Current Report Filing (8-k)

15 Maio 2023 - 9:05AM

Edgar (US Regulatory)

FALSE000006674000000667402023-05-122023-05-120000066740exch:XCHIus-gaap:CommonStockMember2023-05-122023-05-120000066740us-gaap:CommonStockMemberexch:XNYS2023-05-122023-05-120000066740mmm:Notes0950PercentDue2023Memberexch:XNYS2023-05-122023-05-120000066740mmm:Notes1500PercentDue2026Memberexch:XNYS2023-05-122023-05-120000066740mmm:Notes1750PercentDue2030Memberexch:XNYS2023-05-122023-05-120000066740exch:XNYSmmm:Notes1.500PercentDue2031Member2023-05-122023-05-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): May 12, 2023

3M COMPANY

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

Delaware | | File No. 1-3285 | | 41-0417775 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

3M Center, St. Paul, Minnesota | | | | 55144-1000 |

(Address of Principal Executive Offices) | | | | (Zip Code) |

(Registrant’s Telephone Number, Including Area Code) (651) 733-1110

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, Par Value $.01 Per Share | | MMM | | New York Stock Exchange |

| | MMM | | Chicago Stock Exchange, Inc. |

0.950% Notes due 2023 | | MMM23 | | New York Stock Exchange |

1.500% Notes due 2026 | | MMM26 | | New York Stock Exchange |

1.750% Notes due 2030 | | MMM30 | | New York Stock Exchange |

1.500% Notes due 2031 | | MMM31 | | New York Stock Exchange |

Note: The common stock of the Registrant is also traded on the SIX Swiss Exchange.

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b) Michael G. Vale, Group President and Chief Business and Country Officer, has been terminated for cause from 3M Company (the Company), effective May 12, 2023. His dismissal is due to inappropriate personal conduct and violation of company policy, unrelated to the Company’s operations and financial performance. When the Company learned of and verified the violation, it took immediate action.

The Company has initiated a search for Mr. Vale’s successor. Effective immediately, the leaders of 3M’s Safety and Industrial Business, Consumer Business, and Transportation and Electronics Business report to 3M Chairman and CEO Michael F. Roman.

Forward-Looking Statements

This report contains forward-looking information about 3M's financial results and estimates and business prospects that involve substantial risks and uncertainties. You can identify these statements by the use of words such as "anticipate, "estimate," "expect," "aim," "project," "intend," "plan," "believe," "will," "should," "could," "target," "forecast" and other words and terms of similar meaning in connection with any discussion of future operating or financial performance or business plans or prospects. Among the factors that could cause actual results to differ materially are the following: (1) worldwide economic, political, regulatory, international trade, geopolitical, capital markets and other external conditions and other factors beyond the Company's control, including inflation, recession, military conflicts, natural and other disasters or climate change affecting the operations of the Company or its customers and suppliers; (2) risks related to unexpected events such as the public health crises associated with the coronavirus (COVID-19) global pandemic; (3) foreign currency exchange rates and fluctuations in those rates; (4) risks related to certain fluorochemicals, including liabilities related to claims, lawsuits, and government regulatory proceedings concerning various PFAS-related products and chemistries, as well as risks related to the Company's plans to exit PFAS manufacturing and discontinue use of PFAS across its product portfolio; (5) legal proceedings, including significant developments that could occur in the legal and regulatory proceedings described in the Company's Annual Report on Form 10-K for the year ended Dec. 31, 2022 and any subsequent quarterly reports on Form 10-Q (the "Reports"); (6) competitive conditions and customer preferences; (7) the timing and market acceptance of new product and service offerings; (8) the availability and cost of purchased components, compounds, raw materials and energy due to shortages, increased demand and wages, supply chain interruptions, or natural or other disasters; (9) unanticipated problems or delays with the phased implementation of a global enterprise resource planning (ERP) system, or security breaches and other disruptions to the Company's information technology infrastructure; (10) the impact of acquisitions, strategic alliances, divestitures, and other strategic events resulting from portfolio management actions and other evolving business strategies; (11) operational execution, including the extent to which the Company can realize the benefits of planned productivity improvements, as well as the impact of organizational restructuring activities; (12) financial market risks that may affect the Company's funding obligations under defined benefit pension and postretirement plans; (13) the Company's credit ratings and its cost of capital; (14) tax-related external conditions, including changes in tax rates, laws or regulations; (15) matters relating to the proposed spin-off of the Company's Health Care business; and (16) matters relating to the voluntary chapter 11 proceedings of the Company's subsidiary Aearo Technologies and certain of its affiliates. Changes in such assumptions or factors could produce significantly different results. A further description of these factors is located in the Reports under "Cautionary Note Concerning Factors That May Affect Future Results" and "Risk Factors" in Part I, Items 1 and 1A (Annual Report) and in Part I, Item 2 and Part II, Item 1A (Quarterly Reports). The Company assumes no obligation to update any forward-looking statements discussed herein as a result of new information or future events or developments.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| 3M COMPANY |

| |

| By: | /s/ Michael M. Dai |

| | |

| | Michael M. Dai |

| | Vice President, Associate General Counsel & Secretary |

Dated: May 15, 2023

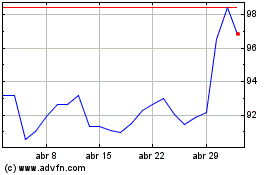

3M (NYSE:MMM)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

3M (NYSE:MMM)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024