(Ad hoc announcement pursuant to Article 53 of the SIX

Exchange Regulation Listing Rules)

Regulatory News:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250203802726/en/

Key highlights (Graphic: UBS Group

AG)

UBS (NYSE:UBS) (SWX:UBSN):

4Q24 and FY24 highlights

- 4Q24 PBT of USD 1.0bn and underlying1 PBT of USD 1.8bn,

up 198% YoY, net profit of USD 0.8bn, RoCET1 4.2% and

underlying RoCET1 of 7.2%

- FY24 PBT of USD 6.8bn and net profit of USD

5.1bn; underlying1 PBT of USD 8.8bn and underlying RoCET1 of

8.7%

- Franchise strength continues to drive client momentum

with USD 18bn of net new assets in Global Wealth Management for the

quarter and USD 97bn for FY24, Asset Management net new money of

USD 33bn in 4Q24 and USD 45bn in FY24; Group invested assets of USD

6.1trn, up 7% YoY; granted or renewed over CHF 70bn in loans in

Switzerland throughout the year

- High client activity in the fourth quarter, underlying

transaction-based income up double digits YoY in both GWM and

P&C; Investment Bank underlying revenues up 37% YoY with strong

growth in Global Banking and Global Markets leading to market share

gains in areas of strategic investments

- Integration on track with all key 2024 milestones

achieved significantly reducing the execution risk of Credit

Suisse acquisition; consolidated key operating entities and

successfully migrated wealth management client accounts across APAC

and Europe in the fourth quarter; continuing to decommission legacy

applications

- Delivered on cost-reduction ambitions with additional

USD 0.7bn in gross cost savings realized in 4Q24 for a total of USD

3.4bn in FY24; USD 7.5bn saved compared to 2022 baseline and

achieved almost 60% of planned cost saves

- Non-core wind-down well ahead of schedule, reduced risk

weighted assets by USD 3bn in 4Q24 to USD 41bn, down USD 33bn over

the course of FY24

- Maintained a strong capital position, UBS Group finished

the year with 14.3% CET1 capital ratio and 4.7% CET1 leverage

ratio, providing a solid capital buffer during integration, while

self-funding growth and returning capital to shareholders

- Completed USD 1bn in share buybacks and proposed dividend

payout of USD 0.90 per share, an increase of 29% YoY in line

with our intention to calibrate the proportion of cash dividends

and share repurchases

- Attractive capital returns to continue in 2025, accruing

for around 10% growth in dividend per share; plan to repurchase USD

1bn of shares in the first half of 2025 and aim to repurchase up to

an additional USD 2bn in the second half. Share repurchase levels

will be consistent with maintaining our target CET1 ratio of

~14%2

Investor update

highlights

- Confirming financial targets and ambitions for 2026 exit

rate and 20283, targeting underlying RoCET1 of ~15% and

underlying cost/income ratio of <70% as of 2026 exit rate; well

positioned to deliver long-term growth and higher returns with ~18%

reported RoCET1 in 2028

- Increasingly confident in substantially completing

integration by end-2026, majority of client-account transfers

in Switzerland and all the portfolio migrations in Asset Management

are set to be completed in 2025; expect to materially complete NCL

wind-down, as well as app and IT infrastructure decommissioning by

end-2026, unlocking substantial cost reductions

- On track to deliver USD ~13bn gross cost reductions by

end-2026 with cumulative integration expenses of USD ~14bn; USD

~2.5bn of gross cost saves expected in 2025

- Building on our attractive global business model and

diversified footprint, including investments in GWM Americas, a

key component of our business model, where we already started to

make changes to help improve operating leverage, increase

profitability and drive sustainable growth towards ~15% PBT margin

in 2027

- Continuing to invest in technology to drive business

outcomes, expanding cloud infrastructure and GenAI usage to

transform how we operate in terms of client service, efficiency and

security; on track with roll out of 50,000 Copilot licenses to UBS

employees

- Ongoing financial resource discipline to create room for

profitable growth with reductions in NCL footprint to create

USD ~15bn capacity for profitable growth in core franchises, mainly

GWM; Day 1 impact from Basel III finalization at USD 1bn

“Our strong full-year performance reflects our unwavering

commitment to serving our clients, the strength of our diversified

global franchise and the progress we have made on the integration.

Throughout 2024, we maintained robust momentum as we captured

growth in Global Wealth and Asset Management and gained market

share in the Investment Bank in the areas where we have made

strategic investments. With over 70 billion Swiss francs of loans

granted or renewed, we continued to be a reliable partner for the

Swiss economy.

We achieved all key integration milestones in 2024 and

significantly reduced execution risk, while our capital position

remained robust. In 2025, we will continue to execute on the next

phase of the integration with discipline and deliver on our

priorities. We are confident in our ability to substantially

complete the integration by the end of 2026, achieve our financial

targets, and fulfill our growth initiatives as we position UBS for

a successful future.” Sergio P. Ermotti, Group CEO

Selected financials for

4Q24

Profit before tax

Cost/income ratio

RoCET1 capital

Net profit

CET1 capital ratio

1.0

89.0

4.2

0.8

14.3

USD bn

%

%

USD bn

%

Underlying1

Underlying1

Underlying1

Diluted

CET1

profit before tax

cost/income ratio

RoCET1 capital

EPS

leverage ratio

1.8

81.9

7.2

0.23

4.7

USD bn

%

%

USD

%

Selected financials for

FY24

Profit before tax

Cost/income ratio

RoCET1 capital

Net profit

CET1 capital ratio

6.8

84.8

6.7

5.1

14.3

USD bn

%

%

USD bn

%

Underlying1

Underlying1

Underlying1

Diluted

CET1

profit before tax

cost/income ratio

RoCET1 capital

EPS

leverage ratio

8.8

79.5

8.7

1.52

4.7

USD bn

%

%

USD

%

Information in this news release is

presented for UBS Group AG on a consolidated basis unless otherwise

specified.

1 Underlying results exclude items

of profit or loss that management believes are not representative

of the underlying performance. Underlying results are a non-GAAP

financial measure and alternative performance measure (APM). Refer

to “Group Performance” and “Appendix-Alternative Performance

Measures” in the financial report for the fourth quarter of 2024

for a reconciliation of underlying to reported results and

definitions of the APMs; 2 Subject to maintaining our CET1

capital ratio target of ~14%, achieving our financial targets and

the absence of material and immediate changes to the current

capital regime in Switzerland; 3 All forward-looking

guidance assumes ~14% CET1 capital ratio.

4Q24 and FY24 Group

performance

Strong financial performance

In 4Q24, we reported PBT of USD 1,047m and underlying PBT of USD

1,768m. Net profit attributable to shareholders was USD 770m and

return on CET1 capital was 4.2%, or 7.2% on an underlying

basis.

Reported revenues were USD 11,635m, up 7% YoY. On an underlying

basis, revenues increased by 6% YoY to USD 11,059m, reflecting the

strength, scale and geographic diversity of our core businesses.

Reported Group operating expenses decreased by 10% YoY to USD

10,359m. On an underlying basis, operating expenses decreased by 6%

YoY to USD 9,062m as we continued to execute on our integration and

efficiency plans.

For the full-year, the reported net profit reached USD 5,085m,

with USD 2,877m in PPA accretion effects and other items directly

related to the integration and USD 4,766m in integration-related

expenses and other PPA effects, and return on CET1 capital of 6.7%,

or 8.7% on an underlying basis.

Maintained robust client momentum

During the fourth quarter, we remained close to our clients,

providing them with expert advice and solutions across franchises

to best leverage supportive market conditions. As demonstrated by

USD 18bn in net new assets in GWM and USD 13bn in net new fee

generating assets, clients continue to value our CIO-led advisory

and mandate solutions. With USD 97bn in NNA in 2024 we are well

positioned to deliver further growth of around USD 100bn in net new

assets in 2025. Group invested assets increased by 7% YoY to USD

6.1trn.

As a leading provider of credit to Swiss households and

corporates, we continue to deliver on our commitments to our home

market, having granted or renewed over CHF 70bn of loans in

Switzerland in 2024.

Transactional activity was strong during the quarter across both

private and institutional clients. In GWM, underlying

transaction-based income increased by 12% YoY with strong momentum

across all regions, led by Americas and APAC. In the IB, Global

Markets delivered revenues of USD 1.9bn, up 44% YoY, mainly driven

by higher client activity in equities and FX, showcasing the

strength of our expanded franchise, with gains across all regions,

particularly in the Americas. In Global Banking, underlying

revenues increased 19% YoY with strong Advisory and leveraged

capital markets performance in Asia and the US.

For the FY24 GWM underlying transaction-based income increased

by 27% YoY, while the IB’s underlying revenues increased 23% YoY

with double-digit growth in both Global Markets and Global

Banking.

Achieved all key integration milestones in 2024 and delivered

on cost reduction ambitions

We continued to execute on our integration plans, achieving over

4,000 milestones in 2024 and significantly reducing the execution

risk of the Credit Suisse acquisition. With the successful

migration of wealth management client accounts across booking

centers in Hong Kong, Singapore, Japan, and Luxembourg, we have now

transferred over 90% of client accounts outside of Switzerland onto

UBS platforms.

Seamless transfers were achieved thanks to our teams executing

at pace on an intensive integration and preparation program

throughout the year, which culminated with mergers of the parent

and Swiss banks, as well as the establishment of a single IHC in

the US.

In the fourth quarter we drove further progress on

cost-reduction work in Non-core and Legacy, having decommissioned

over 10% of its applications, for a total of 42% since its

inception. We also continued to exit positions, having closed

around 14% of its books in the quarter and further reducing RWA by

USD 3bn, bringing the year’s total RWA reduction in NCL to USD

33bn. Similarly, NCL LRD decreased by 68% over the last 12 months,

including USD 15bn in the fourth quarter.

In the fourth quarter across the Group we delivered an

additional USD 0.7bn in exit rate gross cost saves, for a total of

USD 3.4bn in 2024 and USD 7.5bn from the 2022 baseline, or 58% of

our total cumulative gross cost save ambition.

Strong capital position and commitment to capital returns

ambitions

A strong capital position and sustainable capital generation

remain the key pillars of our strategy. We ended the year with USD

71.4bn in CET1 capital after accruing USD 2.8bn for dividend and

buying back USD 1bn in shares under our ongoing share repurchase

program.

The year-end CET1 capital ratio was 14.3% and the CET1 leverage

ratio was 4.7%, both in excess of our guidance of ~14% and >4.0%

and providing a solid capital buffer during the integration, while

self-funding growth and returning capital to shareholders.

For the 2024 financial year, the Board of Directors plans to

propose a dividend to UBS Group AG shareholders of USD 0.90 per

share. Subject to approval at the Annual General Meeting, scheduled

for 10 April 2025, the dividend will be paid on 17 April 2025 to

shareholders of record on 16 April 2025. The ex-dividend date will

be 15 April 2025 on the SIX Swiss Exchange and 16 April 2025 on the

New York Stock Exchange.

We remain committed to progressive dividends and are accruing

for an increase of around 10% in the ordinary dividend per share

for the 2025 financial year.

In the fourth quarter of 2024, we completed our planned USD 1bn

of share repurchases. We plan to repurchase USD 1bn of shares in

the first half of 2025. We aim to repurchase up to an additional

USD 2bn of shares in the second half of 2025 and are maintaining

our ambition for share repurchases in 2026 to exceed full year 2022

levels. Our share repurchase levels will be subject to maintaining

our CET1 capital ratio target of ~14%, achieving our financial

targets and the absence of material and immediate changes to the

current capital regime in Switzerland.

Investor update summary

Reiterating medium and long-term targets

We remain well positioned to build towards our 2026-exit rate

targets of an underlying 15% return on CET1 capital and underlying

cost/income ratio of <70% as we continue to execute our

integration plans and capture the benefits of enhanced scale across

our core businesses.

As we progress towards our goals, we expect to generate an

underlying RoCET1 of ~10% in FY25, reflecting our expectation that

increased profitability in our core franchises will offset planned

financial performance of our Non-core and Legacy division, as it

continues its cost and financial resource reductions. In 2026, we

expect underlying RoCET1 to reach ~13%.

Beyond 2026, we maintain our goal of delivering a reported

return on CET1 capital of ~18% in 2028, as we reap the benefits of

the acquisition to unlock additional value for our shareholders and

deliver sustainably higher returns.

Our targets and ambitions are based on our Group target of ~14%

CET1 capital ratio and the existing Swiss capital regime.

Building on our attractive global business model and

diversified footprint

Throughout 2025 we expect our core businesses to be the main

drivers of our returns, leveraging their strong market position and

constructive economic backdrop while continuing to deliver on our

integration priorities.

Leveraging our unrivaled global scale and footprint and enduring

competitive advantages, GWM aims to increase returns and achieve

USD ~100bn in net new assets in 2025, and afterwards building to

USD ~200bn annually by 2028, when invested assets are expected to

surpass USD 5trn.

An integral part of our growth plans is to improve profitability

across our Americas wealth business, which manages USD 2.1trn in

invested assets and is a key pillar of our strategy and value

proposition to clients. We are executing on our targeted

investments to enhance and build out our multi-disciplinary

coverage model of the ultra high net worth client segment and

increase penetration of the high-net worth and core affluent

segments to further drive scale. These growth initiatives will be

supported by investments in our banking capabilities with the aim

to enhance our offering while working towards obtaining a National

Charter. We are also increasing technology investments and

transforming how we approach them by focusing on delivering new and

advanced digital capabilities in a more dynamic and modular

fashion. Finally, we remain disciplined on costs and have already

taken actions to streamline our organizational structure to drive

operating leverage.

We expect our efforts to support our profitability and progress

towards achieving a sustainable profit margin of ~15% for our

Americas wealth business in 2027. We are confident that the

execution of our plans across the franchise, including the

Americas, will lead to GWM delivering improved profitability with

an underlying cost/income ratio ambition of <70% by end-2026

(exit rate).

In our P&C franchise in Switzerland, we expect that the

disciplined execution of our integration plans and consistent

investments to improve the client experience will lead to increased

efficiency and higher returns on capital. Our ambition is to

achieve an underlying cost/income ratio <50% by end-2026 (exit

rate) and an underlying return on attributed equity of ~19% in the

medium term.

In AM, we are focused on capturing opportunities where we have a

differentiated and scalable offering, including the recently

launched Unified Global Alternatives (UGA) unit which brings

together our GWM and AM capabilities. With nearly USD 300bn in

combined assets, UGA provides our clients and partners with

enhanced access to exclusive investment opportunities and the full

distribution power of UBS. In addition to driving growth, we expect

the realization of cost synergies and efficiencies to help achieve

our ambition of <70% underlying cost/income ratio by end-2026

(exit rate).

Our focus in the IB remains deploying our products and services

across our institutional client base and leveraging connectivity

with GWM and P&C while maintaining capital discipline. The IB

aims to achieve a ~15% underlying return on attributed equity

through the cycle while operating with no more than 25% of the

Group’s RWA.

Continuing to invest in technology to drive business

outcomes

We continue to build out our best-in-class cloud infrastructure,

already having reached ~73% private and public cloud adoption. We

are also on our way to becoming an AI-first institution where our

clients, people, and shareholders benefit from the latest AI

technologies.

After the successful rollout of Red, our proprietary new AI

assistant, to around 20,000 of our client advisors, they now have

intelligent access to insights, UBS products, research and CIO

reports. Meanwhile, our advanced analytics platform in the US has

generated 13m insights for our financial advisors.

The rollout of 50,000 Copilot licenses to our employees is on

track as well, and we are already seeing increased usage of GenAI

tools with 1.75m prompts across all of our tools in 2024, with an

expected 10-fold increase in usage in 2025.

On track to substantially complete integration by end-2026

and deliver USD 13bn in gross cost saves

We are continuing our disciplined execution of the Credit Suisse

integration and remain on track to substantially complete it by

end-2026.

Following our success in 2024, further client account

transitions are taking place across our European booking centers,

and we intend to commence the next phase of transfers in

Switzerland in the second quarter of 2025. In Asset Management we

also expect to finalize the ongoing portfolio migration in 2025.

Non-core and Legacy will continue to actively wind down its

positions and reduce its cost base with an ambition to exit 2026

with USD ~0.8bn in underlying operating expenses (excluding

litigation) and risk weighted assets below 5% of the Group’s

RWA.

After reaching 58% of our planned cumulative gross cost saves

plan at the end of 2024, we maintain our expectation that the

execution of our integration plans and the run-down of NCL to

result in USD ~13bn in gross cost saves by end-2026 compared to

FY22 combined. We now expect integration-related expenses to reach

USD ~14bn by the end of 2026. Our gross cost savings will provide

necessary capacity for reinvestment to further reinforce the

resilience of our infrastructure and to drive sustainable growth by

investing in talent, products and services.

Ongoing financial resource discipline to create room for

profitable growth

Over the next two years we expect our balance sheet optimization

efforts and ongoing reduction of the Non-core and Legacy footprint

to create capacity for sustainable and profitable growth in our

core businesses. We expect business growth in our franchises to add

around 3% to Group RWAs in constant FX terms from estimated January

1 level of USD 500bn, of which around half will come from GWM. The

overall Group RWA is expected to increase by around 2% over that

time frame.

The adoption of the final Basel III standards in January 2025

led to a USD 1bn day-1 increase in the UBS Group’s RWA, primarily

driven by a USD 7bn increase in market risk RWA and a USD 3bn

increase in credit valuation adjustments related RWA from the

Fundamental Review of the Trading Book, largely offset by a USD 7bn

reduction in operational risk RWA.

Outlook

Investor sentiment remained positive in the fourth quarter of

2024, driving strong institutional and private client activity

supported by a constructive market backdrop that reflected an

increase in investors’ risk appetite following the results of the

US presidential election.

Constructive market conditions have continued into the first

quarter of 2025 sustained by the greater optimism regarding growth

prospects in the US. However, investor behavior may be affected by

the clouded macroeconomic outlook outside the US, increased

uncertainties around global trade, inflation and central bank

policies, as well as geopolitics, including the upcoming elections

in Germany. We see the markets as remaining particularly sensitive

to new developments, positive or negative, leading to potential

spikes in volatility across all asset classes.

In the first quarter, we expect a low-to-mid single digit

percentage sequential decline in net interest income (NII) in

Global Wealth Management and around a 10% sequential decline in

Personal & Corporate Banking’s NII, measured in Swiss francs.

Higher asset levels are expected to support recurring fee income

across our asset-gathering businesses. As we progress our

integration plans, integration-related expenses are expected to be

around USD 1.1bn and accretion of PPA effects to contribute around

USD 0.5bn to the Group’s total revenues.

We remain focused on supporting clients with advice and

solutions and continue to execute on our priorities, investing in

people, products, and capabilities to drive sustainable long-term

value for our stakeholders while maintaining a balance sheet for

all seasons.

Fourth quarter 2024 performance

overview – Group

Group PBT USD 1,047m, underlying PBT USD 1,768m

PBT of USD 1,047m included PPA effects and other integration

items of USD 656m, a loss related to an investment in an associate

of USD 80m, integration-related expenses and PPA effects of USD

1,255m, and an expense related to the Swisscard transactions of USD

41m. Underlying PBT was USD 1,768m, including net credit loss

expenses of USD 229m. The cost/income ratio was 89.0%, and 81.9% on

an underlying basis. Net profit attributable to shareholders was

USD 770m, with diluted earnings per share of USD 0.23. Return on

CET1 capital was 4.2%, and 7.2% on an underlying basis.

Global Wealth Management (GWM) PBT USD 867m, underlying PBT

USD 1,147m

Total revenues increased by USD 567m, or 10%, to USD 6,121m,

largely driven by higher recurring net fee income, a decrease in

negative other income and higher transaction-based income. Total

revenues included a USD 149m decrease in PPA effects. It also

included a loss of USD 21m related to an investment in an

associate. Excluding PPA effects of USD 200m and the aforementioned

loss, underlying total revenues were USD 5,942m, an increase of

10%. Net credit loss releases were USD 14m, compared with net

credit loss releases of USD 8m in the fourth quarter of 2023.

Operating expenses decreased by USD 14m to USD 5,268m, and included

a USD 42m decrease in integration-related expenses. The remaining

variance was mainly due to the fourth quarter of 2023 including a

charge of USD 60m for the special assessment by the US Federal

Deposit Insurance Corporation (the FDIC). These decreases were

partly offset by higher underlying personnel expenses, which

resulted from higher financial advisor compensation, reflecting

increases in compensable revenues, and an increase in provisions

for litigation, regulatory and similar matters. Excluding

integration-related expenses and PPA effects of USD 460m,

underlying operating expenses were USD 4,808m, broadly stable year

over year. The cost/income ratio was 86.1%, and 80.9% on an

underlying basis. Invested assets decreased sequentially by USD

77bn to USD 4,182bn. Net new assets were USD 17.7bn.

Personal & Corporate Banking (P&C) PBT CHF 524m,

underlying PBT CHF 572m

Total revenues increased by CHF 151m, or 8%, to CHF 1,983m,

largely reflecting improvement in other income, partly offset by

lower net interest income. Total revenues change included a CHF 40m

decrease in PPA effects. Total revenues also included a loss of CHF

54m related to an investment in an associate. Excluding PPA effects

of CHF 227m and the aforementioned loss, underlying total revenues

were CHF 1,810m, a decrease of 1%. Net credit loss expenses were

CHF 155m, mainly reflecting net credit loss expenses of CHF 177m on

credit-impaired positions primarily in the legacy Credit Suisse

corporate loan book, partly offset by net credit loss releases of

CHF 22m related to performing positions. Operating expenses

increased by CHF 83m, or 7%, to CHF 1,305m and included a CHF 23m

increase in integration-related expenses. The cost/income ratio was

65.8%, and 59.8% on an underlying basis.

Asset Management (AM) PBT USD 128m, underlying PBT USD

224m

Total revenues decreased by USD 59m, or 7%, to USD 766m, mostly

due to lower net management fees and net gains of USD 13m on the

sale of our shareholding in Credit Suisse Investment Partners,

compared with net gains on sale of USD 27m in the fourth quarter of

2023, which predominantly related to the completion of the sale of

a majority stake in UBS Hana Asset Management Co., Ltd. Operating

expenses decreased by USD 65m, or 9%, to USD 639m, mainly

reflecting lower personnel expenses, and included a USD 32m

increase in integration-related expenses. Excluding

integration-related expenses of USD 96m, underlying operating

expenses were USD 543m, a decrease of 15%. The cost/income ratio

was 83.3%, and 70.8% on an underlying basis. Invested assets

decreased sequentially by USD 25bn to USD 1,773bn. Net new money

was USD 33bn, and USD 26bn excluding money market flows and

associates.

Investment Bank (IB) PBT USD 479m, underlying PBT USD

452m

Total revenues increased by USD 608m, or 28%, to USD 2,749m, due

to higher Global Markets and Global Banking revenues, and included

a USD 75m decrease in PPA effects. Underlying total revenues,

excluding PPA effects of USD 202m, were USD 2,547m, an increase of

37%. Net credit loss expenses increased by USD 15m to USD 63m.

Operating expenses decreased by USD 76m, or 3%, to USD 2,207m,

largely due to a decrease in personnel expenses. Operating expenses

included a USD 7m increase in integration-related expenses.

Excluding integration-related expenses of USD 174m, underlying

operating expenses were USD 2,032m, a decrease of USD 84m, or 4%.

The cost/income ratio was 80.3%, and 79.8% on an underlying basis.

Return on attributed equity was 11.1%, and 10.5% on an underlying

basis.

Non-core and Legacy (NCL) PBT USD (923m), underlying PBT USD

(606m)

Total revenues were negative USD 58m, compared with total

revenues of USD 145m in the fourth quarter of 2023, mainly due to

lower net interest income as a result of portfolio reductions and

also due to lower trading revenues, mainly reflecting lower gains

on disposals compared with the fourth quarter of 2023. These

decreases were partly offset by lower funding costs. Operating

expenses decreased by USD 929m, or 52%, to USD 858m, mainly due to

a USD 433m decrease in integration-related expenses, which included

a decrease in real estate expenses, and also due to lower personnel

expenses and technology expenses. Excluding the aforementioned

integration-related expenses, underlying operating expenses in the

fourth quarter of 2024 were USD 541m, a decrease of 48%.

Group Items PBT USD (100m), underlying PBT USD (96m)

UBS’s sustainability and impact

highlights

We are guided by our ambition to be a global leader in

sustainability.

We will communicate further details on our approach in our 2024

Sustainability Report, which will be published on 17 March

2025.

Celebrating 25 years of the UBS Optimus Foundation

UBS Optimus Foundation celebrated its 25th anniversary in

December 2024. To mark this very special milestone, UBS donated USD

25m to the Optimus Foundation in 2024 to fund its anniversary

impact initiative. Of that, USD 10m will be used to provide direct

funding and USD 15m to match our clients’ and employees’ donations

to our anniversary appeal. The donation will also be used to fund

four transformative initiatives that aim to amplify the impact of

donations through innovative financing approaches and partnerships,

driving meaningful change in health, education and climate.

In the past 10 years alone, Optimus – together with our clients

and employees – has raised over USD 1.5bn in donations and our

programs have helped nearly 35 million people. It has worked with

over 700 carefully selected delivery partners and evaluates impact

rigorously to make sure that every donation and every investment we

make with our clients delivers lasting, scalable results.

UBS’s real assets investment strategies top-ranked for

sustainability

UBS’s Global Real Assets strategies continue to be recognized

for their sustainability efforts with sustained strong performance

in the 2024 GRESB Real Estate and Infrastructure Assessments. GRESB

is a third-party organization that provides financial markets with

sustainability data. Five disclosed UBS real estate strategies came

first in their respective peer group. Of the 16 disclosed UBS real

estate strategies, 11 achieved the highest rating of five stars and

five received four stars.

UBS completes first carbon dioxide removal (CDR)

trade

Our firm’s first carbon dioxide removal (CDR) trade was

completed in the UK. This trade involved a new investment product

that aims to provide a return to investors from the sale of carbon

removal credits generated by a carbon removals project. The project

implements carbon capture technology, which removes carbon dioxide

from the atmosphere, in this case from the supply chain of the

Scotch whisky industry. The transaction utilized the Carbonplace

platform, a carbon credit transaction network and settlement

technology founded by nine banks including UBS.

Los Angeles Wildfire Relief efforts

Communities impacted by the LA wildfires face a range of urgent

needs as they navigate the immediate aftermath of these powerful

firestorms and transition into long-term rebuilding and recovery.

UBS Optimus Foundation is supporting our partners Americares, World

Central Kitchen, Team Rubicon and GiveDirectly who are providing

ongoing assistance to victims. In addition, UBS committed USD

100,000 to match US and Puerto Rico employee donations to the

selected relief partners.

Selected financial information of the

business divisions and Group Items

For the quarter ended

31.12.24

USD m

Global

Wealth

Management

Personal &

Corporate

Banking

Asset

Management

Investment

Bank

Non-core

and Legacy

Group

Items

Total

Total revenues as reported

6,121

2,245

766

2,749

(58)

(188)

11,635

of which: PPA effects and other

integration items1

200

258

202

(4)

656

of which: loss related to an investment in

an associate

(21)

(59)

(80)

Total revenues (underlying)

5,942

2,047

766

2,547

(58)

(184)

11,059

Credit loss expense / (release)

(14)

175

0

63

6

0

229

Operating expenses as reported

5,268

1,476

639

2,207

858

(88)

10,359

of which: integration-related expenses and

PPA effects2

460

209

96

174

317

(1)

1,255

of which: items related to the Swisscard

transactions3

41

41

Operating expenses (underlying)

4,808

1,226

543

2,032

541

(88)

9,062

Operating profit / (loss) before tax as

reported

867

595

128

479

(923)

(100)

1,047

Operating profit / (loss) before tax

(underlying)

1,147

646

224

452

(606)

(96)

1,768

For the quarter ended 30.9.24

USD m

Global

Wealth

Management

Personal &

Corporate

Banking

Asset

Management

Investment

Bank

Non-core

and Legacy

Group

Items

Total

Total revenues as reported

6,199

2,394

873

2,645

262

(39)

12,334

of which: PPA effects and other

integration items1

224

278

185

(25)

662

Total revenues (underlying)

5,975

2,116

873

2,461

262

(14)

11,672

Credit loss expense / (release)

2

83

0

9

28

0

121

Operating expenses as reported

5,112

1,465

722

2,231

837

(84)

10,283

of which: integration-related expenses and

PPA effects2

419

198

86

156

270

(11)

1,119

Operating expenses (underlying)

4,693

1,267

636

2,076

567

(74)

9,165

Operating profit / (loss) before tax as

reported

1,085

846

151

405

(603)

45

1,929

Operating profit / (loss) before tax

(underlying)

1,280

766

237

377

(333)

60

2,386

For the quarter ended

31.12.234

USD m

Global

Wealth

Management

Personal &

Corporate

Banking

Asset

Management

Investment

Bank

Non-core

and Legacy

Group

Items

Total

Total revenues as reported

5,554

2,083

825

2,141

145

107

10,855

of which: PPA effects and other

integration items1

349

306

277

12

944

of which: loss related to an investment in

an associate

(190)

(317)

(508)

Total revenues (underlying)

5,395

2,094

825

1,864

145

95

10,419

Credit loss expense / (release)

(8)

85

(1)

48

15

(2)

136

Operating expenses as reported

5,282

1,398

704

2,283

1,787

16

11,470

of which: integration-related expenses and

PPA effects2

502

187

64

167

750

109

1,780

of which: acquisition-related costs

(1)

(1)

Operating expenses (underlying)

4,780

1,210

639

2,116

1,037

(92)

9,690

Operating profit / (loss) before tax as

reported

280

601

122

(190)

(1,657)

93

(751)

Operating profit / (loss) before tax

(underlying)

624

800

186

(300)

(907)

189

592

1 Includes accretion of PPA adjustments on

financial instruments and other PPA effects, as well as temporary

and incremental items directly related to the integration. 2

Includes temporary, incremental operating expenses directly related

to the integration, as well as amortization of newly recognized

intangibles resulting from the acquisition of the Credit Suisse

Group. 3 Represents the termination fee to American Express related

to the expected sale in 2025 of our 50% holding in Swisscard. 4

Comparative-period information has been restated for changes in

business division perimeters, Group Treasury allocations and

Non-core and Legacy cost allocations, resulting in decreases in

Operating profit / (loss) before tax of USD 101m for Global Wealth

Management, USD 187m for Personal & Corporate Banking and USD

21m for the Investment Bank and increases in Operating profit /

(loss) before tax of USD 233m for Group Items, USD 69m for Non-core

and Legacy and USD 7m for Asset Management. Refer to “Note 3

Segment reporting” in the “Consolidated financial statements”

section of the UBS Group third quarter 2024 report, available under

“Quarterly reporting” at ubs.com/investors, for more information

about the relevant changes.

Selected financial information of the

business divisions and Group Items (continued)

For the year ended

31.12.24

USD m

Global

Wealth

Management

Personal &

Corporate

Banking

Asset

Management

Investment

Bank

Non-core

and Legacy

Group

Items

Total

Total revenues as reported

24,516

9,334

3,182

10,948

1,605

(975)

48,611

of which: PPA effects and other

integration items1

891

1,038

989

(41)

2,877

of which: loss related to an investment in

an associate

(21)

(59)

(80)

Total revenues (underlying)

23,646

8,355

3,182

9,958

1,605

(933)

45,814

Credit loss expense / (release)

(16)

404

(1)

97

69

(2)

551

Operating expenses as reported

20,608

5,741

2,663

8,934

3,512

(220)

41,239

of which: integration-related expenses and

PPA effects2

1,807

749

351

717

1,154

(12)

4,766

of which: items related to the Swisscard

transactions3

41

41

Operating expenses (underlying)

18,802

4,951

2,312

8,217

2,359

(208)

36,432

Operating profit / (loss) before tax as

reported

3,924

3,189

520

1,917

(1,976)

(752)

6,821

Operating profit / (loss) before tax

(underlying)

4,860

3,000

871

1,644

(822)

(723)

8,831

For the year ended

31.12.234,5

USD m

Global

Wealth

Management

Personal &

Corporate

Banking

Asset

Management

Investment

Bank

Non-core

and Legacy

Group

Items

Negative

goodwill

Total

Total revenues as reported

21,556

7,687

2,686

8,703

697

(495)

40,834

of which: PPA effects and other

integration items1

923

783

583

(9)

2,280

of which: loss related to an investment in

an associate

(190)

(317)

(508)

Total revenues (underlying)

20,823

7,222

2,686

8,120

697

(486)

39,062

Negative goodwill

27,264

27,264

Credit loss expense / (release)

166

482

0

190

193

6

1,037

Operating expenses as reported

17,945

4,394

2,353

8,585

5,091

438

38,806

of which: integration-related expenses and

PPA effects2

1,018

398

205

697

1,775

451

4,543

of which: acquisition-related costs

202

202

Operating expenses (underlying)

16,927

3,996

2,149

7,889

3,316

(215)

34,061

Operating profit / (loss) before tax as

reported

3,445

2,811

332

(72)

(4,587)

(938)

27,264

28,255

Operating profit / (loss) before tax

(underlying)

3,730

2,744

537

42

(2,812)

(277)

3,963

1 Includes accretion of PPA adjustments on

financial instruments and other PPA effects, as well as temporary

and incremental items directly related to the integration. 2

Includes temporary, incremental operating expenses directly related

to the integration, as well as amortization of newly recognized

intangibles resulting from the acquisition of the Credit Suisse

Group. 3 Represents the termination fee to American Express related

to the expected sale in 2025 of our 50% holding in Swisscard. 4

Comparative-period information has been restated for changes in

business division perimeters, Group Treasury allocations and

Non-core and Legacy cost allocations, resulting in decreases in

Operating profit / (loss) before tax of USD 144m for Global Wealth

Management, USD 337m for Personal & Corporate Banking and USD

28m for the Investment Bank and increases in Operating profit /

(loss) before tax of USD 341m for Group Items, USD 154m for

Non-core and Legacy and USD 14m for Asset Management. Refer to

“Note 3 Segment reporting” in the “Consolidated financial

statements” section of the UBS Group third quarter 2024 report,

available under “Quarterly reporting” at ubs.com/investors, for

more information about the relevant changes. 5 Comparative-period

information as previously reported in the 2023 Annual Report has

been revised to reflect measurement period adjustments impacting

negative goodwill. Refer to “Note 2 Accounting for the acquisition

of the Credit Suisse Group” in the “Consolidated financial

statements” section of the UBS Group third quarter 2024 report,

available under “Quarterly reporting” at ubs.com/investors, for

more information about the relevant adjustments.

Our key figures

As of or for the quarter

ended

As of or for the year ended

USD m, except where indicated

31.12.24

30.9.24

31.12.231

31.12.24

31.12.231

Group results

Total revenues

11,635

12,334

10,855

48,611

40,834

Negative goodwill

27,264

Credit loss expense / (release)

229

121

136

551

1,037

Operating expenses

10,359

10,283

11,470

41,239

38,806

Operating profit / (loss) before tax

1,047

1,929

(751)

6,821

28,255

Net profit / (loss) attributable to

shareholders

770

1,425

(279)

5,085

27,366

Diluted earnings per share (USD)2

0.23

0.43

(0.09)

1.52

8.30

Profitability and growth3,4

Return on equity (%)

3.6

6.7

(1.3)

6.0

36.9

Return on tangible equity (%)

3.9

7.3

(1.4)

6.5

40.8

Underlying return on tangible equity

(%)5

6.6

9.0

4.8

8.5

4.1

Return on common equity tier 1 capital

(%)

4.2

7.6

(1.4)

6.7

41.8

Underlying return on common equity tier 1

capital (%)5

7.2

9.4

4.8

8.7

4.2

Return on leverage ratio denominator,

gross (%)

3.0

3.1

2.6

3.0

2.9

Cost / income ratio (%)6

89.0

83.4

105.7

84.8

95.0

Underlying cost / income ratio (%)5,6

81.9

78.5

93.0

79.5

87.2

Effective tax rate (%)

25.6

26.0

n.m.7

24.6

3.1

Net profit growth (%)

n.m.

n.m.

n.m.

(81.4)

258.7

Resources3

Total assets

1,565,028

1,623,941

1,716,924

1,565,028

1,716,924

Equity attributable to shareholders

85,079

87,025

85,624

85,079

85,624

Common equity tier 1 capital8

71,367

74,213

78,002

71,367

78,002

Risk-weighted assets8

498,538

519,363

546,505

498,538

546,505

Common equity tier 1 capital ratio

(%)8

14.3

14.3

14.3

14.3

14.3

Going concern capital ratio (%)8

17.6

17.5

16.8

17.6

16.8

Total loss-absorbing capacity ratio

(%)8

37.2

37.5

36.4

37.2

36.4

Leverage ratio denominator8

1,519,477

1,608,341

1,695,403

1,519,477

1,695,403

Common equity tier 1 leverage ratio

(%)8

4.7

4.6

4.6

4.7

4.6

Liquidity coverage ratio (%)9

188.4

199.2

215.7

188.4

215.7

Net stable funding ratio (%)

125.5

126.9

124.7

125.5

124.7

Other

Invested assets (USD bn)4,10

6,087

6,199

5,714

6,087

5,714

Personnel (full-time equivalents)

108,648

109,396

112,842

108,648

112,842

Market capitalization2,11

105,719

106,528

107,355

105,719

107,355

Total book value per share (USD)2

26.80

27.32

26.68

26.80

26.68

Tangible book value per share (USD)2

24.63

25.10

24.34

24.63

24.34

Credit-impaired lending assets as a

percentage of total lending assets, gross (%)4

1.0

0.9

0.8

1.0

0.8

Cost of credit risk (bps)4

15

8

8

9

19

1 Comparative-period information has been

revised. Refer to “Note 2 Accounting for the acquisition of the

Credit Suisse Group” in the “Consolidated financial statements”

section of the UBS Group third quarter 2024 report, available under

“Quarterly reporting” at ubs.com/investors, for more information. 2

Refer to the “Share information and earnings per share” section of

the UBS Group fourth quarter 2024 report, available under

“Quarterly reporting” at ubs.com/investors, for more information. 3

Refer to the “Recent developments” section of the UBS Group fourth

quarter 2024 report, available under “Quarterly reporting” at

ubs.com/investors, for more information about targets and

ambitions. 4 Refer to “Alternative performance measures” in the

appendix to the UBS Group fourth quarter 2024 report, available

under “Quarterly reporting” at ubs.com/investors, for the

definition and calculation method. 5 Refer to the “Group

performance” section of the UBS Group fourth quarter 2024 report,

available under “Quarterly reporting” at ubs.com/investors, for

more information about underlying results. 6 Negative goodwill is

not used in the calculation as it is presented in a separate

reporting line and is not part of total revenues. 7 The effective

tax rate for the fourth quarter of 2023 is not a meaningful

measure, due to the distortive effect of current unbenefited tax

losses at the former Credit Suisse entities. 8 Based on the Swiss

systemically relevant bank framework as of 1 January 2020. Refer to

the “Capital management” section of the UBS Group fourth quarter

2024 report, available under “Quarterly reporting” at

ubs.com/investors, for more information. 9 The disclosed ratios

represent quarterly averages for the quarters presented and are

calculated based on an average of 64 data points in the fourth

quarter of 2024, 65 data points in the third quarter of 2024 and 63

data points in the fourth quarter of 2023. Refer to the “Liquidity

and funding management” section of the UBS Group fourth quarter

2024 report, available under “Quarterly reporting” at

ubs.com/investors, for more information. 10 Consists of invested

assets for Global Wealth Management, Asset Management (including

invested assets from associates) and Personal & Corporate

Banking. Refer to “Note 32 Invested assets and net new money” in

the “Consolidated financial statements” section of the UBS Group

Annual Report 2023, available under “Annual reporting” at

ubs.com/investors, for more information. 11 The calculation of

market capitalization reflects total shares issued multiplied by

the share price at the end of the period.

Income statement

For the quarter ended

% change from

For the year ended

USD m

31.12.24

30.9.24

31.12.23

3Q24

4Q23

31.12.24

31.12.231

Net interest income

1,838

1,794

2,095

2

(12)

7,108

7,297

Other net income from financial

instruments measured at fair value through profit or loss

3,144

3,681

3,158

(15)

0

14,690

11,583

Net fee and commission income

6,598

6,517

5,780

1

14

26,138

21,570

Other income

56

341

(179)

(84)

675

384

Total revenues

11,635

12,334

10,855

(6)

7

48,611

40,834

Negative goodwill

27,264

Credit loss expense / (release)

229

121

136

89

68

551

1,037

Personnel expenses

6,361

6,889

7,061

(8)

(10)

27,318

24,899

General and administrative expenses

3,004

2,389

2,999

26

0

10,124

10,156

Depreciation, amortization and impairment

of non-financial assets

994

1,006

1,409

(1)

(29)

3,798

3,750

Operating expenses

10,359

10,283

11,470

1

(10)

41,239

38,806

Operating profit / (loss) before

tax

1,047

1,929

(751)

(46)

6,821

28,255

Tax expense / (benefit)

268

502

(473)

(47)

1,675

873

Net profit / (loss)

779

1,428

(278)

(45)

5,146

27,382

Net profit / (loss) attributable to

non-controlling interests

9

3

1

185

60

16

Net profit / (loss) attributable to

shareholders

770

1,425

(279)

(46)

5,085

27,366

Comprehensive income

Total comprehensive income

(1,878)

3,910

2,695

3,401

28,374

Total comprehensive income attributable to

non-controlling interests

(27)

27

18

13

22

Total comprehensive income attributable

to shareholders

(1,851)

3,883

2,677

3,388

28,352

1 Comparative-period information as

previously reported in the 2023 Annual Report has been revised to

reflect measurement period adjustments impacting negative goodwill.

Refer to “Note 2 Accounting for the acquisition of the Credit

Suisse Group” in the “Consolidated financial statements” section of

the UBS Group third quarter 2024 report, available under “Quarterly

reporting” at ubs.com/investors, for more information about the

relevant adjustments.

Information about results materials and

the earnings call

UBS’s fourth quarter 2024 report, news release and slide

presentation are available from 06:45 CET on Tuesday, 4 February

2025, at ubs.com/quarterlyreporting.

UBS will hold a presentation of its fourth quarter 2024 results

on Tuesday, 4 February 2025. The results will be presented by

Sergio P. Ermotti (Group Chief Executive Officer), Todd Tuckner

(Group Chief Financial Officer) and Sarah Mackey (Head of Investor

Relations).

Time

09:00 CET 08:00 GMT 03:00 US EST

Audio webcast

The presentation for analysts can be followed live on

ubs.com/quarterlyreporting with a simultaneous slide show.

Webcast playback

An audio playback of the results presentation will be made

available at ubs.com/investors later in the day.

Cautionary statement regarding forward-looking

statements

This news release contains statements that constitute

“forward-looking statements”, including but not limited to

management’s outlook for UBS’s financial performance, statements

relating to the anticipated effect of transactions and strategic

initiatives on UBS’s business and future development and goals or

intentions to achieve climate, sustainability and other social

objectives. While these forward-looking statements represent UBS’s

judgments, expectations and objectives concerning the matters

described, a number of risks, uncertainties and other important

factors could cause actual developments and results to differ

materially from UBS’s expectations. In particular, the global

economy may be negatively affected by shifting political

circumstances, including increased tension between world powers,

conflicts in the Middle East, as well as the continuing

Russia–Ukraine war. In addition, the ongoing conflicts may continue

to cause significant population displacement, and lead to shortages

of vital commodities, including energy shortages and food

insecurity outside the areas immediately involved in armed

conflict. Governmental responses to the armed conflicts, including

successive sets of sanctions on Russia and Belarus, and Russian and

Belarusian entities and nationals, and the uncertainty as to

whether the ongoing conflicts will further widen and intensify, may

have significant adverse effects on the market and macroeconomic

conditions, including in ways that cannot be anticipated. UBS’s

acquisition of the Credit Suisse Group has materially changed its

outlook and strategic direction and introduced new operational

challenges. The integration of the Credit Suisse entities into the

UBS structure is expected to continue through 2026 and presents

significant operational and execution risk, including the risks

that UBS may be unable to achieve the cost reductions and business

benefits contemplated by the transaction, that it may incur higher

costs to execute the integration of Credit Suisse and that the

acquired business may have greater risks or liabilities than

expected. Following the failure of Credit Suisse, Switzerland is

considering significant changes to its capital, resolution and

regulatory regime, which, if proposed and adopted, may

significantly increase our capital requirements or impose other

costs on UBS. These factors create greater uncertainty about

forward-looking statements. Other factors that may affect UBS’s

performance and ability to achieve its plans, outlook and other

objectives also include, but are not limited to: (i) the degree to

which UBS is successful in the execution of its strategic plans,

including its cost reduction and efficiency initiatives and its

ability to manage its levels of risk-weighted assets (RWA) and

leverage ratio denominator (LRD), liquidity coverage ratio and

other financial resources, including changes in RWA assets and

liabilities arising from higher market volatility and the size of

the combined Group; (ii) the degree to which UBS is successful in

implementing changes to its businesses to meet changing market,

regulatory and other conditions; (iii) inflation and interest rate

volatility in major markets; (iv) developments in the macroeconomic

climate and in the markets in which UBS operates or to which it is

exposed, including movements in securities prices or liquidity,

credit spreads, currency exchange rates, residential and commercial

real estate markets, general economic conditions, and changes to

national trade policies on the financial position or

creditworthiness of UBS’s clients and counterparties, as well as on

client sentiment and levels of activity; (v) changes in the

availability of capital and funding, including any adverse changes

in UBS’s credit spreads and credit ratings of UBS, as well as

availability and cost of funding to meet requirements for debt

eligible for total loss-absorbing capacity (TLAC); (vi) changes in

central bank policies or the implementation of financial

legislation and regulation in Switzerland, the US, the UK, the EU

and other financial centers that have imposed, or resulted in, or

may do so in the future, more stringent or entity-specific capital,

TLAC, leverage ratio, net stable funding ratio, liquidity and

funding requirements, heightened operational resilience

requirements, incremental tax requirements, additional levies,

limitations on permitted activities, constraints on remuneration,

constraints on transfers of capital and liquidity and sharing of

operational costs across the Group or other measures, and the

effect these will or would have on UBS’s business activities; (vii)

UBS’s ability to successfully implement resolvability and related

regulatory requirements and the potential need to make further

changes to the legal structure or booking model of UBS in response

to legal and regulatory requirements and any additional

requirements due to its acquisition of the Credit Suisse Group, or

other developments; (viii) UBS’s ability to maintain and improve

its systems and controls for complying with sanctions in a timely

manner and for the detection and prevention of money laundering to

meet evolving regulatory requirements and expectations, in

particular in the current geopolitical turmoil; (ix) the

uncertainty arising from domestic stresses in certain major

economies; (x) changes in UBS’s competitive position, including

whether differences in regulatory capital and other requirements

among the major financial centers adversely affect UBS’s ability to

compete in certain lines of business; (xi) changes in the standards

of conduct applicable to its businesses that may result from new

regulations or new enforcement of existing standards, including

measures to impose new and enhanced duties when interacting with

customers and in the execution and handling of customer

transactions; (xii) the liability to which UBS may be exposed, or

possible constraints or sanctions that regulatory authorities might

impose on UBS, due to litigation, contractual claims and regulatory

investigations, including the potential for disqualification from

certain businesses, potentially large fines or monetary penalties,

or the loss of licenses or privileges as a result of regulatory or

other governmental sanctions, as well as the effect that

litigation, regulatory and similar matters have on the operational

risk component of its RWA; (xiii) UBS’s ability to retain and

attract the employees necessary to generate revenues and to manage,

support and control its businesses, which may be affected by

competitive factors; (xiv) changes in accounting or tax standards

or policies, and determinations or interpretations affecting the

recognition of gain or loss, the valuation of goodwill, the

recognition of deferred tax assets and other matters; (xv) UBS’s

ability to implement new technologies and business methods,

including digital services, artificial intelligence and other

technologies, and ability to successfully compete with both

existing and new financial service providers, some of which may not

be regulated to the same extent; (xvi) limitations on the

effectiveness of UBS’s internal processes for risk management, risk

control, measurement and modeling, and of financial models

generally; (xvii) the occurrence of operational failures, such as

fraud, misconduct, unauthorized trading, financial crime,

cyberattacks, data leakage and systems failures, the risk of which

is increased with persistently high levels of cyberattack threats;

(xviii) restrictions on the ability of UBS Group AG, UBS AG and

regulated subsidiaries of UBS AG to make payments or distributions,

including due to restrictions on the ability of its subsidiaries to

make loans or distributions, directly or indirectly, or, in the

case of financial difficulties, due to the exercise by FINMA or the

regulators of UBS’s operations in other countries of their broad

statutory powers in relation to protective measures, restructuring

and liquidation proceedings; (xix) the degree to which changes in

regulation, capital or legal structure, financial results or other

factors may affect UBS’s ability to maintain its stated capital

return objective; (xx) uncertainty over the scope of actions that

may be required by UBS, governments and others for UBS to achieve

goals relating to climate, environmental and social matters, as

well as the evolving nature of underlying science and industry and

the possibility of conflict between different governmental

standards and regulatory regimes; (xxi) the ability of UBS to

access capital markets; (xxii) the ability of UBS to successfully

recover from a disaster or other business continuity problem due to

a hurricane, flood, earthquake, terrorist attack, war, conflict),

pandemic, security breach, cyberattack, power loss,

telecommunications failure or other natural or man-made event; and

(xxiii) the effect that these or other factors or unanticipated

events, including media reports and speculations, may have on its

reputation and the additional consequences that this may have on

its business and performance. The sequence in which the factors

above are presented is not indicative of their likelihood of

occurrence or the potential magnitude of their consequences. UBS’s

business and financial performance could be affected by other

factors identified in its past and future filings and reports,

including those filed with the US Securities and Exchange

Commission (the SEC). More detailed information about those factors

is set forth in documents furnished by UBS and filings made by UBS

with the SEC, including the UBS Group AG and UBS AG Annual Reports

on Form 20-F for the year ended 31 December 2023. UBS is not under

any obligation to (and expressly disclaims any obligation to)

update or alter its forward-looking statements, whether as a result

of new information, future events, or otherwise.

Rounding

Numbers presented throughout this news release may not add up

precisely to the totals provided in the tables and text.

Percentages and percent changes disclosed in text and tables are

calculated on the basis of unrounded figures. Absolute changes

between reporting periods disclosed in the text, which can be

derived from numbers presented in related tables, are calculated on

a rounded basis.

Tables

Within tables, blank fields generally indicate non-applicability

or that presentation of any content would not be meaningful, or

that information is not available as of the relevant date or for

the relevant period. Zero values generally indicate that the

respective figure is zero on an actual or rounded basis. Values

that are zero on a rounded basis can be either negative or positive

on an actual basis.

Websites

In this news release, any website addresses are provided solely

for information and are not intended to be active links. UBS is not

incorporating the contents of any such websites into this news

release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250203802726/en/

UBS Group AG

Investor contact Switzerland: +41-44-234 41 00 Americas:

+1-212-882 57 34

Media contact Switzerland: +41-44-234 85 00 UK: +44-207-567 47

14 Americas: +1-212-882 58 58 APAC: +852-297-1 82 00

ubs.com

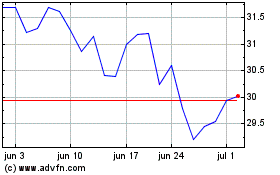

UBS (NYSE:UBS)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

UBS (NYSE:UBS)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025