Issues Statement in Response to Ancora

United States Steel Corporation (NYSE: X) (“U. S. Steel” or the

“Company”) today issued the following statement in response to the

submission by Ancora Catalyst Institutional, LP (“Ancora”), who has

a reported 0.18% stake in the Company, of nine nominees to stand

for election to the U. S. Steel Board of Directors at the Company’s

2025 Annual Meeting of Stockholders (“2025 Annual Meeting”):

U. S. Steel has an experienced and

independent Board of Directors (the “Board”) with a proven track

record of acting in the best interests of the Company and creating

value for stockholders – as evidenced by their tireless efforts

over the past year to complete the Company’s value-maximizing

transaction with Nippon Steel and deliver $55.00 per share for its

stockholders. Our Board has taken every action to deliver value,

including running a robust strategic alternatives process, which

resulted in a 142% premium to the unaffected closing price of

$22.72 on August 11, 2023.

We remain confident that our partnership with

Nippon Steel is the best deal for American steel, American jobs,

American communities and American supply chains. With Nippon Steel,

U. S. Steel remains an American company and its headquarters will

stay in Pittsburgh, its iconic name will not change, and its

products will remain mined, melted and made in America. U. S.

Steel’s partnership with Nippon Steel is the only path that enables

the necessary know-how, technology and investments to secure the

future of U. S. Steel – including no less than $1 billion to Mon

Valley Works and approximately $300 million to Gary Works as part

of the $2.7 billion committed to invest in BLA-covered facilities.

The transaction has received overwhelming support from our

stockholders, communities and employees – including local union

leadership.

Ancora’s interests are not aligned with all U. S. Steel stockholders.

Our stockholders will not be well served by turning over control of

the Company to Ancora. We are also concerned about the motivations

behind these nominations, given Ancora’s and Alan Kestenbaum’s

recent dealings with failed bidder Cleveland-Cliffs.

The Board will present its recommendation regarding director

nominees in the Company’s proxy statement and other materials, to

be filed with the Securities and Exchange Commission and mailed to

all stockholders eligible to vote at the 2025 Annual Meeting. The

2025 Annual Meeting has not yet been scheduled and no stockholder

action is required at this time.

About U. S. Steel

Founded in 1901, U. S. Steel is a leading steel manufacturer.

With an unwavering focus on safety, the Company’s customer-centric

Best for All® strategy is advancing a more secure, sustainable

future for U. S. Steel and its stakeholders. With a renewed

emphasis on innovation, U. S. Steel serves the automotive,

construction, appliance, energy, containers, and packaging

industries with high value-added steel products. The Company also

maintains advanced iron ore production and has an annual raw

steelmaking capability of 25.4 million net tons. U. S. Steel is

headquartered in Pittsburgh, Pennsylvania, with world-class

operations across the United States and in Central Europe. For more

information, please visit: www.ussteel.com.

IMPORTANT ADDITIONAL INFORMATION REGARDING PROXY

SOLICITATION

United States Steel Corporation (the “Company”) intends to file a proxy statement and

WHITE proxy card with the Securities and Exchange Commission

(“SEC”) in connection with the

solicitation of proxies for the Company’s 2025 Annual Meeting of

Stockholders (the “Proxy Statement”

and such meeting the “2025 Annual

Meeting”). The Company, its directors and certain of its

executive officers and employees may be deemed to be participants

in the solicitation of proxies from the Company’s stockholders in

respect of the 2025 Annual Meeting. Information regarding the

directors and executive officers of the Company who may, under the

rules of the SEC, be deemed participants in the solicitation of the

Company’s stockholders in connection with the proposed transaction,

including a description of their direct or indirect interests, by

security holdings or otherwise, in the Company, is set forth in the

Company’s proxy statement for the 2024 Annual Meeting of

Stockholders, a definitive version of which was filed with the SEC

on March 15, 2024 and available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/1163302/000110465924035006/tm2332710d3_def14a.htm.

Please refer to the sections captioned “Stock Ownership of

Directors and Executive Officers”, “Corporation Governance –

Director Compensation”, and “Executive Compensation Tables” in the

2024 proxy statement. To the extent holdings of such participants

in the Company’s securities have changed since the amounts

described in the 2024 proxy statement, such changes have been

reflected on Initial Statements of Beneficial Ownership on Form 3

or Statements of Change in Ownership on Form 4 filed with the SEC.

Additional information can also be found in the Company’s Annual

Report on Form 10-K for the year ended December 31, 2023, filed

with the SEC on February 2, 2024 and available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/1163302/000116330224000009/x-20231231.htm.

Details concerning the nominees of the Company’s Board of Directors

for election at the 2025 Annual Meeting will be included in the

Proxy Statement. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S

STOCKHOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR

FURNISHED TO OR TO BE FILED WITH OR FURNISHED TO THE SEC, INCLUDING

THE PROXY STATEMENT, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO

THOSE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

These documents, including the definitive Proxy Statement when

available (and any amendments or supplements thereto) and other

documents filed by the Company with the SEC, are available for no

charge at the SEC’s website (www.sec.gov). Copies of the definitive

Proxy Statement (when available) and the other documents filed with

the SEC by the Company can also be obtained, without charge, by

directing a request to United States Steel Corporation, 600 Grant

Street, Suite 1884, Pittsburgh, Pennsylvania 15219, Attention:

Corporate Secretary; telephone 412-433-1121, or from the Company’s

website www.ussteel.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains information regarding U. S. Steel

and Nippon Steel that may constitute “forward-looking statements,”

as that term is defined under the Private Securities Litigation

Reform Act of 1995 and other securities laws, that are subject to

risks and uncertainties. We intend the forward-looking statements

to be covered by the safe harbor provisions for forward-looking

statements in those sections. Generally, we have identified such

forward-looking statements by using the words “believe,” “expect,”

“intend,” “estimate,” “anticipate,” “project,” “target,”

“forecast,” “aim,” “should,” “plan,” “goal,” “future,” “will,”

“may” and similar expressions or by using future dates in

connection with any discussion of, among other things, statements

expressing general views about trends, events or developments that

we expect or anticipate will occur in the future, potential changes

in the global economic environment, anticipated capital

expenditures, the construction or operation of new or existing

facilities or capabilities and the costs associated with such

matters, as well as statements regarding the proposed transaction,

including the timing of the completion of the transaction. However,

the absence of these words or similar expressions does not mean

that a statement is not forward-looking. Forward-looking statements

include all statements that are not historical facts, but instead

represent only U. S. Steel’s beliefs regarding future goals, plans

and expectations about our prospects for the future and other

events, many of which, by their nature, are inherently uncertain

and outside of U. S. Steel’s or Nippon Steel’s control and may

differ, possibly materially, from the anticipated events indicated

in these forward-looking statements. Management of U. S. Steel or

Nippon Steel, as applicable, believes that these forward-looking

statements are reasonable as of the time made. However, caution

should be taken not to place undue reliance on any such

forward-looking statements because such statements speak only as of

the date when made. In addition, forward looking statements are

subject to certain risks and uncertainties that could cause actual

results to differ materially from U. S. Steel’s or Nippon Steel’s

historical experience and our present expectations or projections.

Risks and uncertainties include without limitation: the ability of

the parties to consummate the proposed transaction, on a timely

basis or at all; the occurrence of any event, change or other

circumstances that could give rise to the termination of the

definitive agreement and plan of merger relating to the proposed

transaction (the “Merger Agreement”); risks arising from

transaction-related litigation, either brought by or against the

parties; the risk that the parties to the Merger Agreement may not

be able to satisfy the conditions to the proposed transaction in a

timely manner or at all; risks related to disruption of management

time from ongoing business operations due to the proposed

transaction and related litigation; certain restrictions during the

pendency of the proposed transaction that may impact U. S. Steel’s

ability to pursue certain business opportunities or strategic

transactions; the risk that any announcements relating to the

proposed transaction could have adverse effects on the market price

of U. S. Steel’s common stock or Nippon Steel’s common stock or

American Depositary Receipts; the risk of any unexpected costs or

expenses resulting from the proposed transaction; the risk that the

proposed transaction and its announcement could have an adverse

effect on the ability of U. S. Steel or Nippon Steel to retain

customers and retain and hire key personnel and maintain

relationships with customers, suppliers, employees, stockholders

and other business relationships and on its operating results and

business generally; and the risk the pending proposed transaction

could distract management of U. S. Steel. U. S. Steel directs

readers to its Form 10-K for the year ended December 31, 2023 and

Quarterly Report on Form 10-Q for the quarter ended September 30,

2024, and the other documents it files with the SEC for other risks

associated with U. S. Steel’s future performance. These documents

contain and identify important factors that could cause actual

results to differ materially from those contained in the

forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250126107771/en/

U. S. Steel Contacts Media Corporate

Communications T- 412-433-1300 E- media@uss.com

Kelly Sullivan / Ed Trissel Joele Frank, Wilkinson

Brimmer Katcher T- 212-355-4449

Investors Emily Chieng Investor Relations Officer

T – 412-618-9554 E – ecchieng@uss.com

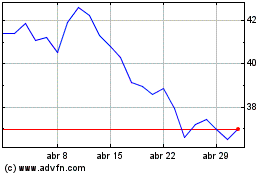

US Steel (NYSE:X)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

US Steel (NYSE:X)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025