U.S. Futures Pause Post-Nvidia Rally; WTI and Brent Decline in April Futures

23 Fevereiro 2024 - 10:04AM

IH Market News

In the pre-market on Friday, U.S. index futures showed a

moderate trend, reflecting a pause after the euphoria outbreak in

the market caused by Nvidia’s rally. This event led American

exchanges to climb to new heights, setting historical marks.

At 05:34 AM, Dow Jones futures (DOWI:DJI) rose 3 points, or

0.01%. S&P 500 futures dropped 0.03%, and Nasdaq-100 futures

fell back by 0.18%. The yield on 10-year Treasury notes was at

4.345%.

In the commodities market, West Texas Intermediate crude oil for

April fell by 1.22%, to $77.63 per barrel. Brent crude for April

dropped 1.09%, near $82.76 per barrel. Iron ore traded on the

Dalian exchange rose by 0.45%, to $124.89 per metric ton. The

benchmark iron ore for March on the Singapore Exchange went up by

0.43%, to $120.2 a ton.

During Thursday’s trading in the United States, the Dow Jones

and S&P 500 reached new closing highs, reflecting widespread

optimism driven by positive results from Nvidia

(NASDAQ:NVDA), which exceeded fourth-quarter earnings expectations.

The strong demand for Nvidia’s AI chips contributed to this rally,

while the Nasdaq nearly beat its previous record. Moreover, an

unexpected drop in unemployment insurance claims and an increase in

existing home sales bolstered market sentiment. The Dow Jones

closed up 456.87 points or 1.18% at 39,069.11 points. The S&P

500 advanced 105.23 points or 2.11% to 5,087.03 points. The Nasdaq

soared 460.75 points or 2.96% to 16,041.62 points.

Asian exchanges mostly advanced on Friday, with Japan’s Nikkei

standing out by rising 2.19%, driven by Nvidia’s rally on Wall

Street and economic support from Beijing. Although Hong Kong’s Hang

Seng recorded a slight decline of 0.10%, indices in China, South

Korea, and Australia showed modest gains, reflecting regional

optimism fueled by AI innovations and favorable government

policies.

European markets followed the upward trajectory, capitalizing on

the momentum generated by the record closing of the pan-European

index in the previous session, which reached 495.1, surpassing the

previous milestone. This optimism comes even in the face of

economic challenges, such as the drop in consumer confidence in the

UK due to persistent inflation, which threatens economic recovery.

Investors also paid attention to the financial results of giants

such as Allianz (TG:ALV), BASF

(TG:BASF), and Standard Chartered (LSE:STAN),

looking for signs of corporate health and overall economic trends

in the region.

On the quarterly earnings front for Friday, scheduled to present

financial reports are Warner Bros. Discovery

(NASDAQ:WBD), Bloomin’ Brands (NASDAQ:BLMN),

Lamar Advertising Company

(NASDAQ:LAMR), Northwest Natural Gas (NYSE:NWN),

Diana Shipping Inc. (NYSE:DSX),

Docebo (NASDAQ:DCBO), AerCap

(NYSE:AER), Sunstone Hotel

Invertors (NYSE:SHO), Gray Television

(NYSE:GTN), Frontier Communications (NASDAQ:FYBR),

among others.

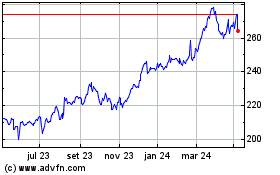

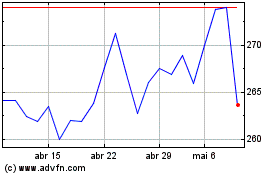

Allianz (TG:ALV)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Allianz (TG:ALV)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025