SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of February, 2024

Commission File Number 1-14668

COMPANHIA PARANAENSE DE ENERGIA

(Exact name of registrant as specified in its

charter)

Energy Company of Paraná

(Translation of Registrant's name into English)

José Izidoro Biazetto, 158

81200-240 Curitiba, Paraná

Federative Republic of Brazil

+55 (41) 3331-4011

(Address of principal executive offices)

Indicate by check

mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form

20-F ___X___ Form 40-F _______

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

COMPANHIA

PARANAENSE DE ENERGIA – COPEL

Corporate Taxpayer ID (CNPJ/ME) 76.483.817/0001-20 –

Company

Registry (NIRE) 41300036535 - CVM Registration

B3

(CPLE3, CPLE5, CPLE6, CPLE11)

NYSE

(ELP)

LATIBEX

(XCOP, XCOPO, XCOPU)

Petrobras'

accession to CCVA of UEGA

COPEL (“Company”),

a company that generates, transmits, distributes and sells energy, announces to its shareholders and the market in general, in continuity

with that published in Material Facts nº 05/22, 08/22 and 20/23 and Notices to the Market nº 21/23 and 25/23, which received

from Petróleo Brasileiro S.A. – Petrobras information on the effective exercise of the tag along (joint sale) in the divestment

in UEG Araucária (“UEGA”), in accordance with the terms of the Purchase and Sale Agreement (“CCVA”) signed

between Copel, Copel Geração e Transmissão (“Copel GeT”) and Âmbar Energia S.A (“Buyer”),

on December 14, 2023.

Therefore, the thermoelectric plant

will be sold in full of its shareholdings as per the following table:

The operation is subject to

the implementation of common conditions precedent in this type of business, such as approval by the Administrative Council for Economic

Defense (“CADE”). The closing of the transaction is estimated to occur before March 31, 2024.

The divestment of this asset

is part of the decarbonization process of the generation matrix, strengthening the pillars for the longevity and sustainable growth of

the business, in addition to being in line with Copel's Business Strategic Planning – Vision 2030.

About the Araucária

TPP – Araucária Gas Thermoelectric Plant

TPP Araucária is a natural

gas generation plant with an installed capacity of 484.15 MW that operates in a combined cycle (two gas turbines and one steam turbine)

and operates in the mode known as “merchant”[1].

Curitiba, February

26, 2023.

Adriano Rudek de Moura

Chief Financial and Investor Relations Officer

For further information, please contact the Investor

Relations team:

ri@copel.com or (41) 3331-4011

[1]

Plants without electricity sales contracts, whether in the free (ACL) or regulated (ACR) environment, subject to fluctuations in the Difference

Settlement Price – PLD. In this modality, the UEGA, as a thermoelectric plant dispatched centrally by the National Electric System

Operator (ONS), is dispatched in situations in which the Marginal Operating Cost (CMO) of the electrical system exceeds its Unitary Variable

Cost (CVU) approved by ANEEL , or outside the order of merit, when requested by the ONS.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date February 26, 2024

| COMPANHIA PARANAENSE DE ENERGIA – COPEL |

| |

|

|

| By: |

/S/

Daniel Pimentel Slaviero

|

|

| |

Daniel Pimentel Slaviero

Chief Executive Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates of future

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

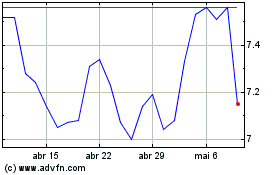

Companhia Parana De Energ (NYSE:ELP)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

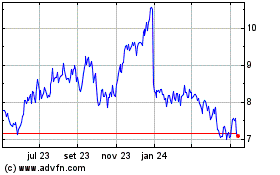

Companhia Parana De Energ (NYSE:ELP)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025