SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of November, 2023

Commission File Number 1-14732

COMPANHIA SIDERÚRGICA NACIONAL

(Exact name of registrant as specified in its charter)

National Steel Company

(Translation of Registrant's name into English)

Av. Brigadeiro Faria Lima 3400, 20º andar

São Paulo, SP, Brazil

04538-132

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

|

RESULTS

3Q23

|

| |

|

São Paulo, Brazil, November 13th,

2023 - Companhia Siderúrgica Nacional ("CSN") (B3: CSNA3) (NYSE: SID) discloses its third quarter of 2023

(3Q23) financial results in Brazilian Reais, with all financial statements consolidated in accordance with accounting practices adopted

in Brazil issued by the Accounting Pronouncements Committee ("CPC"), approved by the Brazilian Securities and Exchange Commission

("CVM") and the Federal Accounting Council ("CFC") and in accordance with international financial reporting standards

(“IFRS”), issued by the International Accounting Standards Board (“IASB”).

The comments address the Company's consolidated results

for the third quarter of 2023 (3Q23) and the comparisons are in relation to the second quarter of 2023 (2Q23) and the third quarter

of 2022 (3Q22). The dollar exchange rate was R$ 5.41 on 09/30/2022; R$ 4.82 on 06/30/2023 and R$ 5.01 on 09/30/2023.

| | |

For more information, please visit our website: https://ri.csn.com.br/en/ | 2 |

| RESULTS 3Q23 |

| | |

Consolidated Table - Highlights

¹ Adjusted EBITDA is calculated from net income

(loss), plus depreciation and amortization, taxes on profit, net financial result, investment participation result, other operating income/expenses

result and includes the proportional share of 37.27% of the EBITDA of the joint subsidiary MRS Logística.

² Adjusted EBITDA Margin is calculated from Adjusted

EBITDA divided by Management Net Revenue.

³ Adjusted Net Debt and Adjusted Cash/Availability

consider 37.27% of MRS, in addition to not considering Forfaiting and Drawn Risk operations.

Consolidated Results

| · | Net Revenue totaled R$ 11,125 million

in 3Q23, which represents an increase of 1.2% when compared to 2Q23, mainly as a result of the strong performance in the mining segment,

which combined a new sales record with an increase in realized price. In addition, the logistics and cement segments also contributed

positively to the higher revenues recorded in the period. |

| · | Cost of Goods Sold (COGS) totaled R$

8,320 million in 3Q23, down 4.9% from the previous quarter, reflecting the normalization of production in the steel industry. |

| · | In 3Q23, CSN recorded Gross Profit of R$ 2,805

million, with a Gross Margin of 25.2% or 4.8 p.p. higher than in the previous quarter. This growth in profitability reflects the

strong operational performance seen in the period, in addition to the positive effect of the increase in the exchange rate on sales to

the foreign market. |

| · | Selling, General and Administrative Expenses

totaled R$ 1,175 million in 3Q23, 8.6% higher than in 2Q23, as a result of the higher volume sold in mining, resulting in higher freight

expenses. |

| · | The group of Other Revenues and Operating

Expenses was negative by R$ 113 million in 3Q23, which represents a reduction of 11.5% compared to 2Q23, explained by the positive

effect of iron ore hedging operations, which generated a gain of R$ 31 million in the period. |

| · | In 3Q23, the Financial Result was negative

by R$ 1,223 million, in line with the previous quarter, as a consequence of the maintenance of the cost of debt and a lesser impact of

Usiminas' shares. |

| | |

For more information, please visit our website: https://ri.csn.com.br/en/ | 3 |

| RESULTS 3Q23 |

| | |

·

Equity Result was positive by R$ 131 million in 3Q23, an increase

of 22.4% compared to the previous quarter, as a result of the strong performance achieved by MRS.

·

CSN recorded Net Income of R$ 91 million in 3Q23, which represents

a reduction of 67.8% compared to the previous quarter, as 2Q23 was positively impacted by a reversal of the provision with IR/CSLL. This

situation ended up offsetting the operational improvement seen in this quarter.

Adjusted EBITDA

*The Company discloses its Adjusted EBITDA excluding

participation in investments and other operating income (expenses) because it understands that they should not be considered in the calculation

of recurring operating cash generation.

| · | In 3Q23, Adjusted EBITDA was R$ 2,815 million,

with an Adjusted EBITDA Margin of 24.3% or 4.7 p.p. above that seen in the last quarter. This increase in profitability is a direct

consequence of the improvement in prices in the mining segment, which, combined with a higher sales volume, ended up offsetting the more

challenging situation in the steel segment. Additionally, the stronger performance achieved in the logistics segment and the positive

dynamics seen in the cement segment, with price increases and capture of synergies, also contributed favorably to the EBITDA improvement. |

| | |

For more information, please visit our website: https://ri.csn.com.br/en/ | 4 |

| RESULTS 3Q23 |

| | |

Adjusted EBITDA (R$ MM) and Adjusted

EBITDA Margin¹ (%)

¹ The Adjusted EBITDA Margin is calculated from

the division between Adjusted EBITDA and Adjusted Net Revenue, which considers the interests of 100% in the consolidation of CSN Mineração

and 37.27% in MRS.

Adjusted Cash Flow

Adjusted Cash Flow in 3Q23 was positive by R$ 1,022

million, as a result of the combination of strong operating performance and efficient working capital management, yet with another reduction

in inventory observed during the period.

Adjusted cash flow¹ in 3Q23

(R$ MM)

¹ The concept of Adjusted cash flow is calculated

from Adjusted EBITDA, subtracting Ebitda from Joint Subsidiaries, CAPEX, IR, Financial Result and changes in Assets and Liabilities²,

excluding the effect of the Glencore advance.

² The Adjusted Working Capital is composed of

the variation of the Net Working Capital, plus the variation of accounts of long-term assets and liabilities and disregarding the net

variation of IR and CS.

Indebtedness

On 09/30/2023, consolidated net debt reached R$ 29,939

million, with the leverage indicator measured by the LTM Net Debt/EBITDA ratio reaching 2.63x, which represents a reduction of 150 basis

points compared to the previous quarter. With the peak leverage of the year behind us, the Company remains firm in its path of reducing

its debt ratio and is on track to deliver an increasingly solid capital structure, even more so when considering the normalization of

the steel operation and the growth potential of the cement segment, after synergy captures are complete. In addition, CSN maintained its

policy of carrying a high cash position, which reached R$ 16 billion in this quarter.

| | |

For more information, please visit our website: https://ri.csn.com.br/en/ | 5 |

| RESULTS 3Q23 |

| | |

¹ Net Debt / EBITDA: For debt calculation considers the final dollar

of each period and for net debt and EBITDA the average dollar of the period.

The Company remains very active in its objective

of extending the amortization period, focusing on long-term operations and the local capital market. Among the main transactions in 3Q23,

CSN's 14th issuance of simple debentures stands out, in the total amount of R$ 700 million, with the objective of investing

in railway infrastructure, in the logistics and transportation segment.

Amortization Schedule (R$ Bi)

¹ IFRS: does not consider participation in MRS

(37.27%).

² Management Gross / Net Debt considers participation

in MRS (37.27%), without accrued interest.

3 Average Term after completion of the Liability Management

Plan.

Foreign Exchange Exposure

The accumulated net foreign

exchange exposure in the consolidated balance sheet up to 3Q23 was US$ 456 million, as shown in the table below, in line with the company's

policy of minimizing the impacts of exchange rate volatility on the result. The Hedge Accounting adopted by CSN correlates the

projected flow of dollar exports in dollars with the future maturities of the debt in the same currency. As a result, the exchange variation

of the dollar debt is temporarily recorded in the shareholders' equity and is taken to the result when the dollar revenues from such exports

occur.

| | |

For more information, please visit our website: https://ri.csn.com.br/en/ | 6 |

| RESULTS 3Q23 |

| | |

Investments

A total of R$ 1,191 million were invested in 3Q23,

20.2% higher than the amount invested in 2Q23, with emphasis on repairs to coke batteries at UPV and general repairs to steel operations.

In the mining segment, we highlight the current investments to maintain operational capacity and progress in expansion projects (mainly

related to P15, recovery of tailings from dams and expansion of the Itaguaí port), accompanied by current investments in cement

operations.

Net Working Capital

Net Working Capital applied to the business totaled

R$ 1,922 million in 3Q23, a reduction of 36.1% compared to 2Q23, due to (i) the Company's lower inventory volume, in line with

the increase in sales recorded in the period, and (ii) an increase in the number of CSN suppliers.

The calculation of the Net Working Capital applied

to the business disregards the advance on the sales of ore, as shown in the following table:

| | |

For more information, please visit our website: https://ri.csn.com.br/en/ | 7 |

| RESULTS 3Q23 |

| | |

¹ Other CCL Assets: Considers

employee advances and other accounts receivable.

² Other CCL Liabilities:

Considers other accounts payable, dividends payable, installment taxes and other provisions.

³ Inventories: Does not

consider the effect of the provision for inventory/inventory losses. For the calculation of the SME, the balances of warehouse stocks

are not considered.

| | |

For more information, please visit our website: https://ri.csn.com.br/en/ | 8 |

| RESULTS 3Q23 |

| | |

Results by Business Segments

| | |

For more information, please visit our website: https://ri.csn.com.br/en/ | 9 |

| RESULTS 3Q23 |

| | |

| 3Q23 Results (R$ million) |

Steel |

Mining |

Logistics (Port) |

Logistics (Rail) |

Energy |

Cement |

Corporate Expenses/

Eliminations |

Consolidated |

| |

|

|

|

|

|

|

|

|

| Net Revenue |

5,344 |

4,335 |

75 |

730 |

122 |

1,159 |

(640) |

11,125 |

| Internal Market |

4,130 |

567 |

75 |

730 |

122 |

1,159 |

(1,170) |

5,613 |

| Foreign Market |

1,214 |

3,768 |

- |

- |

- |

- |

530 |

5,512 |

| COGS |

(5,209) |

(2,567) |

(65) |

(367) |

(106) |

(915) |

909 |

(8,320) |

| Gross profit |

135 |

1,768 |

10 |

363 |

16 |

244 |

270 |

2,805 |

| DGA/DVE |

(299) |

(71) |

(3) |

(57) |

(16) |

(145) |

(588) |

(1,175) |

| Depreciation |

346 |

269 |

12 |

100 |

25 |

167 |

(77) |

842 |

| Proportional EBITDA of jointly controlled Companies |

- |

- |

- |

- |

|

- |

343 |

343 |

| Adjusted EBITDA |

183 |

1,966 |

19 |

406 |

25 |

266 |

(50) |

2,815 |

| |

|

|

|

|

|

|

|

|

| 2Q23 Results (R$ million) |

Steel |

Mining |

Logistics (Port) |

Logistics (Rail) |

Energy |

Cement |

Corporate Expenses/

Eliminations |

Consolidated |

| |

|

|

|

|

|

|

|

|

| Net Revenue |

5,943 |

3,631 |

54 |

668 |

159 |

1,142 |

(609) |

10,989 |

| Internal Market |

4,368 |

372 |

54 |

668 |

159 |

1,142 |

(1,012) |

5,752 |

| Foreign Market |

1,574 |

3,260 |

- |

- |

- |

- |

403 |

5,237 |

| COGS |

(5,419) |

(2,626) |

(61) |

(352) |

(100) |

(952) |

765 |

(8,746) |

| Gross profit |

523 |

1,006 |

(7) |

316 |

59 |

191 |

156 |

2,243 |

| DGA/DVE |

(288) |

(147) |

(3) |

(51) |

(15) |

(123) |

(455) |

(1,082) |

| Depreciation |

318 |

254 |

13 |

98 |

24 |

156 |

(75) |

788 |

| Proportional EBITDA of jointly controlled Companies |

- |

|

- |

- |

- |

- |

313 |

313 |

| Adjusted EBITDA |

553 |

1,112 |

3 |

362 |

69 |

224 |

(60) |

2,263 |

| |

|

|

|

|

|

|

|

|

| 3Q22 Results (R$ million) |

Steel |

Mining |

Logistics (Port) |

Logistics (Rail) |

Energy |

Cement |

Corporate Expenses/

Eliminations |

Consolidated |

| |

|

|

|

|

|

|

|

|

| Net Revenue |

7,698 |

2,527 |

69 |

653 |

48 |

778 |

(875) |

10,897 |

| Internal Market |

5,655 |

438 |

69 |

653 |

48 |

778 |

(1,091) |

6,549 |

| Foreign Market |

2,044 |

2,089 |

- |

- |

- |

- |

215 |

4,348 |

| COGS |

(6,426) |

(1,800) |

(54) |

(397) |

(53) |

(501) |

873 |

(8,359) |

| Gross profit |

1,272 |

727 |

14 |

256 |

(5) |

276 |

(3) |

2,538 |

| DGA/DVE |

(334) |

(63) |

(7) |

(37) |

(10) |

(100) |

(248) |

(798) |

| Depreciation |

313 |

253 |

9 |

108 |

4 |

82 |

(78) |

689 |

| Proportional EBITDA of jointly controlled Companies |

- |

- |

- |

- |

- |

- |

285 |

285 |

| Adjusted EBITDA |

1,251 |

916 |

16 |

327 |

(10) |

257 |

(44) |

2,713 |

Results of the Steel Industry

According to the World

Steel Association (WSA), global crude steel production totaled 460.4 million tons (Mt) in the third quarter of 2023, which represents

a decrease of 4.5% compared to the previous quarter as a consequence of the seasonality of the period, but an increase of 1.9% compared

to the same period in 2022, reflecting the higher level of activity in the Chinese market. The European Union reduced its production

by 9.9% compared to the previous quarter and 6.5% compared to the same period last year, impacted by the environment of high interest

rates, inflation and still high energy costs. In turn, China produced 56.3% of the global volume (259.3 Mt) in 3Q23, which corresponds

to a quarterly reduction of 5.3 p.p., but an increase of 2.8 p.p. compared to the same period of the previous year. The expectations

for 2023 remain positive as Chinese government incentives indicate a prospect of a 1.8% increase in global steel production, after a

3.3% contraction in 2022. Brazil, on the other hand, produced 8.0 Mt in 3Q23, which corresponds to a decrease of 2.4% in relation to

the previous quarter and 3.6% when compared to the same period of the previous year, mainly impacted by the increase in imports. The

outlook for local market activity in 2023 is less encouraging, even after the normalization of production by relevant players, but with

intense competition with imported material and with demand still responding slowly to the cycle of cuts in the Selic rate and government

stimulus through programs such as PAC, Minha Casa, Minha Vida, Plano Safra and etc.

| | |

For more information, please visit our website: https://ri.csn.com.br/en/ | 10 |

| RESULTS 3Q23 |

| | |

Steel Production (thousand tons)

In the case of CSN, Slab Production in 3Q23

totaled 922 thousand tons, a performance 25.9% higher than in the previous quarter, which reflects the normalization of the operation

after a series of bottlenecks faced in the first semester. In turn, the production of flat rolled products, our main market, reached 835

Kton, which represents an increase of 7.8% compared to 2Q23, reflecting the resumption of the production process and bringing the volume

produced to numbers closer to previous periods.

Sales Volume (Kton) – Steel

Total sales reached 1,018 thousand tons in

the third quarter of 2023, a volume 3.1% lower than in 2Q23. When analyzing the behavior in different markets, it can be seen that

the domestic market showed growth even with all the pressure faced with imported products, with emphasis on the hot rolled products

performance. Domestic sales totaled 747 thousand tons of steel products in 3Q23, which represents an increase of 1.1% compared

to 2Q23 and reinforces the normalization of the operation and the Company's resilience in managing to maintain an assertive commercial

strategy even with all the pressure seen in the period. In the foreign market, sales totaled 271 thousand tons in 3Q23 and were

13.0% lower than in 2Q23, as a result of seasonality and weaker dynamics in the European market. During the quarter, 5,000 tons were

exported directly, and 267,000 tons were sold by subsidiaries abroad, of which, 67,000 tons were sold by LLC, 132,000 tons by SWT and

68,000 tons by Lusosider.

Regarding total Sales Volume in 3Q23, the

main highlight was the flat steel segment for construction, with a 24.1% increase compared to the previous quarter. On the other hand,

Automotive (-11.9%) and Home Appliances (-4.2%) appear among the main negative highlights after a stronger start to the year. In the year-on-year

comparison, there was a significant recovery in Home Appliances and flat steel for construction, but with decreases in the other segments.

| | |

For more information, please visit our website: https://ri.csn.com.br/en/ | 11 |

| RESULTS 3Q23 |

| | |

| According

to ANFAVEA (National Association of Automotive Vehicle Manufacturers),

production in 3Q23 registered 619 thousand units, an increase of 3.8% over the previous quarter. According to the Association, the volume

of vehicle registrations increased by 19.8% in the third quarter.

When looking at data from the Brazil Steel Institute

(IABr), Crude Steel production in 3Q23 reached 7.96 Mton, a performance 6.6% lower than in the same period of 2022 and 1.6% below

2Q23. Apparent Consumption was 6.34 Mton, an increase of 2.8% year-on-year and 7.9% compared to 2Q23. In turn, the Steel Industry Confidence

Indicator (ICIA) for September was 37.7 points, which represents a reduction of 4.9 p.p. compared to December 2022, a performance that

reflects all the dissatisfaction and insecurity with the greater entry of imported products into the Brazilian market.

According to IBGE data, the production

of home appliances for the month of September 2023 registered an increase of 6.8% compared to the previous year, reinforcing the continuous

improvement of the home appliances segment after the weak performance observed last year.

|

|

| · | Net Revenue in the Steel Industry reached

R$ 5,344 million in 3Q23, a performance 10.1% lower than in 2Q23, as a result of the adjustment in prices in the domestic market

and the lower dynamism in the foreign market. In this sense, the Average Price in 3Q23 in the domestic market was 6.7% lower than

in 2Q23, which shows the pressure exerted by imported material. On the other hand, the price in the foreign market was even lower, with

a drop of 11.5% compared to the previous quarter, impacted both by lower commercial activity and by a greater penetration of external

material at more competitive prices. |

| · | In turn, the Slab Cost in 3Q23 reached

R$ 3,563/t, a reduction of 13.4% compared to the previous quarter, as a direct consequence of the normalization of production, helping

to dilute fixed costs, in addition to the lower volume of plates purchased. |

| · | The steel industry's Adjusted EBITDA

reached R$ 183 million in 3Q23 and was 67.0% lower than in 2Q23, with an Adjusted EBITDA Margin of 3.4% (-5.9 p.p.). This result

reflects the combination of a weaker foreign market and a domestic performance marked by operational normalization and price adjustments

in order to make the local product more competitive. On the other hand, it is worth highlighting the transient effect of this lower profitability,

as all necessary adjustments have already been made, while a gradual recovery of the Brazilian market is becoming evident. |

| | |

For more information, please visit our website: https://ri.csn.com.br/en/ | 12 |

| RESULTS 3Q23 |

| | |

Mining Result

In the mining sector, the quarter was marked by high

demand for iron ore in China and an improvement in price levels, with the appreciation of Platts that closed 3Q23 US$ 3.06 above the average

observed in the previous quarter. Steel production in China remains at high levels, leading to increases in capacity utilization at Chinese

steel mills and low levels of ore inventories at both Chinese mills and ports. This situation ended up weighing favorably on the price

of ore and has been driven by the Chinese government's stimulus packages, in an attempt to inject liquidity into the economy and ensure

low financing costs for the consumer, manufacturing, infrastructure and real estate segments. Such moves have boosted demand for iron

ore, including for lower-quality products as margins at Chinese steel mills remain quite tight. In this scenario, the iron ore price

closed 3Q23 with an average of US$ 114.04/dmt (Platts, Fe62%, N. China), 2.8% higher than in 2Q23 (US$ 110.98/dmt) and 10.4% higher

than in 3Q22 (US$ 103.31 /dmt).

Regarding Sea Freight, the BCI-C3 Route (Tubarão-Qingdao)

presented an average of US$ 20.3/wmt in 3Q23, which represents a reduction of 3.6% compared to the freight cost of the previous

quarter, as a reflection of the increase in spot supply in the Atlantic Ocean. In addition, the rainy season in Africa and the large amount

of cargo negotiated within contracts supported this scenario, helping to offset the increase in fuel prices in the period.

| · | Iron Ore Production added yet another

record volume of 11,589 thousand tons in 3Q23, which represents an increase of 3.9% compared to the volume recorded in 2Q23 and an increase

of 20.4% compared to the same period last year. This is the second consecutive production record achieved by the Company and confirms

the excellent operational momentum seen this year, even more so when it is observed that there was a significant improvement in the

mix of own production and consequent reduction in the volume of purchases from third parties when compared to the previous period.

Additionally, the performance achieved in 9M23 places CSN in a comfortable position to revise its production and purchase guidance to

42.0 - 42.5 Mton stipulated for 2023. |

| | |

For more information, please visit our website: https://ri.csn.com.br/en/ | 13 |

| RESULTS 3Q23 |

| | |

| · | Sales Volume, in turn, also reached a

record result of 11,641 thousand tons in 3Q23, surpassing by 3.4% the record set in the previous quarter and 28.0% above the same period

of the previous year. The company was able to take advantage of the favorable scenario with strong Chinese demand and the dryer period

to deliver a quarterly sales record. |

| · | In 3Q23, Adjusted Net Revenue totaled R$

4,335 million and was 19.4% higher than in 2Q23, a performance that reflects not only the higher volume of shipments, but also the

higher price realization seen in the period. As a result, Net Unitary Revenue was US$ 75.23 per wet ton, which represents

an increase of 14.5% compared to 2Q23, following the upward trajectory of the price of Platts and open cargoes that offset the 5.1% appreciation

of the exchange rate. |

| · | In turn, the Cost of Goods

Sold from mining totaled R$ 2,567 million in 3Q23, a reduction of 2.2% compared to the previous quarter, even with higher

commercial activity, which is justified by the lower volume of third-party purchases and lower use of third-party ports. On the other

hand, the C1 cost reached US$ 21.3/t in 3Q23, 1.4% lower than in the previous quarter, reflecting the higher dilution of fixed

costs and lower SG&A unit costs that ended up offsetting the increase in diesel in the period. |

·

Adjusted EBITDA reached R$ 1,966 million in 3Q23, with a significant

quarterly Adjusted EBITDA Margin, reaching 45.4% or 14.7 p.p. higher than in the previous quarter. This increase in profitability

is the result of a very favorable situation that combined record sales volume with better ore prices.

Cement Result

According to the National Union of the Cement

Industry (SNIC), cement sales in Brazil from January to September 2023 had a slight decrease of 2.0% when compared to the same period

of the previous year. This scenario reflects a normalization of the market after the boom experienced during the pandemic, plus

the effects of a still high interest rate, the maturation of the new public policies of a government in its first year in office and

a volume of rainfall above the historical average, especially in some regions such as the South of the country. On the other hand, even

considering all these effects, the market remains quite resilient and already shows some signs of recovery. For example, cement sales

in Brazil grew 8.3% in 3Q23 compared to the previous quarter and the consumer confidence index reached the highest level since 2014.

In addition, job recovery scenario and GDP, in addition to the cooling of inflation and the beginning of the downward trajectory of interest

rates are other indications that should boost sales in the coming months. Finally, the announcement of the new modality of the Growth

Acceleration Program (PAC) and the reformulation of Minha Casa, Minha Vida are new evidence that should provide even more support for

a new growth cycle in the sector.

In terms of commercial performance, CSN's

sales in 3Q23 totaled 3,263 Kton, which represents a small decrease of 2.1% compared to the previous quarter, but 4% above

the same period of the previous year.

| | |

For more information, please visit our website: https://ri.csn.com.br/en/ | 14 |

| RESULTS 3Q23 |

| | |

| · | Net Revenue, in turn, reached R$ 1,159

million in 3Q23 and was 1.5% higher than in the previous quarter, reinforcing the more assertive commercial strategy and the better price

level practiced in the period, especially for the structured cement and bulk market. This eventually compensated for the lower sales volume

in the period. |

| · | In 3Q23, cement Unitary Cost fell 1.8%

compared to the previous quarter, as a result of lower costs with raw materials. |

| · | In turn, the segment’s Adjusted EBITDA

increased by 19.1% compared to the previous quarter, reaching R$ 266 million in 3Q23 and with an Adjusted EBITDA Margin of 23.0%,

or 3.4 p.p. higher than in 2Q23, reinforcing all the synergy capture achieved in the period. In addition, the environment remains favorable

for margin expansion as there is room for further recovery in prices and sales in the coming months. |

Energy Result

In 3Q23, energy prices remained at a level

still below the average of recent years, due to the high level of water that has been recorded in the reservoirs. As a result, the volume

of energy traded in the quarter generated Net Revenue of R$ 122 million, which represents a reduction of 23.5% compared to the

previous quarter. Adjusted EBITDA also decreased in the period, reaching R$ 25 million and generating an Adjusted EBITDA Margin

of 20.3%, which represents a reduction of 23.1 p.p. compared to the previous quarter, when the recognition of tax credits favored

profitability.

Logistics Result

Railway Logistics: In 3Q23, Net Revenue

reached RR$ 730 million, with an Adjusted EBITDA of R$ 406 million and Adjusted EBITDA Margin of 55.7%. Compared to 2Q23, revenue

increased 9.2% due to the seasonality of the period and a higher volume of goods transported. In the same line of comparison, Adjusted

EBITDA was 12.2% higher.

Port Logistics: In 3Q23, 292 thousand

tons of steel products were shipped by Sepetiba Tecon, in addition to 14 thousand containers, 4 thousand tons of general cargo and 239

thousand tons of bulk. Compared to the previous quarter, the Company significantly increased its shipments, with the increase in the volume

of steel products and in the volume of bulk. As a result, Net Revenue from the port segment was 37.3% higher than in the previous

quarter, reaching R$ 75 million in 3Q23, with a positive impact on Adjusted EBITDA for the period, which was R$ 19 million in the

quarter and Adjusted EBITDA Margin of 25.2%, or 20.2 p.p. higher than in 2Q23.

| | |

For more information, please visit our website: https://ri.csn.com.br/en/ | 15 |

| RESULTS 3Q23 |

| | |

ESG – Environmental, Social & Governance

ESG PERFORMANCE – CSN GROUP

Since the beginning of 2023, CSN has adopted

a new format for disclosing its ESG actions and performance, providing its performance in ESG indicators on an individual basis. The new

model allows stakeholders to have access to the main results and indicators on a quarterly basis and to monitor them effectively and even

more quickly. Access can be made through the results center on CSN's IR website: https://ri.csn.com.br/informacoes-financeiras/central-de-resultados/

The information included in this release was

selected based on relevance and materiality to the company. Quantitative indicators are presented compared to the period that best represents

the metric for monitoring them. Thus, some are compared to the same quarter of the previous year, and others will be compared to the average

of the previous period, ensuring a comparison based on seasonality and periodicity. Additionally, it is important to highlight that the

ESG Performance Report also incorporates the performance indicators of the new assets of CSN Cimentos, acquired in 2022, so that some

absolute indicators will change significantly when compared to the previous period.

More detailed historical data on CSN's performance

and initiatives can be found in the 2022 Integrated Report, released in April 2023 (https://esg.csn.com.br/nossa-empresa/relatorio-integrado-gri

). ESG indicator assurance occurs annually for the Integrated Report's closing, so the information contained in quarterly releases is

subject to adjustments resulting from this process.

It is also possible to track CSN's ESG performance

in an agile and transparent manner on our website through the following electronic address: https://esg.csn.com.br .

| | |

For more information, please visit our website: https://ri.csn.com.br/en/ | 16 |

| RESULTS 3Q23 |

| | |

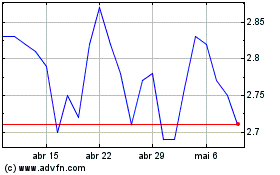

Capital Markets

In the third quarter of 2023, CSN's shares

were practically stable (+0.1%), while the Ibovespa index fell 1.3%. The average daily volume (CSNA3) traded on B3, in turn, was R$ 100.8

million in 3Q23. On the New York Stock Exchange (NYSE), the Company's American Depositary Receipts (ADRs) depreciated 7.7%

in dollar terms, while the Dow Jones index decreased 2.6%. The average daily trading of ADRs (SIDs) on the NYSE in 3Q23 was US$

5.9 million.

| |

3Q23 |

| No. of shares in thousands |

|

1,326,094 |

| Market Cap |

|

|

| Closing Quote (R$/share) |

|

12.14 |

| Closing Quote (US$/ADR) |

|

2.39 |

| Market Value (R$ million) |

|

16,099 |

| Market Value (US$ million) |

|

3,169 |

| Change in the period |

|

|

| CSNA3 (R$) |

|

-0.08% |

| SID (US$) |

|

-7.72% |

| Ibovespa (R$) |

|

-1.29% |

| Dow Jones (US$) |

|

-2.62% |

| Volume |

|

|

| Daily average (thousand shares) |

|

8,013 |

| Daily average (R$ thousands) |

|

100,786 |

| Daily average (thousand ADRs) |

|

2,316 |

| Daily Average (US$ thousand) |

|

5,995 |

|

Source: Bloomberg

|

|

|

| |

|

|

|

Earnings Conference Call:

3Q23

Earnings Presentation Webcast Investor Relations Team

Conference Call in Portuguese with Simultaneous Translation into English November 14, 2023

11:30

a.m. (Brasilia time)

09:30 a.m. (New York time)

+55 11 3181-8565 / +55 11 4090-1621

Code: CSN

Replay Phone: +55 11 4118-5151

Replay Code:

219011#

Webcast: click here |

Marcelo Cunha Ribeiro – CFO and Executive Director of IR

Pedro Gomes de Souza (pedro.gs@csn.com.br)

Rafael Costa Byrro (rafael.byrro@csn.com.br)

Ricardo Reis (ricardo.reis.rr2@csn.com.br)

|

| Some

of the statements contained herein are forward-looking statements that express or imply expected results, performance or events. These

perspectives include future results that may be influenced by historical results and the statements made in 'Outlook'. Current results,

performance and events may differ materially from assumptions and prospects and involve risks such as: general and economic conditions

in Brazil and other countries; interest and exchange rate levels, protectionist measures in the U.S., Brazil, and other countries, changes

in laws and regulations, and general competitive factors (on a global, regional, or national basis).

|

| | |

For more information, please visit our website: https://ri.csn.com.br/en/ | 17 |

| RESULTS 3Q23 |

| | |

INCOME STATEMENT

CONSOLIDATED – Corporate Law – In Thousands of Reais

| | |

For more information, please visit our website: https://ri.csn.com.br/en/ | 18 |

| RESULTS 3Q23 |

| | |

BALANCE SHEET

CONSOLIDATED – Corporate Law – In Thousands of Reais

| | |

For more information, please visit our website: https://ri.csn.com.br/en/ | 19 |

| RESULTS 3Q23 |

| | |

CASH FLOW STATEMENT

CONSOLIDATED – Corporate Law – In Thousands of Reais

| | |

For more information, please visit our website: https://ri.csn.com.br/en/ | 20 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 13, 2023

|

COMPANHIA SIDERÚRGICA NACIONAL |

|

|

|

By: |

/S/ Benjamin Steinbruch

|

| |

Benjamin Steinbruch

Chief Executive Officer

|

|

|

|

|

|

By: |

/S/ Marcelo Cunha Ribeiro

|

| |

Marcelo Cunha Ribeiro

Chief Financial and Investor Relations Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

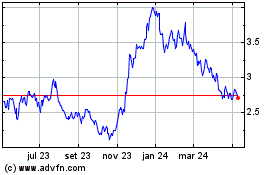

Companhia Siderurgica Na... (NYSE:SID)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Companhia Siderurgica Na... (NYSE:SID)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024