0001609253false00016092532024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

_____________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 27, 2024

_____________________

California Resources Corporation

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | |

| Delaware | 001-36478 | 46-5670947 |

(State or Other Jurisdiction of

Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | |

| 1 World Trade Center | |

| Suite 1500 | |

| Long Beach | |

| California | 90831 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (888) 848-4754

_____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☑ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

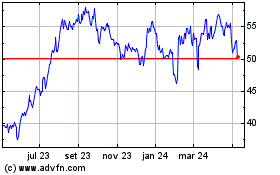

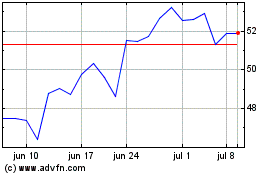

| Common Stock | CRC | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 27, 2024, California Resources Corporation (the “Company”) issued a press release announcing its financial condition and results of operations for the three and twelve months ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this report on Form 8-K, and is incorporated herein by reference.

The information contained in this report and the exhibits hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and shall not be incorporated by reference into any filings made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| California Resources Corporation |

| | | |

| | | |

| | | |

| /s/ Michael L. Preston | |

| Name: | Michael L. Preston |

| Title: | Executive Vice President, Chief Strategy Officer and General Counsel |

DATED: February 27, 2024

California Resources Reports Fourth Quarter and Full-Year 2023 Financial and Operating Results

CRC Delivers Record Cash Flow and Free Cash Flow per Share Annual Results

LONG BEACH, California, February 27, 2024 - California Resources Corporation (NYSE: CRC) today reported financial and operating results for the fourth quarter and full-year 2023. The Company plans to host a conference call and webcast on Wednesday, February 28th at 1:00 p.m. Eastern Time (10:00 a.m. Pacific Time). Participation details can be found within this release. In addition, supplemental slides are posted to CRC’s website at www.crc.com.

2023 Highlights:

•Generated $653 million of net cash from operating activities and $468 million of free cash flow1

•Demonstrated strong capital efficiency with lower-than-expected total capital of $185 million delivering 6% entry to exit gross production decline

•Reported net income of $564 million, or $7.78 per diluted share. When adjusted for items analysts typically exclude from estimates (including gains on asset divestitures, business transformation costs and mark-to-market adjustments on commodity derivative contracts) adjusted net income1 was $372 million, or $5.13 per share

•Average annual net production of 86 thousand barrels of oil equivalent per day (MBoe/d). Oil production averaged 52 thousand barrels of oil per day (MBo/d)

•Returned $280 million to stakeholders, more than half of 2023 free cash flow1, through share repurchases, debt repurchases and dividends

•Exited 2023 with a leverage ratio1 of 0.1 times, down from 0.3 times at year-end 2022

•Through the business transformation initiative, strengthened future outlook by achieving $65 million in annual, sustainable cost savings

•Announced receipt of California’s first U.S. Environmental Protection Agency (EPA) draft Class VI well permits for underground carbon dioxide (CO2) injection and storage at Elk Hills. See Carbon TerraVault's 2023 Update for additional information

"Our 2023 results were exceptional, and our teams executed on our plan to build a stronger CRC while creating long-term value for all stakeholders," said Francisco Leon, CRC’s President and Chief Executive Officer. “We profitably grew our business and generated significant free cash flow that maintained our premier balance sheet and allowed us to prioritize cash returns to our shareholders. Our focus now is on securing the requisite approvals to close the recently announced merger with Aera Energy, while preparing for integration of their experienced team members and high value assets into CRC after closing. The Aera merger will provide CRC greater operating scale for the entire business, thereby improving our operating cash flows and liquidity profile. The Aera assets will also enhance CRC’s carbon management business from which CRC will accelerate the decarbonization of California.”

Fourth Quarter 2023 Financial and Operating Summary

The Company reported fourth quarter net cash from operating activities of $131 million and free cash flow1 of $65 million. Net income for the period was $188 million, or $2.60 per diluted share of common stock, and adjusted net income1 was $67 million, or $0.93 per diluted share. Adjusted EBITDAX1 was $179 million.

CRC’s daily gross production in the fourth quarter averaged 98 MBoe/d. Net production averaged 83 MBoe/d, including 50 MBo/d. Average realized oil prices during the period were 99% of Brent.

Operating costs in the fourth quarter of 2023 averaged $24.49 per Boe, compared to $24.96 per Boe in the third quarter of 2023 and reflect a positive impact of recent organizational changes. In August 2023, CRC took actions to better align its resources to strategic priorities and improve operational efficiency. The Company realized approximately $15 million of savings in the fourth quarter and expects these actions to result in approximately $65 million of savings in operating costs and general and administrative expenses on an annualized basis.

Capital investments in the fourth quarter were in line with expectations and totaled $66 million. Capital allocation during the period was focused on a one-rig program in the Los Angeles basin.

Fourth Quarter and Full Year Financial Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Selected Production, Price Information and Results of Operations | 4th Quarter | | | 3rd Quarter | | | Total Year | | | Total year | | | | | | |

| ($ in millions) | 2023 | | | 2023 | | | 2023 | | | 2022 | | | | | | |

| | | | | | | | | | | | | | | | |

| Average net oil production per day (MBbl/d) | 50 | | | | 51 | | | | 52 | | | | 55 | | | | | | | |

| Realized oil price with derivative settlements ($ per Bbl) | $ | 71.34 | | | | $ | 66.12 | | | | $ | 65.97 | | | | $ | 61.8 | | | | | | | |

| Average net NGL production per day (MBbl/d) | 11 | | | | 11 | | | | 11 | | | | 11 | | | | | | | |

| Realized NGL price ($ per Bbl) | $ | 49.08 | | | | $ | 44.95 | | | | $ | 48.94 | | | | $ | 64.33 | | | | | | | |

| Average net natural gas production per day (Mmcf/d) | 130 | | | | 138 | | | | 135 | | | | 147 | | | | | | | |

| Realized natural gas price with derivative settlements ($ per Mcf) | $ | 4.66 | | | | $ | 4.83 | | | | $ | 8.59 | | | | $ | 7.54 | | | | | | | |

| Average net total production per day (MBoe/d) | 83 | | | | 85 | | | | 86 | | | | 91 | | | | | | | |

| | | | | | | | | | | | | | | | |

| Margin from marketing purchased natural gas ($ millions) | $ | 28 | | | | $ | 47 | | | | $ | 180 | | | | $ | 41 | | | | | | | |

| Margin from electricity sales ($ millions) | $ | 24 | | | | $ | 44 | | | | $ | 108 | | | | $ | 94 | | | | | | | |

| Net gain (loss) from commodity derivatives ($ millions) | $ | 119 | | | | $ | (204) | | | | $ | (12) | | | | $ | (551) | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Selected Financial Statement Data and non-GAAP measures: | 4th Quarter | | | 3rd Quarter | | | Total Year | | | Total year | | | | | | |

| ($ and shares in millions, except per share amounts) | 2023 | | | 2023 | | | 2023 | | | 2022 | | | | | | |

| | | | | | | | | | | | | | | | |

| Statements of Operations: | | | | | | | | | | | | | | | | |

| Revenues | | | | | | | | | | | | | | | | |

| Total operating revenues | $ | 726 | | | | $ | 460 | | | | $ | 2,801 | | | | $ | 2,707 | | | | | | | |

| | | | | | | | | | | | | | | | |

| Selected Expenses | | | | | | | | | | | | | | | | |

| Operating costs | $ | 186 | | | | $ | 196 | | | | $ | 822 | | | | $ | 785 | | | | | | | |

| General and administrative expenses | $ | 66 | | | | $ | 65 | | | | $ | 267 | | | | $ | 222 | | | | | | | |

Adjusted general and administrative expenses1 | $ | 55 | | | | $ | 51 | | | | $ | 218 | | | | $ | 201 | | | | | | | |

| Taxes other than on income | $ | 33 | | | | $ | 48 | | | | $ | 165 | | | | $ | 162 | | | | | | | |

| Transportation costs | $ | 18 | | | | $ | 16 | | | | $ | 67 | | | | $ | 50 | | | | | | | |

| Exploration expense | $ | 1 | | | | $ | — | | | | $ | 3 | | | | $ | 4 | | | | | | | |

| Operating Income (loss) | $ | 283 | | | | $ | (15) | | | | $ | 808 | | | | $ | 812 | | | | | | | |

| Interest and debt expense | $ | (13) | | | | $ | (15) | | | | $ | (56) | | | | $ | (53) | | | | | | | |

| Income tax provision (benefit) | $ | (79) | | | | $ | 8 | | | | $ | (184) | | | | $ | (237) | | | | | | | |

| Net (loss) Income | $ | 188 | | | | $ | (22) | | | | $ | 564 | | | | $ | 524 | | | | | | | |

| | | | | | | | | | | | | | | | |

Adjusted net income1 | $ | 67 | | | | $ | 74 | | | | $ | 372 | | | | $ | 384 | | | | | | | |

| Weighted-average common shares outstanding - diluted | 72.3 | | | | 68.7 | | | | 72.5 | | | | 77.6 | | | | | | | |

| Net (loss) income per share - diluted | $ | 2.60 | | | | $ | (0.32) | | | | $ | 7.78 | | | | $ | 6.75 | | | | | | | |

Adjusted net income1 per share - diluted | $ | 0.93 | | | | $ | 1.02 | | | | $ | 5.13 | | | | $ | 4.95 | | | | | | | |

Adjusted EBITDAX1 | $ | 179 | | | | $ | 187 | | | | $ | 862 | | | | $ | 852 | | | | | | | |

Net cash provided by operating activities before changes in operating assets and liabilities, net1 | $ | 104 | | | | $ | 129 | | | | $ | 647 | | | | $ | 747 | | | | | | | |

| Net cash provided by operating activities | $ | 131 | | | | $ | 104 | | | | $ | 653 | | | | $ | 690 | | | | | | | |

| Capital investments | $ | 66 | | | | $ | 33 | | | | $ | 185 | | | | $ | 379 | | | | | | | |

Free cash flow1 | $ | 65 | | | | $ | 71 | | | | $ | 468 | | | | $ | 311 | | | | | | | |

| Cash and cash equivalents | $ | 496 | | | | $ | 479 | | | | $ | 496 | | | | $ | 307 | | | | | | | |

2023 Reserves

As of December 31, 2023, CRC’s proved reserves totaled an estimated 377 million Boe (MMBoe), of which 68% was oil and 331 MMBoe was proved developed. Estimated future net cash flows had a PV-10* value of $5.5 billion based on SEC pricing of Brent $82.84 per barrel for oil and Henry Hub $2.64 per thousand cubic feet (Mcf) for natural gas, as of December 31, 2023.

| | | | | | | | | | | |

PV-10 AND STANDARDIZED MEASURE |

| | | |

The following table presents a reconciliation of the GAAP financial measure of Standardized Measure of discounted future net cash flows (Standardized Measure) to the non-GAAP financial measure of PV-10: |

| | | |

($ millions) | | | December 31, 2023 |

Standardized Measure of discounted future net cash flows | | | $ | 4,069 | |

Present value of future income taxes discounted at 10% | | | 1,464 | |

PV-10 of cash flows (*) | | | $ | 5,533 | |

| | | | | | | | | | | |

| | | |

(*) PV-10 is a non-GAAP financial measure and represents the year-end present value of estimated future cash inflows from proved oil and natural gas reserves, less future development and operating costs, discounted at 10% per annum to reflect the timing of future cash flows and using SEC prescribed pricing assumptions for the period. PV-10 differs from Standardized Measure because Standardized Measure includes the effects of future income taxes on future net cash flows. Neither PV-10 nor Standardized Measure should be construed as the fair value of our oil and natural gas reserves. Standardized Measure is prescribed by the SEC as an industry standard asset value measure to compare reserves with consistent pricing costs and discount assumptions. PV-10 facilitates the comparisons to other companies as it is not dependent on the tax-paying status of the entity. |

Pending Aera Merger

On February 7, 2024, CRC entered into a definitive merger agreement (Merger Agreement) to combine with Aera Energy, LLC (Aera) in an all-stock transaction with an effective date of January 1, 2024. Aera is a leading operator of mature fields in California, primarily in the San Joaquin and Ventura basins, with high oil-weighted production. At closing, Aera's owners will receive 21.2 million shares of CRC's common stock plus an additional number of shares determined by reference to the dividends declared by CRC having a record date between the effective date and closing. CRC also agreed to assume Aera’s outstanding long-term indebtedness of $950 million. CRC expects to repay a significant portion of this indebtedness with cash on hand and borrowings under its revolving credit facility. CRC expects to refinance the balance through one or more debt capital markets transactions and, only to the extent necessary, borrowings under a bridge loan facility.

The Merger Agreement has been unanimously approved by CRC’s Board of Directors and the shareholders of Aera. The transaction is subject to certain closing conditions, including among others, regulatory approvals and approval of the stock issuance by CRC's shareholders. The transaction is expected to close in the second half of 2024.

For more information about this transaction please visit: https://www.crc.com/news/news-details/2024/California-Resources-Corporation-to-Combine-with-Aera-Energy/default.aspx

2024 Preliminary Outlook and First Quarter 2024 Guidance and Capital Program2

CRC’s 2024 guidance estimates exclude the pending merger with Aera. The Company intends to update guidance after the transaction closes.

CRC expects its total 2024 capital program to range between $300 million and $340 million assuming normal operating conditions. Of this amount, $250 million to $260 million is related to oil and natural gas development, $30 million to $40 million is related to maintenance of one of its gas processing facilities and a power plant, both of which are located in CRC's Elk Hills field, $15 million to $25 million is for carbon management projects and $5 million to $15 million is for corporate and other activities.

Through 2024, CRC expects to run a one rig program executing projects using existing permits. Subject to the availability of well permits, the Company expects to increase to a four rig program in the second half of 2024. The actual amount of spending related to oil and gas development under CRC's 2024 capital program will depend on a variety of factors. In particular, the rate and amount of this spending depends on its ability to obtain new well permits in the second half of the year. If CRC is not able to obtain these permits, CRC could reduce its capital program by up to $100 million.

| | | | | |

| |

2024 PRELIMINARY OUTLOOK2 | TOTAL 2024E |

| | | | | |

| Net Total Production (MBoe/d) | 78 - 82 |

| Oil Production (%) | ~60% |

| Capital ($ millions) | $300 - $340 |

| Drilling & completions, workovers ($ millions) | $250 -$260 |

| Facilities ($ millions) | $30 - $40 |

| Carbon management business ($ millions) | $15 - $25 |

| Corporate & other ($ millions) | $5 - $15 |

| Note: If CRC is not able to receive drilling permits or permits are delayed, the Company plans to run a one rig program with a $200 million to $240 million 2024E total capital program and would expect a 5% to 7% entry to exit decline rate. |

CRC expects its first quarter capital program to range between $65 million to $75 million. The program includes capital of $36 million to $42 million for oil and natural gas, and facilities development3, $4 million to $6 million for carbon management projects and $25 million to $27 million for corporate and other activities, including maintenance at CRC's Elk Hills power plant.

CRC expects to produce 76 to 80 MBoe/d (~60% oil) in the first quarter of 2024. The table below provides highlights of the Company's first quarter 2024 guidance. See Attachment 2 for complete information on CRC's first quarter 2024 guidance.

| | | | | | | | | | | | | | | | | |

| | | | | |

CRC GUIDANCE2 | Total 1Q24E | | CMB 1Q24E | | E&P, Corp. & Other 1Q24E |

| Net Total Production (MBoe/d) | 76 - 80 | | | | 76 - 80 |

| CMB Expenses and Operating Costs ($ millions) | $175 - $185 | | $6 - $10 | | $169 - $175 |

| General and Administrative Expenses ($ millions) | $61 - $72 | | $2 - $3 | | $59 - $69 |

Adjusted General and Administrative Expenses1 ($ millions) | $48 - $58 | | $2 - $3 | | $46 - $55 |

| Capital ($ millions) | $65 - $75 | | $4 - $6 | | $61 - $69 |

| | | | | |

| Natural Gas Marketing Margin ($ millions) | $8 - $13 | | | | $8 - $13 |

| Electricity Margin ($ millions) | $5 - $10 | | | | $5 - $10 |

Shareholder Return & Deleveraging Strategy

CRC is committed to returning significant cash to shareholders through dividends and repurchases of its common stock. On February 6th, 2024, CRC’s Board of Directors approved a $250 million increase of the Share Repurchase Program, bringing the aggregate program to $1.35 billion, and extended the program through December 31, 2025. Adjusting for this increase, CRC has approximately $747 million of capacity remaining under the repurchase program as of February 6, 2024.

In 2023, CRC repurchased 3.4 million shares for approximately $143 million at an average price of $41.69 per share. Since the inception of the Share Repurchase Program in May 2021 through December 31, 2023, 14.9 million shares have been repurchased for $604 million at an average price of $40.53 per share, including commissions and excise taxes. These total repurchases represent ~18% of CRC’s shares outstanding since December 31, 2020.

In 2023, CRC repurchased $55 million in principal of its Senior Notes at par. After these repurchases, the remaining principal amount of CRC’s Senior Notes is $545 million due February 1, 2026.

On February 27, 2024, CRC's Board of Directors declared a quarterly cash dividend of $0.31 per share of common stock. The dividend is payable to shareholders of record on March 6, 2024 and will be paid on March 18, 2024.

Through December 31, 2023, CRC has returned $813 million of cash to its stakeholders, including $604 million in share repurchases, $154 million of dividends and $55 million in principal of its Senior Notes repurchases.

Balance Sheet and Liquidity Update

On October 30, 2023, the borrowing base for the Revolving Credit Facility was reaffirmed at $1.2 billion as part of CRC's semi-annual redetermination. CRC's aggregate commitment from lenders under the Revolving Credit Facility was $630 million as of December 31, 2023.

As of December 31, 2023, CRC had liquidity of $973 million, which consisted of $496 million in cash and cash equivalents plus $477 million of available borrowing capacity under its Revolving Credit Facility (which is net of $153 million of issued letters of credit).

In connection with the Merger Agreement, on February 9, 2024, CRC entered into a second amendment to its Revolving Credit Facility to permit CRC to incur indebtedness under a bridge loan facility that may be used in connection with closing the Aera Merger.

Acquisitions and Divestitures

On December 29, 2023, CRC sold its non-operating working interest in the Round Mountain Unit in the San Joaquin basin for $35 million, before transaction costs and purchase price adjustments, recognizing a gain of $25 million. CRC retained an option to capture, transport and store carbon dioxide (CO2) emissions from the production at Round Mountain Unit for future carbon management projects.

On February 22, 2024, CRC entered into an agreement to sell its 0.9 acre Fort Apache real estate property in Huntington Beach to a local real estate developer for approximately $10 million.

Sustainability

“2023 was another important year in CRC’s sustainability journey,” said Francisco Leon, CRC’s President and Chief Executive Officer. “We are dedicated to becoming an even more sustainable energy company while continuously prioritizing health, safety, and the environment in all we do. We achieved our second-best safety rate in the Company’s history, our best since the period during COVID. Throughout the year, our skilled teams plugged and abandoned more than 600 wells, exceeding stringent local and state requirements. Furthermore, we received the 2023 S&P Global Energy Transition - Upstream Award recognizing CRC’s perseverance in developing solutions to help reduce carbon emissions and tackle climate change, one of many industry awards we received during the year.”

Additional 2023 sustainability highlights and achievements include:

•Eliminated 269 gas venting pneumatics, keeping CRC on track with its 2030 methane reduction ESG goal

•Delivered more than 113 million barrels of water for agricultural use, or more than 3 times the amount for CRC's internal use

•Qualified for 22 National Safety Awards for 2023 safety performance

•Provided more than $2.5 million in charitable giving to local groups, organizations, and nonprofits

Upcoming Investor Conference Participation

CRC's executives will be participating in the following events in March and April of 2024:

•MS Global Energy and Power Conference on March 6 and 7 in New York, NY

•CERAWeek 2024 on March 18 to 20 in Houston, TX

•Capital One Carbon Capture Conference on March 27 in New York, NY

•North America CCUS & Hydrogen Decarbonization Summit on April 16 to 18 in Chicago, IL

CRC’s presentation materials will be available the day of the events on the Events and Presentations page in the Investor Relations section on www.crc.com.

Conference Call Details

A conference call is scheduled for Wednesday, February 28th at 1:00 p.m. Eastern Time (10:00 a.m. Pacific Time). To participate in the call, please dial (877) 328-5505 (International calls please dial +1 (412) 317-5421) or access via webcast at www.crc.com 15 minutes prior to the scheduled start time to register. Participants may also pre-register for the conference call at https://dpregister.com/sreg/10184870/fb2ecfed18. A digital replay of the conference call will be archived for approximately 90 days and supplemental slides for the conference call will be available online in the Investor Relations section of www.crc.com.

1 See Attachment 3 for the non-GAAP financial measures of operating costs per BOE (excluding effects of PSCs), adjusted net income (loss), adjusted net income (loss) per share - basic and diluted, net cash provided by operating activities before changes in operating assets and liabilities, net, adjusted EBITDAX, free cash flow, adjusted G&A and adjusted capital, including reconciliations to their most directly comparable GAAP measure, where applicable. For the 1Q24 estimates of the non-GAAP measure of adjusted general and administrative expenses, including reconciliations to its most directly comparable GAAP measure, see Attachment 2.

2 Current preliminary 2024 outlook assumes a four rigs program starting from 2H24 subject to the availability of well permits. If CRC is not able to receive drilling permits or permits are delayed, the Company plans to run a one rig program with a $200 million to $240 million 2024E total capital program and would expect a 5% to 7% entry to exit decline rate. 1Q24 guidance assumes Brent price of $78.73 per barrel of oil, NGL realizations as a percentage of Brent consistent with prior years and a NYMEX gas price of $2.87 per mcf. CRC's share of production under PSC contracts decreases when commodity prices rise and increases when prices fall.

About California Resources Corporation

California Resources Corporation (CRC) is an independent energy and carbon management company committed to energy transition. CRC produces some of the lowest carbon intensity oil in the US and is focused on maximizing the value of its land, mineral and technical resources for decarbonization efforts. For more information about CRC, please visit www.crc.com.

About Carbon TerraVault

Carbon TerraVault Holdings, LLC (CTV), a subsidiary of CRC, provides services that include the capture, transport and storage of carbon dioxide for its customers. CTV is engaged in a series of CCS projects that inject CO2 captured from industrial sources into depleted underground reservoirs and permanently store CO2 deep underground. For more information about CTV, please visit www.carbonterravault.com.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the transactions contemplated by the merger agreement pursuant to which California Resources Corporation (“CRC”) has agreed to combine with Aera Energy, LLC (“Aera”) (the “Merger Agreement”),

including the proposed issuance of CRC’S common stock pursuant to the Merger Agreement. In connection with the transaction, CRC will file a proxy statement on Schedule 14A with the U.S. Securities and Exchange Commission (“SEC”), as well as other relevant materials. Following the filing of the definitive proxy statement, CRC will mail the definitive proxy statement and a proxy card to its stockholders. INVESTORS AND SECURITY HOLDERS OF CRC ARE URGED TO READ THE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT CRC, AERA, THE TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain copies of the proxy statement (when available) as well as other filings containing information about CRC, Aera and the transaction, without charge, at the SEC’s website, www.sec.gov. Copies of documents filed with the SEC by CRC will be available, without charge, at CRC’s website, www.crc.com.

Participants in Solicitation

CRC and its directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the transaction. Information about the directors and executive officers of CRC is set forth in the proxy statement for CRC’s 2023 Annual Meeting of Stockholders, which was filed with the SEC on March 16, 2023. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement regarding the transaction when it becomes available.

Forward-Looking Statements

This document contains statements that CRC believes to be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than historical facts are forward-looking statements, and include statements regarding CRC's future financial position, business strategy, projected revenues, earnings, costs, capital expenditures and plans and objectives of management for the future. Words such as "expect," “could,” “may,” "anticipate," "intend," "plan," “ability,” "believe," "seek," "see," "will," "would," “estimate,” “forecast,” "target," “guidance,” “outlook,” “opportunity” or “strategy” or similar expressions are generally intended to identify forward-looking statements. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, such statements. Additionally, the information in this report contains forward-looking statements related to the recently announced Aera merger.

Although CRC believes the expectations and forecasts reflected in its forward-looking statements are reasonable, they are inherently subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond its control. No assurance can be given that such forward-looking statements will be correct or achieved or that the assumptions are accurate or will not change over time. Particular uncertainties that could cause CRC's actual results to be materially different than those expressed in its forward-looking statements include:

•fluctuations in commodity prices, including supply and demand considerations for CRC's products and services;

•decisions as to production levels and/or pricing by OPEC or U.S. producers in future periods;

•government policy, war and political conditions and events, including the military conflicts in Israel, Ukraine and Yemen and the Red Sea;

•the ability to successfully integrate the business of Aera once the Aera merger is completed;

•the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the Aera merger that could reduce anticipated benefits or cause the parties to abandon the Aera merger;

•the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement;

•the possibility that the stockholders of CRC may not approve the issuance of new shares of common stock in the Aera merger;

•the ability to obtain the required debt financing in connection with the Aera merger and, if obtained, the potential impact of additional debt on its business and the financial impacts and restrictions due to the additional debt;

•regulatory actions and changes that affect the oil and gas industry generally and CRC in particular, including (1) the availability or timing of, or conditions imposed on, permits and approvals necessary for drilling or development activities or its carbon management business; (2) the management of energy, water, land, greenhouse gases (GHGs) or other emissions, (3) the protection of health, safety and the environment, or (4) the transportation, marketing and sale of CRC's products;

•the impact of inflation on future expenses and changes generally in the prices of goods and services;

•changes in business strategy and CRC's capital plan;

•lower-than-expected production or higher-than-expected production decline rates;

•changes to CRC's estimates of reserves and related future cash flows, including changes arising from its inability to develop such reserves in a timely manner, and any inability to replace such reserves;

•the recoverability of resources and unexpected geologic conditions;

•general economic conditions and trends, including conditions in the worldwide financial, trade and credit markets;

•production-sharing contracts' effects on production and operating costs;

•the lack of available equipment, service or labor price inflation;

•limitations on transportation or storage capacity and the need to shut-in wells;

•any failure of risk management;

•results from operations and competition in the industries in which CRC operates;

•CRC's ability to realize the anticipated benefits from prior or future efforts to reduce costs;

•environmental risks and liability under federal, regional, state, provincial, tribal, local and international environmental laws and regulations (including remedial actions);

•the creditworthiness and performance of CRC's counterparties, including financial institutions, operating partners, CCS project participants and other parties;

•reorganization or restructuring of CRC's operations;

•CRC's ability to claim and utilize tax credits or other incentives in connection with its CCS projects;

•CRC's ability to realize the benefits contemplated by its energy transition strategies and initiatives, including CCS projects and other renewable energy efforts;

•CRC's ability to successfully identify, develop and finance carbon capture and storage projects and other renewable energy efforts, including those in connection with the Carbon TerraVault JV, and its ability to convert its CDMAs to definitive agreements and enter into other offtake agreements;

•CRC's ability to maximize the value of its carbon management business and operate it on a stand alone basis;

•CRC's ability to successfully develop infrastructure projects and enter into third party contracts on contemplated terms;

•uncertainty around the accounting of emissions and its ability to successfully gather and verify emissions data and other environmental impacts;

•changes to CRC's dividend policy and share repurchase program, and its ability to declare future dividends or repurchase shares under its debt agreements;

•limitations on CRC's financial flexibility due to existing and future debt;

•insufficient cash flow to fund CRC's capital plan and other planned investments and return capital to shareholders;

•changes in interest rates;

•CRC's access to and the terms of credit in commercial banking and capital markets, including its ability to refinance its debt or obtain separate financing for its carbon management business;

•changes in state, federal or international tax rates, including CRC's ability to utilize its net operating loss carryforwards to reduce its income tax obligations;

•effects of hedging transactions;

•the effect of CRC's stock price on costs associated with incentive compensation;

•inability to enter into desirable transactions, including joint ventures, divestitures of oil and natural gas properties and real estate, and acquisitions, and CRC's ability to achieve any expected synergies;

•disruptions due to earthquakes, forest fires, floods, extreme weather events or other natural occurrences, accidents, mechanical failures, power outages, transportation or storage constraints, labor difficulties, cybersecurity breaches or attacks or other catastrophic events;

•pandemics, epidemics, outbreaks, or other public health events, such as the COVID-19 pandemic; and

•other factors discussed in Part I, Item 1A – Risk Factors in CRC's Annual Report on Form 10-K and its other SEC filings available at www.crc.com.

CRC cautions you not to place undue reliance on forward-looking statements contained in this document, which speak only as of the filing date, and the company undertakes no obligation to update this information. This document may also contain information from third party sources. This data may involve a number of assumptions and limitations, and CRC has not independently verified them and does not warrant the accuracy or completeness of such third-party information.

Contacts: | | | | | |

Joanna Park (Investor Relations) 818-661-3731 Joanna.Park@crc.com | Richard Venn (Media) 818-661-6014 Richard.Venn@crc.com |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Attachment 1 |

| SUMMARY OF RESULTS | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 4th Quarter | | 3rd Quarter | | 4th Quarter | | | Total Year | | Total Year |

| ($ and shares in millions, except per share amounts) | 2023 | | 2023 | | 2022 | | | 2023 | | 2022 |

| | | | | | | | | | |

| Statements of Operations: | | | | | | | | | | |

| Revenues | | | | | | | | | | |

| Oil, natural gas and NGL sales | $ | 483 | | | $ | 510 | | | $ | 617 | | | | $ | 2,155 | | | $ | 2,643 | |

| Net gain (loss) from commodity derivatives | 119 | | | (204) | | | (132) | | | | (12) | | | (551) | |

| Marketing of purchased natural gas | 67 | | | 78 | | | 94 | | | | 401 | | | 314 | |

| Electricity sales | 42 | | | 67 | | | 90 | | | | 211 | | | 261 | |

| Other revenue | 15 | | | 9 | | | 13 | | | | 46 | | | 40 | |

| Total operating revenues | 726 | | | 460 | | | 682 | | | | 2,801 | | | 2,707 | |

| | | | | | | | | | |

| Operating Expenses | | | | | | | | | | |

| Operating costs | 186 | | | 196 | | | 199 | | | | 822 | | | 785 | |

| General and administrative expenses | 66 | | | 65 | | | 59 | | | | 267 | | | 222 | |

| Depreciation, depletion and amortization | 55 | | | 56 | | | 49 | | | | 225 | | | 198 | |

| Asset impairment | — | | | — | | | — | | | | 3 | | | 2 | |

| Taxes other than on income | 33 | | | 48 | | | 42 | | | | 165 | | | 162 | |

| Exploration expense | 1 | | | — | | | 1 | | | | 3 | | | 4 | |

| Purchased natural gas marketing expense | 39 | | | 31 | | | 87 | | | | 221 | | | 273 | |

| Electricity generation expenses | 18 | | | 23 | | | 68 | | | | 103 | | | 167 | |

| Transportation costs | 18 | | | 16 | | | 13 | | | | 67 | | | 50 | |

| Accretion expense | 11 | | | 12 | | | 11 | | | | 46 | | | 43 | |

| | | | | | | | | | |

| Carbon management business expenses | 17 | | | 9 | | | 11 | | | | 37 | | | 14 | |

| Other operating expenses, net | 24 | | | 19 | | | 9 | | | | 66 | | | 34 | |

| Total operating expenses | 468 | | | 475 | | | 549 | | | | 2,025 | | | 1,954 | |

| Net gain on asset divestitures | 25 | | | — | | | (1) | | | | 32 | | | 59 | |

| Operating Income (Loss) | 283 | | | (15) | | | 132 | | | | 808 | | | 812 | |

| | | | | | | | | | |

| Non-Operating (Expenses) Income | | | | | | | | | | |

| | | | | | | | | | |

| Interest and debt expense | (13) | | | (15) | | | (14) | | | | (56) | | | (53) | |

| Loss from investment in unconsolidated subsidiary | (3) | | | (3) | | | (1) | | | | (9) | | | (1) | |

| Net loss on early extinguishment of debt | (1) | | | — | | | — | | | | (1) | | | — | |

| Other non-operating income, net | 1 | | | 3 | | | — | | | | 6 | | | 3 | |

| | | | | | | | | | |

| Income (Loss) Before Income Taxes | 267 | | | (30) | | | 117 | | | | 748 | | | 761 | |

| Income tax (provision) benefit | (79) | | | 8 | | | (34) | | | | (184) | | | (237) | |

| Net Income Loss) | $ | 188 | | | $ | (22) | | | $ | 83 | | | | $ | 564 | | | $ | 524 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Net income (loss) per share - basic | $ | 2.74 | | | $ | (0.32) | | | $ | 1.14 | | | | $ | 8.10 | | | $ | 6.94 | |

| Net income (loss) per share - diluted | $ | 2.60 | | | $ | (0.32) | | | $ | 1.11 | | | | $ | 7.78 | | | $ | 6.75 | |

| | | | | | | | | | |

| Adjusted net income | $ | 67 | | | $ | 74 | | | $ | 93 | | | | $ | 372 | | | $ | 384 | |

| Adjusted net income per share - basic | $ | 0.98 | | | $ | 1.08 | | | $ | 1.28 | | | | $ | 5.34 | | | $ | 5.09 | |

| Adjusted net income per share - diluted | $ | 0.93 | | | $ | 1.02 | | | $ | 1.24 | | | | $ | 5.13 | | | $ | 4.95 | |

| | | | | | | | | | |

| Weighted-average common shares outstanding - basic | 68.7 | | | 68.7 | | | 72.7 | | | | 69.6 | | | 75.5 | |

| Weighted-average common shares outstanding - diluted | 72.3 | | | 68.7 | | | 75.0 | | | | 72.5 | | | 77.6 | |

| | | | | | | | | | |

| Adjusted EBITDAX | $ | 179 | | | $ | 187 | | | $ | 208 | | | | $ | 862 | | | $ | 852 | |

| Effective tax rate | 30 | % | | 27 | % | | 29 | % | | | 25 | % | | 31 | % |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

|

| 4th Quarter | | 3rd Quarter | | 4th Quarter | | | Total Year | | Total Year |

| ($ in millions) | 2023 | | 2023 | | 2022 | | | 2023 | | 2022 |

| Cash Flow Data: | | | | | | | | | | |

| Net cash provided by operating activities | $ | 131 | | | $ | 104 | | | $ | 114 | | | | $ | 653 | | | $ | 690 | |

| Net cash used in investing activities | $ | (42) | | | $ | (28) | | | $ | (79) | | | | $ | (175) | | | $ | (317) | |

| Net cash used in financing activities | $ | (72) | | | $ | (45) | | | $ | (86) | | | | $ | (289) | | | $ | (371) | |

| | | | | | | | | | |

| December 31, | | December 31, | | | | | | | |

| ($ in millions) | 2023 | | 2022 | | | | | | | |

| Selected Balance Sheet Data: | | | | | | | | | | |

| Total current assets | $ | 929 | | | $ | 864 | | | | | | | | |

| Property, plant and equipment, net | $ | 2,770 | | | $ | 2,786 | | | | | | | | |

| Deferred tax asset | $ | 132 | | | $ | 164 | | | | | | | | |

| Total current liabilities | $ | 616 | | | $ | 894 | | | | | | | | |

| Long-term debt, net | $ | 540 | | | $ | 592 | | | | | | | | |

| Noncurrent asset retirement obligations | $ | 422 | | | $ | 432 | | | | | | | | |

| Stockholders' Equity | $ | 2,219 | | | $ | 1,864 | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAINS AND LOSSES FROM COMMODITY DERIVATIVES | | |

| | | | | | | | |

|

| 4th Quarter | | 3rd Quarter | | 4th Quarter | Total Year | | Total Year |

| ($ millions) | 2023 | | 2023 | | 2022 | 2023 | | 2022 |

| | | | | | | | |

| Non-cash derivative gain (loss) | $ | 168 | | | $ | (109) | | | $ | 2 | | $ | 260 | | | $ | 187 | |

| | | | | | | | |

| | | | | | | | |

| Non-cash gas supply derivative loss | (8) | | | — | | | — | | (8) | | | — | |

| Net payments on settled commodity derivatives | (49) | | | (95) | | | (134) | | (272) | | | (738) | |

| Net gain (loss) from commodity derivatives | $ | 111 | | | $ | (204) | | | $ | (132) | | $ | (20) | | | $ | (551) | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | 1st Quarter | | | 1st Quarter | | 4th Quarter | | 4th Quarter | | | 4th Quarter | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CAPITAL INVESTMENTS | | | | |

| | | | | | | | | |

|

| 4th Quarter | | 3rd Quarter | | 4th Quarter | | Total Year | | Total Year |

| ($ millions) | 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | |

Facilities (1) | $ | 20 | | | $ | 7 | | | $ | 19 | | | $ | 47 | | | $ | 71 | |

| Drilling | 16 | | | 13 | | | 48 | | | 67 | | | 242 | |

| Workovers | 11 | | | 11 | | | 14 | | | 39 | | | 36 | |

| Total E&P capital | 47 | | | 31 | | | 81 | | | 153 | | | 349 | |

CMB (1) | 4 | | | — | | | (13) | | | 5 | | | 4 | |

| Corporate and other | 15 | | | 2 | | | 7 | | | 27 | | | 26 | |

| Total capital program | $ | 66 | | | $ | 33 | | | $ | 75 | | | $ | 185 | | | $ | 379 | |

| | | | | | | | | |

(1) Facilities capital includes $1 million, $1 million and $3 million in the fourth and third quarter of 2023 and fourth quarter of 2022, respectively, and $4 million and $12 million for the years 2023 and 2022, respectively to build replacement water injection facilities which will allow CRC to divert produced water away from a depleted oil and natural gas reservoir held by the Carbon TerraVault JV. Construction of these facilities supports the advancement of CRC’s carbon management business and CRC reported these amounts as part of adjusted CMB capital in this Earnings Release. Where adjusted CMB capital is presented, CRC removed the amounts from facilities capital and presented adjusted E&P, Corporate and Other capital. |

|

| | | | | | | | | | | | | | | | | |

| | | | | Attachment 2 |

2024 PRELIMINARY OUTLOOK1 | | | Total 2024E | | |

| Net Total Production (MBoe/d) | | | 78 - 82 | | |

| Oil Production (%) | | | ~60% | | |

| | | | | |

| Capital ($ millions) | | | $300 - $340 | | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| CRC GUIDANCE | Total

1Q24E | | CMB

1Q24E | | E&P, Corp. & Other 1Q24E |

| Net Total Production (MBoe/d) | 76 - 80 | | | | 76 - 80 |

| Oil Production (%) | ~60% | | | | ~60% |

| CMB Expenses & Operating Costs ($ millions) | $175 - $185 | | $6 - $10 | | $169 - $175 |

| General and Administrative Expenses ($ millions) | $61 - $72 | | $2 - $3 | | $59 - $69 |

| Adjusted General and Administrative Expenses ($ millions) | $48 - $58 | | $2 - $3 | | $46 - $55 |

| Capital ($ millions) | $65 - $75 | | $4 - $6 | | $61 - $69 |

| | | | | |

| Natural Gas Marketing Margin ($ millions) | $8 - $13 | | | | $8 - $13 |

| Electricity Margin ($ millions) | $5 - $10 | | | | $5 - $10 |

| Other Operating Revenue & Expenses, net ($ millions) | $5 - $10 | | | | $5 - $10 |

| Transportation Expense ($ millions) | $16 - $21 | | | | $16 - $21 |

| Taxes Other Than on Income ($ millions) | $35 - $50 | | | | $35 - $50 |

| Interest and Debt Expense ($ millions) | $12 - $14 | | | | $12 - $14 |

| | | | | |

| Commodity Assumptions: | | | | | |

| Brent ($/Bbl) | $78.73 | | | | $78.73 |

| NYMEX ($/Mcf) | $2.87 | | | | $2.87 |

| Oil - % of Brent: | 96% - 99% | | | | 96% - 99% |

| NGL - % of Brent: | 60% - 66% | | | | 60% - 66% |

| Natural Gas - % of NYMEX: | 120% - 140% | | | | 120% - 140% |

See Attachment 3 for management's disclosure of its use of these non-GAAP measures and how these measures provide useful information to investors about CRC's results of operations and financial condition.

1 Current preliminary 2024 outlook assumes a four rigs scenario starting from 2H24 subject to the availability of well permits. If CRC is not able to receive drilling permits or permits are delayed, the Company plans to run a one rig program with a $200 million to $240 million 2024E total capital program and would expect a 5% to 7% entry to exit decline rate.

ESTIMATED ADJUSTED GENERAL AND ADMINISTRATIVE EXPENSES RECONCILIATION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1Q24 Estimated |

| Consolidated | | CMB | | E&P, Corporate & Other |

| ($ millions) | Low | | High | | Low | | High | | Low | | High |

| General and administrative expenses | $ | 61 | | | $ | 72 | | | $ | 2 | | | $ | 3 | | | $ | 59 | | | $ | 69 | |

| Equity-settled stock-based compensation | (8) | | | (6) | | | | | | | (8) | | | (6) | |

| Other | (5) | | | (8) | | | | | | | (5) | | | (8) | |

| Estimated adjusted general and administrative expenses | $ | 48 | | | $ | 58 | | | $ | 2 | | | $ | 3 | | | $ | 46 | | | $ | 55 | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Attachment 3 |

| NON-GAAP FINANCIAL MEASURES AND RECONCILIATIONS |

|

To supplement the presentation of its financial results prepared in accordance with U.S generally accepted accounting principles (GAAP), management uses certain non-GAAP measures to assess its financial condition, results of operations and cash flows. The non-GAAP measures include adjusted net income (loss), adjusted EBITDAX, E&P, Corporate & Other adjusted EBITDAX, CMB adjusted EBITDAX, net cash provided by operating activities before changes in operating assets and liabilities, net, free cash flow, E&P, Corporate & Other free cash flow, CMB free cash flow, adjusted general and administrative expenses, operating costs per BOE, and adjusted total capital among others. These measures are also widely used by the industry, the investment community and CRC's lenders. Although these are non-GAAP measures, the amounts included in the calculations were computed in accordance with GAAP. Certain items excluded from these non-GAAP measures are significant components in understanding and assessing CRC's financial performance, such as CRC's cost of capital and tax structure, as well as the effect of acquisition and development costs of CRC's assets. Management believes that the non-GAAP measures presented, when viewed in combination with CRC's financial and operating results prepared in accordance with GAAP, provide a more complete understanding of the factors and trends affecting the Company's performance. The non-GAAP measures presented herein may not be comparable to other similarly titled measures of other companies. Below are additional disclosures regarding each of the non-GAAP measures reported in this earnings release, including reconciliations to their most directly comparable GAAP measure where applicable. | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ADJUSTED NET INCOME (LOSS) | | | | | | | | | | | |

|

| Adjusted net income (loss) and adjusted net income (loss) per share are non-GAAP measures. CRC defines adjusted net income as net income excluding the effects of significant transactions and events that affect earnings but vary widely and unpredictably in nature, timing and amount. These events may recur, even across successive reporting periods. Management believes these non-GAAP measures provide useful information to the industry and the investment community interested in comparing CRC's financial performance between periods. Reported earnings are considered representative of management's performance over the long term. Adjusted net income (loss) is not considered to be an alternative to net income (loss) reported in accordance with GAAP. The following table presents a reconciliation of the GAAP financial measure of net income and net income attributable to common stock per share to the non-GAAP financial measure of adjusted net income and adjusted net income per share. | |

| | | | | |

| | 4th Quarter | | 3rd Quarter | | 4th Quarter | | Total Year | | Total Year | |

| ($ millions, except per share amounts) | | 2023 | | 2023 | | 2022 | | 2023 | | 2022 | |

| Net (loss) income | | $ | 188 | | | $ | (22) | | | $ | 83 | | | $ | 564 | | | $ | 524 | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Unusual, infrequent and other items: | | | | | | | | | | | |

| Non-cash derivative loss (gain) | | (160) | | | 109 | | | (2) | | | (252) | | | (187) | | |

| Asset impairment | | — | | | — | | | — | | | 3 | | | 2 | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Severance and termination costs | | — | | | 7 | | | — | | | 10 | | | — | | |

| Net loss on early extinguishment of debt | | 1 | | | — | | | — | | | 1 | | | — | | |

| Net gain on asset divestitures | | (25) | | | — | | | 1 | | | (32) | | | (59) | | |

| | | | | | | | | | | |

| Other, net | | 16 | | | 17 | | | 15 | | | 46 | | | 22 | | |

| Total unusual, infrequent and other items | | (168) | | | 133 | | | 14 | | | (224) | | | (222) | | |

| Income tax (benefit) provision of adjustments at effective tax rate | | 47 | | | (37) | | | (4) | | | 63 | | | 63 | | |

| Income tax (benefit) provision - out of period | | — | | | — | | | — | | | (31) | | | 19 | | |

| | | | | | | | | | | |

| Adjusted net income attributable to common stock | | $ | 67 | | | $ | 74 | | | $ | 93 | | | $ | 372 | | | $ | 384 | | |

| | | | | | | | | | | |

| Net income (loss) per share - basic | | $ | 2.74 | | | $ | (0.32) | | | $ | 1.14 | | | $ | 8.10 | | | $ | 6.94 | | |

| Net income (loss) per share - diluted | | $ | 2.60 | | | $ | (0.32) | | | $ | 1.11 | | | $ | 7.78 | | | $ | 6.75 | | |

| Adjusted net income per share - basic | | $ | 0.98 | | | $ | 1.08 | | | $ | 1.28 | | | $ | 5.34 | | | $ | 5.09 | | |

| Adjusted net income per share - diluted | | $ | 0.93 | | | $ | 1.02 | | | $ | 1.24 | | | $ | 5.13 | | | $ | 4.95 | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ADJUSTED EBITDAX | | | | | | | | | |

|

CRC defines Adjusted EBITDAX as earnings before interest expense; income taxes; depreciation, depletion and amortization; exploration expense; other unusual, infrequent and out-of-period items; and other non-cash items. CRC believes this measure provides useful information in assessing its financial condition, results of operations and cash flows and is widely used by the industry, the investment community and its lenders. Although this is a non-GAAP measure, the amounts included in the calculation were computed in accordance with GAAP. Certain items excluded from this non-GAAP measure are significant components in understanding and assessing CRC’s financial performance, such as its cost of capital and tax structure, as well as depreciation, depletion and amortization of CRC's assets. This measure should be read in conjunction with the information contained in CRC’s financial statements prepared in accordance with GAAP. A version of Adjusted EBITDAX is a material component of certain of its financial covenants under CRC's Revolving Credit Facility and is provided in addition to, and not as an alternative for, income and liquidity measures calculated in accordance with GAAP.

The following table represents a reconciliation of the GAAP financial measures of net income and net cash provided by operating activities to the non-GAAP financial measure of adjusted EBITDAX. CRC has supplemented its non-GAAP measures of consolidated adjusted EBITDAX with adjusted EBITDAX for its exploration and production and corporate items (Adjusted EBITDAX for E&P, Corporate & Other) which management believes is a useful measure for investors to understand the results of the core oil and gas business. CRC defines adjusted EBITDAX for E&P, Corporate & Other as consolidated adjusted EBITDAX less results attributable to its carbon management business (CMB).

| |

| | | | | | |

| | 4th Quarter | | 3rd Quarter | | | 4th Quarter | | Total Year | | | Total Year | |

| ($ millions, except per BOE amounts) | | 2023 | | 2023 | | | 2022 | | 2023 | | | 2022 | |

| Net income (loss) | | $ | 188 | | | $ | (22) | | | | $ | 83 | | | $ | 564 | | | | $ | 524 | | |

| Interest and debt expense | | 13 | | | 15 | | | | 14 | | | 56 | | | | 53 | | |

| Depreciation, depletion and amortization | | 55 | | | 56 | | | | 49 | | | 225 | | | | 198 | | |

| Income tax provision (benefit) | | 79 | | | (8) | | | | 34 | | | 184 | | | | 237 | | |

| Exploration expense | | 1 | | | — | | | | 1 | | | 3 | | | | 4 | | |

| Interest income | | (7) | | | (5) | | | | (3) | | | (21) | | | | (4) | | |

Unusual, infrequent and other items (1) | | (168) | | | 133 | | | | 14 | | | (224) | | | | (222) | | |

| Non-cash items | | | | | | | | | | | | | |

| Accretion expense | | 11 | | | 12 | | | | 11 | | | 46 | | | | 43 | | |

| Stock-based compensation | | 6 | | | 6 | | | | 4 | | | 27 | | | | 17 | | |

| Post-retirement medical and pension | | 1 | | | — | | | | 1 | | | 2 | | | | 2 | | |

| | | | | | | | | | | | | |

| Adjusted EBITDAX | | $ | 179 | | | $ | 187 | | | | $ | 208 | | | $ | 862 | | | | $ | 852 | | |

| | | | | | | | | | | | | |

| Net cash provided by operating activities | | $ | 131 | | | $ | 104 | | | | $ | 114 | | | $ | 653 | | | | $ | 690 | | |

| Cash interest payments | | 1 | | | 23 | | | | 2 | | | 49 | | | | 50 | | |

| Cash interest received | | (7) | | | (5) | | | | (3) | | | (21) | | | | (4) | | |

| Cash income taxes | | 41 | | | 29 | | | | — | | | 121 | | | | 20 | | |

| Exploration expenditures | | 1 | | | — | | | | 1 | | | 3 | | | | 4 | | |

| Adjustments to changes in operating assets and liabilities | | 12 | | | 36 | | | | 94 | | | 57 | | | | 92 | | |

| | | | | | | | | | | | | |

| Adjusted EBITDAX | | $ | 179 | | | $ | 187 | | | | $ | 208 | | | $ | 862 | | | | $ | 852 | | |

| | | | | | | | | | | | | |

| E&P, Corporate & Other Adjusted EBITDAX | | $ | 199 | | | $ | 199 | | | | $ | 223 | | | $ | 916 | | | | $ | 879 | | |

| CMB Adjusted EBITDAX | | $ | (20) | | | $ | (12) | | | | $ | (15) | | | $ | (54) | | | | $ | (27) | | |

| | | | | | | | | | | | | |

| Adjusted EBITDAX per Boe | | $ | 23.57 | | | $ | 23.81 | | | | $ | 24.94 | | | $ | 27.51 | | | | $ | 25.77 | | |

| | | | | | | | | | | | | |

(1) See Adjusted Net Income (Loss) reconciliation. | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FREE CASH FLOW AND SUPPLEMENTAL FREE CASH FLOW MEASURES |

| | | | | | | | | | |

Management uses free cash flow, which is defined by CRC as net cash provided by operating activities less capital investments, as a measure of liquidity. The following table presents a reconciliation of CRC's net cash provided by operating activities to free cash flow. CRC supplemented its non-GAAP measure of free cash flow with (i) net cash provided by operating activities before changes in operating assets and liabilities, net, (ii) adjusted free cash flow, and (iii) free cash flow of exploration and production, and corporate and other items (Free Cash Flow for E&P, Corporate & Other), which it believes is a useful measure for investors to understand the results of CRC's core oil and gas business. CRC defines Free Cash Flow for E&P, Corporate & Other as consolidated free cash flow less results attributable to its carbon management business (CMB). CRC defines adjusted free cash flow as net cash provided by operating activities less adjusted capital investments. |

| | | | | | | | | | |

| | 4th Quarter | | 3rd Quarter | | 4th Quarter | | Total Year | | Total Year |

| ($ millions) | | 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | |

| Net cash provided by operating activities before changes in operating assets and liabilities, net | | $ | 104 | | | $ | 129 | | | $ | 192 | | | $ | 647 | | | $ | 747 | |

| Changes in operating assets and liabilities, net | | 27 | | | (25) | | | (78) | | | 6 | | | (57) | |

| Net cash provided by operating activities | | 131 | | | 104 | | | 114 | | | 653 | | | 690 | |

| Capital investments | | (66) | | | (33) | | | (75) | | | (185) | | | (379) | |

| Free cash flow | | $ | 65 | | | $ | 71 | | | $ | 39 | | | $ | 468 | | | $ | 311 | |

| | | | | | | | | | |

| E&P, Corporate and Other | | $ | 84 | | | $ | 79 | | | $ | 61 | | | $ | 511 | | | $ | 362 | |

| CMB | | $ | (19) | | | $ | (8) | | | $ | (22) | | | $ | (43) | | | $ | (51) | |

| | | | | | | | | | |

| Adjustments to capital investments: | | | | | | | | | | |

Replacement water facilities(1) | | $ | 1 | | | $ | 1 | | | $ | 3 | | | $ | 4 | | | $ | 12 | |

| Adjusted capital investments: | | | | | | | | | | |

| E&P, Corporate and Other | | $ | 61 | | | $ | 32 | | | $ | 85 | | | $ | 176 | | | $ | 363 | |

| CMB | | $ | 5 | | | $ | 1 | | | $ | (10) | | | $ | 9 | | | $ | 16 | |

| | | | | | | | | | |

| Adjusted free cash flow: | | | | | | | | | | |

|

| E&P, Corporate and Other | | $ | 85 | | | $ | 80 | | | $ | 64 | | | $ | 515 | | | $ | 374 | |

| CMB | | $ | (20) | | | $ | (9) | | | $ | (25) | | | $ | (47) | | | $ | (63) | |

| | | | | | | | | | |

(1) Facilities capital includes $1 million, $1 million and $4 million in the third and second quarter of 2023 and third quarter of 2022, respectively, to build replacement water injection facilities which will allow CRC to divert produced water away from a depleted oil and natural gas reservoir held by the Carbon TerraVault JV. Construction of these facilities supports the advancement of CRC’s carbon management business and CRC reported these amounts as part of adjusted CMB capital in this press release. Where adjusted CMB capital is presented, CRC removed the amounts from facilities capital and presented adjusted E&P, Corporate and Other capital.

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ADJUSTED GENERAL & ADMINISTRATIVE EXPENSES | |

| | | | | | | | | | | |

Management uses a measure called adjusted general and administrative (G&A) expenses to provide useful information to investors interested in comparing CRC's costs between periods and performance to our peers. CRC supplemented its non-GAAP measure of adjusted general and administrative expenses with adjusted general and administrative expenses of its exploration and production and corporate items (adjusted general & administrative expenses for E&P, Corporate & Other) which it believes is a useful measure for investors to understand the results or CRC's core oil and gas business. CRC defines adjusted general & administrative Expenses for E&P, Corporate & Other as consolidated adjusted general and administrative expenses less results attributable to its carbon management business (CMB). | |

| | | | | | | | | | | |

| | 4th Quarter | | 3rd Quarter | | 4th Quarter | | Total Year | | Total Year | |

| ($ millions) | | 2023 | | 2023 | | 2022 | | 2023 | | 2022 | |

| General and administrative expenses | | $ | 66 | | | $ | 65 | | | $ | 59 | | | $ | 267 | | | $ | 222 | | |

| Stock-based compensation | | (6) | | | (6) | | | (4) | | | (27) | | | (17) | | |

| Information technology infrastructure | | (4) | | | (6) | | | (2) | | | (17) | | | (4) | | |

| Other | | (1) | | | (2) | | | — | | | (5) | | | — | | |

| Adjusted G&A expenses | | $ | 55 | | | $ | 51 | | | $ | 53 | | | $ | 218 | | | $ | 201 | | |

| | | | | | | | | | | |

| E&P, Corporate and Other adjusted G&A expenses | | $ | 53 | | | $ | 47 | | | $ | 51 | | | $ | 206 | | | $ | 189 | | |

| CMB adjusted G&A expenses | | $ | 2 | | | $ | 4 | | | $ | 2 | | | $ | 12 | | | $ | 12 | | |

| | | | | | | | | | | |

| OPERATING COSTS PER BOE | |

| | | | | | | | | | | |

| The reporting of PSC-type contracts creates a difference between reported operating costs, which are for the full field, and reported volumes, which are only CRC's net share, inflating the per barrel operating costs. The following table presents operating costs after adjusting for the excess costs attributable to PSCs. | |

| | | | | | | | | | | |

| | 4th Quarter | | 3rd Quarter | | 4th Quarter | | Total Year | | Total Year | |

| ($ per BOE) | | 2023 | | 2023 | | 2022 | | 2023 | | 2022 | |

Energy operating costs (1) | | $ | 8.65 | | | $ | 9.42 | | | $ | 9.56 | | | $ | 10.31 | | | $ | 9.76 | | |

Gas processing costs (2) | | 0.60 | | | 0.64 | | | 0.48 | | | 0.58 | | | 0.52 | | |

| Non-energy operating costs | | 15.24 | | | 14.90 | | | 13.82 | | | 15.35 | | | 13.47 | | |

| Operating costs | | $ | 24.49 | | | $ | 24.96 | | | $ | 23.86 | | | $ | 26.24 | | | $ | 23.75 | | |

| | | | | | | | | | | |

| Costs attributable to PSCs | | | | | | | | | | | |

| Excess energy operating costs attributable to PSCs | | $ | (1.01) | | | $ | (1.09) | | | $ | (0.76) | | | $ | (1.00) | | | $ | (0.92) | | |

| Excess non-energy operating costs attributable to PSCs | | (1.32) | | | (1.30) | | | (1.14) | | | (1.25) | | | (1.31) | | |

| Excess costs attributable to PSCs | | $ | (2.33) | | | $ | (2.39) | | | $ | (1.90) | | | $ | (2.25) | | | $ | (2.23) | | |

| | | | | | | | | | | |

Energy operating costs, excluding effect of PSCs (1) | | $ | 7.64 | | | $ | 8.33 | | | $ | 8.80 | | | $ | 9.31 | | | $ | 8.84 | | |

Gas processing costs, excluding effect of PSCs (2) | | 0.60 | | | 0.64 | | | 0.48 | | | 0.58 | | | 0.52 | | |

| Non-energy operating costs, excluding effect of PSCs | | 13.92 | | | 13.60 | | | 12.68 | | | 14.10 | | | 12.16 | | |

| Operating costs, excluding effects of PSCs | | $ | 22.16 | | | $ | 22.57 | | | $ | 21.96 | | | $ | 23.99 | | | $ | 21.52 | | |

| | | | | | | | | | | |

(1) Energy operating costs consist of purchased natural gas used to generate electricity for operations and steamfloods, purchased electricity and internal costs to generate electricity used in CRC's operations. | |

(2) Gas processing costs include costs associated with compression, maintenance and other activities needed to run CRC's gas processing facilities at Elk Hills. | |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Attachment 4 |

| PRODUCTION STATISTICS | | | | | | | | | | | |

| | 4th Quarter | | 3rd Quarter | | 4th Quarter | | Total Year | | Total Year | |

| Net Production Per Day | | 2023 | | 2023 | | 2022 | | 2023 | | 2022 | |

| | | | | | | | | | | |

| Oil (MBbl/d) | | | | | | | | | | | |

| San Joaquin Basin | | 32 | | | 33 | | | 36 | | | 33 | | | 37 | | |

| Los Angeles Basin | | 18 | | | 18 | | | 19 | | | 19 | | | 18 | | |

| | | | | | | | | | | |

| Total | | 50 | | | 51 | | | 55 | | | 52 | | | 55 | | |

| | | | | | | | | | | |

| NGLs (MBbl/d) | | | | | | | | | | | |

| San Joaquin Basin | | 11 | | | 11 | | | 11 | | | 11 | | | 11 | | |

| Total | | 11 | | | 11 | | | 11 | | | 11 | | | 11 | | |

| | | | | | | | | | | |

| Natural Gas (MMcf/d) | | | | | | | | | | | |

| San Joaquin Basin | | 114 | | | 122 | | | 129 | | | 119 | | | 129 | | |

| Los Angeles Basin | | 1 | | | 1 | | | 1 | | | 1 | | | 1 | | |

| | | | | | | | | | | |

| Sacramento Basin | | 15 | | | 15 | | | 17 | | | 15 | | | 17 | | |

| Total | | 130 | | | 138 | | | 147 | | | 135 | | | 147 | | |

| | | | | | | | | | | |

| Total Production (MBoe/d) | | 83 | | | 85 | | | 91 | | | 86 | | | 91 | | |

| | | | | | | | | | | |

| Gross Operated and Net Non-Operated | | 4th Quarter | | 3rd Quarter | | 4th Quarter | | Total Year | | Total Year | |

| Production Per Day | | 2023 | | 2023 | | 2022 | | 2023 | | 2022 | |

| | | | | | | | | | | |

| Oil (MBbl/d) | | | | | | | | | | | |

| San Joaquin Basin | | 36 | | | 36 | | | 40 | | | 37 | | | 41 | | |

| Los Angeles Basin | | 25 | | | 25 | | | 25 | | | 25 | | | 25 | | |

| | | | | | | | | | | |

| Total | | 61 | | | 61 | | | 65 | | | 62 | | | 66 | | |

| | | | | | | | | | | |

| NGLs (MBbl/d) | | | | | | | | | | | |

| San Joaquin Basin | | 11 | | | 13 | | | 12 | | | 12 | | | 12 | | |

| Total | | 11 | | | 13 | | | 12 | | | 12 | | | 12 | | |

| | | | | | | | | | | |

| Natural Gas (MMcf/d) | | | | | | | | | | | |

| San Joaquin Basin | | 129 | | | 135 | | | 136 | | | 135 | | | 136 | | |

| Los Angeles Basin | | 8 | | | 8 | | | 8 | | | 7 | | | 7 | | |

| | | | | | | | | | | |

| Sacramento Basin | | 18 | | | 18 | | | 21 | | | 19 | | | 22 | | |

| Total | | 155 | | | 161 | | | 165 | | | 161 | | | 165 | | |

| | | | | | | | | | | |

| Total Production (MBoe/d) | | 98 | | | 102 | | | 105 | | | 101 | | | 106 | | |

| | | | | | | | | | | |

| |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Attachment 5 | | | |

| PRICE STATISTICS | | | | | | | | | | | | | |

| 4th Quarter | | 3rd Quarter | | | 4th Quarter | | Total Year | | Total Year | | | |

| | 2023 | | 2023 | | | 2022 | | 2023 | | 2022 | | | |

| Oil ($ per Bbl) | | | | | | | | | | | | | |

| Realized price with derivative settlements | $ | 71.34 | | | $ | 66.12 | | | | $ | 61.33 | | | $ | 65.97 | | | $ | 61.80 | | | | |

| Realized price without derivative settlements | $ | 82.00 | | | $ | 85.36 | | | | $ | 87.15 | | | $ | 80.41 | | | $ | 98.26 | | | | |

| | | | | | | | | | | | | |

| NGLs ($/Bbl) | $ | 49.08 | | | $ | 44.95 | | | | $ | 56.55 | | | $ | 48.94 | | | $ | 64.33 | | | | |

| | | | | | | | | | | | | |

| Natural gas ($/Mcf) | | | | | | | | | | | | | |

| Realized price with derivative settlements | $ | 4.66 | | | $ | 4.83 | | | | $ | 8.51 | | | $ | 8.59 | | | $ | 7.54 | | | | |

| Realized price without derivative settlements | $ | 4.66 | | | $ | 4.83 | | | | $ | 8.73 | | | $ | 8.59 | | | $ | 7.68 | | | | |

| | | | | | | | | | | | | |

| Index Prices | | | | | | | | | | | | | |

| Brent oil ($/Bbl) | $ | 82.69 | | | $ | 85.95 | | | | $ | 88.60 | | | $ | 82.22 | | | $ | 98.89 | | | | |

| WTI oil ($/Bbl) | $ | 78.32 | | | $ | 82.26 | | | | $ | 82.64 | | | $ | 77.62 | | | $ | 94.23 | | | | |

| NYMEX average monthly settled price ($/MMBtu) | $ | 2.88 | | | $ | 2.55 | | | | $ | 6.26 | | | $ | 2.74 | | | $ | 6.64 | | | | |

| | | | | | | | | | | | | |

| Realized Prices as Percentage of Index Prices | | | | | | | | | | | | | |

| Oil with derivative settlements as a percentage of Brent | 86 | % | | 77 | % | | | 69 | % | | 80 | % | | 62 | % | | | |

| Oil without derivative settlements as a percentage of Brent | 99 | % | | 99 | % | | | 98 | % | | 98 | % | | 99 | % | | | |

| | | | | | | | | | | | | |

| Oil with derivative settlements as a percentage of WTI | 91 | % | | 80 | % | | | 74 | % | | 85 | % | | 66 | % | | | |

| Oil without derivative settlements as a percentage of WTI | 105 | % | | 104 | % | | | 105 | % | | 104 | % | | 104 | % | | | |

| | | | | | | | | | | | | |

| NGLs as a percentage of Brent | 59 | % | | 52 | % | | | 64 | % | | 60 | % | | 65 | % | | | |

| NGLs as a percentage of WTI | 63 | % | | 55 | % | | | 68 | % | | 63 | % | | 68 | % | | | |

| | | | | | | | | | | | | |

| Natural gas with derivative settlements as a percentage of NYMEX contract month average | 162 | % | | 189 | % | | | 136 | % | | 314 | % | | 114 | % | | | |

| | | | | | | | | | | | | |

| Natural gas without derivative settlements as a percentage of NYMEX contract month average | 162 | % | | 189 | % | | | 139 | % | | 314 | % | | 116 | % | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Attachment 6 |

| FOURTH QUARTER 2023 DRILLING ACTIVITY | | | | | | | | | | |

| | | San Joaquin | | Los Angeles | | Ventura | | Sacramento | | |

| Wells Drilled | | Basin | | Basin | | Basin | | Basin | | Total |

| | | | | | | | | | |

| Development Wells | | | | | | | | | | |

| Primary | | — | | — | | — | | — | | — |

| Waterflood | | — | | 8 | | — | | — | | 8 |

| Steamflood | | — | | — | | — | | — | | — |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Total (1) | | — | | 8 | | — | | — | | 8 |

| | | | | | | | | | |

| | | | | | | | | | |

| TOTAL YEAR 2023 DRILLING ACTIVITY | | | | | | | | | | |

| | | San Joaquin | | Los Angeles | | Ventura | | Sacramento | | |

| Wells Drilled | | Basin | | Basin | | Basin | | Basin | | Total |

| | | | | | | | | | |

| Development Wells | | | | | | | | | | |

| Primary | | 2 | | — | | — | | — | | 2 |

| Waterflood | | 1 | | 29 | | — | | — | | 30 |

| Steamflood | | — | | — | | — | | — | | — |

Total (1) | | 3 | | 29 | | — | | — | | 32 |

| | | | | | | | | | |

(1) Includes steam injectors and drilled but uncompleted wells, which are not included in the SEC definition of wells drilled. | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Attachment 7 |

| OIL HEDGES AS OF DECEMBER 31, 2023 | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | Q1 2024 | | Q2 2024 | | Q3 2024 | | Q4 2024 | | 2025 |

| | | | | | | | | | | | |

| Sold Calls | | | | | | | | | | | | |

| Barrels per day | | | | 23,650 | | 30,000 | | 30,000 | | 29,000 | | 19,748 |

| Weighted-average Brent price per barrel | | | | $90.00 | | $90.07 | | $90.07 | | $90.07 | | $85.63 |

| | | | | | | | | | | | |

| Swaps | | | | | | | | | | | | |

| Barrels per day | | | | 9,500 | | 8,875 | | 7,750 | | 5,500 | | 3,374 |

| Weighted-average Brent price per barrel | | | | $79.81 | | $79.28 | | $79.64 | | $77.45 | | $72.66 |

| | | | | | | | | | | | |

| Purchased Puts | | | | | | | | | | | | |

| Barrels per day | | | | 30,584 | | 30,000 | | 30,000 | | 29,000 | | 19,748 |

| Weighted-average Brent price per barrel | | | | $67.27 | | $65.17 | | $65.17 | | $65.17 | | $60.00 |

| | | | | | | | | | | | |

|

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |