‘We are worried about a recession,’ but there’s a silver lining — Cathie Wood

18 Março 2025 - 1:51PM

Cointelegraph

ARK Invest CEO Cathie Wood believes the White House is

underestimating the recession risk facing the US economy stemming

from US President Donald Trump’s tariff policies — an oversight

that will eventually force the president and Federal Reserve to

enact pro-growth policies.

Speaking virtually at the Digital Asset Summit in New York on

March 18, Wood said US Treasury Secretary Scott Bessent isn’t

worried about a recession.

However, Wood said, “We are worried about a recession,” adding,

“We think the velocity of money is slowing down dramatically.”

Cathie Wood speaks virtually at the Digital Asset Summit.

Source: Cointelegraph

A slowdown in the velocity of money means capital is changing

hands less frequently, which is typically associated with a

recession, as consumers and businesses spend and invest less

money.

“I think what’s happening, though, is that if we do have a

recession, declining GDP, that this is going to give the president

and the Fed many more degrees of freedom to do what they want in

terms of tax cuts and monetary policy,” said Wood.

Investors believe the first domino could fall in the coming

months when the Fed puts an end to its quantitative tightening

program — something

bettors on Polymarket believe is 100% certain to happen before

May.

Meanwhile, expectations for multiple rate cuts by the Fed in the

second half of the year are growing, according to CME Group’s Fed

Fund futures prices.

The probability of rates being lower than they are now by

the Fed’s June 18 meeting is nearly 65%. Source:

CME Group

Related:

As Trump tanks Bitcoin, PMI offers a roadmap of what

comes next

Focus remains long term

ARK and Cathie Wood have been active cryptocurrency investors

for many years. ARK and 21Shares’ spot Bitcoin

(BTC) exchange-traded fund (ETF) was

approved on Jan. 11, 2024, and currently has more than $3.9 billion

in net assets, according to Yahoo Finance

data.

Spot Bitcoin ETFs have recorded heavy outflows in recent

weeks, but the overall trend shows investors are holding their

positions. Source: Farside

ARK also offers crypto portfolio solutions to wealth managers

through its partnership with Eaglebrook Advisors.

Wood told the New York Digital Asset Summit that “long-term

innovation wins as we go through these trials and tribulations,”

referring to the recent market correction.

When asked if crypto assets remain an “investable arc” over the

long term, Wood said this strategy was the cornerstone of ARK’s

investment approach.

“[W]e’ve built out positions in more than just the big three,”

she said, referring to Bitcoin, Ether (ETH) and Solana

(SOL).

This long-term arc is being supported by favorable regulations,

which have improved the investment landscape

dramatically.

Pro-crypto policy changes are “giving institutions the green

light, and if you look at our studies as long ago as 2016, we wrote

a paper called ‘Bitcoin: Ringing the Bell for a New Asset Class,’

and, yet many institutions just dismissed it out of hand,” said

Wood.

Now, institutions are looking at ARK’s studies and saying they

“have a fiduciary responsibility to expose [their] clients to a new

asset class.”

Magazine:

Bitcoin ETFs make Coinbase a ‘honeypot’ for hackers and

governments — Trezor CEO

...

Continue reading ‘We are worried about a recession,’

but there’s a silver lining — Cathie Wood

The post

‘We are worried about a recession,’ but there’s a

silver lining — Cathie Wood appeared first on

CoinTelegraph.

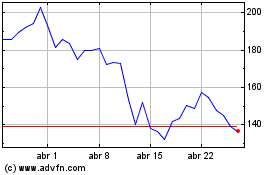

Solana (COIN:SOLUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Solana (COIN:SOLUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025