Filed Pursuant to Rule 424(b)(3)

Registration No. 333-252814

PROSPECTUS SUPPLEMENT NO. 7

(to Prospectus dated June 3, 2021)

HIMS & HERS HEALTH, INC.

174,516,077 Shares of Class A Common Stock

3,904,086 Warrants to Purchase Shares of Class A Common Stock

10,612,401 Shares of Class A Common Stock Underlying Warrants

This prospectus supplement supplements the prospectus dated June 3, 2021 (the “Prospectus”), which forms a part of our registration statement on Form S-1 (No. 333-252814). This prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our current report on Form 8-K, filed with the Securities and Exchange Commission on November 18, 2021 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the offer and sale from time to time by the selling securityholders named in the Prospectus (the “Selling Securityholders”) of (A) up to 174,516,077 shares of Class A common stock, par value $0.0001 per share ("Class A common stock"), consisting of (i) up to 7,500,000 shares of Class A common stock issued in a private placement pursuant to subscription agreements entered into on September 30, 2020; (ii) up to 3,773,437 shares of Class A common stock issued upon consummation of the Business Combination (as defined in the Prospectus), in exchange for our Class B ordinary shares originally issued in a private placement to Oaktree Acquisition Holdings, L.P.; (iii) up to 136,191,471 shares of Class A common stock issued to former stockholders and advisors of Hims, Inc.; (iv) up to 8,377,623 shares of Class A common stock reserved for issuance by us upon conversion of Class V common stock held by trusts affiliated with Andrew Dudum, our Chief Executive Officer; (v) up to 14,153,520 shares of restricted Class A common stock issued in connection with the Business Combination and subject to certain stock price-based vesting conditions; (vi) up to 615,940 shares of Class A common stock reserved for issuance by us upon exercise of assumed warrants to purchase Class A common stock held by former warrant holders of Hims, Inc. and (vii) up to 3,904,086 shares of Class A common stock that are issuable upon exercise of the private placement warrants and business combination warrants (each as defined in the Prospectus); and (B) up to 3,904,086 warrants.

In addition, the Prospectus and this prospectus supplement relate to the offer and sale of up to 6,708,315 shares of Class A common stock that are issuable by us upon the exercise of 6,708,315 warrants (the “public warrants”) that were previously registered by the holders thereof. Additionally, this prospectus relates to the offer and sale of (i) up to 3,012,500 shares of Class A common stock issuable by us upon exercise of 3,012,500 warrants to purchase shares of Class A common stock originally issued to the Sponsor (as defined in the Prospectus) in a private placement by the holders thereof and (ii) up to 891,586 shares of Class A common stock issuable by us upon exercise of 891,586 warrants to purchase shares of Class A common stock issued or issuable to former stockholders of Hims, Inc. by the holders thereof other than the initial holders.

Our Class A common stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “HIMS”. On November 17, 2021, the closing price of our Class A common stock was $8.12.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is

any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Investing in our securities involves risks. See the section entitled “Risk Factors” beginning on page 13 of the Prospectus to read about factors you should consider before buying our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is November 18, 2021.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 15, 2021

HIMS & HERS HEALTH, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-38986

|

|

98-1482650

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

2269 Chestnut Street, #523

San Francisco, CA 94123

(Address of principal executive offices)

(415) 851-0195

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading symbol

|

|

Name of each exchange on which registered

|

|

Class A Common Stock, $0.0001 par value

|

|

HIMS

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

|

|

|

|

|

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On November 15, 2021, Spencer Lee resigned from his position as chief financial officer, principal financial officer and principal accounting officer of Hims & Hers Health, Inc. (the “Company”) consistent with previously disclosed plans for Mr. Lee to transition out of the Company. Concurrently with Mr. Lee’s resignation, the Company’s board of directors appointed Irene A. Becklund as interim principal financial officer and principal accounting officer of the Company, effective immediately. Ms. Becklund has served as the Company’s controller since June 2019 and will serve as interim principal financial officer and principal accounting officer while the Company continues its search for a permanent chief financial officer to replace Mr. Lee. As previously disclosed, Mr. Lee is supporting the Company’s ongoing transition plan until a new permanent chief financial officer is appointed. On November 16, 2021, Mr. Lee and the Company entered into a Consulting Agreement pursuant to which Mr. Lee will continue to support the Company as a consultant until February 28, 2022, subject to renewal, and will receive a fee of $15,000 per month.

Prior to joining the Company, Ms. Becklund, 37, served as the controller for various companies, including Minted, an online marketplace of independent artists and designers, from October 2016 to May 2019, Dot & Bo, a furniture ecommerce company, from June 2015 to September 2016, and C12 Energy, a developer of geologic assets, from June 2013 to April 2015. Additionally, Ms. Becklund has nearly seven years of public accounting experience from her time working at KPMG LLP from September 2006 to May 2013. Ms. Becklund is a certified public accountant and holds a bachelor’s degree, with a double major in economics with an accounting emphasis and global studies, from the University of California, Santa Barbara.

In connection with Ms. Becklund’s appointment as interim principal financial officer and principal accounting officer, Ms. Becklund received a grant of 25,000 restricted stock units under the Company’s 2020 Equity Incentive Plan, of which 25% will vest on each of December 15, 2021, March 15, 2022, June 15, 2022, and September 15, 2022, subject to Ms. Becklund’s continued service with the Company through each vesting date. There are no arrangements or understandings between Ms. Becklund and any other persons pursuant to which she was appointed as principal financial officer and principal accounting offer of the Company. There are no family relationships between Ms. Becklund and any director, executive officer, or any person nominated or chosen by the Company to become a director or executive officer. Ms. Becklund is not a party to any current or proposed transaction with the Company for which disclosure is required under Item 404(a) of Regulation S-K. Ms. Becklund has entered into the Company’s standard form of indemnification agreement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HIMS & HERS HEALTH, INC.

|

|

|

|

|

|

Date: November 18, 2021

|

By:

|

|

/s/ Andrew Dudum

|

|

|

|

|

Andrew Dudum

|

|

|

|

|

Chief Executive Officer

|

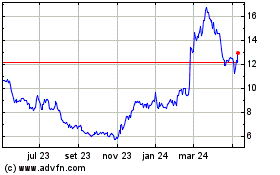

Hims and Hers Health (NYSE:HIMS)

Gráfico Histórico do Ativo

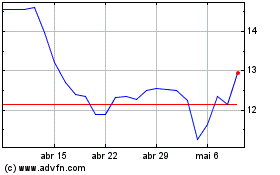

De Mar 2024 até Abr 2024

Hims and Hers Health (NYSE:HIMS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024