false

0001883685

0001883685

2024-05-22

2024-05-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 23, 2024 (May 22, 2024)

DRAFTKINGS INC.

(Exact name of registrant as specified in its charter)

| Nevada |

001-41379 |

87-2764212 |

| (State or other jurisdiction of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

222 Berkeley Street, 5th Floor

Boston, MA 02116

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including area code: (617) 986-6744

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

|

Title of

each class |

|

Trading Symbol(s) |

|

Name of each

exchange on which registered |

| Class A common stock, par value $0.0001 per share |

|

DKNG |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 3.02 | Unregistered Sale of Equity Securities. |

On May 22, 2024, DraftKings

Inc., a Nevada corporation (the “Company” or “DraftKings”), issued 7,507,817 shares of its Class

A common stock, par value $0.0001 per share (such issuance, the “Stock Consideration”), in connection with the consummation

of the transactions contemplated by the agreement and plan of merger and plan of reorganization, dated as of February 11, 2024, by and

among DraftKings, JackPocket Inc., a Delaware corporation (“Jackpocket”), DraftKings Holdings Inc., a Nevada corporation

and a direct wholly-owned subsidiary of DraftKings (“DK HoldCo”), Fortune Merger Sub Inc., a Delaware corporation and

a direct wholly-owned subsidiary of DK HoldCo, Fortune Merger Sub LLC, a Delaware limited liability company and a direct wholly-owned

subsidiary of DK HoldCo, and Shareholder Representative Services LLC, a Colorado limited liability company, solely in its capacity as

representative, agent and attorney-in-fact of the Jackpocket securityholders (the “Transactions”).

The Stock Consideration

was issued in respect of Jackpocket capital stock held by accredited investors in reliance upon the exemption from registration

afforded by Section 4(a)(2) and Rule 506 promulgated under the Securities Act of 1933, as amended (the “Securities

Act”). Shares of Jackpocket capital stock held by non-accredited investors received additional cash consideration in

respect of their shares of Jackpocket capital stock in lieu of Stock Consideration, and shares of Jackpocket capital stock held by

accredited investors received consideration reflecting a corresponding reduction in cash consideration and increase in Stock

Consideration in respect of their shares of Jackpocket capital stock.

| Item 7.01. | Regulation FD Disclosure. |

On May 23, 2024, DraftKings

issued a press release, a copy of which is attached hereto as Exhibit 99.1, announcing, among other things, the consummation of the Transactions.

The information in this Item

7.01, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act, except

as shall be expressly set forth by specific reference in such filing. This Current Report on Form 8-K will not be deemed an admission

as to the materiality of any information in this Item 7.01, including Exhibit 99.1.

| Item 9.01 | Financial Statements and Exhibits. |

Exhibit Number

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

DRAFTKINGS INC. |

| Date: May 23, 2024 |

|

| |

By: |

/s/ R. Stanton Dodge |

| |

Name |

R. Stanton Dodge |

| |

Title: |

Chief Legal Officer and Secretary |

Exhibit 99.1

DraftKings Completes Acquisition of Jackpocket

Unlocks

Access to the U.S. Digital Lottery Industry and Significant Cross-Sell Capabilities

BOSTON

& NEW YORK, May 23, 2024 — DraftKings Inc. (Nasdaq: DKNG) (“DraftKings” or the “Company”) today

announced the completion of its previously announced proposed acquisition of JackPocket Inc. (“Jackpocket”), the leading digital

lottery app in the United States.

“Today

we are announcing the completion of our acquisition of Jackpocket, and the commencement of our value creation plan,” said Jason

Robins, CEO and Co-Founder of DraftKings. “We are well-prepared to quickly launch cross-sell programs, further improve customer

acquisition efficiency, and continue to innovate and differentiate with our overall product portfolio for our customers. We look forward

to continuing to deliver enhanced value to our customers and shareholders as we integrate Jackpocket into the DraftKings ecosystem.”

Jackpocket

is renowned for its innovative digital lottery services, robust technology infrastructure, and strong brand presence. This acquisition

empowers DraftKings to tap into the expansive U.S. lottery vertical, while expanding its position in sportsbook and iGaming by enhancing

customer lifetime value and bolstering customer acquisition capabilities.

“The

completion of the acquisition represents an exciting new chapter for Jackpocket and DraftKings alike,” said Peter Sullivan, CEO

of Jackpocket. “Together, we are confident that we will be even more capable of helping lotteries fulfill their mission of delivering

revenue back to the beneficiaries they support. DraftKings’ proven reach and cutting-edge mobile platforms will continue to allow

us to drive growth and innovation in the digital lottery vertical.”

With

the acquisition now complete, DraftKings is focused on integrating Jackpocket into its operations and leveraging synergies to drive sustained

growth and value creation. The Company remains committed to delivering an exceptional experience to its customers while advancing its

mission of responsibly providing safe, innovative, and engaging real-money gaming offerings.

About

DraftKings

DraftKings Inc. is a digital sports entertainment and gaming company

created to be the Ultimate Host and fuel the competitive spirit of sports fans with products that range across daily fantasy, regulated

gaming, and digital media. Headquartered in Boston and launched in 2012 by Jason Robins, Matt Kalish and Paul Liberman, DraftKings is

the only U.S.-based vertically integrated sports betting operator. DraftKings’ mission is to make life more exciting by responsibly

creating the world’s favorite real-money games and betting experiences. DraftKings Sportsbook is live with mobile and/or retail

sports betting operations pursuant to regulations in 27 states and in Ontario, Canada. The Company operates iGaming pursuant to regulations

in five states and in Ontario, Canada under its DraftKings brand and pursuant to regulations in three states under its Golden Nugget

Online Gaming brand. DraftKings owns Jackpocket, the leading digital lottery app in the United States. DraftKings’

daily fantasy sports product is available in 44 states, certain Canadian provinces, and the United Kingdom. DraftKings is both an official

daily fantasy and sports betting partner of the NFL, NHL, PGA TOUR, and UFC, as well as an official daily fantasy partner of NASCAR,

an official sports betting partner of the NBA and an authorized gaming operator of MLB. In addition, DraftKings owns and operates both

DraftKings Network and Vegas Sports Information Network (VSiN), to provide a multi-platform content ecosystem with original programming.

DraftKings is committed to being a responsible steward of this new era in real-money gaming with a Company-wide focus on responsible

gaming and corporate social responsibility.

Forward-Looking Statements

This press release contains forward-looking statements within the

meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995,

including statements about the Company, Jackpocket and their respective industries that involve substantial risks and uncertainties.

All statements, other than statements of historical fact, contained in this press release, including statements regarding DraftKings’

future results of operations or financial condition, strategic plans and focus, user growth and engagement, product initiatives, and

the objectives and expectations of management for future operations (including launches in new jurisdictions and the expected timing

thereof), are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such

as “anticipate,” “believe,” “confident,” “contemplate,” “continue,” “could,”

“estimate,” “expect,” “forecast,” “going to,” “intend,” “may,”

“plan,” “poised,” “potential,” “predict,” “project,” “propose,”

“should,” “target,” “will,” or “would” or the negative of these words or other similar

terms or expressions. DraftKings cautions you that the foregoing may not include all of the forward-looking statements made in this press

release.

You should not rely on forward-looking statements as predictions of

future events. DraftKings has based the forward-looking statements contained in this press release primarily on its current expectations

and projections about future events and trends, including the current macroeconomic environment, that it believes may affect its business,

financial condition, results of operations, and prospects. These forward-looking statements are not guarantees of future performance,

conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of

which are outside DraftKings’ control and that could cause actual results or outcomes to differ materially from those discussed

in the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include, but are not limited

to, the risk that DraftKings’ acquisition of Jackpocket disrupts current plans or operations; the ability to recognize the anticipated

benefits of DraftKings’ acquisition of Jackpocket; DraftKings’ ability to execute its business plans and meet its projections;

potential litigation involving DraftKings; changes in applicable laws or regulations, particularly with respect to online gaming, digital

lottery courier or similar businesses; general economic and market conditions impacting demand for DraftKings’ products and services;

economic and market conditions in the media, entertainment, gaming, lottery and software industries in the jurisdictions in which DraftKings

operates; market and global conditions and economic factors, as well as the potential impact of general economic conditions, including

inflation, rising interest rates and instability in the banking system, on DraftKings’ liquidity, operations and personnel, as well

as the risks, uncertainties, and other factors described in “Risk Factors” in DraftKings’ filings with the Securities

and Exchange Commission (the “SEC”), which are available on the SEC’s website at www.sec.gov. Additional information

will be made available in other filings that DraftKings makes from time to time with the SEC. The forward-looking statements contained

herein are based on DraftKings management’s current expectations and beliefs and speak only as of the date hereof, and DraftKings

makes no commitment to update or publicly release any revisions to forward-looking statements in order to reflect new information or subsequent

events, circumstances or changes in expectations, except as required by law.

Media Contacts

media@draftKings.com

@DraftKingsNews

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

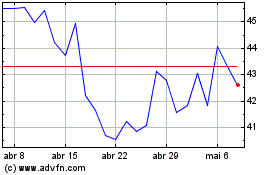

DraftKings (NASDAQ:DKNG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

DraftKings (NASDAQ:DKNG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024