By Chris Matthews and Mark DeCambre, MarketWatch

All three major benchmarks reverse earlier gains

U.S. stocks were trading flat in the final hour of exchange

Tuesday, with all three major benchmarks turning negative after

attempting a modest rally earlier in the day, and as investors

remain laser-focused on the Federal Reserve, which begins its final

policy meeting of the year Tuesday, with a policy announcement set

for Wednesday.

How are benchmarks performing?

The Dow Jones Industrial Average edged up 40 points, or 0.2%, at

23,640, while S&P 500 index was down 4 points, or 0.2% at

2,541. The Nasdaq Composite Index climbed 18 points, an ascent of

0.3%, to 6,774.

All three benchmarks are off their early morning highs, when the

Dow climbed as high as 335 points, the S&P 28 points, while the

Nasdaq rose 83 points, at its highest.

Read: Here's why the Fed won't save the stock market, despite

its worst December start since 1980

(http://www.marketwatch.com/story/heres-why-the-fed-wont-save-the-stock-market-despite-its-worst-december-start-since-1980-2018-12-15)

What's driving the market?

Persistent fears that sluggish global growth will wash up on

U.S. shores continues to unsettle investors, and has resulted in

the worst equity market selloff in recent memory, underpinned by

rising interest rates and trade-war jitters.

That downdraft comes as the Federal Open Market Committee is set

to conclude its final rate-setting gathering of 2018 on Wednesday.

While the market is fixated on the pace of rate hikes in 2019,

investors expect a 25 basis point increase in the benchmark rate at

the meeting.

CME Group data

(https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html),

gauging Federal-funds futures, indicate a 71.5% likelihood for the

rate increase to a range of 2.25%-2.50%. This figure has fallen

from 75.8% just one week ago, and investor uncertainty over the

Fed's next move has been fueled by calls for the Fed to decline to

raise rate, with the most recent coming

(https://www.wsj.com/articles/time-for-a-fed-pause-11545092108) in

the form of a Wall Street Journal editorial published Tuesday

morning.

President Donald Trump has also been a consistent proponent of

halting interest-rate increases, and he took to Twitter again

Tuesday morning

(https://twitter.com/realDonaldTrump/status/1075001077576151041) to

promote the Journal editorial.

Potentially more important that the decision to raise rates will

be Fed's communication strategy, including the statement it issues

to accompany the interest-rate decision, as well as a news

conference at 2:30 Wednesday, where Federal Reserve Chair Jerome

Powell will discuss future interest rate hikes.

Meanwhile, Chinese leader Xi Jinping, speaking at an event to

commemorate the 40th anniversary of China's economic reforms,

called for China to "stay the course" on economic reforms, adding a

defiant note that "no one is in a position to dictate to the

Chinese people what should or should not be done," an apparent

reference to the continuing tariff spat between Beijing and

Washington, led by President Donald Trump's administration.

What are analysts saying?

"Equities are down, and I think they have a lot further to go,"

Larry Benedict, CEO of the Opportunistic Trader told

MarketWatch.

He said that whatever relief the Fed may provide markets

tomorrow will be overwhelmed in the final trading days of 2018 by

other factors, like extremely negative sentiment, tax-motivated

selling, and a "triple witching" day coming later this week, when

contracts for stock index futures, stock index options, and stock

options all expire on the same day, which will force traders to

close out positions and will raise stock market volatility.

A worsening global economy is reason that markets continue to

struggle for altitude. The S&P 500 is "only down 7% on the

year. Markets abroad are down twice that or more," Benedict said.

"We're the only market that hasn't gotten annihilated."

"Today feels like one of those oversold bounces," Yousef Abbasi

global market strategist with INTL FCStone told MarketWatch.

He predicted that markets may drift higher this afternoon ahead

of what investors predict will be a dovish hike from the Fed

tomorrow, "but in terms of the broader outlook, it is hard to

imagine this market rallying with any sort of fervor and retaining

those gains," he said, because there is just too much uncertainty

regarding global growth and trade policy.

What data are traders watching?

U.S. home builders

(http://www.marketwatch.com/story/housing-starts-increase-in-november-a-rare-bright-spot-for-housing-market-2018-12-18)

began construction at a seasonally-adjusted annual rate of 1.26

million homes in November, above the 1.23 million expected,

according to a MarketWatch poll of economists.

New building permits in November

(http://www.marketwatch.com/story/housing-starts-increase-in-november-a-rare-bright-spot-for-housing-market-2018-12-18)

were issued at a seasonally adjusted annual rate of 1.33 million,

versus consensus estimates of 1.27 million, according to

FactSet.

Which stocks are in focus?

Oracle Corp.(ORCL) is up 1.6% after the software company

reported an earnings beat late Monday.

Opinion:Oracle's strong earnings thanks to hefty share

repurchases

(http://www.marketwatch.com/story/oracle-bought-an-earnings-beat-with-share-repurchases-2018-12-17)

Shares of CBS Corp. (CBSA) are up 0.3%, after the broadcaster

announced Monday that former CEO Les Moonves won't receive a $120

million severance package

(http://www.marketwatch.com/story/cbs-says-disgraced-former-ceo-les-moonves-wont-get-his-120-million-severance-2018-12-17)after

the board of directors concluded he violated company policy and was

uncooperative with an investigation into sexual misconduct

allegations.

Boeing Co. (BA) stock is up 4.1%, after the company announced

(http://www.marketwatch.com/story/boeing-hikes-dividend-20-increases-share-buyback-2018-12-17)

a 20% dividend increase and a new share buyback program Monday

evening.

Shares of Tilray, Inc. are rising 7.8% Tuesday, after the

cannabis company announced that it has reached a global supply and

distribution agreement for medical marijuana with pharmaceutical

giant Novartis AG (NOVN.EB).

General Electric Co. (GE) stock is staging a rally Tuesday, with

shares up 4.7% Tuesday. The stock has fallen more than 56%

year-to-date.

Shares of Darden Restaurants, Inc. (DRI) are up 5.5%, after the

Olive Garden parent company reported second-quarter same-store

sales figures that beat Wall Street expectations.

How did the benchmarks trade yesterday?

On Monday, the Dow retreated 507.53 points, or 2.1%, at

23,592.98, the S&P 500 fell 54.01 points, or 2.1%, at 2,545.94,

and the Nasdaq Composite Index retreated 156.93 points to 6,753.73,

a drop of 2.3%.

The S&P 500 closed at its lowest level since October of 2017

on Monday, the Nasdaq finished at its lowest since November of

2017, and the Dow closed at lowest level since March 23, according

to Dow Jones Market Data.

How are other markets trading?

Asian markets closed lower Tuesday

(http://www.marketwatch.com/story/asian-markets-fall-ahead-of-xi-speech-fed-meeting-2018-12-17),

with Japan's Nikkei , Hong Kong's Hang Seng Index and China's

Shanghai Composite Index losing ground.

In Europe, closed lower, with the Stoxx Europe 600 and the FTSE

100 ending the day in the red.

Crude oil is continuing to slide Tuesday

(http://www.marketwatch.com/story/oil-prices-hit-fresh-lows-as-supply-worries-plague-market-2018-12-18),

down more than 5% on the day. The price of gold , meanwhile, rose

0.1%, while the U.S. dollar

(http://www.marketwatch.com/story/with-a-rate-hike-priced-in-dollar-traders-wait-for-feds-2019-guidance-2018-12-17)

is down 0.1%

(END) Dow Jones Newswires

December 18, 2018 15:33 ET (20:33 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

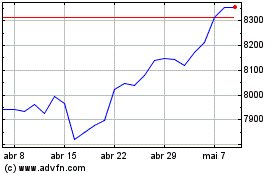

FTSE 100 (FTSE:UKX)

Gráfico Histórico do Índice

De Mar 2024 até Abr 2024

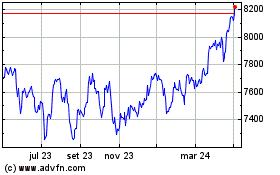

FTSE 100 (FTSE:UKX)

Gráfico Histórico do Índice

De Abr 2023 até Abr 2024