UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 4)*

| Bitfarms

Ltd. |

| (Name

of Issuer) |

| |

| Common

Shares |

| (Title

of Class of Securities) |

| |

| 09173B107 |

| (CUSIP

Number) |

Riot

Platforms, Inc.

3855

Ambrosia Street, Suite 301

Castle Rock, CO 80109

Telephone:

(303) 794-2000 |

Attention to:

William Jackman

Executive Vice

President, General Counsel and Secretary

|

(Name,

Address and Telephone Number of Person

Authorized to Receive Notices and Communications) |

| |

| June 11,

2024 |

| (Date

of Event Which Requires Filing of This Statement) |

If the filing

person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing

this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

* The remainder of this cover page shall be filled out for a

reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

| CUSIP

No. 09173B107 |

Page 2

of 6 |

SCHEDULE 13D

| 1 |

NAME OF REPORTING PERSON

Riot Platforms, Inc. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

WC |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Nevada |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

53,793,440 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

53,793,440 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED

BY EACH REPORTING PERSON

53,793,440 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES:

|

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED

BY AMOUNT IN ROW (11)

13.1% |

| 14 |

TYPE OF REPORTING PERSON

CO |

| CUSIP

No. 09173B107 |

Page 3

of 6 |

SCHEDULE 13D

Item 1. Security and Issuer.

This

Amendment No. 4 to Schedule 13D (“Amendment No. 4”) relates to the Schedule 13D filed on May 28, 2024

(as amended by Amendment No. 1, dated May 29, 2024, Amendment No. 2, dated June 4, 2024 and Amendment No. 3

dated June 5, 2024, the “Schedule 13D”) by Riot Platforms, Inc., a Nevada corporation (the “Reporting

Person”), relating to the Common Shares, no par value per share (the “Common Shares”), of Bitfarms Ltd.,

a corporation incorporated under the Canada Business Corporations Act and continued under the Business Corporations Act (Ontario) (the

“Company”), whose principal executive offices are located at 110 Yonge Street, Suite 1601, Toronto, Ontario,

M5C 1T4.

Except as specifically amended by this Amendment

No. 4, the Schedule 13D is unchanged.

Item 2. Identity and Background.

The third and fourth paragraphs of Item 2 of the Schedule 13D are hereby amended and restated to read

in full as follows:

The information required by General Instruction

C to Schedule 13D is attached hereto as Schedule A and is hereby incorporated by reference.

(d)-(e) The Reporting Person and the individuals

listed on Schedule A have not, during the last five years, been (i) convicted in a criminal proceeding (excluding traffic violations

or similar misdemeanors) or (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as

a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or

mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

Item 3. Source and Amount of Funds or Other Consideration.

Item 3 of the Schedule 13D is hereby amended

and restated to read in full as follows:

The information disclosed under Item 4 of the

Schedule 13D (as amended by Amendment No. 4) is hereby incorporated by reference into this Item 3.

The

aggregate purchase price of the Common Shares held by the Reporting Person reported herein was US$111,090,522. The Common Shares beneficially

owned by the Reporting Person were purchased using funds out of its working capital.

Item 4. Purpose of Transaction.

Item 4 of the Schedule 13D is hereby amended

and supplemented by adding the following information:

On June 12, 2024, the Reporting Person issued

a press release commenting on the shareholder rights plan unilaterally adopted by the Company on June 10, 2024. The foregoing summary

of the press release is not intended to be complete and is qualified in its entirety by reference to the full text of the press release,

which is filed as Exhibit 1 hereto and is incorporated herein by reference.

Item 5. Interest in Securities of the Issuer.

Item 5(a) and (b) of the Schedule 13D is hereby amended

and restated to read in full as follows:

(a) and (b) The aggregate number and percentage of the Common

Shares that are beneficially owned by the Reporting Person and as to which the Reporting Person has sole voting power, shared voting

power, sole dispositive power and shared dispositive power are set forth on the cover page of this Statement, and such information

is incorporated herein by reference. The percentages used herein are calculated based on an aggregate of 411,621,686 Common Shares outstanding,

calculated based on the information contained in the press release included as Schedule A to the Company’s Material Change Report,

dated June 10, 2024, filed as Exhibit 99.1 to the Company’s Report of Foreign Private Issuer filed on Form 6-K on

June 10, 2024 (the press release stated that the 47,830,440 Common Shares beneficially owned by the Reporting Person as of June 5,

2024 represented 11.62% of the outstanding Common Shares, equating to a total of 411,621,686.75 Common Shares outstanding as of June 10,

2024).

| CUSIP

No. 09173B107 |

Page 4

of 6 |

SCHEDULE 13D

Item 5 of the Schedule 13D is hereby amended and supplemented by adding

the following information:

(c) The following information concerning

the Common Shares purchased by (or on behalf of) the Reporting Person during the 60-day period prior to this filing is added:

| Trade Date | |

Shares Purchased | |

Weighted Average Price

per Share (US$) | |

Price Range (US$) |

| 06/07/2024 | |

1,745,433 | |

2.48 | |

2.40 – 2.54 |

| 06/10/2024 | |

1,924,885 | |

2.35 | |

2.26 – 2.40 |

| 06/11/2024 | |

2,292,682 | |

2.22 | |

2.14 – 2.27 |

| CUSIP

No. 09173B107 |

Page 5

of 6 |

SCHEDULE 13D

Item 7. Material to Be Filed as Exhibits.

| CUSIP

No. 09173B107 |

Page 6

of 6 |

SCHEDULE 13D

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, the undersigned certifies that the information set forth in this Statement is true, complete and correct.

Dated: June 12, 2024

| |

Riot Platforms, Inc.

|

| |

|

| |

By: |

/s/

Colin Yee |

| |

|

Name: |

Colin Yee |

| |

|

Title: |

Chief Financial Officer |

SCHEDULE A

Directors and Executive Officers of the Reporting

Person

The following table sets forth certain information

with respect to the directors and executive officers of the Reporting Person. Unless otherwise specified below, the business address

and address of the organization of principal occupation or employment of each director and executive officer of the Reporting Person

is 3855 Ambrosia Street, Suite 301 Castle Rock, CO, USA 80109.

| Name |

Position |

Citizenship |

| Benjamin

Yi |

Director

and Executive Chairman |

Canada |

| Jason

Les |

Director

and Chief Executive Officer |

United

States |

| Hubert

Marleau |

Director |

Canada |

| Hannah

Cho |

Director

|

United

States |

| Lance D’Ambrosio |

Director |

United

States |

| Colin

Yee |

Executive

Vice President, Chief Financial Officer |

Canada |

| William

Jackman |

Executive

Vice President, General Counsel and Secretary |

Canada |

| Jason

Chung |

Executive

Vice President, Head of Corporate Development & Strategy |

Canada |

| Ryan

Werner |

Senior

Vice President, Chief Accounting Officer |

United

States |

| Stephen

Howell |

Chief

Operating Officer |

United

States |

Exhibit 1

Riot Comments on Bitfarms’ Adoption of

Shareholder-Unfriendly Poison Pill

Poison Pill Comes Just Days After Riot Privately

Urged Bitfarms to Consult with Riot and Other Large Shareholders on New Board Members and Stressed that Chairman Nicolas Bonta Must Resign

to Address Corporate Governance Concerns

CASTLE ROCK, Colo., June 12, 2024 –

Riot Platforms, Inc. (NASDAQ: RIOT) (“Riot”) today commented on the shareholder rights plan (the “Poison Pill”)

unilaterally adopted by Bitfarms Ltd. (NASDAQ/TSX: BITF) (“Bitfarms” or the “Company”), which takes immediate

effect and effectively prevents any shareholder from acquiring 15% or more of Bitfarms’ common shares without making a formal take-over

bid for all of the Company’s shares. The 15% trigger is in direct conflict with established legal and governance standards, including

those published by leading proxy advisory firms Institutional Shareholder Services Inc. and Glass, Lewis & Co., and is further

evidence of the Bitfarms Board of Directors (the “Bitfarms Board”) disregarding good corporate governance.

Jason Les, Chief Executive Officer of Riot, stated:

“We have attempted to privately engage with

the Bitfarms Board and recently sent two letters urging constructive collaboration with us around the addition of at least two new directors

who are fully independent of Bitfarms and Riot. Instead of engaging with us privately and in good faith, Bitfarms has responded by implementing

an off-market Poison Pill with a trigger well below the customary 20% threshold.

“This action further demonstrates the Bitfarms

Board’s entrenchment and disregard for the perspectives of its shareholders, who clearly signaled their discontent less than two

weeks ago when they voted out Company co-founder Emiliano Grodzki. In our most recent letter, we urged the Bitfarms Board to facilitate

the resignation and removal of Chairman and interim CEO Nicolas Bonta, who has led the Bitfarms Board since 2018 and bears direct responsibility

for its poor corporate governance practices, as a first step to address shareholders’ concerns.

“We will continue to push to address the serious

corporate governance issues at Bitfarms and ensure that shareholders have a say on the Company’s path forward.”

About Riot Platforms, Inc.

Riot’s (NASDAQ: RIOT) vision is to be the

world’s leading Bitcoin-driven infrastructure platform. Our mission is to positively impact the sectors, networks, and communities

that we touch. We believe that the combination of an innovative spirit and strong community partnership allows the Company to achieve

best-in-class execution and create successful outcomes.

Riot is a Bitcoin mining and digital infrastructure

company focused on a vertically integrated strategy. The Company has Bitcoin mining operations in central Texas and electrical switchgear

engineering and fabrication operations in Denver, Colorado.

For more information,

visit www.riotplatforms.com.

Non-Binding Proposal

Riot cautions Riot shareholders,

Bitfarms shareholders and others considering trading in Riot securities or Bitfarms securities that the proposal Riot has made for a business

combination transaction with Bitfarms is non-binding, does not constitute and should not be construed as an offer or intention to make

an offer directly to Bitfarms shareholders, and there can be no assurance that any definitive offer will be made by Riot, that Bitfarms

will accept any offer made by Riot, that any agreement will be entered into by Riot and Bitfarms or that the proposal or any other transaction

will be approved or consummated. Riot does not undertake any obligation to provide any updates with respect to the proposed transaction,

except as required by applicable law.

Cautionary Note Regarding

Forward Looking Statements

Statements contained

herein that are not historical facts constitute “forward-looking statements” and “forward-looking information”

(together, “forward-looking statements”) within the meaning of applicable U.S. and Canadian securities laws that reflect

management’s current expectations, assumptions, and estimates of future events, performance and economic conditions. Such forward-looking

statements rely on the safe harbor provisions of Section 27A of the U.S. Securities Act of 1933 and Section 21E of the U.S.

Securities Exchange Act of 1934 and the safe harbor provisions of applicable Canadian securities laws. Because such statements are subject

to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements.

Words and phrases such as “anticipate,” “believe,” “combined company,” “create,” “drive,”

“expect,” “forecast,” “future,” “growth,” “intend,” “hope,” “opportunity,”

“plan,” “potential,” “proposal,” “synergies,” “unlock,” “upside,”

“will,” “would,” and similar words and phrases are intended to identify forward-looking statements. These forward-looking

statements may include, but are not limited to, statements concerning: uncertainties as to whether

any definitive offer will be made by Riot or Bitfarms will accept any offer made by Riot; whether Bitfarms will enter into discussions

with Riot regarding the proposed combination of Riot and Bitfarms; the outcome of any such discussions, including the possibility

that the terms of any such combination will be materially different from those described herein; the conditions to the completion of

any combination, including the receipt of Bitfarms shareholder approval and the receipt of all required regulatory approvals; the future

performance, results of operations, liquidity and financial position of each of Riot, Bitfarms and the company resulting from the combination

of Riot and Bitfarms; the possibility that the combined company may be unable to achieve expected synergies and operating efficiencies

within the expected timeframes or at all; the integration of Bitfarms’ operations with those of Riot and the possibility that such

integration may be more difficult, time-consuming and costly than expected or that operating costs and business disruption may be greater

than expected in connection with the proposed transaction. Such forward-looking statements are not guarantees of future performance or

actual results, and readers should not place undue reliance on any forward-looking statement as actual results may differ materially

and adversely from forward-looking statements. Detailed information regarding the factors identified by the management of Riot, which

they believe may cause actual results to differ materially from those expressed or implied by such forward-looking statements in this

press release, may be found in Riot’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including

the risks, uncertainties and other factors discussed under the sections entitled “Risk Factors” and “Cautionary Note

Regarding Forward-Looking Statements” of Riot’s Annual Report on Form 10-K for the fiscal year ended December 31,

2023, filed with the SEC on February 23, 2024, and the other filings Riot has made or will make with the SEC after such date, copies

of which may be obtained from the SEC’s website at www.sec.gov. All forward-looking statements contained herein are made

only as of the date hereof, and Riot disclaims any intention or obligation to update or revise any such forward-looking statements to

reflect events or circumstances that subsequently occur, or of which Riot hereafter becomes aware, except as required by applicable law.

No Offer or Solicitation

This

press release is for informational purposes only and is not intended to and does not constitute an offer to sell or the solicitation

of an offer, or an intention to offer, to subscribe for or buy or an invitation to purchase or subscribe for any securities, nor shall

there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. Such an offer to purchase

securities would only be made pursuant to a registration statement, prospectus, tender offer, takeover bid circular, management information

circular or other regulatory filing filed by Riot with the SEC and available at www.sec.gov or filed with applicable Canadian

securities regulatory authorities on SEDAR+ and available at www.sedarplus.ca. This press release is not intended to, and does

not, solicit a proxy from any shareholder of Bitfarms. Such a solicitation of proxies would only be made pursuant to a proxy circular

filed with applicable Canadian securities regulatory authorities on SEDAR+ and available at www.sedarplus.ca or pursuant to an

exemption from the proxy solicitation rules under applicable Canadian securities law.

Important Information

for Investors

This

communication relates to, among other things, a proposal that Riot has made for a business combination transaction with Bitfarms. In

furtherance of this proposal and subject to future developments, Riot (and, if applicable, Bitfarms) may file one or more registration

statements, prospectuses, management information circulars, proxy statements, proxy circulars, tender offers, takeover bid circulars

or other documents with the SEC and applicable Canadian securities regulatory authorities. This communication is not a substitute for

any registration statement, prospectus, management information circular, proxy statement, proxy circular, tender offer, takeover bid

circular or other document (collectively, “Regulatory Filings”) Riot and/or Bitfarms may file with the SEC and/or applicable

Canadian securities regulatory authorities in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF RIOT AND BITFARMS

ARE URGED TO READ EACH REGULATORY FILING WHEN AND IF FILED BY RIOT AND/OR BITFARMS WITH THE SEC AND/OR APPLICABLE CANADIAN SECURITIES

REGULATORY AUTHORITIES CAREFULLY IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

RIOT, BITFARMS, THE PROPOSED TRANSACTION AND RELATED MATTERS. Any proxy circular, takeover bid circular, management information circular,

prospectus or other applicable Regulatory Filing (if and when filed) will be mailed to shareholders of Bitfarms (if and when required

to be mailed by applicable law). Investors and security holders will be able to obtain free copies of Regulatory Filings (if and when

available) and other documents filed by Riot with the SEC and available at www.sec.gov, and on the “Investor Relations”

page of Riot’s corporate website, www.Riotplatforms.com. Investors and security holders will be able to obtain free

copies of any documents filed with applicable Canadian securities regulatory authorities by Riot on SEDAR+ at www.sedarplus.ca,

and on the “Investor Relations” page of Riot’s corporate website, www.Riotplatforms.com.

This

communication is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the

SEC or Canadian securities regulatory authorities. Nonetheless, Riot and its directors and executive officers and other members of management

and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. You can find information

about Riot’s executive officers and directors in Riot’s Annual Report on Form 10-K for the year ended December 31,

2023. Additional information regarding the interests of such potential participants will be included in one or more Regulatory Filings

filed with the SEC and Canadian securities regulatory authorities if and when they become available. These documents (if and when available)

may be obtained free of charge from the SEC’s website at www.sec.gov,

on SEDAR+ at www.sedarplus.ca and by visiting the “Investor Relations”

page of Riot’s corporate website, www.Riotplatforms.com.

Contacts

Investor Contacts:

Phil McPherson

303-794-2000 ext. 110

IR@Riot.Inc

Okapi Partners

Bruce Goldfarb / Chuck Garske, (877) 285-5990

info@okapipartners.com

Media Contact:

Longacre Square Partners

Joe Germani / Dan Zacchei

jgermani@longacresquare.com

/ dzacchei@longacresquare.com

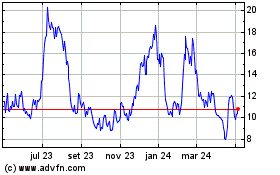

Riot Platforms (NASDAQ:RIOT)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

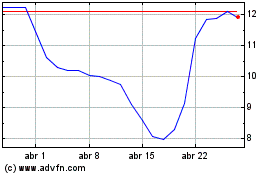

Riot Platforms (NASDAQ:RIOT)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024