New Electric Vehicle Financing Grows More Than 30% Year-Over-Year, According to Experian Report

05 Dezembro 2024 - 11:30AM

Business Wire

The automotive finance market continues to

stabilize in Q3 2024

Following several quarters of incremental growth, consumer

interest in electric vehicles (EVs) re-emerged in the third quarter

of 2024. According to Experian’s (LSE: EXPN) State of the

Automotive Finance Market Report: Q3 2024, EVs accounted for 10.06%

of new vehicle financing during the quarter—growing more than 30%

compared to the previous year.

“The growth in EV financing can be attributed to two factors:

the EV tax credit and more affordable models hitting the market,”

said Melinda Zabritski, Experian’s head of automotive financial

insights. “While vehicle pricing, particularly with EVs, continues

to be a driving factor in consumers’ purchasing decisions, we’re

seeing consumers lean on some of the lease incentive and rebate

programs to make the overall cost and monthly payment of EVs more

palatable for their specific situations.”

Interestingly, leasing accounted for nearly 45% of all new

electric vehicle transactions in Q3 2024, up from 24.97% the

previous year and 9.53% in Q3 2022. Part of the appeal could be

attributed to significantly lower monthly payments. The average

monthly payment for a new EV lease was $198 lower than the average

monthly payment for a new EV loan in Q3 2024.

Among the most leased EV models, the Tesla Model 3 (13.60%) held

the top spot, followed by the Tesla Model Y (9.30%), Hyundai IONIQ

5 (6.51%), Honda Prologue (5.11%) and Ford Mustang Mach-E

(4.86%).

New vehicle inventory and incentives bring stability to the

market

Largely driven by the availability of new vehicle inventory and

incentives, captives (58.67%) continued to capture an overwhelming

share of the new vehicle finance market in Q3 2024, followed by

banks (22.65%), credit unions (10.07%) and finance companies

(6.52%).

In addition to lender market share, the effects of increased

inventory and incentives were felt across other aspects of the

industry. For example, although the average loan amount ($41,068)

for a new vehicle experienced a slight uptick, growing $736

compared to the previous year, the average monthly payment for a

new vehicle only increased $5 over the same period, reaching $737.

Meanwhile, the average interest rate for a new vehicle loan

decreased from 7.09% in Q3 2023 to 6.61% in Q3 2024.

Affordability pushing some prime and super prime borrowers to

return to used vehicles

While the new vehicle finance market continued to stabilize in

Q3 2024, interestingly, the data showed prime and super prime

borrowers may be returning to the used vehicle market. Nearly 66%

of prime borrowers chose to finance a used vehicle in Q3 2024, up

from 65.47% the previous year, while 48.92% of super prime

borrowers followed a similar path, up from 47.96% over the same

period.

According to the report, the average loan amount for a used

vehicle was $26,091 in Q3 2024, down $1,195 from the previous year.

Similarly, the average monthly payment for a used vehicle dropped

$18 to reach $520 over the same period.

“We’ve seen the effects of the reintroduction of new vehicle

inventory over the past several quarters, and it’s brought some

stability to the market,” Zabritski continued. “With the

re-emergence of leasing and more availability of late-model

vehicles, it’ll be important to keep a close eye on how consumer

preferences evolve over the coming years. It will likely shape our

market for the near future.”

Additional findings for Q3 2024:

- Leasing accounted for 24.03% of new vehicle financing in Q3

2024, up from 20.35% the previous year.

- Prime and super prime borrowers comprised nearly 71% of the

total vehicle finance market in Q3 2024.

- Tesla accounted for the top three transacted EV models in Q3

2024, led by the Tesla Model Y (31.76%), Tesla Model 3 (14.25%) and

the Tesla Cybertruck (4.93%).

- Outstanding automotive loan balances increased 1.10%

year-over-year, reaching $1.49 trillion.

- 30-day delinquencies increased from 2.91% last year to 3.09%

this quarter, while 60-day delinquencies increased from 0.92% to

0.96% over the same period.

To learn more, watch the entire State of the Automotive Finance

Market Report: Q3 2024 presentation on demand.

About Experian

Experian is a global data and technology company, powering

opportunities for people and businesses around the world. We help

to redefine lending practices, uncover and prevent fraud, simplify

healthcare, deliver digital marketing solutions, and gain deeper

insights into the automotive market, all using our unique

combination of data, analytics and software. We also assist

millions of people to realize their financial goals and help them

to save time and money.

We operate across a range of markets, from financial services to

healthcare, automotive, agrifinance, insurance, and many more

industry segments.

We invest in talented people and new advanced technologies to

unlock the power of data and innovate. As a FTSE 100 Index company

listed on the London Stock Exchange (EXPN), we have a team of

22,500 people across 32 countries. Our corporate headquarters are

in Dublin, Ireland. Learn more at experianplc.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241205189694/en/

Jordan Takeyama Experian Public Relations 1 951

733 8768 jordan.takeyama@experian.com

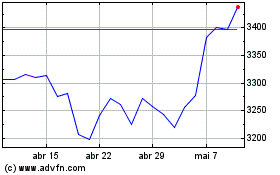

Experian (LSE:EXPN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Experian (LSE:EXPN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024