0000920371PRE 14AFALSE00009203712023-01-012023-12-31iso4217:USDiso4217:USDxbrli:shares00009203712022-01-012022-12-3100009203712021-01-012021-12-3100009203712020-01-012020-12-310000920371ecd:PeoMemberssd:AdjForGrantDateFairValuesOfStockAwardsGrantedInApplicableYearMember2023-01-012023-12-310000920371ssd:AdjForFairValueOfStockOptionAwardsGrantedInCurrentYearOutstandingAndUnvestedMemberecd:PeoMember2023-01-012023-12-310000920371ssd:AdjForChangesInFairValueFromPriorYearToApplicableYearOfAwardsGrantedInPriorYearThatAreOutstandingAndUnvestedMemberecd:PeoMember2023-01-012023-12-310000920371ssd:AdjForFairValueOfAwardsGrantedInPriorYearAsToWhichVestingConditionsFailedToBeMetDuringApplicableYearMemberecd:PeoMember2023-01-012023-12-310000920371ecd:PeoMember2023-01-012023-12-310000920371ecd:NonPeoNeoMemberssd:AdjForGrantDateFairValuesOfStockAwardsGrantedInApplicableYearMember2023-01-012023-12-310000920371ecd:NonPeoNeoMemberssd:AdjForChangeInActuarialPresentValueOfPensionBenefitsMember2023-01-012023-12-310000920371ecd:NonPeoNeoMemberssd:AdjForPensionServiceCostMember2023-01-012023-12-310000920371ecd:NonPeoNeoMemberssd:AdjForFairValueOfStockOptionAwardsGrantedInCurrentYearOutstandingAndUnvestedMember2023-01-012023-12-310000920371ecd:NonPeoNeoMemberssd:AdjForChangesInFairValueFromPriorYearToApplicableYearOfAwardsGrantedInPriorYearThatAreOutstandingAndUnvestedMember2023-01-012023-12-310000920371ecd:NonPeoNeoMemberssd:AdjForFairValueOfAwardsGrantedInPriorYearAsToWhichVestingConditionsFailedToBeMetDuringApplicableYearMember2023-01-012023-12-310000920371ecd:NonPeoNeoMember2023-01-012023-12-31000092037112023-01-012023-12-31000092037122023-01-012023-12-31000092037132023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | | | | | | | |

| ☒ | | | Preliminary Proxy Statement |

☐ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ | | | Definitive Proxy Statement |

☐ | | | Definitive Additional Materials |

☐ | | | Soliciting Material Pursuant to §240.14a-12 |

| | |

| Simpson Manufacturing Co., Inc. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | | | No fee required. |

☐ | | | Fee paid previously with preliminary materials. |

☐ | | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Letter to Stockholders

| | | | | | | | | | | |

| To Our Fellow Stockholders: | | Thank you for your continued investment in Simpson Manufacturing Co., Inc. (the “Company”, “Simpson”, “we” or “us”). We cordially invite you to attend Simpson’s 2024 Annual Meeting of Stockholders (the “Annual Meeting”), to be held virtually, via live webcast at www.virtualshareholdermeeting.com/SSD2024, at 10:00 a.m., Pacific Daylight Time, on Wednesday, May 1, 2024. Stockholders attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting. Further information on attending, voting, and submitting questions at the Annual Meeting are included in the accompanying Notice of Annual Meeting and Proxy Statement.

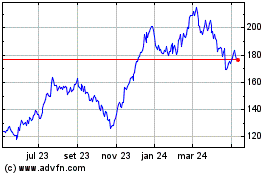

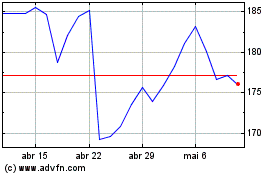

Despite a challenging combination of high housing prices, rising interest rates, and lowered housing starts compared to the prior year, our industry position and growth strategies continued to deliver above-market growth and strong profitability in 2023 and we remain committed to positioning Simpson to continue this growth over the long-term. To this end, in 2023 we achieved consolidated full-year net sales of approximately $2.2 billion, and produced strong earnings of $8.26 per diluted share. In addition, we delivered on nearly every target we had set as part of our 2023 initiatives, strengthened our position in the end markets of residential, component manufacturers, national retail, and Europe with the ongoing integration of ETANCO.

Our Proxy Statement is an opportunity to reflect on the Company’s performance, highlight the strengths and efforts of our Board and provide transparency into our corporate governance, sustainability and executive compensation practices. Our Board has a long-standing history of being overseen by independent directors with a diverse set of skills and experiences. We are very proud that 7 out of 8 directors will be independent and 37.5% of our directors will be female if all of the Board nominees are elected at the Annual Meeting.

The accompanying Proxy Statement further highlights key activities and accomplishments in 2023 and contains information on the matters that we are seeking your vote at the Annual Meeting. On behalf of the Board, our executive management team, and the entire Simpson organization, thank you for your continued interest and support. Sincerely yours, |

| | |

| | Mike Olosky President and Chief Executive Officer | James Andrasick Independent Chair of the Board |

| | March [•], 2024 |

| | |

| | Your vote is important. Whether or not you plan to attend the meeting, please take a few minutes now to vote your shares. |

| | | | | |

| Simpson Manufacturing Co., Inc. – 2024 Proxy Statement | i |

Notice of 2024 Annual Meeting of Stockholders

| | | | | | | | | | | |

Date Wednesday, May 1, 2024 | | Record Date and Voting You are entitled to vote at the Simpson Manufacturing Co., Inc. (the “Company,” “Simpson,” “we” or “us”) 2024 Annual Meeting of Stockholders, and any adjournment or postponement thereof (the “Annual Meeting”) if you were a stockholder of record at the close of business on March 4, 2024 (the “Record Date”). Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on at the Annual Meeting. There were 42,441,160 shares of our common stock outstanding on the Record Date. |

| | |

Time 10:00 a.m., Pacific Daylight Time | | Items of Business |

| |

| 1 | To elect eight members to our Board of Directors, for terms expiring in 2025. |

| | |

| 2 | To approve, on an advisory basis, named executive officer compensation. |

| | | |

Place www.virtualshare holdermeeting .com/SSD2024 | | 3 | To approve an amendment to the Company’s Certificate of Incorporation to adopt provisions limiting the liability of certain officers as permitted by Delaware law. |

| | |

| 4 | To ratify our Audit and Finance Committee’s appointment of Grant Thornton LLP as our independent registered public accounting firm for the year ending December 31, 2024. |

| | | |

| | 5 | To transact such other business that properly comes before the meeting or any adjournment thereof. |

Record Date March 4, 2024 | | | |

| | |

| Notice and Access Instead of mailing a printed copy of our proxy materials, including our Annual Report to Stockholders and Annual Report on Form 10-K, to each stockholder of record, we are providing access to these materials via the Internet. This reduces the amount of paper necessary to produce these materials, as well as the costs associated with mailing these materials to all stockholders. Accordingly, on March [•], 2024, we will begin mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to all stockholders of record as of the Record Date, and post our proxy materials on the website referenced in the Notice (www.proxyvote.com). As more fully described in the Notice, all stockholders may choose to access our proxy materials on the website referred to in the Notice and/or may request a printed set of our proxy materials. In addition, the Notice and website provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. Attending the Annual Meeting Attend the Annual Meeting virtually and follow the instructions on the website. See page 75 “Questions and Answers About the Annual Meeting of Stockholders and Voting” for details. |

| | | | | |

ii | Simpson Manufacturing Co., Inc. – 2024 Proxy Statement |

| | |

| Notice of 2024 Annual Meeting of Stockholders |

| | | | | | | | | | | | | | |

| | Proxy Voting Whether or not you plan to attend the meeting, it is important that your shares are represented and voted. We encourage you to vote before the meeting by returning your proxy card or voting via the internet or by telephone. |

| | |

| | | | |

| | By Internet www.proxyvote.com | By Telephone Toll-free 1-800-690-6903 | By Mail Follow instructions on your proxy card |

| | | | |

| | |

| | The Proxy Statement, Annual Report to Stockholders and Annual Report on Form 10-K are available on the Internet at www.proxyvote.com. The following information applicable to the Annual Meeting may be found in the Proxy Statement and accompanying proxy card: •The date, time and location of the Annual Meeting; •A list of the matters intended to be acted on and our board’s recommendations regarding those matters; •Any control/identification numbers that you need to access your proxy card; and •Information about attending and voting at the Annual Meeting. By Order of the Board of Directors, Cari Fisher Corporate Secretary March [], 2024 |

| | |

| | Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on May 1, 2024. |

| | | | | |

| Simpson Manufacturing Co., Inc. – 2024 Proxy Statement | iii |

Table of Contents

| | | | | |

| Notice of 2024 Annual Meeting of Stockholders | |

| |

| Proxy Summary | |

| Directors Skills and Experience | |

| Corporate Governance Highlights | |

| Corporate Social Responsibility Highlights | |

| Recent Leadership Changes | |

| 2023 Executive Compensation Highlights | |

| |

| Corporate Governance | |

| |

| Item 1: Election of Directors | |

| Election Process | |

| 2024 Nominees | |

| Director Qualifications | |

| Director Independence | |

| Director Nominations | |

| |

| The Board's Role and Responsibilities | |

| The Board’s Role in Risk Management and ESG Oversight | |

| Board and Committees Risk Oversight Responsibilities | |

| Director Orientation and Education | |

| Board and Committee Evaluations | |

| Sustainability and Environmental and Social Responsibility | |

| Communications with the Board | |

| Political Activities and Contributions | |

| Board Leadership Structure | |

| Executive Sessions | |

| Board of Directors and Its Committees | |

| Restrictions on Hedging and Pledging Arrangements for All Employees and Directors | |

| Board Committees | |

| Compensation Committee Interlocks and Insider Participation | |

| Compensation Consultant | |

| Involvement in Certain Legal Proceedings | |

| Related-Party Transactions | |

| Compensation of Directors | |

| 2023 Director Compensation Table | |

| | | | | |

iv | Simpson Manufacturing Co., Inc. – 2024 Proxy Statement |

| | | | | |

| Item 2: Advisory Vote To Approve Named Executive Officer Compensation | |

| Executive Officer Profiles | |

| |

| Compensation Discussion & Analysis | |

| Executive Summary | |

| NEO Compensation Program Design | |

| Executive Compensation Analysis | |

| Comparative Market Information in the Executive Compensation-Setting Process | |

| Compensation Committee Report | |

| |

| Executive Compensation Tables | |

| 2023 Summary Compensation Table | |

| 2023 Grants of Plan-Based Awards | |

| Outstanding Equity Awards at 2023 Fiscal Year End | |

| 2023 Option Exercises and Stock Vested | |

| Pension Benefits | |

| 2023 Non-Qualified Deferred Compensation Plans | |

| Potential Payments Upon Termination or Change in Control | |

| CEO Pay Ratio | |

| Pay Versus Performance | |

| |

| Item 3: Approval of an Amendment to the Company’s Certificate of Incorporation to Adopt Provisions Limiting the Liability of Certain Officers as Permitted by Delaware Law | |

| Proposed Charter Amendment | |

| |

| Item 4: Ratification of Appointment of Independent Registered Public Accounting Firm for Year Ending December 31, 2024 | |

| Audit and Finance Committee Evaluation | |

| Report of the Audit and Finance Committee | |

| Principal Accounting Fees and Services | |

| |

| Stock Ownership Information | |

| Security Ownership of Directors and Executive Officers | |

| Security Ownership of Certain Beneficial Owners | |

| Delinquent Section 16(a) Reports | |

| Equity Compensation Plan Information | |

| |

| Other Information | |

| Questions and Answers About the Annual Meeting of Stockholders and Voting | |

| Stockholders’ Proposals | |

| |

| Appendix A - Amendment to Certificate of Incorporation | |

| | | | | |

| Simpson Manufacturing Co., Inc. – 2024 Proxy Statement | v |

Proxy Summary

| | | | | | | | | | | | | | | | | | | | | | | |

Date Wednesday, May 1, 2024 Time 10:00 a.m., Pacific Daylight Time Place www.virtualshare holdermeeting .com/SSD2024 Record Date March 4, 2024 | | This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully. As used in this Proxy Statement, unless the context otherwise indicates or requires, references to “Simpson,” the “Company,” “we,” “us,” and “our” mean Simpson Manufacturing Co., Inc. and its consolidated subsidiaries. We will first send and/or make available this Proxy Statement and the form of proxy for our 2024 Annual Meeting of Stockholders (the “Annual Meeting”) to our stockholders on or about March [], 2024. |

|

| How to Vote |

|

| | |

By Internet www.proxyvote.com | By Telephone Toll-free 1-800-690-6903 | By Mail Follow instructions on your proxy card |

| | |

|

| Matters to be Voted On | |

| Voting Recommendation | Page

Reference |

| 1 | the election of each director nominee | “FOR” | 9 |

|

| 2 | the advisory vote to approve named executive officer compensation | “FOR” | 31 |

|

| 3 | the approval of an amendment to the Company’s Certificate of Incorporation to adopt provisions limiting the liability of certain officers as permitted by Delaware law. | “FOR” | 68 |

|

| 4 | the ratification of our Audit and Finance Committee’s appointment of Grant Thornton LLP as our independent registered public accounting firm for the year ending December 31, 2024. | “FOR” | 69 |

| | |

Performance Highlights

| | | | | |

| Simpson Manufacturing Co., Inc. – 2024 Proxy Statement | 1 |

| | | | | | | | | | | | | | | | | |

| | | | |

| Item 1: Election of Directors | | | The Board of Directors (the “Board”) has nominated eight nominees, for one year terms expiring in 2025, and recommends that stockholders vote for each nominee based on their specific background, experience, qualifications, attributes and skills. The Board recommends a vote FOR each director nominee. Page 9 |

| | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Director Nominees | | | | | | | |

| | | Age | Director Since | Committees | Other Current Public Company Boards |

| | | | | | |

| | | | | | |

| | James S. Andrasick Independent Non-Executive Chair of the Board, Former Chief Executive Officer of Matson Navigation Company, Inc. | 79 | 2012 | •Audit and Finance •Compensation and Leadership Development •Corporate Strategy and Acquisitions •Nominating and ESG | None |

| | | | | | |

| | | | | | |

| | Chau Banks Independent Chief Information and Data Officer of The Clorox Company | 54 | 2023 | •Audit and Finance •Compensation and Leadership Development | None |

| | | | | | |

| | | | | | |

| | Felica Coney Independent Vice President, Global Server Operations of Google, Inc. | 53 | 2023 | •Audit and Finance •Corporate Strategy and Acquisitions | None |

| | | | | | |

| | | | | | |

| | Gary M. Cusumano Independent Retired Chairman, Chief Executive Officer and President of The Newhall Land and Farming Company | 80 | 2007 | •Compensation and Leadership Development Chair •Corporate Strategy and Acquisitions | None |

| | | | | | |

| | | | | | |

| | Philip E. Donaldson Independent Executive Vice President & Chief Financial Officer of Andersen Corporation | 62 | 2018 | •Audit and Finance Chair •Corporate Strategy and Acquisitions | None |

| | | | | |

| | | | | | |

| | Celeste Volz Ford Independent Board Chair and Founder of Stellar Solutions | 67 | 2014 | •Audit and Finance •Corporate Strategy and Acquisitions Chair | None |

| | | | | |

| | | | | | |

| | Kenneth D. Knight Independent President and Chief Executive Officer of Invitae Corporation | 63 | 2021 | •Audit and Finance •Nominating and ESG | Invitae Corporation |

| | | | | |

| | | | | | |

| | Michael Olosky President and Chief Executive Officer, Simpson Manufacturing Co., Inc. | 55 | 2023 | •Corporate Strategy and Acquisitions | None |

| | | | | | | |

| | | | | | | |

| | | We believe our Board is appropriately refreshed, and our directors bring a balance of experience and fresh perspectives. |

| | | | | |

2 | Simpson Manufacturing Co., Inc. – 2024 Proxy Statement |

| | | | | | | | |

| | Directors Skills and Expertise |

| | |

Average Age 65 Average Tenure 7.1 Years Independence 88% | | The Board is comprised of directors with strong professional reputations, skills and experience in established companies and other organizations of comparable status and size to us and/or in areas or industries relevant to our business, strategy and operations. Core skills, experiences, and statistics for each of our director nominees are included in the summary graphics below. The current composition of the Board and its director nominees reflect director-selection criteria developed by the Nominating and ESG Committee to address our needs and priorities.

This past year, the Nominating and ESG Committee engaged with Heidrick & Struggles to refresh its method of reviewing and evaluating Board skills in an effort to (i) develop a more robust skills matrix that reflects each individual’s strengths and expertise and (ii) better communicate to stockholders the key qualifications that each director nominee brings to the Board. Further discussion on the qualifications and experience of director nominees is included in the “2024 Nominees” section of this Proxy Statement. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Gender Diversity | Racial Diversity | Board Tenure | |

| | | | | | | | | |

| | | | | | | | | | | |

| Board Skills | |

| | Olosky | Andrasick | Banks | Coney | Cusumano | Donaldson | Ford | Knight | |

| Financial Expertise | | n | | | | n | | | |

| Public Company CEO Experience | n | n | | | n | | | n | |

| Innovation and Business Transformation | n | | n | n | | n | n | n | |

| Building Industry | n | | | | n | n | | | |

| Public Company Executive Leadership and/or Corporate Governance | n | n | n | n | n | n | n | n | |

| Manufacturing | n | | n | n | | n | | n | |

| M&A/Strategic Transactions | n | n | | | | n | n | n | |

| Technology Expertise | n | | n | n | | n | n | | |

| International Perspective | n | n | | n | | | | n | |

| Customer Experience and Brand Management | n | | | | | n | n | n | |

| Supply Chain/Logistics | n | n | | n | | | n | n | |

| Human Capital/Talent Mgmt. | n | | | | | | | n | |

| Enterprise Risk Mgmt. | n | | n | | | n | | n | |

| Sustainability and Environmental | | | | n | | | n | | |

| | | | | | | | | | | |

| n Directors with experience in each category | |

| n Experience that qualifies but falls outside of the defined temporal range | |

| * Statistics above are for director nominees, and do not include Ms. Chatman or Ms. MacGillivray. ** Average Age and Average Tenure are for nonemployee director nominees, and do not include Ms. Chatman, Ms. MacGillivray or Mr. Olosky. |

| | | | | |

| Simpson Manufacturing Co., Inc. – 2024 Proxy Statement | 3 |

Corporate Governance Highlights

Our Board has implemented policies and structures that we believe are among the best practices in corporate governance. The Corporate Governance section of this Proxy Statement beginning on page 8 describes our governance framework, which includes the following:

Current Board and Governance Information

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| 10 | | | 9 | | | 6 | | | 99% | |

| Size of Board | | | Number of Independent Directors | | | Board Meetings Held in 2023 | | | Attendance at all Board and Committee Meetings Held in 2023 | |

| | | | | | | | | | | |

Recent Board Composition and Governance Changes

In June 2023, Chau Banks and Felica Coney were appointed to the Board in anticipation of Jennifer Chatman and Robin MacGillivray not standing for re-election at the 2024 Annual Meeting of Stockholders.

In January 2024, in connection with the Company’s regular Board and Committee composition review and rotation plan and based on the recommendation of the Nominating and ESG Committee, the Board elected Phil Donaldson to serve as Chair of the Board, effective May 1, 2024, subject to his re-election to the Board at the Annual Meeting. Mr. Andrasick, our current Chair, will continue to serve as a director on the Board, also subject to his re-election at the Annual Meeting.

Our Corporate Governance Policies Are Among Best Practices

We are committed to maintaining the highest standards of corporate governance. The Board has built a strong and effective governance framework, which has been designed to promote the long-term interests of stockholders and support Board and management accountability.

| | | | | |

Majority Vote Standard for Uncontested Director Elections | Annual Board and Committee Self-Evaluations and Review of Director Qualifications |

Annual Election of All Directors | Executive Sessions of Independent Directors Regularly Held at Scheduled Board Meetings, and Directors Meet Periodically Throughout the Year with Individual Members of Management |

Separation of Chair and CEO | 99% Attendance of Incumbent Directors at Board and Committee Meetings |

Seven of Eight Director Nominees Are Independent | Audit and Finance, Compensation and Leadership Development, and Nominating and ESG Committee Members Are All Independent |

Corporate Social Responsibility Highlights

We have established deeply rooted core values that define our business. Our founder, Barclay Simpson, outlined nine essential attributes for company and employee success. Those “Nine Principles of Business” are our company values, and we continue to uphold them.

At the forefront of these values is doing what is right for our employees’ safety and well-being, as well as for our customers, communities and environment. We honor the Nine Principles of Business through our involvement in our local communities and efforts to help protect our environment.

| | | | | |

4 | Simpson Manufacturing Co., Inc. – 2024 Proxy Statement |

•At the management level, the ESG Steering Committee provides oversight of companywide ESG strategy and performance

•Our Nominating and ESG Committee provides Board-level oversight of our ESG performance

•We continuously review our energy, water and waste usage to determine capacity for improvement

•More than 500 North American employees participated in various charitable activities benefiting individuals and families

•UN Sustainable Development Goals assessment provides insight into our alignment with societal goals

•We produce a SASB Index to provide stakeholders with our performance on materials topics

| | | | | | | | | | | | | | | | | |

| | | | |

| Item 2: Advisory Vote to Approve Named Executive Officer Compensation | | | We recommend that you review our executive compensation disclosure, including the Compensation Discussion & Analysis beginning on page 34, which explains in greater detail the philosophy of the Compensation and Leadership Development Committee and its actions and decisions in 2023 regarding our named executive officer compensation programs. While the outcome of this proposal is non-binding, the Board and Compensation and Leadership Development Committee consider the outcome of the vote when making future compensation decisions. The Board recommends a vote FOR this proposal. Page 31 |

| | | |

| | | |

Recent Leadership Changes

As previously disclosed, effective January 1, 2023, following the appointment of Michael Olosky as President and Chief Executive Officer (“CEO”), the executive officers were as follows:

•Mike Olosky, President and Chief Executive Officer

•Brian Magstadt, Chief Financial Officer and Treasurer

•Michael Andersen, Executive Vice President, Europe

•Phil Burton, Executive Vice President, North America

•Roger Dankel, Executive Vice President, North American Sales

•Jeremy Gilstrap, Executive Vice President, Innovation

•Jennifer Lutz, Executive Vice President, Human Resources

•Kevin Swartzendruber, Senior Vice President, Finance

In October 2023, we announced that Kevin Swartzendruber, Senior Vice President, Finance, intended to retire effective March 1, 2024, and that retirement has occurred.

Effective December 1, 2023, Cassandra Payton was appointed as Executive Vice President, General Counsel.

2023 Executive Compensation Highlights

Below we highlight certain of our executive compensation policies and practices, including both those which we utilize to drive performance and those which we prohibit because we do not believe they would serve our stockholders’ long-term interests.

Executive Compensation Summary

Compensation Philosophy

Simpson’s executive compensation philosophy emphasizes pay-for-performance. Our philosophy is to provide executive compensation opportunities that are competitively positioned in light of appropriate

| | | | | |

| Simpson Manufacturing Co., Inc. – 2024 Proxy Statement | 5 |

comparative market data for companies similar to us in terms of revenue size and industry. Our incentive plans are designed to reward strong performance, with greater compensation paid when performance exceeds expectations and less compensation paid when performance falls below expectations. Thus, the actual compensation realized by our Named Executive Officers (“NEOs”) will be commensurate with the Company’s actual performance.

Our Compensation and Leadership Development Committee regularly reviews our executive compensation program’s components, targets and payouts to support the strength of our pay-for-performance alignment. Our performance is evaluated against both short-term goals, which support Simpson’s business strategy, and long-term goals, which measure the creation of sustainable stockholder value.

Executive Compensation Key Policies and Practices

| | | | | | | | | | | | | | |

| Competitive Target Total Compensation Versus Market Competitive Levels | | Executive Officer Stock Ownership Guidelines and Stock Holding Policy | |

| Independent Consultant Retained by the Compensation and Leadership Development Committee | | Executive Compensation Clawback Policy | |

| “Double-Trigger” Change-in-Control Treatment for Long-Term Compensation Awards | | Directors and Executive Officers Prohibited from Hedging or Pledging of Common Stock | |

| Payout Caps on Incentive Awards | | Annual Review of Risk Related to Compensation Programs | |

| Compensation Programs that Emphasize Pay and Performance Alignment | | Annual Say on Pay Vote | |

At our 2023 Annual Meeting of Stockholders, Simpson again received strong support for its NEO compensation programs, with over 99.5% of votes cast approving, on an advisory basis, our NEO compensation. In 2023, as in prior years, the Compensation and Leadership Development Committee considered input from our stockholders and other stakeholders as part of its annual review of Simpson’s executive compensation program.

Please see the “Compensation Discussion & Analysis” section in this Proxy Statement for a detailed description of our NEO compensation programs.

Compensation Risk Assessment

As part of its oversight of the Company’s executive compensation program, the Compensation and Leadership Development Committee reviews and considers any potential risk implications created by compensation. The Compensation and Leadership Development Committee believes that the executive compensation program is designed with the appropriate balance of risk and reward in relation to the Company’s overall business strategy and that the balance of compensation elements does not encourage excessive risk taking. The Compensation and Leadership Development Committee will continue to consider compensation risk implications, as appropriate, in designing any new executive compensation components. In connection with its ongoing risk assessment, the Compensation and Leadership Development Committee notes the following attributes of the executive compensation program:

•the balance between fixed and variable compensation, short- and long-term compensation, and cash and equity payouts;

•the alignment of long-term incentives with selected performance measures that consider peer performance expectations and reflect the Company’s historical results, business plan and its financial and operational goals;

| | | | | |

6 | Simpson Manufacturing Co., Inc. – 2024 Proxy Statement |

•the placement of a significant portion of executive pay “at risk” and dependent upon the achievement of specific corporate performance goals with verifiable results, with pre-established threshold, target and maximum payment levels;

•the Company’s compensation recovery policy, which applies to performance-based cash and performance-based equity compensation paid to executive officers and other recipients;

•the balance between risks and benefits of compensation as related to attracting and retaining executives and other senior leaders;

•the Company’s executive stock ownership guidelines, which align the interests of the executive officers with those of the Company’s stockholders; and

•regular review of the executive compensation program by an independent compensation consultant.

The Compensation and Leadership Development Committee also has oversight over the Company’s responsibility to review significant Company compensation policies and procedures, including the incentives that they create, to assess risk. At the Compensation and Leadership Development Committee’s direction, the Company’s Human Resources Department, in partnership with Meridian, the Compensation and Leadership Development Committee’s independent consultant, annually conducts a risk assessment of the Company’s compensation programs. Based on the most recent assessment, management has concluded that the compensation policies and practices of the Company and its subsidiaries for employees do not create risks that are reasonably likely to have a material adverse effect on the Company, and management has presented the results of its assessment to the Compensation and Leadership Development Committee.

| | | | | | | | | | | | | | | | | |

| | | | |

| Item 3: Approval of an Amendment to the Company’s Certificate of Incorporation to Adopt Provisions Limiting the Liability of Certain Officers Permitted By Delaware Law | | | Since August 1, 2022, a Delaware corporation is permitted to extend the exculpation provisions under Section 102(b)(7) of the Delaware General Corporation Law (the “DGCL”) to cover certain executive officers, in addition to directors (the “Officer Exculpation”). The Board has determined that it is in the best interests of the Company and its stockholders to amend the Company’s Certificate of Incorporation, as amended, (our “Charter”) to provide for such Officer Exculpation. The Board recommends a vote FOR this proposal. Page 68 |

| | |

| | |

| | | | | |

| | | | | | | | | | | | | | | | | |

| | | | |

| Item 4: Ratification of Appointment of Grant Thorton LLP as Auditors | | | Our Board has ratified our Audit and Finance Committee’s appointment of Grant Thornton LLP as Simpson’s independent registered public accounting firm for the year ending December 31, 2024, and, as a matter of good governance, we are seeking stockholder ratification of that appointment. The Board recommends a vote FOR this proposal. Page 69 |

| | | |

| | | | | |

| Simpson Manufacturing Co., Inc. – 2024 Proxy Statement | 7 |

Corporate Governance

Introduction

Our Board maintains a strong commitment to corporate governance and has implemented policies and procedures that we believe are among the best practices in corporate governance.

We maintain a corporate governance section on our website which contains copies of our principal governance documents. The corporate governance section, which may be found at www.ir.simpsonmfg.com under “Investor Relations - Corporate Governance,” includes, among others, the following documents:

•Anti Hedging and Anti Pledging Policy

•Audit and Finance Committee Charter

•Code of Business Conduct and Ethics

•Compensation and Leadership Development Committee Charter

•Compensation Recovery Policy

•Corporate Governance Guidelines

•Corporate Strategy and Acquisitions Committee Charter

•Nominating and ESG Committee Charter

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Board Independence | | Board Expertise | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| 7 | Independent Directors | | | 2 | Financial Experts on Audit Committee | | |

| | |

| Gender Diversity | | Racial Diversity | |

| | | | | | | | | | | | | | | | | | | | |

| Board Tenure | |

| | | | | | | | | | | | | | | | | | | | |

|

| * Statistics above are for director nominees, and do not include Ms. Chatman or Ms. MacGillivray. |

| | | | | |

8 | Simpson Manufacturing Co., Inc. – 2024 Proxy Statement |

Item 1: Election of Directors

Unless otherwise directed, the persons named as proxies on the enclosed proxy card intend to vote “FOR” the election of each of the nominees. If any nominee should become unavailable for election, the shares will be voted for such substitute nominee as may be proposed by our Board. However, we are not aware of any circumstances that would prevent any of the nominees from serving.

Election Process

Our Charter provides that all directors shall be elected annually for a term expiring at the next succeeding annual meeting of stockholders or until their respective successors are duly elected and qualified. Accordingly, on the recommendation of our Nominating and ESG Committee, our Board nominates James Andrasick, Chau Banks, Felica Coney, Gary Cusumano, Philip Donaldson, Celeste Volz Ford, Kenneth Knight, and Michael Olosky who will stand for election as directors at this year’s Annual Meeting, each for a term extending until our 2025 Annual Meeting of Stockholders. All director nominees are current directors of the Company who were previously elected by stockholders, except for Chau Banks and Felica Coney, who were appointed to the Board effective June 1, 2023.

2024 Nominees

In nominating individuals to become members of the Board, the Nominating and ESG Committee considers the experience, qualifications, attributes and skills of each potential member. Each nominee brings a strong and unique background and set of skills to the Board, giving the Board, as a whole, competence and experience in a wide variety of areas.

The Nominating and ESG Committee and the Board considered the following information, including the specific experience, qualifications, attributes or skills of each individual, in concluding each was an appropriate nominee to serve as a member of our Board for the term commencing at the Annual Meeting (ages are as of March 8, 2024).

| | | | | | | | |

| | |

| Our Board of Directors recommends that stockholders vote “FOR” each of the nominees named below. | |

| | |

| | | | | |

| Simpson Manufacturing Co., Inc. – 2024 Proxy Statement | 9 |

| | | | | |

| Item 1: Election of Directors | |

| | | | | | | | | | | | | | | | | | | | |

| | | James Andrasick |

|

| | |

| Professional Highlights: Mr. Andrasick joined the Board in 2012 and became Chair of the Board on January 1, 2019. He was the Chairman of Matson Navigation Company Inc.’s (“Matson”) board of directors, until his retirement in 2009, and was its President and Chief Executive Officer from 2002 through 2008. Prior to his positions at Matson, he was the Chief Financial Officer of Alexander & Baldwin, Inc., the parent company of Matson, and was responsible for all business development activity. Prior to that, Mr. Andrasick was President for 8 years of C. Brewer & Company, Ltd., a privately-held international agribusiness, transportation and real estate development company based in Honolulu. He recently served as a Trustee and Chair of the finance committee of Mills College and is presently a Trustee of the U.S. Coast Guard Foundation; a Trustee (and previous Chairman) of the Big Sur Land Trust; and as Governor and Vice-Chair of the Santa Lucia Conservancy. He also previously served as a director and the Chairman of the Board of the American Red Cross, Hawaii State Chapter; served on the boards of the Aloha United Way, Arthritis Foundation and Hawaii Maritime Center; and as the Chairman and a Trustee of the University of Hawaii Foundation. |

| | | |

| Former CEO Matson Navigation Age: 79 Director Since: 2012 Committee Assignments: •Audit and Finance Committee •Compensation and Leadership Development Committee •Corporate Strategy and Acquisitions Committee •Nominating and ESG Committee | |

| |

| | |

| | |

| | Contribution to and function on the Board: Mr. Andrasick brings to the Board a balanced perspective and his consensus-building style along with his business acumen stemming from his 40 years of business experience, including international experience. He also brings his financial and capital allocation and management expertise, and a strong understanding of developing markets. His experience in developing the China market for Matson, in real estate development for Alexander & Baldwin, Inc. and in mergers and acquisitions gives him a unique understanding of the Company’s current opportunities, and his strong financial and operations background adds depth to the Board’s understanding of our business. |

| | |

| | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | Chau Banks |

|

| |

Professional Highlights: Ms. Banks joined the Board in 2023. She has been the Chief Information and Data Officer at The Clorox Company since 2020. Prior to that, Ms. Banks was the Chief Technology and Digital Officer at Revlon, Inc., from 2018 to 2020; and was the Executive Vice President, Chief Information Officer and Channel Integration at New York & Company from 2013 to 2017. Ms. Banks also currently serves as a Board Member of NextUp, a non-profit organization. |

| | |

Chief Information and Data Officer, The Clorox Company Age: 54 Director Since: 2023 Committee Assignments: •Audit and Finance Committee •Compensation and Leadership Development Committee |

|

|

Contribution to and function on the Board: Ms. Banks brings to the board her significant experience in information technology including cyber infrastructure, digital and data transformations, and customer facing-digital technology. |

|

|

| |

| | | | | |

10 | Simpson Manufacturing Co., Inc. – 2024 Proxy Statement |

| | | | | |

| Item 1: Election of Directors |

| | | | | | | | | | | | | | | | | | | | |

| | | Felica Coney |

|

| |

Professional Highlights: Ms. Coney joined the Board in 2023. She has been Vice President, Global Server Operations with Google, Inc. since May 2023. Prior to that she served as Vice President, Server Operations, Americas since her start with Google, Inc. in 2021. Google, Inc. is an American multinational technology company focusing on artificial intelligence, online advertising, search engine technology, cloud computing, computer software, quantum computing, e-commerce, and consumer electronics. Prior to that, Ms. Coney was the Vice President, Walmart Supply Chain, Southeast Division at Walmart Inc., from 2019 to 2021; and held numerous roles as Vice President of Operations at Collins Aerospace from 2017 to 2019. Ms. Coney also serves as a member of the North Carolina A&T Engineering Advisory Board and as a member of the Albert Lepage Center for DEI. |

| | |

Vice President, Global Server Operations, Google, Inc. Age: 53 Director Since: 2023 Committee Assignments: •Audit and Finance Committee •Corporate Strategy and Acquisitions Committee |

|

|

|

Contribution to and function on the Board: Ms. Coney brings to the board her extensive experience in operations, supply chain and environmental, health and safety across technology, aerospace and consumer-focused public companies. |

|

|

| |

| | | | | | | | | | | | | | | | | | | | |

| | | Gary Cusumano |

|

| |

Professional Highlights: Mr. Cusumano joined the Board in 2007. He was with the Newhall Land and Farming Company for more than 35 years, most recently as the Chairman of its board of directors, until his retirement in 2006. He is a director of Forest Lawn Memorial Park and was a director of Granite Construction, Inc., Sunkist Growers, Inc., Watkins-Johnson Company and Zero Corporation and has served on the boards of many not-for-profit and community service organizations. |

| | |

Retired Chairman, CEO & President The Newhall Land and Farming Company Age: 80 Director Since: 2007 Committee Assignments: •Compensation and Leadership Development Committee (Chair) •Corporate Strategy and Acquisitions Committee |

|

|

Contribution to and function on the Board: Mr. Cusumano brings to the Board his deep understanding of real estate development, his business acumen and his industry knowledge, which give him the ability to constructively challenge management in a positive manner. He also brings to the Board a balanced perspective from both the management and board member perspectives given his extensive leadership abilities and significant boardroom experience. |

|

|

| |

| | | | | |

| Simpson Manufacturing Co., Inc. – 2024 Proxy Statement | 11 |

| | | | | |

| Item 1: Election of Directors | |

| | | | | | | | | | | | | | | | | | | | |

| | | Philip Donaldson |

|

| |

Professional Highlights: Mr. Donaldson joined the Board in 2018. He has been the Chief Financial Officer at Andersen Corporation since 2004 and serves as its Executive Vice President, a member of its Executive Committee, and as a member of its Board of Directors. Andersen Corporation is a leading maker of windows and doors for residential and commercial markets with 13,000 employees in locations across North America and sales worldwide. Prior to joining Andersen Corporation in 1999, Mr. Donaldson spent sixteen years at Armstrong World Industries, Inc. in various management roles in sales and marketing, quality management, manufacturing and general management. Mr. Donaldson also serves as Chair of the Board of Directors of HealthPartners, Inc., and previously served, from 2010 to 2022, as a Board Member of HealthPartners, Inc., and from 2018 to 2022, as the Chairman of the Window and Door Manufacturer’s Association. |

| | |

Executive Vice President & CFO Andersen Corporation Age: 62 Director Since: 2018 Committee Assignments: •Audit and Finance Committee (Chair) •Corporate Strategy and Acquisitions Committee |

|

|

Contribution to and function on the Board: Mr. Donaldson has extensive industry, operational, and financial management experience and brings to the Board his strong focus on driving stockholder value as well as expertise in capital markets financing, acquisitions and integration, information systems and technology, and sales and marketing. |

|

| |

| | | | | | | | | | | | | | | | | | | | |

| | | Celeste Volz Ford |

|

| | |

| Professional Highlights: Ms. Ford joined the Board in 2014. She was the Chief Executive Officer of Stellar Solutions, Inc., from the time she founded the company in 1995 until 2018, when she transitioned to board chair. Stellar Solutions is a global provider of systems engineering expertise and a recognized leader in government and commercial aerospace programs. She is a proven leader of the Stellar companies, including Stellar Solutions, Inc., which provides engineering services, Stellar Solutions Aerospace Ltd. their UK-based affiliate, Stellar Solutions Aerospace France, QuakeFinder, the humanitarian R&D division of Stellar Solutions, and the Stellar Solutions Foundation, a division focused on charitable giving to promote community involvement and outreach efforts. In 2022, Ms. Ford established Stellar Ventures, a woman-led venture capital firm, and serves as a managing partner. Ms. Ford previously served, from 2020 to 2023, on the boards of CHG Group, Inc. a subsidiary of Chemring Group, PLC, a provider of advanced technology products and services to the aerospace, defense and security markets; and IRIS automation, a safety avionics technology company; and from 2015 to 2017, on the board of Seagate Government Solutions, which is a business unit of Seagate Technology Public Limited Company. She is also a part of the University of Notre Dame Board of Trustees, the American Conservatory Theater and the Business Advisory Counsel of Illuminate Ventures. |

| | | |

| Founder and Former CEO Stellar Solutions Former Public Company Directorships: Heritage Commerce Corporation Age: 67 Director Since: 2014 Committee Assignments: •Corporate Strategy and Acquisitions Committee (Chair) •Audit and Finance Committee | |

| |

| | |

| | |

| | Contribution to and function on the Board: Ms. Ford brings to the Board her proven record of leadership and entrepreneurial spirit as well as her deep understanding of and experience with cyber, technology and software. She also brings her deep knowledge of strategic planning, a significant focus of the Company, and risk management, as well as her valuable insights regarding activities in Europe. |

| | | |

| | | | | |

12 | Simpson Manufacturing Co., Inc. – 2024 Proxy Statement |

| | | | | |

| Item 1: Election of Directors |

| | | | | | | | | | | | | | | | | | | | |

| | | Kenneth Knight |

|

| |

Professional Highlights: Mr. Knight joined the Board in 2021. He has been the Chief Executive Officer and a member of the Board of Directors of Invitae Corporation, a medical genetics company, since 2022, and was their Chief Operating Officer from 2020 until 2022. Prior to joining Invitae Corporation, Mr. Knight was Vice President, Amazon Transportation Services, at Amazon.com from 2019 to 2020, and served as its Vice President, Global Delivery and Fulfillment, Human Resources from 2016 to 2019. Prior to that, Mr. Knight held management positions at Caterpillar Inc. from 2012 to 2016 and at General Motors Company from 2004 to 2012. Mr. Knight also serves as a member of the Georgia Tech President’s Advisory Board. |

| | |

President and Chief Executive Officer Invitae Corporation Current Public Company Directorships: Invitae Corporation Age: 63 Director Since: 2021 Committee Assignments: •Audit and Finance Committee •Nominating and ESG Committee |

|

|

|

Contribution to and function on the Board: Mr. Knight brings to the Board his strong and extensive background in industrial manufacturing, as well as his wealth of knowledge in mergers and acquisitions, customer and innovative growth, building supply management and domestic and international sourcing and distribution. |

|

|

| |

| | | | | | | | | | | | | | | | | | | | |

| | | Michael Olosky |

|

| | |

| Professional Highlights: Mr. Olosky has served as our President and Chief Executive Officer and a member of the Board since January 2023. From January 2022 to December 2022, Mr. Olosky previously served as our President and Chief Operating Officer, and from November 2020 to January 2022, as our Chief Operating Officer. Prior to joining Simpson, Mr. Olosky spent more than 22 years in numerous leadership positions at Henkel, a global chemical and consumer goods company. He most recently served as the Regional President, Henkel North America and Head of the Electronics and Industrial Division. |

| | | |

| President and Chief Executive Officer Simpson Manufacturing Company, Inc. Age: 55 Director Since: 2023 | |

| |

| | |

| | |

| | Contribution to and function on the Board: Mr. Olosky brings to the board over 25 years of industry experience, a proven track record of leadership, and a dedication to the ongoing success of the Company. He has played an integral role in defining the Company’s growth strategy and brings his deep knowledge of Simpson’s daily operations, company performance and growth initiatives. Mr. Olosky’s experience at Henkel includes over nine years of international operations leadership, providing unique and valuable insights regarding activities in Europe. He is committed to maintaining the Company’s culture with a continued focus on innovation and customer service, and has demonstrated a commitment to integrity in all aspects of the Company’s business and transparency during his leadership. |

| | |

| | |

| | | | | | |

| | | | | |

| Simpson Manufacturing Co., Inc. – 2024 Proxy Statement | 13 |

| | | | | |

| Item 1: Election of Directors | |

Director Qualifications

In identifying director candidates, the Board seeks to achieve a mix of members who collectively bring significant value to the Company through their experience and personal backgrounds relevant to Simpson’s strategic priorities and the scope and complexity of our business and industry. In light of Simpson’s strategic priorities, and based on its self-assessment, the Board identified key skills and experiences for director candidates that include, but are not limited to, current public company senior executive and board experience in managing a diversified enterprise, industry experience or understanding, an appreciation of the impacts of rapidly changing technologies and experience in managing and expanding business outside of the United States, especially in Europe. To complement its oversight responsibilities, the Board also identified implementing or overseeing company growth, experience in information technology and cyber matters, strategy development, mergers and acquisitions and operations experience as key Board skills. In addition, each candidate should:

•have a record of integrity and ethics in his/her personal and professional life;

•have a record of professional accomplishment in his/her field;

•be prepared to represent the best interests of our stockholders;

•not have a material personal, financial or professional interest in any competitor of ours; and

•be prepared to participate fully in Board activities, including (in the case of a non-executive director) active membership on at least one Board committee and attendance at, and active participation in, meetings of the Board and the committee(s) of which he/she is a member, and not have other personal or professional commitments that would, in the Nominating and ESG Committee’s sole judgment, interfere with or limit his/her ability to do so.

| | | | | | | | | | | | | | |

| The Board recognizes the benefits of a diversified board and believes that any search for potential director candidates should consider diversity as to gender, race, ethnic background and personal and professional experiences. | | Our Corporate Governance Guidelines place limits on the number of boards on which Simpson directors may serve. Such limits provide that any director who is a chief executive officer or other senior executive of a public company should serve on no more than two public company boards, and any other director should serve on no more than four public company boards, in both instances including the Simpson Board. Additionally, any member of our Audit and Finance Committee may serve on the audit committee of no more than two other public companies. The Nominating and ESG Committee also considers it desirable that candidates contribute positively to the collaborative culture among Board members and possess professional and personal experiences and expertise relevant to our business and industry. The Nominating and ESG Committee solicits ideas for possible candidates from a number of sources, including independent search firms, such as Heidrick & Struggles, members of the Board and our senior-level executives. Once a prospective candidate has come to the Nominating and ESG Committee’s attention, including candidates recommended by its advisors or suggested by stockholders, the Nominating and ESG Committee evaluates the candidate’s qualifications and skills, against the desired director attributes, and makes an initial determination as to whether to conduct a full evaluation. In making this determination, the Nominating and ESG Committee takes into account the information provided to it with the recommendation of the candidate, as well as the Nominating and ESG Committee’s own knowledge and information obtained through inquiries to third parties to the extent the Nominating and ESG Committee deems appropriate. The preliminary determination is based primarily on the current need for additional Board members and the likelihood that the prospective candidate can satisfy the criteria that the Nominating and ESG Committee has established. If the Nominating and ESG Committee determines, in consultation with the Chair of the Board and other directors, as appropriate, that additional consideration is warranted, it may request a third party to gather additional information about the prospective candidate’s background and experience and to report its findings to the Nominating and ESG Committee. The Nominating and ESG Committee may then evaluate the prospective candidate against the Board selection criteria that it has developed. |

| | | | | |

14 | Simpson Manufacturing Co., Inc. – 2024 Proxy Statement |

| | | | | |

| Item 1: Election of Directors |

Board Diversity

While we do not have a formal policy with regard to diversity in identifying director nominees, the Board believes that the backgrounds and qualifications of directors, considered as a group, should provide a significant composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities. The Board nominees come from a variety of backgrounds and 37.5% of our directors will be women if all eight Board nominees are elected to the Board at the Annual Meeting. We do not discriminate against nominees on the basis of race, color, religion, gender, gender identity or expression, sexual orientation, age, national origin, disability, covered veteran status or any other status protected by law.

Director Tenure

The Board currently believes that a robust board evaluation process - one focused on the assessment and alignment of director skills with company strategy and priorities - is more effective than relying solely on age or tenure limits to achieve board refreshment. Therefore, we do not have a fixed retirement age for directors. Under our current Corporate Governance Guidelines, a nonemployee director who came on to the Board prior to 2016 will not be nominated for re-election after 20 years of board service, and the Board generally will not nominate nonemployee directors who come on to the Board after 2016 for re-election after 15 years of board service. If all eight Board nominees are elected to the Board at the Annual Meeting, the average tenure of our nonemployee directors will be 7.1 years.

Director Independence

The NYSE listing standards require our Board to be comprised of at least a majority of independent directors. Our Corporate Governance Guidelines require that the Board be comprised substantially of independent directors. For a director to be considered independent, our Board must determine that the director does not have any direct or indirect material relationship with us. To assist it in determining director independence, and as permitted by NYSE rules then in effect, the Board previously established categorical standards which conform to, or are more exacting than, the independence requirements in the NYSE listing standards. These standards are contained in our Corporate Governance Guidelines, which can be found on our website at www.ir.simpsonmfg.com under “Investor Relations - Corporate Governance.”

Based on these independence standards, our Board has affirmatively determined that the following directors are independent and meet our categorical independence standards:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| James Andrasick | | Chau Banks | | Felica Coney | | Gary Cusumano |

| Philip Donaldson | | Celeste Volz Ford | | Kenneth Knight | |

In determining the independence of the directors, our Board considered ordinary course transactions between us and other entities with which the directors are associated, none of which were determined to constitute a material relationship with us. None of the above listed directors has any relationship with Simpson, except as a director and stockholder. Our Board also considered contributions by us to charitable organizations with which the directors were associated. No director is related to any executive or significant stockholder of Simpson, nor is any director, with the exception of Mr. Olosky, a current employee of Simpson.

Director Nominations

Any stockholder may nominate one or more persons for election as one of our directors at the Annual Meeting if the stockholder complies with the notice, information and consent provisions contained in our By-Laws. See “Stockholders’ Proposals” in this Proxy Statement. All recommendations for nomination received by the Corporate Secretary that satisfy our by-law requirements relating to such nominations will be presented to the Nominating and ESG Committee.

The Nominating and ESG Committee will consider candidates identified through the processes described above and will evaluate the candidates, including incumbents, based on the same criteria. The Nominating and ESG Committee also takes into account the contributions of incumbent directors as Board members and the benefits to us arising from their experience on the Board. Although the Nominating and ESG Committee will consider candidates identified by stockholders, the Nominating and ESG Committee has sole discretion whether to recommend those candidates to the Board.

| | | | | |

| Simpson Manufacturing Co., Inc. – 2024 Proxy Statement | 15 |

The Board’s Role and Responsibilities

Overview

The Board’s Key Responsibilities include:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Establishing the appropriate “Tone at the Top” | | Choosing and monitoring performance of the CEO and establishing succession plans | | Determining executive compensation | | Setting standards for and monitoring compliance: responding appropriately to ‘redflags’ | Interviewing and nominating director candidates and monitoring the board’s performance | | Overseeing relations with governments, communities and other constituents |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Our Board of Directors oversees, monitors and directs management in the long-term interest of Simpson and our stockholders. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Approving our long-term strategy and annual operating plan, monitoring performance and providing advice to management | Determining risk appetite; setting standards for managing risk; monitoring risk management | | | Setting standards for corporate social responsibility and monitoring compliance | Evaluating proposed transactions that create a seeming conflict between the best interests of stockholders and those of management | Reviewing corporate governance guidelines and committee charters | | | |

The Board’s Role in Risk Management and ESG Oversight

As part of its oversight function, the Board is actively involved in overseeing risk management. In connection with overseeing risk management, the Board exercises its oversight responsibility with respect to key external, strategic, operational and financial risks through the committees of the Board and discusses the effectiveness of current efforts to mitigate certain focus risks as identified by senior management and the Board.

Our Nominating and ESG Committee generally oversees the Company’s environmental, social and governance (ESG) goals and objectives, and supports the implementation of the Company’s ESG priorities. Specific ESG topics are overseen by other committees generally responsible for the subject matter. For example, the Audit and Finance Committee has oversight responsibility for certain aspects of the environmental and social aspects of ESG, and the Compensation and Leadership Development Committee has oversight responsibility for certain aspects of the social aspects of ESG.

| | | | | |

16 | Simpson Manufacturing Co., Inc. – 2024 Proxy Statement |

| | | | | |

| The Board’s Role and Responsibilities |

Board and Committees Risk Oversight Responsibilities

Full Board

Although the Board is ultimately responsible for risk oversight, the Board is assisted in discharging its risk oversight responsibility by the Audit and Finance, the Compensation and Leadership Development, the Nominating and ESG and the Corporate Strategy and Acquisitions Committees. Each committee oversees management of risks, including, but not limited to, the areas of risk summarized below, and periodically reports to the Board on those areas of risk:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Audit and Finance Committee | | | | Compensation and Leadership Development Committee | | | | Nominating and ESG Committee | | | | Corporate Strategy and Acquisitions Committee | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Oversees management of risks related to our financial statements, the financial reporting process and cybersecurity | | | | Oversees management of risks related to our compensation policies and practices, employee benefit plans and the administration of equity plans as well as succession and leadership development | | | | Oversees management of risks related to environment, social and governance of the company and the Board, including board and committee composition | | | | Oversees management of risks related to our corporate strategy and strategic acquisitions | |

| | | | | | | | | | | | | | |

Stockholder Engagement

In an effort to continuously improve our governance and compensation practices, our Board is firmly committed to constructive engagement with our stockholders and regularly reviews and responds to their expressed views.

The Board places considerable weight on stockholder feedback in making decisions impacting our governance processes and compensation programs. Increased dialogue with our stockholders has led to meaningful changes in our corporate governance, environmental, social and executive compensation policies and practices, such as those highlighted below.

Enhancements to our practices and policies

Governance:

•Maintaining a Separate Chair of the Board and CEO

•Maintaining a Board comprised of all independent directors, except our CEO

•Maintaining a commitment to Board refreshment

•Removing rights plan/poison pill and staggered board

Sustainability and Environmental and Social Responsibility:

•Increasing disclosures on our sustainability and environmental and social responsibility

Compensation:

•Enhancing transparency in proxy statement disclosures regarding compensation matters, including disclosing specific targets of our compensation programs and how they tie to our strategy

| | | | | |

| Simpson Manufacturing Co., Inc. – 2024 Proxy Statement | 17 |

| | | | | |

| The Board’s Role and Responsibilities | |

•Maintaining longer performance-based equity award performance periods (3 years rather than just 1) per cycle, and removal of duplicate performance metrics between short-term incentive and long-term incentive awards

•Requiring double-trigger vesting of equity awards upon a change in control

•Adopting a rigorous approach to establishing performance goals under the incentive plans

Director Orientation and Education

New directors are oriented to our business and governance through meetings with our officers and directors and visits to our facilities. We also support and pay for participation in continuing education programs to assist directors in performing their Board responsibilities.

Board and Committee Evaluations

Our Board recognizes the critical role of annual Board and committee evaluations in ensuring the Board and each committee are functioning effectively. The Board has a regular practice of assessing its own effectiveness as well as the diversity of skill sets of its members, the alignment of areas of expertise with the Company’s strategy and priorities, and stewardship of company performance. The evaluation process also includes periodic evaluations by a third-party facilitator. To that end, in 2023, at the recommendation of the Nominating and ESG Committee, the Board engaged Heidrick & Struggles to administer an independent third-party evaluation consisting of both survey data and one-on-one interviews with each director. As of the date of this Proxy Statement, that process is ongoing. When complete, the findings will be aggregated, analyzed and reported to the full Board collectively and specific feedback will be provided to each individual director.

Sustainability and Environmental and Social Responsibility

Throughout our organization, we have core values that shape our approach to business. Our Board, through its Nominating and ESG Committee oversees the Company’s environmental and social strategy. Management provides the Nominating and ESG Committee with an update on environmental and social matters at each of its regular quarterly meetings.

Internally, environmental, social and governance risks and opportunities are managed by the legal department, and, our ESG Steering Committee oversees and guides our environmental and social priorities and performance.

Sustainability and environmental and social responsibility are integral components of our business strategy. We evaluate environmental and social risks and opportunities and, based on our analysis, we enact initiatives to drive improvement and generate business value. Our Annual CSR (Corporate Social Responsibility) Report provides a comprehensive review of our extra financial strategy. This report also outlines the steps we take to benefit our shareholders, customers, employees, suppliers and the communities in which we operate.

We take a holistic approach to managing our environmental and social impact. We have policies and procedures in place that outline environmental and social expectations for our suppliers. Within our operations, we have set both EHS (Environmental, Health & Safety) and DE&I (Diversity, Equity & Inclusion) goals to drive our performance. Further, we commit to continuously improving our energy, water and waste profile. In our downstream operations, our products are instrumental in keeping structures strong during natural disasters such as hurricanes and seismic events. Increasingly, we are innovating to create products that restore and strengthen concrete structures, reducing the greenhouse gas emissions resulting from both demolition and construction. Finally, through our mass timber capabilities, we innovate to increase the use of sustainable materials in construction.

You can find additional details regarding our environmental and social efforts and other related programs in our CSR Report on our website at https://simpsonmfg-esg.metrio.net/.

| | | | | |

18 | Simpson Manufacturing Co., Inc. – 2024 Proxy Statement |

| | | | | |

| The Board’s Role and Responsibilities |

Human Capital Management

The Board believes that attracting, developing and retaining employees is vital to Simpson’s continued success. Our Board is actively involved in our human capital management in its oversight of our long-term strategy and through its committees and engagement with management. Our focus on talent management stretches from the board level to our approximately 5,500 associates through programs overseen by management and reported on to the Board that are designed to identify, train and grow future leaders.

Inclusion & Diversity

We strive to have a diverse culture of employees of various ages, genders, ethnicities and abilities. Our commitment to diversity and inclusion starts at the top with a highly skilled and diverse board. As of December 31, 2023, women held 33% of the Company’s top five executive positions and board seats, helping to pave the way for gender diversity in corporate leadership.

Talent Development

Human capital development underpins our efforts to execute our strategy and continue to develop, manufacture and market innovative products and services. The opportunity to grow and develop skills and abilities, regardless of job role, division, or geographical location is critical to the success of Simpson as a global organization and we continually invest in our employees’ career growth and provide employees access to a wide variety of learning and development resources, including a suite of online courses for developing both soft and technical skills. We design these resources to encourage a growth mindset and continuous learning. Accordingly, we also have leadership development programs that provide employees with training, tools and experiences that are targeted to develop their full leadership potential.

Pay Equity

Simpson’s compensation philosophy is to be able to attract, retain, motivate, and differentiate employees through its rewards programs. We believe people should be paid for what they do and how they do it, regardless of their gender, race, or other personal characteristics and are committed to internal pay equity. Our Compensation and Leadership Development Committee monitors the relationship between the pay received by our executive officers and non-managerial employees. We believe our compensation philosophy and strategy are strongly aligned with our corporate strategic priorities and our vision for stockholder value creation.

In addition to our financial compensation, we offer a health and wellness package to our employees, which we designed to provide options for their individual and/or family needs. In addition, in an effort to continue to attract, retain, and motivate our workforce, in the United States, we offer remote and flexible work packages for positions that allow for remote work. We continue to engage our partners and benefits consultants to ensure our health and wellness package continues to meet the needs of our diverse workforce today and into the future.

Workplace Safety and Health

A vital part of our business is providing our workforce with a safe, healthy and sustainable working environment. Our Environmental, Health and Safety program focuses on implementing change through our employee observation feedback channels to recognize risk and continuously improve our processes. We also conduct regular risk reviews and self-audits at our manufacturing facilities around the world to explore new opportunities to reduce potential employee exposure to occupational injuries.

| | |

|

A vital part of our business is providing our workforce with a safe, healthy and sustainable working environment. |

| | | | | |

| Simpson Manufacturing Co., Inc. – 2024 Proxy Statement | 19 |

| | | | | |

| The Board’s Role and Responsibilities | |

Environmental Sustainability

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | |

| Manufacturing Processes | | Waste Reduction and Recycling | | Energy Conservation | | Sustainable Building Practices |

| | | | | | |

Manufacturing Processes

•We strive to minimize the amount of total waste generated by our manufacturing processes through company-wide lean practices.

•Our Research & Development engineers are focused on material efficiencies and innovative product features that minimize waste generation in our steel connector, anchor and fastener designs.

•We do not manufacture steel, instead we purchase large quantities for direct use in our manufacturing processes.

Waste Reduction and Recycling

•We support the Circular Economy by minimizing our largest recognized waste stream and sending unused steel from our processes upstream for reintroduction into the material supply chain.

•Our metal stamping production dies and factory tooling are designed to help minimize unused steel generation, reducing waste.

•In addition to steel, we recycle many of the materials that we use to reduce our impact on the environment, including cardboard, plastic and glass bottles, aluminum cans, paper, wood pallets, used electronics, water, oils, coolants and lubricants and stretch film/wrap — low density polyethylene.

Energy Conservation

•We work hard to improve energy efficiencies, reducing carbon emissions while reducing our costs.

•Energy-efficient lighting, heating and cooling systems further reduce our impact on the environment, including reducing our carbon footprint.

Sustainable Building Practices

•We support sustainable building practices, such as those established by the U.S. Green Building Council’s Leadership in Energy and Environmental Design (LEED) Green Building Rating System™, NAHB Green, and state and city specific green building codes.

•Many homes and buildings built today use green building technology, and we support green building systems by developing products that use or incorporate engineered wood and insulated concrete forms.

•Our use of advanced framing techniques helps to reduce total material usage and improves energy performance in wood-frame construction.

•We use non-toxic materials for connector products that require painting.

| | | | | |

20 | Simpson Manufacturing Co., Inc. – 2024 Proxy Statement |

| | | | | |

| The Board’s Role and Responsibilities |

Community Engagement

Simpson is committed to giving back to our communities through four key areas:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Construction & Building Repair | | | Disaster Preparedness & Resilience | |

| | | | |

| | | | | | | | | | |

| | | | | | |

| Disaster Relief | | | Construction Trades Education | |

| | | | |

| | | | | | | | | | | | | | |

1,500 scholarships awarded to students through Simpson Strong-Tie’s Student Scholarship program $2.5M awarded through the Simpson Strong-Tie’s Put Something Back Scholarship program since 1998 | | •In commemoration of our Founder, Barclay Simpson, we established Do What You Can Day in 2016 to continue his philanthropic legacy. Every year, our employees are encouraged to participate in a voluntary charitable activity in his honor. •The Simpson Strong-Tie Student Scholarship program awards 120 scholarships every year to provide financial assistance for civil/structural engineering, architecture and construction management students at participating colleges and universities throughout the United States. To date, we have awarded over 1,500 scholarships to aspiring students. •The Simpson Strong-Tie Put Something Back (PSB) Scholarship program awards dependent children of our employees with academic scholarships for continuing education. More than 342 scholarships worth over $2.5 million have been awarded since the program began in 1998. •Simpson Strong-Tie has been a national sponsor of Habitat for Humanity International since 2007 and is the lead sponsor of their Habitat Strong program, designed to promote the building of homes that are more durable, resilient and physically stronger. |

|

|

|

Ethics and Compliance