As filed with the Securities and Exchange Commission on June 11, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

FLOTEK INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 90-0023731 |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

5775 N. Sam Houston Parkway W., Suite 400

Houston, Texas (Address of Principal Executive Offices) | 77086 (Zip Code) |

FLOTEK INDUSTRIES, INC. 2018 LONG-TERM INCENTIVE PLAN, AS AMENDED

FLOTEK INDUSTRIES, INC. 2012 EMPLOYEE STOCK PURCHASE PLAN, AS AMENDED

(Full Title of the Plan)

Bond Clement

Chief Financial Officer

Flotek Industries, Inc.

5775 N. Sam Houston Parkway W., Suite 400

Houston, Texas 77086

(Name and Address of Agent for Service)

(713) 849-9911

(Telephone Number, including Area Code, of Agent for Service)

Copies to:

E. James Cowen

Porter Hedges LLP

1000 Main Street, 36th Floor

Houston, Texas 770002

(713) 226-6000

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | |

| |

Large accelerated filer | Accelerated filer |

Non-accelerated filer ☒ | Smaller reporting company ☒

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

EXPLANATORY NOTE

This Registration Statement on Form S-8 is filed by Flotek Industries, Inc. (the “Company”) to register (i) an additional 500,000 shares of common stock, $0.0001 par value per share, of the Company (the “Common Stock”), for issuance pursuant to the Flotek Industries, Inc. 2018 Long-Term Incentive Plan, as amended (the “2018 Plan”), and (ii) an additional 83,333 shares of Common Stock for issuance pursuant to the Flotek Industries, Inc. 2012 Employee Stock Purchase Plan, as amended (the “ESPP”). The 2018 Plan was described in the Company’s definitive Proxy Statement for its 2024 Annual Meeting of Stockholders held on June 5, 2024 (the “2024 Meeting”). The ESPP was described in the Company’s definitive Proxy Statement for its 2022 Annual Meeting of Stockholders held on June 9, 2022 (the “2022 Meeting”). Unless noted otherwise, all references to the number of shares of Common Stock and per share information in this Registration Statement have been adjusted retroactively to reflect the 1 for 6 reverse split of the Company’s Common Stock that became effective on September 25, 2023 (the “Reverse Stock Split”).

An amendment to the 2018 Plan (the “2018 Plan Amendment”) to add an additional 500,000 shares of Common Stock to the 2018 Plan was approved by the Company’s stockholders at the 2024 Meeting. Also, as previously approved by the Compensation Committee of the Board of Directors of the Company, the 2018 Plan Amendment amends the 2018 Plan to reflect the Reverse Stock Split adjustments as required by the 2018 Plan in connection with the Reverse Stock Split, which includes changing all references to “1,000,000” shares of Common Stock to “166,667” shares of Common Stock.

An amendment to the ESPP (the “ESPP Amendment”) to add an additional 83,333 shares (or 500,000 shares prior to giving effect to the Reverse Stock Split) of Common Stock to the ESPP was approved by the Company’s stockholders at the 2022 Meeting. Also, the ESPP Amendment amends the ESPP to extend the duration of the ESPP through June 30, 2025.

The 583,333 shares of Common Stock being registered hereby are in addition to the shares of Common Stock registered by the Company’s prior Registration Statements on Form S-8 (the “Prior Registration Statements”) filed on August 29, 2012 (File No. 333-183617), June 25, 2018 (File No. 333-225865), May 24, 2019 (File No. 333-231749), May 11, 2022 (File No. 333-264865) and June 28, 2023 (File No. 333-272968). Pursuant to General Instruction E of Form S-8, the contents of the Prior Registration Statements are incorporated by reference herein except as otherwise amended or superseded hereby. After giving effect to the additional shares of Common Stock registered under this Registration Statement and the Reverse Stock Split, the aggregate number of shares of Common Stock registered for issuance under the 2018 Plan and the ESPP will be 2,416,667 and 250,000, respectively.

Item 8. Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| 4.1 | | |

| 4.2 | | |

| *5.1 | | |

| *23.1 | | |

| *23.2 | | |

| *24.1 | | |

| *107.1 | | |

*Filed herewith

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Houston, State of Texas, on June 11, 2024.

FLOTEK INDUSTRIES, INC.

By: /s/ Ryan Ezell

Name: Ryan Ezell

Title: Chief Executive Officer

POWER OF ATTORNEY

Each person whose signature appears below constitutes and appoints Ryan Ezell and Bond Clement, and each of them, either of whom may act without joinder of the other, his true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him and in his name, place and stead, in any and all capacities, to sign any or all pre- and post-effective amendments and supplements to this registration statement, and to file the same, or cause to be filed the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto such attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, and each of them, or the substitute or substitutes of either of them, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

/s/ Ryan Ezell Ryan Ezell | Chief Executive Officer and Director (Principal Executive Officer) | June 11, 2024 |

| | | | | | | | |

/s/ Bond Clement Bond Clement | Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) | June 11, 2024 |

| | | | | | | | |

/s/ Harsha V. Agadi Harsha V. Agadi | Chairman of the Board | June 11, 2024 |

| | | | | | | | |

/s/ Evan R. Farber Evan R. Farber | Director | June 11, 2024 |

| | | | | | | | |

/s/ Michael Fucci Michael Fucci | Director | June 11, 2024 |

| | | | | | | | |

/s/ Lisa Mayr Lisa Mayr | Director | June 11, 2024 |

| | | | | | | | |

/s/ Matthew D. Wilks Matthew D. Wilks | Director | June 11, 2024 |

Exhibit 107.1

Calculation of Filing Fee Tables

Form S-8

(Form Type)

Flotek Industries, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | |

Security Type | Security Class Title | Fee Calculation Rule | Amount Registered | Proposed Maximum Offering Price Per Unit | Maximum Aggregate Offering Price | Fee Rate | Amount of Registration Fee |

| Equity | Common stock, par value $0.0001 per share | 457(c) and 457(h) | $500,000

(1)(2) | $4.59 (4) | $2,295,000 | 0.00014760 | $339 |

| Equity | Common stock, par value $0.00001 per share | 457(c) and 457(h) | $83,333

(1)(3) | $4.59 (4) | $382,499 | 0.00014760 | $57 |

Total Offering Amounts | | $2,677,499 | | $396 |

Total Fee Offsets | | | | N/A |

Net Fee Due | | | | $396 |

(1)Pursuant to Rule 416(a) of the Securities Act of 1933, as amended, this registration statement also registers hereunder an indeterminate number of shares of common stock issuable as a result of the anti-dilution provisions of the Registrant’s 2018 Long-Term Incentive Plan, as amended (the “2018 Plan”), and the Registrant’s 2012 Employee Stock Purchase Plan, as amended (the “ESPP”).

(2)Represents 500,000 additional shares of common stock reserved for issuance under the 2018 Plan.

(3)Represents 83,333 additional shares of common stock reserved for issuance under the ESPP.

(4)Pursuant to Rule 457(c) and Rule 457(h), the registration fee is calculated on the basis of the average of the high and low sale prices for the common stock on the NYSE on June 6, 2024, $4.59. Pursuant to General Instruction E to Form S-8, the registration fee is calculated only with respect to additional securities registered under the Plan.

Table 2: Fee Offset Claims and Sources

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Registrant or Filer Name | Form or Filing Type | File Number | Initial Filing Date | Filing Date | Fee Offset Claimed | Security Type Associated with Fee Offset Claimed | Security Title Associated with Fee Offset Claimed | Unsold Securities Associated with Fee Offset Claimed | Unsold Aggregate Offering Amount Associated with Fee Offset Claimed | Fee Paid with Fee Offset Source |

| Rule 457(p) |

Fee Offset Claims | N/A | N/A | N/A | N/A | | N/A | N/A | N/A | N/A | N/A | |

Fee Offset Sources | N/A | N/A | N/A | | N/A | | | | | | N/A |

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We consent to the use of our report dated March 15, 2024, with respect to the consolidated financial statements of Flotek Industries, Inc., incorporated herein by reference.

/s/ KPMG LLP

Houston, Texas

June 11, 2024

Exhibit 5.1

[Porter Hedges LLP Letterhead]

June 11, 2024

Flotek Industries, Inc.

5775 N. Sam Houston Parkway W., Suite 400

Houston, Texas 77086

Re: Flotek Industries, Inc. Registration Statement on Form S-8; Flotek Industries, Inc. 2018 Long-Term Incentive Plan, as amended; Flotek Industries, Inc. 2012 Employee Stock Purchase Plan, as amended

Ladies and Gentlemen:

We have acted as counsel to Flotek Industries, Inc., a Delaware corporation (the “Company”), in connection with the preparation for filing with the Securities and Exchange Commission (the “Commission”) of a Registration Statement on Form S-8 (the “Registration Statement”) under the Securities Act of 1933, as amended (the “Securities Act”). The Registration Statement relates to the registration of an additional 500,000 shares (the “2018 Plan Shares”) of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), issuable pursuant to the Flotek Industries, Inc. 2018 Long-Term Incentive Plan, as amended (the “2018 Plan”), and 83,333 shares (the “ESPP Shares” and together with the 2018 Plan Shares, the “Shares”) of the Common Stock issuable pursuant to Flotek Industries, Inc. 2012 Employee Stock Purchase Plan, as amended (the “ESPP” and together with the 2018 Plan, the “Plans”).

We have examined the Plans and such corporate records, documents, instruments and certificates of the Company, and have reviewed such questions of law as we have deemed necessary, relevant or appropriate to enable us to render the opinion expressed herein. In such examination, we have assumed without independent investigation the authenticity of all documents submitted to us as originals, the genuineness of all signatures, the legal capacity of all natural persons, and the conformity of any documents submitted to us as copies to their respective originals. As to certain questions of fact material to this opinion, we have relied without independent investigation upon statements or certificates of public officials and officers of the Company.

Based upon such examination and review, we are of the opinion that the Shares have been duly and validly authorized and will, upon issuance and delivery as contemplated by the Plans, be validly issued, fully paid and nonassessable outstanding shares of Common Stock.

The opinion set forth above is limited in all respects to matters of the General Corporation Law of the State of Delaware.

This Firm consents to the filing of this opinion as an exhibit to the Registration Statement. In giving this consent, we do not admit that this Firm is in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission promulgated thereunder.

This opinion is rendered on the date hereof and we disclaim any duty to advise you regarding any changes in the matters addressed herein.

Very truly yours,

/s/ Porter Hedges LLP

PORTER HEDGES LLP

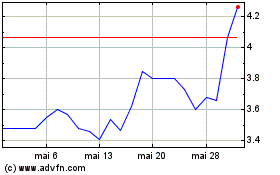

Flotek Industries (NYSE:FTK)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

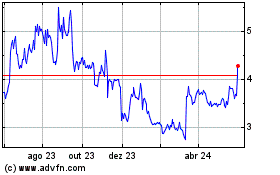

Flotek Industries (NYSE:FTK)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024