false

0000316253

0000316253

2024-05-23

2024-05-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

May 23, 2024

ENZO BIOCHEM, INC.

(Exact name of registrant as specified in its charter)

| New York |

|

001-09974 |

|

13-2866202 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

21 Executive Blvd.

Farmingdale, New York 11735

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (631) 755-5500

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.01 per share |

|

ENZ |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On May 23, 2024, the Compensation

Committee (the “Committee”) of the board of directors (the “Board”) of Enzo Biochem, Inc. (the “Company”)

approved a second amended and restated employment agreement, effective as of January 1, 2024, with Kara Cannon, Chief Executive Officer

of the Company (the “CEO Amended Agreement”).

Under the CEO Amended Agreement,

Ms. Cannon’s annual base salary increased from $375,000 to $400,000, effective as of January 1, 2024, and she is entitled to receive

a sign-on equity grant (the “Equity Grant”) of options to purchase 200,000 shares of the Company’s common stock at an

exercise price equal to $2.00 per share, subject to the terms and conditions of the Company’s 2011 Amended and Restated Incentive

Plan. The options will have a five-year term and vest in equal annual installments over three years, commencing on the first anniversary

of the grant date, provided Ms. Cannon remains employed in good standing on any such vesting date. In addition, Ms. Cannon remains eligible

to receive (i) an annual discretionary bonus, (ii) an annual equity grant, as determined by the Board in its sole discretion and (iii)

a transaction bonus in the event the Company undergoes a change of control. Ms. Cannon also remains eligible to receive reimbursement

for reasonable business expenses and to participate in customary employment benefits.

The foregoing description of the CEO

Amended Agreement is not complete and is qualified in its entirety by reference to full text of the CEO

Amended Agreement, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ENZO BIOCHEM, INC. |

| |

|

| |

By: |

/s/ Patricia Eckert |

| |

Name: |

Patricia Eckert |

| |

Title: |

Chief Financial Officer |

| Date: May 24, 2024 |

|

Exhibit 10.1

SECOND AMENDED AND RESTATED

EXECUTIVE EMPLOYMENT AGREEMENT

This Second Amended

and Restated Executive Employment Agreement (the “Agreement”), dated as of January

1, 2024 (the “Effective Date”), is made between Enzo Biochem, Inc., a New York

corporation, with its principal office at 81 Executive Boulevard, Farmingdale, New York 11735 (the “Company”)

and Kara Cannon (the “Executive”) (each individually a “Party”,

and collectively the “Parties”).

WHEREAS,

Executive is currently a full-time employee of the Company working pursuant to the terms of that certain First Amended and Restated Executive

Employment dated as of March 21, 2022 (the “Existing Agreement”); and

WHEREAS,

the Company desires for Executive to continue to provide services to the Company, and wishes to provide Executive with certain compensation

and benefits in return for such employment services; and

WHEREAS,

Executive wishes to continue to be employed by the Company and to provide personal services to the Company in return for certain compensation

and benefits;

WHEREAS,

Executive and the Company agree to, and do hereby, terminate the Existing Agreement and replace it with this Agreement as of the Effective

Date hereof;

Now,

THEREFORE, in consideration of the mutual promises and covenants contained herein

and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties hereto agree as

follows:

1. Employment by the Company.

1.1 Term.

The Executive’s employment pursuant to this Agreement commenced on the Effective Date, and shall continue until terminated in accordance

as provided in Section 4 (the “Term”). Subject to the terms contained herein, Executive’s employment shall be

“at-will” and may be terminated by either side, with or without notice.

1.2 Position.

Executive shall serve as the Company’s Chief Executive Officer and shall be a member of the Company’s Board of Directors (the

“Board”) during the time period that Executive serves as Chief Executive Officer. During Executive’s employment

with the Company, Executive will devote Executive’s best efforts and substantially all of Executive’s business time and attention

to the business of the Company, except for approved vacation periods and reasonable periods of illness or other incapacities permitted

by the Company’s general employment policies.

1.3 Duties

and Location. Executive shall report to the Company’s Board. Executive’s primary office location shall be the Company’s

office located in Farmingdale, New York. The Company reserves the right to reasonably require Executive to perform Executive’s duties

at places other than Executive’s primary office location from time to time, and to require business travel.

1.4 Policies

and Procedures. The employment relationship between the Parties shall be governed by the general employment policies and practices

of the Company. Executive shall at all times comply with all applicable laws, rules, and regulations, including those promulgated by regulatory

and self-regulatory authorities, securities exchanges, and domestic and foreign agencies and authorities, as well as the Employee Handbook,

the Compliance Manual and any other internal policies and procedures established by the Company and made available to employees generally.

2. Compensation.

2.1 Salary.

For services to be rendered hereunder while Executive is employed by the Company, Executive shall receive a base salary of no less than

$400,000 per year (the “Base Salary”), subject to standard payroll deductions and withholdings and payable in accordance

with the Company’s regular payroll schedule. Executive’s Base Salary shall be reviewed on an annual basis with increases approved

by the Board on notice to the Executive.

2.2 Annual

Bonus. Executive will be eligible for an annual discretionary bonus (the “Annual Bonus”), which will be based on

a fiscal year basis (the “Bonus Period”). Executive’s target for each Annual Bonus shall be up to 100% of Executive’s

Base Salary (“Target”). Whether Executive receives an Annual Bonus for any Bonus Period will be determined by the Board

or the compensation committee thereof in its sole discretion. The Annual Bonus will be paid when bonuses are paid to similarly situated

executives, which shall be prior to seventy-five (75) days following the conclusion of the Bonus Period.

2.3 Sign-On

Equity Grant. Subject to the approval of the Board and pursuant to the Company’s 2011 Amended and Restated Incentive Plan, as

amended or replaced (the “Plan”), Executive will receive 200,000 shares (“Options”) of the Company’s

common at stock at a strike price of $2.00 per share (the “Option Grant”). The Option Grant shall vest in equal one

third annual increments, with the first vesting on the first anniversary of the grant date provided Executive remains employed in good

standing on any such vesting date, and in all cases subject to the terms of the Plan.

2.4 Annual

Equity Grant. For each year of employment during the Term, pursuant to the Plan, as hereinafter amended, restated, or replaced, Executive

shall receive grants thereunder in an amount and pursuant to terms as determined by the Board in its sole discretion. Each annual grant

provided hereunder, if any, shall vest on terms as provided by the Company and shall be subject to the terms of the Plan, the execution

of which by Executive is required for any such grant. Notwithstanding the foregoing, nothing herein requires the Board to make any grant

under the Plan or otherwise.

3. Transaction Bonus.

3.1 Upon

consummation of a Change in Control (as defined herein) or sale of an Operating Subsidiary during the Term, in addition to any other

payments or benefits applicable thereto under this Agreement, Executive shall be eligible to receive a Transaction Bonus equal to

one percent (1.00%) of the “Transaction Value” in excess of $50 million. Transaction Value which means the total amount

of Sale Proceeds paid in respect of the transaction that resulted in the Change in Control or sale of an Operating Subsidiary. Said

Transaction Bonus shall be paid 50% as soon as practicable following the closing date of the Change in Control or sale of an

Operating Subsidiary and 50% on the first anniversary thereof and shall be paid in the same form of consideration (e.g., cash, stock

in the acquiring company, promissory note or a combination thereof) as is the consideration received by the holders of the majority

of the outstanding voting securities of the Company who participate in the Change in Control. Executive must be employed on the

payment date of either portion of the Transaction Bonus in order to be eligible for same, provided, however, that such requirement

shall not apply in the event that, after a Change in Control or sale of an Operating Subsidiary but before payment of the

Transaction Bonus, the Company terminates Executive’s employment without Cause or Executive terminates her employment for Good

Reason, in which case Executive shall receive the Transaction Bonus on the anniversary of the Change in Control or sale of an

Operating Subsidiary as if Executive were still employed, subject to the terms of Section 6. For the sake of clarity, “Sale

Proceeds” shall mean the fair market value of the gross consideration received by the Company or its stockholders in the

Change in Control or sale of an Operating Subsidiary transaction, as determined by the Company in its reasonable discretion

immediately prior to the consummation of the Change in Control or sale of an Operating Subsidiary, taking into account such factors

as the Board deems appropriate, and less, (a) cash or cash equivalents held by the Company as of the date of the Change in Control

or sale of an Operating Subsidiary, and (b) any expenses attributable to the Change in Control or sale of an Operating

Subsidiary.

3.2 “Change in Control”

shall mean, in respect of the Company or Operating Subsidiary of the Company, any of (i) the beneficial ownership (as defined in

Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) of securities representing more than

50% of the combined voting power of the Company is acquired by any “person” as defined in sections 13(d) and 14(d) of the

Exchange Act (other than the Company, any subsidiary of the Company, or any trustee or other fiduciary holding securities under an employee

benefit plan of the Company), (ii) the merger or consolidation of the Company with or into another corporation where the shareholders

of the Company, immediately prior to the consolidation or merger, would not, immediately after the consolidation or merger, beneficially

own (as such term is defined in Rule 13d-3 under the Exchange Act), directly or indirectly, shares representing in the aggregate 50%

or more of the combined voting power of the securities of the corporation issuing cash or securities in the consolidation or merger (or

of its ultimate parent corporation, if any) in substantially the same proportion as their ownership of the Company immediately prior

to such merger or consolidation, or (iii) the sale or other disposition of all or substantially all of the Company’s assets to

an entity, other than a sale or disposition by the Company of all or substantially all of the Company’s assets to an entity, at

least 50% of the combined voting power of the voting securities of which are owned directly or indirectly by shareholders of the Company,

immediately prior to the sale or disposition, in substantially the same proportion as their ownership of the Company. “Operating

Subsidiary” shall mean, a major division of the Company through which the parent Company directly or indirectly conducts a portion

of its business, or company assets.

4. Company Benefits.

During the Term, Executive shall be eligible to participate in all employee benefit programs for which Executive is eligible under

the terms and conditions of the benefit plans that may be in effect from time to time and provided by the Company to its senior

level employees including medical and dental insurance, life and disability insurance, and participation in the Company’s

401(k) retirement plan. During the Term, Executive shall further receive paid vacation and a car allowance as determined by the

Company in its sole discretion. The Company reserves the right to cancel or change the benefit plans or programs it offers to the

Executive at any time; provided, however, that any such change shall be across the board changes similarly affecting the eligibility

requirements of all senior-level employees of the Company.

5. Termination of Employment; Severance.

5.1 Employment.

During the Term, either Executive or the Company may terminate Executive’s employment relationship at any time, provided, however,

that if Executive resigns during the Term, Executive shall provide no less than ninety (90) days’ advance written notice of any

such termination (the “Notice Period”). During the Notice Period, Executive shall remain an employee of the Company,

and shall continue to receive Base Salary, but no other compensation. The Company may elect to have Executive not report to work for all

or any portion of such Notice Period. The Company shall have the right, at its sole discretion, to accelerate Executive’s termination

date to any date subsequent to receiving written notice from Executive, and thus conclude the Notice Period.

5.2 Termination Without Cause or With Good Reason

a. The

Company may terminate Executive’s employment with the Company at any time with or without Cause (as defined below) during the Term.

b. If

Executive’s employment is terminated by the Company without Cause, or if Executive terminates her employment with Good Reason, the

Company shall pay Executive, as severance, (x) the equivalent of twelve (12) months of Executive’s Base Salary and Executive’s

portion of the premium to continue health insurance pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985 (“COBRA”),

(y) if the termination date occurs subsequent to the conclusion of the fiscal year but prior to the payment of the Annual Bonus to

which the fiscal year relates, such Annual Bonus, as computed in accordance with Section 2.2 above, and (z) the Annual Bonus for the Bonus

Period in which the termination occurs at the Target level; all of which payments shall be subject to standard payroll deductions and

withholdings (the “Severance”). The Severance will be paid as a continuation on the Company’s regular payroll,

beginning no later than the first regularly-scheduled payroll date following the sixtieth (60th) day after Executive’s Separation

from Service (as defined below), provided the Separation Agreement (as discussed in Paragraph 6) has become effective and further provided

that the Bonus components under (y), if any, and (z) shall be paid in a lump sum on the sixtieth day after Executive’s Separation

from Service.

c. Any

stock options held by Executive as of the Effective Date of the Agreement or hereinafter granted shall immediately vest upon a termination

of Executive’s employment without Cause or with Good Reason, or as a result of a Change in Control, subject to any other terms as

provided in the Plan. Furthermore, all RSUs shall become unrestricted immediately upon termination without Cause or with Good Reason or

Change in Control.

d. For purposes of

this Agreement, “Cause” for termination will mean: (a) commission of any (i) felony or (ii) crime involving

fraud, dishonesty or moral turpitude (whether or not a felony); (b) any action by Executive involving fraud, breach of the duty of

loyalty, malfeasance, willful misconduct, or negligence, (c) the failure or refusal by Executive to perform any material duties

hereunder or to follow any lawful and reasonable direction of the Company; (d) intentional damage to any property of the Company;

(e) willful misconduct, gross negligence, or other material violation of a material Company policy or code of conduct that causes an

adverse effect upon the Company; or (f) breach of any written agreement with the Company (including this Agreement). Prior to any

termination for Cause under section (c), (e), or (f), the Board shall provide Executive by written notice with ten (10) calendar

days to cure same, provided any such actions underlying Cause are determined by the Board to be curable. Any determination of Cause

hereunder shall be made by the Board in its good faith discretion, which shall only be made by the Board and, to the extent deemed

practicable by the Board, after providing the Executive an opportunity to respond to any determination or allegation of Cause.

5.3 For purposes of this

Agreement, “Good Reason” for termination will mean: (i) material diminution of the Executive’s title or

duties below that of the level of a Chief Executive Officer; (ii) a reduction in Executive’s Base Salary; (iii) the Company

requiring Executive to work on a full-time basis outside of the state of New York; or (iv) a material and uncured breach by the

Company of any provision of this Agreement; provided that Executive shall give written notice to the Company within ninety (90) days

following the occasion of any allegation of Good Reason, and the Company shall have thirty (30) days to cure same. In the event such

occurrence is not cured, then Executive may terminate Executive’s employment for Good Reason hereunder within ninety (90) days

from the end of the cure period. The Executive’s continued employment prior to the conclusion of the ninety (90) day period

stated in the preceding sentence shall not constitute consent to, or waiver of rights with respect to, any act or failure to act by

the Company constituting “Good Reason” hereunder, if not cured in the preceding thirty day period.

5.4 Termination for Any Other Reason.

a. Upon

a termination for any reason other than without Cause or with Good Reason, then upon Executive’s termination date all payments of

compensation by the Company to Executive hereunder will terminate immediately (except as to amounts already earned), and Executive will

not be entitled to any Severance.

b. In

the event of termination for any reason, Executive shall resign from all positions and terminate any relationships as an employee, advisor,

officer or director with the Company and any of its affiliates, each effective on the date of termination.

6. Conditions

to Receipt of Severance Benefits. In order to receive any Severance Benefits, the termination of Executive’s employment must

constitute a “separation from service” (as defined under Treasury Regulation Section 1.409A-l(h), without regard to any alternative

definition thereunder, a “Separation from Service”), and Executive must be in compliance with the terms of this Agreement.

Further, the receipt of the Severance Benefits will be conditioned on Executive signing, not revoking, and complying with a separation

agreement and release of claims in a form provided by the Company (the “Separation Agreement”). No Severance Benefits

will be paid or provided until the Separation Agreement becomes effective.

7. Section

409A. It is intended that all of the Severance and other payments payable under this Agreement satisfy, to the greatest extent possible,

the exemptions from the application of Code Section 409A provided under Treasury Regulations l.409A-l(b)(4), l.409A-l(b)(5) and l.409A-l(b)(9),

and this Agreement will be construed to the greatest extent possible as consistent with those provisions, and to the extent not so exempt,

this Agreement (and any definitions hereunder) will be construed in a manner that complies with Section 409A. For purposes of Code Section

409A (including, without limitation, for purposes of Treasury Regulation Section 1.409A- 2(b)(2)(iii)), Executive’s right to receive

any installment payments under this Agreement (whether severance payments, reimbursements or otherwise) shall be treated as a right to

receive a series of separate payments and, accordingly, each installment payment hereunder shall at all times be considered a separate

and distinct payment.

8. Restrictive

Covenants

8.1 Definitions.

The following capitalized terms used in this Agreement shall have the meanings assigned to them below, which definitions shall apply to

both the singular and the plural forms of such terms:

i. “Confidential

Information” “Confidential Information” shall be given its broadest possible interpretation and shall

mean any and all non-public, proprietary information of the Company, its affiliates, subsidiaries, and parents (each, a “Company

Entity”, and collectively, “Company Entities”), including without limitation: (i) financial and

business information relating to any Company Entity, such as information with respect to costs, fees, profits, revenues, markets,

mailing/client lists, strategies and plans for future business, new business, product or other development, potential acquisitions

or divestitures and new marketing ideas; (ii) product and technical information relating to any Company Entity, such as software,

software codes, computer models and research and development projects; (iii) customer or investor information, such as the identity

of any Company Entity’s clients or investors, the names of representatives of Company Entity customer or investors responsible

for entering into contracts with a Company Entity, the amounts paid by such investors or customers to any Company Entity, specific

customer or investor needs and requirements, specific customer or investor risk characteristics, and specific customer or investor

preferences; (iv) personnel information, such as the identity and number of any Company Entity’s other employees and officers,

their salaries, bonuses, benefits, skills, qualifications, and abilities; (v) any and all information in whatever form relating to

any customer or prospective customer of a Company Entity, including but not limited to its business, employees, operations, systems,

assets, liabilities, finances, products, and marketing, selling and operating practices; (vi) any information related to any

security system of any Company Entity or any of employees, (vii) any and all information pertaining to the business and or personal

affairs of the Company’s partners, members and employees, including but not limited to their personal lives, characteristics,

opinions, ideas, conduct, habits or background or their business or financial condition, affairs, dealings or operations or their

personal database, personal photographs or videotapes, purchases, travel itineraries, social interactions, tax information, emails,

private conversations, phone calls and correspondence; (viii) any information not included in (i) through (vii), above, which the

Executive knows or should know is subject to a restriction on disclosure or which the Executive knows or should know is considered

by any Company Entity’s clients or prospective clients to be confidential, sensitive, proprietary, or a trade secret or is not

readily available to the public; or (ix) intellectual property, including inventions and copyrightable works. Confidential

Information is not generally known or available to the general public, but has been developed, compiled, or acquired by the Company

at its effort and expense. Confidential Information can be in any form, including but not limited to verbal, written, or machine

readable, including electronic files. By way of example but not limitation of the foregoing, Confidential Information may be

acquired by observing documents, things, people or events, by direct communication with clients or others or by overhearing

conversations in person or over the telephone or otherwise. “Confidential Information” shall not include information

that has become generally available to the public by the act of one who has the right to disclose such information without violating

any right or privilege of the Company.

ii. “Restricted

Period” from the Start Date through the twelve-month anniversary of Executive’s Termination Date.

iii. “Person”

means any individual or any corporation, partnership, joint venture, limited liability company, association or other entity or

enterprise.

iv. “Restricted

Business” means any person, business, entity, organization or group within a larger firm that engages in, or plans to engage

in, (i) those parts of the business of the Company and any Company Entity with which you were involved during the employment or about

which you received Confidential Information, or (ii) any business activity which the Company or any Company Entity was actively planning

to engage in as of the Termination Date;

v. “Restrictive

Covenants” means the covenants contained in this Section 8.

vi. “Termination” means

the termination of Executive’s employment with the Company, for any reason, whether with or without Cause, upon the initiative

of either party.

vii. “Termination Date”

means the date of Executive’s Termination.

viii. “Work

Product” means all memoranda, summaries, written work product, business plans, formulas, recipes, inventions, innovations,

improvements, developments, methods, designs, analyses, drawings, reports and all similar or related information (whether patentable

or not) that are based upon Confidential Information and that are conceived, developed or made by Executive during her

employment.

8.2 Restriction on

Disclosure and Use of Confidential Information. Executive agrees that Executive shall not, directly or indirectly, use any

Confidential Information on Executive’s own behalf or on behalf of any Person other than the Company, or reveal, divulge, or

disclose any Confidential Information to any Person not expressly authorized by the Company to receive such Confidential

Information. This obligation shall remain in effect for as long as the information or materials in question retain their status as

Confidential Information. Executive further agrees that he shall fully cooperate with the Company in maintaining the Confidential

Information to the extent permitted by law. The parties acknowledge and agree that this Agreement is not intended to, and does not,

alter either the Company’s rights or Executive’s obligations under any state or federal statutory or common law

regarding trade secrets and unfair trade practices. Anything herein to the contrary notwithstanding, Executive shall not be

restricted from: (i) disclosing information that is required to be disclosed by law, court order or other valid and appropriate

legal process: provided, however, that in the event such disclosure is required

by law, Executive shall provide the Company with prompt notice of such requirement so that the Company may seek an appropriate

protective order prior to any such required disclosure by Executive; or (ii) reporting possible violations of federal, state, or

local law or regulation to any governmental agency or entity, or from making other disclosures that are protected under the

whistleblower provisions of federal, state, or local law or regulation, and Executive shall not need the prior authorization of the

Company to make any such reports or disclosures and shall not be required to notify the Company that Executive has made such reports

or disclosures. Notwithstanding anything in the foregoing to the contrary, in accordance with the Defend Trade Secrets Act of 2016,

Executive will not be criminally or civilly liable for disclosing a trade secret if it was disclosed: (1) to any government official

or attorney in confidence directly or indirectly for the sole purpose of reporting or investigating a suspected violation of law;

(2) in a complaint or other document filed in a lawsuit or other proceeding if filed under seal; or (3) to an attorney or used in a

court proceeding in a retaliation lawsuit if any document containing a trade secret is filed under seal and is not disclosed except

pursuant to court order.

8.3 Non-Competition.

The Executive acknowledges and agrees that solely by reason of employment by the Company, the Executive has and will come into contact

with a significant number of the Company’s customers and prospective customers and have access to Confidential Information (as defined

herein) and trade secrets relating thereto, including those regarding the Company’s clients, prospective clients, proprietary business

models and strategies, and related information. Consequently, the Executive covenants and agrees that during the Restricted Period, Executive

shall not directly or indirectly, an individual proprietor, partner, stock-holder, officer, employee, director, joint venturer, investor,

lender, or in any other capacity whatsoever (other than as the holder of not more than three percent (3%) of the total outstanding stock

of a publicly held company), engage in the Restricted Business.

8.4 Non-Solicitation.

Executive agrees that, during the Restricted Period, he shall not, directly or indirectly, in her own capacity or through any other entity

or person: (i) solicit, persuade or induce any investor of the Company to terminate, reduce, disrupt or refrain from renewing or extending

its contractual or other relationship with the Company in regard to the purchase of products or services, procured, performed, manufactured,

marketed, or sold, by the Company; (ii) in any way interfere with the relationship between any such investor, client, supplier, licensee,

licensor, franchisee or business relation of the Company and/or any of its affiliates; (iii) induce or attempt to induce any employee

of the Company or any of its affiliates to leave the employ of the Company and/or any of its affiliates, or in any way interfere with

the relationship between the Company and/or any of its affiliates on the one hand and any employee thereof on the other hand; or (iv)

solicit to hire (other than through general advertisements for employment not directed at employees of the Company or any of its affiliates)

or hire any person who was an employee of any of the Company or any of its affiliates at any time during the one (1) year preceding such

solicitation.

8.5 Non-Disparagement. Executive agrees

that, at any time hereinafter, Executive will not do or say anything, including but not limited to communicating on the internet (including

but not limited to any posting or reference on any social networking site), or via e-mail, telephone, face-to-face communication, or

otherwise, that (i) criticizes or disparages the Company or its products or services; (ii) disrupts or impairs the normal, ongoing business

operations of Company, or any member of the Company Group; or (iii) harms the business reputation of Company or the Company Group with

its employees, customers, suppliers, contractors or the public. Executive will not discuss any information (whether confidential or not)

about the Company with any reporter, author, producer, or similar person or entity, or take any other action seeking to publicize or

disclose any such information in any way likely to result in such information being made available to the general public in any form,

including books, articles or writings of any kind, as well as film, videotape, audiotape or any other medium or as commonly provided

on a resume. Executive acknowledges and agree that these prohibitions extend to statements, written or verbal, made to anyone and includes

statements made via social media including on blogs or social networking sites, including but not limited to Facebook, LinkedIn, or Twitter.

Neither the Board nor the Company or any of its affiliates shall authorize any disparaging comments about Executive. Notwithstanding

the foregoing, nothing in this paragraph shall prevent either Executive, the Board or the Company or any of its affiliates from making

any truthful statement to the extent necessary with respect to any litigation, arbitration, or mediation involving this Agreement, including,

but not limited to, enforcement of this Agreement or as required by law or by any court, arbitrator, mediator, or administrative or legislative

body with actual or apparent jurisdiction to order such person to disclose or make accessible such information.

8.6 Return of

Materials. Executive agrees that she will not retain or destroy (except as set forth below), and will immediately return to the

Company on or, if specifically requested, prior to the Termination Date, or at any other time the Company requests such return, any

and all Company property, including Confidential Information and all other documents, materials, information, and property,

including but not limited to memoranda, letters, notes, plans, reports, analyses, recaps, jump drives, disks, tapes, journals,

notebooks, and any Company provided computer, cell phone, Blackberry, beeper, keys, key fob, security card, phone card, credit

cards, computer user name and password, and/or voicemail code, all other files and documents relating to the Company and its

business (regardless of form, but specifically including all electronic files and data of the Company). Executive will not make,

distribute, or retain copies of any such information or property. Executive agrees that the ownership and right of control of all

programs, databases, electronic files, reports, records and supporting documents prepared by, for or on behalf of Executive in

connection with the performance of Executive’s duties during her employment are vested exclusively in the Company and remain

the exclusive property of the Company.

8.7 Inventions.

Executive acknowledges and agrees that any and all Work Product, products, improvements, and inventions or creations conceived or

made by Executive during the period of Executive’s employment with the Company relating to the activities or business of the

Company or the Company Group are the sole and exclusive property of the Company or its nominee. Executive shall promptly disclose

any Work Product to the Company and perform all acts and things and sign whatever documents and agreements are necessary to confirm

and vest the entire right, title and interest in such Work Product in the Company, including copyright assignments, patent

applications and other documents and papers. Any assignment of Work Product includes all rights of attribution, paternity,

integrity, modification, disclosure and withdrawal, and any other rights throughout the world that may be known as or referred to as

“moral rights,” “artist’s rights,” “droit moral” or the like (collectively, “Moral

Rights”). To the extent that Moral Rights cannot be assigned under applicable law, Executive hereby waives and agrees not

to enforce any and all Moral Rights, including, without limitation, any limitation on subsequent modification, to the extent

permitted under applicable law. Executive agrees to assist the Company, or its designee, at its expense, in every proper way to

secure the Company’s, or its designee’s, rights in the Company Inventions and any copyrights, patents, trademarks, mask

work rights, Moral Rights, or other intellectual property rights relating thereto in any and all countries, including the disclosure

to the Company or its designee of all pertinent information and data with respect thereto, the execution of all applications,

specifications, oaths, assignments, recordations, and all other instruments which the Company or its designee shall deem necessary

in order to apply for, obtain, maintain and transfer such rights, or if not transferable, waive and agree never to assert such

rights, and in order to assign and convey to the Company or its designee, and any successors, assigns and nominees the sole and

exclusive right, title and interest in and to such Company Inventions, and any copyrights, patents, mask work rights or other

intellectual property rights relating thereto. Executive hereby irrevocably designates and appoints the Company and its duly

authorized officers and agents as Executive’s agent and attorney-in-fact, to act for and in Executive’s behalf and stead

to execute and file any such instruments and papers and to do all other lawfully permitted acts to further the application for,

prosecution, issuance, maintenance or transfer of patent, copyright, mask work and other registrations related to such Work Product.

These obligations shall be binding upon Executive and Executive’s heirs, assigns, executors, administrators, agents or other

legal representatives. Executive may not use, disclose to third parties or otherwise retain any such works or inventions, without

the prior written permission of the Company.

8.8 Cooperation.

The Executive shall cooperate with the Company and its counsel in connection with any litigation or regulatory or self-regulatory inquiry,

investigation or proceeding relating to activities of Executive, or by activities of others of which the Executive may have knowledge,

and this obligation shall survive the termination of this Agreement. The Company shall reimburse the Executive for reasonable out-of-pocket

travel and other reasonable incidental expenses (other than legal expenses unless such legal expenses are requested by the Executive as

a result of divergent interests between Executive and the Company, and approved by the Board in writing) incurred as a result of the Executive’s

cooperation pursuant to the immediately preceding sentence.

8.9 Exceptions.

Nothing in this Agreement shall limit the rights of any government agency or any party’s right of access to, participation or

cooperation with any government agency. Notwithstanding anything to the foregoing, nothing herein, or in any other agreement or

policy, shall limit Executive’s right under applicable law to file a charge or complaint with the U.S. Equal Employment

Opportunity Commission, the National Labor Relations Board, the Occupational Safety and Health Administration, the Securities and

Exchange Commission, or any other federal, state or local governmental agency or commission (“Government Agencies”). Executive

further understands that this Agreement does not limit her ability to communicate with any Government Agencies or otherwise

participate in any investigation or proceeding that may be conducted by any Government Agency, including providing documents or

other information, without notice to the Company. This Agreement does not limit Executive’s right to receive an award for

information provided to any Government Agencies.

8.10 Enforcement of

Restrictive Covenants.

i. Rights

and Remedies Upon Breach. The parties specifically acknowledge and agree that the remedy at law for any breach of the Restrictive

Covenants will be inadequate, and that in the event Executive breaches, or threatens to breach, any of the Restrictive Covenants, the

Company shall have the right and remedy, without the necessity of proving actual damage or posting any bond, to enjoin, preliminarily

and permanently, Executive from violating or threatening to violate the Restrictive Covenants and to have the Restrictive Covenants specifically

enforced by any court of competent jurisdiction, it being agreed that any breach or threatened breach of the Restrictive Covenants would

cause irreparable injury to the Company and that money damages would not provide an adequate remedy to the Company.

ii. Severability

and Modification of Covenants. Executive acknowledges and agrees that each of the Restrictive Covenants is reasonable and valid in

time and scope and in all other respects. The parties agree that it is their intention that the Restrictive Covenants be enforced in accordance

with their terms to the maximum extent permitted by law. Each of the Restrictive Covenants shall be considered and construed as a separate

and independent covenant. Should any part or provision of any of the Restrictive Covenants be held invalid, void, or unenforceable, such

invalidity, voidness, or unenforceability shall not render invalid, void, or unenforceable any other part or provision of this Agreement

or such Restrictive Covenant. If any of the provisions of the Restrictive Covenants should ever be held by a court of competent jurisdiction

to exceed the scope permitted by the applicable law, such provision or provisions shall be automatically modified to such lesser scope

as such court may deem just and proper for the reasonable protection of the Company’s legitimate business interests and may be enforced

by the Company to that extent in the manner described above and all other provisions of this Agreement shall be valid and enforceable.

The Restrictive Covenants shall survive the termination of the Term and this Agreement.

9.

Governing Law; Dispute Resolution. The interpretation and application of this Employment shall be governed by the laws of the

State of New York without regard to principles of conflict of laws, other than laws which violate a fundamental public policy of the

state of employ, in which case such state’s laws shall govern with regard to such policies. Except for claims requesting

injunctive relief, any dispute or claim arising out of, in connection with, or relating to this Agreement (including without

limitation its subject matter, interpretation, or formation) or to Executive’s employment or relationship with the Company

shall be resolved by binding arbitration to be held in or around Farmingdale, New York, before three (3) arbitrators selected by the

American Arbitration Association, conducted in accordance with the then prevailing Employment Arbitration Rules and Mediation

Procedures of the American Arbitration Association. A copy of these rules can be accessed through the American Arbitration

Association’s website (www.adr.org). The arbitrators’ decision will be final and binding in accordance with the Federal

Arbitration Act and may be enforced in any court of

competent jurisdiction. The arbitrators will not have the right to modify or change any of the terms of this Employment Agreement.

The arbitrators, and not any court, shall have exclusive authority to resolve any dispute relating to the interpretation,

applicability, enforceability or formation of this Employment Agreement including any claim that all or any part of this

Agreement is void or voidable. The parties agree that the arbitrators may provide all appropriate remedies at law and equity and

will have the power to summarily adjudicate claims and/or enter summary judgment in appropriate cases. In any arbitration proceeding

conducted pursuant to this paragraph, the parties shall have the right to discovery, to call witnesses, and to cross-examine the

other party’s witnesses. The arbitrator shall render a final decision in writing, setting forth the reasons for the

arbitration award. Both parties are bound by this agreement to arbitrate, but it does not include disputes, controversies or

differences which may not by law be arbitrated. The parties agree that the arbitration proceedings described in this Section are to

be treated as confidential, and that the parties will act to protect the confidentiality of the documents, facts, and proceedings

related to the arbitration. THE PARTIES WAIVE THEIR RIGHT TO HAVE ANY SUCH DISPUTE, CLAIM OR CONTROVERSY DECIDED BY A JUDGE OR JURY

IN A COURT. THE PARTIES ALSO AGREE THAT EACH MAY BRING CLAIMS AGAINST THE OTHER ONLY IN THEIR INDIVIDUAL CAPACITIES, AND NOT AS A

PLAINTIFF OR CLASS MEMBER IN ANY PURPORTED CLASS OR COLLECTIVE PROCEEDING. THE PARTIES ALSO AGREE THAT EACH MAY NOT BRING CLAIMS

AGAINST THE OTHER IN ANY PURPORTED REPRESENTATIVE ACTION, EXCEPT TO THE EXTENT THIS STATEMENT IS UNENFORCEABLE UNDER THE LAW. All

American Arbitration Association filing fees, administrative costs, and arbitrator fees (as well as other related fees) shall be

paid by the Company, with the exception of fees that would be paid by the Executive should the dispute be settled in a Court of

Law.

10. General Provisions.

10.1 Notices.

Any notices provided must be in writing and will be deemed effective upon the earlier of personal delivery, email, or the next day after

sending by overnight carrier, to the Company at its primary office location and to Executive at the address as listed on the Company payroll.

10.2 Severability.

Whenever possible, each provision of this Agreement will be interpreted in such manner as to be effective and valid under applicable law,

but if any provision of this Agreement is held to be invalid, illegal or unenforceable in any respect under any applicable law or rule

in any jurisdiction, such invalidity, illegality or unenforceability will not affect any other provision or any other jurisdiction, but

this Agreement will be reformed, construed and enforced in such jurisdiction to the extent possible in keeping with the intent of the

parties.

10.3 Indemnification.

The Company shall indemnify the Executive and hold the Executive harmless from and against any claim, loss or cause of action

arising from or out of the Executive’s performance as an officer, director, consultant or employee of the Company or in any

other capacity, including any fiduciary capacity, in which the Executive serves at the request of the Company to the maximum extent

permitted by applicable law; provided, however, that the Executive shall not be entitled to indemnification hereunder with

respect to any expense, loss, liability or damage which was caused by the Executive’s own willful misconduct or any conduct,

action or omission that falls within the definition of “Cause” set forth in this Agreement. The Company shall advance or

pay any and all reasonable legal fees incurred by the Executive in the defense of any such claim on a current basis, provided,

however, that the Executive shall be obligated to reimburse the Company for fees if it is determined the Executive is not

entitled to be indemnified or have any defenses costs or fees paid by the Company under applicable law. The Executive shall have the

right to select counsel reasonably acceptable to the Company to defend such claim. The Executive shall not settle any action or

claim against the Executive without the prior written consent of the Company, except at the Executive’s sole cost and expense.

The Company shall maintain Directors and Officers insurance and the Company’s obligations set forth herein will remain in

place notwithstanding the existence or limitations of such coverage.

10.4 Waiver.

Any waiver of any breach of any provisions of this Agreement must be in writing to be effective, and it shall not thereby be deemed to

have waived any preceding or succeeding breach of the same or any other provision of this Agreement.

10.5 Complete

Agreement. This Agreement constitutes the entire agreement between Executive and the Company with regard to this subject matter and

is the complete, final, and exclusive embodiment of the Parties’ agreement with regard to this subject matter, inclusive of any

earlier offer letter. This Agreement is entered into without reliance on any promise or representation, written or oral, other than those

expressly contained herein, and it supersedes any other such promises, warranties or representations. It is entered into without reliance

on any promise or representation other than those expressly contained herein, and it cannot be modified or amended except in a writing

signed by a duly authorized officer of the Company.

10.6 Counterparts.

This Agreement may be executed in separate counterparts, any one of which need not contain signatures of more than one party, but all

of which taken together will constitute one and the same Agreement.

10.7 Headings.

The headings of the paragraphs hereof are inserted for convenience only and shall not be deemed to constitute a part hereof nor to affect

the meaning thereof

10.8 Successors

and Assigns. This Agreement is intended to bind and inure to the benefit of and be enforceable by Executive and the Company, and their

respective successors, assigns, heirs, executors and administrators. The Company may freely assign this Agreement, without Executive’s

prior written consent. Executive may not assign any of her duties hereunder and she may not assign any of her rights hereunder without

the written consent of the Company. The Company will require any successor (whether direct or indirect, by purchase, merger, consolidation,

assign or otherwise) to all or substantially all of the business and/or assets of the Company to assume expressly and agree to perform

this Agreement in the same manner and to the same extent that the Company would be required to perform it if no such succession had taken

place. As used in this Agreement, “Company” shall mean the Company as hereinbefore defined and any successor to its business

and/or assets as aforesaid.

10.9 Background

Check and Ability to Work. This offer of employment is contingent upon verification of Executive’s identity and authorization

to legally work in the United States, a background and reference check, and all other Company practices and procedures as reasonably requested

by the Company.

10.10 Tax

Withholding. All payments and awards contemplated or made pursuant to this Agreement will be subject to withholdings of

applicable taxes in compliance with all relevant laws and regulations of all appropriate government authorities. Executive

acknowledges and agrees that the Company has neither made any assurances nor any guarantees concerning the tax treatment of any

payments or awards contemplated by or made pursuant to this Agreement. Executive has had the opportunity to retain a tax and

financial advisor and fully understands the tax and economic consequences of all payments and awards made pursuant to the

Agreement.

***

You

acknowledge and agree that you have read and understand this Employment agreement

and you voluntarily agree to the terms and conditions contained herein.

We

look forward to you continuing your employment with the Company. if you accept this amended offer of employment, please sign and return

to me this amended and restated Employment Agreement attached by no later than May 20, 2024 or this offer shall expire.

In

Witness Whereof, the Parties have executed this Agreement on the day and year first written above.

| |

ENZO BIOCHEM INC. |

| |

|

|

| |

By: |

/s/ Steven J. Pully |

| |

Name: |

Steven J. Pully |

| |

Title: |

Chairman of the Board |

| |

|

|

| |

EXECUTIVE |

| |

|

|

| |

/s/ Kara

Cannon |

| |

Kara Cannon |

13

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

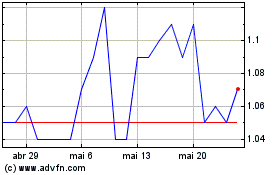

Enzo Biochem (NYSE:ENZ)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Enzo Biochem (NYSE:ENZ)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024