Griffon Corporation (“Griffon” or the “Company”) (NYSE:GFF)

today reported results for the fiscal 2025 first quarter ended

December 31, 2024.

Revenue for the first quarter totaled $632.4 million, a 2%

decrease compared to $643.2 million in the prior year quarter.

Net income totaled $70.9 million, or $1.49 per share, compared

to $42.2 million, or $0.82 per share, in the prior year quarter.

Excluding all items that affect comparability from both periods,

adjusted net income was $65.9 million, or $1.39 per share, in the

current year quarter compared to $55.3 million, or $1.07 per share,

in the prior year quarter. For a reconciliation of net income to

adjusted net income, and earnings per share to adjusted earnings

per share, see the attached table.

Adjusted EBITDA for the first quarter was $131.2 million, a 13%

increase from the prior year quarter of $116.4 million. Adjusted

EBITDA, excluding unallocated amounts (primarily corporate

overhead) of $14.0 million in the current quarter and $13.9 million

in the prior year quarter, totaled $145.2 million, increasing 11%

from the prior year of $130.3 million. For a reconciliation of

adjusted EBITDA, a non-GAAP measure, to income before taxes, and

the definition of adjusted EBITDA, see the attached table.

“Fiscal 2025 is off to a strong start, with our first quarter

results highlighted by free cash flow of $143 million, continued

solid operating performance at Home and Building Products ("HBP"),

and improved profitability from our global sourcing expansion

initiative at Consumer and Professional Products (“CPP”),” said

Ronald J. Kramer, Chairman and Chief Executive Officer. “We are

pleased with our performance and are on track to meet our financial

targets for the year.”

Segment Operating

Results

Home and Building Products ("HBP")

HBP's first quarter revenue of $395.4 million remained

consistent with the prior year quarter reflecting increased

residential volume, offset by reduced commercial volume.

Adjusted EBITDA of $127.0 million increased 2% from $124.7

million in the prior year quarter. The variance to the prior year

resulted from reduced material costs, partially offset by increased

labor and distribution costs.

Consumer and Professional Products ("CPP")

CPP's first quarter revenue of $237.0 million decreased 4%

compared to the prior year quarter, primarily driven by decreased

volume of 8% due to reduced consumer demand in North America and

the United Kingdom, partially offset by organic growth in

Australia. The Pope acquisition contributed 4%.

Adjusted EBITDA of $18.2 million increased by $12.7 million from

$5.5 million in the prior year quarter, primarily due to the

benefits from the global sourcing expansion initiative and

increased revenue in Australia as noted above.

Taxes

The Company reported pretax income from operations for the

quarters ended December 31, 2024 and December 31, 2023, and

recognized effective tax rates of 27.3% and 29.9%, respectively.

Excluding all items that affect comparability, the effective tax

rates for the quarters ended December 31, 2024 and 2023 were 27.7%

and 27.9%, respectively.

Balance Sheet and Capital

Expenditures

As of December 31, 2024, the Company had cash and equivalents of

$152.0 million and total debt outstanding of $1.48 billion,

resulting in net debt of $1.32 billion. Leverage, as calculated in

accordance with our credit agreement (see the attached table), was

2.4x net debt to EBITDA compared to 2.5x at December 31, 2023 and

2.6x at September 30, 2024. Free cash flow of $142.7 million for

the three month period ended December 31, 2024 reflects the

Company's strong operating results through the first quarter of

2025. At December 31, 2024, borrowing availability under the

revolving credit facility was $427.5 million, subject to certain

loan covenants. During the quarter the Company sold real estate as

a result of the CPP sourcing expansion initiative, realizing $17.2

million in proceeds. This offset capital expenditures of $17.5

million, resulting in net capital expenditures of $0.2 million for

the quarter ended December 31, 2024. For a reconciliation of free

cash flow, a non-GAAP measure, to net cash provided by operating

activities, and the definition of free cash flow, see the attached

table.

Share Repurchases

Share repurchases during the quarter ended December 31, 2024

totaled 0.6 million for a total of $42.3 million, or an average of

$69.40 per share. Since April 2023 and through December 31, 2024,

the Company purchased 9.5 million shares of common stock or 16.7%

of the outstanding shares, for a total of $467.6 million or an

average of $49.09 per share. As of December 31, 2024, $390.3

million remained under the Board authorized share repurchase

program.

Conference Call

Information

The Company will hold a conference call today, February 5, 2025,

at 8:30 AM ET.

The call can be accessed by dialing 1-877-407-0792 (U.S.

participants) or 1-201-689-8263 (International participants).

Callers should ask to be connected to the Griffon Corporation

teleconference or provide conference ID number 13751075.

Participants are encouraged to dial-in at least 10 minutes before

the scheduled start time.

A replay of the call will be available starting on Wednesday,

February 5, 2025 at 11:30 AM ET by dialing 1-844-512-2921 (U.S.) or

1-412-317-6671 (International), and entering the conference ID

number: 13751075. The replay will be available through Wednesday,

February 19, 2025 at 11:59 PM ET.

Forward-looking

Statements

“Safe Harbor” Statements under the Private Securities Litigation

Reform Act of 1995: All statements related to, among other things,

income (loss), earnings, cash flows, revenue, changes in

operations, operating improvements, industries in which Griffon

Corporation (the “Company” or “Griffon”) operates and the United

States and global economies that are not historical are hereby

identified as “forward-looking statements,” and may be indicated by

words or phrases such as “anticipates,” “supports,” “plans,”

“projects,” “expects,” “believes,” "achieves", “should,” “would,”

“could,” “hope,” “forecast,” “management is of the opinion,” “may,”

“will,” “estimates,” “intends,” “explores,” “opportunities,” the

negative of these expressions, use of the future tense and similar

words or phrases. Such forward-looking statements are subject to

inherent risks and uncertainties that could cause actual results to

differ materially from those expressed in any forward-looking

statements. These risks and uncertainties include, among others:

current economic conditions and uncertainties in the housing,

credit and capital markets; Griffon’s ability to achieve expected

savings and improved operational results from cost control,

restructuring, integration and disposal initiatives (including the

expanded CPP global outsourcing strategy announced in May 2023);

the ability to identify and successfully consummate, and integrate,

value-adding acquisition opportunities; increasing competition and

pricing pressures in the markets served by Griffon’s operating

companies; the ability of Griffon’s operating companies to expand

into new geographic and product markets, and to anticipate and meet

customer demands for new products and product enhancements and

innovations; increases in the cost or lack of availability of raw

materials such as steel, resin and wood, components or purchased

finished goods, including any potential impact on costs or

availability resulting from tariffs; changes in customer demand or

loss of a material customer at one of Griffon’s operating

companies; the potential impact of seasonal variations and

uncertain weather patterns on certain of Griffon’s businesses;

political events or military conflicts that could impact the

worldwide economy; a downgrade in Griffon’s credit ratings; changes

in international economic conditions including inflation, interest

rate and currency exchange fluctuations; the reliance by certain of

Griffon’s businesses on particular third party suppliers and

manufacturers to meet customer demands; the relative mix of

products and services offered by Griffon’s businesses, which

impacts margins and operating efficiencies; short-term capacity

constraints or prolonged excess capacity; unforeseen developments

in contingencies, such as litigation, regulatory and environmental

matters; Griffon’s ability to adequately protect and maintain the

validity of patent and other intellectual property rights; the

cyclical nature of the businesses of certain of Griffon’s operating

companies; possible terrorist threats and actions and their impact

on the global economy; effects of possible IT system failures, data

breaches or cyber-attacks; the impact of pandemics, such as

COVID-19, on the U.S. and the global economy, including business

disruptions, reductions in employment and an increase in business

and operating facility failures, specifically among our customers

and suppliers; Griffon’s ability to service and refinance its debt;

and the impact of recent and future legislative and regulatory

changes, including, without limitation, changes in tax laws. Such

statements reflect the views of the Company with respect to future

events and are subject to these and other risks, as previously

disclosed in the Company’s Securities and Exchange Commission

filings. Readers are cautioned not to place undue reliance on these

forward-looking statements. These forward-looking statements speak

only as of the date made. Griffon undertakes no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise, except

as required by law.

About Griffon

Corporation

Griffon Corporation is a diversified management and holding

company that conducts business through wholly-owned subsidiaries.

Griffon oversees the operations of its subsidiaries, allocates

resources among them and manages their capital structures. Griffon

provides direction and assistance to its subsidiaries in connection

with acquisition and growth opportunities as well as divestitures.

As long-term investors, we intend to continue to grow and

strengthen our existing businesses, and to diversify further

through investments in our businesses and acquisitions.

Griffon conducts its operations through two reportable

segments:

- Home and Building Products ("HBP") conducts its operations

through Clopay Corporation. Founded in 1964, Clopay is the largest

manufacturer and marketer of garage doors and rolling steel doors

in North America. Residential and commercial sectional garage doors

are sold through professional dealers and leading home center

retail chains throughout North America under the brands Clopay,

Ideal, and Holmes. Rolling steel door and grille products designed

for commercial, industrial, institutional, and retail use are sold

under the Cornell and Cookson brands.

- Consumer and Professional Products (“CPP”) is a global provider

of branded consumer and professional tools; residential, industrial

and commercial fans; home storage and organization products; and

products that enhance indoor and outdoor lifestyles. CPP sells

products globally through a portfolio of leading brands including

AMES, since 1774, Hunter, since 1886, True Temper, and

ClosetMaid.

For more information on Griffon and its operating subsidiaries,

please see the Company’s website at www.griffon.com.

Griffon evaluates performance and allocates resources based on

segment adjusted EBITDA and adjusted EBITDA, non-GAAP measures,

which are defined as income before taxes, excluding interest income

and expense, depreciation and amortization, strategic review

charges, non-cash impairment charges, restructuring charges,

gain/loss from debt extinguishment and acquisition related

expenses, as well as other items that may affect comparability, as

applicable. Segment adjusted EBITDA also excludes unallocated

amounts, mainly corporate overhead. Griffon believes this

information is useful to investors.

The following tables provide operating highlights and a

reconciliation of segment adjusted EBITDA and adjusted EBITDA to

income before taxes:

(in thousands)

For the Three Months Ended

December 31,

REVENUE

2024

2023

Home and Building Products

$

395,401

$

395,791

Consumer and Professional Products

236,970

247,362

Total revenue

$

632,371

$

643,153

For the Three Months Ended

December 31,

(in thousands)

2024

2023

ADJUSTED EBITDA

Home and Building Products

$

127,042

$

124,719

Consumer and Professional Products

18,192

5,539

Segment adjusted EBITDA

145,234

130,258

Unallocated amounts, excluding

depreciation*

(14,042

)

(13,907

)

Adjusted EBITDA

131,192

116,351

Net interest expense

(24,481

)

(24,875

)

Depreciation and amortization

(15,614

)

(14,823

)

Restructuring charges

—

(12,400

)

Gain on sale of real estate

7,974

547

Strategic review - retention and other

(1,651

)

(4,658

)

Income before taxes

$

97,420

$

60,142

* Primarily Corporate Overhead

(in thousands)

For the Three Months Ended

December 31,

DEPRECIATION and AMORTIZATION

2024

2023

Segment:

Home and Building Products

$

4,275

$

3,633

Consumer and Professional Products

11,218

11,057

Total segment depreciation and

amortization

15,493

14,690

Corporate

121

133

Total consolidated depreciation and

amortization

$

15,614

$

14,823

Griffon believes free cash flow ("FCF", a non-GAAP measure) is a

useful measure for investors because it demonstrates the Company's

ability to generate cash from operations for purposes such as

repaying debt, funding acquisitions and paying dividends. FCF is

defined as net cash provided by operating activities less capital

expenditures, net of proceeds.

The following table provides a reconciliation of net cash

provided by operating activities to FCF:

For the Three Months Ended

December 31,

(in thousands)

2024

2023

Net provided by operating activities

$

142,922

$

146,058

Acquisition of property, plant and

equipment

(17,456

)

(14,330

)

Proceeds from the sale of property, plant

and equipment

17,220

787

FCF

$

142,686

$

132,515

Net debt to EBITDA (Leverage ratio), a non-GAAP measure, is a

key financial measure that is used by management to assess the

borrowing capacity of the Company. The Company has defined its net

debt to EBITDA leverage ratio as net debt (total principal debt

outstanding net of cash and equivalents) divided by the sum of

trailing twelve-month (“TTM”) adjusted EBITDA (as defined above)

and TTM stock-based compensation expense. The following table

provides a calculation of our net debt to EBITDA leverage ratio as

calculated per our credit agreement:

(in thousands)

December 31,

2024

September 30,

2024

December 31,

2023

Cash and equivalents

$

151,952

$

114,438

$

110,546

Notes payable and current portion of

long-term debt

$

8,143

$

8,155

$

9,274

Long-term debt, net of current

maturities

1,466,889

1,515,897

1,430,235

Debt discount/premium and issuance

costs

14,604

15,633

19,227

Total gross debt

1,489,636

1,539,685

1,458,736

Debt, net of cash and

equivalents

$

1,337,684

$

1,425,247

$

1,348,190

TTM Adjusted EBITDA (1)

$

528,442

$

513,602

$

513,123

TTM Stock and ESOP-based compensation

25,799

26,838

25,293

TTM Adjusted EBITDA

$

554,241

$

540,440

$

538,416

Leverage ratio

2.4x

2.6x

2.5x

1. Griffon defines Adjusted EBITDA as

operating results before interest income and expense, income taxes,

depreciation and amortization, restructuring charges, debt

extinguishment, net and acquisition related expenses, as well as

other items that may affect comparability, as applicable.

The following tables provide a reconciliation of gross profit

and selling, general and administrative expenses for items that

affect comparability for the three months ended December 31, 2024,

and 2023:

(in thousands)

For the Three Months Ended

December 31,

2024

2023

Gross profit, as reported

$

264,276

$

236,641

% of revenue

41.8

%

36.8

%

Adjusting items:

Restructuring charges(1)

—

11,646

Gross profit, as adjusted

$

264,276

$

248,287

% of revenue

41.8

%

38.6

%

(1) For the quarter ended December 31,

2023, restructuring charges relate to the CPP global sourcing

expansion.

(in thousands)

For the Three Months Ended

December 31,

2024

2023

Selling, general and administrative

expenses, as reported

$

152,181

$

152,803

% of revenue

24.1

%

23.8

%

Adjusting items:

Restructuring charges(1)

—

(754

)

Strategic review - retention and other

(1,651

)

(4,658

)

Selling, general and administrative

expenses, as adjusted

$

150,530

$

147,391

% of revenue

23.8

%

22.9

%

(1) For the quarter ended December 31,

2023, restructuring charges relate to the CPP global sourcing

expansion.

GRIFFON CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(in thousands, except per

share data)

(Unaudited)

Three Months Ended December

31,

2024

2023

Revenue

$

632,371

$

643,153

Cost of goods and services

368,095

406,512

Gross profit

264,276

236,641

Selling, general and administrative

expenses

152,181

152,803

Income from operations

112,095

83,838

Other income (expense)

Interest expense

(24,887

)

(25,299

)

Interest income

406

424

Gain on sale of real estate

7,974

547

Other, net

1,832

632

Total other expense, net

(14,675

)

(23,696

)

Income before taxes

97,420

60,142

Provision for income taxes

26,569

17,965

Net income

$

70,851

$

42,177

Basic earnings per common share

$

1.56

$

0.86

Basic weighted-average shares

outstanding

45,538

48,784

Diluted earnings per common share

$

1.49

$

0.82

Diluted weighted-average shares

outstanding

47,541

51,467

Dividends paid per common share

$

0.18

$

0.15

Net income

$

70,851

$

42,177

Other comprehensive income (loss), net of

taxes:

Foreign currency translation

adjustments

(20,018

)

10,238

Pension and other post retirement

plans

55

532

Change in cash flow hedges

2,264

(295

)

Total other comprehensive income (loss),

net of taxes

(17,699

)

10,475

Comprehensive income, net

$

53,152

$

52,652

The accompanying notes to

condensed consolidated financial statements are an integral part of

these statements.

GRIFFON CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands)

(Unaudited)

December 31,

2024

September 30,

2024

CURRENT ASSETS

Cash and equivalents

$

151,952

$

114,438

Accounts receivable, net of allowances of

$11,766 and $10,986

268,951

312,765

Inventories

418,164

425,489

Prepaid and other current assets

49,850

61,604

Assets held for sale

5,559

14,532

Assets of discontinued operations

650

648

Total Current Assets

895,126

929,476

PROPERTY, PLANT AND EQUIPMENT,

net

287,755

288,297

OPERATING LEASE RIGHT-OF-USE

ASSETS

169,984

171,211

GOODWILL

329,393

329,393

INTANGIBLE ASSETS, net

609,232

618,782

OTHER ASSETS

30,231

30,378

ASSETS OF DISCONTINUED

OPERATIONS

3,431

3,417

Total Assets

$

2,325,152

$

2,370,954

CURRENT LIABILITIES

Notes payable and current portion of

long-term debt

$

8,143

$

8,155

Accounts payable

142,702

119,354

Accrued liabilities

166,890

181,918

Current portion of operating lease

liabilities

33,928

35,065

Liabilities of discontinued operations

4,368

4,498

Total Current Liabilities

356,031

348,990

LONG-TERM DEBT, net

1,466,889

1,515,897

LONG-TERM OPERATING LEASE

LIABILITIES

147,463

147,369

OTHER LIABILITIES

123,757

130,540

LIABILITIES OF DISCONTINUED

OPERATIONS

3,236

3,270

Total Liabilities

2,097,376

2,146,066

COMMITMENTS AND CONTINGENCIES

SHAREHOLDERS’ EQUITY

Total Shareholders’ Equity

227,776

224,888

Total Liabilities and Shareholders’

Equity

$

2,325,152

$

2,370,954

GRIFFON CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

(Unaudited)

Three Months Ended

December 31,

2024

2023

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income

$

70,851

$

42,177

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

15,614

14,823

Stock-based compensation

5,378

6,417

Asset impairment charges -

restructuring

—

8,482

Provision for losses on accounts

receivable

1,182

562

Amortization of debt discounts and

issuance costs

1,029

1,056

Loss (gain) on sale of assets and

investments

168

(3

)

Gain on sale of real estate

(7,974

)

(547

)

Change in assets and liabilities:

Decrease in accounts receivable

35,445

14,491

(Increase) decrease in inventories

(393

)

24,623

Increase in prepaid and other assets

(5,066

)

(3,631

)

Increase in accounts payable, accrued

liabilities, income taxes payable and operating lease

liabilities

26,423

36,491

Other changes, net

265

1,117

Net cash provided by operating

activities

142,922

146,058

CASH FLOWS FROM INVESTING ACTIVITIES:

Acquisition of property, plant and

equipment

(17,456

)

(14,330

)

Proceeds from the sale of property, plant

and equipment

17,220

787

Net cash used in investing activities

(236

)

(13,543

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Dividends paid

(9,037

)

(9,965

)

Purchase of shares for treasury

(49,083

)

(81,449

)

Proceeds from long-term debt

—

31,500

Payments of long-term debt

(50,000

)

(63,860

)

Financing costs

(42

)

(114

)

Other, net

41

(59

)

Net cash used in financing activities

(108,121

)

(123,947

)

CASH FLOWS FROM DISCONTINUED

OPERATIONS:

Net cash used in operating activities

(180

)

(2,926

)

Net cash used in discontinued

operations

(180

)

(2,926

)

Effect of exchange rate changes on cash

and equivalents

3,129

2,015

NET INCREASE IN CASH AND EQUIVALENTS

37,514

7,657

CASH AND EQUIVALENTS AT BEGINNING OF

PERIOD

114,438

102,889

CASH AND EQUIVALENTS AT END OF PERIOD

$

151,952

$

110,546

Supplemental Disclosure of Non-Cash Flow

Information:

Capital expenditures in accounts

payable

$

2,064

$

2,306

Griffon evaluates performance based on adjusted net income and

the related adjusted earnings per share, which excludes

restructuring charges, gain/loss from debt extinguishment,

acquisition related expenses, discrete and certain other tax items,

as well other items that may affect comparability, as applicable,

non-GAAP measures. Griffon believes this information is useful to

investors. The following table provides a reconciliation of net

income to adjusted net income and earnings per common share to

adjusted earnings per common share:

For the Three Months

Ended

December 31,

2024

2023

(in thousands, except per share

data)

(Unaudited)

Net income

$

70,851

$

42,177

Adjusting items:

Restructuring charges(1)

—

12,400

Gain on sale of real estate

(7,974

)

(547

)

Strategic review - retention and other

1,651

4,658

Tax impact of above items(2)

1,595

(4,204

)

Discrete and certain other tax (benefits)

provisions, net(3)

(250

)

783

Adjusted net income

$

65,873

$

55,267

Earnings per common share

$

1.49

$

0.82

Adjusting items, net of tax:

Restructuring charges(1)

—

0.18

Gain on sale of real estate

(0.13

)

(0.01

)

Strategic review - retention and other

0.03

0.07

Discrete and certain other tax (benefits)

provisions, net(3)

(0.01

)

0.02

Adjusted earnings per common share

$

1.39

$

1.07

Diluted weighted-average shares

outstanding

47,541

51,467

Note: Due to rounding, the sum of earnings

per common share and adjusting items, net of tax, may not equal

adjusted earnings per common share.

(1) For the three months ended December

31, 2023, restructuring charges relate to the CPP global sourcing

expansion, of which $11.6 million is included in Cost of goods and

services and $0.8 million is included in SG&A in the Company's

Condensed Consolidated Statements of Operations.

(2) The tax impact for the above

reconciling adjustments from GAAP to non-GAAP net income and EPS is

determined by comparing the Company's tax provision, including the

reconciling adjustments, to the tax provision excluding such

adjustments.

(3) Discrete and certain other tax

provisions (benefits) primarily relate to the impact of a rate

differential between statutory and annual effective tax rate on

items impacting the quarter.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250204831282/en/

Company Contact Brian G. Harris EVP

& Chief Financial Officer Griffon Corporation (212) 957-5000

IR@griffon.com

Investor Relations Contact Tom Cook

Managing Director ICR Inc. (203) 682-8250

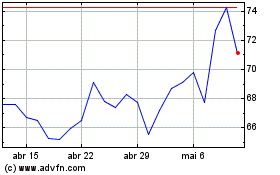

Griffon (NYSE:GFF)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Griffon (NYSE:GFF)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025