false2024Q20001656472--12-3100-0000000P3YP3YP3Yxbrli:sharesiso4217:USDiso4217:USDxbrli:sharescron:segmentxbrli:pureiso4217:CADiso4217:ILSiso4217:CADxbrli:sharescron:shareholdercron:complaintcron:defendant00016564722024-01-012024-06-3000016564722024-08-0500016564722024-06-3000016564722023-12-3100016564722024-04-012024-06-3000016564722023-04-012023-06-3000016564722023-01-012023-06-300001656472us-gaap:CommonStockMember2023-12-310001656472us-gaap:AdditionalPaidInCapitalMember2023-12-310001656472us-gaap:RetainedEarningsMember2023-12-310001656472us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001656472us-gaap:NoncontrollingInterestMember2023-12-310001656472us-gaap:CommonStockMember2024-01-012024-03-310001656472us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-3100016564722024-01-012024-03-310001656472us-gaap:RetainedEarningsMember2024-01-012024-03-310001656472us-gaap:NoncontrollingInterestMember2024-01-012024-03-310001656472us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001656472us-gaap:CommonStockMember2024-03-310001656472us-gaap:AdditionalPaidInCapitalMember2024-03-310001656472us-gaap:RetainedEarningsMember2024-03-310001656472us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001656472us-gaap:NoncontrollingInterestMember2024-03-3100016564722024-03-310001656472us-gaap:CommonStockMember2024-04-012024-06-300001656472us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001656472us-gaap:RetainedEarningsMember2024-04-012024-06-300001656472us-gaap:NoncontrollingInterestMember2024-04-012024-06-300001656472us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001656472us-gaap:CommonStockMember2024-06-300001656472us-gaap:AdditionalPaidInCapitalMember2024-06-300001656472us-gaap:RetainedEarningsMember2024-06-300001656472us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001656472us-gaap:NoncontrollingInterestMember2024-06-300001656472us-gaap:CommonStockMember2022-12-310001656472us-gaap:AdditionalPaidInCapitalMember2022-12-310001656472us-gaap:RetainedEarningsMember2022-12-310001656472us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001656472us-gaap:NoncontrollingInterestMember2022-12-3100016564722022-12-310001656472us-gaap:CommonStockMember2023-01-012023-03-310001656472us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-3100016564722023-01-012023-03-310001656472us-gaap:RetainedEarningsMember2023-01-012023-03-310001656472us-gaap:NoncontrollingInterestMember2023-01-012023-03-310001656472us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001656472us-gaap:CommonStockMember2023-03-310001656472us-gaap:AdditionalPaidInCapitalMember2023-03-310001656472us-gaap:RetainedEarningsMember2023-03-310001656472us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001656472us-gaap:NoncontrollingInterestMember2023-03-3100016564722023-03-310001656472us-gaap:CommonStockMember2023-04-012023-06-300001656472us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001656472us-gaap:RetainedEarningsMember2023-04-012023-06-300001656472us-gaap:NoncontrollingInterestMember2023-04-012023-06-300001656472us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001656472us-gaap:CommonStockMember2023-06-300001656472us-gaap:AdditionalPaidInCapitalMember2023-06-300001656472us-gaap:RetainedEarningsMember2023-06-300001656472us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001656472us-gaap:NoncontrollingInterestMember2023-06-3000016564722023-06-300001656472cron:CannabisFlowerMember2024-04-012024-06-300001656472cron:CannabisFlowerMember2023-04-012023-06-300001656472cron:CannabisExtractsMember2024-04-012024-06-300001656472cron:CannabisExtractsMember2023-04-012023-06-300001656472us-gaap:ProductAndServiceOtherMember2024-04-012024-06-300001656472us-gaap:ProductAndServiceOtherMember2023-04-012023-06-300001656472cron:CannabisFlowerMember2024-01-012024-06-300001656472cron:CannabisFlowerMember2023-01-012023-06-300001656472cron:CannabisExtractsMember2024-01-012024-06-300001656472cron:CannabisExtractsMember2023-01-012023-06-300001656472us-gaap:ProductAndServiceOtherMember2024-01-012024-06-300001656472us-gaap:ProductAndServiceOtherMember2023-01-012023-06-300001656472country:CA2024-04-012024-06-300001656472country:CA2023-04-012023-06-300001656472country:IL2024-04-012024-06-300001656472country:IL2023-04-012023-06-300001656472cron:OtherCountriesMember2024-04-012024-06-300001656472cron:OtherCountriesMember2023-04-012023-06-300001656472country:CA2024-01-012024-06-300001656472country:CA2023-01-012023-06-300001656472country:IL2024-01-012024-06-300001656472country:IL2023-01-012023-06-300001656472cron:OtherCountriesMember2024-01-012024-06-300001656472cron:OtherCountriesMember2023-01-012023-06-3000016564722023-01-012023-12-310001656472cron:OneCustomerMemberus-gaap:CreditConcentrationRiskMemberus-gaap:AccountsReceivableMember2024-01-012024-06-300001656472cron:OneCustomerMemberus-gaap:CreditConcentrationRiskMemberus-gaap:AccountsReceivableMember2023-01-012023-12-310001656472cron:TwoMajorCustomersMember2024-04-012024-06-300001656472cron:TwoMajorCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2024-04-012024-06-300001656472cron:ThreeMajorCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2023-04-012023-06-300001656472cron:ThreeMajorCustomersMember2024-01-012024-06-300001656472cron:ThreeMajorCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2024-01-012024-06-300001656472cron:ThreeMajorCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-06-300001656472us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsAbandonmentMembercron:CannabisExtractsMember2023-04-012023-06-300001656472us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsAbandonmentMembercron:CannabisExtractsMember2023-01-012023-06-300001656472us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsAbandonmentMember2023-04-012023-06-300001656472us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsAbandonmentMember2023-01-012023-06-300001656472us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsAbandonmentMembercron:FacilityInLosAngelesCaliforniaMember2023-01-012023-06-300001656472us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsAbandonmentMembercron:FacilityInLosAngelesCaliforniaMember2023-04-012023-06-300001656472us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsAbandonmentMemberus-gaap:EmployeeSeveranceMember2023-03-310001656472us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsAbandonmentMemberus-gaap:EmployeeSeveranceMember2023-04-012023-06-300001656472us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsAbandonmentMemberus-gaap:EmployeeSeveranceMember2023-06-300001656472us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsAbandonmentMemberus-gaap:OtherRestructuringMember2023-03-310001656472us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsAbandonmentMemberus-gaap:OtherRestructuringMember2023-04-012023-06-300001656472us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsAbandonmentMemberus-gaap:OtherRestructuringMember2023-06-300001656472us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsAbandonmentMember2023-03-310001656472us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsAbandonmentMember2023-06-300001656472us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsAbandonmentMemberus-gaap:EmployeeSeveranceMember2022-12-310001656472us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsAbandonmentMemberus-gaap:EmployeeSeveranceMember2023-01-012023-06-300001656472us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsAbandonmentMemberus-gaap:OtherRestructuringMember2022-12-310001656472us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsAbandonmentMemberus-gaap:OtherRestructuringMember2023-01-012023-06-300001656472us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsAbandonmentMember2022-12-310001656472us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsAbandonmentMember2024-01-012024-06-300001656472cron:CronosGrowingCompanyInc.Member2024-06-300001656472cron:CronosGrowingCompanyInc.Member2023-12-310001656472cron:CronosGrowingCompanyInc.Member2024-04-012024-06-300001656472cron:CronosGrowingCompanyInc.Member2023-04-012023-06-300001656472cron:CronosGrowingCompanyInc.Member2024-01-012024-06-300001656472cron:CronosGrowingCompanyInc.Member2023-01-012023-06-300001656472cron:PharmacannMember2021-06-142021-06-1400016564722021-06-1400016564722021-06-142021-06-140001656472cron:PharmacannMember2024-06-300001656472cron:PharmacannMember2023-12-310001656472cron:PharmacannMember2024-01-012024-03-310001656472cron:PharmacannMember2024-04-012024-06-300001656472cron:VituraHealthLimitedMember2024-06-300001656472cron:PharmacannMember2024-03-310001656472cron:PharmacannMember2024-06-300001656472cron:VituraHealthLimitedMember2024-03-310001656472cron:VituraHealthLimitedMember2024-04-012024-06-300001656472cron:VituraHealthLimitedMember2024-06-300001656472cron:PharmacannMember2023-12-310001656472cron:PharmacannMember2024-01-012024-06-300001656472cron:VituraHealthLimitedMember2023-12-310001656472cron:VituraHealthLimitedMember2024-01-012024-06-300001656472cron:PharmacannMember2023-03-310001656472cron:PharmacannMember2023-04-012023-06-300001656472cron:PharmacannMember2023-06-300001656472cron:VituraHealthLimitedMember2023-03-310001656472cron:VituraHealthLimitedMember2023-04-012023-06-300001656472cron:VituraHealthLimitedMember2023-06-300001656472cron:PharmacannMember2022-12-310001656472cron:PharmacannMember2023-01-012023-06-300001656472cron:VituraHealthLimitedMember2022-12-310001656472cron:VituraHealthLimitedMember2023-01-012023-06-300001656472cron:CronosGrowCoCreditFacilityMemberus-gaap:LoansReceivableMember2024-06-300001656472cron:CronosGrowCoCreditFacilityMemberus-gaap:LoansReceivableMember2023-12-310001656472us-gaap:LoansReceivableMember2024-06-300001656472us-gaap:LoansReceivableMember2023-12-310001656472cron:OntarioIncMucciPromissoryNoteMemberus-gaap:LoansReceivableMember2024-06-300001656472cron:OntarioIncMucciPromissoryNoteMemberus-gaap:LoansReceivableMember2023-12-310001656472cron:CannasoulCollaborationLoanMemberus-gaap:LoansReceivableMember2024-06-300001656472cron:CannasoulCollaborationLoanMemberus-gaap:LoansReceivableMember2023-12-310001656472cron:CronosGrowCoCreditFacilityMemberus-gaap:LoansReceivableMember2019-08-230001656472cron:CronosGrowCoCreditFacilityMemberus-gaap:LoansReceivableMember2021-08-310001656472cron:CronosGrowCoCreditFacilityMemberus-gaap:LoansReceivableMember2024-06-012024-06-300001656472cron:CronosGrowCoCreditFacilityMemberus-gaap:LoansReceivableMember2024-06-202024-06-200001656472cron:CronosGrowCoCreditFacilityMemberus-gaap:LoansReceivableMember2024-01-012024-06-300001656472cron:CronosGrowCoCreditFacilityMemberus-gaap:LoansReceivableMember2023-01-012023-12-310001656472cron:CronosGrowCoCreditFacilityMemberus-gaap:LoansReceivableMember2022-03-310001656472cron:CronosGrowCoCreditFacilityMemberus-gaap:LoansReceivableMember2024-04-012024-06-300001656472cron:CronosGrowCoCreditFacilityMemberus-gaap:LoansReceivableMember2019-08-232024-06-300001656472cron:OntarioIncMucciPromissoryNoteMemberus-gaap:LoansReceivableMember2019-06-280001656472cron:OntarioIncMucciPromissoryNoteMemberus-gaap:LoansReceivableMember2022-09-3000016564722024-06-302024-06-300001656472cron:OntarioIncMucciPromissoryNoteMemberus-gaap:LoansReceivableMember2024-06-302024-06-300001656472cron:OntarioIncMucciPromissoryNoteMemberus-gaap:LoansReceivableMember2019-06-282022-12-310001656472cron:OntarioIncMucciPromissoryNoteMemberus-gaap:LoansReceivableMember2023-01-012023-06-300001656472cron:OntarioIncMucciPromissoryNoteMemberus-gaap:LoansReceivableMember2023-04-012023-06-300001656472cron:OntarioIncMucciPromissoryNoteMemberus-gaap:LoansReceivableMember2024-04-012024-06-300001656472cron:OntarioIncMucciPromissoryNoteMemberus-gaap:LoansReceivableMember2024-01-012024-06-300001656472cron:CannasoulAnalyticsLtdMemberus-gaap:LoansReceivableMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMembercron:CannasoulCollaborationLoanMemberus-gaap:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementMember2023-12-310001656472cron:CannasoulAnalyticsLtdMemberus-gaap:LoansReceivableMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMembercron:CannasoulCollaborationLoanMemberus-gaap:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementMember2024-06-300001656472cron:CronosGrowCoCreditFacilityMemberus-gaap:LoansReceivableMember2024-03-310001656472cron:OntarioIncMucciPromissoryNoteMemberus-gaap:LoansReceivableMember2024-03-310001656472cron:CannasoulCollaborationLoanMemberus-gaap:LoansReceivableMember2024-03-310001656472cron:CannasoulCollaborationLoanMemberus-gaap:LoansReceivableMember2024-04-012024-06-300001656472cron:CannasoulCollaborationLoanMemberus-gaap:LoansReceivableMember2024-01-012024-06-300001656472cron:CronosGrowCoCreditFacilityMemberus-gaap:LoansReceivableMember2023-03-310001656472cron:CronosGrowCoCreditFacilityMemberus-gaap:LoansReceivableMember2023-04-012023-06-300001656472cron:CronosGrowCoCreditFacilityMemberus-gaap:LoansReceivableMember2023-06-300001656472cron:OntarioIncMucciPromissoryNoteMemberus-gaap:LoansReceivableMember2023-03-310001656472cron:OntarioIncMucciPromissoryNoteMemberus-gaap:LoansReceivableMember2023-06-300001656472cron:CannasoulCollaborationLoanMemberus-gaap:LoansReceivableMember2023-03-310001656472cron:CannasoulCollaborationLoanMemberus-gaap:LoansReceivableMember2023-04-012023-06-300001656472cron:CannasoulCollaborationLoanMemberus-gaap:LoansReceivableMember2023-06-300001656472cron:CronosGrowCoCreditFacilityMemberus-gaap:LoansReceivableMember2022-12-310001656472cron:CronosGrowCoCreditFacilityMemberus-gaap:LoansReceivableMember2023-01-012023-06-300001656472cron:OntarioIncMucciPromissoryNoteMemberus-gaap:LoansReceivableMember2022-12-310001656472cron:CannasoulCollaborationLoanMemberus-gaap:LoansReceivableMember2022-12-310001656472cron:CannasoulCollaborationLoanMemberus-gaap:LoansReceivableMember2023-01-012023-06-300001656472cron:RealignmentMember2024-01-012024-06-300001656472us-gaap:DiscontinuedOperationsHeldforsaleMembercron:CronosFermentationMember2024-01-012024-06-300001656472cron:RealignmentMember2024-04-012024-06-300001656472cron:RealignmentMember2023-01-012023-06-300001656472cron:RealignmentMember2023-04-012023-06-300001656472us-gaap:EmployeeSeveranceMembercron:RealignmentMember2024-03-310001656472us-gaap:EmployeeSeveranceMembercron:RealignmentMember2024-04-012024-06-300001656472us-gaap:EmployeeSeveranceMembercron:RealignmentMember2024-06-300001656472us-gaap:OtherRestructuringMembercron:RealignmentMember2024-03-310001656472us-gaap:OtherRestructuringMembercron:RealignmentMember2024-04-012024-06-300001656472us-gaap:OtherRestructuringMembercron:RealignmentMember2024-06-300001656472cron:RealignmentMember2024-03-310001656472cron:RealignmentMember2024-06-300001656472us-gaap:EmployeeSeveranceMembercron:RealignmentMember2023-12-310001656472us-gaap:EmployeeSeveranceMembercron:RealignmentMember2024-01-012024-06-300001656472us-gaap:OtherRestructuringMembercron:RealignmentMember2023-12-310001656472us-gaap:OtherRestructuringMembercron:RealignmentMember2024-01-012024-06-300001656472cron:RealignmentMember2023-12-310001656472us-gaap:EmployeeStockOptionMember2024-04-012024-06-300001656472us-gaap:EmployeeStockOptionMember2023-04-012023-06-300001656472us-gaap:EmployeeStockOptionMember2024-01-012024-06-300001656472us-gaap:EmployeeStockOptionMember2023-01-012023-06-300001656472us-gaap:RestrictedStockUnitsRSUMember2024-04-012024-06-300001656472us-gaap:RestrictedStockUnitsRSUMember2023-04-012023-06-300001656472us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300001656472us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-300001656472us-gaap:EmployeeStockOptionMembersrt:MinimumMember2024-01-012024-06-300001656472us-gaap:EmployeeStockOptionMembersrt:MaximumMember2024-01-012024-06-300001656472us-gaap:EmployeeStockOptionMembercron:A2020OmnibusPlanMember2024-01-012024-06-300001656472us-gaap:EmployeeStockOptionMembercron:A2018StockOptionPlanMember2024-01-012024-06-3000016564722022-01-012022-12-310001656472cron:A2020OmnibusPlanMember2024-06-300001656472cron:A2020OmnibusPlanMember2023-12-310001656472cron:A2018StockOptionPlanMember2024-06-300001656472cron:A2018StockOptionPlanMember2023-12-310001656472us-gaap:RestrictedStockUnitsRSUMember2023-12-310001656472us-gaap:RestrictedStockUnitsRSUMember2024-06-300001656472us-gaap:RestrictedStockUnitsRSUMember2022-12-310001656472us-gaap:RestrictedStockUnitsRSUMember2023-06-300001656472us-gaap:RestrictedStockUnitsRSUMembersrt:MinimumMember2024-01-012024-06-300001656472us-gaap:RestrictedStockUnitsRSUMembersrt:MaximumMember2024-01-012024-06-300001656472cron:DeferredShareUnitsDSUsMember2023-12-310001656472cron:DeferredShareUnitsDSUsMember2024-01-012024-06-300001656472cron:DeferredShareUnitsDSUsMember2024-06-300001656472cron:DeferredShareUnitsDSUsMember2022-12-310001656472cron:DeferredShareUnitsDSUsMember2023-01-012023-06-300001656472cron:DeferredShareUnitsDSUsMember2023-06-300001656472cron:U.S.DistrictCourtofEasternDistrictofNewYorkVs.CronosMemberus-gaap:PendingLitigationMember2020-03-112020-03-120001656472cron:OSCSettlementMemberus-gaap:SettledLitigationMember2022-10-242022-10-240001656472cron:GreenLeafVsCronosMember2023-04-172023-04-170001656472cron:GreenLeafVsCronosMembercron:CronosGroupInc.Member2023-04-172023-04-170001656472cron:GreenLeafVsCronosMember2024-05-162024-05-160001656472us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001656472us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001656472us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001656472us-gaap:FairValueMeasurementsRecurringMember2024-06-300001656472us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001656472us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001656472us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001656472us-gaap:FairValueMeasurementsRecurringMember2023-12-310001656472us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsNonrecurringMember2024-06-300001656472us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMember2024-06-300001656472us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2024-06-300001656472us-gaap:FairValueMeasurementsNonrecurringMember2024-06-300001656472us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001656472us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001656472us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001656472us-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001656472us-gaap:RelatedPartyMembercron:CannabisPurchasesMember2024-04-012024-06-300001656472us-gaap:RelatedPartyMembercron:CannabisPurchasesMember2023-04-012023-06-300001656472us-gaap:RelatedPartyMembercron:CannabisPurchasesMember2024-01-012024-06-300001656472us-gaap:RelatedPartyMembercron:CannabisPurchasesMember2023-01-012023-06-300001656472us-gaap:RelatedPartyMembercron:CannabisPurchasesMember2024-06-300001656472us-gaap:RelatedPartyMembercron:CannabisPurchasesMember2023-12-310001656472us-gaap:RelatedPartyMembercron:CannabisGermplasmSupplyAgreementMember2024-04-012024-06-300001656472us-gaap:RelatedPartyMembercron:CannabisGermplasmSupplyAgreementMember2024-01-012024-06-300001656472us-gaap:RelatedPartyMember2024-06-202024-06-200001656472us-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMembercron:ManufacturingServicesMember2023-04-012023-06-300001656472us-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMembercron:ManufacturingServicesMember2023-01-012023-06-300001656472us-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMembercron:ManufacturingServicesMember2024-06-300001656472us-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMembercron:ManufacturingServicesMember2023-12-310001656472us-gaap:RelatedPartyMembercron:ManufacturingServicesMember2024-04-012024-06-300001656472us-gaap:RelatedPartyMembercron:ManufacturingServicesMember2024-01-012024-06-300001656472us-gaap:RelatedPartyMembercron:ManufacturingServicesMember2024-06-300001656472us-gaap:RelatedPartyMembercron:ManufacturingServicesMember2023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to .

Commission File No. 001-38403

__________________________

CRONOS GROUP INC.

(Exact name of registrant as specified in its charter)

__________________________ | | | | | | | | |

British Columbia, Canada | | N/A |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

| | |

4491 Concession Rd 12 | | |

Stayner, Ontario | | L0M 1S0 |

| (Address of principal executive offices) | | (Zip Code) |

416-504-0004

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Shares, no par value | | CRON | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or Section 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | |

| Large accelerated filer | o | | Accelerated filer | x |

| Non-accelerated filer | o | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

As of August 5, 2024, there were 382,280,725 common shares of the registrant issued and outstanding.

| | | | | | | | | | | | | | |

| | Table of Contents | | |

| | | | |

| | PART I | | |

| | FINANCIAL INFORMATION | | |

| Item 1. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | | | |

| | PART II | | |

| | OTHER INFORMATION | | |

| Item 1. | | |

| Item 1A. | | | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | | |

| Item 6. | | |

Unless otherwise noted or the context indicates otherwise, references in this Quarterly Report on Form 10-Q (this “Quarterly Report”) to the “Company,” “Cronos Group,” “we,” “us” and “our” refer to Cronos Group Inc., its direct and indirect wholly owned subsidiaries and, if applicable, its joint ventures and investments accounted for by the equity method; the term “cannabis” means the plant of any species or subspecies of genus Cannabis and any part of that plant, including all derivatives, extracts, cannabinoids, isomers, acids, salts, and salts of isomers; the term “U.S. hemp” has the meaning given to term “hemp” in the United States (“U.S.”). Agricultural Improvement Act of 2018 (the “2018 Farm Bill”), including hemp-derived cannabidiol (“CBD”); and the term “U.S. Schedule I cannabis” means cannabis excluding U.S. hemp.

This Quarterly Report contains references to our trademarks and trade names and to trademarks and trade names belonging to other entities. Solely for convenience, trademarks and trade names referred to in this Quarterly Report may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend our use or display of other companies’ trademarks or trade names to imply a relationship with, or endorsement or sponsorship of us or our business by, any other companies. In addition, this Quarterly Report includes website addresses. These website addresses are intended to provide inactive, textual references only. The information on or referred to on these websites is not part of or incorporated into this Quarterly Report.

All currency amounts in this Quarterly Report are stated in U.S. dollars, which is our reporting currency, unless otherwise noted. All references to “dollars” or “$” are to U.S. dollars; all references to “C$” are to Canadian dollars; all references to “A$” are to Australian dollars; and all references to “ILS” are to New Israeli Shekels.

| | | | | | | | | | | | | | | | | |

| (Exchange rates are shown as C$ per $) | As of |

| June 30, 2024 | | June 30, 2023 | | December 31, 2023 |

| | | | | |

| Spot rate | 1.3674 | | 1.3242 | | 1.3243 |

| Year-to-date average rate | 1.3581 | | 1.3474 | | N/A |

| | | | | | | | | | | | | | | | | |

| (Exchange rates are shown as ILS per $) | As of |

| June 30, 2024 | | June 30, 2023 | | December 31, 2023 |

| | | | | |

| Spot rate | 3.7742 | | 3.7051 | | 3.6163 |

| Year-to-date average rate | 3.6950 | | 3.5892 | | N/A |

All summaries of agreements described herein are qualified by the full text of such agreements (certain of which have been filed as exhibits with the U.S. Securities and Exchange Commission).

PART I

FINANCIAL INFORMATION

Item 1. Financial Statements

| | | | | |

| Cronos Group Inc. | |

| Condensed Consolidated Balance Sheets | |

| |

(In thousands of U.S. dollars, except share amounts, unaudited) | |

| | | | | | | | | | | |

| As of June 30, 2024 | | As of December 31, 2023 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 848,189 | | | $ | 669,291 | |

| Short-term investments | — | | | 192,237 | |

| Accounts receivable, net | 16,179 | | | 13,984 | |

| Interest receivable | 5,183 | | | 10,012 | |

| Other receivables | 7,227 | | | 6,341 | |

| Current portion of loans receivable, net | 4,875 | | | 5,541 | |

| Inventory, net | 29,182 | | | 30,495 | |

| Prepaids and other current assets | 5,246 | | | 5,405 | |

| Held-for-sale assets | 19,197 | | | — | |

| Total current assets | 935,278 | | | 933,306 | |

| Equity method investments, net | 21,226 | | | 19,488 | |

| Other investments | 3,168 | | | 35,251 | |

| Non-current portion of loans receivable, net | 73,165 | | | 69,036 | |

| Property, plant and equipment, net | 36,964 | | | 59,468 | |

| Right-of-use assets | 1,079 | | | 1,356 | |

| Goodwill | 1,024 | | | 1,057 | |

| Intangible assets, net | 19,103 | | | 21,078 | |

| | | |

| Other assets | 41 | | | 45 | |

| Total assets | $ | 1,091,048 | | | $ | 1,140,085 | |

| | | |

| Liabilities | | | |

| Current liabilities | | | |

| Accounts payable | $ | 7,840 | | | $ | 12,130 | |

| Income taxes payable | 61 | | | 64 | |

| Accrued liabilities | 23,846 | | | 27,736 | |

| Current portion of lease obligation | 931 | | | 994 | |

| Derivative liabilities | 21 | | | 102 | |

| Current portion due to non-controlling interests | 358 | | | 373 | |

| Total current liabilities | 33,057 | | | 41,399 | |

| Non-current portion due to non-controlling interests | 1,137 | | | 1,003 | |

| Non-current portion of lease obligation | 1,062 | | | 1,559 | |

| | | |

| Total liabilities | 35,256 | | | 43,961 | |

| | | |

| | | |

| Shareholders’ equity | | | |

Share capital (authorized for issue as of June 30, 2024 and December 31, 2023: unlimited; shares outstanding as of June 30, 2024 and December 31, 2023: 382,280,725 and 381,298,853, respectively) | 616,379 | | | 613,725 | |

| Additional paid-in capital | 49,298 | | | 48,449 | |

| Retained earnings | 405,650 | | | 416,719 | |

| Accumulated other comprehensive gain (loss) | (12,013) | | | 20,678 | |

| Total equity attributable to shareholders of Cronos Group | 1,059,314 | | | 1,099,571 | |

| Non-controlling interests | (3,522) | | | (3,447) | |

| Total shareholders’ equity | 1,055,792 | | | 1,096,124 | |

| Total liabilities and shareholders’ equity | $ | 1,091,048 | | | $ | 1,140,085 | |

See notes to condensed consolidated interim financial statements.

| | | | | |

| Cronos Group Inc. | |

| Condensed Consolidated Statements of Net Loss and Comprehensive Income (Loss) | |

|

(In thousands of U.S dollars, except share and per share amounts, unaudited) | |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net revenue, before excise taxes | $ | 38,678 | | | $ | 25,798 | | | $ | 74,045 | | | $ | 52,352 | |

| Excise taxes | (10,916) | | | (6,777) | | | (20,995) | | | (13,836) | |

| Net revenue | 27,762 | | | 19,021 | | | 53,050 | | | 38,516 | |

| Cost of sales | 21,070 | | | 15,922 | | | 41,875 | | | 32,490 | |

| Inventory write-down | 395 | | | — | | | 395 | | | — | |

| Gross profit | 6,297 | | | 3,099 | | | 10,780 | | | 6,026 | |

| Operating expenses | | | | | | | |

| Sales and marketing | 4,330 | | | 5,297 | | | 9,662 | | | 11,038 | |

| Research and development | 962 | | | 1,107 | | | 1,959 | | | 3,146 | |

| General and administrative | 12,767 | | | 13,451 | | | 21,674 | | | 25,307 | |

| Restructuring costs | 547 | | | — | | | 630 | | | — | |

| Share-based compensation | 2,236 | | | 2,331 | | | 4,251 | | | 4,866 | |

| Depreciation and amortization | 1,016 | | | 1,533 | | | 2,139 | | | 3,058 | |

| | | | | | | |

| Impairment loss on long-lived assets | — | | | — | | | 1,974 | | | — | |

| Total operating expenses | 21,858 | | | 23,719 | | | 42,289 | | | 47,415 | |

| Operating loss | (15,561) | | | (20,620) | | | (31,509) | | | (41,389) | |

| Other income | | | | | | | |

| Interest income, net | 13,451 | | | 12,471 | | | 27,696 | | | 23,646 | |

| Share of income (loss) from equity method investments | 917 | | | 270 | | | 2,365 | | | (226) | |

| Gain (loss) on revaluation of financial instruments | (3,615) | | | 5,193 | | | (6,257) | | | (2,565) | |

| Impairment loss on other investments | (12,916) | | | — | | | (25,650) | | | — | |

| Foreign currency transaction gain (loss) | 6,543 | | | (3,174) | | | 19,802 | | | (4,817) | |

| Other, net | 248 | | | 17 | | | (422) | | | 37 | |

| Total other income | 4,628 | | | 14,777 | | | 17,534 | | | 16,075 | |

| Loss before income taxes | (10,933) | | | (5,843) | | | (13,975) | | | (25,314) | |

| Income tax benefit | (2,174) | | | (180) | | | (2,732) | | | (1,616) | |

| Loss from continuing operations | (8,759) | | | (5,663) | | | (11,243) | | | (23,698) | |

| Loss from discontinued operations | — | | | (2,834) | | | — | | | (4,056) | |

| Net loss | (8,759) | | | (8,497) | | | (11,243) | | | (27,754) | |

| Net loss attributable to non-controlling interest | (2) | | | (137) | | | (245) | | | (225) | |

Net loss attributable to Cronos Group | $ | (8,757) | | | $ | (8,360) | | | $ | (10,998) | | | $ | (27,529) | |

| | | | | | | |

| Comprehensive income (loss) | | | | | | | |

| Net loss | $ | (8,759) | | | $ | (8,497) | | | $ | (11,243) | | | $ | (27,754) | |

| Other comprehensive income (loss) | | | | | | | |

| Foreign exchange gain (loss) on translation | (10,160) | | | 16,580 | | | (32,521) | | | 18,994 | |

| Comprehensive income (loss) | (18,919) | | | 8,083 | | | (43,764) | | | (8,760) | |

| Comprehensive income (loss) attributable to non-controlling interests | 58 | | | (87) | | | (75) | | | (95) | |

| Comprehensive income (loss) attributable to Cronos Group | $ | (18,977) | | | $ | 8,170 | | | $ | (43,689) | | | $ | (8,665) | |

| | | | | | | |

| Net loss per share | | | | | | | |

| Basic and diluted - continuing operations | $ | (0.02) | | | $ | (0.01) | | | $ | (0.03) | | | $ | (0.06) | |

| Basic and diluted - discontinued operations | — | | | (0.01) | | | — | | | (0.01) | |

Basic and diluted - total | $ | (0.02) | | | $ | (0.02) | | | $ | (0.03) | | | $ | (0.07) | |

See notes to condensed consolidated interim financial statements.

| | |

| Cronos Group Inc. |

| Condensed Consolidated Statements of Changes in Equity |

| For the six months ended June 30, 2024 and 2023 |

| (In thousands of U.S. dollars, except share amounts, unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Number of shares | | Share capital | | | | Additional paid-in capital | | Retained earnings | | Accumulated other comprehensive income (loss) | | Non-controlling interests | | Total shareholders’ equity |

| Balance as of January 1, 2024 | 381,298,853 | | | $ | 613,725 | | | | | $ | 48,449 | | | $ | 416,719 | | | $ | 20,678 | | | $ | (3,447) | | | $ | 1,096,124 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Activities relating to share-based compensation | 712,325 | | | 1,900 | | | | | (401) | | | — | | | — | | | — | | | 1,499 | |

| Net loss | — | | | — | | | | | — | | | (2,241) | | | — | | | (243) | | | (2,484) | |

| Foreign exchange gain (loss) on translation | — | | | — | | | | | — | | | — | | | (22,471) | | | 110 | | | (22,361) | |

| Balance as of March 31, 2024 | 382,011,178 | | | $ | 615,625 | | | | | $ | 48,048 | | | $ | 414,478 | | | $ | (1,793) | | | $ | (3,580) | | | $ | 1,072,778 | |

| Activities relating to share-based compensation | 269,547 | | | 754 | | | | | 1,250 | | | (71) | | | — | | | — | | | 1,933 | |

| Net loss | — | | | — | | | | | — | | | (8,757) | | | — | | | (2) | | | (8,759) | |

| Foreign exchange gain (loss) on translation | — | | | — | | | | | — | | | — | | | (10,220) | | | 60 | | | (10,160) | |

| Balance as of June 30, 2024 | 382,280,725 | | | $ | 616,379 | | | | | $ | 49,298 | | | $ | 405,650 | | | $ | (12,013) | | | $ | (3,522) | | | $ | 1,055,792 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Number of shares | | Share capital | | | | Additional paid-in capital | | Retained earnings | | Accumulated other comprehensive income (loss) | | Non-controlling interests | | Total shareholders’ equity | | | | | | |

| Balance as of January 1, 2023 | 380,575,403 | | | $ | 611,318 | | | | | $ | 42,682 | | | $ | 490,682 | | | $ | (797) | | | $ | (2,921) | | | $ | 1,140,964 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Activities relating to share-based compensation | 240,518 | | | 917 | | | | | 1,362 | | | — | | | — | | | — | | | 2,279 | | | | | | | |

| Net loss | — | | | — | | | | | — | | | (19,169) | | | — | | | (88) | | | (19,257) | | | | | | | |

| Foreign exchange gain on translation | — | | | — | | | | | — | | | — | | | 2,334 | | | 80 | | | 2,414 | | | | | | | |

| Balance as of March 31, 2023 | 380,815,921 | | | $ | 612,235 | | | | | $ | 44,044 | | | $ | 471,513 | | | $ | 1,537 | | | $ | (2,929) | | | $ | 1,126,400 | | | | | | | |

| Activities relating to share-based compensation | 273,436 | | | 917 | | | | | 1,273 | | | — | | | — | | | — | | | 2,190 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss | — | | | — | | | | | — | | | (8,360) | | | — | | | (137) | | | (8,497) | | | | | | | |

| Foreign exchange gain on translation | — | | | — | | | | | — | | | — | | | 16,530 | | | 50 | | | 16,580 | | | | | | | |

| Balance as of June 30, 2023 | 381,089,357 | | | $ | 613,152 | | | | | $ | 45,317 | | | $ | 463,153 | | | $ | 18,067 | | | $ | (3,016) | | | $ | 1,136,673 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

See notes to condensed consolidated interim financial statements.

| | | | | |

| Cronos Group Inc. | |

| Condensed Consolidated Statements of Cash Flows | |

| |

| (In thousands of U.S. dollars, except share amounts, unaudited) | |

| | | | | | | | | | | | | |

| Six months ended June 30, | | |

| 2024 | | 2023 | | |

| Operating activities | | | | | |

| Net loss | $ | (11,243) | | | $ | (27,754) | | | |

| Adjustments to reconcile net loss to cash used in operating activities: | | | | | |

| Share-based compensation | 4,251 | | | 4,887 | | | |

| Depreciation and amortization | 3,244 | | | 4,785 | | | |

| | | | | |

| Impairment loss on long-lived assets | 1,974 | | | 205 | | | |

| Impairment loss on other investments | 25,650 | | | — | | | |

Loss from investments | 3,732 | | | 2,955 | | | |

| | | | | |

| Changes in expected credit losses on long-term financial assets | 1,021 | | | (1,146) | | | |

Foreign currency transaction (gain) loss | (19,802) | | | 4,817 | | | |

| Other non-cash operating activities, net | 829 | | | (554) | | | |

| Changes in operating assets and liabilities: | | | | | |

| Accounts receivable, net | (2,723) | | | 10,623 | | | |

| Interest receivable | 1,174 | | | (10,243) | | | |

| Other receivables | (1,009) | | | (200) | | | |

| Prepaids and other current assets | (5) | | | 480 | | | |

| Inventory | 292 | | | (7,259) | | | |

| Accounts payable | (4,482) | | | (2,478) | | | |

| Income taxes payable | (47) | | | (32,801) | | | |

| Accrued liabilities | (3,316) | | | (5,784) | | | |

| Cash flows used in operating activities | (460) | | | (59,467) | | | |

| Investing activities | | | | | |

| Purchase of short-term investments | — | | | (479,763) | | | |

| Proceeds from short-term investments | 187,447 | | | 169,418 | | | |

| | | | | |

| | | | | |

| Dividends received from equity method investment | — | | | 1,299 | | | |

| | | | | |

Advances on loans receivable | (8,836) | | | — | | | |

| Proceeds from repayment on loans receivable | 5,298 | | | 11,388 | | | |

| Purchase of property, plant and equipment | (2,453) | | | (1,298) | | | |

| Purchase of intangible assets | (457) | | | (8) | | | |

| | | | | |

| Cash flows provided by (used in) investing activities | 180,999 | | | (298,964) | | | |

| Financing activities | | | | | |

| Withholding taxes paid on share-based awards | (905) | | | (782) | | | |

| | | | | |

| Cash flows used in financing activities | (905) | | | (782) | | | |

| Effect of foreign currency translation on cash and cash equivalents | (736) | | | 3,997 | | | |

| Net change in cash and cash equivalents | 178,898 | | | (355,216) | | | |

| Cash and cash equivalents, beginning of period | 669,291 | | | 764,644 | | | |

| Cash and cash equivalents, end of period | $ | 848,189 | | | $ | 409,428 | | | |

| Supplemental cash flow information | | | | | |

| Interest paid | $ | — | | | $ | — | | | |

| Interest received | $ | 28,291 | | | $ | 13,385 | | | |

| Income taxes paid | $ | 614 | | | $ | 32,995 | | | |

See notes to condensed consolidated interim financial statements.

| | | | | |

| Cronos Group Inc. | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

| |

| (In thousands of U.S. dollars, except share amounts) | |

1. Background, Basis of Presentation, and Summary of Significant Accounting Policies

(a)Background

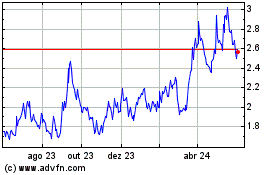

Cronos Group Inc. (“Cronos” or the “Company”) is incorporated in the province of British Columbia under the Business Corporations Act (British Columbia) with principal executive offices at 4491 Concession Rd 12, Stayner, Ontario, L0M 1S0. The Company’s common shares are listed on the Toronto Stock Exchange (“TSX”) and Nasdaq Global Market (“Nasdaq”) under the ticker symbol “CRON.”

Cronos is an innovative global cannabinoid company committed to building disruptive intellectual property by advancing cannabis research, technology and product development. With a passion to responsibly elevate the consumer experience, Cronos is building an iconic brand portfolio. Cronos’ diverse international brand portfolio includes Spinach®, PEACE NATURALS® and Lord Jones®.

(b)Basis of presentation

These condensed consolidated interim financial statements of Cronos are unaudited. They have been prepared in accordance with Generally Accepted Accounting Principles in the United States (“U.S. GAAP”) for interim financial information and with applicable rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”) relating to interim financial statements. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring adjustments) considered necessary for a fair presentation have been included. Operating results for the three and six months ended June 30, 2024 are not necessarily indicative of the results that may be expected for any other reporting period.

These condensed consolidated interim financial statements should be read in conjunction with the Company’s audited consolidated financial statements and related notes included in its Annual Report on Form 10-K for the year ended December 31, 2023 (the “Annual Report”).

Certain prior period amounts have been reclassified to conform to the current year presentation of our condensed consolidated interim financial statements. These reclassifications had no effect on the reported results of operations and ending shareholders’ equity.

(c)Discontinued Operations

In the second quarter of 2023, the Company exited its U.S. hemp-derived cannabinoid product operations. The exit of the U.S. operations represented a strategic shift that had a major effect on the Company’s operations and financial results, and as such, qualifies for reporting as discontinued operations in our condensed consolidated statements of net loss and comprehensive income (loss). Prior period amounts have been reclassified to reflect the discontinued operations classification of the U.S. operations. For more information, see Note 2 “Discontinued Operations.”

(d)Segment information

Segment reporting is prepared on the same basis that the Company’s chief operating decision maker (the “CODM”) manages the business, makes operating decisions and assesses the Company’s performance. Prior to the second quarter of 2023, the Company reported results for two reportable segments, the U.S. and Rest of World. In the second quarter of 2023, as a result of the Company’s exit of its then-existing U.S. operations, the Company determined that it has one operating segment and therefore one reportable segment, which is comprised of operations in Canada and Israel and is involved in the cultivation, manufacture, and marketing of cannabis and cannabis-derived products for the medical and adult-use markets. All prior period segment disclosure information has been reclassified to conform to the current reporting structure in this Form 10-Q. These reclassifications had no effect on our consolidated financial statements in any period presented.

(e)Revenue recognition

The following tables present the Company’s revenue by major product category for continuing operations:

| | | | | | | | | | | |

| Three months ended June 30, |

| 2024 | | 2023 |

| Cannabis flower | $ | 20,661 | | | $ | 14,014 | |

| Cannabis extracts | 7,064 | | | 4,926 | |

| Other | 37 | | | 81 | |

| Net revenue | $ | 27,762 | | | $ | 19,021 | |

| | | | | |

| Cronos Group Inc. | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

| |

| (In thousands of U.S. dollars, except share amounts) | |

| | | | | | | | | | | |

| Six months ended June 30, |

| 2024 | | 2023 |

| Cannabis flower | $ | 38,186 | | | $ | 27,142 | |

| Cannabis extracts | 14,791 | | | 11,227 | |

| Other | 73 | | | 147 | |

| Net revenue | $ | 53,050 | | | $ | 38,516 | |

Net revenue attributed to a geographic region based on the location of the customer were as follows for continuing operations:

| | | | | | | | | | | |

| Three months ended June 30, |

| 2024 | | 2023 |

| Canada | $ | 19,844 | | | $ | 13,595 | |

| Israel | 6,889 | | | 5,426 | |

| | | |

| Other countries | 1,029 | | | — | |

| Net revenue | $ | 27,762 | | | $ | 19,021 | |

| | | | | | | | | | | |

| Six months ended June 30, |

| 2024 | | 2023 |

| Canada | $ | 38,715 | | | $ | 28,029 | |

| Israel | 13,306 | | | 10,487 | |

| | | |

| Other countries | 1,029 | | | — | |

| Net revenue | $ | 53,050 | | | $ | 38,516 | |

(f)Concentration of risk

Credit risk is the risk of financial loss to the Company if a customer or counterparty to a financial instrument fails to meet its contractual obligations. The Company is exposed to credit risk from its operating activities, primarily accounts receivable and other receivables, and its investing activities, including cash held with banks and financial institutions, short-term investments and loans receivable. The Company’s maximum exposure to this risk is equal to the carrying amount of these financial assets, which amounted to $954,818 and $966,442 as of June 30, 2024 and December 31, 2023, respectively.

An impairment analysis is performed at each reporting date using a provision matrix to measure expected credit losses. The provision rates are based on the days past due for groupings of various customer segments with similar loss patterns. The calculation reflects the probability-weighted outcome, the time value of money and reasonable and supportable information that is available at the reporting date about past events, current conditions and forecasts of future economic conditions. Accounts receivable are written off when there is no reasonable expectation of recovery. Indicators that there is no reasonable expectation of recovery include, amongst others, the failure of a debtor to engage in a repayment plan and a failure to make contractual payments for a period of greater than 120 days past due. As of June 30, 2024 and December 31, 2023, the Company had $20 and $3, respectively, in expected credit losses that have been recognized on receivables from contracts with customers.

As of June 30, 2024, the Company assessed that there is a concentration of credit risk, as 30% of the Company’s accounts receivable were due from one customer with an established credit history with the Company. As of December 31, 2023, 37% of the Company’s accounts receivable were due from one customer with an established credit history with the Company.

The Company sells products to a limited number of major customers. Major customers are defined as customers that each individually accounted for greater than 10% of the Company’s revenue. During the three months ended June 30, 2024, the Company earned a total net revenue before excise taxes of $19,941 from two major customers, together accounting for 52% of the Company’s total net revenues before excise taxes. During the three months ended June 30, 2023, the Company earned a total net revenue before excise taxes of $16,839 from three major customers, together accounting for 67% of the Company’s total net revenues before excise taxes. During the six months ended June 30, 2024, the Company earned a total net revenue before excise taxes of $45,482 from three customers, together accounting for 62% of the Company’s total net revenues before excise taxes. During the six months ended June 30, 2023, the Company earned a total net revenue before excise taxes of $34,732 from three major customers, together accounting for 67% of the Company’s total net revenue before excise taxes.

| | | | | |

| Cronos Group Inc. | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

| |

| (In thousands of U.S. dollars, except share amounts) | |

(g)New accounting pronouncements not yet adopted

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures (“ASU 2023-07”). ASU 2023-07 enhances reportable segment disclosures by requiring disclosures such as significant segment expenses, information on the CODM and disclosures for entities with a single reportable segment. Additionally, the amendments enhance interim disclosure requirements, clarify circumstances in which an entity can disclose multiple segment measures of profit or loss, and contain other disclosure requirements. ASU 2023-07 is effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024, and we expect to adopt ASU 2023-07 retrospectively. The Company does not expect the adoption of ASU 2023-07 to have a material impact on its consolidated financial statements.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures (“ASU 2023-09”). ASU 2023-09 enhances the existing income tax disclosures to provide additional information to better assess how an entity’s operations, related tax risks and tax planning, and operational opportunities affect its tax rate and prospects for future cash flows. ASU 2023-09 is effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024, and we expect to adopt ASU 2023-09 prospectively. The Company does not expect the adoption of ASU 2023-09 to have a material impact on its consolidated financial statements.

(h)Adoption of new accounting pronouncements

On January 1, 2024, the Company adopted ASU 2022-03, Fair Value Measurement (Topic 820): Fair Value Measurement of Equity Securities Subject to Contractual Sale Restrictions (“ASU 2022-03”). ASU 2022-03 clarifies that a contractual restriction on the sale of an equity security is not considered in measuring fair value. The amendments also require additional disclosures for equity securities subject to contractual sale restrictions. The adoption of ASU 2022-03 did not have a material impact on the Company’s condensed consolidated interim financial statements. With respect to the adoption of ASU 2022-03, see Note 4 “Investments” for discussion of the contractual restrictions related to the PharmaCann Option (as defined below).

2. Discontinued Operations

In the second quarter of 2023, the Company exited its then-existing U.S. hemp-derived cannabinoid product operations. Accordingly, the net loss of the U.S. operations for the three and six months ended June 30, 2023 are reported separately as loss from discontinued operations on the condensed consolidated statements of net loss and comprehensive income (loss). There was no activity in discontinued operations for the three and six months ended June 30, 2024.

| | | | | |

| Cronos Group Inc. | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

| |

| (In thousands of U.S. dollars, except share amounts) | |

The following table presents the major components comprising loss from discontinued operations in the condensed consolidated statements of operations for the three and six months ended June 30, 2023: | | | | | | | | | | | | | | | | | | | |

| | | | | Three months ended June 30, | | | | Six months ended June 30, |

| | | | | | | 2023 |

| Net revenue | | | | | | | $ | 380 | | | | | $ | 1,029 | |

| Cost of sales | | | | | | | 848 | | | | | 2,044 | |

| Inventory write-down | | | | | | | 839 | | | | | 839 | |

| Gross profit | | | | | | | (1,307) | | | | | (1,854) | |

| Operating expenses | | | | | | | | | | | |

| Sales and marketing | | | | | | | 387 | | | | | 518 | |

Research and development | | | | | | | 18 | | | | | 20 | |

| General and administrative | | | | | | | 213 | | | | | 736 | |

| Restructuring costs | | | | | | | 534 | | | | | 534 | |

| Share-based compensation | | | | | | | 5 | | | | | 21 | |

| Depreciation and amortization | | | | | | | 5 | | | | | 13 | |

| | | | | | | | | | | |

Impairment loss on long-lived assets(i) | | | | | | | 205 | | | | | 205 | |

| Total operating expenses | | | | | | | 1,367 | | | | | 2,047 | |

| Interest income | | | | | | | 3 | | | | | 8 | |

Other, net(ii) | | | | | | | (163) | | | | | (163) | |

Total other income (loss) | | | | | | | (160) | | | | | (155) | |

| Loss before income taxes | | | | | | | (2,834) | | | | | (4,056) | |

| Income tax expense (benefit) | | | | | | | — | | | | | — | |

| Net loss from discontinued operations | | | | | | | $ | (2,834) | | | | | $ | (4,056) | |

(i)During the three and six months ended June 30, 2023, as a result of the exit of the U.S. operations, the Company recognized an impairment charge of $205 related to the right-of-use lease assets associated with the Company’s former U.S. manufacturing facility in Los Angeles, California.

(ii)For the three and six months ended June 30, 2023, Other, net related to loss on disposal of assets that were part of the U.S. operations.

The following tables present the Company’s discontinued operations revenue by major product category:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, | | | | |

| 2023 | | | | |

| Cannabis extracts | 380 | | | 1,029 | | | | | |

| Net revenue | $ | 380 | | | $ | 1,029 | | | | | |

The following tables summarize the Company’s discontinued operations restructuring activity for the three and six months ended June 30, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Accrual as of April 1, 2023 | | Expenses | | Payments/Write-offs | | | | Accrual as of June 30, 2023 |

| Employee Termination Benefits | $ | — | | | $ | 442 | | | $ | (223) | | | | | $ | 219 | |

| | | | | | | | | |

| Other Restructuring Costs | — | | | 92 | | | — | | | | | 92 | |

| Total | $ | — | | | $ | 534 | | | $ | (223) | | | | | $ | 311 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Accrual as of January 1, 2023 | | Expenses | | Payments/Write-offs | | | | Accrual as of June 30, 2023 |

| Employee Termination Benefits | $ | — | | | $ | 442 | | | $ | (223) | | | | | $ | 219 | |

| | | | | | | | | |

| Other Restructuring Costs | — | | | 92 | | | — | | | | | 92 | |

| Total | $ | — | | | $ | 534 | | | $ | (223) | | | | | $ | 311 | |

| | | | | |

| Cronos Group Inc. | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

| |

| (In thousands of U.S. dollars, except share amounts) | |

The Company had no assets or liabilities presented in the condensed consolidated balance sheets related to its discontinued operations as of both June 30, 2024 and December 31, 2023.

For the six months ended June 30, 2024, there were no purchases of property plant and equipment related to discontinued operations. For the six months ended June 30, 2023, purchases of property plant and equipment related to discontinued operations were $67.

3. Inventory, net

Inventory, net is comprised of the following items:

| | | | | | | | | | | | | | |

| | As of June 30, 2024 | | As of December 31, 2023 |

| Raw materials | | $ | 5,351 | | | $ | 4,795 | |

| Work-in-progress | | 9,116 | | | 10,593 | |

| Finished goods | | 14,367 | | | 14,819 | |

| Supplies and consumables | | 348 | | | 288 | |

| Total | | $ | 29,182 | | | $ | 30,495 | |

4. Investments

(a)Equity method investments, net

A reconciliation of the carrying amount of the investments in equity method investees, net is as follows:

| | | | | | | | | | | | | | | | | |

| Ownership interest | | As of June 30, 2024 | | As of December 31, 2023 |

| | | | | |

Cronos Growing Company Inc. (“Cronos GrowCo”) | 50% | | $ | 21,226 | | | $ | 19,488 | |

| | | | | |

| | | $ | 21,226 | | | $ | 19,488 | |

The following is a summary of the Company’s share of net income (losses) from equity investments accounted for under the equity method of accounting:

| | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended June 30, | | For the six months ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cronos GrowCo | $ | 917 | | | $ | 270 | | | $ | 2,365 | | | $ | (226) | |

| | | | | | | |

| $ | 917 | | | $ | 270 | | | $ | 2,365 | | | $ | (226) | |

Beginning in the third quarter of 2024, the results of Cronos GrowCo will be consolidated into the results of the Company, and the Company’s investment in Cronos GrowCo will be reclassified as an intercompany transaction and eliminated upon consolidation. For more information, see Note 12 “Subsequent Events.”

(b)Other investments

Other investments consist of investments in common shares and options of two companies in the cannabis industry.

PharmaCann Option

On June 14, 2021, the Company purchased an option (the “PharmaCann Option”) to acquire 473,787 shares of Class A Common Stock of PharmaCann, Inc. (“PharmaCann”), a vertically integrated cannabis company in the United States, at an exercise price of $0.0001 per share, representing approximately 10.5% of PharmaCann’s issued and outstanding capital stock on a fully diluted basis as of the date of the PharmaCann Option, for an aggregate purchase price of approximately $110,392. The PharmaCann Option is classified as an investment in an equity security without a readily determinable fair value. The Company measures the PharmaCann Option at cost less accumulated impairment charges, if any, and subsequently adjusted for observable price changes in orderly transactions for the identical or a similar investment of the same issuer. As of June 30, 2024 and December 31, 2023, based on updated information provided by PharmaCann in the second quarter, the Company’s ownership percentage in PharmaCann on a fully diluted basis was approximately 6.2% and 6.6%, respectively. The decrease in the Company’s ownership percentage since acquisition does not materially affect the Company’s rights under the PharmaCann Option. The PharmaCann Option is measured at fair value on a non-recurring basis and is a level 3 asset. See Note 10 “Fair Value Measurements” for more information on the fair value hierarchy. The PharmaCann Option is reported as Other investments on the consolidated balance sheet as of June 30, 2024 and December 31, 2023.

| | | | | |

| Cronos Group Inc. | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

| |

| (In thousands of U.S. dollars, except share amounts) | |

During the first and second quarters of 2024, the Company identified adverse forecast changes in the financial performance of PharmaCann as indicators of impairment related to the PharmaCann Option and conducted analyses comparing the PharmaCann Option’s carrying amount to its estimated fair value. The fair value was estimated using the market approach. Under the market approach, the key assumptions are the selected multiples and the discount for lack of marketability. As a result of these analyses, the Company recorded non-cash impairment charges of $12,734 and $12,916 in the first and second quarters of 2024, respectively, as the difference between the carrying amount of the PharmaCann Option and its estimated fair value, in the condensed consolidated statements of net loss and comprehensive loss for the six months ended June 30, 2024.

The Company may sell, transfer or dispose of the PharmaCann Option without PharmaCann’s prior written consent, subject to the following conditions: (i) any transferee of any part of the PharmaCann Option must comply with and commit to comply with all regulations issued by a governmental entity applicable to such transferee in all material respects; (ii) any transferee of any part of the PharmaCann Option must agree to be bound by the terms of the Option Purchase Agreement, dated as of June 14, 2021 (the “Option Purchase Agreement”), as a “Purchaser” thereunder; (iii) the Company may not split and/or transfer the PharmaCann Option, in the aggregate, to more than four persons (with certain exceptions); (iv) no transferee may be a Prohibited Assignee (as defined in the Option Purchase Agreement); and (v) subject to certain exceptions, in the event that the Company (or a Permitted Transferee of the whole PharmaCann Option) transfers less than all of the PharmaCann Option to any third party that is not a Permitted Transferee, certain governance and information rights terminate immediately, unless waived by the PharmaCann board of directors in its sole and absolute discretion.

Additionally, in the event of an initial underwritten public offering of PharmaCann’s common stock pursuant to an effective registration statement, to the extent that holders of PharmaCann common stock are subject to any lock-up period imposed by the underwriter in connection therewith, the Company will, if applicable, execute a customary lock-up agreement on the same material terms and conditions as the other holders of common stock are subject to or as otherwise agreed between PharmaCann and the Company, subject to certain conditions with respect to the duration of the lock-up period.

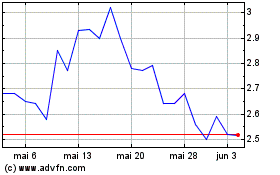

Vitura Health Limited (formerly known as Cronos Australia)

The Company owns approximately 10% of the outstanding common shares of Vitura Health Limited (“Vitura”). The investment is considered an equity security with a readily determinable fair value. Changes in the fair value of the investment are recorded as gain (loss) on revaluation of financial instruments on the condensed consolidated statements of net loss and comprehensive loss.

The following table summarizes the Company’s other investments activity:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of April 1, 2024 | | Unrealized loss | | Impairment charges | | Foreign exchange effect | | As of June 30, 2024 |

| PharmaCann | $ | 12,916 | | | $ | — | | | $ | (12,916) | | | $ | — | | | $ | — | |

| Vitura | 6,842 | | | (3,755) | | | — | | | 81 | | | 3,168 | |

| $ | 19,758 | | | $ | (3,755) | | | $ | (12,916) | | | $ | 81 | | | $ | 3,168 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of January 1, 2024 | | Unrealized loss | | Impairment charges | | Foreign exchange effect | | As of June 30, 2024 |

| PharmaCann | $ | 25,650 | | | $ | — | | | $ | (25,650) | | | $ | — | | | $ | — | |

| Vitura | 9,601 | | | (6,097) | | | — | | | (336) | | | 3,168 | |

| $ | 35,251 | | | $ | (6,097) | | | $ | (25,650) | | | $ | (336) | | | $ | 3,168 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of April 1, 2023 | | Unrealized gain | | Impairment charges | | Foreign exchange effect | | As of June 30, 2023 |

| PharmaCann | $ | 49,000 | | | $ | — | | | $ | — | | | $ | — | | | $ | 49,000 | |

| Vitura | 13,833 | | | 5,194 | | | — | | | (102) | | | 18,925 | |

| $ | 62,833 | | | $ | 5,194 | | | $ | — | | | $ | (102) | | | $ | 67,925 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of January 1, 2023 | | Unrealized loss | | Impairment charges | | Foreign exchange effect | | As of June 30, 2023 |

| PharmaCann | $ | 49,000 | | | $ | — | | | $ | — | | | $ | — | | | $ | 49,000 | |

| Vitura | 21,993 | | | (2,729) | | | — | | | (339) | | | 18,925 | |

| $ | 70,993 | | | $ | (2,729) | | | $ | — | | | $ | (339) | | | $ | 67,925 | |

| | | | | |

| Cronos Group Inc. | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

| |

| (In thousands of U.S. dollars, except share amounts) | |

5. Loans Receivable, net

Loans receivable, net consists of the following: | | | | | | | | | | | | | | | | | |

| | As of June 30, 2024 | | As of December 31, 2023 |

| | | | |

GrowCo Credit Facility | | $ | 4,875 | | | $ | 5,034 | |

| Add: Current portion of accrued interest | | — | | | 507 | |

Total current portion of loans receivable, net | | 4,875 | | | 5,541 | |

GrowCo Credit Facility | | 57,271 | | | 53,638 | |

Mucci Promissory Note | | 13,929 | | | 13,379 | |

| Cannasoul Collaboration Loan | | 1,692 | | | 1,771 | |

| Add: Long-term portion of accrued interest | | 273 | | | 248 | |

Total long-term portion of loans receivable, net | | 73,165 | | | 69,036 | |

| Total loans receivable, net | | $ | 78,040 | | | $ | 74,577 | |

Cronos GrowCo Credit Facility

On August 23, 2019, the Company, as lender, and Cronos GrowCo, as borrower, entered into a senior secured credit agreement for an aggregate principal amount of C$100,000 (the “GrowCo Credit Facility”). The GrowCo Credit Facility is secured by substantially all present and after-acquired personal and real property of Cronos GrowCo. In August 2021, the GrowCo Credit Facility was amended to increase the aggregate principal amount available to C$105,000.

In June 2024, the GrowCo Credit Facility was amended to increase the aggregate principal amount available by C$70,000 by providing a second secured non-revolving credit facility (“Term Loan B”). The funds from Term Loan B will be used to expand Cronos GrowCo’s purpose-built cannabis facility and will mature 10 years after the commencement of sales from the expansion area, following which, principal will be repaid on a quarterly basis. Interest on Term Loan B is payable on a quarterly basis until maturity beginning after the first borrowing under Term Loan B. Prior to July 1, 2024, only C$12,000 of the C$70,000 increased principal availability could be drawn, which Cronos GrowCo drew in full on June 20, 2024.

As of June 30, 2024 and December 31, 2023, Cronos GrowCo had drawn C$116,000 and C$104,000 ($84,833 and $78,532, respectively), respectively from the GrowCo Credit Facility. The interest rate on the outstanding borrowings is the Canadian Prime Rate plus 1.25%, with interest payments due quarterly. Principal payments of C$1,000 commenced in March 2022 and are currently C$1,667, due quarterly. For the three months ended June 30, 2024, Cronos GrowCo repaid C$1,667 ($1,216) in principal and C$1,920 ($1,401) in interest related to the GrowCo Credit Facility. For the six months ended June 30, 2024, Cronos GrowCo repaid C$3,333 ($2,447) in principal and C$3,862 ($2,835) in interest related to the GrowCo Credit Facility. As of June 30, 2024, Cronos GrowCo had repaid an aggregate C$14,833 ($10,848) and C$24,384 ($17,832) in principal and interest, respectively, under the terms of the GrowCo Credit Facility.

Beginning in the third quarter of 2024, the results of Cronos GrowCo will be consolidated into the results of the Company, and the Cronos GrowCo Credit Facility will be reclassified as an intercompany transaction and eliminated upon consolidation. For more information, see Note 12 “Subsequent Events.”

Mucci Promissory Note

On June 28, 2019, the Company entered into a promissory note receivable agreement (the “Mucci Promissory Note”) for C$16,350 (approximately $11,957) with the Cronos GrowCo joint venture partner (“Mucci”). The Mucci Promissory Note is secured by a general security agreement covering all the assets of Mucci. On September 30, 2022, the Mucci Promissory Note was amended and restated to increase the interest rate from 3.95% to the Canadian Prime Rate plus 1.25%, change the interest payments from quarterly to annual, and defer Mucci’s initial cash interest payment from September 30, 2022 to July 1, 2023. On June 20, 2024, the Mucci Promissory Note was amended and restated. As a result, interest accrued on the Mucci Promissory Note between July 1, 2023 and July 1, 2024 was capitalized as part of the principal balance, which increased the loans receivable and decreased interest receivable by $974 on the condensed consolidated balance sheets as of June 30, 2024. As of July 1, 2024, interest is accrued and to be paid in cash beginning on July 1, 2025.

Prior to July 1, 2022, interest accrued on the Mucci Promissory Note was capitalized as part of the principal balance. As of July 1, 2022, interest was accrued and to be paid in cash beginning on July 1, 2023. Prior to 2023, there were no repayments of principal or interest on the Mucci Promissory Note. For the three and six months ended June 30, 2023, Mucci made a payment of C$1,750 (approximately $1,322) under the Mucci Promissory Note, with C$1,187 ($897) related to accrued interest and C$563 ($425) related to outstanding principal. For the three and six months ended June 30, 2024, there were no repayments of principal or interest on the Mucci Promissory Note.

| | | | | |

| Cronos Group Inc. | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

| |

| (In thousands of U.S. dollars, except share amounts) | |

Cannasoul Collaboration Loan

As of both June 30, 2024 and December 31, 2023, Cannasoul Lab Services Ltd. has received ILS 8,297 (approximately $2,198 and $2,294, respectively), from the Cannasoul Collaboration Loan.

Expected credit loss allowances on the Company’s long-term financial assets for the six months ended June 30, 2024 and 2023 were comprised of the following items:

| | | | | | | | | | | | | | | | | | | | | | | |

| As of April 1, 2024 | | Increase(i) | | Foreign exchange effect | | As of June 30, 2024 |

| GrowCo Credit Facility | $ | 10,740 | | | $ | 1,207 | | | $ | (109) | | | $ | 11,838 | |

| | | | | | | |

| Mucci Promissory Note | 89 | | | 1 | | | — | | | 90 | |

| Cannasoul Collaboration Loan | 518 | | | 4 | | | (16) | | | 506 | |

| $ | 11,347 | | | $ | 1,212 | | | $ | (125) | | | $ | 12,434 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| As of January 1, 2024 | | Increase(i) | | Foreign exchange effect | | As of June 30, 2024 |

| GrowCo Credit Facility | $ | 11,176 | | | $ | 1,010 | | | $ | (348) | | | $ | 11,838 | |

| | | | | | | |

| Mucci Promissory Note | 89 | | | 3 | | | (2) | | | 90 | |

| Cannasoul Collaboration Loan | 524 | | | 8 | | | (26) | | | 506 | |

| $ | 11,789 | | | $ | 1,021 | | | $ | (376) | | | $ | 12,434 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| As of April 1, 2023 | | Increase (decrease) | | Foreign exchange effect | | As of June 30, 2023 |

| GrowCo Credit Facility | $ | 11,719 | | | $ | (379) | | | $ | 239 | | | $ | 11,579 | |

| | | | | | | |

| Mucci Promissory Note | 91 | | | (7) | | | 2 | | | 86 | |

| Cannasoul Collaboration Loan | 514 | | | 4 | | | (15) | | | 503 | |

| $ | 12,324 | | | $ | (382) | | | $ | 226 | | | $ | 12,168 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| As of January 1, 2023 | | Increase (decrease) | | Foreign exchange effect | | As of June 30, 2023 |

| GrowCo Credit Facility | $ | 12,455 | | | $ | (1,149) | | | $ | 273 | | | $ | 11,579 | |

| | | | | | | |

| Mucci Promissory Note | 89 | | | (5) | | | 2 | | | 86 | |

| Cannasoul Collaboration Loan | 522 | | | 8 | | | (27) | | | 503 | |

| $ | 13,066 | | | $ | (1,146) | | | $ | 248 | | | $ | 12,168 | |

(i)During the three and six months ended June 30, 2024, $1,212 and $1,021, respectively, were recorded as increases to general and administrative expenses on the condensed consolidated statements of net loss and comprehensive income (loss) primarily as a result of the increased loans under the GrowCo Credit Facility. During the three and six months ended June 30, 2023, $382 and $1,146, respectively, were recorded as decreases to general and administrative expenses on the condensed consolidated statements of net loss and comprehensive income (loss) as a result of adjustments to our expected credit losses.

| | | | | |

| Cronos Group Inc. | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

| |

| (In thousands of U.S. dollars, except share amounts) | |

6. Restructuring

In the first quarter of 2022, the Company initiated a strategic plan to realign the business around its brands, centralize functions and evaluate the Company’s supply chain (the “Realignment”). As part of the Realignment, on February 28, 2022, the Board approved plans to leverage the Company’s strategic partnerships to improve supply chain efficiencies and reduce manufacturing overhead by exiting its production facility in Stayner, Ontario, Canada (the “Peace Naturals Campus”). On February 27, 2023, the Board approved revisions to the Realignment, which were expected to result in the Company maintaining select components of its operations at the Peace Naturals Campus, namely distribution warehousing, certain research and development activities and manufacturing of certain of the Company’s products, while seeking to sell and lease back all or some of the Peace Naturals Campus or to lease certain portions of the Peace Naturals Campus to third parties. In the third quarter of 2023, the Board approved revisions to the Realignment to wind-down operations at its Winnipeg, Manitoba facility (“Cronos Fermentation”), list the Cronos Fermentation facility for sale, and implement additional organization-wide cost reductions as the Company continues its Realignment initiatives. The Realignment initiatives were intended to position the Company to drive profitable and sustainable growth over time.

On November 26, 2023, the Company entered into an agreement with Future Farmco Canada Inc. for the sale and leaseback of the Peace Naturals Campus. This agreement was subsequently terminated pursuant to its terms during the second quarter of 2024. The Company is continuing to evaluate its strategic options for the Peace Naturals Campus, which may include continuing and expanding operations at the facility.

During the first quarter of 2024, the Company ceased operations at Cronos Fermentation and performed an assessment under ASC 360 of the recoverability of the carrying value of the Cronos Fermentation assets, and determined the carrying value of the assets was not fully recoverable. The fair value was estimated using a combination of the market and income approaches. As a result of this analysis, an impairment loss on long-lived assets of $1,631 was recorded to the condensed consolidated statements of net loss and comprehensive loss in the six months ended June 30, 2024. As of June 30, 2024, the assets of Cronos Fermentation met the held-for-sale criteria and were classified to assets held for sale on the condensed consolidated balance sheet and the assets are valued at their fair value less costs to sell. A $445 loss for estimated costs to sell was recorded in the six months ended June 30, 2024 as a result of the classification of the Cronos Fermentation assets as held for sale.