Regarding Filing Draft Response Document

Prepared by Exclusive Networks

in Response to the Draft Offer Document

Relating to the Simplified Tender Offer on Its Shares

Initiated by

Etna French Bidco

Regulatory News:

Exclusive Networks (Paris:EXN):

This press release does not constitute a

tender offer. The offer described below and the draft

response document remain subject to review by the French financial

market authority.

Translation for information purposes only –

In case of discrepancy between the French and English version, the

French version shall prevail.

This press release was prepared and

published by Exclusive Networks on 16 January 2025 pursuant to

Article 231-26 of the general regulation of the French financial

market authority (Autorité des Marchés Financiers) (the

“AMF”).

The draft offer, the draft offer document

and the draft response document remain subject to review by the

AMF.

IMPORTANT NOTICE

Pursuant to Articles 231-19 and 261-1 et

seq. of the general regulation of the AMF (the “AMF

General Regulation”), the report prepared by Finexsi, acting

as independent expert, is presented in the draft response document

filed by Exclusive Networks with the AMF on 16 January 2025 (the

“Draft Response Document”).

The Draft Response Document is available on the websites of

Exclusive Networks (www.exclusive-networks.com) and of the AMF

(www.amf-france.org) and may be obtained free of charge at:

Exclusive Networks 20, quai du Point du Jour

92100 Boulogne-Billancourt, France

In accordance with Article 231-28 of the AMF General Regulation,

the information relating, in particular, to the legal, financial

and accounting characteristics of Exclusive Networks will be filed

with the AMF and made available to the public at the latest on the

day preceding the opening of the offer.

A press release will be published to inform the public about how

this information may be obtained.

1. OVERVIEW OF THE KEY TERMS AND

CONDITIONS OF THE OFFER

1.1. Overview of the Offer

Pursuant to Title III of Book II and more specifically Articles

233-1 and 234-2 et seq. of the AMF General Regulation, Etna French

Bidco, a simplified joint stock company (société par actions

simplifiée) with a share capital of EUR 108,272,026.16, having its

registered office at 37, avenue Pierre 1er de Serbie 75008 Paris,

registered with the Paris Trade and Companies Registry under number

930 705 991 (“Bidco” or the “Offeror”) irrevocably

offers to the shareholders of Exclusive Networks, a public limited

company (société anonyme) with a board of directors and a share

capital of EUR 7,333,622.88, having its registered office at 20,

Quai du Point du Jour 92100 Boulogne-Billancourt, registered with

the Nanterre Trade and Companies Registry under number 839 082 450

(“Exclusive Networks” or the “Company”, and together

with its directly or indirectly controlled subsidiaries, the

“Group”), to acquire in cash all of their shares in the

Company admitted to trading on compartment A of Euronext Paris

regulated market (“Euronext Paris”) under ISIN code

FR0014005DA7, mnemonic “EXN” (the “Shares”) that the Offeror

does not directly or indirectly hold, in the context of a

simplified mandatory tender offer (the “Offer”) at a price

of EUR 18.96 per Share (the “Offer Price”)1.

The Offeror is 100% owned by French Midco, which is 100% owned

by French Topco, which is 100% owned by UK Midco, which is 7.74%

owned by HTIVB and 92.26% owned by UK Topco, and UK Topco is 48.76%

owned by CD&R Stratos and 51.24% owned by Everest (as defined

respectively in the Draft Response Document).

As a result of the crossing of the thresholds of 30% of the

Company’s share capital and voting right following the completion

of the Acquisitions and Contributions (as defined in the Draft

Response Document), the Offer is mandatory pursuant to Article L.

433-3, I of the French Monetary and Financial Code and Article

234-2 of the AMF General Regulation. As of the date of the filing

of the Offer, the Offeror directly held 66.66% of the share capital

and theorical voting rights of the Company2.

Given the acquisitions made by the Offeror since the filing of

the Offer in accordance with Article 231-38, IV of the AMF General

Regulation, the Offeror directly holds, On the date of the Draft

Response Document3, 69,973,626 Shares and 69,973,626 voting rights

representing 76.33% of the share capital and theoretical voting

rights of the Company4.

In accordance with Article 231-6 of the AMF General Regulation,

the Offer targets all the Shares, whether outstanding or to be

issued before the closing of the Offer, that are not held, directly

or indirectly, by the Offeror, i.e., to the knowledge of the

Company and as at the date of the Draft Response Document, a

maximum of 20,683,428 Shares, except for the 1,013,232 Shares held

in treasury by the Company, which the board of directors of the

Company (the “Board”) decided not to tender to the

Offer.

As indicated in the draft offer document filed by the Offeror

with the AMF on 19 December 2024 (the “Draft Offer

Document”), the Offer takes the form of a simplified public

tender offer in accordance with Article 233-1, 2° of the AMF

General Regulation.

In accordance with Article 231-13 of the AMF General Regulation,

BNP Paribas, Lazard Frères Banque, Morgan Stanley, and Société

Générale acting as the presenting banks of the Offer (the

“Presenting Banks”), have filed, on behalf of the Offeror,

the draft Offer and the Draft Offer Document with the AMF on 19

December 2024.

Only BNP Paribas is guaranteeing, in accordance with Article

231-13 of the AMF General Regulation, the content and irrevocable

nature of the commitments made by the Offeror in the context of the

Offer.

In accordance with Articles L. 433-4 III of the French Monetary

and Financial Code and 237-1 et seq. of the AMF General Regulation,

if, at the end of the Offer, the number of Shares not tendered by

minority shareholders (other than treasury shares) represents no

more than 10% of the share capital and voting rights of the

Company, the Offeror intends to request the AMF to implement a

squeeze-out procedure through the transfer of the Shares not held

by the Offeror and that have not been tendered to the Offer (the

“Squeeze-Out”).

The context and reasons for the Offer are detailed in Section

2.1 of the Draft Response Document.

The indicative timetable for the Offer is presented in Section

2.13 of the Draft Response Document.

1.2. Key terms of the Offer

In accordance with Articles 231-13 and 231-18 of the AMF General

Regulation, the Presenting Banks, acting as presenting institutions

on behalf of the Offeror, filed the draft Offer with the AMF on 19

December 2024.

BNP Paribas, as guaranteeing bank, guarantees the content and

the irrevocable nature of the commitments made by the Offeror as

part of the Offer, in accordance with Article 231-13 of the AMF

General Regulation.

In the context of the Offer, which will be carried out in

accordance with the simplified procedure in accordance with

Articles 233-1 et seq. of the AMF General Regulation, the Offeror

irrevocably undertakes to the Company’s shareholders to acquire all

the Shares that will be tendered to the Offer, during the Offer

period, at the Offer Price during a period of twelve (12) trading

days.

The attention of the Company’s shareholders is drawn to the fact

that, as the Offer will be conducted following the simplified

procedure, it will not be reopened following the publication of the

result of the Offer by the AMF.

In the event of a Squeeze-Out, the Shares (except for the

treasury Shares held by the Company) that have not been tendered to

the Offer will be transferred to the benefit of the Offeror, in

exchange for an indemnification in a per Share amount equal to the

Offer Price, net of all costs.

The characteristics of the Offer (including the details of the

terms of the Offer, the procedures for tendering Shares to the

Offer, the situation of the beneficiaries of free shares, and the

Offer restrictions outside of France) are detailed in Section 2 of

the Draft Response Document.

1.3. Terms and conditions of the

Offer

In accordance with Articles 231-13 and 231-18 of the AMF General

Regulation, the Presenting Banks, acting as presenting institutions

on behalf of the Offeror, filed the draft Offer with the AMF on 19

December 2024. On the same day, the AMF published a notice of

filing relating to the Draft Offer Document on its website

(www.amf-france.org).

In accordance with Article 231-16 of the AMF General Regulation,

the Draft Offer Document will be posted on the websites of the AMF

(www.amf-france.org) and the Company (www.exclusive-networks.com)

and is available to the public free of charge at the Company’s

registered office or from the Presenting Banks.

In accordance with Articles 231-19 and 231-26 of the AMF General

Regulation, the Company filed with the AMF on 16 January 2025 a

Draft Response Document, which includes, in particular, the report

from the independent expert appointed under Article 261-1 I and II

of the AMF General Regulation, as well as the reasoned opinion of

the Board on the interest and consequences of the Offer for the

Company, its shareholders and its employees.

The Offer, the Draft Offer Document, and the Draft Response

Document remain subject to the AMF's review.

The AMF will publish a clearance decision on the Offer on its

website after ensuring that the Offer complies with the applicable

legal and regulatory provisions. This clearance decision will

approve the Offeror’s Offer document and of the Company’s response

document.

In accordance with Articles 231-27 and 231-28 of the AMF General

Regulation, the response document approved by the clearance

decision of the AMF and the document "other information related to

the characteristics, notably legal, financial, and accounting" of

the Company will be available on the websites of the AMF

(www.amf-france.org) and the Company (www.exclusive-networks.com)

and will be made available to the public no later than the day

before the opening of the Offer. Copies of these documents will

also be available to the public free of charge at the Company’s

registered office.

In accordance with Articles 231-27 and 231-28 of the AMF General

Regulation, a press release specifying the methods of making these

documents available will be published no later than the day before

the opening of the Offer.

2. REASONED OPINION OF THE BOARD

2.1. Previous decisions of the Board

relating to the Offer

On 21 May 2024, following receipt of a non-binding offer from

CD&R (as defined in the Draft Response Document) to take

private the Company, the Board decided to set up an ad hoc

committee (the “Ad Hoc Committee”) initially comprising

Barbara Thoralfsson, Marie-Pierre de Bailliencourt, Nathalie Lomon

and Michail Zekkos. The Ad Hoc Committee’s mission was to monitor

the work of the independent expert and to make recommendations to

the Board regarding its reasoned opinion on the Offer.

On 3 June 2024, although the transaction was at an early stage,

the Board decided, upon recommendation of the Ad Hoc Committee,

that it was in the interest of the Company to benefit as soon as

possible from the work of the independent expert and thus appointed

Finexsi, represented by Christophe Lambert, as independent expert

in the context of the Offer, to draw up a report on the financial

terms and conditions of the proposed Offer, including with a view

to a possible Squeeze-Out, pursuant to articles 261-1 I, 1°, 2° and

4°, 261-1 II and 262-1 of the AMF General Regulation. The members

of the Ad Hoc Committee have had several opportunities to exchange

views with the independent expert and to monitor his work.

On 14 June 2024, considering the constitution of the Consortium

comprising Permira (as defined in the Draft Response Document), the

Board decided the Ad Hoc Committee's new composition, consisting

only of Barbara Thoralfsson, Marie-Pierre de Bailliencourt and

Nathalie Lomon, all being independent directors.

On 24 July 2024, upon the recommendation of the Ad Hoc

Committee, the Board with the unanimous vote of the directors

members present or represented (the directors related to the

Offeror did not attend the meeting), amongst others, welcomed

favourably the proposed Offer.

On 4 and 29 November 2024, the Board approved a senior

facilities agreement under which the Company and Everest SubBidCo

are borrowers and the related intercreditor agreement to, among

others, finance the payment on 16 December 2024 of the exceptional

distribution approved by the shareholders meeting of 31 October

2024 and refinance the existing indebtedness of the Group.

On 18 December 2024, the Board decided to:

- proceed to an adjustment of the free shares plans, increasing

the total number of Shares that may be acquired by beneficiaries at

the end of the free share vesting period; and

- co-opt Grégory Laï as a new director in replacement of Pierre

Pozzo, who resigned.

On 14 January 2025, the Board decided to amend its internal

regulations to remove the requirement for directors to hold 1,000

shares.

2.2. Reasoned opinion of the Board

In accordance with the provisions of Article 231-19 of the AMF

General Regulation, the directors met on 15 January 2025, at the

invitation of Barbara Thoralfsson (chairperson of the Board), to

(i) examine the draft Offer submitted by the Offeror for the Shares

not held by the latter, and (ii) give a reasoned opinion on the

interest and consequences of the Offer for the Company, its

shareholders and its employees.

All the directors were present or represented except Olivier

Breittmayer, Michail Zekkos and Grégory Laï who, upon

recommendation of the Ad Hoc Committee, did not take part to the

meeting.

An excerpt from the minutes of this meeting, containing the

reasoned opinion of the Board, is reproduced below, being specified

that the directors' intentions whether to tender or not their

Shares to the Offer, which the Board has taken note of, are

reproduced in Section 3 of this press release:

“The Chairperson of the Board of Directors reminds that the

Board met today, in accordance with the provisions of article

231-19 of the General Regulation of the French Financial Markets

Authority (Autorité des marchés financiers) (the "AMF"), to

issue a reasoned opinion on the merits of the simplified tender

offer for the Company's shares filed by Etna French Bidco ("Etna

French Bidco" or the "Offeror") at a price of EUR 18.96

per share (the "Offer Price"), and on the consequences that

the project of cash simplified tender offer filed by Etna French

Bidco on 19 December 2024 (the "Offer") would have for the

Company, its shareholders and its employees.

The Chairperson reminded that on 24 July 2024, CD&R and

Everest UK HoldCo Limited, entity controlled by Permira funds and

then the majority shareholder of Exclusive Networks, announced the

formation of a consortium with Olivier Breittmayer, founder of

Exclusive Networks, (together, the "Consortium") to acquire

(directly or indirectly, by way of acquisitions and contributions

in kind), through Etna French Bidco, the shares in Exclusive

Networks held by Everest UK HoldCo Limited and Olivier Breittmayer,

representing together 66.66% of the share capital and 66.66% of the

theoretical voting rights of Exclusive Networks (the

"Acquisitions", and together with the Offer, the

"Transaction").

These Acquisitions were subject to the following conditions

precedent:

- The approval by a shareholders’ meeting of the Company of the

payment of an exceptional distribution of EUR 5.29 per share paid

from "Other reserves" and "Share premium" (the "Exceptional

Distribution");

- The draw down of the B1 facility put in place as part of the

Transaction, as agreed upon among the members of the

Consortium;

- The obtaining of the applicable regulatory approvals; and

- The payment by the Company of the Exceptional

Distribution.

On 20 November 2024, CD&R and Permira announced that they

had received all the necessary regulatory approvals to complete the

Acquisitions.

On 16 December 2024, the Company paid out the Exceptional

Distribution which had been authorised by the Company’s general

meeting of shareholders held on 31 October 2024.

The Acquisitions were, after the Exceptional Distribution,

definitively completed on 17 December 2024.

In this context, on 19 December 2024, in accordance with the

provisions of article 231-13 of the AMF general regulation, Morgan

Stanley, Lazard, Société Générale and BNP Paribas, acting as banks

presenting the Offer (the "Presenting Banks"), filed the

draft Offer and the draft Offer document with the AMF on behalf of

the Offeror. To date, the Offeror directly holds 69,973,626 shares

representing 76.33% of the Company's share capital and theoretical

voting rights.

In accordance with article 231-6 of the AMF general regulation,

the Offer targets all shares that are not held, directly or

indirectly, by the Offeror, i.e. a maximum of 20,683,428 shares,

except for the 1,013,232 shares held in treasury by the

Company.

In addition, the free shares allocated by the Company to certain

employees and corporate officers which are in the process of being

acquired are not targeted by the Offer. The Offeror will propose to

the beneficiaries of these free shares to enter into put and call

options to enable them to benefit from a cash liquidity on the free

shares that cannot be tendered to the Offer.

Lastly, the Chairperson reminded that the Offer would be

conducted following the simplified procedure through acquisitions

on the market and a Euronext Paris semi-centralised offer. The

Offer will be opened for 12 trading days.

The Offeror has also announced its intention to request the AMF

to implement a squeeze-out for the shares not tendered to the Offer

by the minority shareholders of the Company (other than (a) the

shares held by the Company or its subsidiaries and (b) the shares

assimilated to shares held by the Offeror) to be transferred to the

Offeror, if such shares do not represent more than 10% of the share

capital and voting rights of the Company following the Offer.

The Chairperson recalled that on 21 May 2024, the Board of

Directors decided to set up an ad hoc committee (the "Ad Hoc

Committee") composed exclusively of independent directors, Mrs

Barbara Thoralfsson (Chairperson), Ms Marie-Pierre de Bailliencourt

and Ms Nathalie Lomon with the mission, in particular, of (a)

monitoring the discussions and negotiations relating to the Offer,

(b) keeping the Board of Directors informed of the progress of

these discussions and negotiations and (c) making a recommendation

to the Board of Directors on the merits and proposed terms of the

contemplated Offer.

The Chairperson also reminded that on 3 June 2024, the Board of

Directors, upon recommendation of the Ad Hoc Committee, appointed

Finexsi as independent expert to draw up a fairness opinion on the

financial terms and conditions of the proposed Offer, in accordance

with the provisions of article 261-1 et seq. of the AMF general

regulation (the "Independent Expert").

The Ad Hoc Committee met on 11 occasions.

Prior to today's meeting, the directors were able to examine the

following documents in particular:

- The draft Offer document relating to the Offer including, in

particular, the Offeror's reasons and intentions, and a summary of

the factors used to assess the Offer price, which is set out in

section 3 of the draft Offer;

- The Independent Expert's report ; and

- The Company's draft response document.

The Chairperson stated that the Independent Expert, the

Company's management, the Presenting Banks, the Consortium and the

legal advisers of the Company and the Offeror had exchanged

information on several occasions to provide the Independent Expert

with all the information required to draw up its fairness

opinion.

The Board of Directors noted that the Independent Expert had

confirmed that he had received all the information required to

carry out its fairness opinion.

The Chairperson also informed the Board of Directors that the Ad

Hoc Committee had several discussions with the Independent Expert

and followed up its work.

Conclusions of the Independent

Expert

The Chairperson gave the floor to Christophe Lambert,

representing Finexsi, to present his work on the valuation of the

Offer and his conclusions on the Offer, which will be appended to

the Company's draft response document and are the following:

Regarding Company's shareholder

This Offer is proposed to all Company shareholders at a price of

€18.96 per share which may be followed by a squeeze-out where the

compensation will be equal to the Offer Price.

The Offer Price is aligned with the price of the recent block

acquisition, granting overall control to Etna French Bidco, which

holds 66.66% of the Company's capital.

The Offer Price is at the upper end of the range of the

Company's intrinsic value, as derived from the DCF analysis based

on a business plan that reflects the management's strong ambitions

and potential for development. It therefore gives minority

shareholders the full value for their shares without the execution

risk of the business plan.

For shareholders of the Company wishing to tender their shares,

the Offer provides immediate liquidity, with a premium range of

39.7% to 48.7% over the last share price prior to the rumors of the

transaction (on 28 June 2024 and 13 March 2024 respectively), and

28.6% to 42.2% on the average 60-day share price on the same

dates.

The Independent Expert notes that the price targets published by

analysts prior to the announcement of the transaction show a

limited discount ranging from 1.3% to 3.8%. As of 14 March 2024,

the date of the first rumor, the median target price indicated a

discount of 2.6%, while the average showed a 5.6% premium over the

Offer price.

Regarding the relative method of comparable companies analysis

presented as a secondary approach, the Offer price represents a

premium of 77.8% to 85.6%.

For reference, the Independent Expert notes that the Offer price

represents a 65.5% to 123.9% premium over the value derived from

the precedent transaction analysis.

Regarding related agreements

The review of the agreements that may have a material influence

on the assessment or outcome of the Offer, as presented in the

draft offer document, namely (i) the Consortium and Investment

Agreement, (ii) the Acquisitions and Contributions Agreements,

(iii) the Shareholders' Agreement, (iv) the Liquidity Agreements,

and (v) the Managers and employees undertakings, has not revealed

any provision that would, in the opinion of the Independent Expert,

call into question the fairness of the Offer from a financial

perspective.

Consequently, and at the date of his report, the Independent

Expert concludes that the Offer Price of €18.96 per share is fair

for Company' shareholders from a financial perspective. This

conclusion extends to the compensation of the same amount that

would apply in the event of a squeeze-out following the Offer.

Conclusions and recommendations of the

Ad Hoc Committee

The Chairperson presented a detailed report on the analysis made

on the Offer and the discussions held during the meeting of the Ad

Hoc Committee held today, in presence of the Independent Expert,

and confirmed the recommendation of reasoned opinion made by the Ad

Hoc Committee to the Board of Directors to conclude that the Offer

and its consequences are to the benefit of the Company, its

shareholders and its employees and that they are therefore

recommended to tender their shares in the Company to the Offer.

Reasoned opinion of the Board of

Directors

The Chairperson then invited the Board of Directors to

discuss.

Having carefully examined the different documents made available

to it and the explanations given by the Independent Expert and the

Ad Hoc Committee, the Board of Directors duly noted this

information.

The Board of Directors took the following items into

consideration:

- The strategic intentions of the Offeror, who intends to

maintain the group’s integrity and to continue the main strategic

orientations implemented by the Company, with no material

modifications of the operational model of the Company (outside the

normal evolution of the business);

- The intentions in terms of employment as set out in the

Offeror’s draft tender offer document;

- The financial terms of the Offer including a significant

premium over the weighted average share prices, valuing the Company

at an attractive price and representing an opportunity for

immediate liquidity for all the Company's shareholders on terms

that are considered fair;

- The liquidity mechanisms that would be implemented, aiming at

offering to the beneficiaries of free share plans subject or not to

performance conditions a cash liquidity – the Board of Directors

noted that this mechanism ensures fair treatment for all holders of

deferred compensation wishing to benefit from it;

- The intention of the Offeror and certain executives and

employees to enter into, during the Offer Period, a contribution

agreement pursuant to which such executives and employees would

contribute their shares of the Company to UK MidCo (the Offeror's

great-grandparent company), in consideration for ordinary shares

issued by UK MidCo valued consistently with the Offer Price;

and

- The Independent Expert's report, which concluded in particular

that the Offer was fair on a financial standpoint, including in the

context of the squeeze-out.

The Board of Directors also noted that its composition will be

changed following the Offer to reflect the new shareholding

structure of the Company.

There was an exchange of views on all these items.

The Board of Directors, upon recommendation of the Ad Hoc

Committee, having considered the terms of the Offer presented to

it, the reasons and intentions of the Offeror, the valuation

elements set out in the draft Offer document relating to the

simplified tender Offer and the report of the Independent Expert,

after deliberating, Mr. Olivier Breittmayer, Mr. Michail Zekkos and

Mr. Gregory Laï, directors in a position of conflict of interest,

having taken part neither in the deliberations nor in the

vote,

Decided unanimously,

- to issue a favourable reasoned opinion on the draft Offer as

presented to it;

- to subsequently recommend that the Company's shareholders

tender their shares in the Company to the Offer;

- not to tender the treasury shares held by the Company (i.e.,

1,013,232 shares as at the date hereof);

- to approve the Company's draft response document;

- to authorise, as necessary, the Chief Executive Officer of

the Company to:

- finalise the draft response document and any other documents

that may be useful or necessary in connection with the Offer, in

particular the "Other Information" document relating notably to the

legal, financial and accounting information of the

Company;

- prepare, sign and file with the AMF all documents required

in connection with the Offer;

- sign any certificates required as part of the Offer;

and

- more generally, to take all steps and measures necessary or

useful for the completion of the Offer.

The Board of Directors also decided to terminate the

liquidity contract with Kepler Cheuvreux.”

3. INTENTIONS OF THE DIRECTORS

The directors5 holding Shares have expressed the following

intentions:

Name

Function

Shares held at the date of the

reasoned opinion

Intention

Barbara Thoralfsson*

Chairperson of the Board and

member of the audit and risk and of the nomination and remuneration

committees

15,000

Tender 15,000 Shares to the

Offer

Jesper Trolle

Director and Chief Executive

Officer

350,714

Tender 287,422 Shares to the

Offer6 7

Michail Zekkos

Director and member of the

nomination and remuneration committee

1,500

Tender 1,500 Shares to the

Offer

Marie-Pierre de Bailliencourt*

Director and chairperson of the

nomination and remuneration committee

1,250

Tender 1,250 Shares to the

Offer

Nathalie Lomon*

Director and chairperson of the

audit and risk committee

1,000

Tender 1,000 Shares to the

Offer

*independent members

4. INTENTIONS OF THE COMPANY WITH RESPECT

TO TREASURY SHARES

As at the date of the Draft Response Document, the Company holds

1,013,232 of its own Shares.

On 15 January 2025, the Board acknowledged that the 1,013,232

treasury Shares are not targeted by the Offer and unanimously

confirmed, as necessary, that such Shares shall not be tendered

within the Offer.

5. REPORT OF THE INDEPENDENT EXPERT

PURSUANT TO ARTICLE 261-1 OF THE AMF GENERAL REGULATION

Pursuant to Articles 261-1, I, 1°, 2° and 4° and II of the AMF’s

General Regulation, Finexsi, represented by Mr. Christophe Lambert,

was appointed as an independent expert by the Board on 3 June 2024,

upon recommendation of the Ad Hoc Committee, in order to prepare a

report on the financial terms of the Offer and the Squeeze-Out.

The conclusion of the report of the independent expert dated 15

January 2025 is reproduced in the reasoned opinion of the Board in

Section 2.2 of this press release.

6. AVAILABILITY OF OTHER INFORMATION ABOUT

THE COMPANY

The other information relating to notably the legal, financial

and accounting characteristics of the Company will be filed with

the AMF by no later than the day preceding the opening of the

Offer. Pursuant to Article 231-28 of the AMF General Regulation,

such information will be available on the websites of the Company

(www.exclusive-networks.com) and of the AMF (www.amf-france.org) on

the day preceding the opening of the Offer and may be obtained free

of charge from the registered office of the Company, 20 quai du

Point du Jour 92100 Boulogne-Billancourt, France.

A press release will be issued to inform the public of the

arrangements for making this information available.

IMPORTANT NOTICE

This press release was prepared for

informational purposes only. It does not constitute an offer to the

public. The distribution of this press release, the Offer, and its

acceptance may be subject to specific regulations or restrictions

in certain countries. The Offer is not addressed to individuals

subject to such restrictions, either directly or indirectly, and

cannot be accepted from a country where the Offer would be subject

to such restrictions. This press release is not intended for

distribution in those countries. Consequently, individuals in

possession of this press release are required to inquire about any

local restrictions that may apply and comply with them.

Exclusive Networks disclaims any

responsibility for any potential violation of these restrictions by

any individual.

1 Following payment by the Company of an exceptional

distribution of an amount of EUR 5.29 per share on 16 December

2024. 2 Based on a share capital comprising 91,670,286 Shares and a

total number of 91,670,286 theoretical voting rights as at 31

December 2024. 3 On 20 December 2024, the Offeror declared having

acquired, on 19 December 2024, 8,864,326 Shares (i.e., 30% of the

existing Shares targeted by the Offer) in accordance with Article

231-38 of the AMF General Regulation. 4 Based on a share capital

comprising 91,670,286 Shares and a total number of 91,670,286

theoretical voting rights as at 31 December 2024. 5 It being

specified that (i) Olivier Breittmayer definitively transferred all

of his 17,826 shares in the Company to the Offeror on 17 December

2024, (ii) Paul-Philippe Bernier returned all of his 1,000 shares

in the Company that were lent to him by Bpifrance Investissement on

14 January 2025, and (iii) Gregory Laï has not yet purchased any

shares in the Company due to his recent co-optation on 18 December

2024. 6 The balance of the shares held by Jesper Trolle (63,292

shares) cannot be tendered as these shares are subject to a

retention obligation under article L. 225-197-1 of the French

Commercial Code. 7 From which will be deducted the shares covered

by the contribution undertakings to UK Midco (described in Section

7.5 of the Draft Response Document).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250116052689/en/

Exclusive Networks

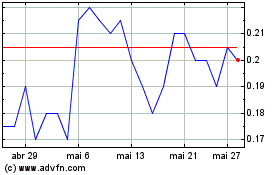

Excellon Resources (TSX:EXN)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Excellon Resources (TSX:EXN)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025