Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

11 Março 2024 - 2:59PM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

For the

month of March

HSBC Holdings plc

42nd

Floor, 8 Canada Square, London E14 5HQ, England

(Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F).

Form

20-F X Form 40-F

HSBC HOLDINGS PLC

11 March 2024

Transaction in own shares

HSBC Holdings plc ("HSBC" or the "Company") announces that it has purchased for

cancellation the following number of its ordinary shares of US$0.50

from Merrill Lynch International ("Merrill

Lynch ") as part of

its buy-back announced on 22 February

2024.

UK Venues

|

Date of purchase:

|

11 March 2024

|

|

Number of ordinary shares of US$0.50 each purchased:

|

3,628,429

|

|

Highest price paid per share:

|

£5.8100

|

|

Lowest price paid per share:

|

£5.7290

|

|

Volume weighted average price paid per share:

|

£5.7554

|

All repurchases on the London Stock Exchange, Cboe Europe Limited

(through the BXE and CXE order books) and/or Turquoise

("UK

Venues") are implemented as "on

Exchange" transactions (as such term is defined in the rules of the

London Stock Exchange) and as "market purchases" for the purposes

of the Companies Act 2006.

Hong Kong Stock Exchange

|

Date of purchase:

|

11 March 2024

|

|

Number of ordinary shares of US$0.50 each purchased:

|

2,898,400

|

|

Highest price paid per share:

|

HK$58.6500

|

|

Lowest price paid per share:

|

HK$58.3000

|

|

Volume weighted average price paid per share:

|

HK$58.4359

|

All repurchases on The Stock Exchange of Hong Kong Limited

("Hong Kong

Stock Exchange") are "off

market" for the purposes of the Companies Act 2006 but are

transactions which occur "on Exchange" for the purposes of the

Rules Governing the Listing of Securities on The Stock Exchange of

Hong Kong Limited and which constitute an "on-market share

buy-back" for the purposes of the Codes on Takeovers and Mergers

and Share Buy-backs.

Since the commencement of the buy-back announced on 22 February

2024, the Company has repurchased 72,542,743 ordinary shares for a

total consideration of approximately US$554.2m.

Following the cancellation of the shares repurchased on the UK

Venues, the Company's issued ordinary share capital will consist of

19,043,499,384 ordinary shares with voting rights. There are no

ordinary shares held in treasury. Cancellation of the shares

repurchased on the Hong Kong Stock Exchange takes longer than those

repurchased on the UK Venues and a further announcement of total

voting rights will be made once those shares have been

cancelled.

The above figure of 19,043,499,384 may be used by shareholders as

the denominator for the calculations by which they will determine

if they are required to notify their interest in, or a change to

their interest in, the Company under the Financial Conduct

Authority's Disclosure Guidance and Transparency

Rules.

In accordance with Article 5(1)(b) of the Market Abuse Regulation

(EU) No 596/2014 (as it forms part of domestic law of the United

Kingdom by virtue of the European Union (Withdrawal) Act 2018), a

full breakdown of the individual trades made by Merrill Lynch on

behalf of the Company is available via the link below.

http://www.rns-pdf.londonstockexchange.com/rns/4141G_1-2024-3-11.pdf

This announcement will also be available on HSBC's website

at www.hsbc.com/sea

Enquiries to:

Lee Davis

Corporate Governance & Secretariat

+44 (0) 207 991 3048

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

HSBC

Holdings plc

|

|

|

|

|

|

By:

|

|

|

Name:

Aileen Taylor

|

|

|

Title:

Group Company Secretary and Chief Governance Officer

|

|

|

|

|

|

Date:

11 March 2024

|

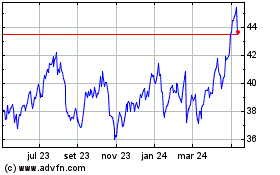

HSBC (NYSE:HSBC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

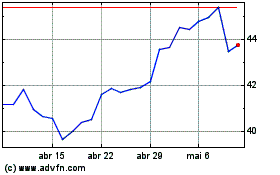

HSBC (NYSE:HSBC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024