-- Companies to host a joint investor call

on December 11, 2024 at 4:30 p.m. ET --

Arcadia Biosciences, Inc.® (Nasdaq: RKDA) and Roosevelt

Resources LP announced today that they have entered into a

definitive securities exchange agreement which, when completed,

will combine the two companies in an all-stock transaction. Under

the terms of the agreement, Arcadia will issue to the partners of

Roosevelt shares of Arcadia common stock at the closing of the

transaction in exchange for all of the equity interests in

Roosevelt. Following the closing of the transaction, the current

equity owners of Roosevelt and the Arcadia shareholders as of the

closing are expected to own approximately 90% and 10%,

respectively, of the outstanding shares of Arcadia, subject to

certain possible adjustments as provided in the definitive

agreement.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241205151921/en/

Roosevelt Resources LP is a Dallas-based

oil and gas company. (Graphic: Business Wire)

“Since July 2023, Arcadia has been undergoing a strategic review

with external advisors to evaluate the best alternatives for

maximizing shareholder value,” said T.J. Schaefer, president and

CEO of Arcadia. “During that time, we have streamlined our

operations to focus on Zola® coconut water, reduced operating

expenses and generated non-dilutive capital through the sale of our

GoodWheatTM brand and our wheat IP. After a comprehensive and

prolonged review, we have concluded that a business combination

with Roosevelt Resources is the best alternative to create value

for Arcadia and its shareholders.”

Roosevelt is a privately held, Dallas, Texas based exploration

and production company led by industry veteran Elliott “Tony”

Roosevelt, Jr. and his team of experienced oil and gas

professionals with an extensive background in development of major

oil and natural gas projects. Roosevelt’s primary asset is a carbon

capture utilization and storage (CCUS) oil and natural gas project

spanning 16,208 (13,892 net) contiguous acres on the Northwest

Shelf of the Texas Permian Basin that Roosevelt plans to develop

over the next 40+ years as an enhanced oil recovery (EOR) project

reaching an anticipated peak production capacity in 2051 of 55,000

gross barrels of oil equivalent per day (boepd).1

Roosevelt’s Assets and Operations

- Roosevelt’s CCUS project is located within the RR-Googins

field, which is part of the Texas Railroad Commission designated

Platang (San Andres) Field in Yoakum County, Texas and covers 25

square-miles. The planned development of the project is expected to

result in one of the largest CCUS projects in the United

States.

- Roosevelt has commissioned third party studies with respect to

the oil in place in the project which serve as the framework for

the full field development. The most recent model prepared by

Schlumberger estimates 956 million gross technically recoverable

barrels of oil equivalent (boe) over an estimated 70-year life of

the project.2

- Over $82 million has been invested by Roosevelt in the project

to date with a goal of reducing risks relating to the development

plan. Appraisal wells confirming hydrocarbon saturation in the San

Andres reservoir within the RR-Googins field have been on-line

since 2015, and have produced approximately 1.2 million gross boe

since then, with current production of approximately 450 gross

boepd. The internally prepared reserve report of Roosevelt as of

September 30, 2024 using the SEC pricing methodology estimates

proved undeveloped reserves of approximately 780 million gross boe

and proved developed producing reserves of approximately 3.8

million gross boe.

- Roosevelt intends to deploy the use of horizontal drilling to

construct carbon dioxide (CO2) injection wells together with

producing hydrocarbon wells, with the goal of leveraging improved

capital efficiency compared to conventional straight hole drilling

for subsurface CO2 flooding.

- Roosevelt estimates that development costs to complete the

initial CO2 distribution system, drill CO2 injection wells and

complete initial CO2 injection(s) through 2025 will be in the range

of $125 million. Roosevelt’s development anticipates that field

total production will increase an average of approximately 4,000

gross boepd each year for the first ten years after CO2 response,

reaching an anticipated rate exceeding 40,000 gross boepd and

remaining greater than 40,000 gross boepd for over 30 years. It is

anticipated that a peak production rate of approximately 55,000

gross boepd will be achieved for ten years beginning in 2051.

- Roosevelt is currently in discussions with various groups to

source anthropogenic CO2 long-term supply agreements that Roosevelt

believes should result in carbon advantaged oil production as the

project develops.

- The RR-Googins field is transversed by a major CO2 pipeline and

is strategically located approximately 20 miles from existing

infrastructure in the Permian Basin including Denver City, the

world’s largest CO2 hub distributing CO2 from the Cortez, Sheep

Mountain and Bravo CO2 pipelines.

- Roosevelt intends to apply a Miscible Ascending Dispersion

(MAD) method to the field utilizing both natural and anthropogenic

CO2 in seeking to recognize a higher recovery factor compared to

traditional CO2 floods elsewhere in the Permian Basin. The MAD

application currently has a processing patent application pending

that, if granted, would allow Roosevelt to apply the MAD method to

other fields and basins to achieve higher rates of oil

recovery.

About the Proposed Transaction, Management and

Organization

At the closing of the transaction and thereafter, the following

are expected to occur:

- Arcadia will effectuate a change of its corporate name to

Roosevelt Resources, Inc.

- Assuming Nasdaq approval of the company’s application for

continued listing of its shares on the Nasdaq Capital Market, the

company’s shares are expected to trade under a new trading

symbol.

- Current management of Roosevelt will manage the combined entity

with Tony Roosevelt serving as chief executive officer, Jimmy

Hawkins serving as president and chief operations officer, and

Jerrel Branson serving as chief financial officer.

- One or more members of Arcadia management and personnel may

continue to assist in managing the existing on-going operations of

Arcadia.

Elliott “Tony” Roosevelt, Jr., chairman and CEO of Roosevelt

stated, “This asset has been in the Roosevelt Family for over 100

years. Starting in 2007, we started the study and evaluation of the

RR-Googins field to position it for field wide development. Through

the application of technology, drilling and producing oil and

planning and sourcing necessary components for field development,

we believe we are positioned to now execute on this promising

project. This business combination with Arcadia will position us to

continue the next steps in this field development.”

Investor Call

Senior management from Arcadia and Roosevelt will hold an

investor call on December 11, 2024 at 4:30 p.m. ET to discuss key

details and benefits of this transaction. Interested participants

may join the conference call using the following options:

- An audio-only webcast of the conference call will be available,

with a link posted in the Investors section of Arcadia’s

website.

- To join the live call, please register here, and a dial-in

number and unique PIN will be provided.

The related slide presentation will be available in the

Investors section of Arcadia’s website at www.arcadiabio.com and on

Roosevelt’s website at www.rooseveltresources.com.

Timing and Approvals

The transaction is expected to close during the first quarter of

2025 or thereafter, and it is subject to customary closing

conditions and regulatory approvals, including the filing and

effectiveness of a registration statement to be filed by Arcadia

with the Securities and Exchange Commission, approval by the

Arcadia stockholders, at a special meeting of stockholders, of

proposals relating to the proposed transaction, approval by Nasdaq

of the shares to be issued in the transaction and continued listing

of the common stock on the Nasdaq Capital Market, and other closing

conditions.

Transaction Advisors

Lake Street Capital Markets acted as exclusive financial advisor

to Arcadia, and Weintraub Tobin is serving as legal advisor to

Arcadia.

Roth Capital Partners acted as exclusive financial advisor to

Roosevelt, and Jones & Keller is serving as legal advisor to

Roosevelt.

About Arcadia Biosciences, Inc.

Since 2002, Arcadia Biosciences (Nasdaq: RKDA) has been

innovating high-value, healthy ingredients to meet consumer demands

for healthier choices. With its roots in agricultural innovation,

Arcadia cultivates next-generation wellness products. For more

information, visit www.arcadiabio.com.

About Roosevelt Resources, LP

Since 2007, Roosevelt has assembled a proposed carbon capture

utilization and storage (CCUS) project spanning 16,208 gross

(13,892 net) contiguous acres in the Permian Basin planned to be

produced as a CO2 enhanced oil recovery (EOR) project. For more

information visit www.rooseveltresources.com.

Cautionary Statement Regarding Forward-Looking

Information

This press release contains forward-looking statements within

the meaning of the safe harbor provided by Section 27A of the

Securities Act of 1933, Section 21E of the Securities Exchange Act

of 1934 and the Private Securities Litigation Reform Act of 1995,

about Arcadia and Roosevelt. Forward-looking statements are all

statements other than statements of historical facts. The words

“anticipate,” “believe,” “ensure,” “expect,” “if,” “intend,”

“estimate,” “probable,” “project,” “forecasts,” “predict,”

“outlook,” “aim,” “will,” “could,” “should,” “would,” “potential,”

“may,” “might,” “anticipate,” “likely” “plan,” “positioned,”

“strategy,” and similar expressions or other words of similar

meaning, and the negatives thereof, are intended to identify

forward-looking statements. Forward-looking statements include any

statements regarding the expected timetable for completing the

proposed transaction, the results, effects, and benefits of the

proposed transaction, future opportunities for the combined

company, future financial performance and condition, guidance. Any

other statements regarding Arcadia’s or Roosevelt’s future

expectations, beliefs, plans, objectives, financial conditions,

assumptions or future events or performance that are not historical

facts are forward-looking statements based on assumptions currently

believed to be valid. Forward-looking statements involve a wide

variety of risks and uncertainties that could cause actual results

to differ materially, and reported results should not be considered

as an indication of future performance. These risks and

uncertainties relating to Arcadia include, but are not limited to,

the risks set forth in filings that Arcadia makes with the SEC from

time to time, including in Arcadia’s Annual Report on Form 10-K for

the year ended December 31, 2023 and other filings that Arcadia has

made with the SEC since that date. Specific forward-looking

statements also include statements regarding Roosevelt’s

technology, Roosevelt’s anticipated development and production

plans, and the ability of Roosevelt to grow production. The risks

and uncertainties relating to Roosevelt include, without

limitation, statements with respect to Roosevelt’s strategy and

prospects; statements about resource potential, expected future

expenditures, production, financial position, business strategy,

revenues, costs, capital expenditures and debt levels.

Forward-looking statements are based on current expectations and

assumptions and analyses made by Roosevelt and its management in

light of their experience and perception of historical trends,

current conditions and expected future developments, as well as

other factors appropriate under the circumstances. However, whether

actual results and developments will conform to expectations is

subject to a number of material risks and uncertainties, including

but not limited to: declines in oil, natural gas liquids or natural

gas prices; the level of success in development and production

activities; adverse weather conditions that may negatively impact

development or production activities; the timing of development

expenditures; inaccuracies of reserve estimates or assumptions

underlying them; revisions to reserve estimates as a result of

changes in commodity prices; risks related to level of indebtedness

and periodic redeterminations of the borrowing base and interest

rates under Roosevelt’s credit facility; Roosevelt’s ability to

generate sufficient cash flows from operations to meet the

internally funded portions of its capital expenditures budget; the

effects of future regulatory or legislative actions; cost and

availability of transportation and storage capacity as a result of

oversupply, government regulation or other factors; and possible

changes in taxation and environmental regulation. The combined

company will have other risks and uncertainties as set forth

below.

In addition, these forward-looking statements involve

significant risks and uncertainties that could cause actual results

to differ materially from those anticipated, including, but not

limited to, the possibility that stockholders of Arcadia may not

approve the issuance of new shares of Arcadia common stock in the

transaction or other proposals that are a condition to the

transaction or that the stockholders of Arcadia and the partners of

Roosevelt may not approve matters relating to the exchange

agreement; the risk that any condition to closing of the proposed

transaction may not be satisfied, that either party may terminate

the exchange agreement or that the closing of the proposed

transaction might be delayed or not occur at all; potential adverse

reactions or changes to business or employee relationships,

including those resulting from the announcement or completion of

the transaction; the diversion of management time on

transaction-related issues; the ultimate timing, outcome and

results of integrating the operations of Arcadia and Roosevelt; the

effects of the business combination of Arcadia and Roosevelt,

including the combined company’s future financial condition,

results of operations, strategy and plans; changes in capital

markets and the ability of the combined company to finance

operations in the manner expected; the risks of oil and gas

activities; and the fact that operating costs and business

disruption may be greater than expected following the public

announcement or consummation of the proposed transaction.

Expectations regarding business outlook, including changes in

revenue, pricing, capital expenditures, cash flow generation,

strategies for our operations, oil and natural gas market

conditions, legal, economic and regulatory conditions, and

environmental matters are only forecasts regarding these

matters.

All forward-looking statements speak only as of the date they

are made and are based on information available at that time.

Neither Arcadia nor Roosevelt assumes any obligation to update

forward-looking statements to reflect circumstances or events that

occur after the date the forward-looking statements were made or to

reflect the occurrence of unanticipated events except as required

by federal securities laws. As forward-looking statements involve

significant risks and uncertainties, caution should be exercised

against placing undue reliance on such statements.

This press release contains hyperlinks to information that is

not deemed to be incorporated by reference into this press

release.

No Offer or Solicitation

This press release and the information contained herein is not

intended to and does not constitute (i) a solicitation of a proxy,

consent or approval with respect to any securities or in respect of

the proposed transaction or (ii) an offer to sell or the

solicitation of an offer to subscribe for or buy or an invitation

to purchase or subscribe for any securities pursuant to the

proposed transaction or otherwise, nor shall there be any sale,

issuance or transfer of securities in any jurisdiction in

contravention of applicable law. No offer of securities shall be

made except by means of a prospectus meeting the requirements of

the Securities Act of 1933, as amended, or an exemption

therefrom.

Subject to certain exceptions to be approved by the relevant

regulators or certain facts to be ascertained, the public offer

will not be made directly or indirectly, in or into any

jurisdiction where to do so would constitute a violation of the

laws of such jurisdiction, or by use of the mails or by any means

or instrumentality (including without limitation, facsimile

transmission, telephone and the internet) of interstate or foreign

commerce, or any facility of a national securities exchange, of any

such jurisdiction.

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED

OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS PRESS

RELEASE IS TRUTHFUL OR COMPLETE.

Additional Information for Stockholders

In connection with the proposed transaction, Arcadia intends to

file materials with the SEC, including a Registration Statement on

Form S-4 (the “Registration Statement”) that will include a proxy

statement/prospectus. After the Registration Statement is declared

effective by the SEC, Arcadia intends to mail a definitive proxy

statement/prospectus to the stockholders of Arcadia. This press

release is not a substitute for the proxy statement/prospectus or

the Registration Statement or for any other document that Arcadia

may file with the SEC and send to Arcadia’s stockholders in

connection with the proposed transaction. INVESTORS AND SECURITY

HOLDERS OF ARCADIA ARE URGED TO CAREFULLY AND THOROUGHLY READ THE

REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS, AS EACH

MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND OTHER

RELEVANT DOCUMENTS FILED BY ARCADIA WITH THE SEC, WHEN THEY BECOME

AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

ARCADIA, ROOSEVELT, THE PROPOSED TRANSACTION, THE RISKS RELATED

THERETO AND RELATED MATTERS.

Investors will be able to obtain free copies of the Registration

Statement and proxy statement/prospectus, as each may be amended

from time to time, and other relevant documents filed by Arcadia

with the SEC (when they become available) through the website

maintained by the SEC at www.sec.gov. Copies of documents filed

with the SEC by Arcadia will be available free of charge from

Arcadia’s website at www.arcadiabiosciences.com under the

“Investor” tab.

Participants in the Proxy Solicitation

Arcadia, Roosevelt and their respective directors, partners and

certain of their officers and other members of management and

employees may be deemed, under SEC rules, to be participants in the

solicitation of proxies from Arcadia’s stockholders in connection

with the proposed transactions. Information regarding the officers

and directors of Arcadia is included in Arcadia’s most recent

Annual Report on Form 10-K/A filed with the SEC on April 29, 2024,

including any information incorporated therein by reference, as

filed with the SEC, and its definitive proxy statement for its 2024

annual meeting filed with the SEC on May 16, 2024. Additional

information regarding such persons, as well as information

regarding Roosevelt’s directors, managers and officers and other

persons who may be deemed participants in the proposed transaction,

will be set forth in the Registration Statement and proxy

statement/prospectus and other materials when they are filed with

the SEC in connection with the proposed transaction. Free copies of

these documents may be obtained as described in the paragraphs

above.

1 Estimates of produceable and recoverable hydrocarbons are

dependent on many factors, including the costs of development and

operations, capital expenditures to be made and actual prices

received for oil and natural gas. Estimates of produceable and

recoverable hydrocarbons are not estimates of reserves prepared in

accordance with regulations of the Securities and Exchange

Commission (SEC).

2 Estimates of produceable and recoverable hydrocarbons are

dependent on many factors, including the costs of development and

operations, capital expenditures to be made and actual prices

received for oil and natural gas. Estimates of produceable and

recoverable hydrocarbons are not estimates of reserves prepared in

accordance with regulations of the Securities and Exchange

Commission (SEC).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241205151921/en/

Arcadia Biosciences Contact: Sue Wandell

ir@arcadiabio.com

Roosevelt Resources Contact: Jerrel Branson

jerrel@rooseveltresources.com

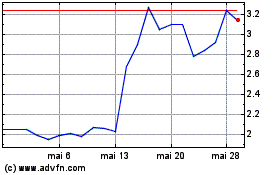

Arcadia Biosciences (NASDAQ:RKDA)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Arcadia Biosciences (NASDAQ:RKDA)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024