0001584831

false

0001584831

2023-08-14

2023-08-14

0001584831

OXBR:OrdinarySharesParValue0.001Member

2023-08-14

2023-08-14

0001584831

OXBR:WarrantsToPurchaseOrdinarySharesMember

2023-08-14

2023-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 14, 2023

OXBRIDGE

RE HOLDINGS LIMITED

(Exact

Name of Registrant as Specified in Charter)

| Cayman

Islands |

|

001-36346 |

|

98-1150254 |

| (State

or Other Jurisdiction |

|

(Commission |

|

(I.R.S.

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

No.) |

| Suite

201, |

|

|

| 42

Edward Street, George Town |

|

|

| P.O.

Box 469 |

|

|

| Grand

Cayman, Cayman Islands |

|

KY1-9006 |

| (Address

of Principal Executive Office) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (345) 749-7570

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class: |

|

Trading

symbol |

|

Name

of each exchange on which registered |

| Ordinary

Shares (par value $0.001) |

|

OXBR |

|

The

Nasdaq Stock Market LLC |

| Warrants

to Purchase Ordinary Shares |

|

OXBRW |

|

The

Nasdaq Stock Market LLC

(The Nasdaq Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR§230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition

On

August 14, 2023, Oxbridge Re Holdings Limited issued a press release announcing its financial results for the quarter and six months

ended June 30, 2023. A copy of the press release is attached hereto as Exhibit 99.1 to this Form 8-K and incorporated herein by reference.

The

information in this item shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the

“Exchange Act”), or otherwise subject to the liabilities of Section 18, nor shall it be deemed incorporated by reference

in any of the Company’s filings under the Securities Act of 1933, as amended or the Exchange Act, except to the extent, if any,

expressly set forth by specific reference in such filing.

Item

9.01 Financial Statements and Exhibits.

See

the Exhibit Index set forth below for a list of exhibits included with this Form 8-K.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

OXBRIDGE

RE HOLDINGS LIMITED |

| |

|

| |

/s/

Wrendon Timothy |

| Date:

August 14, 2023 |

Wrendon

Timothy |

| |

Chief

Financial Officer and Secretary |

| |

(Principal

Accounting Officer and |

| |

Principal

Financial Officer) |

A

signed original of this Form 8-K has been provided to Oxbridge Re Holdings Limited and will be retained by Oxbridge Re Holdings Limited

and furnished to the Securities and Exchange Commission or its staff upon request.

EXHIBIT

INDEX

Exhibit 99.1

Company

Contact:

Oxbridge

Re Holdings Limited

Jay

Madhu, CEO

345-749-7570

jmadhu@oxbridgere.com

Oxbridge

Re Holdings Limited Reports Second Quarter 2023 Results

GRAND

CAYMAN, Cayman Islands (August 14, 2023) — Oxbridge Re Holdings Limited (NASDAQ: OXBR), (the “Company”),

a provider of reinsurance solutions primarily to property and casualty insurers, reported its results for the three and six months ended

June 30, 2023.

“Our

stable performance continued in the second quarter of 2023 with, again, no losses incurred,” commented Oxbridge Re Holdings Chairman

and Chief Executive Officer Jay Madhu

“During

the second quarter we were pleased to complete the private placement of approximately $2.4 million in securitized tokens by our

new Web3-focused subsidiary SurancePlus Inc., an alternative investment opportunity leveraging key qualities of blockchain technology

to create a well-designed digital security,” Mr. Madhu continued. “Assuming there are no losses underwritten by our reinsurance

contracts, investors in the securitized tokens are expected to generate a potential annual return of an estimated 42%.” (See

SurancePlus Offering below.)

“SurancePlus

is now a brand-new, well-capitalized business and growth opportunity for our shareholders, created without any new debt and no equity

dilution. We are very proud of this accomplishment and look for this exciting new entity to diversify and accelerate our growth prospects

in the years ahead.”

“We

were also pleased that, subsequent to the second quarter, Oxbridge Acquisition Corp. (NASDAQ: OXAC), the special purpose acquisition

company in which we have a significant investment, completed its business combination agreement with Jet.AI Inc., a software and aviation

company. The company develops software leveraging artificial intelligence and offers fractional aircraft ownership, jet card,

aircraft brokerage and charter through its fleet of private aircraft and those of its operating partner. The software segment of the

company features the B2C CharterGPT app and the B2B Jet.AI Operator platform. The CharterGPT app uses natural language processing and

machine learning to improve the private jet booking experience. The Jet.AI operator platform offers a suite of stand-alone software products

to enable FAA Part 135 charter providers to add revenue, maximize efficiency and reduce carbon footprint. The Aviation segment features

jet aircraft fractions, jet cards, on-fleet charter, management, and buyer’s brokerage.’’ (See Subsequent Event below.)

“Looking

ahead, with a strong balance sheet, no debt, and with our recent transactions a well-diversified business, we remain highly confident

in our future ability to deliver shareholder value,” Jay Madhu concluded.

Financial

Performance

For

the three months ended June 30, 2023, the Company generated a net loss of $85,000 or $(0.01) per basic and diluted common share compared

to net income of $77,000 or $0.01 per basic and diluted common share in the second quarter of 2022. The loss in the quarter is due primarily

to higher general and administrative expenses as a result of the recognition of all costs associated with the SurancePlus token

offering completed during the quarter. For the six months ended June 30, 2023, the Company generated a net profit of $57,000

or $0.01 per basic and diluted common share compared to a net loss of $310,000 or $(0.05) basic and diluted common share for the

six months ended June 30, 2022. The improved results were primarily due to higher revenues driven by the increase in unrealized gains

on other investment and equity securities.

Net

premiums earned for the three months ended June 30, 2023 were $183,000 compared to $194,000 in the same prior year period. For the six

months ended June 30, 2023 net premiums earned were $183,000 compared to $404,000 in the prior year. The decrease was due to reinsurance

contracts in force during the period ended June 30, 2023 compared to the prior year.

There

were no losses incurred for the three and six months ended June 30, 2023 or 2022.

Total

expenses were $697,000 for the three months ended June 30, 2023 compared to $410,000 for the same period in the prior year. For the six

months ended June 30, 2023 total expenses were $1.1 million compared to $772,000 in the prior year. The increase was due to higher general

and administrative expenses resulting from inflationary expense fluctuations compared to the prior year, as well as the recognition during

the second quarter of 2023 of all the one-time offering costs associated with the completion of the SurancePlus token offering.

At

June 30, 2023, cash and cash equivalents, and restricted cash and cash equivalents were $3.5 million compared to $3.9 million at December

31, 2022.

Financial

Ratios

Loss

Ratio. The loss ratio, which measures underwriting profitability, is the ratio of losses and loss adjustment expenses incurred

to net premiums earned. The loss ratio was 0% for the period ended June 30, 2023 and 2022 due to no loss or loss adjustment expenses

in either period.

Acquisition

Cost Ratio. The acquisition cost ratio, which measures operational efficiency and compares policy acquisition costs with net

premiums earned, remained consistent at 10.9% for the six-month periods ended June 30, 2023 and 2022.

Expense

Ratio. The expense ratio, which measures operating performance, compares policy acquisition costs and general and administrative

expenses with net premiums earned. The expense ratio increased to 601.6% for the six months ended June 30, 2023 from 191.1% in the prior

year due to the higher general and administrative expenses incurred in 2023.

Combined

ratio. The combined ratio, which is used to measure underwriting performance, is the sum of the loss ratio and the expense ratio.

The combined ratio increased to 601.6% for the six months ended June 30, 2023 from 191.1% in the prior year due to the higher general

and administrative expenses incurred in 2023.

SurancePlus

Offering

On

June 27, 2023, SurancePlus Inc. completed its private placement (the “Private Placement”) of Series DeltaCat Re Preferred

Shares represented by DeltaCat Re Tokens (the “Securities”). On June 27, 2023, SurancePlus entered into subscription agreements

with accredited investors and non-U.S. persons in the Private Placement with respect to 229,766 of the Securities at a purchase price

of $10.00 per token for aggregate gross proceeds of $2,297,660. SurancePlus also previously entered into subscription agreements for

and sold 15,010 of the Securities between April 5, 2023 and May 18, 2023 for gross proceeds of $150,100, also at a purchase price of

$10.00 per token. The aggregate amount raised in the Private Placement was $2,447,760 for the issuance of 244,776 Securities of which

approximately $1,280,000 was received from third-party investors and approximately $1,167,000 from Oxbridge Re Holdings Limited. Approximately

$300,000 and $273,000 of management fees were deducted from the gross proceeds from the third-party investors and Oxbridge Re Holdings

Limited, respectively, The tokens were issued on the Avalanche blockchain. Ownership of DeltaCat Re tokenized reinsurance securities

indirectly confers fractionalized interests in reinsurance contracts underwritten by Oxbridge Re’s reinsurance subsidiary, Oxbridge

Re NS, for the 2023-2024 treaty year.

Subsequent

Event

On

August 7, 2023, OXAC held an extraordinary general meeting at which the business combination with Jet Token, Inc. was approved by OXAC

shareholders. In conjunction with the business combination, OXAC was redomesticated as a Delaware entity, and changed its name to Jet.AI

Inc. The business combination was closed on August 10, 2023, and on August 11, 2023, OXAC common stock and warrants began trading on

the Nasdaq Global Market under the new ticker symbols JTAI and JTAIW.

Conference

Call

Management

will host a conference call later today to discuss these financial results, followed by a question and-answer session. President and

Chief Executive Officer Jay Madhu and Chief Financial Officer Wrendon Timothy will host the call starting at 4:30 p.m. Eastern time.

The live presentation can be accessed by dialing the number below or by clicking the webcast link available on the Investor Information

section of the company’s website at www.oxbridgere.com.

Date:

August 14, 2023

Time:

4.30 p.m. Eastern time

Toll-free

number: 800 343-4136

International

number: +1 203 518-9843

Passcode

(required): OXBRIDGE

Please

call the conference telephone number 10 minutes before the start time. An operator will register your name and organization. If you have

any difficulty connecting with the conference call, please contact InComm Conferencing at 201 493-6280 or 877 804-2066

A

replay of the call will be available by telephone after 4:30 p.m. Eastern time on the same day of the call and via the Investor Information

section of Oxbridge’s website at www.oxbridgere.com until August 28th, 2023.

Toll-free

replay number: 877-660-6853

International

replay number: +1-201-612-7415

Conference

ID: 13740555

About

Oxbridge Re Holdings Limited

Oxbridge

Re Holdings Limited (www.oxbridgere.com) (NASDAQ: OXBR, OXBRW) (“Oxbridge Re”) is a Cayman Islands exempted company.

Its primary subsidiaries are SurancePlus, Oxbridge Reinsurance Limited & Oxbridge Re NS. SurancePlus; is a Web3-focused subsidiary

that currently leverages blockchain technology to democratize access to high-return reinsurance contracts via digital securities. Oxbridge

Reinsurance Limited; is a licensed reinsurance subsidiary that provides reinsurance business solutions primarily to property and casualty

insurers in the Gulf Coast region of the United States; Oxbridge Re NS; a licensed reinsurance SPV/side car that provides third-party

investors with access to reinsurance contracts with returns uncorrelated to the financial markets. In addition, Oxbridge Re is also the

founding and lead investor of Oxbridge Acquisition Corp. (NASDAQ: OXAC), a special purpose acquisition company (“SPAC”).

Forward-Looking

Statements

This

press release may contain forward-looking statements made pursuant to the Private Securities Litigation Reform Act of 1995. Words such

as “anticipate,” “estimate,” “expect,” “intend,” “plan,” “project”

and other similar words and expressions are intended to signify forward-looking statements. Forward-looking statements are not guarantees

of future results and conditions but rather are subject to various risks and uncertainties. A detailed discussion of risks and uncertainties

that could cause actual results and events to differ materially from such forward-looking statements is included in the section

entitled “Risk Factors” contained in our Form 10-K filed with the Securities and Exchange Commission (“SEC”)

on 30th March, 2023. The occurrence of any of these risks and uncertainties could have a material adverse effect on the Company’s

business, financial condition and results of operations. Any forward-looking statements made in this press release speak only as of the

date of this press release and, except as required by law, the Company undertakes no obligation to update any forward-looking statement

contained in this press release, even if the Company’s expectations or any related events, conditions or circumstances change.

OXBRIDGE

RE HOLDINGS LIMITED AND SUBSIDIARIES

Consolidated

Balance Sheets

(expressed

in thousands of U.S. Dollars, except per share and share amounts)

| | |

At

June 30, 2023 | | |

At

December 31,2022 | |

| | |

(Unaudited) | | |

| |

| Assets | |

| | |

| |

| Investments: | |

| | |

| |

| Equity securities, at fair value (cost: $1,926) | |

$ | 723 | | |

| 642 | |

| Cash and cash equivalents | |

| 3,117 | | |

| 1,207 | |

| Restricted cash and cash equivalents | |

| 372 | | |

| 2,721 | |

| Accrued interest and dividend receivable | |

| 7 | | |

| - | |

| Premiums receivable | |

| 1,954 | | |

| 282 | |

| Other Investments | |

| 11,928 | | |

| 11,423 | |

| Due from Related Party | |

| 99 | | |

| 45 | |

| Deferred policy acquisition costs | |

| 221 | | |

| - | |

| Operating lease right-of-use assets | |

| 60 | | |

| 44 | |

| Prepayment and other assets | |

| 85 | | |

| 114 | |

| Prepaid Offering Costs | |

| 135 | | |

| 133 | |

| Property and equipment, net | |

| 7 | | |

| 5 | |

| Total assets | |

$ | 18,708 | | |

| 16,616 | |

| | |

| | | |

| | |

| Liabilities and Shareholders’ Equity | |

| | | |

| | |

| Unearned Premium | |

| 2,013 | | |

| - | |

| Other Liabilities - Delta Cat Re Token Holders | |

| 1,059 | | |

| - | |

| Notes payable to noteholders | |

| 118 | | |

| 216 | |

| Losses payable | |

| - | | |

| 1,073 | |

| Operating lease liabilities | |

| 60 | | |

| 44 | |

| Accounts payable and other liabilities | |

| 303 | | |

| 294 | |

| Total liabilities | |

| 3,553 | | |

| 1,627 | |

| | |

| | | |

| | |

| Shareholders’ equity: | |

| | | |

| | |

| Ordinary share capital, (par value $0.001, 50,000,000 shares authorized; 5,870,234

and 5,769,587 shares issued and outstanding) | |

| 6 | | |

| 6 | |

| Additional paid-in capital | |

| 32,591 | | |

| 32,482 | |

| Accumulated Deficit | |

| (17,442 | ) | |

| (17,499 | ) |

| Total shareholders’ equity | |

| 15,155 | | |

| 14,989 | |

| Total liabilities and shareholders’ equity | |

$ | 18,708 | | |

| 16,616 | |

OXBRIDGE

RE HOLDINGS LIMITED AND SUBSIDIARIES

Consolidated

Statements of Operations

(Unaudited)

(expressed

in thousands of U.S. Dollars, except per share amounts)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

| | | |

| | | |

| | | |

| | |

| Assumed premiums | |

$ | 2,196 | | |

| 669 | | |

| 2,196 | | |

| 705 | |

| Premiums ceded | |

| - | | |

| (24 | ) | |

| - | | |

| (60 | ) |

| Change in unearned premiums reserve | |

| (2,013 | ) | |

| (451 | ) | |

| (2,013 | ) | |

| (241 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net premiums earned | |

| 183 | | |

| 194 | | |

| 183 | | |

| 404 | |

| SurancePlus management fee income | |

| 300 | | |

| - | | |

| 300 | | |

| - | |

| Net investment and other income | |

| 79 | | |

| 41 | | |

| 168 | | |

| 75 | |

| Net realized investment gain | |

| - | | |

| 19 | | |

| - | | |

| 27 | |

| Unrealized gain on other investments | |

| 124 | | |

| 571 | | |

| 505 | | |

| 341 | |

| Change in fair value of equity securities | |

| 5 | | |

| (322 | ) | |

| 81 | | |

| (342 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Total revenue | |

| 691 | | |

| 503 | | |

| 1,237 | | |

| 505 | |

| | |

| | | |

| | | |

| | | |

| | |

| Expenses | |

| | | |

| | | |

| | | |

| | |

| Policy acquisition costs and underwriting expenses | |

| 20 | | |

| 21 | | |

| 20 | | |

| 44 | |

| General and administrative expenses | |

| 677 | | |

| 389 | | |

| 1,081 | | |

| 728 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total expenses | |

| 697 | | |

| 410 | | |

| 1,101 | | |

| 772 | |

| | |

| | | |

| | | |

| | | |

| | |

| (Loss) income before income attributable to noteholders and tokenholders | |

| (6 | ) | |

| 93 | | |

| 136 | | |

| (267 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income attributable to noteholders and tokenholders | |

| (79 | ) | |

| (16 | ) | |

| (79 | ) | |

| (43 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net (loss) income | |

$ | (85 | ) | |

| 77 | | |

| 57 | | |

| (310 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| (Loss) earnings per share | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted | |

$ | (0.01 | ) | |

| 0.01 | | |

| 0.01 | | |

| (0.05 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted-average shares outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted | |

| 5,870,234 | | |

| 5,781,586 | | |

| 5,863,973 | | |

| 5,766,382 | |

| | |

| | | |

| | | |

| | | |

| | |

| Performance ratios to net premiums earned: | |

| | | |

| | | |

| | | |

| | |

| Loss ratio | |

| 0.0 | % | |

| 0.0 | % | |

| 0.0 | % | |

| 0.0 | % |

| Acquisition cost ratio | |

| 10.9 | % | |

| 10.8 | % | |

| 10.9 | % | |

| 10.9 | % |

| Expense ratio | |

| 380.9 | % | |

| 211.3 | % | |

| 601.6 | % | |

| 191.1 | % |

| Combined ratio | |

| 380.9 | % | |

| 211.3 | % | |

| 601.6 | % | |

| 191.1 | % |

v3.23.2

Cover

|

Aug. 14, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 14, 2023

|

| Entity File Number |

001-36346

|

| Entity Registrant Name |

OXBRIDGE

RE HOLDINGS LIMITED

|

| Entity Central Index Key |

0001584831

|

| Entity Tax Identification Number |

98-1150254

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

Suite

201

|

| Entity Address, Address Line Two |

42

Edward Street, George Town

|

| Entity Address, Address Line Three |

P.O.

Box 469

|

| Entity Address, City or Town |

Grand

Cayman

|

| Entity Address, Country |

KY

|

| Entity Address, Postal Zip Code |

KY1-9006

|

| City Area Code |

(345)

|

| Local Phone Number |

749-7570

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Ordinary Shares (par value $0.001) |

|

| Title of 12(b) Security |

Ordinary

Shares (par value $0.001)

|

| Trading Symbol |

OXBR

|

| Security Exchange Name |

NASDAQ

|

| Warrants to Purchase Ordinary Shares |

|

| Title of 12(b) Security |

Warrants

to Purchase Ordinary Shares

|

| Trading Symbol |

OXBRW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=OXBR_OrdinarySharesParValue0.001Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=OXBR_WarrantsToPurchaseOrdinarySharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

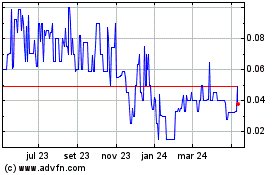

Oxbridge Re (NASDAQ:OXBRW)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

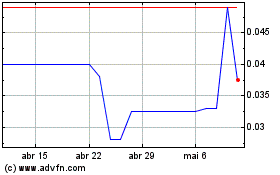

Oxbridge Re (NASDAQ:OXBRW)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025