The Global Offering, for approximately 10% of the Company’s

share capital, is aimed at international institutional investors,

via a Private Placement through an accelerated book-building

process.

The Global Offering is also aimed at retail investors via

PrimaryBid platform, exclusively in France.

Funds raised will enable Medincell to strengthen licensing

opportunities by expanding BEPO® technology’s reach into new

molecules and indications, and potentially by potentially

considering complementary technologies. Additionally, funds raised

will improve our shareholder structure and reinforce the company’s

balance sheet, enhancing financial flexibility to drive additional

long-term value creation.

Regulatory News:

Medincell (Paris:MEDCL):

THIS PRESS RELEASE IS NOT BEING MADE IN AND

COPIES OF IT MAY NOT BE DISTRIBUTED OR SENT, DIRECTLY OR

INDIRECTLY, INTO THE UNITED STATES, CANADA, SOUTH AFRICA, JAPAN OR

AUSTRALIA

Medincell (Paris:MEDCL), a commercial-stage pharmaceutical

technology company developing a portfolio of long-acting injectable

products in various therapeutic areas (the “Company”), announces

today the launch of a Global Offering (as defined below) of

approximately 10% of its share capital, through an offering to

institutional investors via a Private Placement and to retail

investors via the PrimaryBid platform.

Stéphane Postic, CFO of Medincell, said: “Our financial

trajectory is clear: achieve operational profitability by the

fiscal year ending March 31, 2027, then reach the €100 million

revenue threshold, through royalties and milestones payments, and

then accelerate our profitable growth far beyond. We are now

launching a value-enhancing capital increase to accelerate

development and licensing opportunities. The envisages transaction

will broaden our shareholder base with tier one investors according

to our financial strategy and provide the resources and flexibility

needed to fully execute our strategy and create additional

long-term value.”

Christophe Douat, CEO of Medincell, said: “The success of

UZEDY, our first marketed product, is a testimony of our ability to

design best-in-class, innovative treatments. Our potential second

royalty-generating product, a long-acting olanzapine, has now

completed its Phase 3 trial and is on track to reach the market

next year as a first-in-class treatment with tremendous potential.

With strong partners like Teva and AbbVie, a robust portfolio, and

a world-class team, we have built a solid foundation with

significant value-creation potential over the next five years.”

Christophe Douat added: “We have a path to

expanding the reach of our technology and continuing to forge new

partnerships to have a greater impact on global health while

generating additional value for our shareholders. To achieve this,

we continue to innovate, expand our technological reach, and grow

our collaboration network. It is also very important to keep

expanding our shareholder base especially in the US to prepare the

future. This ambition and vision are the driving forces behind the

capital increase we are launching today.”

The net proceeds from the Global Offering (as defined below),

combined with the Company’s existing funds, are intended to

contribute to:

- Expand BEPO® technology into new molecules and high value

indications

- Potential integration of complementary technologies

- Strengthening the company’s balance sheet

- General corporate purpose

Medincell’s portfolio as of February 1st, 2025

UZEDY®, the first treatment using Medincell's BEPO® technology

and commercialized by Teva, generated net sales of $117 million in

2024 in the US, its first year of commercialization, exceeding

expectations.

Teva and Medincell announced positive Phase 3 results for

TEV-‘749, their second partnered product - a once-monthly

olanzapine injectable for schizophrenia - demonstrating strong

efficacy and a favorable safety profile, with potential

first-in-class status and FDA submission expected in H2 2025.

Additionally, Medincell entered into strategic co-development

and licensing agreement with AbbVie to develop up to six

cutting-edge long-acting injectables, with up to $1.9 billion in

potential development and commercial milestones, plus royalties on

worldwide sales. Preclinical and CMC activities of the first drug

candidate have already been initiated.

Terms of the Global Offering

The Global Offering will be carried out in two distinct but

concomitant components:

- an offering without shareholders' preferential subscription

rights in favor of qualified investors or a restricted circle of

investors under the provisions of Article L. 411-2 1° of the French

Monetary and Financial Code, meeting the characteristics set out in

the 18th resolution of the Company's combined ordinary and

extraordinary general shareholders' meeting of 12 September 2024

(the “General Meeting”) (the "Private Placement"),

and

- a public offering without shareholders' preferential

subscription rights in favor of retail investors via the PrimaryBid

platform only in France, pursuant to Article L. 225-136 of the

French Commercial Code and in accordance with the 16th resolution

of the General Meeting (the “PrimaryBid Offering”, and,

together with the Private Placement, the “Global

Offering”).

The Private Placement will be carried out in accordance with the

18th resolution of the General Meeting, to (i) qualified investors

within the meaning of Article 2(e) of Regulation 2017/1129 of the

European Parliament and of the Council of 14 June 2017, as amended

(the “Prospectus Regulation”) or in other circumstances

falling within the scope of Article 1(4) of the Prospectus

Regulation in the European Union (including France) and outside the

European Union with the exception of the United States, Canada,

Australia, South Africa and Japan and (ii) certain institutional

investors in the United States.

The PrimaryBid Offering will not be made available to retail

investors outside France.

The gross proceeds of the Global Offering will depend

exclusively on the orders received for each of the above-mentioned

components without the possibility of reallocating the sums

allocated from one to the other. It is specified that the

PrimaryBid Offering is incidental to the Private Placement and will

represent a maximum of 20 % of the total amount of the Global

Offering and be limited to a maximum of €8 million. Allocations

will be proportional to demand, limited to the amount allocated to

this public offer, with allocations reduced should demand exceed

this limit. In any event, the PrimaryBid Offering will not be

carried out if the Private Placement does not occur. The Private

Placement is not conditional on the PrimaryBid Offering.

The Global Offering is subject to market and other conditions

and the final aggregate amount of the Global Offering is subject to

change. The Private Placement will be carried out via an

accelerated book-building process, following which the number and

price of the new shares to be issued will be decided by the Chief

Executive Officer, pursuant to and within the limits of the

delegations of authority granted by the Board of Directors and the

General Meeting, it being specified that the maximum number of new

shares that may be issued in the Global Offering in accordance with

such delegations and authorizations is 8,014,710 new shares,

representing a maximum of 30% of the capital.

The subscription price of the new shares in the Private

Placement shall be at least equal to the volume-weighted average of

the closing prices of the Company's share of the last 3 trading

sessions preceding the beginning of the Private Placement, reduced

by a maximum discount of 10% in accordance with the 18th

resolution. The subscription price of the new shares in the

PrimaryBid Offering will be equal to the price of the new shares

offered in the Private Placement, as determined by the accelerated

book-building initiated with institutional investors.

The accelerated book-building process for the Private Placement

will begin immediately following the publication of this press

release and is expected to close before the markets open on 19

February 2025, subject to any early closing. The PrimaryBid

Offering will begin immediately and close at 10:00pm CET on 18

February 2025, subject to any early closing. The Company will

announce the pricing and the definitive number of new shares to be

issued in the Global Offering via a press release as soon as

possible after the book-building ends.

Settlement-Delivery of the new ordinary shares to be issued in

the Global Offering and their admission for trading on the

regulated market of Euronext Paris are expected on 21 February

2025. The new ordinary shares will be of the same category and

fungible with the existing shares, will be entitled to all the

rights associated with the existing shares, and will be admitted to

trading on the regulated market of Euronext Paris under the same

ISIN FR0004065605.

Lock-up commitments

In connection with the Global Offering, the Company and, the

members of the Board of Directors and certain members of the

management team have signed a lock-up commitment that comes into

effect on the date of the signing of the placement agreement

entered into between the Company and the banks today and for a

period of 90 days following the settlement/delivery of the Global

Offering, subject to certain customary exceptions.

Financial Intermediaries

Jefferies, Evercore and Bryan Garnier & Co and are acting as

Joint Global Coordinators and Joint Bookrunners and Truist as Joint

Bookrunner on the Private Placement. The Private Placement is

subject to a placement agreement signed today between the Company

and the Joint Bookrunners.

Within the framework of the PrimaryBid Offering, investors may

only subscribe via the PrimaryBid partners mentioned on the

PrimaryBid website (www.PrimaryBid.fr). The PrimaryBid Offering is

governed by an engagement letter entered into between the Company

and PrimaryBid and not covered by a placement agreement. For

further details, please go to the PrimaryBid website at

www.PrimaryBid.fr.

Risk factors

The attention of the public is drawn to the risk factors

associated with the Company and its activity presented in Section 2

of the universal registration document filed with the French

Financial Market Authority (Autorité des Marchés Financiers) (the

"AMF") under number D.24-0649 on 30 July 2024, which is available

free of charge on the Company’s website

(https://www.medincell.com/regulated-information/). The occurrence

of all or part of these risks could have a negative impact on the

Company’s activity, financial situation, results, development or

outlook. The risk factors presented in that document are the same

today.

Additionally, investors are invited to consider the following

risks specific to this Global Offering: (i) the market price of the

Company’s shares may fluctuate and fall below the subscription

price of the shares issued as part of the Global Offering, (ii) the

volatility and liquidity of the Company’s shares may fluctuate

significantly, (iii) sales of the Company’s shares may take place

on the market and have a negative impact on the market price of its

share and (iv) the Company’s shareholders could suffer potentially

significant dilution resulting from any future capital increases

required to provide the Company with additional financing.

No Prospectus

The Global Offering is not subject to a prospectus requiring an

approval from the AMF.

This press release does not constitute a prospectus within the

meaning of Regulation (EU) 2017/1129 of the European Parliament and

of the Council of June 14, 2017, as amended, nor an offer to the

public.

About Medincell

Medincell is a clinical- and commercial-stage biopharmaceutical

licensing company developing long-acting injectable drugs in many

therapeutic areas. Our innovative treatments aim to guarantee

compliance with medical prescriptions, to improve the effectiveness

and accessibility of medicines, and to reduce their environmental

footprint. They combine active pharmaceutical ingredients with our

proprietary BEPO® technology which controls the delivery of a drug

at a therapeutic level for several days, weeks or months from the

subcutaneous or local injection of a simple deposit of a few

millimeters, entirely bioresorbable. The first treatment based on

BEPO® technology, intended for the treatment of schizophrenia, was

approved by the FDA in April 2023, and is now distributed in the

United States by Teva under the name UZEDY® (BEPO® technology is

licensed to Teva under the name SteadyTeq™). We collaborate with

leading pharmaceutical companies and foundations to improve global

health through new treatment options. Based in Montpellier,

Medincell currently employs more than 140 people representing more

than 25 different nationalities.

UZEDY® and SteadyTeq™ are trademarks of Teva Pharmaceuticals

medincell.com

This announcement does not, and shall not, in any circumstances,

constitute a public offering nor an invitation to the public in

connection with any offer. The distribution of this document may be

restricted by law in certain jurisdictions. Persons into whose

possession this document comes are required to inform themselves

about and to observe any such restrictions.

Not for release, directly or indirectly, in or into the United

States of America, Australia, South Africa, Canada or Japan. This

document (and the information contained herein) does not contain or

constitute an offer of securities for sale, or solicitation of an

offer to purchase securities, in the United States, Australia,

South Africa, Canada or Japan or any other jurisdiction where such

an offer or solicitation would be unlawful. The securities referred

to herein have not been and will not be registered under the U.S.

Securities Act of 1933, as amended (the "Securities Act"), and may

not be offered or sold in the United States, unless the securities

are registered under the Securities Act or pursuant to an exemption

from the registration requirements of the Securities Act. No public

offering of the securities will be made in the United States."

This communication does not constitute an offer of securities to

the public in the United Kingdom, has not been approved by an

authorised person in the United Kingdom for the purposes of Section

21(1) of the FSMA and is being distributed only to and is directed

only at (a) persons outside the United Kingdom, (b) persons who are

"qualified investors" a defined in Article 2(e) of Regulation (EU)

2017/2019, as it forms part of domestic law by virtue of the

European Union (Withdrawal) Act 2018, as amended by the European

Union (Withdrawal) Act 2020 who are also (i) persons who have

professional experience in matters relating to investments, falling

within the meaning of Article 19(5) of the Financial Services and

Markets Act 2000 (Financial Promotion) Order 2005, as amended (the

"Order"), (ii) persons falling within Article 49(2)(a) to

(d) of the Order (high net worth entities, unincorporated

associations etc.) and (iii) persons to whom an invitation or

inducement to engage in investment activity within the meaning of

Section 21 of the FSMA in connection with the sale of securities

may otherwise lawfully be communicated (all such persons together

being referred to as "Relevant Persons"). The securities are

available only to, and any invitation, offer or agreement to

subscribe, purchase or otherwise acquire such securities will be

available only to and will be engaged in only with, Relevant

Persons. Any person who is not a Relevant Person should not act or

rely on this communication or any of its contents.

In France, the offering of Medincell shares described below will

be made in the context of a capital increase in favor of qualified

investors or a restricted circle of investors, pursuant to Article

L. 411-2 1° of the French Code monétaire et financier and

applicable regulatory provisions and retail investors in France via

PrimaryBid. Pursuant to Article 211-3 of the General regulations of

the AMF, Articles 1(4) and 3 of the Regulation (EU) 2017/1129 of

the European Parliament and of the Council of 14 June 2017, as

amended (the "Prospectus Regulation") and any applicable

regulation, the offer of Medincell shares will not require the

publication of a prospectus approved by the AMF.

With respect to Member States of the European Economic Area

("Member State"), no action has been taken or will be taken

to permit a public offering of the securities referred to in this

press release requiring the publication of a prospectus in any

Member State. Therefore, such securities may not be and shall not

be offered in any Member State other than in accordance with the

exemptions of Article 1(4) of the Prospectus Regulation or,

otherwise, in cases not requiring the publication of a prospectus

under Article 3 of the Prospectus Regulation and/or the applicable

regulations in such Member State.

MIFID II Product Governance/Target Market: For the sole purposes

of the requirements of Article 9.8 of the EU Delegated Directive

2017/593 relating to the product approval process, the target

market assessment in respect of the shares of Medincell has led to

the conclusion, with respect to the type of clients criteria only

that: (i) the type of clients to whom the shares are targeted is

eligible counterparties and professional clients and retail

clients, each as defined in Directive 2014/65/EU, as amended

("MiFID II"); and (ii) all channels for distribution of the shares

of Medincell to eligible counterparties and professional clients

and retail clients are appropriate. Any person subsequently

offering, selling or recommending the shares of Medincell (a

“distributor”) should take into consideration the type of

clients assessment; however, a distributor subject to MiFID II is

responsible for undertaking its own target market assessment in

respect of the shares of Medincell and determining appropriate

distribution channels.

Statements contained herein may constitute "forward-looking

statements". These statements include all matters that are not

historical fact and generally, but not always, may be identified by

the use of words such as "believes," "expects," "are expected to,"

"anticipates," "intends," "estimates," "should," "will," "will

continue," "may," "is likely to," "plans" or similar expressions,

including variations and the negatives thereof or comparable

terminology.

Forward-looking statements are not guarantees of future

performance, involve a number of known and unknown risks,

uncertainties and other factors and the Company's actual results of

operations, financial condition and the development of the industry

in which it operates may differ significantly from those made in or

suggested by the forward-looking statements contained herein. In

addition, even if the Company's results of operations and financial

condition and the development of the industry in which it operates

are consistent with the forward-looking statements contained

herein, those results or developments may not be indicative of

results or developments in subsequent periods. The Company does not

undertake publicly to update or revise any forward-looking

statement that may be made herein, whether as a result of new

information, future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218740113/en/

David Heuzé Head of Corporate and Financial

Communications, and ESG david.heuze@Medincell.com / +33 (0)6 83 25

21 86

Grace Kim Chief Strategy Officer, U.S. Finance

grace.kim@Medincell.com / +1 (646) 991-4023

Nicolas Mérigeau/ Arthur Rouillé Media Relations

Medincell@newcap.eu / +33 (0)1 44 71 94 94

Louis-Victor Delouvrier/Alban Dufumier Investor Relations

France Medincell@newcap.eu / +33 (0)1 44 71 94 94

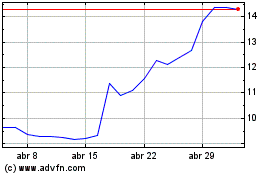

Medincell (EU:MEDCL)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Medincell (EU:MEDCL)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025