UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE

13A-16 OR 15D-16 UNDER THE SECURITIES

EXCHANGE

ACT OF 1934

For

the month of May, 2024

Commission

File Number: 001-41353

Genius

Group Limited

(Translation

of registrant’s name into English)

8

Amoy Street, #01-01

Singapore

049950

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ________.

Note:

Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report

to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ________.

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that

the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on

which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on EDGAR.

Exhibit

Index

Exhibit

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

GENIUS

GROUP LIMITED |

| |

|

|

| Date:

May 15, 2024 |

|

|

| |

By: |

/s/

Roger James Hamilton |

| |

Name: |

Roger

James Hamilton |

| |

Title: |

Chief

Executive Officer and Chairman

(Principal

Executive Officer) |

Exhibit 99.1

Genius

Group Announces 2023 Financial Results, 150% Pro Forma Revenue Growth to $70.4 million

Singapore,

May 15, 2024 — Genius Group Limited (NYSE American: GNS) (“Genius Group”

or the “Company”), a leading provider of AI-powered, digital-first education solutions, announced today its

financial results for the year ended December 31, 2023.

Business

Highlights for Fiscal 2023

| ● | 2023

audited revenue increased 27% to $23.1 million from $18.2 million in 2022. |

| ● | Pro

forma 2023 revenue increased 150% to $70.4 million from $28.1 million in 2022, including

revenue from the FatBrain AI transaction. |

| ● | Students

and users increased 24% to 5.5 million from 4.4 million in 2022. |

| ● | Gross

profit increased to $11.9 million or 52% of revenue compared to $8.6 million, or 47% of revenue

in 2022. |

| ● | Net

loss after tax reduced 90% to ($5.7) million compared to ($56.0) million in 2022. On a pro

forma basis, net loss after tax reduced further to ($0.8) million. |

| ● | Reiterates

previously issued 2024 pro forma revenue guidance of at least $105 million for the full year,

a 50% increase compared to 2023’s pro forma revenue of $70.4 million |

Roger

James Hamilton, Founder and CEO of Genius Group, commented “2023 was a year of significant growth in revenue combined with a significant

reduction in costs, positioning us for strong, sustainable growth in 2024.”

“2024

is already proving to be a truly transformative year for Genius Group. The completion of the recent of acquisition FatBrain AI and pending

OpenExO transaction have accelerated our plans to build a global AI education and acceleration group. We are building upon our AI-driven

Edtech platform, GeniusU, with in-demand AI training and AI tools to power the exponential economies of tomorrow.”

“We

are launching our Genius City Model, beginning with Singapore, Dubai and Abu Dhabi, to deliver localized learning ecosystems for students,

entrepreneurs, businesses and governments to access AI education and acceleration tools with their own localized AI avatars and assistants.

Our Genius City Model has attracted global interest, with nine new Genius Cities now scheduled to launch in 2024: London, Tokyo, Mumbai,

Miami, Las Vegas, Toronto, Vancouver, Stockholm and Santiago.”

Audited

Financial Results

The

audited financial results are for the seven companies within Genius Group (excluding the FatBrain AI and pending OpenExO transactions

completed and to be completed in 2024) and including nine months of Entrepreneur Resorts Ltd prior to its spin off in October 2023.

| ● | During

the year ended December 31, 2023, overall revenue totaled $23.1 million, or an increase of

27%, compared to $18.2 million in the previous year. This was driven by an increase in Education

Revenue of 37% from $13.6 million to $18.6 million and decrease in campus revenue by 4% from

$4.6 million in 2022 to $4.5 million in 2023 as a result of the ERL spin off. |

| ● | Gross

profit increased to $11.9 million or 52% of revenue compared to $8.6 million, or 47% or revenue

in 2022. |

| ● | Operating

expenses decreased to $48.3 million in 2023 compared to $51.1 million in 2022. The decrease

in our operating expenses is the result of lower impairments offset by continued investment

in our business. |

| ● | Net

loss for 2023 was ($5.7) million compared to a net loss of ($56.0) million in 2022. Earnings

per diluted share were $(0.10) in 2023 compared to $(2.47) in 2022. |

| ● | Cash

and equivalents on December 31, 2023 were $1.3 million. Total assets at December 31, 2023

were $43.2 million. |

Pro

Forma Financial Results

Genius

Group pro forma financial results is for the seven companies within Genius Group, taking into account the Group Companies including FatBrain

AI with the transaction completed in March 2024, and excluding Entrepreneur Resorts Ltd, which spun off in October 2023, and pending

OpenExO, as the agreement was completed in 2024 but final closing is pending various closing conditions being met.

The

Pro Forma Financial Results should be viewed as the current group’s financial performance, of which the audited financial results

represent a subset of this group – the group prior to the 2024 FatBrain AI transaction. The historical results do not necessarily

indicate our expected results for any future periods.

| ● | During

the year ended December 31, 2023, overall pro forma revenue totaled $70.4 million, compared

to $28.1 million in 2022. |

| ● | Pro

forma gross profit was $17.0 million or 24% of revenue. |

| ● | Pro

forma net loss after tax was ($0.8) million. |

| ● | Pro

forma total assets was $97.9 million. |

Strategic

and Operational Highlights

| ● | Welcomed

leading education entrepreneurs to our investor base, including Michael Moe (Founder and

CEO of GSV Ventures), Brent Richardson (Past CEO and Chairman of Grand Canyon Education),

Dr Ali Saeed Bin Harmal Aldhaheri (Founder and Chairman of Abu Dhabi University). |

| ● | Added

new Board Members and Executive Team, including Salim Ismail (Founder, OpenExO), Eric Pulier

(Founder, Vatom), new Chairman, Michael Moe, and new CFO, Adrian Reese. |

| ● | Completed

transaction with FatBrain AI and signed agreement with OpenExo, building AI product suite |

| ● | Launched

Genius City model with first cities Singapore, Dubai and Abu Dhabi |

| ● | Launched

AI educator suite of AI Genie and AI Avatars |

| ● | Launched

full AI-driven partner portal for education and community partners |

| ● | Moved

from campus to digital revenue with spin off of ERL and closure of UAV |

| ● | Restructured

financing with full repayment of $18.3 million convertible note eighteen months ahead of

schedule. |

Financial

Guidance

Genius

Group maintains its 2024 financial guidance as we scale our GeniusU, AI-Driven Edtech platform and scale our Genius City model of local

teams delivering AI training and AI tools to participating cities around the world. We believe we are on a strong, sustainable pathway

of ongoing organic growth and acquisitions, leading to continued revenue growth and a path to sustainable, cash positive, profitable

growth.

Profit

& Loss Performance

| | |

Pro forma | | |

Audited Financials | |

| | |

Year Ended | | |

Year Ended | |

| | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2023 | | |

2022 | |

| | |

(USD 000’s) | | |

(USD 000’s) | | |

(USD 000’s) | |

| Revenue | |

| 70,371 | | |

| 23,063 | | |

| 18,194 | |

| Cost of revenue | |

| (53,325 | ) | |

| (11,127 | ) | |

| (9,555 | ) |

| Gross profit | |

| 17,046 | | |

| 11,936 | | |

| 8,639 | |

| Other Operating Income | |

| 346 | | |

| 344 | | |

| 144 | |

| Operating Expenses | |

| (47,753 | ) | |

| (48,347 | ) | |

| (51,121 | ) |

| Operating Loss | |

| (30,361 | ) | |

| (36,067 | ) | |

| (42,338 | ) |

| Other income | |

| 32,965 | | |

| 32,981 | | |

| 418 | |

| Other Expense | |

| (4,070 | ) | |

| (3,704 | ) | |

| (15,151 | ) |

| Net Loss Before Tax | |

| (1,466 | ) | |

| (6,790 | ) | |

| (57,070 | ) |

| Tax Benefits | |

| 644 | | |

| 1,079 | | |

| 1,063 | |

| Net Loss | |

| (822 | ) | |

| (5,711 | ) | |

| (56,007 | ) |

| Other Comprehensive Income | |

| (204 | ) | |

| (204 | ) | |

| (290 | ) |

| Total Comprehensive Loss | |

| (1,026 | ) | |

| (5,915 | ) | |

| (56,297 | ) |

| Net income per share, basic and diluted | |

| (0.01 | ) | |

| (0.10 | ) | |

| (2.47 | ) |

| Weighted-average number of shares outstanding, basic and diluted | |

| 55,501,971 | | |

| 55,501,971 | | |

| 22,634,366 | |

About

Genius Group

Genius

Group (NYSE: GNS) is a leading provider of AI-powered, digital-first education solutions, disrupting the highly standardized system of

traditional education with a personalized, flexible and life-long learning curriculum for the modern student. Genius Group services 5.4

million users in over 200 countries, providing personalized curriculums for individuals, enterprises and governments. The comprehensive,

AI-powered platform offers programs for K-12 education, accredited university courses and skills-based courses for entrepreneurs. To

learn more, please visit https://www.geniusgroup.net/.

Investor

Notice

Investing

in our securities involves a high degree of risk. Before making an investment decision, you should carefully consider the risks, uncertainties

and forward-looking statements described in our most recent Annual Report on Form 20-F for the fiscal year ended December 31, 2023, filed

with the SEC on May 14, 2023. If any of these risks were to occur, our business, financial condition or results of operations would likely

suffer. In that event, the value of our securities could decline, and you could lose part or all of your investment. The risks and uncertainties

we describe are not the only ones facing us. Additional risks not presently known to us or that we currently deem immaterial may also

impair our business operations. In addition, our past financial performance may not be a reliable indicator of future performance, and

historical trends should not be used to anticipate results in the future. See “Forward-Looking Statements” below.

Forward-Looking

Statements

Statements

made in this press release include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the use of words such as “may,”

“will,” “plan,” “should,” “expect,” “anticipate,” “estimate,”

“continue,” or comparable terminology. Such forward-looking statements are inherently subject to certain risks, trends and

uncertainties, many of which the Company cannot predict with accuracy and some of which the Company might not even anticipate and involve

factors that may cause actual results to differ materially from those projected or suggested. Readers are cautioned not to place undue

reliance on these forward-looking statements and are advised to consider the factors listed above together with the additional factors

under the heading “Risk Factors” in the Company’s Annual Reports on Form 20-F, as may be supplemented or amended by

the Company’s Reports of a Foreign Private Issuer on Form 6-K. The Company assumes no obligation to update or supplement forward-looking

statements that become untrue because of subsequent events, new information or otherwise.

Investor

Relations Contact:

Brian M. Prenoveau, CFA

Managing Director

MZ Group - MZ North America

(561) 489-5315

GNS@mzgroup.us

www.mzgroup.us

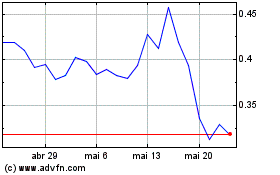

Genius (AMEX:GNS)

Gráfico Histórico do Ativo

De Out 2024 até Out 2024

Genius (AMEX:GNS)

Gráfico Histórico do Ativo

De Out 2023 até Out 2024