false

0001682852

PRE 14A

0001682852

2023-01-01

2023-12-31

0001682852

2022-01-01

2022-12-31

0001682852

2021-01-01

2021-12-31

0001682852

2020-01-01

2020-12-31

0001682852

ecd:PeoMember

mrna:DeductionForAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsOfTheSummaryCompensationTableMember

2023-01-01

2023-12-31

0001682852

ecd:NonPeoNeoMember

mrna:DeductionForAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsOfTheSummaryCompensationTableMember

2023-01-01

2023-12-31

0001682852

ecd:PeoMember

mrna:DeductionForAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsOfTheSummaryCompensationTableMember

2022-01-01

2022-12-31

0001682852

ecd:NonPeoNeoMember

mrna:DeductionForAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsOfTheSummaryCompensationTableMember

2022-01-01

2022-12-31

0001682852

ecd:PeoMember

mrna:DeductionForAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsOfTheSummaryCompensationTableMember

2021-01-01

2021-12-31

0001682852

ecd:NonPeoNeoMember

mrna:DeductionForAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsOfTheSummaryCompensationTableMember

2021-01-01

2021-12-31

0001682852

ecd:PeoMember

mrna:DeductionForAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsOfTheSummaryCompensationTableMember

2020-01-01

2020-12-31

0001682852

ecd:NonPeoNeoMember

mrna:DeductionForAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsOfTheSummaryCompensationTableMember

2020-01-01

2020-12-31

0001682852

ecd:PeoMember

mrna:IncreaseDecreaseForTheInclusionOfRule402vEquityValuesMember

2023-01-01

2023-12-31

0001682852

ecd:NonPeoNeoMember

mrna:IncreaseDecreaseForTheInclusionOfRule402vEquityValuesMember

2023-01-01

2023-12-31

0001682852

ecd:PeoMember

mrna:IncreaseDecreaseForTheInclusionOfRule402vEquityValuesMember

2022-01-01

2022-12-31

0001682852

ecd:NonPeoNeoMember

mrna:IncreaseDecreaseForTheInclusionOfRule402vEquityValuesMember

2022-01-01

2022-12-31

0001682852

ecd:PeoMember

mrna:IncreaseDecreaseForTheInclusionOfRule402vEquityValuesMember

2021-01-01

2021-12-31

0001682852

ecd:NonPeoNeoMember

mrna:IncreaseDecreaseForTheInclusionOfRule402vEquityValuesMember

2021-01-01

2021-12-31

0001682852

ecd:PeoMember

mrna:IncreaseDecreaseForTheInclusionOfRule402vEquityValuesMember

2020-01-01

2020-12-31

0001682852

ecd:NonPeoNeoMember

mrna:IncreaseDecreaseForTheInclusionOfRule402vEquityValuesMember

2020-01-01

2020-12-31

0001682852

ecd:PeoMember

mrna:YearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearMember

2023-01-01

2023-12-31

0001682852

ecd:NonPeoNeoMember

mrna:YearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearMember

2023-01-01

2023-12-31

0001682852

ecd:PeoMember

mrna:YearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearMember

2022-01-01

2022-12-31

0001682852

ecd:NonPeoNeoMember

mrna:YearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearMember

2022-01-01

2022-12-31

0001682852

ecd:PeoMember

mrna:YearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearMember

2021-01-01

2021-12-31

0001682852

ecd:NonPeoNeoMember

mrna:YearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearMember

2021-01-01

2021-12-31

0001682852

ecd:PeoMember

mrna:YearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearMember

2020-01-01

2020-12-31

0001682852

ecd:NonPeoNeoMember

mrna:YearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearMember

2020-01-01

2020-12-31

0001682852

ecd:PeoMember

mrna:ChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsMember

2023-01-01

2023-12-31

0001682852

ecd:NonPeoNeoMember

mrna:ChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsMember

2023-01-01

2023-12-31

0001682852

ecd:PeoMember

mrna:ChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsMember

2022-01-01

2022-12-31

0001682852

ecd:NonPeoNeoMember

mrna:ChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsMember

2022-01-01

2022-12-31

0001682852

ecd:PeoMember

mrna:ChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsMember

2021-01-01

2021-12-31

0001682852

ecd:NonPeoNeoMember

mrna:ChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsMember

2021-01-01

2021-12-31

0001682852

ecd:PeoMember

mrna:ChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsMember

2020-01-01

2020-12-31

0001682852

ecd:NonPeoNeoMember

mrna:ChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsMember

2020-01-01

2020-12-31

0001682852

ecd:PeoMember

mrna:ChangeInFairValueOfPriorYearsEquityAwardsThatVestedDuringTheYearMember

2023-01-01

2023-12-31

0001682852

ecd:NonPeoNeoMember

mrna:ChangeInFairValueOfPriorYearsEquityAwardsThatVestedDuringTheYearMember

2023-01-01

2023-12-31

0001682852

ecd:PeoMember

mrna:ChangeInFairValueOfPriorYearsEquityAwardsThatVestedDuringTheYearMember

2022-01-01

2022-12-31

0001682852

ecd:NonPeoNeoMember

mrna:ChangeInFairValueOfPriorYearsEquityAwardsThatVestedDuringTheYearMember

2022-01-01

2022-12-31

0001682852

ecd:PeoMember

mrna:ChangeInFairValueOfPriorYearsEquityAwardsThatVestedDuringTheYearMember

2021-01-01

2021-12-31

0001682852

ecd:NonPeoNeoMember

mrna:ChangeInFairValueOfPriorYearsEquityAwardsThatVestedDuringTheYearMember

2021-01-01

2021-12-31

0001682852

ecd:PeoMember

mrna:ChangeInFairValueOfPriorYearsEquityAwardsThatVestedDuringTheYearMember

2020-01-01

2020-12-31

0001682852

ecd:NonPeoNeoMember

mrna:ChangeInFairValueOfPriorYearsEquityAwardsThatVestedDuringTheYearMember

2020-01-01

2020-12-31

0001682852

ecd:PeoMember

mrna:ChangeInFairValueOfPriorYearsEquityAwardsThatForfeitedDuringTheYearMember

2023-01-01

2023-12-31

0001682852

ecd:NonPeoNeoMember

mrna:ChangeInFairValueOfPriorYearsEquityAwardsThatForfeitedDuringTheYearMember

2023-01-01

2023-12-31

0001682852

ecd:PeoMember

mrna:ChangeInFairValueOfPriorYearsEquityAwardsThatForfeitedDuringTheYearMember

2022-01-01

2022-12-31

0001682852

ecd:NonPeoNeoMember

mrna:ChangeInFairValueOfPriorYearsEquityAwardsThatForfeitedDuringTheYearMember

2022-01-01

2022-12-31

0001682852

ecd:PeoMember

mrna:ChangeInFairValueOfPriorYearsEquityAwardsThatForfeitedDuringTheYearMember

2021-01-01

2021-12-31

0001682852

ecd:NonPeoNeoMember

mrna:ChangeInFairValueOfPriorYearsEquityAwardsThatForfeitedDuringTheYearMember

2021-01-01

2021-12-31

0001682852

ecd:PeoMember

mrna:ChangeInFairValueOfPriorYearsEquityAwardsThatForfeitedDuringTheYearMember

2020-01-01

2020-12-31

0001682852

ecd:NonPeoNeoMember

mrna:ChangeInFairValueOfPriorYearsEquityAwardsThatForfeitedDuringTheYearMember

2020-01-01

2020-12-31

0001682852

1

2023-01-01

2023-12-31

0001682852

2

2023-01-01

2023-12-31

0001682852

3

2023-01-01

2023-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

|

Filed by the Registrant |

|

Filed by a Party other than the Registrant |

| Check the appropriate box: |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

MODERNA, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): |

|

No fee required. |

|

Fee paid previously with preliminary materials. |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Notice of Annual Meeting

of Shareholders

|

MONDAY, MAY 6, 2024

8:00 a.m., Eastern Time

www.virtualshareholdermeeting.com/MRNA2024

|

| |

|

HOW TO VOTE

Review your proxy statement and vote

in one of three ways:

|

| |

|

|

Internet

www.proxyvote.com |

| |

|

|

Telephone

1-800-690-6903 |

| |

|

|

Mail

Complete, sign, date, and return your proxy card or voting instruction form |

YOUR VOTE IS IMPORTANT.

Even if you plan to participate in the Annual Meeting, we urge you to submit your proxy in advance to ensure your shares are represented.

This will not affect your right to participate in the meeting and to vote your shares at that time. For additional information on voting

and participating in the meeting, please see “Information About the 2024 Annual Meeting of Shareholders” beginning on page 83.

To the Shareholders of Moderna, Inc.:

You are cordially

invited to the Annual Meeting of Shareholders of Moderna, Inc., which will be held on Monday, May 6, 2024, beginning at 8:00 a.m., Eastern

Time (the Annual Meeting), for the following purposes:

| 1. |

To elect three Class III directors, each to serve for a three-year term expiring at the 2027 annual meeting of shareholders; |

| 2. |

To approve, on a non-binding, advisory basis, the compensation of our named executive officers; |

| 3. |

To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2024; |

| 4. |

To approve a management proposal to amend our Certificate of Incorporation to provide shareholders the right to call a special meeting; |

| 5. |

To approve a management proposal to amend our Certificate of Incorporation to reflect new Delaware law provisions allowing for officer exculpation; and |

| 6. |

To transact such other business as may be properly brought before the Annual Meeting or any adjournment or postponement thereof. |

The Annual Meeting

will be conducted virtually. You will be able to participate in the Annual Meeting online and submit your questions during the meeting

by visiting www.virtualshareholdermeeting.com/MRNA2024. You also will be able to vote your shares electronically during the Annual Meeting.

For more information about our virtual Annual Meeting, please see “Information About the 2024 Annual Meeting of Shareholders”

beginning on page 83.

Our

Board of Directors has fixed the close of business on March 7, 2024, as the Record Date for determining the shareholders that are entitled

to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof.

This

proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2023, are first being mailed on or about March [

], 2024, to all shareholders entitled to vote at the Annual Meeting. These materials also are available at www.proxyvote.com, using

the control number provided with your materials.

By order of the Board of Directors,

Stéphane Bancel

Chief Executive Officer and Director

Cambridge, Massachusetts

March [ ], 2024

|

2024

Proxy statement |

1 |

Proxy Summary

This summary highlights certain

information from this Proxy Statement, but does not contain all the information that you should consider. Please read the entire Proxy

Statement before voting your shares. For more complete information regarding Moderna’s 2023 performance, please review our Annual

Report on Form 10-K for the year ended December 31, 2023, including the sections captioned "Special Note Regarding Forward-Looking Statements" and "Risk Factors", for a description of the substantial risks and uncertainties related to the forward-looking statements included herein. Expected product launches are subject to, among other risks, assumptions and uncertainties, clinical trial, regulatory and commercial success, and availability of supply.

When

|

Where

|

Record date

|

Monday,

May 6,

2024, at 8:00 a.m.,

Eastern time. |

The meeting

will be held virtually at

www.virtualshareholdermeeting.com/MRNA2024 |

March

7, 2024 |

Meeting Agenda

The matters we will act upon at

the Annual Meeting are:

| Proposal |

|

|

Board voting

recommendation |

|

Where to find

more information |

| Proposal 1: Elect three Class III directors, each for a three-year

term |

|

|

FOR all nominees |

|

Page 8 |

| Proposal 2: Approve, on a non-binding, advisory basis the

compensation of our named executive officers |

|

|

FOR |

|

Page 35 |

| Proposal 3: Ratify the appointment of Ernst & Young

LLP as our independent registered public accounting firm for 2024 |

|

|

FOR |

|

Page 76 |

| Proposal 4: Amend our Certificate of Incorporation to provide

shareholders the right to call a special meeting |

|

|

FOR |

|

Page 79 |

| Proposal 5: Amend our Certificate of Incorporation to reflect

new Delaware law provisions allowing for officer exculpation |

|

|

FOR |

|

Page 81 |

|

2024

Proxy statement |

2 |

Our Mission

| To deliver the greatest possible impact to people through mRNA medicines |

About Moderna

Moderna is a leader in the

creation of the field of mRNA medicines. Through the advancement of mRNA technology, Moderna is reimagining how medicines are made

and transforming how we treat and prevent disease for everyone. By working at the intersection of science, technology and health for

more than a decade, the Company has developed medicines at unprecedented speed and efficiency, including one of the earliest and

most effective COVID-19 vaccines.

Moderna’s mRNA platform has enabled the development of therapeutics and vaccines for

infectious diseases, immuno-oncology, rare diseases and autoimmune diseases. With a unique culture and a global team driven by

the Moderna values and mindsets to responsibly change the future of human health, Moderna strives to deliver the greatest possible

impact to people through mRNA medicines.

2023 Performance

| $6.7 billion |

|

48% U.S.

market share |

|

9 late-stage

programs |

| |

|

|

|

|

| in net product sales from COVID-19 vaccines in 2023. |

|

for COVID-19 vaccine sales to the retail market in the 2023 fall season, up from 37% in 2022 (Source: IQVIA). |

|

including Phase 3 programs for next-generation COVID, RSV, seasonal flu, seasonal flu + COVID, CMV, and INT (melanoma and non-small cell lung cancer) and late-stage programs for PA and MMA. |

| |

|

|

|

|

| $13.3 billion |

|

45 programs |

|

19 markets |

| |

|

|

|

|

| in cash, cash equivalents and investments as of December 31, 2023, available to fund future pipeline growth plans. |

|

in development, reflecting continued investment in the pipeline, laying the groundwork for future growth and profitability. |

|

with Moderna employees around the globe as of December 31, 2023, with a presence in key markets for our products. |

Our Strategic Priorities

Commercial

Execution: We are focused on commercial execution to drive sales growth and profitability. This

includes building on the current momentum from U.S. Spikevax sales and preparing for multiple product launches, including the expected

launch of our RSV vaccine candidate and other potential launches in 2025 and beyond.

Disciplined

Investment: We plan to continue to review our cost structure to find efficiencies, and to remain

disciplined around spending. We expect to leverage our existing manufacturing and commercial infrastructure as we launch new products

in our respiratory franchise in 2024 and 2025.

Executing

on Late-Stage Pipeline: We are focused on advancing our late-stage pipeline to drive organic sales

growth. Moderna expects to launch up to 15 products in the next five years, with up to four of those launches possibly occurring by 2025.

|

2024

Proxy statement |

3 |

Proposal 1: Director Nominees

At the Annual Meeting, three Class

III directors will be elected for a three-year term. The Class III directors up for election are set forth below.

| Name |

Age |

Independent |

Principal occupation |

Committees* |

Other public boards |

Director

since |

| Class III directors nominated for re-election for

a three-year term |

Audit |

Comp |

Nom Gov |

Prod Dev |

Sci Tech |

|

|

| Robert Langer, Sc.D. |

75 |

|

David H. Koch Institute Professor, MIT; Academic Co-Founder, Moderna |

|

|

|

|

|

2 |

2010 |

| Elizabeth Nabel, M.D. |

72 |

|

Former President, Brigham Health |

|

|

|

|

|

3 |

2015** |

| Elizabeth Tallett |

74 |

|

Former Principal, Hunter Partners |

|

|

|

|

|

2 |

2020 |

| Continuing directors |

Noubar Afeyan,

Ph.D. Chairman |

61 |

|

CEO, Flagship Pioneering; Co-founder and Chairman, Moderna |

|

|

|

|

|

0 |

2010 Chairman since 2012 |

| Stéphane Bancel |

51 |

|

Chief Executive Officer, Moderna |

|

|

|

|

|

0 |

2011 |

| Stephen Berenson |

63 |

|

Managing Partner, Flagship Pioneering |

|

|

|

|

|

1 |

2017 |

| Sandra Horning, M.D. |

75 |

|

Former Chief Medical Officer and Global Head of Product Development, Roche |

|

|

|

|

|

3 |

2020 |

| François Nader, M.D. |

67 |

|

Former President, CEO and Executive Director, NPS Pharmaceuticals |

|

|

|

|

|

1 |

2019 |

| Paul Sagan |

65 |

|

Catalyst Advisor, General Catalyst |

|

|

|

|

|

0 |

2018 |

Chairman |

Member |

* Comp = Compensation and Talent

Nom Gov = Nominating and Corporate Governance

Prod Dev = Product Development

Sci Tech = Science and Technology

|

** Dr. Nabel was a member of our Board from

December 2015 to July 2020, and rejoined the Board in March 2021, following her retirement from Brigham Health. |

| |

|

|

|

|

The Board of Directors recommends a vote “FOR” the

election of each of the three nominees as a Class III director to serve for a three-year term. For more information on the nominees,

see page 8. |

|

2024

Proxy statement |

4 |

Board Highlights

In 2023, our Board of Directors

contributed to Moderna’s strategic advancement through its oversight of management’s execution of our business plans and strategy.

Advice and guidance from the full Board, and relevant Committees where applicable, was instrumental in the following key accomplishments,

among others, in 2023.

| Commercial Execution |

|

2023 marked our first year of endemic commercial sales for our COVID-19 vaccine

in the U.S., and we achieved retail market share of 48%, up significantly from 37% U.S. retail market share in 2022 (Source: IQVIA).

Preparing for this launch entailed significant strategic investments and commercial execution decisions, which were guided by input

from our Board. The Board has similarly also been heavily engaged in preparations for the anticipated launch of RSV in 2024, our

second commercial product. |

| Pipeline Advancement |

|

The Board and Product Development Committee oversaw investments to advance our pipeline, such that

by year-end 2023, nine of our 45 programs were late-stage, including seven programs in Phase 3 and two rare disease programs. This

significant advancement of our programs lays the foundation for future growth. |

| Capital Allocation |

|

The Board continued to oversee significant capital allocation decisions in 2023. This included

investments in research & development to advance our pipeline, both internally and through external collaborations. It also

included investments in our internal manufacturing capabilities in Norwood and Marlborough, the UK, Australia, and Canada, and the

decision to right-size our manufacturing footprint and to restructure our relationships with contract manufacturers as we seek to

return our COVID franchise to profitability in 2024. |

| Board Succession |

|

The Board and Nominating and Corporate Governance

Committee are continuing to advance our Board succession planning and recruitment of new directors who will bring additional expertise

reflective of Moderna’s future strategic plan and increased scale. |

| Governance Enhancements |

|

In response to investor feedback, our Board approved several

enhancements to our governance practices, including (i) the adoption of majority voting for uncontested director elections, (ii)

the implementation of a proxy access bylaw, and (iii) requesting that shareholders approve the implementation of a right for shareholders

to call a special meeting (see Proposal No. 4). We have also enhanced our processes for assessment and mitigation of potential conflicts

of interest as we expand into new areas. |

| Human Capital and ESG Efforts |

|

The Board and its committees oversaw human capital and environmental,

social and governance (ESG) initiatives. This included efforts to refine our talent strategy as we shift into an endemic market,

focused on retention of key talent, development and performance management. ESG efforts included launching a double-materiality assessment

and climate risk analysis, as well as continuing to enhance transparency through our second ESG Report and ESG Day, and by publishing

Scope 1, 2 and 3 data on greenhouse gas emissions, as well as waste and water statistics. |

|

2024

Proxy statement |

5 |

Proposal 2: Advisory Vote on Compensation of our Executive

Officers

Shareholders will be asked to

approve, on a non-binding, advisory basis, the compensation of Moderna’s named executive officers. This is commonly known

as a “say on pay” proposal.

Over the last several years,

we have evolved our executive compensation programs in order to:

| • |

Enhance alignment with shareholders through our pay-for-performance philosophy; |

| • |

Align with competitive market practices; and |

| • |

Reflect input received from shareholders. |

| Overall Performance |

|

• We

made significant progress in 2023 advancing our mRNA platform and our broad clinical pipeline.

• We

achieved 48% U.S. retail market share for the 2023 fall season, an 11 percentage point increase from 2022.

• Corporate

performance did not meet expectations for our financial goals, falling short on product sales and operating income objectives. |

| Base Salary |

|

• Modest increases in 2023, reflective of merit and market adjustments to better align our executives’ salaries to market, as well as cost-of-living adjustments across our broader employee base. |

| Bonus |

|

• 2023 corporate performance did not meet our expectations, resulting in our Executive Committee members, including our CEO, receiving below target annual bonuses, at 81% of target. |

| Long-Term Incentive |

|

• Increased the weighting to more performance-based restricted share units (PSUs), with the CEO PSU mix increasing to 50%, further tying executive compensation to the long-term achievement of our financial and pipeline expansion objectives, reinforcing our commitment to creating shareholder value. |

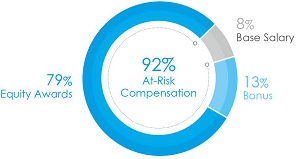

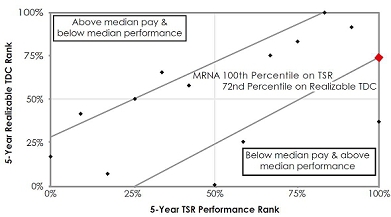

| Realizable Pay |

|

• Weighted

the vast majority of compensation for the CEO and our other named executive officers (NEOs) to “at-risk” compensation,

including bonus and equity awards (stock options, restricted stock units (RSUs) and PSUs) focusing on financial and operational

goals, stock price appreciation and pipeline development goals.

• 92%

at-risk target compensation for CEO, and 85% on average for other NEOs, see charts below.

• CEO

realizable pay demonstrates a strong correlation between stock price performance and pay; see page 41 for more details in the

“Pay for Performance” section of the Compensation Discussion & Analysis (CD&A). |

| Transparency |

|

• Augmented our CD&A to provide shareholders with visibility on the goals underlying our short-term and long-term incentive programs. |

| |

|

|

Our executive compensation program

is based on a pay-for-performance philosophy, which is reflected in both our annual and long-term incentive compensation programs.

We believe that a significant portion of each executive’s compensation should be variable and at-risk and tied to the achievement

of pre-established Company performance goals that drive value creation for our business and align our executives’ interests

with those of our shareholders. The largest component of our 2023 long-term incentive compensation program is delivered in the

form of stock options, which directly aligns payouts with outcomes for our shareholders.

The charts below set forth

the target total compensation mix for Mr. Bancel, our Chief Executive Officer, and our average NEO’s target

compensation for 2023.

| CEO Target Pay Mix |

|

Average NEO Target Pay Mix |

| |

|

|

|

|

|

|

The

Board of Directors recommends a vote “FOR” approval,

on a non-binding, advisory basis, of the compensation of the Company’s Named Executive Officers. For more information,

see page 35. |

|

2024

Proxy statement |

6 |

Proposal 3: Auditor Ratification

| • |

We are asking shareholders to ratify the appointment of Ernst & Young LLP as our independent auditor for the year ended December 31, 2024. |

| • |

The Audit Committee is committed to ensuring the independence of Ernst & Young, and has taken steps in recent years to ensure that we minimize spending on items with the firm other than the audit or audit-related matters. |

|

The

Board of Directors recommends a vote “FOR” the

ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year

ending December 31, 2024. For more information, see page 76. |

Proposal 4: Amend Our Certificate of Incorporation

to Provide Shareholders the Right to Call a Special Meeting

| • |

In response to feedback from our investors, our Board of Directors is proposing to amend our Certificate of Incorporation to permit shareholders representing at least 20% of our outstanding shares to call a special meeting of shareholders. |

| • |

We believe that granting shareholders the right to call a special meeting, while setting a threshold of 20%, will grant investors with a sufficiently large economic and voting interest a valuable right, while also protecting against the potential disruption and possible loss to long-term shareholder value posed by setting a lower threshold. |

| • |

The special meeting right builds on other efforts earlier in 2024—including the adoption of a proxy access bylaw and the adoption of majority voting for uncontested director elections—to respond to investor feedback regarding Moderna’s governance practices. |

|

The

Board of Directors recommends a vote “FOR” the

proposal to amend our Certificate of Incorporation to provide shareholders the right to call a special meeting. For more information,

see page 79. |

Proposal 5: Amend Our Certificate of Incorporation

to Reflect New Delaware Law Provisions Allowing for Officer Exculpation

| • |

In August 2022, Delaware law was amended to permit Delaware companies, like Moderna, to limit the personal liability of certain officers in limited circumstances, similar to protection that was already afforded to directors. |

| • |

The amended law permits a company to exculpate these officers for direct claims brought by shareholders for breach of an officer’s duty of care, but would not eliminate an officer’s monetary liability for breach of fiduciary duty claims brought by the company or in connection with derivative claims brought by shareholders on behalf of the company. It also would not allow officers to be exculpated for breaches of the duty of loyalty to the company, or acts or omissions that are not in good faith or that involve intentional misconduct, a knowing violation of law, or a situation in which an officer derived an improper personal benefit from a transaction. |

| • |

The Board of Directors is proposing to amend our Certificate of Incorporation to allow for the exculpation of officers of Moderna, consistent with the recent changes to Delaware law and to provide our executives similar protections to those already extended to our directors. |

| • |

The Board of Directors recognizes that our officers are called upon to make critical decisions, and that in an increasingly litigious environment our executive team can be exposed to substantial personal liability from litigants seeking to impose liability on the basis of hindsight and regardless of merit. |

| • |

The Board of Directors believes that providing the protection permitted under Delaware law will provide comfort to and empower our officers to best exercise their business judgment in the interests of Moderna and its shareholders, which will encourage agility and critical decision-making, while also enabling us to continue to attract and retain experienced and high-quality officers to the Company. |

|

The

Board of Directors recommends a vote “FOR” the

proposal to amend our Certificate of Incorporation to allow for officer exculpation. For more information, see page 81. |

|

2024

Proxy statement |

7 |

Proposal No. 1: Election of Directors

Our Board of Directors currently

has nine members, who are divided into three equal classes with staggered three-year terms. At the Annual Meeting, three Class

III directors will be elected for a three-year term. Each of these nominees is a Class III director whose current term is expiring.

Each director will continue in office until the election and qualification of a successor or until such director’s earlier

death, resignation, or removal.

Nominees

Our Nominating and Corporate

Governance Committee has recommended, and our Board of Directors has approved, Robert Langer, Elizabeth Nabel, M.D. and Elizabeth

Tallett as nominees for election as Class III directors at the Annual Meeting. Dr. Langer has served on the Board since 2010, Dr.

Nabel has served on the Board since 2015, and Ms. Tallett has served on the Board since 2020.

If you are a shareholder of record

and you sign your proxy card or vote over the Internet or by telephone but do not give instructions with respect to the voting

of directors, your shares will be voted FOR the election of Dr. Langer, Dr. Nabel and Ms. Tallett. We expect that the nominees

will serve if elected. However, if a director nominee is unable or declines to serve as a director at the time of the Annual Meeting,

proxies will be voted for any nominee who is designated by our Board of Directors to fill the resulting vacancy. If you own your

Moderna stock through a broker, bank, or other nominee and you do not give voting instructions, then your shares will not be voted

on this matter. For more information, please see “Information About the 2024 Annual Meeting of Shareholders—What if

I do not specify how my shares are to be voted?” on page 85.

Vote Required

The election of the Class III

directors requires a majority of the votes properly cast to be approved. If a director nominee does not receive a majority of the

votes cast in favor of his or her election to the Board, the director nominee will be required to tender his or her resignation

to the Board for consideration and action by the Board.

|

The

Board of Directors recommends a vote “FOR” the

election of each of the three nominees as a Class III director to serve for a three-year term. |

|

2024

Proxy statement |

8 |

Information About Moderna’s Directors

Nominees

|

Age: 75

Director since: 2010

Independent

Committees:

• Nominating

and Corporate Governance

• Science

and Technology

2023 Attendance: 86% |

Robert Langer, Sc.D. |

|

Why this director is valuable to Moderna

Dr. Langer is one of the world’s

most highly-cited researchers and decorated scientists. His pioneering academic work and extensive knowledge of medical, scientific

and intellectual property matters provide valuable strategic insights into the development of our products and advancement of our

pipeline into new areas. He is intimately familiar with Moderna as one of our founders and largest shareholders, and has decades

of experience applying scientific knowledge and insights to medical and commercial uses. His prior service to the U.S. Food and

Drug Administration (FDA) also provides him with insights into regulatory processes that are key to understanding how we might

obtain approval of our products.

Other Public Boards

• Seer,

Inc. (since 2020)

• Puretech

Health plc (since 2015)

• Abpro

Korea (2020-2024)

• Frequency

Therapeutics, Inc. (2016-2023)

• Rubius

Therapeutics, Inc. (2015-2019)

• Kala

Pharmaceuticals, Inc. (2009-2018)

Education

• B.S.

in chemical engineering from Cornell University

• Sc.D.

in chemical engineering from the Massachusetts Institute of Technology

Dr. Langer has been an Institute Professor at the Massachusetts Institute of Technology (MIT) since 2005, and has been a Professor at MIT since 1977. Dr. Langer served as a member of the Science Board to the U.S. Food and Drug Administration from 1995 to 2002, including as chairman for four years. He is an elected member of the National Academy of Sciences, the National Academy of Engineering, the National Academy of Medicine and the National Academy of Inventors. Dr. Langer has written over 1,550 articles and also has 1,450 issued or pending patents worldwide. Dr. Langer’s patents have been licensed or sublicensed to over 400 pharmaceutical, chemical, biotechnology and medical device companies.

|

|

|

|

|

| |

|

|

| |

|

Age: 72

Director since: 2015

Independent

Committees:

• Compensation

and Talent

• Science

and Technology (Chair)

• Product

Development

2023 Attendance: 100% |

Elizabeth Nabel, M.D. |

|

Why this director is valuable to Moderna

Dr. Nabel brings valuable strategic

insight as a medical doctor and professor of medicine who has spent decades in the healthcare industry. Dr. Nabel has served as

the chief executive of a large hospital organization, which informs her insights into the provision of care and how payors, including

government payors, approach the commercial market, as well as human capital management. Her experience working for governmental

organizations also helps guide our strategy related to the approval and regulation of our products. Her experience working in drug

development and serving as a director for other healthcare companies also provides valuable perspective on our industry.

Other Public Boards

• Medtronic

plc (since 2014)

• Lyell

Immunopharma, Inc. (since 2021)

• Accolade,

Inc. (since 2021)

Education

• B.A.

from St. Olaf College

• M.D.

from Cornell University Medical College

• Postgraduate

training in internal medicine and cardiovascular diseases at Brigham and Women’s Hospital and Harvard University

From 2010 to 2021, Dr. Nabel served as the President of Harvard University-affiliated Brigham Health, which includes Brigham and Women’s Hospital, Brigham and Women’s Faulkner Hospital, and the Brigham and Women’s Physician Organization. Dr. Nabel was also a Professor of Medicine at Harvard Medical School from 2010 to 2021. Following her retirement from Brigham Health, Dr. Nabel served as Executive Vice President for Strategy at ModeX Therapeutics, from 2021 to 2022, when the company was acquired by OPKO Health, Inc. Following the acquisition, Dr. Nabel also served as Chief Medical Officer for OPKO Health until August 2023. She now serves as the Chair of the Advisory Board of OPKO Health. Earlier in her career, Dr. Nabel held a variety of roles, including Director, at the National Heart, Lung and Blood Institute at the National Institutes of Health, a federal agency funding research, training and education programs to promote the prevention and treatment of heart, lung and blood diseases, from 1999 to 2009. She is an elected member of the National Academy of Medicine of the National Academy of Sciences.

|

|

|

|

|

| |

|

|

|

2024

Proxy statement |

9 |

|

Age: 74

Director since: 2020

Independent

Committees:

Audit (Chair)

Compensation and Talent

2023 Attendance: 88% |

Elizabeth Tallett |

|

Why this director is valuable to Moderna

Ms. Tallett provides valuable

strategic insight based upon her extensive professional experience in the pharmaceutical industry, as an executive for organizations

at various stages of development, and as a public company director across different industries. Ms. Tallett’s experience is applied

in helping us identify the opportunities and challenges we face as a commercial-stage pharmaceutical company, as well as understanding

the dynamics impacting customers and payors. Ms. Tallett’s experience as a public company director, including as the Chair or lead

independent director for several public companies, also provides governance expertise, particularly in the areas of financial reporting,

human capital management, and risk management as we scale our organization globally and build out critical internal functions.

Other Public Boards

• Elevance

Health, Inc. (previously Anthem, Inc.) (since 2013), Chair since 2018

• Qiagen,

Inc. (since 2011)

• Principal

Financial Group (2001-2021)

• Meredith

Corp., Inc. (2008-2021)

Education

• Nottingham

University with a dual first class honours degree in mathematics and economics

Ms.

Tallett has spent more than 35 years in strategic leadership and operational roles in worldwide biopharmaceutical and consumer

products industries. From 2002 to 2015, she was a Principal of Hunter Partners, LLC, a management company for pharmaceutical,

biotechnology and medical device companies, and continues to consult with early-stage healthcare companies. She previously served

as President and Chief Executive Officer of Transcell Technologies Inc., President of Centocor Pharmaceuticals, a member of the

Parke-Davis Executive Committee, and Director of Worldwide Strategic Planning for Warner-Lambert Company. Ms. Tallett was a founding

member of the Biotechnology Council of New Jersey and chairs the board of trustees at Solebury School in Pennsylvania. She was

named a Financial Times Outstanding Director of the year in 2015 and recognized as one of the National Association of Corporate

Directors (NACD) Directorship 100 honorees in 2019.

|

|

|

|

|

| |

|

|

Continuing Directors

|

Age: 61

Director since: 2010

Chairman since: 2012

Term expires: 2025

Independent

Committees:

• Nominating

and Corporate Governance (Chair)

2023 Attendance: 92% |

Noubar Afeyan, Ph.D. |

|

Why this director is valuable to Moderna

Dr. Afeyan provides strategic

expertise and vision as one of our co-founders and as our Chairman since 2012. He has decades of experience co-founding, leading

and investing in numerous successful biotechnology companies, applying scientific insights to medical and commercial uses. This

experience helps guide our strategy as we continue to explore ways to expand our platform and as we reimagine the ways in which

we can impact patients. Dr. Afeyan’s experience leading several public and private company boards provides him with valuable leadership

experience as the Chairman of our Board.

Other Public Boards

• Omega

Therapeutics, Inc. (2016-2023), Chair

• Rubius

Therapeutics, Inc. (2013-2022)

• Seres

Therapeutics, Inc. (2012-2020)

• Evelo

Biosciences, Inc. (2014-2019)

• Kaleido

Biosciences, Inc. (2015-2019)

Education

• B.S.

in chemical engineering from McGill University

• Ph.D.

in biochemical engineering from the Massachusetts Institute of Technology

Dr.

Afeyan founded Flagship Pioneering, a company established in 1999 that creates bioplatform companies to transform human health

and sustainability, and serves as its Senior Managing Partner and Chief Executive Officer. He has served on the boards of numerous

privately and publicly held companies. Dr. Afeyan entered biotechnology during its emergence as an academic field and industry,

completing his doctoral work in biochemical engineering at MIT in 1987. He was a senior lecturer at MIT’s Sloan School of

Management where he taught courses on technology-entrepreneurship, innovation and leadership from 2000 to 2016, a lecturer of

business administration at Harvard Business School until 2020, and he currently serves as a member of the MIT Corporation. In

2022, Dr. Afeyan was elected to the National Academy of Engineering.

|

|

|

|

|

| |

|

|

|

2024

Proxy statement |

10 |

|

Age: 51

Director since: 2011

Term expires: 2025

Committees: None

2023 Attendance: 100% |

Stéphane Bancel |

|

Why this director is valuable to Moderna

As our CEO for more than a decade,

Mr. Bancel plays a key role in setting the strategy for Moderna with the rest of the Board, and executing on that strategy with

our management team. Mr. Bancel is intimately familiar with our operations and is a key driver behind our culture and way of working.

Mr. Bancel’s experience prior to Moderna as an executive at other companies provides him with leadership experience and knowledge

of the pharmaceutical industry, including insight into opportunities for Moderna to reimagine how we can have the greatest impact

on patients.

Other Public Boards

• Qiagen

N.V. (2013-2021)

• Syros

Pharmaceuticals, Inc. (2013-2017)

Education

• Master

of Engineering degree from École Centrale Paris

• Master

of Science in chemical engineering from the University of Minnesota

• M.B.A.

from Harvard Business School

Mr. Bancel has served as our CEO since October 2011. Before joining Moderna, Mr. Bancel served for five years as CEO of the French diagnostics company bioMérieux SA. From July 2000 to March 2006, he served in various roles at Eli Lilly and Company, including as Managing Director, Belgium, and as Executive Director, Global Manufacturing Strategy and Supply Chain. Prior to Eli Lilly, Mr. Bancel served as Asia-Pacific Sales and Marketing Director for bioMérieux. He is currently a Venture Partner at Flagship Pioneering. In 2024, Mr. Bancel was elected to the National Academy of Engineering.

|

|

|

|

|

| |

|

|

|

Age: 63

Director since: 2017

Term expires: 2026

Independent

Committees:

• Audit

• Product

Development

2023 Attendance: 100% |

Stephen Berenson |

|

Why this director is valuable to Moderna

Mr. Berenson brings valuable

insight to the Board based upon decades of experience in the investment banking industry, working across different industries and

geographies. This experience has given Mr. Berenson a deep understanding of financial matters, including financial reporting, capital

allocation, and mergers & acquisitions, as well as an understanding of public company board governance, shareholder engagement,

regulation and risk management. His more recent experience at Flagship Pioneering provides Mr. Berenson with valuable insights

into the healthcare industry and the dynamics facing biotech companies at various stages of development.

Other Public Boards

• Seres

Therapeutics, Inc. (since 2019), Chair

Education

• S.B.

in mathematics from the Massachusetts Institute of Technology

Mr.

Berenson is a Managing Partner at Flagship Pioneering. He oversees Flagship’s capital formation and business development

activities, is deeply involved in firm-wide strategy and the firm’s talent agenda and is a member of the firm’s resource

allocation committee. Prior to joining Flagship, Mr. Berenson spent 33 years as an investment banker at J.P. Morgan. During his

last twelve years at J.P. Morgan, Mr. Berenson was Vice Chairman of Investment Banking and focused on providing high-touch strategic

advice to leading companies across all industries globally. He was co-founder of J.P. Morgan’s Global Strategic Advisory

Council and co-founder of the firm’s Board Initiative.

|

|

|

|

|

| |

|

|

|

2024

Proxy statement |

11 |

|

Age: 75

Director since: 2020

Term expires: 2026

Independent

Committees:

• Product

Development (Chair)

• Nominating

and Corporate Governance

• Science

and Technology

2023 Attendance: 94% |

Sandra Horning, M.D. |

|

Why this director is valuable to Moderna

Dr. Horning brings decades of

experience in the healthcare industry to the Board as a practicing oncologist and investigator, professor of medicine, and an executive

leading pharmaceutical drug development with 15 new medicine approvals across multiple therapeutic areas. Dr. Horning provides

valuable insight to our research and development teams as they develop products across our portfolio. These insights inform how

we progress clinical development, engage with regulators and stakeholders, and prepare for commercialization of our product pipeline.

Dr. Horning’s experience as an executive and director at other healthcare companies also informs our understanding of healthcare

industry dynamics and our governance practices.

Other Public Boards

• Revolution

Medicines, Inc. (since 2023)

• Gilead

Sciences, Inc. (since 2020)

• Olema

Pharmaceuticals, Inc. (since 2020)

• EQRx,

Inc. (2021-2023)

Education

• M.D.

from the University of Iowa School of Medicine

• Completed

internal medicine training at the University of Rochester

• Post-graduate

fellowship in Oncology and Cancer Biology at Stanford University

Dr. Horning was the Chief Medical Officer and Global Head of Product Development of Roche, Inc., from 2014 until her retirement in 2019, and, prior to that, served as Global Head of Oncology Clinical Science at Roche from 2009 to 2013. Prior to Roche, Dr. Horning spent 25 years as a practicing oncologist, investigator and tenured Professor of Medicine at Stanford University School of Medicine, where she remains a Professor of Medicine Emerita. From 2005 to 2006, she served as President of the American Society of Clinical Oncology. From 2015 to 2018, Dr. Horning served on the Foundation Medicine Board of Directors.

|

|

|

|

|

| |

|

|

|

Age: 67

Director since: 2019

Term expires: 2026

Independent

Committees:

• Compensation

and Talent (Chair)

• Product

Development

• Science

and Technology

2023 Attendance: 100% |

François Nader, M.D. |

|

Why this director is valuable to Moderna

Dr. Nader brings decades of experience

in the healthcare industry to the Board, having served as an executive for organizations at various stages of development, including

as a public pharmaceutical company CEO. Dr. Nader helps guide our strategy through his insights into various stages of vaccine

development across our portfolio, including clinical development, engagement with regulators, and commercialization. His experience

on the boards of public and private healthcare companies from small cap to large cap across the globe help inform and guide our

growth as we scale our organization.

Other Public Boards

• BenevolentAI

(since 2021), Chair

• Talaris

Therapeutics, Inc. (2018-2023), Chair

• Acceleron

Pharma Inc. (2014-2021), Chair

• Alexion

Pharmaceuticals, Inc. (2017-2021)

• Prevail

Therapeutics Inc. (2018-2021), Chair

• Clementia

Pharmaceuticals Inc. (2014-2019)

• Advanced

Accelerator Applications S.A. (2016-2018)

• Baxalta

(2015-2016)

• NPS

Pharmaceuticals (2008-2015)

Education

• French

doctorate in medicine from St. Joseph University in Lebanon

• Physician

Executive M.B.A. from the University of Tennessee

Dr. Nader served as President, CEO and Executive Director of NPS Pharmaceuticals from 2008 until 2015, when the company was acquired. During his tenure as CEO, Dr. Nader transformed NPS Pharma into a leading global biotechnology company focused on delivering innovative therapies to patients with rare diseases. From September 2023 to January 2024, Dr. Nader served as the acting Chief Executive Officer of BenevolentAI while the company conducted a CEO search. Prior to NPS, Dr. Nader was a venture partner at Care Capital. He previously served on Aventis Pharma’s North America Leadership Team, holding a number of executive positions in integrated healthcare markets and medical and regulatory affairs. Dr. Nader previously led global commercial operations at the Pasteur Vaccines division of Rhone-Poulenc. He is a senior advisor for Blackstone Life Sciences. Dr. Nader is the former Chairman of BioNJ, New Jersey’s biotechnology trade organization, and previously served on the board of the Biotechnology Industry Organization.

|

|

|

|

|

| |

|

|

|

2024

Proxy statement |

12 |

|

Age: 65

Director since: 2018

Term expires: 2026

Independent

Committees:

• Audit

• Nominating

and Corporate Governance

2023 Attendance: 100%

|

Paul Sagan |

|

Why this director is valuable to Moderna

Mr. Sagan brings valuable expertise

to our Board as a former public company CEO, and as an executive and advisor to companies across an array of industries, including

technology, media, and venture capital. Mr. Sagan has decades of experience guiding companies through early stage growth

to maturity and operating as public companies. He has particular insight into how digital technology can facilitate scaling and

growth, while also protecting against cybersecurity threats. His experience as an executive, director and advisor to both public

and private companies provides expertise, particularly in finance and accounting, human capital management and the application

of digital technologies, as we scale our organization globally and build out critical internal functions.

Other Public Boards

• VMware,

Inc. (2014-2023)

• Akamai

Technologies, Inc. (2005-2019)

• EMC

Corp. (2007-2016)

• iRobot,

Inc. (2010-2015)

Education

• B.S.

from the Medill School of Journalism at Northwestern University

Mr. Sagan is a Catalyst Advisor at General Catalyst, a venture capital firm, which he first joined in 2013 and became a Managing Director in 2018. From 2005 to 2013, Mr. Sagan served as CEO at Akamai Technologies, Inc. and was President from 1999 to 2010 and from October 2011 to 2013. Prior to joining Akamai, Mr. Sagan held senior management roles at Time Warner, where he helped to found RoadRunner, the world’s first consumer broadband service; Pathfinder, one of the first web portals that pioneered internet advertising; and NY1, the 24-hour cable news channel.

|

|

|

|

|

|

| |

|

|

|

2024

Proxy statement |

13 |

Governance

Composition of our Board of Directors

Our Board currently consists of

nine members, but the Board has the authority to increase or decrease that size depending on an assessment of its needs and other

relevant circumstances at any given time.

Our Nominating and Corporate Governance

Committee (Nominating Committee) and our Board of Directors consider a broad range of factors when selecting nominees. We strive

to identify candidates who will further the interests of our shareholders. Among other things, we expect that all of our directors

will have the following experience and traits:

| • | substantial experience at a

strategic or policymaking level in a business, government, non-profit,

or academic organization of high standing, able to contribute

to Moderna’s strategic growth and able to offer advice

and guidance to Moderna’s senior management based on that

experience; |

| • | highly accomplished in their

respective fields; |

| • | the ability to contribute positively

to the Board’s collaborative culture; |

| • | knowledge of our business; |

| • | understanding of the competitive

landscape facing our business; and |

| • | expertise relevant to our growth

and business strategy. |

In addition, every nominee must

have sufficient time and availability to devote to Moderna’s affairs, a reputation for high ethical and moral standards,

an understanding of the fiduciary responsibilities assumed by public company directors, and the time and energy necessary to diligently

carry out those responsibilities, and role model our values and demonstrate a willingness to embrace the Moderna Mindsets, further

described in “ESG Topics—Human Capital Management” on page 31.

The Nominating Committee reviews

Board succession regularly, and in considering director candidates is focused on those individuals who can help guide Moderna

as it executes on its strategy over the next several years. This includes seeking out candidates with experience overseeing

global pharmaceutical companies, individuals with significant governmental or public policy experience, and individuals who can

help guide our growth as a digitally enabled and highly innovative company.

In building our Board, we also

believe that the following skills and experiences, while not exhaustive, are helpful in ensuring that our directors collectively

possess the skills and backgrounds necessary for us to execute on our strategic plans and to exercise the Board’s oversight

responsibilities on behalf of our shareholders. Skills and experiences shown below are generally reflective of the individual

having worked in the area, rather than experience obtained as a director in the relevant field.

| Skill/Experience |

Afeyan |

Bancel |

Berenson |

Horning |

Langer |

Nabel |

Nader |

Sagan |

Tallett |

| CEO Experience |

✓ |

✓ |

|

|

|

✓ |

✓ |

✓ |

✓ |

| Digital/Information

Security |

|

✓ |

✓ |

✓ |

|

✓ |

|

✓ |

✓ |

| Drug Development |

✓ |

✓ |

|

✓ |

✓ |

|

✓ |

|

✓ |

| Drug Commercialization |

✓ |

✓ |

|

|

|

|

✓ |

|

✓ |

| Finance/Accounting |

✓ |

✓ |

✓ |

✓ |

|

✓ |

✓ |

✓ |

✓ |

| Government/Regulatory |

✓ |

|

|

✓ |

✓ |

✓ |

✓ |

|

✓ |

| Healthcare

Industry |

✓ |

✓ |

|

✓ |

✓ |

✓ |

✓ |

|

✓ |

| Human Capital

Management |

✓ |

✓ |

✓ |

|

|

✓ |

✓ |

✓ |

✓ |

| International

Experience |

✓ |

✓ |

✓ |

|

|

✓ |

✓ |

✓ |

✓ |

| Investor

Experience |

✓ |

✓ |

✓ |

|

✓ |

|

✓ |

✓ |

✓ |

| Manufacturing/Supply

Chain |

✓ |

✓ |

|

|

|

|

✓ |

|

✓ |

| Science/Technology/R&D |

✓ |

✓ |

|

✓ |

✓ |

✓ |

✓ |

|

|

|

2024

Proxy statement |

14 |

Our directors hold office until

their successors have been elected and qualified or until their earlier death, resignation, or removal. Directors may be removed

only for cause by the affirmative vote of the holders of at least two-thirds of the votes that all our shareholders would be entitled

to cast in an annual election of directors. Any vacancy on our Board of Directors, including a vacancy resulting from an enlargement

of the Board, may be filled only by vote of a majority of the directors then in office.

Board Diversity

The following Board Diversity Matrix

presents our Board diversity statistics in accordance with Nasdaq Rule 5606, as self-disclosed by our current directors. While

the Board satisfies the minimum objectives of Nasdaq Rule 5605(f)(3) by having at least one director who identifies as female

and at least one director who identifies as a member of an Underrepresented Minority (as defined by Nasdaq Rules), we note that

one of our directors also identifies as Middle Eastern. As we pursue future Board recruitment efforts, our Nominating Committee

will continue to seek out candidates who can contribute to the diversity of views and perspectives of the Board in accordance

with the committee’s Policies and Procedures for Director Candidates. This includes seeking out individuals of diverse ethnicities,

a balance in terms of gender, and individuals with diverse perspectives informed by other personal and professional experiences.

Board Diversity Matrix as of

March 7, 2024

| Part I: Gender

Identity |

Female |

Male |

Non-Binary |

Decline

to Disclose |

| Directors (9

total) |

3 |

5 |

- |

1 |

| Part

II: Demographic Background |

Female |

Male |

Non-Binary |

Decline

to Disclose |

| African American

or Black |

- |

- |

- |

- |

| Alaskan Native

or Native American |

- |

- |

- |

- |

| Asian |

- |

1 |

- |

- |

| Hispanic or

Latinx |

- |

- |

- |

- |

| Native Hawaiian

or Pacific Islander |

- |

- |

- |

- |

| White |

3 |

5 |

- |

- |

| Two or More

Races or Ethnicities |

- |

2 |

- |

- |

| LGBTQ+ |

|

|

- |

|

| Did Not Disclose

Demographic Background |

|

|

|

1 |

| Directors

who identify as Middle Eastern |

- |

1 |

- |

- |

Staggered Board

In consultation with our Nominating

Committee, our Board of Directors has determined that a staggered board structure, with directors divided into three classes with

staggered terms, remains appropriate for us at this time. At each annual meeting of shareholders, one class of directors will

be elected for a three-year term to succeed the directors of the same class whose terms are then expiring.

A staggered board provides for

stability, continuity and experience among our Board. This structure helps to resist pressure to focus on short-term results at

the expense of our long-term value and success, which is especially important in our industry given the multi-year time horizons

required for the successful development of pharmaceutical products and product candidates. Our Board also believes that this structure

helps to preserve institutional knowledge that can help us identify new opportunities, such as when our Board noted parallels

early in 2020 between our earlier efforts to develop a vaccine against Middle Eastern Respiratory Syndrome (MERS) and the disease

that came to be known as COVID-19. This led to the successful development and launch of our first product, our COVID-19 vaccine.

|

2024

Proxy statement |

15 |

Board Highlights for 2023

During 2023, the Moderna Board

was focused on continuing to execute on the shift to an endemic, commercial market for the Company’s COVID-19 vaccine, while

also advancing the Company’s pipeline of products beyond COVID-19 and right-sizing the Company’s manufacturing footprint

to lay the foundation for future growth and profitability.

COVID-19

COVID-19 Vaccine Commercial

Launch. In 2023, the market for COVID-19 vaccines further evolved to reflect seasonal market dynamics, with sales

shifting significantly to the second half of the year and significantly lower demand than in 2021 and 2022. Additionally, 2023

marked the shift to an endemic, commercial market in the U.S., with most sales for COVID-19 vaccines occurring in the private

retail channel. The Board remained focused on strategic oversight of these evolving market dynamics and ensuring that Moderna

was ready for a significant product launch of the updated version of its COVID-19 vaccine, Spikevax, in the third quarter of 2023,

which targeted the XBB.1.5 variant of SARS-CoV-2. Launching in a commercial market significantly changed dynamics with respect

to marketing, contracting, distribution and accounting, all of which called on the Board’s expertise. In the U.S. market, the

Moderna team expanded its market share to 48% of the retail market for the 2023 fall vaccination season, up 11 percentage points

from 37% in 2022 (Source: IQVIA). The Company expects to leverage its experience in the commercial market for COVID-19 vaccines

in the anticipated launch of its RSV vaccine in 2024.

Right-Sizing Our Manufacturing

Footprint. Over the course of 2023, evolving market dynamics made clear that the manufacturing footprint that was

necessary for the production of our COVID-19 vaccines in a pandemic setting would no longer be necessary following the shift to

an endemic market. With the Board’s support and oversight, management acted quickly in the third quarter to right-size

the Company’s manufacturing footprint to reflect updated market forecasts. These actions are expected to help return

the COVID-19 vaccine franchise to profitability in 2024.

Pipeline Development

By the end of 2023, Moderna had

nine late-stage programs, including seven programs in Phase 3 development and two rare disease programs poised to enter pivotal

trials in 2024. The Board and its Product Development Committee played a key role in overseeing the advancement and strategic

investment in these programs, laying the groundwork to diversify our business beyond COVID-19 vaccines.

Respiratory Vaccine Franchise. Following

the announcement of positive efficacy data for the Company’s vaccine candidate against respiratory syncytial virus (RSV)

(mRNA-1345) in older adults in January 2023, the Company moved swiftly to apply for approval from regulators in key markets globally.

The Company is anticipating approval and is preparing for commercial launch of this product in 2024. During 2023,

the Company advanced Phase 3 studies for three additional respiratory vaccines programs beyond our original COVID-19 and RSV vaccines:

seasonal flu (mRNA-1010), next-generation COVID-19, which is designed to be refrigerator-stable (mRNA-1283), and our combination

vaccine against seasonal flu and COVID-19 (mRNA-1083). We believe that combination respiratory vaccines have the potential to

improve coverage while also reducing disease burden and producing savings for healthcare systems, both through lower cost of administration

and lower healthcare costs by preventing or reducing the need for care.

Individualized Neoantigen Therapy

(INT). The Board has also been actively engaged in overseeing the advancement of clinical trials and investments to prepare

for commercial readiness for our oncology program, INT (previously referred to as our personalized cancer vaccine) (mRNA-4157),

which we are advancing in collaboration with Merck. The Phase 3 trial of mRNA-4157 for melanoma launched in 2023 and is

enrolling globally. In December 2023, we launched a second Phase 3 trial of mRNA-4157 in non-small cell lung cancer, and

this study is also enrolling globally. Moderna broke ground on an additional manufacturing site in Marlborough, Massachusetts

in 2023, and this facility is expected to be dedicated to the production of INT.

Latent and Rare Diseases. The

Board and its committees continue to oversee our strategy to advance our broader pipeline, including investments in our development

programs and the talent to move them forward. This includes advancing our vaccines against latent and rare diseases and in other

areas. Our Phase 3 study for our vaccine candidate against cytomegalovirus (CMV) (mRNA-1647), the leading infectious cause of

birth defects in the U.S., is fully enrolled and could see an efficacy data readout in 2024. In rare diseases, the Paramount

study of our propionic acidemia (PA) program (mRNA-3927) and the Landmark study of our methylmalonic acidemia (MMA) program (mRNA-3705)

are both ongoing, and are expected to enter into pivotal studies in 2024.

|

2024

Proxy statement |

16 |

Corporate Developments

Governance Updates. In

2023, the Board and Nominating Committee continued to assess feedback from Moderna’s investors regarding its governance

practices. As a result of this feedback, early in 2024, the Board approved updates to the Company’s bylaws to adopt majority

voting for uncontested director elections and to implement a proxy access bylaw on market terms, which will allow shareholders

with a significant, long-term ownership interest to

nominate director candidates for inclusion on the annual meeting ballot. The Board also is requesting approval from shareholders

to amend the Company’s Certificate of Incorporation to allow shareholders to call a special meeting (see “Proposal

4: Amend Our Certificate of Incorporation to Provide Shareholders the Right to Call a Special Meeting,” beginning on page 79). Additionally, during

2023, our Nominating Committee approved updates to our Corporate Governance Guidelines to require that directors obtain the approval

of the Chair of the Committee before taking on any new board or director roles, as described below under “Director Independence.”

Additionally, the Nominating Committee has implemented enhanced screening of potential conflicts as the scope of our business

has expanded.

Capital Allocation. During

2023, the Board played a significant role in steering the Company’s capital allocation strategy. Consistent with the Company’s

announced strategy, this included investments in the pipeline, as discussed above, as well as new manufacturing facilities in

the UK, Canada and Australia to support government partnerships, and investments to facilitate the commercialization of INT. The

Board and the Science and Technology Committee played a key role in overseeing collaborations with other companies, including

those that were announced with Immatics, CytomX and Life Edit Therapeutics. Lastly, the Board played a key role in overseeing

our share buyback program and the decision in the first half of the year to curtail buybacks to preserve capital for future investments.

Executive Compensation and Talent

Management. As discussed in greater detail elsewhere in this Proxy Statement, the Compensation and Talent Committee continues

to update our compensation programs to ensure ongoing alignment between our executives and investors, including tying our performance-based

programs to the Company’s strategy, evolving the weighting of different instruments in our equity programs, and evolving

our culture and ways of working as we seek to scale our operations and prepare for multiple product launches while maintaining

cost discipline. In addition, the Committee oversaw our talent management efforts, including performance, training and retention

programs and the results of our second global pay equity analysis.

ESG Initiatives. The

Board, acting primarily through the Nominating Committee, oversees Moderna’s efforts related to environmental, social and

governance (ESG) matters. In 2023, this included launching a climate-based risk assessment and a double-materiality assessment

to prepare Moderna for potential disclosure requirements related to these matters. In addition, the Committee oversaw efforts

to implement policies related to ESG, and increasing transparency on these matters, including reviewing our roadmap to achieving

publicly announced greenhouse gas reduction targets. For information, see “ESG Topics” below.

Director Independence

Our Corporate Governance Guidelines

provide that at least a majority of the members of the Board must meet the independence standards prescribed by rules of The Nasdaq

Stock Market. Our Board of Directors has determined that all current directors except Mr. Bancel, our Chief Executive Officer,

are independent, as defined by the Securities and Exchange Commission (SEC) and Nasdaq rules.

In making this determination, the

Board considered the relationships that each non-employee director has with Moderna and other relevant facts and circumstances.

There are no family relationships among any of our directors or executive officers.

Directors must notify the Chair

of the Nominating Committee and our Chief Legal Officer prior to accepting any new director roles or in connection with any significant

change in employment status so that the potential for conflicts or other factors that may compromise the director’s ability

to perform his or her duties may be fully assessed. Pre-clearance from the Chair of the Nominating Committee, acting on the advice

of the Chief Legal Officer and in consultation with the full Nominating Committee, where appropriate, is required before a director

may accept any such new roles. At least annually, the Board will evaluate all relationships between Moderna and each director

in light of relevant facts and circumstances for the purpose of determining whether a material relationship exists that might

signal a potential conflict of interest or otherwise interfere with such director’s ability to satisfy his or her responsibilities

as an independent director.

|

2024

Proxy statement |

17 |

Board Leadership Structure

The role of Chairman of the Board

is separated from the role of Chief Executive Officer. Our Chief Executive Officer is responsible for recommending strategic decisions

and capital allocation to the Board and for ensuring the execution of the recommended plans. The Chairman is responsible for leading

the Board of Directors in its fundamental role of providing advice to and independent oversight of management. Our bylaws and

Corporate Governance Guidelines do not require that our Chairman and Chief Executive Officer positions be separate.

Limits on Board Service

Carrying out the duties and fulfilling

the responsibilities of a director requires a significant commitment of time and attention. The Board recognizes that excessive

time commitments can interfere with an individual’s ability to carry out and fulfill his or her duties effectively. In connection

with its assessment of director candidates for nomination, the Board will assess whether the performance of any director has been

or is likely to be adversely affected by excessive time commitments, including service on other boards.

Consistent with this belief, the

Board amended its Corporate Governance Guidelines in 2020 to adopt limits on the number of other boards on which directors may

serve. Under the revised Guidelines, directors who also serve as executives of public companies should not serve on more than

one board of a public company in addition to the Moderna Board, and other directors should not serve on more than three other

boards of public companies in addition to the Moderna Board, absent special circumstances, such as a period of transition.

Application to

Dr. Langer. Dr. Langer is in compliance with our policy related to board service

limits, and serves on the boards of two other public companies. The Nominating Committee notes that while Dr. Langer previously

served on four public company boards (in addition to ours) at the time our policy was adopted in 2020, in the last year he has

come off two of those boards.

Application to

Dr. Nabel. Dr. Nabel is also in compliance with our policy related to board service

limits and has been throughout her term. The Nominating Committee notes that for a temporary period, Dr. Nabel served as

the Chief Medical Officer, part-time, for OPKO Health, while also serving on two public company boards (in addition to ours).

In August 2023, Dr. Nabel ceased acting as Chief Medical Officer for OPKO Health and now serves on an Advisory Board for

that company.

Directors must notify the Chair

of the Nominating Committee and Chief Legal Officer in connection with accepting a seat on the board of directors of another business

and obtain approval before joining so we can fully assess the potential for conflicts or other factors that may compromise the

director’s ability to carry out his or her duties. See “Director Independence” above.

Age and Term Limits

The Board does not believe that

arbitrary limits on the number of consecutive terms a director may serve or on the directors’ ages are appropriate in light

of the substantial benefits resulting from a sustained focus on Moderna’s business, strategy, and industry over a significant

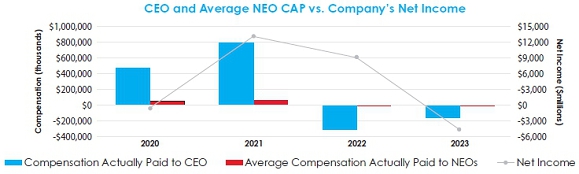

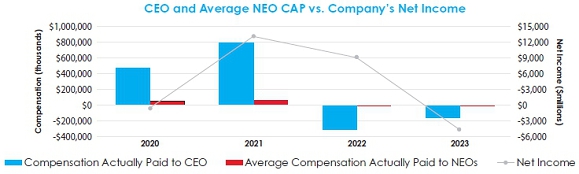

period of time.