Money Managers, Lured by Rich Returns, Venture Into Risky World of Trade Finance

22 Janeiro 2020 - 8:33AM

Dow Jones News

By Joe Wallace

Money managers including Allianz SE and American International

Group Inc. have found a window of opportunity to enter the business

of financing international trade, long the domain of banks.

Banks finance trade deals by offering loans and letters of

credit, as well as through more complex arrangements including the

purchase of an exporter's accounts receivable at a discounted

price. Such deals let lenders shoulder the risk that importers

don't pay on time or exporters don't deliver the goods, greasing

the wheels of international commerce.

Trade finance has historically been dominated by European banks

such as HSBC Holdings PLC and BNP Paribas SA, alongside Citigroup

Inc. in the U.S. But some powerhouses, including Dutch lender ABN

AMRO Bank NV, have dialed back their operations. Others, under

pressure from new capital requirements, are looking to sell their

trade-financing deals, creating an opportunity for new types of

financiers to enter the market.

The interest from some of the world's biggest money managers

signals a potential revival for growth in global trade. In recent

years, the disruption from global trade wars, marked by escalating

tariffs, as well as sanctions triggered by geopolitical

differences, have served to hamper cross-border flows of goods and

services.

Investors finance only a fraction of international goods

exports, which rose to a record $19.5 trillion in 2018, according

to the World Trade Organization. Nonbank financial institutions

bought about $100 billion in trade-finance assets in 2018, but that

could reach $3 trillion in the coming years, according to Christoph

Gugelmann, chief executive of London-based Tradeteq, which runs an

exchange for trade-finance assets.

A $1.5 trillion "trade-finance gap" is holding back

international commerce, the Asian Development Bank said in

September, pointing to the Pacific islands as "an extreme example"

of a region that risks being cut off from the global financial

system if banks retreat from trade finance.

Asset managers say trade financing pays attractive returns

compared with bonds, whose yields have plummeted in recent years as

interest rates dropped to historic lows.

"These investors are looking for alternative asset classes,"

said Dimitri Kouchnirenko, director of Singapore-based Incomlend,

another trade-finance exchange. "They're looking for yield, and

finding yield is very difficult."

But the business can be both hazardous and expensive. Fund

managers, more used to buying stocks and bonds, sometimes find

themselves ill-prepared to assess the risks involved in financing a

diverse and dispersed business that remains dependent on paper

documents for record-keeping and contracts. The perils can include

defective goods, damage to products during transportation, fraud,

or external factors such as weather, tariffs and currency

fluctuations.

To mitigate these risks, large money managers buy trade-finance

assets that lenders have already originated instead of funding

importers and exporters directly. Often these assets are wrapped up

into asset-backed securities.

Allianz Global Investors joined with HSBC, the world's biggest

provider of trade finance by revenue, to set up a fund with just

under $50 million under management last year. Allianz buys

securities backed by trade-finance deals from HSBC and other banks,

via a subsidiary known as a special-purpose vehicle.

Some securities backed by trade financing pay barely positive

yields and are bought by investors seeking a safe place to store

money, according to Tradeteq's Mr. Gugelmann. Others yield around

2% and are typically bought by pension funds and insurers. Riskier

securities, backed by trade financing originated by nonbank

lenders, can yield up to 10% and are purchased by hedge funds.

HSBC has increased the trade financing it sells on to investors

and other lenders from $2 billion in 2015 to $28 billion last year,

said Surath Sengupta, head of trade portfolio management and

distribution at the bank.

"Clearly, the more velocity you can get in terms of

transactions, the more you can continue to grow your business and

not increase your risk-weighted assets," said James Binns, head of

trade and working capital at Barclays PLC. "The complexity is

around investors understanding exactly what they're investing

in."

AIG recently began to invest in trade finance after selling

insurance to the sector for several decades. In September, the

company bought securities backed by receivables as part of an $80

million deal with Cairn Capital Ltd., a fund manager in London.

"Fraud is your biggest risk," said Ihab Salib, a senior

portfolio manager at Federated Investors Inc. One trade-finance

deal that Mr. Salib invested in was secured against what appeared

to be a stockpile of grain. "But when you put a 12-foot pole in the

silo, it was filled with hay," he said.

Federated, which entered the market in 2006, buys trade-finance

assets from banks in syndication deals without slicing them into

securities. Mr. Salib worries that securitization allows banks to

palm off riskier products they don't want to own themselves.

"I want to do deals banks are willing to hold on their own

books," Mr. Salib said. "Someone else needs to have skin in the

game."

Write to Joe Wallace at Joe.Wallace@wsj.com

(END) Dow Jones Newswires

January 22, 2020 06:18 ET (11:18 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

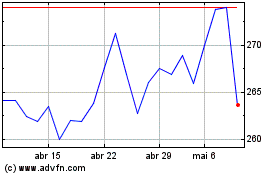

Allianz (TG:ALV)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

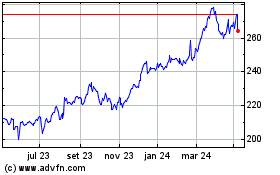

Allianz (TG:ALV)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024