Oxbridge Re Holdings Limited

(NASDAQ: OXBR),

(the “Company”), together with its subsidiaries which is engaged in

the business of tokenized Real-World Assets (“RWAs”) initially in

the form of tokenized reinsurance securities, and reinsurance

solutions to property and casualty insurers in the Gulf Coast

region of the United States, reported its results for the three and

six months ended June 30, 2024.

“Our stable performance persisted into the

second quarter of 2024, with no losses incurred,” stated Jay Madhu,

Chairman and Chief Executive Officer of Oxbridge Re Holdings.

“Following Delta CatRe’s targeted 42% payout

last year, which was successfully exceeded at 49%, we are pleased

to announce the completion of EpsilonCat Re private placement of

approximately $2.8 million in tokenized securities within our

RWA/Web3-focused subsidiary, SurancePlus Inc. This alternative

investment leverages key aspects of blockchain technology to create

a well-designed digital security, issued on the Avalanche

blockchain,” Mr. Madhu continued. “Provided there are no losses

from our reinsurance contracts, investors in EpsilonCat Re

tokenized securities can expect an estimated annual return of

42%.

We also recently announced a strategic

partnership with Zoniqx, which has issued over $4 billion in assets

on-chain to date. SurancePlus is now a well-capitalized business

with substantial growth potential for our shareholders. We are

proud of this accomplishment and look forward to this exciting new

entity diversifying and accelerating our growth in the RWA space in

the coming years.”

“Looking ahead, with a strong balance sheet, no

debt, and a well-diversified business from our recent transactions,

we remain highly confident in our future ability to deliver

shareholder value,” concluded Jay Madhu.

Financial Performance

For the three months ended June 30, 2024, the

Company generated a net loss of $821,000 or $(0.14) per basic and

diluted common share compared to net loss of $85,000 or ($0.01) per

basic and diluted common share in the second quarter of 2023. The

decrease is due primarily negative change in the fair value of

equity securities and other investments during the quarter. For the

six months ended June 30, 2024, the Company generated a net loss of

$1.73 million or ($0.29) per basic and diluted common share

compared to a net profit of $57,000 or $0.01 basic and diluted

common share for the six months ended June 30, 2023. The worsened

results were primarily due to lower total revenues driven by the

increase in unrealized losses on other investment and equity

securities.

Net premiums earned for the three months ended

June 30, 2024 were $564,000 compared to $183,000 in the same prior

year period. For the six months ended June 30, 2024 net premiums

earned were $1.1 million compared to $183,000 in the prior year.

The increases are primarily due to the prior periods recognizing

only one month of premiums because of premium acceleration on the

reinsurance contracts in force. In contrast, the quarter and six

months ended June 30, 2024, recognized a full three and six months

of premiums, respectively.

There were no losses incurred for the three and

six months ended June 30, 2024 or 2023.

Total expenses were $628,000 for the three

months ended June 30, 2024 compared to $697,000 for the same period

in the prior year. For the six months ended June 30, 2024 total

expenses were $1.17 million compared to $1.1 million in the prior

year. The increase was due to higher policy and acquisition costs

when compared to the prior year.

At June 30, 2024, cash and cash equivalents, and

restricted cash and cash equivalents were $3.98 million compared to

$3.7 million at December 31, 2023.

Financial Ratios

Loss Ratio. The loss ratio,

which measures underwriting profitability, is the ratio of losses

and loss adjustment expenses incurred to net premiums earned. The

loss ratio was 0% for the period ended June 30, 2024 and 2023 due

to no loss or loss adjustment expenses in either period.

Acquisition Cost Ratio. The

acquisition cost ratio, which measures operational efficiency and

compares policy acquisition costs with net premiums earned,

increased marginally to 11.0% for the three and six-month periods

ended June 30, 2024 from 10.9% for the same period last year.

Expense Ratio. The expense

ratio, which measures operating performance, compares policy

acquisition costs and general and administrative expenses with net

premiums earned. The expense ratio decreased to 105.7% for the six

months ended June 30, 2024 from 601.6% in the prior year due to the

higher levels of premium earned during the period.

Combined ratio. The combined

ratio, which is used to measure underwriting performance, is the

sum of the loss ratio and the expense ratio. The combined ratio

decreased to 105.7% for the six months ended June 30, 2023 from

601.6% due to the higher levels of premium earned during the

period.

SurancePlus Offering

On July 11, 2024, SurancePlus Inc.

(“SurancePlus”), an indirect wholly owned subsidiary of Oxbridge Re

Holdings Limited (“Oxbridge”), completed its private placement (the

“Private Placement”) of Participation Shares (the “Securities”)

represented by digital tokens issued under a 3-year Participation

Share Investment Contract (the “PSIC”). On July 11, 2024,

SurancePlus entered into subscription agreements with accredited

investors and non-U.S. persons in the Private Placement with

respect to 287,705 of the Participation Shares represented by the

digital tokens, EpsilonCat Re at a purchase price of $10.00 per

Participation Share for aggregate gross proceeds of $2,878,048. The

Participation Shares are not shares in SurancePlus and shall have

no preemptive right or conversion rights. The Participation Shares

solely confer contractual rights against SurancePlus as contained

in the PSIC. The aggregate amount raised in the Private Placement

was $2,878,048 for the issuance of 287,804 Participation Shares

represented by Digital Tokens of which approximately $1,469,000 was

received from third-party investors and approximately $1,409,000

from Oxbridge Re Holdings Limited. Approximately $312,000 and

$299,000 of management fees were deducted from the gross proceeds

from the third-party investors and Oxbridge Re Holdings Limited,

respectively. The tokens were issued on the Avalanche blockchain.

Ownership of DeltaCat Re tokenized reinsurance securities

indirectly confers fractionalized interests in reinsurance

contracts underwritten by Oxbridge Re’s reinsurance subsidiary,

Oxbridge Re NS, for the 2024-2025 treaty year.

Conference Call

Management will host a conference call later

today to discuss these financial results, followed by a question

and-answer session. President and Chief Executive Officer Jay Madhu

and Chief Financial Officer Wrendon Timothy will host the call

starting at 4:30 p.m. Eastern time. The live presentation can be

accessed by dialing the number below or by clicking the webcast

link available on the Investor Information section of the company’s

website at www.oxbridgere.com.

Date: August 8, 2024Time: 4.30 p.m. Eastern

timeToll-free number: 877 524-8416International number: +1 412

902-1028Passcode (required): 13746518

Please call the conference telephone number 10

minutes before the start time. An operator will register your name

and organization. If you have any difficulty connecting with the

conference call, please contact InComm Conferencing at 201 493-6280

or 877 804-2066

A replay of the call will be available by

telephone after 4:30 p.m. Eastern time on the same day of the call

and via the Investor Information section of Oxbridge’s website at

www.oxbridgere.com until August 22nd, 2024.

Toll-free replay number:

877-660-6853International replay number: +1-201-612-7415Conference

ID: 13746518

About Oxbridge Re Holdings

Limited

Oxbridge Re Holdings Limited (NASDAQ: OXBR,

OXBRW) (“Oxbridge Re”) is headquartered in the Cayman Islands. The

company offers tokenized Real-World Assets (“RWAs”) as tokenized

reinsurance securities and reinsurance business solutions to

property and casualty insurers, through its wholly owned

subsidiaries SurancePlus Inc, Oxbridge Re NS, and Oxbridge

Reinsurance Limited.

Insurance businesses in the Gulf Coast region of

the United States purchase property and casualty reinsurance

through our licensed reinsurers Oxbridge Reinsurance Limited and

Oxbridge Re NS.

Our new Web3-focused subsidiary, SurancePlus

Inc. (“SurancePlus”), has developed the first “on-chain”

reinsurance RWA of its kind to be sponsored by a subsidiary of a

publicly traded company. By digitizing interests in reinsurance

contracts as on-chain RWAs, SurancePlus has democratized the

availability of reinsurance as an alternative investment to both

U.S. and non-U.S. investors.

Forward-Looking Statements

This press release may contain forward-looking

statements made pursuant to the Private Securities Litigation

Reform Act of 1995. Words such as “anticipate,” “estimate,”

“expect,” “intend,” “plan,” “project” and other similar words and

expressions are intended to signify forward-looking statements.

Forward-looking statements are not guarantees of future results and

conditions but rather are subject to various risks and

uncertainties. A detailed discussion of risks and uncertainties

that could cause actual results and events to differ materially

from such forward-looking statements is included in the section

entitled “Risk Factors” contained in our Form 10-K filed with the

Securities and Exchange Commission (“SEC”) on 26th March 2024. The

occurrence of any of these risks and uncertainties could have a

material adverse effect on the Company’s business, financial

condition and results of operations. Any forward-looking statements

made in this press release speak only as of the date of this press

release and, except as required by law, the Company undertakes no

obligation to update any forward-looking statement contained in

this press release, even if the Company’s expectations or any

related events, conditions or circumstances change.

Company Contact:Oxbridge Re

Holdings LimitedJay Madhu, CEO345-749-7570jmadhu@oxbridgere.com

OXBRIDGE RE HOLDINGS LIMITED AND

SUBSIDIARIESConsolidated Balance

Sheets(expressed in thousands of U.S. Dollars,

except per share and share amounts)

| |

|

AtJune 30, 2024 |

|

|

AtDecember 31, 2023 |

|

| |

|

(Unaudited) |

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

| Investments: |

|

|

|

|

|

|

|

|

|

Equity securities, at fair value (cost: $1,563 and $1,926) |

|

$ |

213 |

|

|

|

680 |

|

|

Cash and cash equivalents |

|

|

3,594 |

|

|

|

495 |

|

|

Restricted cash and cash equivalents |

|

|

391 |

|

|

|

3,250 |

|

|

Premiums receivable |

|

|

2,118 |

|

|

|

977 |

|

|

Other Investments |

|

|

965 |

|

|

|

2,478 |

|

|

Loan Receivable |

|

|

- |

|

|

|

100 |

|

|

Due from Related Party |

|

|

63 |

|

|

|

63 |

|

|

Deferred policy acquisition costs |

|

|

240 |

|

|

|

101 |

|

|

Operating lease right-of-use assets |

|

|

124 |

|

|

|

9 |

|

|

Prepayment and other assets |

|

|

113 |

|

|

|

96 |

|

|

Property and equipment, net |

|

|

2 |

|

|

|

4 |

|

|

Total assets |

|

$ |

7,823 |

|

|

|

8,253 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and

Shareholders’ Equity |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Notes payable to noteholders |

|

|

118 |

|

|

|

118 |

|

|

Notes payable to Epsilon DeltaCat Re Tokenholders |

|

|

1,239 |

|

|

|

1,523 |

|

|

Unearned Premium Reserve |

|

|

2,181 |

|

|

|

915 |

|

|

Operating lease liabilities |

|

|

124 |

|

|

|

9 |

|

|

Accounts payable and other liabilities |

|

|

374 |

|

|

|

356 |

|

|

Total liabilities |

|

|

4,036 |

|

|

|

2,921 |

|

| |

|

|

|

|

|

|

|

|

| Shareholders’ equity: |

|

|

|

|

|

|

|

|

|

Ordinary share capital, (par value $0.001, 50,000,000 shares

authorized; 6,036,579 and 5,870,234 shares issued and

outstanding) |

|

|

6 |

|

|

|

6 |

|

|

Additional paid-in capital |

|

|

32,921 |

|

|

|

32,740 |

|

|

Accumulated Deficit |

|

|

(29,140 |

) |

|

|

(27,414 |

) |

|

Total shareholders’ equity |

|

|

3,787 |

|

|

|

5,332 |

|

|

Total liabilities and shareholders’ equity |

|

$ |

7,823 |

|

|

|

8,253 |

|

OXBRIDGE RE HOLDINGS LIMITED AND

SUBSIDIARIESConsolidated Statements of

Operations(Unaudited)(expressed

in thousands of U.S. Dollars, except per share

amounts)

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30, |

|

|

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Assumed premiums |

|

$ |

2,379 |

|

|

|

2,196 |

|

|

|

2,379 |

|

|

|

2,196 |

|

| Change in unearned premiums

reserve |

|

|

(1,815 |

) |

|

|

(2,013 |

) |

|

|

(1,266 |

) |

|

|

(2,013 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net premiums earned |

|

|

564 |

|

|

|

183 |

|

|

|

1,113 |

|

|

|

183 |

|

| SurancePlus management fee

income |

|

|

312 |

|

|

|

300 |

|

|

|

312 |

|

|

|

300 |

|

| Net investment and other

income |

|

|

65 |

|

|

|

79 |

|

|

|

126 |

|

|

|

168 |

|

| Interest and gain on

redemption of loan receivable |

|

|

- |

|

|

|

- |

|

|

|

41 |

|

|

|

- |

|

| Unrealized (loss) gain on

other investments |

|

|

(825 |

) |

|

|

124 |

|

|

|

(1,513 |

) |

|

|

505 |

|

| Change in fair value of equity

securities |

|

|

(72 |

) |

|

|

5 |

|

|

|

(160 |

) |

|

|

81 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

|

|

44 |

|

|

|

691 |

|

|

|

(81 |

) |

|

|

1,237 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Policy acquisition costs and

underwriting expenses |

|

|

62 |

|

|

|

20 |

|

|

|

122 |

|

|

|

20 |

|

| General and administrative

expenses |

|

|

566 |

|

|

|

677 |

|

|

|

1,054 |

|

|

|

1,081 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total expenses |

|

|

628 |

|

|

|

697 |

|

|

|

1,176 |

|

|

|

1,101 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (Loss) before income attributable to noteholders and

tokenholders |

|

|

(584 |

) |

|

|

(6 |

) |

|

|

(1,257 |

) |

|

|

136 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income attributable to noteholders and tokenholders |

|

|

(237 |

) |

|

|

(79 |

) |

|

|

(469 |

) |

|

|

(79 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income |

|

$ |

(821 |

) |

|

|

(85 |

) |

|

|

(1,726 |

) |

|

|

57 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) earnings per

share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted |

|

$ |

(0.14 |

) |

|

|

(0.01 |

) |

|

|

(0.29 |

) |

|

|

0.01 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average

shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted |

|

|

6,010,561 |

|

|

|

5,870,234 |

|

|

|

6,007,868 |

|

|

|

5,863,973 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Performance ratios to

net premiums earned: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss ratio |

|

|

0.0 |

% |

|

|

0.0 |

% |

|

|

0.0 |

% |

|

|

0.0 |

% |

| Acquisition cost ratio |

|

|

11.0 |

% |

|

|

10.9 |

% |

|

|

11.0 |

% |

|

|

10.9 |

% |

| Expense ratio |

|

|

111.3 |

% |

|

|

380.9 |

% |

|

|

105.7 |

% |

|

|

601.6 |

% |

| Combined ratio |

|

|

111.3 |

% |

|

|

380.9 |

% |

|

|

105.7 |

% |

|

|

601.6 |

% |

- Oxbridge Re Holdings Limited

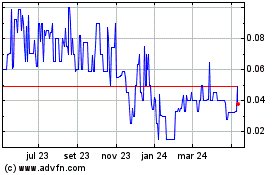

Oxbridge Re (NASDAQ:OXBRW)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

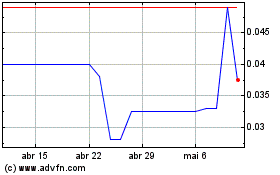

Oxbridge Re (NASDAQ:OXBRW)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025