MetLife Investment Management Named a Best Place to Work in Money Management for Fourth Consecutive Year

09 Dezembro 2024 - 10:30AM

Business Wire

MetLife Investment Management (MIM), the institutional asset

management business of MetLife, Inc. (NYSE: MET), today announced

it has been named a “2024 Best Place to Work in Money Management”

by Pensions & Investments. This marks MIM’s fourth consecutive

year on the list.

“We are proud to receive this recognition, which reflects our

purpose-driven culture and was achieved through the collective

efforts of the entire MIM team,” said Jude Driscoll, President of

MIM. “Our talented teams are empowered to deliver for our clients

and other stakeholders, which in turn fuels our growth and

success.”

Pensions & Investments partnered with Best Companies Group,

an independent research firm specializing in identifying great

places to work, to conduct a two-part survey of employers and their

employees. To evaluate MIM for inclusion on the list, they

evaluated a range of the company's policies, programs and practices

that are designed to attract, retain and reward employees.

MIM provides employees with access to holistic wellness

resources spanning mental, physical, social and financial

well-being; a comprehensive offering of benefits geared toward

health and wellness, financial protection and retirement savings as

well as company-wide programs designed to recognize and reward

exemplary efforts from employees.

MIM is committed to cultivating a diverse work environment that

respects and values inclusion. Its Diversity, Equity and Inclusion

Council and dynamic inclusion networks provide employees dedicated

space to gather and share experiences that empower them to learn,

connect and be a voice in the workplace.

MIM is a top 25 institutional investment manager globally by

assets under management1 and is a premier originator of private

assets. MIM manages more private fixed income assets for

third-party insurance general accounts than any other asset

manager.2 It is the largest infrastructure debt investment manager

based on worldwide assets3 and is the largest real estate

investment manager.4

About MetLife Investment Management

MetLife Investment Management, the institutional asset

management business of MetLife, Inc. (NYSE: MET), is a global

public fixed income, private capital and real estate investment

manager providing tailored investment solutions to institutional

investors worldwide. MetLife Investment Management provides public

and private pension plans, insurance companies, endowments, funds

and other institutional clients with a range of bespoke investment

and financing solutions that seek to meet a range of long-term

investment objectives and risk-adjusted returns over time. MetLife

Investment Management has over 150 years of investment experience

and, as of September 30, 2024, had $609.3 billion in total assets

under management.5

About MetLife

MetLife, Inc. (NYSE: MET), through its subsidiaries and

affiliates (“MetLife”), is one of the world’s leading financial

services companies, providing insurance, annuities, employee

benefits and asset management to help individual and institutional

customers build a more confident future. Founded in 1868, MetLife

has operations in more than 40 markets globally and holds leading

positions in the United States, Asia, Latin America, Europe and the

Middle East. For more information, visit www.metlife.com.

Endnotes

1Pensions & Investments Managers Ranked by Total Worldwide

Institutional Assets Under Management as of 12/31/23.

2Clearwater Analytics Insurance Investment Outsourcing Report

2024 as of 12/31/23.

3IPE Research as of 12/31/23

4Pensions & Investments as of 6/30/24

5Total assets under management is comprised of all MetLife

general account and separate account assets and unaffiliated/third

party assets, at estimated fair value, managed by MIM. For more

information, see the total assets under management fact sheet for

the quarter ended September 30, 2024, available on MetLife’s

Investor Relations webpage (https://investor.metlife.com).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241206457827/en/

For Media: Dave Franecki +1 (973) 264-7465

dave.franecki@metlife.com

MetLife (NYSE:MET)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

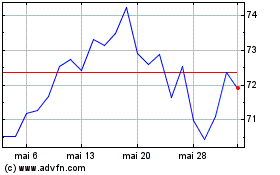

MetLife (NYSE:MET)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025