Experian Introduces No Ding Decline to Help Consumers Apply for Credit Cards With Confidence

09 Dezembro 2024 - 8:00AM

Business Wire

With the Experian Marketplace, shoppers can

avoid hurting their credit scores if they aren’t initially

approved

As consumers assess their budgets for the holiday shopping

season, they can utilize credit cards even more strategically this

year. Experian offers a credit card marketplace with No Ding

Decline offers, so consumers can apply for credit cards without

hurting their FICO® Scorei if they aren’t initially approvedii.

A stress-free way to apply for credit cards

With holiday shopping in full swing, a recent national survey by

Experian reveals that:

- 59% of respondents prefer using credit cards for holiday

shopping

- 25% are reviewing their current credit cards to select the best

ones for shopping

- 15% plan to open a new credit card for holiday shopping, up

from 11% in 2023 and 13% in 2022

No Ding Decline allows consumers to explore credit card options

without the worry of a hard inquiry affecting their credit scores

if their application isn’t initially approved. Additionally, the

Experian Marketplace is the only destination that makes it quick

and easy for consumers to find multiple No Ding Decline offers from

a variety of issuers, all in one place.

“Typically, applying for credit involves a hard inquiry and your

credit scores may dip,” said Rod Griffin, senior director of

Consumer Education and Advocacy at Experian. “This could make it

more difficult for those who are seeking to strengthen their credit

profile and would like to leverage a credit card to do so. Now

consumers can apply with confidence knowing that if their

application is declined they won’t hurt their credit scores.”

According to the survey, consumers are looking to open new

credit cards for the following reasons:

- Access cash back rewards (41%)

- Receive a retail store discount (27%)

- Earn travel rewards (26%)

Nearly 70 percent of consumers see a No Ding Decline offer among

a variety of credit card issuers in the program. All offers from

the Experian Marketplace are tailored based on consumers’ financial

profile including those designated as No Ding Decline.

For more information on the Experian Marketplace and to find the

right credit card, consumers can visit

https://www.experian.com/credit-cards/.

For tips on getting the most out of your credit cards, visit the

Ask Experian blog here.

Experian delivers Financial Power to All™, helping consumers

achieve their financial goals through establishing and building

good credit, providing access to personalized financial products,

aiding them in taking control of their bills and debt, protecting

them from identity theft and fraud, and saving them time and money

at every stage of their financial journey.

About Experian

Experian is a global data and technology company, powering

opportunities for people and businesses around the world. We help

to redefine lending practices, uncover and prevent fraud, simplify

healthcare, deliver digital marketing solutions, and gain deeper

insights into the automotive market, all using our unique

combination of data, analytics and software. We also assist

millions of people to realize their financial goals and help them

to save time and money.

We operate across a range of markets, from financial services to

healthcare, automotive, agrifinance, insurance, and many more

industry segments.

We invest in talented people and new advanced technologies to

unlock the power of data and innovate. As a FTSE 100 Index company

listed on the London Stock Exchange (EXPN), we have a team of

22,500 people across 32 countries. Our corporate headquarters are

in Dublin, Ireland. Learn more at experianplc.com.

i Credit score calculated based on FICO Score 8 model. Your

lender or insurer may use a different FICO® Score than FICO® Score

8, or another type of credit score altogether. Learn more. ii

Applying for cards labeled ‘No Ding Decline’ won’t hurt your credit

scores if you aren’t initially approved. Approval of your

application will result in a hard inquiry, even if you’re unable to

pass final verifications, which may impact your credit scores.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241209056067/en/

Sandra Bernardo 949 529 7550 Sandra.Bernardo@experian.com

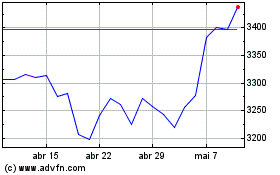

Experian (LSE:EXPN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Experian (LSE:EXPN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024