.8

PVH CORP.

Segment Data (continued)

(In millions)

EARNINGS BEFORE

INTEREST AND TAXES BY SEGMENT

Nine Months Ended

Nine Months Ended

11/3/24

10/29/23

Results

Results

Under

Non-GAAP

Under

Non-GAAP

GAAP

Adjustments (1)

Results

GAAP

Adjustments (2)

Results

Tommy Hilfiger North America

$

91.3

$

(18.5

)

$

109.8

$

55.0

$

(11.8

)

$

66.8

Tommy Hilfiger International

202.1

(46.4

)

248.5

290.5

(15.9

)

306.4

Total Tommy Hilfiger

293.4

(64.9

)

358.3

345.5

(27.7

)

373.2

Calvin Klein North America

114.5

(1.4

)

115.9

71.4

(8.5

)

79.9

Calvin Klein International

255.7

(7.1

)

262.8

275.5

(10.2

)

285.7

Total Calvin Klein

370.2

(8.5

)

378.7

346.9

(18.7

)

365.6

Heritage Brands Wholesale

33.2

10.0

23.2

21.5

(7.8

)

29.3

Corporate

(134.7

)

4.7

(139.4

)

(142.0

)

(3.6

)

(138.4

)

Total earnings before interest and

taxes

$

562.1

$

(58.7

)

$

620.8

$

571.9

$

(57.8

)

$

629.7

(1)

The adjustments for the nine

months ended November 3, 2024 represent the elimination of (i) the

net restructuring costs related to the Growth Driver 5 Actions;

(ii) the costs incurred related to the Mr. Hilfiger amendment; and

(iii) the gain recorded in connection with the Heritage Brands

intimates transaction.

(2)

The adjustments for the nine

months ended October 29, 2023 represent the elimination of the

restructuring costs related to the 2022 cost savings

initiative.

PVH CORP. Reconciliations of Constant Currency

Revenue (In millions)

As a supplement to the Company’s reported operating results, the

Company presents constant currency revenue information, which is a

non-GAAP financial measure. The Company presents results in this

manner because it is a global company that transacts business in

multiple currencies and reports financial information in U.S.

dollars. Foreign currency exchange rate fluctuations affect the

amounts reported by the Company in U.S. dollars with respect to its

foreign revenues. Exchange rate fluctuations can have a significant

impact on reported revenues. The Company believes presenting

constant currency revenue information provides useful information

to investors, as it provides information to assess how its

businesses performed excluding the effects of changes in foreign

currency exchange rates and assists investors in evaluating the

effectiveness of the Company’s operations and underlying business

trends in a manner that is consistent with management’s evaluation

of business performance.

The Company calculates constant currency revenue information by

translating its foreign revenues for the relevant period into U.S.

dollars at the average exchange rates in effect during the

comparable prior year period (rather than at the actual exchange

rates in effect during the relevant period).

Constant currency performance should be viewed in addition to,

and not in lieu of or as superior to, the Company’s operating

performance calculated in accordance with GAAP. The constant

currency revenue information presented may not be comparable to

similarly described measures reported by other companies.

GAAP Revenue

% Change

Quarter Ended

GAAP

Positive Impact of Foreign

Exchange

Constant Currency

11/3/24

10/29/23

Tommy Hilfiger International

$

851.1

$

850.7

—

%

2.4

%

(2.4

)%

Total Tommy Hilfiger

1,200.9

1,209.9

(0.7

)%

1.7

%

(2.4

)%

Calvin Klein International

652.1

646.7

0.8

%

1.7

%

(0.9

)%

Total Calvin Klein

993.9

1,022.2

(2.8

)%

1.1

%

(3.9

)%

Total International Revenue

1,503.2

1,497.4

0.4

%

2.2

%

(1.8

)%

Total Revenue

$

2,255.1

$

2,362.9

(4.6

)%

1.3

%

(5.9

)%

Owned and Operated Retail Stores

$

760.0

$

754.7

0.7

%

1.4

%

(0.7

)%

Owned and Operated Digital Commerce

167.9

169.5

(0.9

)%

1.7

%

(2.6

)%

Total Direct-to-Consumer

$

927.9

$

924.2

0.4

%

1.4

%

(1.0

)%

Wholesale

$

1,203.1

$

1,301.6

(7.6

)%

1.5

%

(9.1

)%

PVH CORP. Full Year and Quarterly Reconciliations of

GAAP to Non-GAAP Amounts

The Company is presenting its 2024 estimated results on a

non-GAAP basis by excluding (i) the net restructuring costs

incurred and expected to be incurred related to the Growth Driver 5

Actions, (ii) the costs incurred in connection with the Mr.

Hilfiger amendment, (iii) the gain recorded in the first quarter of

2024 in connection with the Company’s sale of the Heritage Brands

women’s intimates business and (iv) the estimated tax effects

associated with the foregoing pre-tax items. The Company has

provided the reconciliations set forth below to present its

estimates on a GAAP basis and excluding the foregoing amounts.

The 2024 estimated results are presented on both a GAAP and

non-GAAP basis. The Company believes presenting these results on a

non-GAAP basis provides useful additional information to investors.

The Company excludes such amounts that it deems to be non-recurring

or non-operational and believes that excluding them (i) facilitates

comparing the results being reported against past and future

results by eliminating amounts that it believes are not comparable

between periods, thereby permitting management to evaluate

performance and investors to make decisions based on the ongoing

operations of the Company, and (ii) assists investors in evaluating

the effectiveness of the Company’s operations and underlying

business trends in a manner that is consistent with management’s

evaluation of business performance. The Company uses its results

excluding these amounts to evaluate its operating performance and

to discuss its business with investment institutions, the Company’s

Board of Directors and others. The Company’s results excluding the

items described above are also the basis for certain incentive

compensation calculations. The non-GAAP measures should be viewed

in addition to, and not in lieu of or superior to, the Company’s

operating performance measures calculated in accordance with GAAP.

The information presented on a non-GAAP basis may not be comparable

to similarly titled measures reported by other companies.

The estimated tax effects associated with the above pre-tax

items are based on the Company’s assessment of deductibility. In

making this assessment, the Company evaluated each pre-tax item

identified above as a non-GAAP exclusion to determine if such item

is taxable or tax deductible, and, if so, in what jurisdiction the

tax expense or tax deduction would occur. All of the pre-tax items

identified as non-GAAP exclusions were identified as either

primarily taxable or tax deductible, with the tax effect taken at

the applicable income tax rate in the local jurisdiction, or as

non-taxable or non-deductible, in which case the Company assumed no

tax effect.

2024 Net Income

Per Common Share Reconciliations

Current Guidance

Previous Guidance

Full Year 2024 (Estimated)

Fourth Quarter 2024

(Estimated)

Full Year 2024 (Estimated)

Third Quarter 2024

(Estimated)

GAAP net income per common share

$10.55 to $10.70

$2.83 to $2.98

$11.20 to $11.45

Approximately $2.30

Estimated per common share impact of items

identified as non-GAAP exclusions

$(1.00)

$(0.22)

$(0.35)

$(0.20)

Net income per common share on a non-GAAP

basis

$11.55 to $11.70

$3.05 to $3.20

$11.55 to $11.80

Approximately $2.50

2024 Tax Rate

Reconciliation

Full Year 2024 (Estimated)

GAAP tax rate

Approximately 15%

Estimated tax rate impacts from items

identified as non-GAAP exclusions

(1)%

Tax rate on a non-GAAP basis

Approximately 16%

The GAAP net income per common share amounts presented in the

above table, as well as the amounts excluded in providing non-GAAP

earnings guidance, would be expected to change as a result of (i)

acquisition, divestment or similar transactions or activities, (ii)

the timing and strategy of restructuring and integration

initiatives or other one-time events that the Company engages in or

suffers during the period, (iii) any market or other changes

affecting the Company’s expected actuarial gain or loss on

retirement plans, including the recent volatility in the financial

markets and (iv) any discrete tax events including changes in tax

rates or tax law and events arising from audits or the resolution

of uncertain tax positions.

PVH CORP. Full Year and Quarterly Reconciliations of

GAAP to Non-GAAP Amounts (continued)

2024 Operating

Margin Reconciliation

Current Guidance

Previous Guidance

Full Year 2024 (Estimated)

Full Year 2024 (Estimated)

GAAP operating margin

Approximately 9.2%

Approximately 9.8%

Estimated impact of items identified as

non-GAAP exclusions

(0.9)%

(0.3)%

Operating margin on a Non-GAAP basis

Approximately 10.1%

Approximately 10.1%

Reconciliations

of 2024 Constant Currency Revenue Guidance

Full Year 2024 (Estimated)

Fourth Quarter 2024

(Estimated)

GAAP revenue decrease

(6)% to (7)%

(6)% to (7)%

Negative impact of foreign exchange

—%

(2)%

Non-GAAP revenue decrease on a constant

currency basis

(6)% to (7)%

(4)% to (5)%

Please refer to the section entitled "Reconciliations of

Constant Currency Revenue” on page 17 this release for a

description of the presentation of constant currency amounts.

Reconciliations

of GAAP Diluted Net Income Per Common Share to Diluted Net Income

Per Common Share on a Non-GAAP Basis

Full Year 2023

Fourth Quarter 2023

(Actual)

(Actual)

(In millions, except

per share data)

Results Under GAAP

Adjustments (1)

Non- GAAP Results

Results Under GAAP

Adjustments (2)

Non- GAAP Results

Net income

$

663.6

$

4.7

$

658.9

$

271.8

$

49.7

$

222.1

Total weighted average shares

61.7

61.7

59.7

59.7

Diluted net income per common share

$

10.76

$

10.68

$

4.55

$

3.72

(1)

Represents the impact on net

income in the year ended February 4, 2024 from the elimination of

(i) a $46 million recognized actuarial gain on retirement plans in

the fourth quarter of 2023; (ii) a $15 million gain recorded in

connection with the Heritage Brands intimates transaction in the

fourth quarter of 2023; (iii) $2 million of costs related to the

Heritage Brands intimates transaction incurred in the fourth

quarter of 2023; (iv) $61 million of restructuring costs related to

the 2022 cost savings initiative incurred in the second, third and

fourth quarters of 2023; and (v) a $7 million tax benefit

associated with the foregoing pre-tax items.

(2)

Represents the impact on net

income in the quarter ended February 4, 2024 from the elimination

of (i) a $46 million recognized actuarial gain on retirement plans;

(ii) the $15 million gain recorded in connection with the Heritage

Brands intimates transaction; (iii) $2 million of costs related to

the Heritage Brands intimates transaction; (iv) $4 million of

restructuring costs related to the 2022 cost savings initiative;

and (v) a $6 million tax expense associated with the foregoing

pre-tax items.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241204463690/en/

Investor Contact: Sheryl Freeman

investorrelations@pvh.com Media Contact:

communications@pvh.com

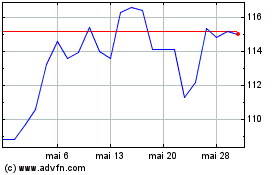

PVH (NYSE:PVH)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

PVH (NYSE:PVH)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024