0001609253false00016092532024-03-082024-03-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

_____________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): March 8, 2024

_____________________

California Resources Corporation

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | |

| Delaware | 001-36478 | 46-5670947 |

(State or Other Jurisdiction of

Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | |

| 1 World Trade Center | |

| Suite 1500 | |

| Long Beach | |

| California | 90831 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (888) 848-4754

_____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☑ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | CRC | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On March 8, 2024, California Resources Corporation (the “Company” or “CRC”) entered into a third amendment (the “Amendment”) to its Amended and Restated Credit Agreement, dated as of April 26, 2023, with Citibank, N.A., as administrative agent, collateral agent and issuing bank, and the several lenders party thereto (as amended, the “Revolving Credit Facility”). The purpose of the Amendment was to facilitate certain matters with respect to its pending merger with Aera Energy, LLC (the “Aera Merger”), including the postponement of its regular spring borrowing base redetermination until the fall of 2024 and certain other amendments. The above description of the Amendment is not complete and is qualified in its entirety by reference to the full text of the Amendment, which is filed as Exhibit 10.1 hereto and incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

In connection with the abovementioned Amendment, the Company separately received commitments from new and existing lenders under its Revolving Credit Facility to increase the aggregate elected commitment amount to $1.1 billion and increase its borrowing base to $1.5 billion. These commitments are subject to satisfaction of certain conditions precedent, including closing of the Aera Merger.

The information contained in this report shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and shall not be incorporated by reference into any filings made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

Forward-Looking Statement Disclosure

This document contains statements that CRC believes to be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than historical facts are forward-looking statements, and include statements regarding CRC’s capital program and drilling program. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, such statements.

Although CRC believes the expectations reflected in its forward-looking statements are reasonable, they are inherently subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond its control. No assurance can be given that such forward-looking statements will be correct or achieved or that the assumptions are accurate or will not change over time. CRC cautions you that these forward-looking statements are subject to all of the risks and uncertainties incident to its business, most of which are difficult to predict and many of which are beyond its control. These risks include, but are not limited to, the risks described under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| California Resources Corporation |

| | | |

| | | |

| | | |

| /s/ Michael L. Preston | |

| Name: | Michael L. Preston |

| Title: | Executive Vice President, Chief Strategy Officer and General Counsel |

DATED: March 11, 2024

EXHIBIT 10.1

Execution Version

THIRD AMENDMENT TO AMENDED AND RESTATED CREDIT AGREEMENT

This THIRD AMENDMENT TO AMENDED AND RESTATED CREDIT AGREEMENT (this “Amendment”) is entered into effective as of March 8, 2024 (the “Third Amendment Effective Date”), among CALIFORNIA RESOURCES CORPORATION, a Delaware corporation (the “Borrower”), each other Credit Party party hereto, the Lenders party hereto and CITIBANK, N.A., as Administrative Agent.

WITNESSETH:

WHEREAS, the Borrower, the Administrative Agent and the Lenders party thereto from time to time are parties to that certain Amended and Restated Credit Agreement, dated as of April 26, 2023 (as amended, restated, amended and restated, supplemented or otherwise modified from time to time prior to the date hereof, the “Existing Credit Agreement” and as amended by this Amendment, the “Credit Agreement”; unless otherwise defined herein, all capitalized terms used herein that are defined in the Credit Agreement shall have the meanings given such terms in the Credit Agreement); and

WHEREAS, the parties to this Amendment desire to enter into this Amendment to amend the Existing Credit Agreement as provided herein.

NOW THEREFORE, in consideration of the premises contained herein, and for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto, intending to be legally bound, hereby agree as follows:

SECTION 1. Postponement of Scheduled Redetermination.

The Lenders party hereto, constituting the Required Lenders, hereby agree that the Scheduled Redetermination to be effective on or about April 1, 2024, shall be postponed until the Scheduled Redetermination scheduled to occur on or about October 1, 2024 (it being understood and agreed that the foregoing agreement to postpone such Scheduled Redetermination shall not constitute an agreement by the Administrative Agent, the Collateral Agent or any Lender to postpone any subsequent Scheduled Redetermination if requested by the Borrower, or otherwise operate as a waiver on the part of the Administrative Agent, the Collateral Agent or any Lender, of any right, remedy, power or privilege under the Credit Agreement or under any other Credit Documents).

SECTION 2. Amendments to Credit Agreement.

Subject to the satisfaction or waiver in writing of each of the conditions set forth in Section 3 below and in reliance upon the representations, warranties, covenants and agreements contained in this Amendment, the parties hereto hereby agree that:

(a) Section 1.1 of the Existing Credit Agreement is hereby amended to add the following defined terms in the appropriate alphabetical order as follows:

“Escrow Indebtedness Cash Amount” shall have the meaning provided in the definition of “Excess Cash”.

“Third Amendment” shall mean that certain Third Amendment to Amended and Restated Credit Agreement, dated as of the Third Amendment Effective Date, among the Borrower, the Guarantors party thereto, the Administrative Agent and the Lenders party thereto.

“Third Amendment Effective Date” shall mean March 8, 2024.

(b) Section 1.1 of the Existing Credit Agreement is hereby amended by amending and restating the following definitions in their entirety as follows:

“Borrowing Base Reduction Debt” shall mean Permitted Additional Debt issued or incurred in accordance with Sections 10.1(j) or (n), as applicable (other than senior unsecured notes issued in connection with the Petra Acquisition).

“Credit Documents” shall mean this Agreement, the First Amendment, the Second Amendment, the Third Amendment, the Guarantee, the Security Documents, each Letter of Credit Application, any Notes issued by the Borrower to a Lender under this Agreement and any other document, instrument or agreement (other than Secured Hedge Agreements or Secured Cash Management Agreements) now or hereafter delivered by or on behalf of a Credit Party under this Agreement.

(c) Section 1.1 of the Existing Credit Agreement is hereby amended by amending the definition of “Consolidated EBITDAX” by deleting the “and” before clause (a)(viii) thereof and inserting a new clause (a)(ix) as follows:

“and (ix) fees, costs and expenses and other transaction costs incurred in connection with the Petra Acquisition”

(d) Section 1.1 of the Existing Credit Agreement is hereby amended by amending the definition of “Consolidated Total Debt” by inserting a new clause (c) thereto as follows:

“minus (c) the Escrow Indebtedness Cash Amount outstanding on such date;”

(e) Section 1.1 of the Existing Credit Agreement is hereby amended by amending the definition of “Excess Cash” by replacing the “and” before clause (e) thereof with “,” and adding a new clause (f) as follows:

“and (f) prior to the consummation of the Petra Acquisition, cash constituting the net proceeds of Indebtedness incurred after the Third Amendment Effective Date and any Indebtedness incurred to Refinance such Indebtedness (plus, in each case, cash held or placed in escrow to pay interest that accrues on such Indebtedness) so long as (i) such Indebtedness is incurred in connection with, and in contemplation of, the consummation of the Petra Acquisition and (ii) the definitive documentation relating to such Indebtedness contains “special mandatory redemption” or escrow provisions (or other similar provisions) or otherwise requires such Indebtedness to be redeemed or prepaid if the Petra Acquisition is not consummated by a date specified in such definitive documentation (the net cash proceeds of the

Indebtedness under this clause (f) together with cash held or placed in escrow to pay interest thereon, the “Escrow Indebtedness Cash Amount”).”

(f) Section 10.10 of the Existing Credit Agreement is hereby amended by adding a proviso to the end of clause (f) thereof as follows:

“; provided, however, notwithstanding the foregoing volume limitation, Hedge Agreements entered into by Petra prior to the consummation of the Petra Acquisition in respect of purchased puts and floors not intended to be physically settled shall be permitted so long as the net notional volumes of all Hedge Agreements in respect of Hydrocarbons subject to this Section 10.10(f) do not exceed (when aggregated with the commodity Hedge Agreements of the Borrower and its Restricted Subsidiaries (other than Petra) then in effect, other than puts, floors and basis differential swaps on volumes already hedged pursuant to other Hedge Agreements), on a pro forma basis after giving effect to the Petra Acquisition, as of the date of the consummation of the Petra Acquisition, one hundred percent (100%) of the reasonably anticipated Hydrocarbon production of crude oil, natural gas and natural gas liquids, calculated separately, from the Credit Parties’ total Proved Reserves (after giving effect to the Petra Acquisition and as forecast based on the Borrower’s most recent Reserve Report and on Petra’s most recent reserve report) for the sixty (60) month period from the date of creation of such hedging arrangement, based on daily volumes on an annual basis.”

SECTION 3. Conditions Precedent.

The effectiveness of this Amendment is subject to satisfaction of each of the following conditions precedent:

3.1 Executed Amendment. The Administrative Agent shall have received counterparts of this Amendment duly executed by the Borrower, the other Credit Parties and Lenders constituting Required Lenders.

3.2 Other Deliverables. The Administrative Agent shall have received a certificate executed by an Authorized Officer of the Borrower certifying that (i) no Default or Event of Default has occurred that is continuing immediately prior to and after giving effect to this Amendment and (ii) each representation and warranty contained in Section 4 hereof shall be true and correct in all material respects, except that any such representations and warranties that are qualified by materiality shall be true and correct in all respects, and except to the extent such representations and warranties expressly relate to an earlier date, in which case such representations and warranties shall have been true and correct on and as of such earlier date.

3.3 Fees. The Borrower shall have paid or caused to be paid, to the extent payable under Section 13.5 of the Credit Agreement, all reasonable and documented out-of-pocket costs and expenses incurred in connection with the preparation, negotiation and execution of this Amendment and the other instruments and documents to be delivered hereunder, if any (including the reasonable and documented fees, disbursements and other charges of Latham & Watkins LLP, counsel for the Administrative Agent).

SECTION 4. Representations and Warranties.

In order to induce the Administrative Agent and the Lenders to enter into this Amendment, each of the Borrower and the other Credit Parties hereby represents and warrants to the Administrative Agent and the Lenders that:

4.1 Accuracy of Representations and Warranties. (a) Both immediately before and after giving effect to this Amendment, no Default or Event of Default has occurred and is continuing and (b) after giving effect to this Amendment, all representations and warranties made by each Credit Party contained herein or in the other Credit Documents shall be true and correct in all material respects with the same effect as though such representations and warranties had been made on and as of the Third Amendment Effective Date (expect where such representations and warranties expressly relate to an earlier date, in which case such representations and warranties shall have been true and correct in all material respects as of such earlier date and except that any representation and warranty that is qualified as to “materiality,” “Material Adverse Effect” or similar language shall be true and correct (after giving effect to any qualification therein) in all respects on such respective dates).

4.2 No Conflicts. None of the execution, delivery or performance by any Credit Party of this Amendment will (a) contravene any Requirement of Law, except to the extent such contravention would not reasonably be expected to result in a Material Adverse Effect, (b) result in any breach of any of the terms, covenants, conditions or provisions of, or constitute a default under, or result in the creation or imposition of (or the obligation to create or impose) any Lien upon any of the property or assets of such Credit Party or any of the Restricted Subsidiaries pursuant to the terms of any Contractual Requirement, except to the extent that such breach, default or Lien would not reasonably be expected to result in a Material Adverse Effect or (c) violate any provision of the Organization Documents of such Credit Party or any of the Restricted Subsidiaries.

4.3 Due Authorization. Each Credit Party has the corporate or other organizational power and authority to execute, deliver and carry out the terms and provisions of this Amendment, and has taken all necessary corporate or other organizational action to authorize the execution, delivery and performance of this Amendment, and has duly executed and delivered this Amendment.

4.4 Validity and Binding Effect. This Amendment constitutes the legal, valid and binding obligation of each Credit Party, enforceable in accordance with its terms, subject to the effects of bankruptcy, insolvency, fraudulent conveyance, reorganization and other similar laws relating to or affecting creditors’ rights generally and general principles of equity (whether considered in a proceeding in equity or law).

SECTION 5. Miscellaneous.

5.1 Confirmation and Effect. The provisions of the Credit Agreement (as amended by this Amendment) shall remain in full force and effect in accordance with its terms following the effectiveness of this Amendment, and this Amendment (except to the extent expressly set forth in Section 1 hereof) shall not constitute a waiver of any provision of the Credit Agreement or any

other Credit Document. Each reference in the Credit Agreement to “this Agreement”, “hereunder”, “hereof”, “herein”, or words of like import shall mean and be a reference to the Credit Agreement as amended hereby, and each reference to the Credit Agreement in any other document, instrument or agreement executed and/or delivered in connection with the Credit Agreement shall mean and be a reference to the Credit Agreement as amended hereby. This Amendment shall not constitute a novation of the Credit Agreement or any of the Loan Documents.

5.2 Ratification and Affirmation of Credit Parties. Each of the Credit Parties hereby expressly (i) acknowledges the terms of this Amendment, (ii) ratifies and affirms its obligations under the Guarantee, the Security Documents and the other Credit Documents to which it is a party, (iii) acknowledges, renews and extends its continued liability under the Guarantee, the Security Documents and the other Credit Documents to which it is a party and (iv) agrees that its guarantee under the Guarantee, the Security Documents and the other Credit Documents to which it is a party remains in full force and effect with respect to the Obligations as amended hereby.

5.3 Parties in Interest. All of the terms and provisions of this Amendment shall bind and inure to the benefit of the parties hereto and their respective successors and assigns.

5.4 Counterparts; Facsimile. This Amendment may be executed by one or more of the parties to this Amendment on any number of separate counterparts and all of said counterparts taken together shall be deemed to constitute one and the same instrument. A set of the copies of this Amendment signed by all the parties shall be lodged with the Borrower and the Administrative Agent. This Amendment may be validly delivered by facsimile or other electronic transmission of an executed counterpart of the signature page hereof. The words “execution,” “execute”, “signed,” “signature,” and words of like import in or related to any document to be signed in connection with this Amendment and the transactions contemplated hereby shall be deemed to include electronic signatures, the electronic matching of assignment terms and contract formations on electronic platforms approved by the Administrative Agent, or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act.

5.5 COMPLETE AGREEMENT. THIS AMENDMENT AND THE OTHER CREDIT DOCUMENTS REPRESENT THE AGREEMENT OF THE BORROWER, THE GUARANTORS, THE GRANTORS, THE COLLATERAL AGENT, THE ADMINISTRATIVE AGENT AND THE LENDERS WITH RESPECT TO THE SUBJECT MATTER HEREOF AND THEREOF, AND THERE ARE NO PROMISES, UNDERTAKINGS, REPRESENTATIONS OR WARRANTIES BY THE BORROWER, THE GUARANTORS, THE GRANTORS, ANY AGENT NOR ANY LENDER RELATIVE TO SUBJECT MATTER HEREOF NOT EXPRESSLY SET FORTH OR REFERRED TO HEREIN OR IN THE OTHER CREDIT DOCUMENTS.

5.6 Interpretation. Wherever the context hereof shall so require, the singular shall include the plural, the masculine gender shall include the feminine gender and the neuter and vice versa. The headings, captions and arrangements used in this Amendment are for convenience only,

shall not affect the interpretation of this Amendment, and shall not be deemed to limit, amplify or modify the terms of this Amendment, nor affect the meaning thereof.

5.7 Titles of Sections. All titles or headings to the sections or other divisions of this Amendment are only for the convenience of the parties and shall not be construed to have any effect or meaning with respect to the other content of such sections, subsections or other divisions, such other content being controlling as to the agreement between the parties hereto.

5.8 Severability. In case any one or more of the provisions contained in this Amendment shall for any reason be held to be invalid, illegal or unenforceable in any respect, such invalidity, illegality, or unenforceability shall not affect any other provision hereof, and this Amendment shall be construed as if such invalid, illegal, or unenforceable provision had never been contained herein.

5.9 Payment of Expenses. The Borrower agrees to pay or reimburse the Administrative Agent in accordance with Section 13.5 of the Credit Agreement for all of its reasonable and documented out-of-pocket costs and expenses incurred in connection with this Amendment, any other documents prepared in connection herewith and the transactions contemplated hereby, including, without limitation, the reasonable fees and disbursements of counsel to Administrative Agent.

5.10 Credit Documents. The Borrower acknowledges and agrees that this Amendment is a Credit Document.

5.11 Governing Law. THIS AMENDMENT AND THE RIGHTS AND OBLIGATIONS OF THE PARTIES HEREUNDER SHALL BE GOVERNED BY, AND CONSTRUED AND INTERPRETED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK.

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed by their respective authorized officers on the date and year first above written.

| | | | | | | | |

| BORROWER: | CALIFORNIA RESOURCES CORPORATION |

|

| |

| | |

| By: | /s/ Manuela Molina |

| Name: | Manuela Molina |

| Title: | Executive Vice President and Chief Financial Officer |

SIGNATURE PAGE

THIRD AMENDMENT – CALIFORNIA RESOURCES CORPORATION

| | | | | | | | |

| SUBSIDIARY GRANTORS: | CALIFORNIA RESOURCES COLES LEVEE, LLC CALIFORNIA RESOURCES ELK HILLS, LLC CALIFORNIA RESOURCES LONG BEACH, INC. CALIFORNIA RESOURCES PETROLEUM CORPORATION CALIFORNIA RESOURCES PRODUCTION CORPORATION CALIFORNIA RESOURCES REAL ESTATE VENTURES, LLC CALIFORNIA RESOURCES ROYALTY HOLDINGS, LLC CALIFORNIA RESOURCES TIDELANDS, INC. CALIFORNIA RESOURCES WILMINGTON, LLC CRC CONSTRUCTION SERVICES, LLC CRC MARKETING, INC. CRC SERVICES, LLC SOCAL HOLDING, LLC SOUTHERN SAN JOAQUIN PRODUCTION, INC. THUMS LONG BEACH COMPANY TIDELANDS OIL PRODUCTION COMPANY LLC CALIFORNIA HEAVY OIL, INC. ELK HILLS POWER, LLC EHP TOPCO HOLDING COMPANY, LLC EHP MIDCO HOLDING COMPANY, LLC |

|

| |

| | |

| By: | /s/ Manuela Molina |

| Name: | Manuela Molina |

| Title: | Executive Vice President and Chief Financial Officer |

| | | | | | | | |

| CALIFORNIA RESOURCES COLES LEVEE, L.P. |

|

| |

| | |

| By: | /s/ Manuela Molina |

| Name: | Manuela Molina |

| Title: | Executive Vice President and Chief Financial Officer of California Resources Coles Levee, LLC, its General Partner |

SIGNATURE PAGE

THIRD AMENDMENT – CALIFORNIA RESOURCES CORPORATION

| | | | | | | | |

| CITIBANK, N.A., as Administrative Agent and as Collateral Agent |

|

| |

| | |

| By: | /s/ Jeff Ard |

| Name: | Jeff Ard |

| Title: | Vice President |

| | | | | | | | |

| CITIBANK, N.A., as a Lender |

|

| |

| | |

| By: | /s/ Jeff Ard |

| Name: | Jeff Ard |

| Title: | Vice President |

SIGNATURE PAGE

THIRD AMENDMENT – CALIFORNIA RESOURCES CORPORATION

| | | | | | | | |

| KEYBANK, NATIONAL ASSOCIATION as a Lender |

|

| |

| | |

| By: | /s/ George McKean |

| Name: | George McKean |

| Title: | Senior Vice President |

SIGNATURE PAGE

THIRD AMENDMENT – CALIFORNIA RESOURCES CORPORATION

| | | | | | | | |

| MUFG BANK, LTD. as a Lender |

|

| |

| | |

| By: | /s/ Kevin Sparks |

| Name: | Kevin Sparks |

| Title: | Director |

SIGNATURE PAGE

THIRD AMENDMENT – CALIFORNIA RESOURCES CORPORATION

| | | | | | | | |

| MIZHUO BANK, LTD., as a Lender |

|

| |

| | |

| By: | /s/ Edward Sacks |

| Name: | Edward Sacks |

| Title: | Executive Director |

SIGNATURE PAGE

THIRD AMENDMENT – CALIFORNIA RESOURCES CORPORATION

| | | | | | | | |

| ROYAL BANK OF CANADA, as a Lender |

|

| |

| | |

| By: | /s/ Michael Sharp |

| Name: | Michael Sharp |

| Title: | Authorized Signatory |

SIGNATURE PAGE

THIRD AMENDMENT – CALIFORNIA RESOURCES CORPORATION

| | | | | | | | |

| THE TORONTO-DOMINION BANK, NEW YORK BRANCH, as a Lender |

|

| |

| | |

| By: | /s/ Evans Swann |

| Name: | Evans Swann |

| Title: | Authorized Signatory |

SIGNATURE PAGE

THIRD AMENDMENT – CALIFORNIA RESOURCES CORPORATION

| | | | | | | | |

| DEUTSCHE BANK AG NEW YORK BRANCH as a Lender |

| | |

| | |

| By: | /s/ Laureline de Lichana |

| Name: | Laureline de Lichana |

| Title: | Director |

|

| |

| | |

| By: | /s/ Prashant Mehra |

| Name: | Prashant Mehra |

| Title: | Managing Director |

SIGNATURE PAGE

THIRD AMENDMENT – CALIFORNIA RESOURCES CORPORATION

| | | | | | | | |

| TRI COUNTIES BANK, as a Lender |

|

| |

| | |

| By: | /s/ Aytom Salomon |

| Name: | Aytom Salomon |

| Title: | SVP, Commercial Division Manager & Market President |

SIGNATURE PAGE

THIRD AMENDMENT – CALIFORNIA RESOURCES CORPORATION

| | | | | | | | |

| GOLDMAN SACHS BANK USA, as a Lender |

|

| |

| | |

| By: | /s/ Priyankush Goswami |

| Name: | Priyankush Goswami |

| Title: | Authorized Signatory |

SIGNATURE PAGE

THIRD AMENDMENT – CALIFORNIA RESOURCES CORPORATION

| | | | | | | | |

| JEFFERIES FINANCE LLC, as a Lender |

|

| |

| | |

| By: | /s/ John Koehler |

| Name: | John Koehler |

| Title: | Managing Director |

SIGNATURE PAGE

THIRD AMENDMENT – CALIFORNIA RESOURCES CORPORATION

| | | | | | | | |

| MORGAN STANLEY SENIOR FUNDING INC., as a Lender |

|

| |

| | |

| By: | /s/ Aaron McLean |

| Name: | Aaron McLean |

| Title: | Vice President |

SIGNATURE PAGE

THIRD AMENDMENT – CALIFORNIA RESOURCES CORPORATION

| | | | | | | | |

| MACQUARIE BANK LIMITED, as a Lender |

| | |

| | |

| By: | /s/ Gabriel Apsan |

| Name: | Gabriel Apsan |

| Title: | Executive Director |

|

| |

| | |

| By: | /s/ Robert Howarth |

| Name: | Robert Howarth |

| Title: | Associate Director |

SIGNATURE PAGE

THIRD AMENDMENT – CALIFORNIA RESOURCES CORPORATION

| | | | | | | | |

| BP ENERGY COMPANY, as a Lender |

|

| |

| | |

| By: | /s/ Will Shappley |

| Name: | Will Shappley |

| Title: | Vice President |

SIGNATURE PAGE

THIRD AMENDMENT – CALIFORNIA RESOURCES CORPORATION

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

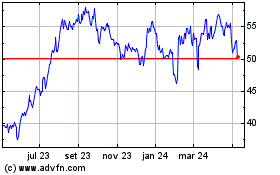

California Resources (NYSE:CRC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

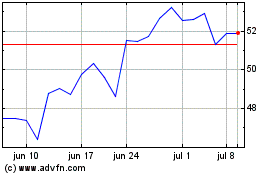

California Resources (NYSE:CRC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024