- Subscription revenues of $2,866 million in Q4 2024,

representing 21% year-over-year growth, 21% in constant

currency

- Total revenues of $2,957 million in Q4 2024, representing 21%

year-over-year growth, 21% in constant currency

- Current remaining performance obligations of $10.27 billion as

of Q4 2024, representing 19% year-over-year growth, 22% in constant

currency

- Remaining performance obligations of $22.3 billion as of Q4

2024, representing 23% year-over-year growth, 26% in constant

currency

- Nearly 500 customers with more than $5 million in ACV,

representing 21% year-over-year growth

- ServiceNow's Board of Directors authorizes additional

repurchases of up to $3 billion of common stock under share

repurchase program with the primary objective of managing the

impact of dilution

ServiceNow (NYSE: NOW), the AI platform for business

transformation, today announced financial results for its fourth

quarter ended December 31, 2024, with subscription revenues of

$2,866 million in Q4 2024, representing 21% year-over-year growth

and 21% in constant currency.

“ServiceNow closed out the year exceeding Q4 expectations on top

of our ‘beat and raise’ track record,” said ServiceNow Chairman and

CEO Bill McDermott. “AI is fueling a top to bottom re-ordering of

the enterprise technology landscape. Leaders are embracing the

ServiceNow Platform as their AI agent control tower to unlock

exponential productivity and seamlessly orchestrate end-to-end

business transformation. We are still in the early days of a

massive opportunity. ServiceNow’s innovation, growth, and

profitability put us in a class of one.”

As of December 31, 2024, current remaining performance

obligations (“cRPO”), contract revenue that will be recognized as

revenue in the next 12 months, was $10.27 billion, representing 19%

year-over-year growth and 22% in constant currency. The company now

has 2,109 customers with more than $1 million in annual contract

value (“ACV”), representing 12% year-over-year growth in customers,

and nearly 500 customers with more than $5 million in ACV,

representing 21% year-over-year growth.

“Q4 was a great quarter, capping a year of incredible innovation

and execution,” said ServiceNow President and CFO Gina Mastantuono.

“Our GenAI net new ACV stepped up meaningfully in Q4, as the number

of Now Assist service desk deals grew over 150%

quarter-over-quarter. We’re just scratching the surface of what’s

possible. The moves we’re making in 2025 aren’t just about

maintaining our lead—they’re about expanding it. We are setting

ourselves up to define the future of agent-powered automation,

solidify ServiceNow as the AI Platform for Business Transformation,

and deliver strong growth year after year.”

Recent Business Highlights

Innovation

- Building on its leadership position in AI, ServiceNow today

announced the latest breakthrough in the ServiceNow Platform,

positioning it as the AI agent control tower. These innovations—a

powerful new AI Agent Orchestrator to harmonize teams of AI agents

working across tasks, systems, and departments, thousands of

pre-built AI agents for every workflow, plus the new AI Agent

Studio for building fully customized AI agents—will be available in

March 2025 as part of ServiceNow’s Pro Plus and Enterprise Plus

offerings to help accelerate enterprise AI agent adoption. As part

of the single, trusted ServiceNow Platform, these capabilities

build on the company's two-decade expertise driving exponential

productivity across every person and every process by handling

complex and ambiguous tasks that traditional automation cannot

solve.

- During the quarter, ServiceNow continued to advance its

innovation roadmap, releasing more than 150 new GenAI innovations

for autonomous, responsible AI on the ServiceNow Platform. This

included expanded capabilities to drive greater visibility and

controls with an AI Governance tool for secure and compliant AI

practices, multilingual support, and purpose-built GenAI solutions

for configuration management, contract management, legal services,

and health and safety.

Partnerships and Acquisitions

- ServiceNow continues to partner with leading companies to

accelerate customers’ AI transformation, today announcing the

latest expansions to its technology partner ecosystem.

- ServiceNow and Google Cloud will broaden their partnership to

launch ServiceNow on Google Cloud Marketplace and Google

Distributed Cloud, as well as integrate ServiceNow Workflow Data

Fabric and cross-enterprise workflows with Google Cloud AI’s

infrastructure, development platforms, and productivity tools, to

address demand from private- and public-sector enterprises.

- ServiceNow and Oracle will expand ServiceNow's Workflow Data

Fabric capabilities through an integration with Oracle data

sources, turning insights into action for enhanced decision-making

and agility.

- ServiceNow and SoftwareOne Holding AG entered a multi-year

strategic partnership to empower mutual customers to maximize the

ROI of their software and cloud investments.

- ServiceNow and Visa expanded their strategic alliance to

streamline costly, lengthy payment card dispute resolutions for

financial institutions worldwide.

- Additional partnerships during the quarter included:

- ServiceNow and ASDA with an expanded collaboration to improve

employee and shopper experiences by uniting operations across

technology, customer, and employee workflows.

- ServiceNow and AWS with new capabilities to accelerate AI

transformation.

- ServiceNow and Five9 with a turnkey AI-powered solution for

unified employee and customer experiences.

- ServiceNow and Microsoft with a vision to modernize the

front-office with Microsoft Copilot and ServiceNow AI Agents,

leveraging the unique strengths of both platforms to solve customer

problems.

- Earlier in January, ServiceNow announced its acquisition of

AI-native conversation data analysis platform Cuein, which will

advance the development of next generation AI agents on the

ServiceNow Platform.

- In Q4, the company also acquired Mission Secure to strengthen

operational technology (OT) services for customers in industrial

markets and provide them with increased visibility and context into

their OT environments, improving decision-making and reducing

downtime.

Investment

- Given ServiceNow’s strong cash position and its strategy of

managing the impact of dilution, the Board of Directors authorized

additional repurchases of up to $3 billion of common stock under

its share repurchase program.1

- ServiceNow repurchased approximately 293,000 shares of its

common stock for $296 million as part of its share repurchase

program, with the primary objective of managing the impact of

dilution. Of the original authorized amount of $1.5 billion,

approximately $266 million remains available for future share

repurchases.

Recognition

- On January 15, ServiceNow announced that it was named a Leader

in the 2024 Gartner® Magic Quadrant™ for CRM Customer Engagement

Center based on an evaluation of its Completeness of Vision and

Ability to Execute.2 During the quarter, ServiceNow was named a

Leader in the first ever 2024 Gartner® Magic Quadrant™ for AI

Applications in IT Service Management (ITSM).3 ServiceNow also was

named a Leader in The Forrester Wave™: Task-Centric Automation

Software, Q4 2024.4

- As a testament to its world-class reputation and culture,

ServiceNow today announced it was again recognized on the Fortune®

World’s Most Admired Companies 2025™ list.5 During the quarter,

ServiceNow also earned a spot on the American Opportunity Index,

ranking No. 1 in the software category and No. 5 overall out of

nearly 400 companies. The company also ranked second on the Forbes

Most Trusted Companies in America 2025 list, in addition to placing

on Fast Company 100 Best Workplaces for Innovators 2024, Fortune®

Best Workplaces for Women 20245, and more.

Executive Leadership

- As ServiceNow continues to scale and sharpen its focus on

strategic growth, its executive leadership team is essential to

realizing its position as the enterprise AI leader. Therefore, the

company is announcing the following executive role expansions: Gina

Mastantuono as president and chief financial officer; Chris Bedi as

chief customer officer and special advisor to the chairman for AI

transformation; Paul Smith as president of global customer and

field operations; Jacqui Canney as chief people and AI enablement

officer; and Nick Tzitzon as vice chair.

(1)

The program does not have a fixed

expiration date, may be suspended, or discontinued at any time, and

does not obligate ServiceNow to acquire any amount of its common

stock. The timing, manner, price, and amount of any repurchases

will be determined by ServiceNow at its discretion and will depend

on a variety of factors, including business, economic and market

conditions, prevailing stock prices, corporate and regulatory

requirements, and other considerations.

(2)

Gartner, “Magic Quadrant for the CRM

Customer Engagement Center,” by Pri Rathnayake, Drew Kraus, Wynn

White, December 11, 2024.

(3)

Gartner, Inc., “Magic Quadrant for

Artificial Intelligence Applications in IT Service Management,” by

Chris Matchett, Rich Doheny, Chris Laske, Ankita Hundal, October 9,

2024.

(4)

Forrester Research, “The Forrester Wave™:

Task-Centric Automation Software, Q4 2024,” by Bernhard Schaffrik

with Pascal Matzke, Faith Born, Kara Hartig, December 5, 2024.

(5)

©2025 Fortune Media IP Limited. All rights

reserved. Used under license. Fortune is a registered trademark and

Fortune World’s Most Admired Companies™ is a trademark of Fortune

Media IP Limited and are used under license. Fortune and Fortune

Media IP Limited are not affiliated with, and do not endorse the

products or services of, ServiceNow.

Gartner Disclaimer

The Gartner content described herein, (the "Gartner Content")

represents research opinion or viewpoints published, as part of a

syndicated subscription service, by Gartner, Inc. ("Gartner"), and

is not representation of fact. Gartner Content speaks as of its

original publication date (and not as of the date of this earnings

call and the opinions expressed in the Gartner Content are subject

to change without notice.

Gartner does not endorse any vendor, product or service depicted

in its research publications, and does not advise technology users

to select only those vendors with the highest ratings or other

designation. Gartner research publications consist of the opinions

of Gartner's research organization and should not be construed as

statements of fact. Gartner disclaims all warranties, expressed or

implied, with respect to this research, including any warranties of

merchantability or fitness for a particular purpose.

GARTNER is a registered trademark and service mark of Gartner,

Inc. and/or its affiliates in the U.S. and internationally, and

MAGIC QUADRANT is a registered trademark of Gartner, Inc. And/or

its affiliates and are used herein with permission. All rights

reserved.

Forrester Disclaimer

Forrester does not endorse any company, product, brand, or

service included in its research publications and does not advise

any person to select the products or services of any company or

brand based on the ratings included in such publications.

Information is based on the best available resources. Opinions

reflect judgment at the time and are subject to change. For more

information, read about Forrester’s objectivity at

www.forrester.com/about-us/objectivity/.

Fourth Quarter 2024 GAAP and Non-GAAP Results:

The following table summarizes our financial results for the

fourth quarter 2024:

Fourth Quarter 2024 GAAP

Results

Fourth Quarter 2024 Non-GAAP

Results(1)

Amount ($

millions)

Year/Year Growth

(%)

Amount ($

millions)(3)

Year/Year Growth

(%)

Subscription revenues

$2,866

21%

$2,859

21%

Professional services and other

revenues

$91

26%

$91

26.5%

Total revenues

$2,957

21%

$2,950

21%

Amount ($

billions)

Year/Year Growth

(%)

Amount ($ billions)(3)

Year/Year Growth

(%)

cRPO

$10.27

19%

$10.49

22%

RPO

$22.3

23%

$22.7

26%

Amount ($

millions)

Margin (%)

Amount ($

millions)(2)

Margin (%)(2)

Subscription gross profit

$2,330

81%

$2,416

84.5%

Professional services and other

gross (loss) profit

($4)

(4%)

$7

8.5%

Total gross profit

$2,326

79%

$2,423

82%

Income from operations

$374

13%

$872

29.5%

Net cash provided by operating

activities

$1,635

55%

Free cash flow

$1,400

47.5%

Amount ($

millions)

Earnings per Basic/Diluted

Share ($)

Amount ($

millions)(2)

Earnings per

Basic/Diluted Share ($)(2)

Net income

$384

$1.86 / $1.83

$769

$3.72 / $3.67

(1)

We report non-GAAP financial measures in

addition to, and not as a substitute for, or superior to, financial

measures calculated in accordance with GAAP. See the section

entitled “Statement Regarding Use of Non-GAAP Financial Measures”

for an explanation of non-GAAP measures.

(2)

Refer to the table entitled “GAAP to

Non-GAAP Reconciliation” for a reconciliation of GAAP to non-GAAP

measures.

(3)

Non-GAAP subscription revenues and total

revenues are adjusted for constant currency by excluding effects of

foreign currency rate fluctuations and any gains or losses from

foreign currency hedge contracts. Professional services and other

revenues, cRPO, and RPO are adjusted only for constant currency.

See the section entitled “Statement Regarding Use of Non-GAAP

Financial Measures” for an explanation of non-GAAP measures.

Note: Numbers rounded for presentation

purposes and may not foot.

Full-Year 2024 GAAP and Non-GAAP Results:

The following table summarizes our financial results for the

full-year 2024:

Full-Year 2024 GAAP

Results

Full-Year 2024 Non-GAAP

Results(1)

Amount ($

millions)

Year/Year Growth

(%)

Amount ($

millions)(3)

Year/Year Growth

(%)

Subscription revenues

$10,646

23%

$10,639

22.5%

Professional services and other

revenues

$338

16%

$337

16%

Total revenues

$10,984

22%

$10,976

22.5%

Amount ($

billions)

Year/Year Growth

(%)

Amount ($ billions)(3)

Year/Year Growth

(%)

cRPO

$10.27

19%

$10.49

22%

RPO

$22.3

23%

$22.7

26%

Amount ($

millions)

Margin (%)

Amount ($

millions)(2)

Margin (%)(2)

Subscription gross profit

$8,704

82%

$9,038

85%

Professional services and other

gross (loss) profit

($7)

(2%)

$39

11.5%

Total gross profit

$8,697

79%

$9,077

82.5%

Income from operations

$1,364

12%

$3,254

29.5%

Net cash provided by operating

activities

$4,267

39%

Free cash flow

$3,455

31.5%

Amount ($

millions)

Earnings per Basic/Diluted

Share ($)

Amount ($

millions)(2)

Earnings per

Basic/Diluted Share ($)(2)

Net income

$1,425

$6.92 / $6.84

$2,902

$14.10 / $13.92

(1)

We report non-GAAP financial measures in

addition to, and not as a substitute for, or superior to, financial

measures calculated in accordance with GAAP. See the section

entitled “Statement Regarding Use of Non-GAAP Financial Measures”

for an explanation of non-GAAP measures, and the table entitled

“GAAP to Non-GAAP Reconciliation” for a reconciliation of GAAP to

non-GAAP measures.

(2)

Refer to the table entitled “GAAP to

Non-GAAP Reconciliation” for a reconciliation of GAAP to non-GAAP

measures.

(3)

Non-GAAP subscription revenues and total

revenues are adjusted for constant currency by excluding effects of

foreign currency rate fluctuations and any gains or losses from

foreign currency hedge contracts. Professional services and other

revenues, cRPO, and RPO are adjusted only for constant currency.

See the section entitled “Statement Regarding Use of Non-GAAP

Financial Measures” for an explanation of non-GAAP measures.

Note: Numbers rounded for presentation

purposes and may not foot.

Financial Outlook

Our guidance includes GAAP and non‑GAAP financial measures. The

non‑GAAP growth rates for subscription revenues are adjusted for

constant currency by excluding the effects of foreign currency rate

fluctuations and any gains or losses from foreign currency hedge

contracts, and the non-GAAP growth rates for cRPO are adjusted only

for constant currency to provide better visibility into the

underlying business trends.

Since September 30, 2024, ServiceNow has seen an incremental

strengthening of the U.S. dollar, resulting in a foreign exchange

(“FX”) headwind of approximately $175 million for 2025 subscription

revenues, which includes $40 million in Q1 2025, and $205 million

for Q1 2025 cRPO.

Our guidance assumes a more pronounced second-half weighted

linearity in our U.S. Federal business due to seasonality from the

change in presidential administration.

In 2025, we will begin shifting more of our business model to

include elements of consumption-based monetization across our AI

and data solutions. For instance, we will include our new AI Agents

in our Pro Plus and Enterprise Plus SKUs, forgoing upfront

incremental new subscriptions to instead drive accelerated adoption

and monetize increasing usage over time. We are also optimizing

certain aspects of our go-to-market approach and creating more

integrated solutions that we will announce at Knowledge 2025. Our

guidance prudently reflects the flexibility to make these moves

while delivering further free cash flow generation. Our free cash

flow margin guidance reflects incremental expansion, building on

the accelerated trajectory driven by our 2024 outperformance.

The following table summarizes our guidance for the first

quarter 2025:

First Quarter 2025 GAAP

Guidance

First Quarter 2025

Non-GAAP Guidance(1)

Amount ($ millions)(3)

Year/Year Growth

(%)(3)

Constant Currency Year/Year

Growth (%)

Subscription revenues

$2,995 - $3,000

18.5% - 19%

19.5% - 20%

cRPO

19.5%

20.5%

Margin (%)(2)

Income from operations

30%

Amount

(millions)

Weighted-average shares used to compute

diluted net income per share

210

(1)

We report non-GAAP financial measures in

addition to, and not as a substitute for, or superior to, financial

measures calculated in accordance with GAAP. See the section

entitled “Statement Regarding Use of Non-GAAP Financial Measures”

for an explanation of non-GAAP measures.

(2)

Refer to the table entitled

“Reconciliation of Non-GAAP Financial Guidance” for a

reconciliation of GAAP to non-GAAP measures.

(3)

Guidance for GAAP subscription revenues

and GAAP subscription revenues and cRPO growth rates are based on

the 31-day average of foreign exchange rates for December 2024 for

entities reporting in currencies other than U.S. Dollars.

The following table summarizes our guidance for the full-year

2025:

Full-Year 2025 GAAP

Guidance

Full-Year 2025 Non-GAAP

Guidance(1)

Amount ($ millions)(3)

Year/Year Growth

(%)(3)

Constant Currency

Year/Year Growth (%)

Subscription revenues

$12,635 - $12,675

18.5% - 19%

19.5% - 20%

Margin (%)(2)

Subscription gross profit

83.5%

Income from operations

30.5%

Free cash flow

32%

Amount

(millions)

Weighted-average shares used to compute

diluted net income per share

210

(1)

We report non-GAAP financial measures in

addition to, and not as a substitute for, or superior to, financial

measures calculated in accordance with GAAP. See the section

entitled “Statement Regarding Use of Non-GAAP Financial Measures”

for an explanation of non-GAAP measures.

(2)

Refer to the table entitled

“Reconciliation of Non-GAAP Financial Guidance” for a

reconciliation of GAAP to non-GAAP measures.

(3)

GAAP subscription revenues and related

growth rate for the future quarter included in our full-year 2025

guidance are based on the 31-day average of foreign exchange rates

for December 2024 for entities reporting in currencies other than

U.S. Dollars.

Note: Numbers are rounded for presentation purposes

and may not foot.

Conference Call Details

The conference call will begin at 2 p.m. Pacific Time (22:00

GMT) on January 29, 2025. Interested parties may listen to the call

by dialing (888) 596-4144 (Passcode: 8135303), or if outside North

America, by dialing (646) 968‑2525 (Passcode: 8135303). Individuals

may access the live teleconference from this webcast.

https://events.q4inc.com/attendee/426481593

An audio replay of the conference call and webcast will be

available two hours after its completion and will be accessible for

30 days. To hear the replay, interested parties may go to the

investor relations section of the ServiceNow website or dial (800)

770‑2030 (Passcode: 8135303), or if outside North America, by

dialing (609) 800‑9909 (Passcode: 8135303).

Investor Presentation Details

An investor presentation providing additional information,

including forward-looking guidance, and analysis can be found at

https://investors.servicenow.com.

Upcoming Investor Conferences

ServiceNow today announced that ServiceNow Chairman and Chief

Executive Officer Bill McDermott will participate in a fireside

chat at the Morgan Stanley Technology, Media & Telecom

Conference on Monday, March 3, 2025, at 11:30 a.m. PT.

The live webcast will be accessible on the investor relations

section of the ServiceNow website at

https://investors.servicenow.com and archived on the ServiceNow

site for a period of 30 days.

Statement Regarding Use of Non-GAAP Financial

Measures

We use the following non-GAAP financial measures in addition to,

and not as a substitute for, or superior to, financial measures

calculated in accordance with GAAP.

- Revenues. We adjust revenues and related growth rates for

constant currency to provide a framework for assessing how our

business performed excluding the effect of foreign currency rate

fluctuations and any gains or losses from foreign currency hedge

contracts that are reported in the current and comparative period.

To exclude the effect of foreign currency rate fluctuations,

current period results for entities reporting in currencies other

than U.S. Dollars (“USD”) are converted into USD at the average

exchange rates in effect during the comparison period (for Q4 2023,

the average exchange rates in effect for our major currencies were

1 USD to 0.93 Euros and 1 USD to 0.81 British Pound Sterling

(“GBP”)), rather than the actual average exchange rates in effect

during the current period (for Q4 2024, the average exchange rates

in effect for our major currencies were 1 USD to 0.94 Euros and 1

USD to 0.78 GBP). Guidance for related growth rates is derived by

applying the average exchange rates in effect during the comparison

period, rather than the exchange rates for the guidance period,

adjusted for any foreign currency hedging effects. We believe the

presentation of revenues and related growth rates adjusted for

constant currency facilitates the comparison of revenues

year-over-year.

- Remaining performance obligations and current remaining

performance obligations. We adjust cRPO and remaining performance

obligations (“RPO”) and related growth rates for constant currency

to provide a framework for assessing how our business performed. To

present this information, current period results for entities

reporting in currencies other than USD are converted into USD at

the exchange rates in effect at the end of the comparison period

(for Q4 2023, the end of the period exchange rates in effect for

our major currencies were 1 USD to 0.91 Euros and 1 USD to 0.79

GBP), rather than the actual end of the period exchange rates in

effect during the current period (for Q4 2024, the end of the

period exchange rates in effect for our major currencies were 1 USD

to 0.96 Euros and 1 USD to 0.80 GBP). Guidance for the related

growth rate is derived by applying the end of period exchange rates

in effect during the comparison period rather than the exchange

rates in effect during the guidance period. We believe the

presentation of cRPO and RPO and related growth rates adjusted for

constant currency facilitates the comparison of cRPO and RPO

year-over-year, respectively.

- Gross profit, Income from operations, Net income and Net income

per share - diluted. Our non-GAAP presentation of gross profit,

income from operations, and net income measures exclude certain

non-cash or non-recurring items, including stock-based compensation

expense, amortization of debt discount and issuance costs related

to our convertible senior notes, loss on early note conversions,

amortization of purchased intangibles, legal settlements, business

combination and other related costs, income tax effects and

adjustments, and the income tax benefit from the release of a

valuation allowance on deferred tax assets. The non-GAAP

weighted-average shares used to compute our non-GAAP net income per

share - diluted excludes the dilutive effect of the in-the-money

portion of convertible senior notes as they are covered by our note

hedges, and includes the dilutive effect of time-based stock

awards, the dilutive effect of warrants and the potentially

dilutive effect of our stock awards with performance conditions not

yet satisfied at forecasted attainment levels to the extent we

believe it is probable that the performance condition will be met.

We believe these adjustments provide useful supplemental

information to investors and facilitates the analysis of our

operating results and comparison of operating results across

reporting periods.

- Free cash flow. Free cash flow is defined as net cash provided

by operating activities plus cash outflows for legal settlements,

repayments of convertible senior notes attributable to debt

discount and business combination and other related costs including

compensation expense, reduced by purchases of property and

equipment. Free cash flow margin is calculated as free cash flow as

a percentage of total revenues. We believe information regarding

free cash flow and free cash flow margin provides useful

information to investors because it is an indicator of the strength

and performance of our business operations.

Our presentation of non-GAAP financial measures may not be

comparable to similar measures used by other companies. We

encourage investors to carefully consider our results under GAAP,

as well as our supplemental non-GAAP information and the

reconciliation between these presentations, to more fully

understand our business. Please see the tables included at the end

of this release for the reconciliation of GAAP and non-GAAP results

for gross profit, income from operations, net income, net income

per share, and free cash flow.

Use of Forward-Looking Statements

This release contains “forward-looking statements” regarding our

performance, including but not limited to statements in the section

entitled “Financial Outlook” and statements regarding the expected

benefits of our announced partnerships. Forward-looking statements

are subject to known and unknown risks and uncertainties and are

based on potentially inaccurate assumptions that could cause actual

results to differ materially from those expected or implied by the

forward-looking statements. If any such risks or uncertainties

materialize or if any of the assumptions prove incorrect, our

results could differ materially from the results expressed or

implied by the forward-looking statements we make.

Factors that may cause actual results to differ materially from

those in any forward-looking statements include, among others,

experiencing an actual or perceived cyber-security event or

weakness; our ability to comply with evolving privacy laws, data

transfer restrictions, and other foreign and domestic standards

related to data and the Internet; errors, interruptions, delays or

security breaches in or of our service or data centers; our ability

to maintain and attract key employees and manage workplace culture;

alleged violations of laws and regulations, including those

relating to anti-bribery and anti-corruption and those relating to

public sector contracting requirements; our ability to compete

successfully against existing and new competitors; our ability to

predict, prepare for and respond promptly to rapidly evolving

technological, market and customer developments; our ability to

grow our business, including converting remaining performance

obligations into revenue, adding and retaining customers, selling

additional subscriptions to existing customers, selling to larger

enterprises, government and regulated organizations with complex

sales cycles and certification processes, and entering new

geographies and markets; our ability to develop and gain customer

demand for and acceptance of existing, new and improved products

and services, including products that incorporate AI technology;

our ability to expand and maintain our partnerships and partner

programs, including expected market opportunity from such

relationships, and realize the anticipated benefits thereof; global

economic conditions; fluctuations in the value of foreign

currencies relative to the U.S. Dollar; fluctuations in interest

rates; our ability to consummate and realize the benefits of any

strategic transactions or acquisitions; the impact of armed

conflicts and bank failures on macroeconomic conditions; inflation;

our ability to execute share repurchases, including the timing,

manner, price, and amount of any repurchase; and fluctuations and

volatility in our stock price.

Further information on these and other factors that could affect

our financial results are included in our Form 10-K for the year

ended December 31, 2024, and in other filings we make with the

Securities and Exchange Commission from time to time.

We undertake no obligation, and do not intend, to update these

forward-looking statements, to review or confirm analysts’

expectations, or to provide interim reports or updates on the

progress of the current financial quarter.

About ServiceNow

ServiceNow (NYSE: NOW) is putting AI to work for people. We move

with the pace of innovation to help customers transform

organizations across every industry while upholding a trustworthy,

human centered approach to deploying our products and services at

scale. Our AI platform for business transformation connects people,

processes, data, and devices to increase productivity and maximize

business outcomes. For more information, visit:

www.servicenow.com.

© 2025 ServiceNow, Inc. All rights reserved. ServiceNow, the

ServiceNow logo, Now, and other ServiceNow marks are trademarks

and/or registered trademarks of ServiceNow, Inc. in the United

States and/or other countries. Other company names, product names,

and logos may be trademarks of the respective companies with which

they are associated.

ServiceNow, Inc.

Condensed Consolidated

Statements of Operations

(in millions, except per share

data)

(unaudited)

Three Months Ended

Year Ended

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Revenues:

Subscription

$

2,866

$

2,365

$

10,646

$

8,680

Professional services and other

91

72

338

291

Total revenues

2,957

2,437

10,984

8,971

Cost of revenues (1):

Subscription

536

443

1,942

1,606

Professional services and other

95

73

345

315

Total cost of revenues

631

516

2,287

1,921

Gross profit

2,326

1,921

8,697

7,050

Operating expenses (1):

Sales and marketing

1,027

847

3,854

3,301

Research and development

668

562

2,543

2,124

General and administrative

257

242

936

863

Total operating expenses

1,952

1,651

7,333

6,288

Income from operations

374

270

1,364

762

Interest income

106

86

419

302

Other expense, net

(17)

(9)

(45)

(56)

Income before income taxes

463

347

1,738

1,008

Provision for (benefit from) income

taxes

79

52

313

(723)

Net income

$

384

$

295

$

1,425

$

1,731

Net income per share - basic

$

1.86

$

1.44

$

6.92

$

8.48

Net income per share - diluted

$

1.83

$

1.43

$

6.84

$

8.42

Weighted-average shares used to compute

net income per share - basic

206

205

206

204

Weighted-average shares used to compute

net income per share - diluted

209

207

208

206

(1) Includes stock-based compensation as follows:

Three Months Ended

Year Ended

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Cost of revenues:

Subscription

$

66

$

54

$

250

$

202

Professional services and other

11

12

46

52

Operating expenses:

Sales and marketing

146

127

565

505

Research and development

176

149

655

579

General and administrative

55

71

230

266

ServiceNow, Inc.

Condensed Consolidated Balance

Sheets

(in millions)

December 31, 2024

December 31, 2023

(unaudited)

Assets

Current assets:

Cash and cash equivalents

$

2,304

$

1,897

Short-term investments

3,458

2,980

Accounts receivable, net

2,240

2,036

Current portion of deferred

commissions

517

461

Prepaid expenses and other current

assets

668

403

Total current assets

9,187

7,777

Deferred commissions, less current

portion

999

919

Long-term investments

4,111

3,203

Property and equipment, net

1,763

1,358

Operating lease right-of-use assets

693

715

Intangible assets, net

209

224

Goodwill

1,273

1,231

Deferred tax assets

1,385

1,508

Other assets

763

452

Total assets

$

20,383

$

17,387

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

68

$

126

Accrued expenses and other current

liabilities

1,369

1,365

Current portion of deferred revenue

6,819

5,785

Current portion of operating lease

liabilities

102

89

Total current liabilities

8,358

7,365

Deferred revenue, less current portion

95

81

Operating lease liabilities, less current

portion

687

707

Long-term debt, net

1,489

1,488

Other long-term liabilities

145

118

Stockholders’ equity

9,609

7,628

Total liabilities and stockholders’

equity

$

20,383

$

17,387

ServiceNow, Inc.

Condensed Consolidated

Statements of Cash Flows

(in millions)

(unaudited)

Three Months Ended

Year Ended

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Cash flows from operating

activities:

Net income

$

384

$

295

$

1,425

$

1,731

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

154

154

564

562

Amortization of deferred commissions

147

126

550

459

Stock-based compensation

454

413

1,746

1,604

Deferred income taxes

51

17

98

(857)

Other

(20)

13

(51)

—

Changes in operating assets and

liabilities, net of effect of business combinations:

Accounts receivable

(981)

(852)

(254)

(300)

Deferred commissions

(252)

(264)

(713)

(717)

Prepaid expenses and other assets

(65)

(20)

(332)

(203)

Accounts payable

(94)

46

(52)

(142)

Deferred revenue

1,534

1,302

1,179

1,085

Accrued expenses and other liabilities

323

375

107

176

Net cash provided by operating

activities

1,635

1,605

4,267

3,398

Cash flows from investing

activities:

Purchases of property and equipment

(253)

(261)

(852)

(694)

Business combinations, net of cash

acquired(1)

(31)

—

(113)

(279)

Purchases of other intangibles

(10)

—

(40)

(3)

Purchases of investments

(1,079)

(829)

(5,031)

(4,634)

Purchases of non-marketable

investments

(32)

(19)

(181)

(75)

Sales and maturities of investments

728

654

3,752

3,522

Other

(61)

11

(36)

(4)

Net cash used in investing activities

(738)

(444)

(2,501)

(2,167)

Cash flows from financing

activities:

Proceeds from employee stock plans

—

1

237

194

Repurchases of common stock

(296)

(256)

(696)

(538)

Taxes paid related to net share settlement

of equity awards

(175)

(126)

(700)

(459)

Business combination (1)

—

—

(184)

—

Net cash used in financing activities

(471)

(381)

(1,343)

(803)

Foreign currency effect on cash, cash

equivalents and restricted cash

(9)

5

(17)

1

Net change in cash, cash equivalents and

restricted cash

417

785

406

429

Cash, cash equivalents and restricted cash

at beginning of period

1,893

1,119

1,904

1,475

Cash, cash equivalents and restricted cash

at end of period

$

2,310

$

1,904

$

2,310

$

1,904

(1)

The year ended December 31, 2024 reflects

a reclassification of $184 million from investing activities to

financing activities related to the second installment payment made

in the acquisition of G2K Group GmbH during the three months ended

March 31, 2024.

ServiceNow, Inc.

GAAP to Non-GAAP

Reconciliation

(in millions, except per share

data)

(unaudited)

Three Months Ended

Year Ended

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Gross profit:

GAAP subscription gross profit

$

2,330

$

1,922

$

8,704

$

7,074

Stock-based compensation

66

54

250

202

Amortization of purchased intangibles

20

20

84

77

Non-GAAP subscription gross profit

$

2,416

$

1,996

$

9,038

$

7,353

GAAP professional services and other gross

loss

$

(4)

$

(1)

$

(7)

$

(24)

Stock-based compensation

11

12

46

52

Non-GAAP professional services and other

gross profit

$

7

$

11

$

39

$

28

GAAP gross profit

$

2,326

$

1,921

$

8,697

$

7,050

Stock-based compensation

77

66

296

254

Amortization of purchased intangibles

20

20

84

77

Non-GAAP gross profit

$

2,423

$

2,007

$

9,077

$

7,381

Gross margin:

GAAP subscription gross margin

81%

81%

82%

82%

Stock-based compensation as % of

subscription revenues

2%

2%

2%

2%

Amortization of purchased intangibles as %

of subscription revenues

1%

1%

1%

1%

Non-GAAP subscription gross margin

84.5%

84.5%

85%

84.5%

GAAP professional services and other gross

margin

(4%)

(1%)

(2%)

(8%)

Stock-based compensation as % of

professional services and other revenues

12%

17%

14%

18%

Non-GAAP professional services and other

gross margin

8.5%

15%

11.5%

9.5%

GAAP gross margin

79%

79%

79%

79%

Stock-based compensation as % of total

revenues

3%

3%

3%

3%

Amortization of purchased intangibles as %

of total revenues

1%

1%

1%

1%

Non-GAAP gross margin

82%

82.5%

82.5%

82.5%

Income from operations:

GAAP income from operations

$

374

$

270

$

1,364

$

762

Stock-based compensation

454

413

1,746

1,604

Amortization of purchased intangibles

23

22

94

85

Business combination and other related

costs

4

12

33

38

Legal settlements

17

—

17

$

—

Non-GAAP income from operations

$

872

$

717

$

3,254

$

2,489

Operating margin:

GAAP operating margin

13%

11%

12%

8%

Stock-based compensation as % of total

revenues

15%

17%

16%

18%

Amortization of purchased intangibles as %

of total revenues

1%

1%

1%

1%

Business combination and other related

costs as % of total revenues

—%

—%

—%

—%

Legal settlements as % of total

revenues

1%

—%

—%

—%

Non-GAAP operating margin

29.5%

29.5%

29.5%

27.5%

Net income:

GAAP net income

$

384

$

295

$

1,425

$

1,731

Stock-based compensation

454

413

1,746

1,604

Amortization of purchased intangibles

23

22

94

85

Business combination and other related

costs

4

12

33

38

Legal settlements

17

—

17

—

Income tax effects and adjustments(1)

(113)

(34)

(413)

(193)

Release of a valuation allowance on

deferred tax assets

—

(65)

—

(1,050)

Non-GAAP net income

$

769

$

643

$

2,902

$

2,215

Net income per share - basic and

diluted:

GAAP net income per share - basic

$

1.86

$

1.44

$

6.92

$

8.48

GAAP net income per share - diluted

$

1.83

$

1.43

$

6.84

$

8.42

Non-GAAP net income per share - basic

$

3.72

$

3.14

$

14.10

$

10.85

Non-GAAP net income per share -

diluted

$

3.67

$

3.11

$

13.92

$

10.78

Weighted-average shares used to compute

net income per share - basic

206

205

206

204

Weighted-average shares used to compute

net income per share - diluted

209

207

208

206

Free cash flow:

GAAP net cash provided by operating

activities

$

1,635

$

1,605

$

4,267

$

3,398

Purchases of property and equipment

(253)

(261)

(852)

(694)

Cash paid for legal settlements

17

—

17

—

Business combination and other related

costs

1

—

23

24

Non-GAAP free cash flow

$

1,400

$

1,344

$

3,455

$

2,728

Free cash flow margin:

GAAP net cash provided by operating

activities as % of total revenues

55%

66%

39%

38%

Purchases of property and equipment as %

of total revenues

(9%)

(11%)

(8%)

(8%)

Cash paid for legal settlements as % of

total revenues

1%

—%

—%

—%

Business combination and other related

costs as % of total revenues

—%

—%

—%

—%

Non-GAAP free cash flow margin

47.5%

55%

31.5%

30.5%

(1)

We use a non-GAAP effective tax rate for

evaluating our operating results to provide consistency across

reporting periods. Based on our long-term projections, we are using

a non-GAAP tax rate of 20% and 19% for the years ended December 31,

2024 and 2023, respectively. This non-GAAP tax rate could change

for various reasons including significant changes in our geographic

earnings mix or fundamental tax law changes in major jurisdictions

in which we operate.

Note: Numbers are rounded for presentation

purposes and may not foot.

ServiceNow, Inc.

Reconciliation of Non-GAAP

Financial Guidance

Three Months Ending

March 31, 2025

GAAP operating margin

13.5%

Stock-based compensation expense as % of

total revenues

16%

Amortization of purchased intangibles as %

of total revenues

1%

Business combination and other related

costs as % of total revenues

—%

Non-GAAP operating margin

30%

Twelve Months Ending

December 31, 2025

GAAP subscription gross margin

80.5%

Stock-based compensation expense as % of

subscription revenues

2%

Amortization of purchased intangibles as %

of subscription revenues

1%

Non-GAAP subscription margin

83.5%

GAAP operating margin

14%

Stock-based compensation expense as % of

total revenues

16%

Amortization of purchased intangibles as %

of total revenues

1%

Business combination and other related

costs as % of total revenues

—%

Non-GAAP operating margin

30.5%

GAAP net cash provided by operating

activities as % of total revenues

40%

Purchases of property and equipment as %

of total revenues

(8%)

Business combination and other related

costs as % of total revenues

—%

Non-GAAP free cash flow margin

32%

Note: Numbers are rounded for presentation

purposes and may not foot.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250129748610/en/

Media Contact: Johnna Hoff (408) 250-8644

press@servicenow.com

Investor Contact: Darren Yip (925) 388-7205

ir@servicenow.com

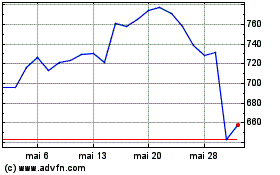

ServiceNow (NYSE:NOW)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

ServiceNow (NYSE:NOW)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025