Filed pursuant to Rule 424(b)(3)

Registration Statement No. 333-276490

abrdn Platinum ETF Trust

(the “Trust”)

Supplement dated May 28, 2024 to the Prospectus

dated January 19, 2024

This Supplement dated May 28, 2024 amends and supplements the prospectus

for the Trust dated January 19, 2024, as supplemented to date (the “Prospectus”), and should be read in conjunction with,

and must be delivered with, the Prospectus.

Appointment of New Custodian and Elimination

of Loco-Zurich Delivery

On May 23, 2024, The Bank of New York Mellon

(the “Trustee”), in its capacity as Trustee of the Trust, and at the direction of abrdn ETFs Sponsor LLC (the “Sponsor”),

the Trust’s Sponsor, entered into an Allocated Account Agreement and Unallocated Account Agreement (collectively, the “New

Custody Agreements”) with ICBC Standard Bank Plc (the “New Custodian”) providing for the custody of the Trust’s

platinum by the New Custodian.

On May 23, 2024, the Trustee delivered to JPMorgan

Chase Bank N.A. (“JPMorgan” or the “Former Custodian”), custodian of the Trust’s platinum, notice of termination

of the Allocated Account Agreement and the Unallocated Account Agreement, each dated as of December 30, 2009 and as between the Trustee,

and the Former Custodian (collectively, and as amended, the “Former Custody Agreements”). Pursuant to the terms of the Former

Custody Agreements, the notice of termination delivered by the Trustee will become effective on the date on which all platinum held in

the allocated and unallocated accounts governed by the Former Custody Agreements has been transferred to the allocated and unallocated

accounts governed by the New Custody Agreements with the New Custodian (the “Termination Effective Date”). Until the Termination

Effective Date, the Trust will have available custodian services under both the Former Custody Agreements and the New Custody Agreements.

Following the Termination Effective Date, the custody of all platinum of the Trust will be pursuant to the New Custody Agreements.

Additionally, in connection with the change in

custodian, effective June 18, 2024, the Trust will no longer accept delivery of platinum loco Zurich, and all delivery of platinum in

relation to the creation or redemption of a Basket will be conducted loco London. Accordingly, the Prospectus is hereby amended to reflect

that the Trust no longer utilizes a Zurich Sub-Custodian or provides for the custody of its platinum at vaults located in Zurich, Switzerland.

References throughout the Prospectus to the Custodian

(and related accounts or agreements with the Custodian) and its role are hereby amended to refer to both Custodians or to either the

Former Custodian or the New Custodian, as context may require. Information with respect to the Former Custodian will be removed as of

the Termination Effective Date. Additionally, effective immediately, the Prospectus is hereby supplemented with the following information

with respect to the New Custodian:

Custody of the Trust’s Platinum

under the Custody Agreements with ICBC Standard Bank Plc

ICBC Standard Bank Plc (“ICBCS”),

a public limited company incorporated under the laws of England and Wales, serves as a Custodian of the Trust’s platinum. ICBCS’s

office is located at 20 Gresham Street, London, EC2V 7JE, United Kingdom.

Description of the Custody

Agreements

The following is a description of

the material terms of the Custody Agreements between the Trustee and ICBC Standard Bank Plc as the custodian under which the Custodian

will hold the platinum that belongs to the Trust. In this section, all references to the “Custodian” are to ICBC Standard

Bank Plc, in its capacity as such.

The Allocated Account Agreement between

the Trustee and the Custodian establishes the Trust Allocated Account. The Unallocated Account Agreement between the Trustee and the

Custodian establishes the Trust Unallocated Account. These agreements are sometimes referred to together as the “Custody Agreements”

in this prospectus. As the Custody Agreements are similar in form, they are discussed together, with material distinctions between the

agreements noted.

Reports

The Custodian will provide the Trustee

with reports for each business day, no later than the following business day, identifying the movements of platinum in and out of the

Trust Allocated Account and the credits and debits of platinum to the Trust Unallocated Account and containing sufficient information

to identify each plate or ingot of platinum held in the Trust Allocated Account and whether the Custodian has possession of such plate

or ingot. The Custodian also provides the Trustee with monthly statements of account for the Trust Allocated Account and the Trust Unallocated

Account as of the last business day of each month. Under the Custody Agreements, a “business day” generally means any day

that is both a “London Business Day,” when commercial banks generally and the London platinum market are open for the transaction

of business in London.

The Custodian’s records of all

deposits to and withdrawals from, and all debits and credits to, the Trust Allocated Account and the Trust Unallocated Account which

are to occur on a business day, and all end of business day account balances in the Trust Allocated Account and Trust Unallocated Account,

are stated as of the close of the Custodian’s business (usually 4:00 p.m. London time) on such business day.

Sub-custodians

Under the Allocated Account Agreement,

the Custodian may select sub-custodians solely for the temporary holding of platinum for it until transported to the Custodian’s

vault premises. These sub-custodians may in turn select other sub-custodians to perform their duties, including temporarily holding platinum

for them, but the Custodian is not responsible for (and therefore has no liability in relation to) the selection of those other sub-custodians.

The Allocated Account Agreement requires the Custodian to use reasonable care in selecting any sub-custodian and provides that, except

for the Custodian’s obligation to use commercially reasonable efforts to obtain delivery of platinum held by any other sub-custodians

when necessary, the Custodian will not be liable for the acts or omissions, or for the solvency, of any sub-custodian that it selects

unless the selection of that sub-custodian was made negligently or in bad faith. Any sub-custodian selected by the Custodian shall be

a member of the LPPM, except for the Governor and Company of the Bank of England. The Custodian does not, as at the date of this Supplement,

use any sub-custodians for platinum. The Allocated Account Agreement provides that the Custodian will notify the Trustee if it selects

any additional sub-custodians or stops using any sub-custodian it has previously selected.

Location and Segregation of

Platinum; Access

Platinum bullion held for the Trust

Allocated Account by the Custodian is held at the Custodian’s London vault premises. Platinum bullion may be temporarily held for

the Trust Allocated Account by other sub-custodians selected by the Custodian and by sub-custodians of sub-custodians in vaults located

in England or in other locations. Where the platinum bullion is held for the Trust Allocated Account by a sub-custodian, the Custodian

agrees to use commercially reasonable efforts to promptly arrange for the delivery of any such platinum bullion held on behalf of the

Trust to the Custodian’s London vault premises at the Custodian’s own cost and risk.

The Custodian segregates by identification

in its books and records the Trust’s platinum in the Trust Allocated Account from any other platinum which it owns or holds for

others and requires any sub-custodians it selects to so segregate the Trust’s platinum held by them. This requirement reflects

the current custody practice in the London platinum market. The Custodian’s books and records are expected, as a matter of current

London bullion market custody practice, to identify each plate or ingot of platinum held in the Trust Allocated Account in its own vault

by refiner, assay or fineness, serial number and gross and fine weight. Any sub-custodians selected by the Custodian are also expected,

as a matter of current industry practice, to identify in their books and records each plate or ingot of platinum held for the Custodian

by serial number and such sub-custodians may use other identifying information.

Under the Custody Agreements, the

Trustee, the Sponsor and the Trust’s auditors and inspectors may visit the premises of the Custodian for the purpose of examining

the Trust’s platinum and certain related records maintained by the Custodian as they may reasonably require to perform their respective

audit duties in respect of the platinum and with regard to investors in the Shares. Any such access is subject to execution of a confidentiality

agreement and agreement to the Custodian’s security procedures, and such inspections are at the Trust’s expense. Under the

Custody Agreements, the Custodian agreed to procure similar inspection rights from any sub-custodian (except for the Bank of England,

which has a policy to not permit any audit visits to its vault premises).

Transfers into the Trust Unallocated

Account

The Custodian credits to the Trust

Unallocated Account the amount of platinum it receives from the Trust Allocated Account, an Authorized Participant Unallocated Account

or from other third-party unallocated accounts for credit to the Trust Unallocated Account. Unless otherwise agreed by the Custodian

in writing, the only platinum the Custodian accepts in physical form for credit to the Trust Unallocated Account is platinum that the

Trustee has transferred from the Trust Allocated Account, an Authorized Participant Unallocated Account or a third-party unallocated

account.

Transfers from the Trust Unallocated

Account

The Custodian transfers platinum from

the Trust Unallocated Account only in accordance with the Trustee’s instructions to the Custodian. A transfer of platinum from

the Trust Unallocated Account may only be made (1) by transferring platinum to an Authorized Participant Unallocated Account or other

loco London account maintained on an unallocated basis by the Custodian or a platinum clearing bank for a beneficial owner of Shares;

(2) by transferring platinum to pay the Sponsor’s Fee; (3) by transferring platinum to the Trust Allocated Account; (4) by making

platinum available for collection at the Custodian’s vault premises or at such other location as the Custodian may direct by notice

to the party taking delivery received not later than one London Business Day prior to the proposed delivery date, at the Trust’s

expense and risk; (5) by delivering the platinum to such location as the Trustee directs, at the Trust’s expense and risk, or (6)

by transfer to an account maintained by the Custodian or by a third party on an unallocated basis in connection with the sale of platinum

or other transfers permitted under the Trust Agreement; (7) by transfer of platinum to an unallocated account with another custodian

of the Trust’s platinum, at the Trust’s expenses and risk; or (8) by delivering platinum to another custodian of the Trust’s

platinum, at the Trust’s expense and risk.. Transfers made pursuant to clauses (4), (5) and (8) will be made only on an exceptional

basis. Transfers under clause (6) would include transfers made in connection with a sale of platinum to pay expenses of the Trust not

paid by the Sponsor or with the liquidation of the Trust. Any platinum made available in physical form will be in a form which complies

with the rules, regulations, practices and customs of the LPPM, the Bank of England or any applicable regulatory body (“Custody

Rules”) or in such other form as may be agreed between the Trustee and the Custodian, and in all cases all platinum made available

will comprise one or more whole platinum plates or ingots selected by the Custodian.

The Custodian uses commercially reasonable

efforts to transfer platinum from the Trust Unallocated Account to the Trust Allocated Account by 2:00 p.m. London time on each business

day. In doing so, the Custodian shall identify plates or ingots of a weight most closely approximating, but not exceeding, the balance

in the Trust Unallocated Account and shall transfer such weight from the Trust Unallocated Account to the Trust Allocated Account.

Transfers into the Trust Allocated

Account

The Custodian receives transfers of

platinum into the Trust Allocated Account in accordance with the Trustee’s instructions to the Custodian. A transfer of platinum

into the Trust Allocated Account may only be made (1) at the Trustee’s instructions given pursuant to the Unallocated Account Agreement

by debiting platinum from the Trust Unallocated Account and crediting such platinum to the Trust Allocated Account; (2) by physical transfer

of platinum to the Trust Allocated Account from another custodian of the Trust’s platinum; or (3) other physical transfers of platinum

to the Trust Allocated Account otherwise permitted under the Custody Agreements.

Transfers from the Trust Allocated

Account

The Custodian transfers platinum from

the Trust Allocated Account only in accordance with the Trustee’s instructions. Generally, the Custodian transfers platinum from

the Trust Allocated Account only by debiting platinum from the Trust Allocated Account and crediting the platinum to the Trust Unallocated

Account. Transfers may also be made on an exceptional basis only (1) by making platinum available for collection at the Custodian’s

vault premises or at such other location as the Custodian may direct by notice to the party taking delivery received not later than one

London Business Day prior to the proposed delivery date, at the Trust’s expense and risk; (2) by delivering platinum to such location

as the Trustee directs, at the Trust’s expense and risk; or (3) by delivering platinum to another custodian of the Trust’s

platinum, at the Trust’s expense and risk.

Right to Refuse Transfers or

Amend Transfer Procedures

The Custodian may refuse to accept

instructions to transfer platinum to or from the Trust Unallocated Account and the Trust Allocated Account if in the Custodian’s

opinion they are or may be contrary to the rules, regulations, practices and customs of the LBMA, or the Bank of England or contrary

to any applicable law. The Custodian may amend the procedures for transferring platinum to or from the Trust Unallocated Account or for

the physical withdrawal of platinum from the Trust Unallocated Account or the Trust Allocated Account or impose such additional procedures

in relation to the transfer of platinum to or from the Trust Unallocated Account as the Custodian may from time to time consider necessary

due to a change in rules of the LPPM, the Bank of England or a banking or regulatory association governing the Custodian. The Custodian

will notify the Trustee within a commercially reasonable time before the Custodian amends these procedures or imposes additional ones.

The Custodian receives no fee under

the Unallocated Account Agreement.

Trust Unallocated Account Credit

and Debit Balances

No interest will be paid by the Custodian

on any credit balance to the Trust Unallocated Account. The Trust Unallocated Account may not at any time have a debit or negative balance.

Exclusion of Liability

The Custodian uses reasonable care

in the performance of its duties under the Custody Agreements and is only responsible for any loss or damage suffered by the Trust as

a direct result of any negligence, fraud or willful default in the performance of its duties. The Custodian’s liability under the

Custody Agreements is further limited to the market value of the platinum lost or damaged at the time such negligence, fraud or willful

default is discovered by the Custodian, provided that the Custodian promptly notifies the Trustee after any discovery of such lost or

damaged platinum.

Furthermore, the Custodian has no

duty to make or take or to require any sub-custodians selected by it to make or take any special arrangements or precautions beyond those

required by the Custody Rules or as specifically set forth in the Custody Agreements.

Indemnity

The Trustee will, solely out of the

Trust’s assets, indemnify the Custodian (on an after tax basis) on demand against all costs and expenses, damages, liabilities

and losses which the Custodian may suffer or incur in connection with the Custody Agreements, except to the extent that such sums are

due directly to the Custodian’s negligence, willful default or fraud.

Insurance

The Custodian maintains such insurance

for its business, including its bullion and custody business, as it deems appropriate in connection with its custodial and other obligations

and is responsible for all costs, fees and expenses arising from the insurance policy or policies attributable to its relationship with

the Trust. The Trust is not a beneficiary of any such insurance and does not have the ability to dictate the existence, nature or amount

of coverage. Therefore, Shareholders cannot be assured that the Custodian maintains adequate insurance or any insurance with respect

to the platinum held by the Custodian on behalf of the Trust. Consistent with industry standards, the Custodian maintains a group insurance

policy that covers all metal types held in its and its sub-custodians’ vaults for the accounts of all its customers for a variety

of events. The Trustee and the Sponsor may, subject to confidentiality restrictions, be provided with details of this insurance coverage

from time to time upon reasonable prior notice.

Force Majeure

The Custodian is not liable for any

delay in performance or any non-performance of any of its obligations under the Custody Agreements by reason of any cause beyond its

reasonable control, including acts of God, war or terrorism.

Termination

The Custody Agreements have an initial

four-year term commencing on May 23, 2024 and ending on the fourth anniversary of such date. At any time after the initial term, the

Trustee and the Custodian may each terminate any Custody Agreement for any reason upon 90 days’ prior written notice. The Custody

Agreements may also be terminated with immediate effect as follows: (1) by the Trustee, if the Custodian ceases to offer the services

contemplated by either Custody Agreement to its clients or proposed to withdraw from the platinum bullion business; (2) by the Trustee

if the Custodian commits any material breach of its obligations under this Agreement and, where such breach is capable of remedy, shall

have failed to make good such breach within seven business days of receipt of written notice requiring it to do so; (3) by the Trustee

or the Custodian, if it becomes unlawful for the Custodian or the Trustee to be a party to either Custody Agreement or for the Custodian

to provide or the Trustee or Trust to receive the services thereunder; (4) by the Custodian, if the Custodian determines in its reasonable

view that the Trust is insolvent or faces impending insolvency; (5) by the Custodian, if it becomes unlawful for the Sponsor to pay the

Custodian’s fees and expenses; (6) by the Trustee if the Trustee determines in its sole view that the Custodian is insolvent or

faces impending insolvency; (7) by the Trustee, if the Trust is to be terminated; or (8) by the Trustee or the Custodian, if either of

the Custody Agreements ceases to be in full force and effect; or (9) by the Custodian, if the Trustee has (or the Custodian has reasonable

grounds to believe the Trustee has) breached sanctions relating to terrorism imposed, administered or enforced by certain sanctioning

bodies.

If redelivery arrangements acceptable

to the Custodian for the platinum held in the Trust Allocated Account are not made, the Custodian may continue to store the platinum

and continue to charge for its fees and expenses, and, after six months from the termination date, the Custodian may sell the platinum

and account to the Trustee for the proceeds. If arrangements acceptable to the Custodian for redelivery of the balance in the Trust Unallocated

Account are not made, the Custodian may continue to charge for its fees and expenses payable under the Allocated Account Agreement, and,

after six months from the termination date, the Custodian may close the Trust Unallocated Account and account to the Trustee for the

proceeds.

Governing Law

The Custody Agreements are governed

by English law. The Trustee and the Custodian both consent to the non-exclusive jurisdiction of the courts of the State of New York and

the federal courts located in the borough of Manhattan in New York City. Such consent is not required for any person to assert a claim

of New York jurisdiction over the Trustee or the Custodian.

Amendment of Benchmark Price to Utilize LBMA Platinum Price AM if LBMA Platinum Price PM is Unavailable

On May 23, 2024, the Sponsor entered into an

Amendment (the “Trust Amendment”) to the Depositary Trust Agreement (the “Trust Agreement”) with the Trustee.

The Trust Amendment reflects the following changes, effective as of June 18, 2024, as approved and directed by the Sponsor on behalf

of the Trust: (1) the amendment of the definition of “Benchmark Price” to mean, “as of any day, (i) such day’s

LBMA Platinum Price PM or such day’s LBMA Platinum Price AM if such day’s LBMA Platinum Price PM is not available; or (ii)

such other publicly available price which is reasonably available to the Trustee at no cost to the Trustee and which the Sponsor may

determine fairly represents the commercial value of platinum held by the Trust and instructs the Trustee to use as the Benchmark Price”;

(2) the deletion and replacement of the defined term for “London PM Fix” with the defined term “LBMA Platinum Price

PM”, which means “the price of a troy ounce of platinum as determined by the LME, the third party administrator of the London

platinum price selected by the LBMA, or any successor administrator of the London platinum price, at or about 2:00 p.m. London, England

time”; and (3) the addition of the new definition for “LBMA Platinum Price AM” which means “the price of a troy

ounce of platinum as determined by the LME, the third party administrator of the London platinum price selected by the LBMA, or any successor

administrator of the London platinum price, at or about 9:45 a.m. London, England time.” Accordingly, effective June 18, 2024,

the Prospectus is hereby amended as follows:

References to the defined term “LME PM

Fix” are replaced with “LBMA Platinum Price PM” throughout the Prospectus. Additionally, under “GLOSSARY OF

DEFINED TERMS”, the defined term “LME PM Fix” is deleted and replaced with the following:

“LBMA Platinum Price PM”

– The USD price for an ounce of platinum as determined by the LME, the third party administrator of the London Platinum price selected

by the LBMA, or any successor administrator of the London platinum price, at or about 2:00 p.m. London, England time. See “Operation

of the Platinum Market” for a description of the operation of the LBMA Platinum Price PM for platinum.

Under “GLOSSARY OF DEFINED TERMS”,

the following definition is added immediately prior to the definition for “LBMA Platinum Price PM”:

“LBMA Platinum Price AM”

– The USD price for an ounce of platinum as determined by the LME, the third party administrator of the London platinum price selected

by the LBMA, or any successor administrator of the London platinum price, at or about 9:45 a.m. London, England time. See “Operation

of the Platinum Market” for a description of the operation of the LBMA Platinum Price PM for platinum.

Under “THE OFFERING”, the

section entitled “Net Asset Value” is deleted and replaced with the following:

| |

Net

Asset Value |

The

net asset value of the Trust will be obtained by subtracting the Trust’s expenses and liabilities on any day from the value

of the platinum owned by the Trust on that day; the NAV per Share will be obtained by dividing the net asset value of the Trust on

a given day by the number of Shares outstanding on that day. On each day on which the Exchange is open for regular trading, the Trustee

will determine the net asset value of the Trust and the NAV per Share as promptly as practicable after 4:00 p.m. (New York time).

The Trustee will value the Trust’s platinum on the basis of the LBMA Platinum Price PM. If there is no LBMA Platinum

Price PM on any day, the Trustee is authorized to use the LBMA Platinum Price AM announced on that day. If neither price is available

for that day, the Trustee will value the Trust’s platinum based on the most recently announced LBMA Platinum Price PM or LBMA

Platinum Price AM. If the Sponsor determines that such price is inappropriate to use, the Sponsor will identify an alternate basis

for evaluation to be employed by the Trustee. Further, the Sponsor may instruct the Trustee to use on an on-going basis a different

publicly available price which the Sponsor determines to fairly represent the commercial value of the Trust’s platinum. See

“DESCRIPTION OF THE TRUST AGREEMENT— Valuation of Platinum, Definition of Net Asset Value and Adjusted Net Asset Value.” |

Under “OPERATION OF THE PLATINUM MARKET— The Platinum

Market—The Zurich and London Platinum Bullion Markets”, the first two paragraphs are amended and restated in their

entirety to read as follows:

Although the market for physical platinum is

distributed globally, most platinum is stored and most OTC market trades are cleared through London and Zurich. In addition to coordinating

market activities, the LPPM acts as the principal point of contact between the market and its regulators. A primary function of the LPPM

is its involvement in the promotion of refining standards by maintenance of the “London/Zurich Good Delivery Lists,” which

are the lists of LPPM accredited refiners of platinum. The LPPM also coordinates market clearing and vaulting, promotes good trading

practices and develops standard documentation.

Platinum is traded generally on a “loco

London” or “loco Zurich” basis, meaning the precious metal is physically held in vaults in London or Zurich or is transferred

into accounts established in London or Zurich. Delivery of the platinum can either be by physical delivery or through the clearing systems

to an unallocated account.

Under “OPERATION OF THE PLATINUM MARKET— The Platinum

Market—The Zurich and London Platinum Bullion Markets”, the last sentence of the second to last paragraph is amended

and restated in its entirety to read as follows:

The Sponsor also determined that the LME PM Fix fairly represents

the commercial value of platinum bullion held by the Trust and the “Benchmark Price” (as defined in Trust Agreement) as of

any day is such day’s LME PM Fix or such day’s LME AM Fix if such day’s LME PM Fix is not available.

The last sentence of the fourth paragraph under the heading “DESCRIPTION

OF THE TRUST” is amended and restated in its entirety to read as follows:

If on a day when the Trust’s NAV is being calculated,

the LBMA Platinum Price PM is not available or has not been announced by 4:00 p.m. New York time, the Trustee is authorized to use the

LBMA Platinum Price AM announced on that day. If neither price is available for that day, the Trustee will value the Trust’s platinum

based on the most recently announced LBMA Platinum Price PM or LBMA Platinum Price AM.

Under “DESCRIPTION OF THE TRUST AGREEMENT— Valuation

of Platinum, Definition of Net Asset Value and Adjusted Net Asset Value”, the first sentence of the second paragraph is amended

and restated in its entirety to read as follows:

At the Evaluation Time, the Trustee will value the Trust’s

platinum on the basis of the LBMA Platinum Price PM. If there is no LBMA Platinum Price PMon any day, the Trustee is authorized to use

the LBMA Platinum Price AMannounced on that day. If neither price is available for that day, the Trustee will value the Trust’s

platinum based on the most recently announced LBMA Platinum Price PM or LBMA Platinum Price AM.

Change to T+1 Standard Settlement Cycle effective

May 28, 2024

Pursuant to an SEC rule amendment adopted in February 2023, the standard

settlement cycle for most securities transactions by broker-dealers will be shortened from two business days after the trade date (“T+2

Settlement”) to one business day following the trade date (“T+1 Settlement”), effective as of May 28, 2024. Consistent

with the rule amendment, beginning on May 28, 2024, the standard creation and redemption processes for the Trust will change from T+2

Settlement to T+1 Settlement. Creation and redemption orders placed before May 28, 2024 will not be subject to this change. Accordingly,

effective May 28, 2024, the Prospectus is hereby amended as follows:

In the section “CREATION AND REDEMPTION

OF SHARES”:

The first sentence of the fourth paragraph under

the heading “CREATION AND REDEMPTION OF SHARES” is amended and restated in its entirety to read as follows:

Prior to initiating any creation or

redemption order, an Authorized Participant must have entered into an agreement with the Custodian or a platinum clearing bank to establish

an Authorized Participant Unallocated Account in London (Authorized Participant Unallocated Bullion Account Agreement). Authorized Participant

Unallocated Accounts may only be used for transactions with the Trust.

The first and second sentences of the first paragraph

under the subheading “— Creation Procedures – Delivery of required deposits” are amended and restated

in their entirety to read as follows:

An Authorized Participant who places

a purchase order is responsible for crediting its Authorized Participant Unallocated Account with the required platinum deposit amount

by the prescribed settlement date in London. Upon receipt of the platinum deposit amount, the Custodian, after receiving appropriate

instructions from the Authorized Participant and the Trustee, will transfer on the prescribed settlement date the platinum deposit amount

from the Authorized Participant Unallocated Account to the Trust Unallocated Account and the Trustee will direct DTC to credit the number

of Baskets ordered to the Authorized Participant’s DTC account.

The second paragraph under the subheading “—

Redemption Procedures” is amended and restated in its entirety to read as follows:

By placing a redemption order, an Authorized

Participant agrees to deliver the Baskets to be redeemed through DTC’s book-entry system to the Trust by the prescribed settlement

date. Prior to the delivery of the redemption distribution for a redemption order, the Authorized Participant must also have wired to

the Trustee the non-refundable transaction fee due for the redemption order.

The first paragraph under the subheading “—

Redemption Procedures – Delivery of redemption distribution” is amended and restated in its entirety to read

as follows:

The redemption distribution due from

the Trust will be delivered to the Authorized Participant on the prescribed settlement date following a loco London redemption order

date if, by 10:00 a.m. New York time on the settlement date, the Trustee’s DTC account has been credited with the Baskets to be

redeemed. If a loco swap or physical transfer is necessary to effect a loco London redemption, the redemption distribution due from the

Trust will be delivered to the Authorized Participant on or before the prescribed settlement date if, by 10:00 a.m. New York time on

the first business day after the loco London redemption order date, the Trustee’s DTC account has been credited with the Baskets

to be redeemed. In the event that, by 10:00 a.m. New York time on the prescribed settlement date, the Trustee’s DTC account has

not been credited with the total number of Shares corresponding to the total number of Baskets to be redeemed pursuant to such redemption

order, the Trustee shall send to the Authorized Participant and the Custodian via fax or electronic mail message notice of such fact

and the Authorized Participant shall have one business day following receipt of such notice to correct such failure. If such failure

is not cured within such one business day period, the Trustee (in consultation with the Sponsor) will cancel such redemption order and

will send via fax or electronic mail message notice of such cancellation to the Authorized Participant and the Custodian, and the Authorized

Participant will be solely responsible for all costs incurred by the Trust, the Trustee or the Custodian related to the cancelled order.

The Trustee is also authorized to deliver the redemption distribution notwithstanding that the Baskets to be redeemed are not credited

to the Trustee’s DTC account by 10:00 a.m. New York time on the prescribed settlement date if the Authorized Participant has collateralized

its obligation to deliver the Baskets through DTC’s book entry system on such terms as the Sponsor and the Trustee may from time

to time agree upon.

*****

The Prospectus remains unchanged in all other respects. Capitalized

terms used but not defined herein shall have the meanings ascribed to them in the Prospectus.

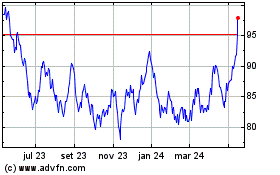

Abrdn Palladium ETF (AMEX:PPLT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

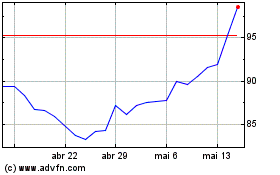

Abrdn Palladium ETF (AMEX:PPLT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024