0001431695false00014316952024-05-072024-05-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

——————————

FORM 8-K

——————————

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 7, 2024

Olo Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Delaware | 001-40213 | 20-2971562 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| |

99 Hudson Street 10th Floor New York, NY | | | 10013 |

(Address of Principal Executive Offices) | | (Zip Code) |

(212) 260-0895

Registrant's telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, $0.001 par value per share | OLO | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

INFORMATION TO BE INCLUDED IN THE REPORT

Item 2.02. Results of Operations and Financial Condition.

On May 7, 2024, Olo Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended March 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K.

Information in this Form 8-K and Exhibit 99.1 attached hereto is intended to be furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing pursuant to the Securities Act of 1933, as amended, or the Exchange Act whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

Stock Buyback Program

On April 30, 2024, the board of directors of the Company (the “Board”) authorized and approved a stock buyback program (the “Stock Buyback Program”), pursuant to which the Company may repurchase up to $100 million of the currently outstanding shares of the Company’s Class A common stock (the “Class A Common Stock”). Under the Stock Buyback Program, the Company intends to repurchase the Class A Common Stock on a discretionary basis from time to time through open market repurchases, privately negotiated transactions, block purchases, or other means, and such repurchases will be structured to occur in accordance with applicable federal securities laws, including within the requirements of Rule 10b-18 under the Exchange Act. The Company also intends, from time to time, to enter into Rule 10b5-1 plans to facilitate repurchases of its shares under this authorization.

The timing and actual number of shares repurchased, if any, will be determined by the Board or a committee established by the Board, depending on a variety of factors, including the Class A Common Stock price, trading volume, market conditions, the Company’s cash flow and liquidity profile, the capital needs of the business, and other considerations. The Stock Buyback Program does not obligate the Company to repurchase any specific dollar amount or acquire any specific number of shares. The Company expects to fund repurchases pursuant to the Stock Buyback Program with existing cash on hand. The Stock Buyback Program has no expiration date and may be modified, suspended, or terminated at any time by the Board at its discretion. Information regarding repurchases will be available in the Company’s periodic reports on Forms 10-Q and 10-K filed with the Securities and Exchange Commission as required by the applicable rules of the Exchange Act.

Forward-Looking Statements

This Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. In some cases, you can identify forward-looking statements by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would,” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. All statements contained in this Form 8-K that do not relate to matters of historical fact should be considered forward-looking statements, including without limitation statements regarding the amount, timing, and sources of funding for the Stock Buyback Program. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements, including, but not limited to, risks relating to the fact that common stock repurchases may not be conducted in the timeframe or in the manner the Company expects, or at all, and the important factors discussed under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, and its other filings with the SEC. These factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this Form 8-K. Any such forward-looking statements represent management’s estimates as of the date of this Form 8-K. While the Company may elect to update such forward-looking statements at some point in the future, the Company disclaims any obligation to do so, even if subsequent events cause its views to change.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

Exhibit No. Description

104 Cover Page Interactive Data File (embedded within the inline XBRL)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Olo Inc.

Dated: May 7, 2024

| | | | | |

| By: | /s/ Noah H. Glass |

| Noah H. Glass Chief Executive Officer (Principal Executive Officer) |

Exhibit 99.1

Olo Announces First Quarter 2024 Financial Results

Revenue up 27%, ARPU up 29% Year-over-Year

New York, New York - May 7, 2024 - Olo Inc. (NYSE:OLO) (“Olo” or the “Company”), a leading open SaaS platform for restaurants, today announced financial results for the first quarter ended March 31, 2024.

“In Q1, we got off to a great start in delivering on our 2024 financial targets, including 27% year-over-year revenue growth and non-GAAP operating margin expansion to 8%,” said Noah Glass, Olo’s Founder and CEO. “We are also very excited about our new partnerships with NCR Voyix and Qu, which move us closer to launching full-stack Pay functionality later this year and will expand our guest data access into non-digital transactions, where more than 80% of restaurant industry transactions are conducted. With omnichannel guest data at scale and the AI and machine learning solutions to leverage it, we believe Olo is uniquely positioned to help brands deliver more personalized guest experiences that increase sales and grow guest lifetime value.”

First Quarter Financial and Other Highlights

•Total revenue increased 27% year-over-year to $66.5 million.

•Total platform revenue increased 28% year-over-year to $65.8 million.

•Gross profit increased 11% year-over-year to $37.2 million, and was 56% of total revenue.

•Non-GAAP gross profit increased 12% year-over-year to $41.5 million, and was 62% of total revenue.

•Operating loss was $7.2 million, or (11)% of total revenue, compared to operating loss of $17.1 million, or (33)% of total revenue, a year ago.

•Non-GAAP operating income was $5.6 million, or 8% of total revenue, compared to $1.2 million, or 2% of total revenue, a year ago.

•Net loss was $2.4 million, or $0.01 per share, compared to a net loss of $13.7 million, or $0.08 per share a year ago.

•Non-GAAP net income was $7.8 million or $0.05 per share, compared to non-GAAP net income of $3.4 million or $0.02 per share a year ago.

•Cash, cash equivalents, and short- and long-term investments totaled $377.4 million as of March 31, 2024.

•Total shares repurchased were approximately 2.8 million for approximately $15.2 million, bringing total repurchases under the current program to 14.3 million shares for approximately $93.1 million and leaving approximately $6.9 million remaining on the current authorization as of March 31, 2024.

•Average revenue per unit (ARPU) increased 29% year-over-year, and increased 4% sequentially to approximately $816.

•Dollar-based net revenue retention (NRR) was above 120%.

•Ending active locations were approximately 81,000, up approximately 1,000 from the quarter ended December 31, 2023.

First Quarter and Recent Business Highlights

•Newly announced point of sale (POS) integrations with NCR Voyix and Qu unlock non-digital transaction data through full-stack Olo Pay payments and integrations into the Engage Guest Data Platform, expanding Olo’s omnichannel data capabilities.

•In enterprise, Quiznos, a fast-casual sandwich chain, deployed Ordering, Rails, Dispatch, Pay, and Engage Sentiment modules. Dutch Bros, a fast-growing coffee chain, is set to deploy Order and Pay modules across their more than 850 locations by the end of the year, marking their first investment in digital ordering.

•Over a dozen new emerging enterprise brands, including moonbowls and RAKKAN Ramen, implemented multiple Olo modules, while others like Bluestone Lane and Mendocino Farms expanded into Pay, and Panini Kabob Grill and Uncle Julio’s expanded into Engage.

•Announced 13 product enhancements during Olo’s 2024 Spring Release event, available by visiting www.olo.com/quarterly-release/spring-2024. Highlights include Smart Cross-Sells, an AI-powered, dynamic item suggestion feature, and Marketing Attribution Reporting for Engage customers that calculates the ROI of campaigns to influence future guest behavior better. Also announced deeper partner integrations with Curbit, kea, and Sparkfly that further Olo’s commitment to an open ecosystem by improving kitchen capacity management, voice ordering, and guest engagement.

•Announced that Olo’s board of directors authorized a new share repurchase program for up to $100 million of the Company’s Class A common stock. The authorization to repurchase has no expiration date and will be executed consistent with the Company’s capital allocation strategy.

Financial Outlook

As of May 7, 2024, Olo is issuing the following outlook:

For the second quarter of 2024, Olo expects to report:

•Revenue in the range of $67.5 million to $68.0 million; and

•Non-GAAP operating income in the range of $5.5 million to $5.9 million.

For fiscal year 2024, Olo expects to report:

•Revenue in the range of $274.5 million to $276.5 million; and

•Non-GAAP operating income in the range of $23.0 million to $24.5 million.

The outlook provided above constitutes forward-looking information within the meaning of applicable securities laws and is based on a number of assumptions and subject to a number of risks. Actual results could vary materially as a result of numerous factors, including inaccuracies in our assumptions and certain risk factors, many of which are beyond Olo’s control. Olo assumes no obligation to update these forward-looking statements. See the cautionary note regarding “Forward-Looking Statements” below.

Webcast and Conference Call Information

Olo will host a conference call today, May 7, 2024, at 5:00 p.m. Eastern Time to discuss the Company’s financial results and financial outlook. A live webcast of this conference call will be available on the “Investor Relations” website at investors.olo.com, and a replay will be archived on the website as well.

Available Information

Olo announces material information to the public about the Company, its products and services, and other matters through a variety of means, including filings with the SEC, press releases, public conference calls, webcasts, the “Investor Relations” website at investors.olo.com, and the Company’s X (formerly Twitter) account @Olo in order to achieve broad, non-exclusionary distribution of information to the public and for complying with its disclosure obligations under Regulation FD.

About Olo

Olo (NYSE: OLO) is a leading restaurant technology provider with ordering, payment, and guest engagement solutions that help brands increase orders, streamline operations, and improve the guest experience. Each day, Olo processes millions of orders on its open SaaS platform, gathering the right data from each touchpoint into a single source—so restaurants can better understand and better serve every guest on every channel, every time. Over 700 restaurant brands trust Olo and its network of more than 400 integration partners to innovate on behalf of the restaurant community, accelerating technology’s positive impact and creating a world where every restaurant guest feels like a regular. Learn more at olo.com.

Contacts

Media

Olo@icrinc.com

Investor Relations

InvestorRelations@olo.com

Non-GAAP Financial Measures and Other Metrics

Non-GAAP Financial Measures

In this press release, we refer to non-GAAP financial measures that are derived on the basis of methodologies other than in accordance with generally accepted accounting principles in the United States, or GAAP. We use non-GAAP financial measures, as described below, in conjunction with financial measures prepared in accordance with GAAP for planning purposes, including in the preparation of our annual operating budget, as a measure of our core operating results and the effectiveness of our business strategy, and in evaluating our financial performance. These measures provide consistency and comparability with past financial performance as measured by such non-GAAP figures, facilitate period-to-period comparisons of core operating results, and assist shareholders in better evaluating us by presenting period-over-period operating results without the effect of certain charges or benefits that may not be consistent or comparable across periods or compared to other registrants’ similarly named non-GAAP financial measures and key performance indicators.

A reconciliation of these non-GAAP measures has been provided in the financial statement tables included in this press release and investors are encouraged to review the reconciliation. Our use of non-GAAP financial measures has limitations as an analytical tool, and these measures should not be considered in isolation or as a substitute for analysis of our financial results as reported under GAAP. Because our non-GAAP financial measures are not calculated in accordance with GAAP, they may not necessarily be comparable to similarly titled measures employed by other companies.

The following are the non-GAAP financial measures referenced in this press release and presented in the tables below: non-GAAP gross profit (total and each line item, and total and each non-GAAP gross profit item on a margin basis as a percentage of revenue), non-GAAP operating expenses (each line item and each non-GAAP operating expense item on a margin basis as a percentage of revenue), non-GAAP operating income (and on a margin basis as a percentage of revenue), non-GAAP net income (and on a per share basis), and free cash flow.

We adjust our GAAP financial measures for the following items: stock-based compensation expense (non-cash expense calculated by companies using a variety of valuation methodologies and subjective assumptions) and related payroll tax expense, certain litigation-related expenses, net of recoveries (which relate to legal and other professional fees associated with litigation-related matters that are not indicative of our core operations and are not part of our normal course of business), loss on disposal of assets, capitalized internal-use software and intangible amortization (non-cash expense), certain severance costs, and transaction costs (typically incurred within one year of the related acquisition, as well as the related tax impacts of the acquisition). Beginning in the second quarter of 2023, we have included the tax impact of the non-GAAP adjustments in determining non-GAAP net income. We determined this amount by utilizing a federal rate plus a net state rate that excluded the impact of net operating losses, or NOLs, and valuation allowances to calculate a non-GAAP blended statutory rate, which we then applied to all non-GAAP adjustments. The prior period non-GAAP net income presentation has also been revised to include the tax impact of the non-GAAP adjustments and conforms with the new presentation.

Reconciliation of non-GAAP operating income guidance to the most directly comparable GAAP measures is not available without unreasonable efforts on a forward-looking basis due to the high variability, complexity, and low visibility with respect to the charges excluded from these non-GAAP measures; in particular, the measures and effects of stock-based compensation expense and related payroll tax expense specific to equity compensation awards that are directly impacted by unpredictable fluctuations in our stock price. We expect the variability of the above charges to have a significant, and potentially unpredictable, impact on our future GAAP financial results.

Management believes that it is useful to exclude certain non-cash charges and non-core operational charges from our non-GAAP financial measures because: (1) the amount of such expenses in any specific period may not directly correlate to the underlying performance of our business operations and we believe does not relate to ongoing operational performance; and (2) such expenses can vary significantly between periods.

Free cash flow represents net cash provided by or used in operating activities, reduced by purchases of property and equipment and capitalization of internal-use software. Free cash flow is a measure used by management to understand and evaluate our liquidity and to generate future operating plans. Free cash flow excludes items that we do not consider to be indicative of our liquidity and facilitates comparisons of our liquidity on a period-to-period basis. We believe providing free cash flow provides useful information to investors and others in understanding and evaluating the strength of our liquidity and future ability to generate cash that can be used for strategic opportunities or investing in our business from the perspective of our management and Board of Directors.

Key Performance Indicators

In addition, we also use the following key performance indicators to help us evaluate our business, identify trends affecting the business, formulate business plans, and make strategic decisions.

Average revenue per unit (ARPU): We calculate ARPU by dividing the total platform revenue in a given period by the average active locations in that same period. We believe ARPU is an important metric that demonstrates our ability to grow within our customer base through the development of our products that our customers value.

Dollar-based net revenue retention (NRR): We calculate NRR as of a period-end by starting with the revenue, defined as platform revenue, from the cohort of all active customers as of 12 months prior to such period-end, or the prior period revenue. An active customer is a specific restaurant brand that utilizes one or more of our modules in a given quarterly period. We then calculate the platform revenue from these same customers as of the current period-end, or the current period revenue. Current period revenue includes any expansion and is net of contraction or attrition over the last 12 months, but excludes platform revenue from new customers in the current period. We then divide the total current period revenue by the total prior period revenue to arrive at the point-in-time dollar-based NRR. We believe that NRR is an important metric to our investors, demonstrating our ability to retain our customers and expand their use of our modules over time, proving the stability of our revenue base and the long-term value of our customer relationships.

Active locations: We define an active location as a unique restaurant location that is utilizing or subscribed to one or more of our modules in a quarterly period (depending on the module). Given this definition, active locations in any one quarter may not reflect (i) the future impact of new customer wins as it can take some time for their locations to go live with our platform, or (ii) the customers who have indicated their intent to reduce or terminate their use of our platform in future periods. Of further note, not all of our customer locations may choose to utilize our products, and while we aim to deploy all of a customer’s locations, not all locations may ultimately deploy.

Gross merchandise volume (GMV): We define GMV as the gross value of orders processed through our platform.

Gross payment volume (GPV): We define GPV as the gross volume of payments processed through Olo Pay.

Our management uses GMV and GPV metrics to assess demand for our products. We also believe GMV and GPV provide investors with useful supplemental information about the financial performance of our business, enable comparison of financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key metrics used by management in operating our business.

Forward-Looking Statements

Statements we make in this press release include statements that are considered forward-looking within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act, which may be identified by the use of words such as “anticipates,” “believes,” “continue,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “outlook,” “seeks,” “should,” “will,” and similar terms or the negative of such terms. All statements other than statements of historical fact are forward-looking statements for purposes of this release.

We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Securities Exchange Act and are making this statement for purposes of complying with those safe harbor provisions. These statements include, but are not limited to, our financial guidance for the second quarter of 2024 and the full year 2024, our future performance and growth and market opportunities, including new products and continued module adoption among new and existing customers, the continued expansion of ARPU, our expectations regarding the growth of active locations, including with respect to Dutch Bros, revenue expectations for our Order, Pay, and Engage suites, our business strategy, our expectations regarding and timing of the launch of Pay card-present functionality, statements regarding the amount, timing, and sources of funding for the share repurchase program, and our expectations regarding other financial and operational metrics and advancements in our industry. Accordingly, actual results could differ materially or such uncertainties could cause adverse effects on our results.

Forward-looking statements are based upon various estimates and assumptions, as well as information known to us as of the date of this press release, and are subject to risks and uncertainties, including but not limited to: the effects of public health crises, macroeconomic conditions, including inflation, changes in discretionary spending, fluctuating interest rates, geopolitical instability, and overall market uncertainty; our ability to acquire new customers, have existing customers (including our emerging enterprise customers) adopt additional modules, and successfully retain existing customers; our ability to compete effectively with existing competitors, new market entrants, and customers generally developing their own solutions to replace our products; our ability to develop and release new and successful products and services, and develop and release successful enhancements, features, and modifications to our existing products and services; the continued growth of Olo Pay; the costs and success of our sales and marketing efforts, and our ability to promote our brand; our long and unpredictable sales cycles; our ability to identify, recruit, and retain skilled personnel; our ability to effectively manage our growth, including any international expansion; our ability to realize the anticipated benefits of past or future investments, strategic transactions, or acquisitions, and the risk that the integration of these acquisitions may disrupt our business and management; our ability to protect our intellectual property rights and any costs associated therewith; the growth rates of the markets in which we compete and our ability to expand our market opportunity; our actual or perceived failure to comply with our obligations related to data privacy, cybersecurity, and processing payment transactions; the impact of new and existing laws and regulations on our business; changes to our strategic relationships with third parties; our reliance on a limited number of delivery service providers and aggregators; our ability to generate revenue from our product offerings and the effects of fluctuations in our level of client spend retention; the durability of the growth we experienced in the past, including due to the COVID-19 pandemic, guest preferences for digital ordering and customer adoption of multiple modules; and other general market, political, economic, and business conditions. Actual results could differ materially from those predicted or implied, and reported results should not be considered an indication of future performance. Additionally, these forward-looking statements, particularly our guidance, involve risks, uncertainties, and assumptions, including those related to our customers’ spending decisions and guest ordering behavior. Significant variations from the assumptions underlying our forward-looking statements could cause our actual results to vary, and the impact could be significant.

Additional risks and uncertainties that could affect our financial results and forward-looking statements are included under the caption “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024 that will be filed following this press release, our Annual Report on Form 10-K for the year ended December 31, 2023, and our other SEC filings, which are available on our “Investor Relations” website at investors.olo.com and on the SEC website at www.sec.gov. Undue reliance should not be placed on the forward-looking statements in this press release. All forward-looking statements contained herein are based on information available to us as of the date hereof, and we do not assume any obligation to update these statements as a result of new information or future events.

OLO INC.

Condensed Consolidated Balance Sheets (Unaudited)

(in thousands, except share and per share amounts)

| | | | | | | | | | | |

| As of March 31,

2024 | | As of December 31,

2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 259,085 | | | $ | 278,218 | |

| Short-term investments | 93,121 | | | 84,331 | |

Accounts receivable, net of expected credit losses of $3,605 and $2,785, respectively | 72,383 | | | 70,264 | |

| Contract assets | 437 | | | 412 | |

| Deferred contract costs | 4,544 | | | 4,743 | |

| Prepaid expenses and other current assets | 12,896 | | | 12,769 | |

| Total current assets | 442,466 | | | 450,737 | |

Property and equipment, net of accumulated depreciation and amortization of $12,225 and $10,111, respectively | 23,957 | | | 22,055 | |

Intangible assets, net of accumulated amortization of $9,254 and $8,264, respectively | 16,748 | | | 17,738 | |

| Goodwill | 207,781 | | | 207,781 | |

| Contract assets, noncurrent | 351 | | | 352 | |

| Deferred contract costs, noncurrent | 6,183 | | | 5,806 | |

| Operating lease right-of-use assets | 11,879 | | | 12,529 | |

| Long-term investments | 25,177 | | | 25,748 | |

| Other assets, noncurrent | 61 | | | 73 | |

| Total assets | $ | 734,603 | | | $ | 742,819 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 2,087 | | | $ | 4,582 | |

| Accrued expenses and other current liabilities | 67,144 | | | 68,240 | |

| Unearned revenue | 2,683 | | | 1,533 | |

| Operating lease liabilities, current | 2,875 | | | 2,859 | |

| Total current liabilities | 74,789 | | | 77,214 | |

| Unearned revenue, noncurrent | 114 | | | 57 | |

| Operating lease liabilities, noncurrent | 13,257 | | | 13,968 | |

| Other liabilities, noncurrent | — | | | 109 | |

| Total liabilities | 88,160 | | | 91,348 | |

| Stockholders’ equity: | | | |

Class A common stock, $0.001 par value; 1,700,000,000 shares authorized at March 31, 2024 and December 31, 2023; 106,952,231 and 108,469,679 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively. Class B common stock, $0.001 par value; 185,000,000 shares authorized at March 31, 2024 and December 31, 2023; 54,891,834 and 54,891,834 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively | 162 | | | 163 | |

Preferred stock, $0.001 par value; 20,000,000 shares authorized at March 31, 2024 and December 31, 2023 | — | | | — | |

| Additional paid-in capital | 864,610 | | | 867,152 | |

| Accumulated deficit | (218,185) | | | (215,829) | |

| Accumulated other comprehensive loss | (144) | | | (15) | |

| Total stockholders’ equity | 646,443 | | | 651,471 | |

| Total liabilities and stockholders’ equity | $ | 734,603 | | | $ | 742,819 | |

OLO INC.

Condensed Consolidated Statements of Operations (Unaudited)

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, |

| | | | | 2024 | | 2023 |

| Revenue: | | | | | | | |

| Platform | | | | | $ | 65,765 | | | $ | 51,371 | |

| Professional services and other | | | | | 746 | | | 869 | |

| Total revenue | | | | | 66,511 | | | 52,240 | |

| Cost of revenue: | | | | | | | |

| Platform | | | | | 28,328 | | | 17,613 | |

| Professional services and other | | | | | 975 | | | 1,136 | |

| Total cost of revenue | | | | | 29,303 | | | 18,749 | |

| Gross profit | | | | | 37,208 | | | 33,491 | |

| Operating expenses: | | | | | | | |

| Research and development | | | | | 16,999 | | | 20,473 | |

| General and administrative | | | | | 12,756 | | | 17,210 | |

| Sales and marketing | | | | | 14,613 | | | 12,881 | |

| | | | | | | |

| Total operating expenses | | | | | 44,368 | | | 50,564 | |

| Loss from operations | | | | | (7,160) | | | (17,073) | |

| Other income, net: | | | | | | | |

| Interest income | | | | | 4,907 | | | 3,454 | |

| Interest expense | | | | | (69) | | | (69) | |

| Other income, net | | | | | 3 | | | — | |

| Total other income, net | | | | | 4,841 | | | 3,385 | |

| Loss before income taxes | | | | | (2,319) | | | (13,688) | |

| Provision for income taxes | | | | | 37 | | | 18 | |

| Net loss | | | | | $ | (2,356) | | | $ | (13,706) | |

| | | | | | | |

| | | | | | | |

| Net loss per share attributable to Class A and Class B common stockholders: | | | | | | | |

| Basic | | | | | $ | (0.01) | | | $ | (0.08) | |

| Diluted | | | | | $ | (0.01) | | | $ | (0.08) | |

| Weighted-average Class A and Class B common shares outstanding: | | | | | | | |

| Basic | | | | | 162,320,759 | | | 161,691,506 | |

| Diluted | | | | | 162,320,759 | | | 161,691,506 | |

OLO INC.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

| | | | | | | | | | | |

| Three Months Ended

March 31, |

| 2024 | | 2023 |

| Operating activities | | | |

| Net loss | $ | (2,356) | | | $ | (13,706) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation and amortization | 3,103 | | | 2,148 | |

| Stock-based compensation | 10,840 | | | 14,044 | |

| | | |

| Provision for expected credit losses | 1,433 | | | 725 | |

| Non-cash lease expense | 650 | | | 797 | |

| | | |

| Loss on disposal of assets | — | | | 38 | |

| | | |

| Other non-cash operating activities, net | (548) | | | (770) | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (3,553) | | | (2,979) | |

| Contract assets | (23) | | | (182) | |

| Prepaid expenses and other current and noncurrent assets | (104) | | | 430 | |

| Deferred contract costs | (178) | | | (1,308) | |

| Accounts payable | (2,531) | | | (1,230) | |

| Accrued expenses and other current liabilities | (1,109) | | | 9,098 | |

| Operating lease liabilities | (695) | | | (835) | |

| Unearned revenue | 1,207 | | | 984 | |

| Other liabilities, noncurrent | (109) | | | (7) | |

| Net cash provided by operating activities | 6,027 | | | 7,247 | |

| Investing activities | | | |

| Purchases of property and equipment | (68) | | | — | |

| Capitalized internal-use software | (3,149) | | | (3,382) | |

| | | |

| Purchases of investments | (34,531) | | | (38,715) | |

| Sales and maturities of investments | 26,732 | | | 34,002 | |

| Net cash used in investing activities | (11,016) | | | (8,095) | |

| Financing activities | | | |

| Cash received for employee payroll tax withholdings | 1,889 | | | 2,834 | |

| Cash paid for employee payroll tax withholdings | (1,876) | | | (2,416) | |

| | | |

| | | |

| | | |

| Proceeds from exercise of stock options | 1,133 | | | 1,890 | |

| Repurchase of common stock | (15,290) | | | (20,052) | |

| Net cash used in financing activities | (14,144) | | | (17,744) | |

| Net decrease in cash and cash equivalents | (19,133) | | | (18,592) | |

| Cash and cash equivalents, beginning of period | 278,218 | | | 350,073 | |

| Cash and cash equivalents, end of period | $ | 259,085 | | | $ | 331,481 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

OLO INC.

Reconciliation of GAAP to Non-GAAP Results (Unaudited)

(in thousands, except for percentages and share and per share amounts)

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, |

| | | | | 2024 | | 2023 |

| Gross profit and gross margin reconciliation: | | | | | | | |

| Platform gross profit, GAAP | | | | | $ | 37,437 | | | $ | 33,758 | |

| Plus: Stock-based compensation expense and related payroll tax expense | | | | | 1,559 | | | 1,899 | |

| Plus: Capitalized internal-use software and intangible amortization | | | | | 2,639 | | | 1,650 | |

| | | | | | | |

| Platform gross profit, non-GAAP | | | | | 41,635 | | | 37,307 | |

| Services gross profit, GAAP | | | | | (229) | | | (267) | |

| Plus: Stock-based compensation expense and related payroll tax expense | | | | | 129 | | | 198 | |

| | | | | | | |

| Services gross profit, non-GAAP | | | | | (100) | | | (69) | |

| Total gross profit, GAAP | | | | | 37,208 | | | 33,491 | |

| Total gross profit, non-GAAP | | | | | 41,535 | | | 37,238 | |

| Platform gross margin, GAAP | | | | | 57 | % | | 66 | % |

| Platform gross margin, non-GAAP | | | | | 63 | % | | 73 | % |

| Services gross margin, GAAP | | | | | (31) | % | | (31) | % |

| Services gross margin, non-GAAP | | | | | (13) | % | | (8) | % |

| Total gross margin, GAAP | | | | | 56 | % | | 64 | % |

| Total gross margin, non-GAAP | | | | | 62 | % | | 71 | % |

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, |

| | | | | 2024 | | 2023 |

| Sales and marketing reconciliation: | | | | | | | |

| Sales and marketing, GAAP | | | | | $ | 14,613 | | | $ | 12,881 | |

| Less: Stock-based compensation expense and related payroll tax expense | | | | | 1,557 | | | 2,567 | |

| Less: Intangible amortization | | | | | 341 | | | 341 | |

| Less: Certain severance costs | | | | | — | | | 121 | |

| | | | | | | |

| Sales and marketing, non-GAAP | | | | | 12,715 | | | 9,852 | |

| Sales and marketing as % total revenue, GAAP | | | | | 22 | % | | 25 | % |

| Sales and marketing as % total revenue, non-GAAP | | | | | 19 | % | | 19 | % |

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, |

| | | | | 2024 | | 2023 |

| Research and development reconciliation: | | | | | | | |

| Research and development, GAAP | | | | | $ | 16,999 | | | $ | 20,473 | |

| Less: Stock-based compensation expense and related payroll tax expense | | | | | 3,134 | | | 4,751 | |

| | | | | | | |

| | | | | | | |

| Research and development, non-GAAP | | | | | 13,865 | | | 15,722 | |

| Research and development as % total revenue, GAAP | | | | | 26 | % | | 39 | % |

| Research and development as % total revenue, non-GAAP | | | | | 21 | % | | 30 | % |

OLO INC.

Reconciliation of GAAP to Non-GAAP Results (Unaudited)

(in thousands, except percentages and share and per share amounts)

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, |

| | | | | 2024 | | 2023 |

| General and administrative reconciliation: | | | | | | | |

| General and administrative, GAAP | | | | | $ | 12,756 | | | $ | 17,210 | |

| Less: Stock-based compensation expense and related payroll tax expense | | | | | 4,749 | | | 5,082 | |

| | | | | | | |

| Less: Certain litigation-related expenses, net of recoveries | | | | | (1,372) | | | 884 | |

| | | | | | | |

| Less: Intangible amortization | | | | | 41 | | | 41 | |

| Less: Certain severance costs | | | | | — | | | 709 | |

| Less: Loss on disposal of assets | | | | | — | | | 38 | |

| Less: Transaction costs | | | | | — | | | 36 | |

| General and administrative, non-GAAP | | | | | 9,338 | | | 10,420 | |

| General and administrative as % total revenue, GAAP | | | | | 19 | % | | 33 | % |

| General and administrative as % total revenue, non-GAAP | | | | | 14 | % | | 20 | % |

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, |

| | | | | 2024 | | 2023 |

| Operating loss reconciliation: | | | | | | | |

| Operating loss, GAAP | | | | | $ | (7,160) | | | $ | (17,073) | |

| Plus: Stock-based compensation expense and related payroll tax expense | | | | | 11,128 | | | 14,497 | |

| | | | | | | |

| Plus: Certain litigation-related expenses, net of recoveries | | | | | (1,372) | | | 884 | |

| | | | | | | |

| | | | | | | |

| Plus: Capitalized internal-use software and intangible amortization | | | | | 3,021 | | | 2,032 | |

| | | | | | | |

| Plus: Certain severance costs | | | | | — | | | 830 | |

| Plus: Loss on disposal of assets | | | | | — | | | 38 | |

| Plus: Transaction costs | | | | | — | | | 36 | |

| Operating income, non-GAAP | | | | | 5,617 | | | 1,244 | |

| Operating margin, GAAP | | | | | (11) | % | | (33) | % |

| Operating margin, non-GAAP | | | | | 8 | % | | 2 | % |

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, |

| | | | | 2024 | | 2023 |

| Net loss reconciliation: | | | | | | | |

| Net loss, GAAP | | | | | $ | (2,356) | | | $ | (13,706) | |

| Plus: Stock-based compensation expense and related payroll tax expense | | | | | 11,128 | | | 14,497 | |

| | | | | | | |

| Plus: Certain litigation-related expenses, net of recoveries | | | | | (1,372) | | | 884 | |

| | | | | | | |

| | | | | | | |

| Plus: Capitalized internal-use software and intangible amortization | | | | | 3,021 | | | 2,032 | |

| | | | | | | |

| Plus: Certain severance costs | | | | | — | | | 830 | |

| Plus: Loss on disposal of assets | | | | | — | | | 38 | |

| Plus: Transaction costs | | | | | — | | | 36 | |

| | | | | | | |

Less: Tax impact of non-GAAP adjustments (1) | | | | | (2,599) | | | (1,207) | |

| Net income, non-GAAP | | | | | 7,822 | | | 3,404 | |

| Fully diluted net loss per share attributable to Class A and Class B common stockholders, GAAP | | | | | $ | (0.01) | | | $ | (0.08) | |

| Fully diluted weighted average Class A and Class B common shares outstanding, GAAP | | | | | 162,320,759 | | | 161,691,506 | |

| Fully diluted net income (loss) per share attributable to Class A and Class B common stockholders, non-GAAP | | | | | $ | 0.05 | | | $ | 0.02 | |

| Fully diluted Class A and Class B common shares outstanding, non-GAAP | | | | | 172,729,774 | | | 178,301,862 | |

(1) We utilized a federal rate plus a net state rate that excluded the impact of NOLs and valuation allowances to calculate our non-GAAP blended statutory rate of 25.83% and 26.46% for the three months ended March 31, 2024 and 2023, respectively.

OLO INC.

Non-GAAP Free Cash Flow (Unaudited)

(in thousands)

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, |

| | | | | 2024 | | 2023 |

| Net cash provided by operating activities | | | | | $ | 6,027 | | | $ | 7,247 | |

| Purchase of property and equipment | | | | | (68) | | | — | |

| Capitalized internal-use software | | | | | (3,149) | | | (3,382) | |

| Non-GAAP free cash flow | | | | | $ | 2,810 | | | $ | 3,865 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

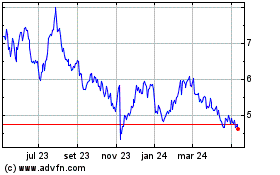

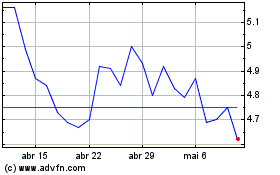

Olo (NYSE:OLO)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Olo (NYSE:OLO)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024