false000174661800017466182024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2024

REVOLVE GROUP, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Delaware |

001-38927 |

46-1640160 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

12889 Moore Street Cerritos, California |

|

90703 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

(562) 677-9480

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class: |

|

Trading Symbol(s): |

|

Name of each exchange on which registered: |

Class A Common Stock, par value $0.001 per share |

|

RVLV |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 27, 2024, Revolve Group, Inc. issued a press release announcing its financial results for its fourth quarter and fiscal year ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information included in Item 2.02 of this Current Report on Form 8-K and the exhibit attached hereto are being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in any such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

REVOLVE GROUP, INC. |

|

|

|

|

Date: February 27, 2024 |

|

By: |

/s/ JESSE TIMMERMANS |

|

|

|

Jesse Timmermans |

|

|

|

Chief Financial Officer |

Exhibit 99.1

Revolve Group Announces Fourth Quarter and Full Year 2023 Financial Results

Los Angeles, CA – February 27, 2024 - Revolve Group, Inc. (NYSE: RVLV), the next-generation fashion retailer for Millennial and Generation Z consumers, today announced financial results for the fourth quarter and full year ended December 31, 2023.

“I’m proud of our team’s accomplishments in 2023 that set us up well for 2024,” said co-founder and co-CEO Mike Karanikolas. “Despite the challenging backdrop for consumer discretionary spending, we closed out the year with a solid fourth quarter that included improved sales trends, year-over-year expansion of our gross margin and early progress on selling and distribution cost efficiencies.”

“Our profitable and cash generative business remains a key competitive advantage that has enabled us to invest in longer-term growth initiatives throughout the cycle at a time when many industry peers have no choice but to significantly reduce investment,” said co-founder and co-CEO Michael Mente. “Our focus on maximizing value creation over the long-term is supported by investments in our brands, technology and operations as well as delivering value to stockholders through our $100 million stock repurchase program.”

Fourth Quarter 2023 Financial Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

2023 |

|

|

2022 |

|

|

YoY Change |

|

|

(in thousands, except percentages) |

Net sales |

|

$ |

257,778 |

|

|

$ |

259,153 |

|

|

(1%) |

Gross profit |

|

$ |

134,049 |

|

|

$ |

133,288 |

|

|

1% |

Gross margin |

|

|

52.0 |

% |

|

|

51.4 |

% |

|

|

Net income |

|

$ |

3,494 |

|

|

$ |

7,868 |

|

|

(56%) |

Adjusted EBITDA (non-GAAP financial measure) |

|

$ |

8,538 |

|

|

$ |

14,137 |

|

|

(40%) |

Net cash used in operating activities |

|

$ |

(3,876 |

) |

|

$ |

(11,015 |

) |

|

NM |

Free cash flow (non-GAAP financial measure) |

|

$ |

(4,960 |

) |

|

$ |

(12,278 |

) |

|

NM |

NM – not meaningful

Fourth Quarter 2023 Operational Metrics

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

2023 |

|

|

2022 |

|

|

YoY Change |

|

|

(in thousands, except average order value and percentages) |

Active customers |

|

|

2,543 |

|

|

|

2,340 |

|

|

9% |

Total orders placed |

|

|

2,022 |

|

|

|

1,954 |

|

|

3% |

Average order value |

|

$ |

303 |

|

|

$ |

306 |

|

|

(1%) |

Additional Fourth Quarter 2023 Metrics and Results Commentary

•Trailing 12-month Active customers increased by 33,000 during the fourth quarter of 2023, growing to 2,543,000 as of December 31, 2023, an increase of 9% year-over-year.

•Total net sales were $257.8 million, a decrease of 1% year-over-year, and a sequential improvement from the 4% decrease year-over-year reported in the third quarter of 2023.

•Gross profit was $134.0 million, an increase of 1% year-over-year.

•Gross margin was 52.0%, a year-over-year increase of 57 basis points that was driven by margin expansion in the REVOLVE segment. It was the first year-over-year increase in gross margin in six quarters.

•Within operating expenses, our variable operating costs were more efficient than implied by our fourth quarter 2023 outlook, primarily driven by early progress in our efforts to contain shipping and logistics costs, which was offset by higher-than-expected general and administrative expenses.

•Net income was $3.5 million, a year-over-year decrease of 56%, primarily due to growth in operating expenses year-over-year that more than offset the slight growth in gross profit referenced above.

•Adjusted EBITDA was $8.5 million, a year-over-year decrease of 40%.

•Diluted earnings per share (EPS) was $0.05, a year-over-year decrease of 55%.

Additional Fourth Quarter 2023 Net Sales Commentary

•REVOLVE segment net sales were $220.0 million, a year-over-year increase of 1%.

•FWRD segment net sales were $37.8 million, a year-over-year decrease of 10%.

•Domestic net sales were $213.7 million, a year-over-year decrease of 2%.

•International net sales were $44.1 million, a year-over-year increase of 7%.

Additional trend information regarding Revolve Group’s fourth quarter and full year 2023 financial results and operating metrics is available in the Q4 and FY 2023 Financial Highlights presentation available on the company’s investor relations website at https://investors.revolve.com.

Results Since the End of Fourth Quarter 2023

During the first eight weeks of 2024 (January 1, 2024 to February 25, 2024), net sales decreased by a mid-single digit percentage year-over-year compared to the same period in 2023.

2024 Business Outlook

Based on information available to us as of February 27, 2024, we are providing the following guidance for the full year ending December 31, 2024 and the first quarter ending March 31, 2024.

|

|

|

FY 2024 Outlook |

Gross margin |

52.5% to 53.0% |

Fulfillment expenses |

3.3% to 3.5% of net sales |

Selling and distribution expenses |

17.8% to 18.0% of net sales |

Marketing expenses |

16.0% to 16.2% of net sales |

General and administrative expenses |

$130 million to $133 million |

Effective tax rate |

24% to 26% |

|

|

|

First Quarter 2024 Outlook |

Gross margin |

51.4% to 51.9% |

Fulfillment expenses |

3.5% of net sales |

Selling and distribution expenses |

18.1% of net sales |

Marketing expenses |

16.0% of net sales |

General and administrative expenses |

$33.0 million |

Full Year 2023 Financial Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

2023 |

|

|

2022 |

|

|

YoY Change |

|

|

(in thousands, except percentages) |

Net sales |

|

$ |

1,068,719 |

|

|

$ |

1,101,416 |

|

|

(3%) |

Gross profit |

|

$ |

554,199 |

|

|

$ |

592,323 |

|

|

(6%) |

Gross margin |

|

|

51.9 |

% |

|

|

53.8 |

% |

|

|

Net income |

|

$ |

28,147 |

|

|

$ |

58,697 |

|

|

(52%) |

Adjusted EBITDA (non-GAAP financial measure) |

|

$ |

43,409 |

|

|

$ |

90,234 |

|

|

(52%) |

Net cash provided by operating activities |

|

$ |

43,342 |

|

|

$ |

23,436 |

|

|

85% |

Free cash flow (non-GAAP financial measure) |

|

$ |

39,144 |

|

|

$ |

18,269 |

|

|

114% |

Full Year 2023 Operational Metrics

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

2023 |

|

|

2022 |

|

|

YoY Change |

|

|

(in thousands, except average order value and percentages) |

Active customers |

|

|

2,543 |

|

|

|

2,340 |

|

|

9% |

Total orders placed |

|

|

8,701 |

|

|

|

8,304 |

|

|

5% |

Average order value |

|

$ |

297 |

|

|

$ |

304 |

|

|

(2%) |

Additional Full Year 2023 Metrics and Results Commentary

•Total net sales were $1.1 billion, a year-over-year decrease of 3%.

•Gross profit was $554.2 million, a year-over-year decrease of 6%.

•Gross margin was 51.9%, a year-over-year decrease of 192 basis points that was primarily driven by our results in the first half of 2023 when our proportion of net sales at full price was significantly lower compared to the same period in 2022. Successful rebalancing of our inventory levels during 2023 resulted in improved year-over-year comparisons for gross margin each quarter throughout 2023.

•Net income was $28.1 million, a year-over-year decrease of 52%, primarily reflecting the slight decrease in net sales, reduced gross profit and an increase in operating expenses year-over-year.

•Adjusted EBITDA was $43.4 million, a year-over-year decrease of 52%.

•Diluted EPS was $0.38, a year-over-year decrease of 52%.

Additional Full Year 2023 Net Sales Commentary

•REVOLVE segment net sales were $904.5 million, a year-over-year decrease of 2%.

•FWRD segment net sales were $164.2 million, a year-over-year decrease of 9%.

•Domestic net sales were $870.4 million, a year-over-year decrease of 5%.

•International net sales were $198.3 million, a year-over-year increase of 6%.

Cash Flow and Balance Sheet Commentary

•Net cash provided by operating activities was $43.3 million and free cash flow was $39.1 million for the year ended December 31, 2023, an increase of 85% and 114%, respectively. The increase in both cash flow measures primarily reflects favorable movements in working capital, partially offset by lower net income.

•Stock repurchases were $30.6 million for the year ended December 31, 2023, exclusive of broker fees and excise taxes. The company repurchased 1,291,635 and 2,198,854 shares of its Class A common stock during

the fourth quarter and full year 2023, respectively, at an average cost of $13.94 and $13.91 per share, respectively. $69.4 million remained available under the company's $100 million stock repurchase program as of December 31, 2023

•Balance sheet: Cash and cash equivalents as of December 31, 2023 grew to $245.4 million, an increase of $10.7 million, or 5%, from $234.7 million as of December 31, 2022. Our balance sheet as of December 31, 2023 remains debt free.

•Inventory as of December 31, 2023 was $203.6 million, a decrease of $11.6 million, or 5%, from the inventory balance of $215.2 million as of December 31, 2022.

Conference Call Information

Revolve Group management will host a call today at 4:30 pm ET / 1:30 pm PT to discuss today’s results in more detail. To participate, please dial (888) 330-2454 within the United States or (240) 789-2714 outside the United States approximately 10 minutes before the scheduled start of the call. The conference ID for the call is 3102771. The conference call will also be accessible, live via audio broadcast, on the Investor Relations section of the Revolve Group website at http://investors.revolve.com. A replay of the conference call will be available online at http://investors.revolve.com. In addition, an audio replay of the call will be available for one week following the call and can be accessed by dialing 1-800-770-2030 within the United States or 1-647-362-9199 outside the United States. The replay conference ID is 3102771.

Forward-Looking Statements

This press release contains ''forward-looking statements'' within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. All statements other than statements of historical or current fact included in this press release are forward-looking statements, including but not limited to our expectations regarding our financial performance for the first quarter and full year of 2024 and statements regarding macroeconomic conditions. Forward-looking statements include statements containing words such as "expect," "anticipate," "believe," "project," "will" and similar expressions intended to identify forward-looking statements. These forward-looking statements are based on our current expectations. Forward-looking statements involve risks and uncertainties. Our actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks related to changing economic conditions and their impact on consumer demand and our business, operating results and financial condition; demand for our products; supply chain challenges; inflationary pressures; wars and conflicts in Ukraine/Russia, Israel/Gaza and the Middle East, other geopolitical tensions; our fluctuating operating results; seasonality in our business; our ability to acquire products on reasonable terms; our e-commerce business model; our ability to attract customers in a cost effective manner; the strength of our brand; competition; fraud; system interruptions; our ability to fulfill orders; the impact of public health crises on our business, operations and financial results; the effect of claims, lawsuits, government investigations, other legal or regulatory proceedings or commercial or contractual disputes; and other risks and uncertainties included under the caption "Risk Factors" and elsewhere in our filings with the Securities and Exchange Commission, or SEC, including, without limitation, our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 and our Annual Report on Form 10-K for the year ended December 31, 2023, which we expect to file with the SEC on February 27, 2024. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. All forward-looking statements are qualified in their entirety by this cautionary statement, and we undertake no obligation to revise or update any forward-looking statements to reflect events or circumstances after the date hereof.

Use of Non-GAAP Financial Measures and Other Operating Metrics

To supplement our condensed consolidated financial statements, which are prepared and presented in accordance with Generally Accepted Accounting Principles in the United States of America (GAAP), we reference in this press release and the accompanying tables the following non-GAAP financial measures: Adjusted EBITDA and free cash flow.

The presentation of this non-GAAP financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP, and our non-GAAP measures may be different from non-GAAP measures used by other companies.

We use these non-GAAP financial measures to evaluate our operating performance, generate future operating plans and make strategic decisions regarding the allocation of capital. Our management believes that these non-GAAP financial measures provide meaningful supplemental information regarding our performance and liquidity by excluding certain expenses that may not be indicative of our ongoing core operating performance. We believe that both management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when analyzing historical performance and liquidity and when planning, forecasting, and analyzing future periods.

For a reconciliation of these non-GAAP financial measures to GAAP measures, please see the tables captioned “Reconciliation of Non-GAAP Financial Measures” included at the end of this release.

Definitions of our non-GAAP financial measures and other operating metrics are presented below.

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP financial measure that we calculate as net income before other (income) expense, net; taxes; and depreciation and amortization; adjusted to exclude the effects of equity-based compensation expense and certain non-routine items. Adjusted EBITDA is a key measure used by management to evaluate our operating performance, generate future operating plans and make strategic decisions regarding the allocation of capital. In particular, the exclusion of certain expenses in calculating Adjusted EBITDA facilitates operating performance comparisons on a period-to-period basis and, in the case of exclusion of the impact of equity-based compensation, excludes an item that we do not consider to be indicative of our core operating performance.

Free Cash Flow

Free cash flow is a non-GAAP financial measure that we calculate as net cash provided by operating activities less cash used in purchases of property and equipment. We view free cash flow as an important indicator of our liquidity because it measures the amount of cash we generate. Free cash flow also reflects changes in working capital.

Active Customers

We define an active customer as a unique customer account from which a purchase was made across our platform at least once in the preceding 12-month period. In any particular period, we determine our number of active customers by counting the total number of customers who have made at least one purchase in the preceding 12-month period, measured from the last date of such period. We view the number of active customers as a key indicator of our growth, the reach of our sites, the value proposition and consumer awareness of our brand, the continued use of our sites by our customers and their desire to purchase our products.

Total Orders Placed

We define total orders placed as the total number of orders placed by our customers, prior to product returns, across our platform in any given period. We view total orders placed as a key indicator of the velocity of our business and an

indication of the desirability of our products and sites to our customers. Total orders placed, together with average order value, is an indicator of the net sales we expect to recognize in a given period.

Average Order Value

We define average order value as the sum of the total gross sales from our sites in a given period, prior to product returns, divided by the total orders placed in that period. We believe our high average order value demonstrates the premium nature of our product assortment. Average order value varies depending on the site through which we sell merchandise, the mix of product categories sold, the number of units in each order, the percentage of sales at full price, and for sales at less than full price, the level of markdowns.

About Revolve Group, Inc.

Revolve Group, Inc. (NYSE: RVLV) is the next-generation fashion retailer for Millennial and Generation Z consumers. As a trusted premium lifestyle brand and a go-to online source for discovery and inspiration, we deliver an engaging customer experience from a vast yet curated offering of apparel, footwear, accessories, beauty and home products. Our dynamic platform connects a deeply engaged community of millions of consumers, thousands of global fashion influencers and more than 1,000 emerging, established and owned brands.

We were founded in 2003 by our co-CEOs, Michael Mente and Mike Karanikolas. We sell merchandise through two complementary segments, REVOLVE and FWRD, that leverage one platform. Through REVOLVE, we offer an assortment of premium apparel, footwear, accessories and beauty products from emerging, established and owned brands. Through FWRD, we offer an assortment of curated and elevated iconic and emerging luxury brands. For more information, visit www.revolve.com.

Contacts:

Investors:

Erik Randerson, CFA

562.677.9513

IR@revolve.com

Media:

Jennifer Walker

revolve@walkerdrawas.com

REVOLVE GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net sales |

|

$ |

257,778 |

|

|

$ |

259,153 |

|

|

$ |

1,068,719 |

|

|

$ |

1,101,416 |

|

Cost of sales |

|

|

123,729 |

|

|

|

125,865 |

|

|

|

514,520 |

|

|

|

509,093 |

|

Gross profit |

|

|

134,049 |

|

|

|

133,288 |

|

|

|

554,199 |

|

|

|

592,323 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Fulfillment |

|

|

8,997 |

|

|

|

8,532 |

|

|

|

36,654 |

|

|

|

31,804 |

|

Selling and distribution |

|

|

45,776 |

|

|

|

45,389 |

|

|

|

197,052 |

|

|

|

190,419 |

|

Marketing |

|

|

42,353 |

|

|

|

39,893 |

|

|

|

171,774 |

|

|

|

181,648 |

|

General and administrative |

|

|

34,724 |

|

|

|

28,815 |

|

|

|

126,585 |

|

|

|

115,312 |

|

Total operating expenses |

|

|

131,850 |

|

|

|

122,629 |

|

|

|

532,065 |

|

|

|

519,183 |

|

Income from operations |

|

|

2,199 |

|

|

|

10,659 |

|

|

|

22,134 |

|

|

|

73,140 |

|

Other (income) expense, net |

|

|

(2,677 |

) |

|

|

293 |

|

|

|

(15,627 |

) |

|

|

(3,476 |

) |

Income before income taxes |

|

|

4,876 |

|

|

|

10,366 |

|

|

|

37,761 |

|

|

|

76,616 |

|

Provision for income taxes |

|

|

1,382 |

|

|

|

2,498 |

|

|

|

9,614 |

|

|

|

17,919 |

|

Net income |

|

$ |

3,494 |

|

|

$ |

7,868 |

|

|

$ |

28,147 |

|

|

$ |

58,697 |

|

Earnings per share of Class A and Class B

common stock: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.05 |

|

|

$ |

0.11 |

|

|

$ |

0.39 |

|

|

$ |

0.80 |

|

Diluted |

|

$ |

0.05 |

|

|

$ |

0.11 |

|

|

$ |

0.38 |

|

|

$ |

0.79 |

|

Weighted average number of shares of Class A and Class B common stock outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

71,782 |

|

|

|

73,349 |

|

|

|

72,961 |

|

|

|

73,314 |

|

Diluted |

|

|

72,171 |

|

|

|

74,286 |

|

|

|

73,583 |

|

|

|

74,520 |

|

REVOLVE GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

245,449 |

|

|

$ |

234,724 |

|

Accounts receivable, net |

|

|

12,405 |

|

|

|

5,421 |

|

Inventory |

|

|

203,587 |

|

|

|

215,224 |

|

Income taxes receivable |

|

|

1,625 |

|

|

|

2,974 |

|

Prepaid expenses and other current assets |

|

|

65,523 |

|

|

|

59,874 |

|

Total current assets |

|

|

528,589 |

|

|

|

518,217 |

|

Property and equipment (net of accumulated depreciation of $17,994 and $13,081

as of December 31, 2023 and December 31, 2022, respectively) |

|

|

7,763 |

|

|

|

8,934 |

|

Right-of-use lease assets |

|

|

36,440 |

|

|

|

22,964 |

|

Intangible assets, net |

|

|

1,875 |

|

|

|

1,600 |

|

Goodwill |

|

|

2,042 |

|

|

|

2,042 |

|

Other assets |

|

|

2,172 |

|

|

|

807 |

|

Deferred income taxes, net |

|

|

30,005 |

|

|

|

24,754 |

|

Total assets |

|

$ |

608,886 |

|

|

$ |

579,318 |

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

47,821 |

|

|

$ |

50,789 |

|

Income taxes payable |

|

|

— |

|

|

|

229 |

|

Accrued expenses |

|

|

40,714 |

|

|

|

38,266 |

|

Returns reserve |

|

|

63,780 |

|

|

|

63,381 |

|

Current lease liabilities |

|

|

6,863 |

|

|

|

5,844 |

|

Other current liabilities |

|

|

30,442 |

|

|

|

22,577 |

|

Total current liabilities |

|

|

189,620 |

|

|

|

181,086 |

|

Non-current lease liabilities |

|

|

34,126 |

|

|

|

18,659 |

|

Total liabilities |

|

|

223,746 |

|

|

|

199,745 |

|

Stockholders’ equity: |

|

|

|

|

|

|

Class A common stock, $0.001 par value; 1,000,000,000 shares

authorized as of December 31, 2023 and December 31, 2022;

38,693,589 and 40,766,510 shares issued and outstanding as of December 31, 2023

and December 31, 2022, respectively. |

|

|

39 |

|

|

|

41 |

|

Class B common stock, $0.001 par value; 125,000,000 shares authorized

as of December 31, 2023 and December 31, 2022; 32,597,119 and

32,597,119 shares issued and outstanding as of December 31, 2023 and

December 31, 2022, respectively. |

|

|

33 |

|

|

|

33 |

|

Additional paid-in capital |

|

|

116,713 |

|

|

|

110,338 |

|

Retained earnings |

|

|

268,355 |

|

|

|

269,161 |

|

Total stockholders’ equity |

|

|

385,140 |

|

|

|

379,573 |

|

Total liabilities and stockholders’ equity |

|

$ |

608,886 |

|

|

$ |

579,318 |

|

REVOLVE GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

Operating activities: |

|

|

|

|

|

|

Net income |

|

$ |

28,147 |

|

|

$ |

58,697 |

|

Adjustments to reconcile net income to net cash provided by operating

activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

5,094 |

|

|

|

4,791 |

|

Equity-based compensation |

|

|

5,839 |

|

|

|

5,862 |

|

Deferred income taxes, net |

|

|

(5,251 |

) |

|

|

(5,695 |

) |

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

(6,984 |

) |

|

|

(782 |

) |

Inventories |

|

|

11,637 |

|

|

|

(43,965 |

) |

Income taxes receivable |

|

|

1,349 |

|

|

|

401 |

|

Prepaid expenses and other current assets |

|

|

(5,649 |

) |

|

|

(17,760 |

) |

Other assets |

|

|

(1,365 |

) |

|

|

1,939 |

|

Accounts payable |

|

|

(2,968 |

) |

|

|

(3,556 |

) |

Income taxes payable |

|

|

(229 |

) |

|

|

229 |

|

Accrued expenses |

|

|

2,448 |

|

|

|

4,367 |

|

Returns reserve |

|

|

399 |

|

|

|

14,085 |

|

Right-of-use lease assets and current and non-current lease liabilities |

|

|

3,010 |

|

|

|

1,162 |

|

Other current liabilities |

|

|

7,865 |

|

|

|

3,661 |

|

Net cash provided by operating activities |

|

|

43,342 |

|

|

|

23,436 |

|

Investing activities: |

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(4,198 |

) |

|

|

(5,167 |

) |

Net cash used in investing activities |

|

|

(4,198 |

) |

|

|

(5,167 |

) |

Financing activities: |

|

|

|

|

|

|

Proceeds from the exercise of stock options, net |

|

|

536 |

|

|

|

887 |

|

Repurchases of Class A common stock |

|

|

(30,913 |

) |

|

|

— |

|

Net cash (used in) provided by financing activities |

|

|

(30,377 |

) |

|

|

887 |

|

Effect of exchange rate changes on cash and cash equivalents |

|

|

1,958 |

|

|

|

(2,887 |

) |

Net increase in cash and cash equivalents |

|

|

10,725 |

|

|

|

16,269 |

|

Cash and cash equivalents, beginning of period |

|

|

234,724 |

|

|

|

218,455 |

|

Cash and cash equivalents, end of period |

|

$ |

245,449 |

|

|

$ |

234,724 |

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

Cash paid during the period for: |

|

|

|

|

|

|

Income taxes, net of refund |

|

$ |

12,995 |

|

|

$ |

23,031 |

|

Operating leases |

|

$ |

7,012 |

|

|

$ |

5,858 |

|

Supplemental disclosure of non-cash activities: |

|

|

|

|

|

|

Lease assets obtained in exchange for new operating lease liabilities |

|

$ |

20,452 |

|

|

$ |

21,938 |

|

REVOLVE GROUP, INC. AND SUBSIDIARIES

SEGMENT INFORMATION

(Unaudited)

The following table summarizes our net sales and gross profit for each of our reportable segments (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

Net sales |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

REVOLVE |

|

$ |

220,025 |

|

|

$ |

217,138 |

|

|

$ |

904,525 |

|

|

$ |

921,676 |

|

FWRD |

|

|

37,753 |

|

|

|

42,015 |

|

|

|

164,194 |

|

|

|

179,740 |

|

Total |

|

$ |

257,778 |

|

|

$ |

259,153 |

|

|

$ |

1,068,719 |

|

|

$ |

1,101,416 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

|

|

|

|

|

|

|

|

|

|

REVOLVE |

|

$ |

121,343 |

|

|

$ |

116,445 |

|

|

$ |

491,817 |

|

|

$ |

514,585 |

|

FWRD |

|

|

12,706 |

|

|

|

16,843 |

|

|

|

62,382 |

|

|

|

77,738 |

|

Total |

|

$ |

134,049 |

|

|

$ |

133,288 |

|

|

$ |

554,199 |

|

|

$ |

592,323 |

|

The following table lists net sales by geographic area (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

United States |

|

$ |

213,658 |

|

|

$ |

217,989 |

|

|

$ |

870,405 |

|

|

$ |

914,364 |

|

Rest of the world |

|

|

44,120 |

|

|

|

41,164 |

|

|

|

198,314 |

|

|

|

187,052 |

|

Total |

|

$ |

257,778 |

|

|

$ |

259,153 |

|

|

$ |

1,068,719 |

|

|

$ |

1,101,416 |

|

REVOLVE GROUP, INC. AND SUBSIDIARIES

KEY OPERATING AND FINANCIAL METRICS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

(in thousands, except average order value and percentages) |

|

Gross margin |

|

|

52.0 |

% |

|

|

51.4 |

% |

|

|

51.9 |

% |

|

|

53.8 |

% |

Adjusted EBITDA |

|

$ |

8,538 |

|

|

$ |

14,137 |

|

|

$ |

43,409 |

|

|

$ |

90,234 |

|

Free cash flow |

|

$ |

(4,960 |

) |

|

$ |

(12,278 |

) |

|

$ |

39,144 |

|

|

$ |

18,269 |

|

Active customers |

|

|

2,543 |

|

|

|

2,340 |

|

|

|

2,543 |

|

|

|

2,340 |

|

Total orders placed |

|

|

2,022 |

|

|

|

1,954 |

|

|

|

8,701 |

|

|

|

8,304 |

|

Average order value |

|

$ |

303 |

|

|

$ |

306 |

|

|

$ |

297 |

|

|

$ |

304 |

|

REVOLVE GROUP, INC. AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(Unaudited)

A reconciliation of non-GAAP Adjusted EBITDA to net income for the three months and year ended December 31, 2023 and 2022 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

(in thousands) |

|

Net income |

|

$ |

3,494 |

|

|

$ |

7,868 |

|

|

$ |

28,147 |

|

|

$ |

58,697 |

|

Excluding: |

|

|

|

|

|

|

|

|

|

|

|

|

Other (income) expense, net |

|

|

(2,677 |

) |

|

|

293 |

|

|

|

(15,627 |

) |

|

|

(3,476 |

) |

Provision for income taxes |

|

|

1,382 |

|

|

|

2,498 |

|

|

|

9,614 |

|

|

|

17,919 |

|

Depreciation and amortization |

|

|

1,342 |

|

|

|

1,272 |

|

|

|

5,094 |

|

|

|

4,791 |

|

Equity-based compensation |

|

|

1,610 |

|

|

|

1,452 |

|

|

|

5,839 |

|

|

|

5,862 |

|

Non-routine items (1) |

|

|

3,387 |

|

|

|

754 |

|

|

|

10,342 |

|

|

|

6,441 |

|

Adjusted EBITDA |

|

$ |

8,538 |

|

|

$ |

14,137 |

|

|

$ |

43,409 |

|

|

$ |

90,234 |

|

|

|

(1) |

Non-routine items in the three months and year ended December 31, 2023 included $0.6 million and $7.5 million in legal fees and charges for two separate settled legal matters, respectively and $2.8 million related to non-routine import and export fees. Non-routine items in the three months and year ended December 31, 2022 included $0.7 million and $6.3 million in legal fees and charges for a settled legal matter, respectively and $0.1 million in other non-routine items. |

A reconciliation of non-GAAP free cash flow to net cash provided by operating activities for the three months and year ended December 31, 2023 and 2022 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

(in thousands) |

|

Net cash (used in) provided by

operating activities |

|

$ |

(3,876 |

) |

|

$ |

(11,015 |

) |

|

$ |

43,342 |

|

|

$ |

23,436 |

|

Purchases of property and equipment |

|

|

(1,084 |

) |

|

|

(1,263 |

) |

|

|

(4,198 |

) |

|

|

(5,167 |

) |

Free cash flow |

|

$ |

(4,960 |

) |

|

$ |

(12,278 |

) |

|

$ |

39,144 |

|

|

$ |

18,269 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in investing activities |

|

$ |

(1,084 |

) |

|

$ |

(1,263 |

) |

|

$ |

(4,198 |

) |

|

$ |

(5,167 |

) |

Net cash (used in) provided by financing activities |

|

$ |

(18,279 |

) |

|

$ |

391 |

|

|

$ |

(30,377 |

) |

|

$ |

887 |

|

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

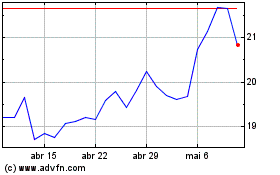

Revolve (NYSE:RVLV)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

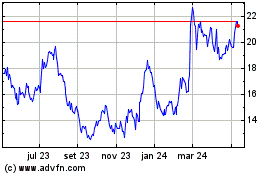

Revolve (NYSE:RVLV)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024