MetLife, Inc. and General Atlantic today announced the formation

of Chariot Reinsurance, Ltd. (“Chariot Re”), a to-be-registered

Class E Bermuda-based life and annuity reinsurance company. Chariot

Re is expected to launch in the first half of 2025 and will have a

future strategic reinsurance partnership with MetLife.

MetLife and General Atlantic anticipate Chariot Re will have an

initial combined equity investment of over $1 billion, and that

they will each initially own approximately 15% of the equity in

Chariot Re. The remaining equity interests will be held by

third-party stakeholders, including Chubb, a global leader in

property and casualty insurance, which is expected to be an anchor

third-party investor.

MetLife anticipates initially reinsuring to Chariot Re an

approximate $10 billion block of liabilities composed of structured

settlement annuity contracts and group annuity contracts associated

with pension risk transfers. The transaction is subject to required

regulatory approvals and the final amount of initial equity raised

to support Chariot Re. MetLife’s ongoing commitment to its

policyholders will remain unchanged following the transaction and

MetLife will continue to be responsible for all customer-related

functions. Going forward, MetLife Investment Management and General

Atlantic will exclusively provide asset management services to

Chariot Re.

Through the execution of Investment Management Agreements,

Chariot Re will leverage the combined global investment management

capabilities of MetLife Investment Management and General Atlantic,

including public fixed income, private credit, private real estate,

and private equity. MetLife Investment Management, with expertise

in Public Fixed Income, Private Capital and Real Estate, is one of

the largest global managers of life insurance assets and General

Atlantic is a leading global investor in the private markets with

expertise across Growth Equity, Credit, Climate, and Sustainable

Infrastructure.

Michel Khalaf, President and Chief Executive Officer of MetLife,

Inc., said: “We are looking forward to seeing our collective vision

to create a world-class provider of innovative reinsurance

solutions come to life, leveraging the insurance and joint

investment expertise of MetLife and General Atlantic. With the

demand for life and retirement solutions anticipated to grow around

the globe, MetLife views a strategic partnership with Chariot Re as

a powerful avenue to further serve those expanding needs.”

Bill Ford, Chairman and Chief Executive Officer of General

Atlantic, said: “General Atlantic and MetLife share a deep

commitment to investment excellence, thoughtful risk management,

and long-term value creation. Guided by MetLife’s robust

origination capabilities and General Atlantic’s nearly 45 years of

leadership in global private markets, we believe that Chariot Re

will be well-positioned to deliver strong returns for its investors

and drive sustainable growth going forward."

It is expected that Chariot Re will be led by Cynthia Smith, a

30-year veteran of MetLife, who will serve as CEO. Most recently,

Smith led MetLife’s Group Benefits Regional Business. Over the

course of her career at MetLife, she has served in a variety of

senior roles across several businesses and functions including

strategy, finance, sales, underwriting, and technology

transformation.

It is anticipated that Toby Srihiran Brown, Global Head of

Reinsurance at MetLife, will represent the company on Chariot Re’s

Board of Directors. It is also expected that Graves Tompkins, Chief

Operating Officer at General Atlantic, will represent the firm on

Chariot Re’s Board of Directors.

Bank of America is expected to provide financing for Chariot Re.

Debevoise & Plimpton LLP and Oliver Wyman are serving as

advisors to MetLife. Ardea Partners LP is serving as financial

advisor, and Paul, Weiss, Rifkind, Wharton & Garrison LLP and

Eversheds Sutherland (US), LLP are serving as legal counsel to

General Atlantic.

About MetLife

MetLife, Inc. (NYSE: MET), through its subsidiaries and

affiliates (“MetLife”), is one of the world’s leading financial

services companies, providing insurance, annuities, employee

benefits and asset management to help individual and institutional

customers build a more confident future. Founded in 1868, MetLife

has operations in more than 40 markets globally and holds leading

positions in the United States, Asia, Latin America, Europe and the

Middle East. For more information, visit www.metlife.com.

About MetLife Investment Management

MetLife Investment Management, the institutional asset

management business of MetLife, Inc. (NYSE: MET), is a global

public fixed income, private capital and real estate investment

manager providing tailored investment solutions to institutional

investors worldwide. MetLife Investment Management provides public

and private pension plans, insurance companies, endowments, funds

and other institutional clients with a range of bespoke investment

and financing solutions that seek to meet a range of long-term

investment objectives and risk-adjusted returns over time. MetLife

Investment Management has over 150 years of investment experience

and, as of September 30, 2024, had $609.3 billion in total assets

under management. For more information, see the total assets under

management fact sheet for the quarter ended September 30, 2024

available on MetLife’s Investor Relations webpage

(https://investor.metlife.com).

About General Atlantic

General Atlantic is a leading global investor in the private

markets with more than four decades of experience providing capital

and strategic support for over 520 growth companies throughout its

history. Established in 1980, General Atlantic continues to be the

dedicated partner to visionary founders and investors seeking to

build dynamic businesses and create long-term value. The firm

leverages its patient capital, operational expertise, and global

platform to support a diversified investment platform spanning

Growth Equity, Credit, Climate, and Infrastructure strategies.

General Atlantic manages approximately $100 billion in assets under

management, inclusive of all strategies, as of October 1, 2024,

with more than 900 professionals in 20 countries across five

regions. For more information on General Atlantic, please visit:

www.generalatlantic.com.

MetLife Forward-Looking Statements

This news release may contain information that includes or is

based upon forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements give expectations or forecasts of future events and do

not relate strictly to historical or current facts. They use words

and terms such as “anticipate,” "are confident," “assume,”

“believe,” “continue,” “could,” “estimate,” “expect,” “if,”

“intend,” “likely,” “may,” “plan,” “potential,” “project,”

“should,” “will,” “would,” and other words and terms of similar

meaning or that are otherwise tied to future periods or future

performance, in each case in all derivative forms. They include

statements relating to future actions, prospective services or

products, future performance or results of current and anticipated

services or products, future sales efforts, future expenses, the

outcome of contingencies such as legal proceedings, and future

trends in operations and financial results.

Many factors determine the results of MetLife, Inc., its

subsidiaries and affiliates, and they involve unpredictable risks

and uncertainties. MetLife’s forward-looking statements depend on

its assumptions, its expectations, and its understanding of the

economic environment, but they may be inaccurate and may change.

MetLife, Inc. does not guarantee any future performance. Its

results could differ materially from those MetLife, Inc. expresses

or implies in forward-looking statements. MetLife, Inc. does not

undertake any obligation to publicly correct or update any

forward-looking statement if MetLife, Inc. later becomes aware that

such statement is not likely to be achieved. Please consult the

“Risk Factors” and any further disclosures MetLife, Inc. makes on

related subjects in reports to the U.S. Securities and Exchange

Commission.

Forward-Looking Statements

The forward-looking statements in this Current Report on Form

8-K, which contain words such as “anticipate,” “are confident,”

“assume,” “believe,” “continue,” “could,” “estimate,” “expect,”

“if,” “intend,” “likely,” “may,” “plan,” “potential,” “project,”

“should,” “target,” “will,” “would” and other words and terms of

similar meaning or that are otherwise tied to future periods or

future performance, in each case in all derivative forms, are based

on assumptions and expectations that involve risks and

uncertainties, including the “Risk Factors” MetLife, Inc. describes

in its U.S. Securities and Exchange Commission filings. MetLife,

Inc.’s future results could differ, and it does not undertake any

obligation to publicly correct or update any forward-looking

statement if MetLife, Inc. later becomes aware that such statement

is not likely to be achieved.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241211694718/en/

Media MetLife Dave Franecki 973-264-7465

Dave.Franecki@metlife.com

General Atlantic Mary Armstrong 917-683-0311

media@generalatlantic.com

Investors John Hall 212-578-7888

John.A.Hall@metlife.com

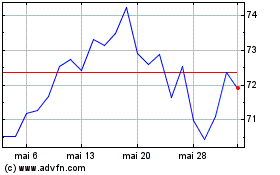

MetLife (NYSE:MET)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

MetLife (NYSE:MET)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024