false

0000314203

0000314203

2024-08-07

2024-08-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported): |

August 7, 2024 |

McEWEN MINING INC.

(Exact name of registrant as specified in

its charter)

| Colorado |

|

001-33190 |

|

84-0796160 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

150 King Street West, Suite 2800

Toronto,

Ontario, Canada

|

M5H 1J9 |

| (Address of principal executive offices) |

(Zip Code) |

| Registrant’s telephone number including area code: |

(866) 441-0690 |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

MUX |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

On August 7, 2024, McEwen Mining Inc. (the

“Company”) issued a press release summarizing its second quarter and half year results for the period ended June 30,

2024 and announcing the quarter-end conference call and webcast to discuss those results. A copy of that press release is furnished with

this report as Exhibit 99.1.

The information furnished under this Item 2.02,

including the referenced exhibit, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly

set forth by reference to such filing.

On August 8, 2024, the McEwen Copper, Inc. (“McEwen Copper”), which is 48.3% owned by the Company, issued a press release

providing an update on new legislation in Argentina supporting domestic and foreign investment in the country, and summarizing the infill

drilling results at the Los Azules copper project owned by McEwen Copper. A copy of that press release is filed with this report as Exhibit

99.2, and incorporated by reference herein.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

The following exhibits are furnished or filed with this report, as applicable:

Cautionary Statement

With the exception of historical matters, the matters

discussed in the press release include forward-looking statements within the meaning of applicable securities laws that involve risks

and uncertainties that could cause actual results to differ materially from projections or estimates contained therein. Such forward-looking

statements include, among others, statements regarding future production and cost estimates, exploration, development, construction and

production activities. Factors that could cause actual results to differ materially from projections or estimates include, among others,

future drilling results, metal prices, economic and market conditions, operating costs, receipt of permits, and receipt of working capital,

as well as other factors described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and

other filings with the United States Securities and Exchange Commission. Most of these factors are beyond the Company’s ability

to predict or control. The Company disclaims any obligation to update any forward-looking statement made in the press release, whether

as a result of new information, future events, or otherwise. Readers are cautioned not to put undue reliance on forward-looking statements.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

McEWEN MINING INC. |

| |

|

| Date: August 9, 2024 |

By: |

/s/ Carmen Diges |

| |

|

Carmen Diges, General Counsel |

Exhibit 99.1

McEWEN MINING: Q2 2024 RESULTS

TORONTO, Aug 7th, 2024

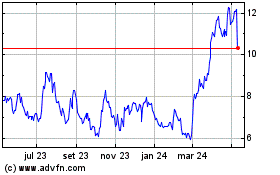

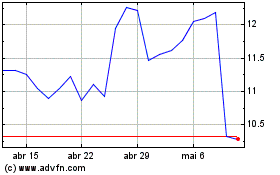

- McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) today reported its second quarter (Q2) and half year (H1) results for the period ended

June 30th, 2024.

“I’m delighted that

this quarter was the most profitable since 2016 as measured by Adjusted EBITDA(1) for our mining operations and Q3 is

off to a good start. Production costs increased 8% quarter-over-quarter, but revenue grew by 38%. Fox and Gold Bar are capitalizing on

the higher gold prices to increase operating cash flow, Gold Bar in particular with its AISC at only $1,400 per GEO in H1. It’s

important to note that our net loss continues to be influenced by McEwen Copper and its expenses at Los Azules, which are non-cash as

it relates to MUX,” commented Rob McEwen, Chairman and Chief Owner. “McEwen Copper continues to grow in value

- based on the most recent injection of capital at $30 per share the implied market value is now $947 million, with MUX owning 48.3% or

$457 million. That is 106% of MUX’s current fully diluted market capitalization. In addition, MUX shareowners also get exposure

to a 1.25% NSR royalty on Los Azules, our cashflow generating gold-silver mines, and development projects.”

Stronger Financial Results

Our gross profit in Q2 was $10.8

million and our Adjusted EBITDA(1) was $7.2 million, compared to a gross loss of $3.5 million and Adjusted

EBITDA of negative $5.8 million in Q2 2023. Higher revenues, driven by a 21% increase in realized gold prices and a 13% increase in GEOs

sold drove improvements in gross profit.

After equity accounting for $35.2 million

in net expenses incurred by McEwen Copper’s Los Azules project ($16.8 million impact on MUX) we reported a net loss in Q2 of $13.0

million, or $0.26 per share, compared to a net loss of $21.6 million, or $0.46 per share in Q2 2023.

In Q2, we invested $5.0 million

in exploration activities at the Grey Fox property and Gold Bar mine. We invested $6.7 million in capital expenditures largely

on the Stock Project where earthwork at the portal entrance is expected to be completed in the second half of 2024. An underground ramp

will be developed to access the Main, East and West zones of the Stock deposit.

Improved Liquidity and Capital

Resources

We reported consolidated cash and cash

equivalents of $40.7 million, debt of $40.0 million, and consolidated working capital of $29.1 million as at June 30,

2024. (December 31, 2023 – $23.0 million, $40.0 million and $22.7 million, respectively).

Steady Gold & Silver

Production

Production from our three operating

mines was 35,265 gold equivalent ounces (GEOs)(2) in Q2, compared to 35,658 GEOs in Q2 2023. Production guidance

remains 130,000-145,000 GEOs for 2024.

Through the efforts of our operating

teams, we have been steadily improving our production and cash flow while improving our prospects for the future with aggressive exploration

drilling.

Attracting and retaining our employees

is a constant priority for us as it is for many of our peers, contractors and suppliers.

Individual Mine Performance

(See Table 1):

| 1. | Gold Bar produced 12,297 GEOs during Q2, an increase of 56% compared to Q2

2023. Increased mine production from our higher-grade Pick pit facilitated higher production. During H1 2024, we produced 24,013

GEOs at Gold Bar and we are on track to potentially exceed annual production guidance of 40,000 to 43,000 GEOs. |

Cash costs and AISC per GEO sold in

Q2 were $1,532 and $1,634, respectively, compared to $2,113 and $2,585 in Q2 2023, respectively. The reduction in cash costs

and AISC per GEO sold was driven by higher GEOs sold, as noted above.

Gold Bar Mine ($ millions) | |

Q2 2024 | | |

Q2 2023 | | |

H1 2024 | | |

H1 2023 | |

| Revenue from gold sales | |

| 29.7 | | |

| 16.0 | | |

| 55.0 | | |

| 27.6 | |

| Cash costs | |

| 19.2 | | |

| 17.1 | | |

| 32.4 | | |

| 26.5 | |

| Gross margin | |

| 10.5 | | |

| (1.1 | ) | |

| 22.6 | | |

| 1.1 | |

| Gross margin % | |

| 35.4 | % | |

| - | | |

| 41.1 | % | |

| 4.0 | % |

| 2. | Fox has had a challenging first half of the year. At Froome we had a stope fail on the boundary

between the ore and the waste, which required us to move out of this area. We are presently formulating a more conservative mining plan

to ensure we can optimize future ore extraction. This event decreased stope availability and gold grade processed during the quarter. |

Froome is entering its final 18 months

of production, focusing on mining areas that are generally smaller in size because they are on the periphery of the ore body, and grades

that are generally lower than the main zones extracted over the last two years. We are preparing to meet these challenges as we transition

from Froome to Stock, where we anticipate beginning limited production by mid-2025. We have increased throughput at our processing plant

by approximately 40% over the last 18 months, growing from 900 tonnes per day (tpd) to over 1,300 tpd.

In Q2, Fox produced 8,297 GEOs,

a 20% decrease compared to Q2 2023. During H1 2024, we produced 15,800 GEOs at Fox. While we engaged a mining contractor at the

end of Q2 2024 to address development, we expect to be approximately 15-20% below our annual production guidance of 40,000-42,000 GEOs.

Cash costs and AISC per GEO sold were

$1,588 and $1,874 in Q2, respectively, compared to $1,237 and $1,371 in Q2 2023, respectively. The increase in unit costs

was driven by lower GEOs sold as described above.

Fox Complex ($ millions) | |

Q2 2024 | | |

Q2 2023 | | |

H1 2024 | | |

H1 2023 | |

| Revenue from gold sales | |

| 17.8 | | |

| 18.4 | | |

| 32.5 | | |

| 41.6 | |

| Cash costs | |

| 12.9 | | |

| 12.5 | | |

| 24.7 | | |

| 26.5 | |

| Gross margin | |

| 4.9 | | |

| 5.9 | | |

| 7.8 | | |

| 15.1 | |

| Gross margin % | |

| 27.5 | % | |

| 32.1 | % | |

| 24.0 | % | |

| 36.3 | % |

| 3. | San José produced 14,672 attributable GEOs during Q2, a 15% decrease compared to

Q2 2023. Production was impacted adversely by lower gold grades processed, slightly offset by higher gold recoveries. With 27,605

attributable GEOs produced in H1 2024, San José remains on track to meet annual production guidance of 50,000 to 60,000 attributable

GEOs(2). |

Cash costs and AISC per GEO sold were

$1,624 and $2,032 in Q2, respectively, compared to $1,362 and $1,811 in Q2 2023, respectively. The increase in cash costs

and AISC per GEO sold resulted from lower GEOs produced and sold as described above, and foreign exchange impacts of a stronger than expected

Argentine Peso.

San José Mine—100% basis ($ millions) | |

Q2 2024 | | |

Q2 2023 | | |

H1 2024 | | |

H1 2023 | |

| Revenue from gold and silver sales | |

| 74.3 | | |

| 67.7 | | |

| 140.3 | | |

| 113.5 | |

| Cash costs | |

| 48.2 | | |

| 46.9 | | |

| 96.1 | | |

| 88.1 | |

| Gross margin | |

| 26.1 | | |

| 20.8 | | |

| 44.2 | | |

| 25.4 | |

| Gross margin % | |

| 35.1 | % | |

| 30.7 | % | |

| 31.5 | % | |

| 22.4 | % |

Exploration

Exploration results from flow-through

funded drilling at the Fox Complex were published in separate press releases on May 27th and June 20th.

Infill and exploration results from

Los Azules were published on May 16th. Drilling to support the upcoming Feasibility Study by the end of Q1 2025

is complete and work on the study is progressing as planned.

Timberline Acquisition

On April 16th, 2024,

we announced the friendly acquisition of Timberline Resources Corporation for all-share consideration. Timberline’s special meeting

to approve the merger will be held on August 16th, 2024.

Benefits to Timberline shareholders

include: 1) significant premium, 2) ownership in a growing gold-silver-copper producer focused in the Americas, and 3) participation in

the potential acceleration of the development of the Eureka project.

Benefits to MUX shareholders include:

1) acquisition of a gold deposit that is near-term development opportunity complimentary to Gold Bar, 2) addition of a large prospective

package of exploration properties, and 3) consolidation of additional land around the Elder Creek property (owned by McEwen Copper).

Any Timberline shareholders who

have not yet voted their proxy are encouraged to vote FOR the merger.

Advancing McEwen Copper

We own a 48.3% interest in McEwen Copper

Inc., which holds a 100% interest in the Los Azules copper project in San Juan, Argentina, and the Elder Creek exploration project in

Nevada, USA. The recent financing by McEwen Copper gave the company a market value of $947.1 million, which means the value of McEwen

Mining shareholding has increased to $457.5 million or $8.45 per fully diluted share. McEwen Mining has three classes of assets, its gold

and silver mines, its portfolio of six gold, silver and copper royalties and its 48.3% interest in McEwen Copper. Based on the recent

financing of McEwen Copper, the implied value of MUX’s ownership in McEwen Copper is approximately 106% of MUX’s current fully

diluted market capitalization as at August 7th, 2024.

On July 12, 2024, McEwen Mining

and Rob McEwen invested $14 million and $5 million, respectively, as part of the previously announced $70 million McEwen Copper financing

at $30 per share (see the June 24, 2024 news release). The balance of the financing is expected to close in Q3 or early Q4 2024.

Milei’s Magic Turbocharging

Argentina

The Argentina National Government led

by President Milei has recently passed important new legislation designed to support and encourage direct foreign investments in large

infrastructure projects including projects like Los Azules. The aim is to create conditions of predictability and legal certainty for

large investments, and to create special tax incentives for qualifying strategic sectors.

On July 29th, 2024,

it was announced that BHP and Lundin Mining would jointly acquire Filo Corp for approximately $3.1 billion; and form a 50/50 joint venture

to develop both the Filo del Sol and Josemaria projects located in the north of San Juan, Argentina. This significant development is an

endorsement by the world’s largest mining company of investing in major copper projects in Argentina.

Management Conference Call

Management will discuss our Q2 financial

results and project developments and follow with a question-and-answer session. Questions can be asked directly by participants over the

phone during the webcast.

|

Thursday

Aug 8th, 2024

at 11:00 AM EDT |

Toll Free Dial-In (US & Canada): |

(888) 210-3454 |

| Toll Free Dial-In (Other Countries): |

https://events.q4irportal.com/custom/access/2324/ |

| Toll Dial-In: |

(646) 960-0130 |

| Conference ID Number: |

3232920 |

| Event Registration Link: |

https://events.q4inc.com/attendee/655979798/guest |

An archived replay of the webcast

will be available approximately 2 hours following the conclusion of the live event. Access the replay on the Company’s media page at

https://www.mcewenmining.com/media.

Table 1 below provides production

and cost results for Q2 and H1, with comparative results from Q2 and H1 2023 and our guidance range for 2024.

| | |

Q2 | | |

H1 | | |

Full Year 2024 | |

| | |

2023 | | |

2024 | | |

2023 | | |

2024 | | |

Guidance Range | |

| Consolidated Production | |

| | | |

| | | |

| | | |

| | | |

| | |

| GEOs(2) | |

| 35,658 | | |

| 35,265 | | |

| 66,022 | | |

| 68,320 | | |

| 130,000-145,000 | |

| Gold Bar Mine, Nevada | |

| | | |

| | | |

| | | |

| | | |

| | |

| GEOs | |

| 7,916 | | |

| 12,297 | | |

| 14,372 | | |

| 24,013 | | |

| 40,000-43,000 | |

| Cash Costs/GEO | |

| 2,113 | | |

| 1,532 | | |

| 1,842 | | |

| 1,313 | | |

| $1,450-1,550 | |

| AISC/GEO | |

| 2,585 | | |

| 1,634 | | |

| 2,190 | | |

| 1,404 | | |

| $1,650-1,750 | |

| Fox Complex, Canada | |

| | | |

| | | |

| | | |

| | | |

| | |

| GEOs | |

| 10,351 | | |

| 8,297 | | |

| 23,051 | | |

| 15,800 | | |

| 40,000-42,000 | |

| Cash Costs/GEO | |

| 1,237 | | |

| 1,588 | | |

| 1,153 | | |

| 1,572 | | |

| $1,225-1,325 | |

| AISC/GEO | |

| 1,371 | | |

| 1,874 | | |

| 1,337 | | |

| 1,886 | | |

| $1,450-1,550 | |

| San José Mine, Argentina (49%)(3) | |

| | | |

| | | |

| | | |

| | | |

| | |

| GEOs | |

| 17,358 | | |

| 14,672 | | |

| 28,599 | | |

| 27,605 | | |

| 50,000-60,000 | |

| Cash Costs/GEO | |

$ | 1,362 | | |

| 1,624 | | |

$ | 1,537 | | |

| 1,615 | | |

| $1,300-1,500 | |

| AISC/GEO | |

$ | 1,811 | | |

| 2,032 | | |

$ | 1,980 | | |

| 1,978 | | |

| $1,500-1,700 | |

| 1. | Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA), cash costs per ounce,

and all-in sustaining costs (AISC) per ounce are non-GAAP financial performance measures with no standardized definition under U.S. GAAP.

For definition of the non-GAAP measures see "Non-GAAP- Financial Measures" section in this press release; for

the reconciliation of the non-GAAP measures to the closest U.S. GAAP measures, see the Management Discussion and Analysis for the quarter

ended June 30, 2024, filed on EDGAR and SEDAR Plus. |

| 2. | 'Gold Equivalent Ounces' are calculated based on a gold to silver

price ratio of 81:1 for Q2 2024 and 83:1 for Q2 2023. 2024 production guidance is calculated based on 85:1

gold to silver price ratio. |

| 3. | Represents the portion attributable to us from our 49% interest in the San José Mine. |

Technical Information

The technical content of this news release related

to financial results, mining and development projects has been reviewed and approved by William (Bill) Shaver, P.Eng., COO of McEwen Mining

and a Qualified Person as defined by SEC S-K 1300 and the Canadian Securities Administrators National Instrument 43-101 "Standards

of Disclosure for Mineral Projects."

Reliability of Information Regarding San José

Minera Santa Cruz S.A., the owner of the San José

Mine, is responsible for and has supplied to the Company all reported results from the San José Mine. McEwen Mining’s joint

venture partner, a subsidiary of Hochschild Mining plc, and its affiliates other than MSC do not accept responsibility for the use of

project data or the adequacy or accuracy of this release.

CAUTIONARY NOTE REGARDING NON-GAAP MEASURES

In this release, we have

provided information prepared or calculated according to United States Generally Accepted Accounting Principles (“U.S. GAAP”),

as well as provided some non-U.S. GAAP ("non-GAAP") performance measures. Because the non-GAAP performance measures do not have

any standardized meaning prescribed by U.S. GAAP, they may not be comparable to similar measures presented by other companies.

Cash Costs and All-in

Sustaining Costs

Cash costs consist of

mining, processing, on-site general and administrative costs, community and permitting costs related to current operations, royalty costs,

refining and treatment charges (for both doré and concentrate products), sales costs, export taxes and operational stripping costs,

and exclude depreciation and amortization. All-in sustaining costs consist of cash costs (as described above), plus accretion of retirement

obligations and amortization of the asset retirement costs related to operating sites, sustaining exploration and development costs, sustaining

capital expenditures, and sustaining lease payments. Both cash costs and all-in sustaining costs are divided by the gold equivalent ounces

sold to determine cash costs and all-in sustaining costs on a per ounce basis. We use and report these measures to provide additional

information regarding operational efficiencies on an individual mine basis, and believe that these measures provide investors and analysts

with useful information about our underlying costs of operations. A reconciliation to production costs applicable to sales, the nearest

U.S. GAAP measure is provided in McEwen Mining's Annual Report on Form 10-K for the year ended December 31, 2023.

| | |

Three months ended June 30, 2024 | | |

Six months ended June 30, 2024 | |

| | |

Gold Bar | | |

Fox Complex | | |

Total | | |

Gold Bar | | |

Fox Complex | | |

Total | |

| | |

(in thousands, except per ounce) | | |

(in thousands, except per ounce) | |

| Production costs applicable to sales (100% owned) | |

$ | 19,170 | | |

$ | 12,896 | | |

$ | 32,066 | | |

$ | 32,437 | | |

$ | 24,739 | | |

$ | 57,176 | |

| Mine site reclamation, accretion and amortization | |

| 307 | | |

| 134 | | |

| 442 | | |

| 615 | | |

| 271 | | |

| 885 | |

| In-mine exploration | |

| 507 | | |

| — | | |

| 507 | | |

| 587 | | |

| — | | |

| 587 | |

| Capitalized underground mine development (sustaining) | |

| — | | |

| 2,102 | | |

| 2,102 | | |

| — | | |

| 4,405 | | |

| 4,405 | |

| Capital expenditures on plant and equipment (sustaining) | |

| 428 | | |

| — | | |

| 428 | | |

| 979 | | |

| — | | |

| 979 | |

| Sustaining leases | |

| 32 | | |

| 81 | | |

| 113 | | |

| 53 | | |

| 266 | | |

| 320 | |

| All-in sustaining costs | |

$ | 20,444 | | |

$ | 15,213 | | |

$ | 35,658 | | |

$ | 34,671 | | |

$ | 29,681 | | |

$ | 64,352 | |

| Ounces sold, including stream (GEO) | |

| 12.5 | | |

| 8.1 | | |

| 20.6 | | |

| 24.7 | | |

| 15.7 | | |

| 40.4 | |

| Cash cost per ounce sold ($/GEO) | |

$ | 1,532 | | |

$ | 1,588 | | |

$ | 1,554 | | |

$ | 1,313 | | |

$ | 1,572 | | |

$ | 1,414 | |

| AISC per ounce sold ($/GEO) | |

$ | 1,634 | | |

$ | 1,874 | | |

$ | 1,728 | | |

$ | 1,404 | | |

$ | 1,886 | | |

$ | 1,592 | |

| | |

Three months ended June 30, 2023 | | |

Six months ended June 30, 2023 | |

| | |

Gold Bar | | |

Fox Complex | | |

Total | | |

Gold Bar | | |

Fox Complex | | |

Total | |

| | |

(in thousands, except per ounce) | | |

(in thousands, except per ounce) | |

| Production costs applicable to sales - Cash costs (100% owned) | |

$ | 17,115 | | |

$ | 12,455 | | |

$ | 29,570 | | |

$ | 26,455 | | |

$ | 26,528 | | |

$ | 52,983 | |

| In-mine exploration | |

| 1,115 | | |

| — | | |

| 1,115 | | |

| 1,597 | | |

| — | | |

| 1,597 | |

| Capitalized underground mine development (sustaining) | |

| — | | |

| 1,177 | | |

| 1,177 | | |

| — | | |

| 3,831 | | |

| 3,831 | |

| Capital expenditures on plant and equipment (sustaining) | |

| 2,484 | | |

| — | | |

| 2,484 | | |

| 3,177 | | |

| — | | |

| 3,177 | |

| Sustaining leases | |

| 221 | | |

| 176 | | |

| 397 | | |

| 229 | | |

| 399 | | |

| 628 | |

| All-in sustaining costs | |

$ | 20,935 | | |

$ | 13,808 | | |

$ | 34,743 | | |

$ | 31,458 | | |

$ | 30,758 | | |

$ | 62,216 | |

| Ounces sold, including stream (GEO) | |

| 8.1 | | |

| 10.1 | | |

| 18.2 | | |

| 14.4 | | |

| 23.0 | | |

| 37.4 | |

| Cash cost per ounce sold ($/GEO) | |

$ | 2,113 | | |

$ | 1,237 | | |

$ | 1,627 | | |

$ | 1,842 | | |

$ | 1,153 | | |

$ | 1,418 | |

| AISC per ounce sold ($/GEO) | |

$ | 2,585 | | |

$ | 1,371 | | |

$ | 1,912 | | |

$ | 2,190 | | |

$ | 1,337 | | |

$ | 1,665 | |

| | |

Three months ended June 30, | | |

Six months ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| San José mine cash costs (100% basis) | |

(in thousands, except per ounce) | |

| Production costs applicable to sales - Cash costs | |

$ | 48,220 | | |

$ | 46,931 | | |

$ | 96,105 | | |

$ | 88,055 | |

| Mine site reclamation, accretion and amortization | |

| 361 | | |

| 95 | | |

| 665 | | |

| 386 | |

| Site exploration expenses | |

| 1,890 | | |

| 2,846 | | |

| 3,321 | | |

| 4,798 | |

| Capitalized underground mine development (sustaining) | |

| 7,049 | | |

| 8,919 | | |

| 14,380 | | |

| 16,049 | |

| Less: Depreciation | |

| (621 | ) | |

| (703 | ) | |

| (1,420 | ) | |

| (1,253 | ) |

| Capital expenditures (sustaining) | |

| 3,443 | | |

| 4,312 | | |

| 4,643 | | |

| 5,401 | |

| All-in sustaining costs | |

$ | 60,342 | | |

$ | 62,400 | | |

$ | 117,694 | | |

$ | 113,436 | |

| Ounces sold (GEO) | |

| 29.7 | | |

| 34.4 | | |

| 59.5 | | |

| 57.3 | |

| Cash cost per ounce sold ($/GEO) | |

$ | 1,624 | | |

$ | 1,362 | | |

$ | 1,615 | | |

$ | 1,537 | |

| AISC per ounce sold ($/GEO) | |

$ | 2,032 | | |

$ | 1,811 | | |

$ | 1,978 | | |

$ | 1,980 | |

Adjusted EBITDA and adjusted EBITDA per share

Adjusted earnings before interest, taxes, depreciation,

and amortization (“Adjusted EBITDA”) is a non-GAAP financial measure and does not have any standardized meaning. We use adjusted

EBITDA to evaluate our operating performance and ability to generate cash flow from our wholly owned operations in production; we disclose

this metric as we believe this measure provides valuable assistance to investors and analysts in evaluating our ability to finance our

precious metal operations and capital activities separately from our copper exploration operations. The most directly comparable measure

prepared in accordance with GAAP is net loss before income and mining taxes. Adjusted EBITDA is calculated by adding back McEwen Copper's

income or loss impacts on our consolidated income or loss before income and mining taxes.

| | |

Three months ended June 30, | | |

Six months ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Adjusted EBITDA | |

(in thousands) | | |

(in thousands) | |

| Net loss before income and mining taxes | |

$ | (15,371 | ) | |

$ | (45,310 | ) | |

$ | (38,311 | ) | |

$ | (82,256 | ) |

| Less: | |

| | | |

| | | |

| | | |

| | |

| Depreciation and depletion | |

| 4,810 | | |

| 8,602 | | |

| 15,088 | | |

| 15,780 | |

| Loss from investment in McEwen Copper Inc. (Note 9) | |

| 16,816 | | |

| — | | |

| 34,828 | | |

| — | |

| Advanced Projects – McEwen Copper Inc. | |

| — | | |

| 28,524 | | |

| — | | |

| 60,405 | |

| General, interest and other – McEwen Copper Inc. | |

| — | | |

| 661 | | |

| — | | |

| (5,211 | ) |

| Interest expense | |

| 972 | | |

| 1,678 | | |

| 1,945 | | |

| 3,025 | |

| Adjusted EBITDA | |

$ | 7,227 | | |

$ | (5,845 | ) | |

$ | (48,583 | ) | |

$ | (17,455 | ) |

| Weighted average shares outstanding (thousands) | |

| 49,718 | | |

| 47,428 | | |

| 49,580 | | |

| 47,428 | |

| Adjusted EBITDA per share | |

$ | 0.15 | | |

$ | (0.12 | ) | |

$ | (0.98 | ) | |

$ | (0.37 | ) |

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking

statements and information, including "forward-looking statements" within the meaning of the Private Securities Litigation Reform

Act of 1995. The forward-looking statements and information expressed, as at the date of this news release, McEwen Mining Inc.'s (the

"Company") estimates, forecasts, projections, expectations or beliefs as to future events and results. Forward-looking statements

and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are

inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no assurance

that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from

those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ materially

from current expectations expressed or implied by the forward-looking statements and information include, but are not limited to, fluctuations

in the market price of precious metals, mining industry risks, political, economic, social and security risks associated with foreign

operations, the ability of the Company to receive or receive in a timely manner permits or other approvals required in connection with

operations, risks associated with the construction of mining operations and commencement of production and the projected costs thereof,

risks related to litigation, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of mineral

resources and reserves, foreign exchange volatility, foreign exchange controls, foreign currency risk, and other risks. Readers should

not place undue reliance on forward-looking statements or information included herein, which speak only as of the date hereof. The Company

undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after

the date hereof except as may be required by law. See McEwen Mining's Annual Report on Form 10-K for the fiscal year ended December 31,

2023, Quarterly Report on Form 10-Q for the three months ended March 31, 2024 and June 30, 2024, and other filings with

the Securities and Exchange Commission, under the caption "Risk Factors", for additional information on risks, uncertainties

and other factors relating to the forward-looking statements and information regarding the Company. All forward-looking statements and

information made in this news release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not

accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by the management of

McEwen Mining Inc.

ABOUT MCEWEN MINING

McEwen Mining

is a gold and silver producer with operations in Nevada, Canada, Mexico and Argentina. In addition, it owns approximately 48% of McEwen

Copper which owns the large, advanced stage Los Azules copper project in Argentina. The Company’s objective is to improve the productivity

and life of its assets with the goal of increasing its share price and providing an investor yield. Rob McEwen, Chairman and Chief Owner,

has a personal investment in the company of US$220 million. His annual salary is US$1.

Want News Fast?

Subscribe to our email list by clicking here:

https://www.mcewenmining.com/contact-us/#section=followUs

and receive news as it happens!

| |

|

|

|

|

|

|

| |

WEB SITE |

|

SOCIAL MEDIA |

|

|

|

| |

www.mcewenmining.com

|

|

McEwen

Mining |

Facebook: |

facebook.com/mcewenmining |

|

| |

|

|

LinkedIn: |

linkedin.com/company/mcewen-mining-inc-

|

|

| |

CONTACT INFORMATION |

|

Twitter: |

twitter.com/mcewenmining |

|

| |

150

King Street West |

|

Instagram:

|

instagram.com/mcewenmining |

|

| |

Suite 2800,

PO Box 24 |

|

|

|

|

|

| |

Toronto,

ON, Canada |

|

McEwen

Copper |

Facebook: |

facebook.com/

mcewencopper |

|

| |

M5H

1J9 |

|

LinkedIn: |

linkedin.com/company/mcewencopper |

|

| |

|

|

Twitter: |

twitter.com/mcewencopper |

|

| |

Relationship

with Investors: |

|

Instagram:

|

instagram.com/mcewencopper |

|

| |

(866)-441-0690

- Toll free line |

|

|

|

|

|

| |

(647)-258-0395

|

|

Rob

McEwen |

Facebook: |

facebook.com/mcewenrob |

|

| |

Mihaela

Iancu ext. 320 |

|

LinkedIn: |

linkedin.com/in/robert-mcewen-646ab24 |

|

| |

info@mcewenmining.com

|

|

Twitter:

|

twitter.com/robmcewenmux

|

|

| |

|

|

|

|

|

|

Exhibit 99.2

McEwen Copper Update,

Excitement in Argentina:

Milei Magic Is Turbocharging

Foreign Investments

US$4.4 Billion Copper

Transaction by BHP and Lundin Mining

Los Azules Infill Drilling

Confirmed High Grade Copper Zone

Infill Drill Highlights:

AZ24375:

217 meters of 1.11 % Cu, incl. 100 meters of 1.32 % Cu

AZ24335:

158 meters of 0.84 % Cu, incl. 78.5 meters of 1.10 % Cu

AZ24403:

276 meters of 0.86 % Cu, incl. 160 meters of 0.96 % Cu

AZ24320:

146 meters of 0.89 % Cu

AZ24332:

119.6 meters of 0.72 % Cu

TORONTO, August 8, 2024 (GLOBE NEWSWIRE)

- McEwen Copper Inc., 48.3% owned by McEwen Mining Inc. (NYSE: MUX) (TSX: MUX), is pleased to comment on the

excitement in Argentina that includes:

| · | Remarkable

new legislation introduced by President Milei to encourage large domestic and foreign investments

in the country; |

| · | A

US$4.4 Billion transaction led by BHP, the world’s largest mining company, and Lundin

Mining to acquire two copper deposits located in the same province in Argentina as Los Azules; |

| · | At

Los Azules, infill drilling during the 2023-24 season upgraded the resource categories, validated

the geological model and confirmed the high-grade zone. Resource drilling for the Los Azules

Feasibility Study is now complete, and the study remains on track for delivery in early 2025. |

Remarkable and Welcoming Legislation –

Milei Magic

President Milei’s government introduced

legislation that has rolled out the welcome mat for large-scale domestic and foreign direct investments in Argentina.

This legislation

recently approved by Argentina’s government is called "Bases and Starting Points for the Freedom of Argentines" and includes

the Incentive Regime for Large Investors (RIGI), offering significant tax and foreign exchange incentives to encourage

domestic and direct foreign investment in key sectors of the economy, including mining.

This program addresses most of all past stumbling

blocks for sustained development of the mining sector in Argentina, and it's a huge step in the right direction.

We are excited

about these changes as they open the door for many infrastructure investments in Argentina and significantly improve the economics of

the Los Azules project and lower risks for investors. Details of the legislation are found in Appendix A - More Information on RIGI

and you can click here for the official summary.

US$4.4 Billion Copper Transaction

Last week, BHP, the world’s largest mining

company, and Lundin Mining announced a US$4.4 Billion transaction through which they have agreed to jointly acquire the two copper deposits

Filo del Sol and Josemaria located in the same San Juan province of Argentina as Los Azules.

We believe that

this transaction is a convincing demonstration of San Juan and Argentina´s attractiveness for large-scale mining projects and evidence

of Argentina moving towards becoming a Tier 1 mining jurisdiction. Click on these links to read details of the transaction, in press

releases by BHP, Lundin

Mining, and Filo Corp.

Los Azules Infill Drilling Highlights Confirming

High Grade Copper Zone

At Los Azules,

infill drilling upgraded the resource categories, validated the geological model and confirmed the high-grade zone. During the

2023-24 drilling season over 70,000 meters (m) were completed, that have strengthened the interpretation of the geological model

in addition to extending the supergene enrichment zone mineralization, both at the edges and to depth.

Resource drilling for the Los Azules Feasibility

Study is now complete, and the study remains on track for delivery in early 2025.

Drilling Highlights

| · | Hole

AZ24375, drilled to a depth of 369 m, returned 217 m of 1.11 % Cu in

the enriched zone, including 100 m of 1.32 % Cu. |

| · | Hole

AZ24335, drilled to a depth of 227.5 m, returned a 158 m intercept of 0.84%

Cu within the enriched zone, including 78.5 m of 1.10 % Cu. |

| · | Hole

AZ24403, drilled to a depth of 427 m, returned a 276 m intercept of 0.86%

Cu within the enriched zone, including 160 m of 0.96 % Cu. |

| · | Hole

AZ24320, drilled to a depth of 204 m, returned 146 m of 0.89% Cu in

the enriched zone. |

| · | Hole

AZ24332, drilled to a depth of 255.6 m, returned 119.6 m of 0.72% Cu

in the enriched zone. |

The 2023-2024 drill campaign successfully achieved

its objective of infilling existing drill hole data to support the conversion of resources to Measured or Indicated Mineral Resources

to include in the Los Azules Feasibility Study. In addition, geotechnical, metallurgical, hydrogeological and condemnation drilling was

carried out.

The locations of the highlighted results are

presented in 8 figures. A plan or aerial view of the resources and the outline of the PEA pit are shown in Figure 1. Figures

2 to 7 show recent drilling in relation to the overburden, the leached, enriched and primary zones, and the 30-year pit shell

of the 2023 Preliminary Economic Assessment (PEA) (marked by the green line in the sections). Figure 8 represents a cross section

with recent drill data and inferred geology.

Drill results and location information for this

press release are available in Appendix B - Detailed Data From the 2023-2024 Drilling Campaign at Los Azules.

Figure 1 shows

a plan view of the location of the sections and drill holes reported in this press release. All cross sections are 50 m equidistant from

each other, with the lowest numbered section starting from the southern end of the deposit. Shown in blue are the collars of the drill

holes included in this news release.

Figure 1 – Plan

View Location of Cross-sections and Drill Holes Reported in This News Release

The section marked

on Figure 1 by the red dashed line is presented in Figure 2 as the longitudinal view looking northeast and indicating the

location of the reported holes. Note the position of the highlighted holes within the zone of enriched (or supergene) mineralization

and how they mostly ended in mineralized material, indicating the potential for mineralization to continue at depth. The length

of the enriched zone on this section is 3.9 kilometers. The enriched zone now continues beyond the southern limit of the PEA mineable

pit shell.

Figure

2 - Longitudinal Section (Looking Northeast)

Figure 3 shows

a 217 m intercept of 1.11 % Cu (AZ24375) and includes a 100 m interval of 1.32% Cu within the

enriched zone. This hole infills a data gap within the center of the deposit and confirms the continuity of higher-grade mineralization.

Figure 3 - Section 45 - Drilling,

Mineralized Zones and 30-Year PEA Pitshell (Looking Northwest)

Figure 4 shows

an intercept of 276 m of 0.86 % Cu (AZ24403) that includes 160 m of 0.96% Cu in the enriched

zone. This hole also infills a drilling gap in the center of the deposit with higher grade mineralization.

Figure 4

- Section 43 - Drilling, Mineralized Zones and 30-Year PEA Pitshell (Looking Northwest)

Figure 5 shows

a 146 m intercept of 0.89 % Cu (AZ24320). The drill hole extends high grade mineralization to the west of a previously

drilled hole (AZ22152MET).

Figure 5 -

Section 32 - Drilling, Mineralized Zones and 30-Year PEA Pitshell (Looking Northwest)

Figure 6 shows

an intercept of 158 m of 0.84 % Cu (AZ24335) that includes 78.5 m of 1.10% Cu within the enriched

zone. The drill hole ended in mineralized material, indicating the potential for mineralization to continue at depth within the enriched

zone, as indicated by previously released drill holes.

Figure 6 - Section 31

- Drilling, Mineralized Zones and 30-Year PEA Pitshell (Looking Northwest)

Figure 7 shows

a 119.6 m intercept of 0.72 % Cu (AZ24332) in the enriched zone. This hole extends the higher-grade mineralization

seen previously in AZ23309 in the central portion of the enriched zone towards the east and at depth.

Figure 7 - Section 28 - Drilling,

Mineralized Zones and 30-Year PEA Pitshell (Looking Northwest)

Geological Model - Interpretation and Its

Relationship with the Copper Mineralization

Geological understanding

of the Los Azules deposit has increased significantly with the drilling performed from 2022 to 2024. A series of copper-bearing

early and inter-mineral porphyry dikes and hydrothermal magmatic breccias are cutting across a pre-mineral diorite intrusive. The dikes

dip steeply to the east in their northwest-southeast orientations.

All rock types contain variable copper mineralization,

depending on their position within the deposit’s vertical profile. From top to bottom, the zoning includes leached, supergene (enriched)

and primary (hypogene), which are characteristic of many porphyry copper deposits worldwide.

Hypogene mineralization,

associated with the early mineral porphyry and proximal host rock, is characterized by a stockwork of abundant type A veinlets containing

quartz, pyrite, and chalcopyrite. In much of the deposit’s footprint, mineralization encountered at depth strongly indicates

the potential to extend further, beyond 1,000 meters.

The supergene copper enrichment process created

higher grades in the early mineral porphyry and associated hydrothermal magmatic breccias, and lower grades in the less permeable pre-mineral

pluton and inter-mineral porphyries. The supergene mineralization will be the principal mineral feed for the leach pad for the Feasibility

Study.

In Figure 8

Section 29 shows, in its central part, the early mineral porphyry (purple color) intruding or cutting the pre-mineral

diorite (light green color). To a lesser extent, thin inter-mineral porphyry dikes (light blue color), affect both the

early mineral porphyry and the pre-mineral diorite. The early mineral porphyry is the primary source of copper mineralization in the

deposit.

Figure 8

- Recent Drill Data and Inferred Geology in Cross Section 29

Technical Information

The technical content of this press release has

been reviewed and approved by Darren King, Director of Exploration of McEwen Copper, who serves as the qualified person (QP) under the

definitions of National Instrument 43-101.

All tasks, including the collection of samples

for geochemical analysis, were carried out in accordance with generally accepted mining industry standards. Drill core samples were analyzed

by Alex Stewart International laboratory, located in the Province of Mendoza, Argentina, whose assays consisted of: gold analysis by

fire fusion assay and an atomic absorption spectroscopy finish (Au4-30); multiple element studies by ICP-OES analysis (ICP-AR 39); determination

of copper content by sequential copper analysis (Cu-Sequential LMC-140). In addition, and for samples with high sulfide content (Cu,

Ag, Pb and Zn) and exceeding the limits of analysis, an ICP-ORE type analysis was performed.

The company is conducting a quality control/assurance

program In accordance with NI 43-101, and industry best practices, using a combination of standards and blanks on approximately one out

of every 25 samples. Results are monitored as final certificates are received and any re-assay requests are sent immediately. Analysis

of pulp and preparation samples is also performed as part of the quality control process. Approximately 5% of the sample pulps are sent

to a secondary laboratory for control purposes. In addition, the laboratory performs its own internal quality control checks, and the

results are made available on certificates for company review.

ABOUT MCEWEN COPPER

McEwen Copper is a well-funded, private company

that owns 100% of the large, advanced-stage Los Azules copper project, located in the San Juan province, Argentina. McEwen Copper is

a 48.3%-owned private subsidiary of McEwen Mining, which trades under the ticker MUX on NYSE and TSX.

Los Azules is being

designed to be distinctly different from a conventional copper mine by consuming significantly less water, emitting much lower carbon,

progressing towards carbon neutral by 2038, and being powered by 100% renewable electricity once in operation. The updated Preliminary

Economic Assessment (PEA) released in June 2023 projects a long life of mine, short payback period, low production cost per pound,

high annual copper production, and a 21.2% after-tax IRR.

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with

operations in Nevada, Canada, Mexico, and Argentina. McEwen Mining also owns a 48.3% interest in McEwen Copper, which is developing the

large, advanced-stage Los Azules copper project in Argentina. The Company’s objective is to improve the productivity and life of

its assets with the goal of increasing the share price and providing investor yield. Rob McEwen, Chairman and Chief Owner, has a personal

investment in the companies of US$225 million. His annual salary is US$1.

Appendix A

- More Information on RIGI -

The RIGI grants a series of benefits in tax,

customs and foreign exchange regulations for investment projects in the mining sector that comply with the requirements set up by the

law.

The main requirements for beneficiaries of RIGI

are as follows:

| · | The

amount for an investment to qualify within the regime will be >US$200 million, as determined

for different industries by the regulations. |

| · | Export

projects with investments greater than US$1 billion are considered strategic and have additional

benefits. |

| · | At

least 40% of the minimum amount must be invested in the first two years. |

| · | The

regime will be open to applications for 2 years. The application period can be extended for

1 more year. The investment can be completed after the application period. |

| · | The

use of incentives may require collateral. |

The Los Azules project is believed to be able

to meet all criteria to be considered a strategic project under the terms of the RIGI legislation.

The main benefits to the beneficiaries of the RIGI are the following:

| · | Corporate

income tax rate is reduced from the current 35% to 25%. |

| · | Equipment

is subject to accelerated depreciation in 2 years, and infrastructure and cost of mine in

60% of its useful life. |

| · | Net

Operating Losses (NOLs) can be carried forward without a time limit. After a 5-year carry

forward, NOLs can be transferred (sold) to third parties. NOLs are adjusted for inflation. |

| · | Interest

is deductible without limitations during the first 5 years even when the lender is foreign

related party. |

| · | Dividend

payments are subject to tax at 7%, which will be reduced to 3.5% after 7 years. |

| · | In

the case of Strategic Export projects, payments to foreign beneficiaries for technical assistance

are not subject to withholding tax. Other payments to foreign beneficiaries are capped at

10.5% withholding with no grossing up. |

| · | Rather

than paying VAT on purchases, the beneficiaries of the RIGI will provide its suppliers with

Tax Credit Certificates. The Tax Credit Certificates can also be used to pay the VAT generated

by imports of equipment. This prevents from tying up funds as VAT credits to be recovered

against future exports. Implementation of this benefit will require extensive regulation. |

| · | Suppliers

may use the certificates to offset their VAT obligations and, if there is a VAT credit left

to recover, they may transfer (sell) the VAT credit to third parties. |

| · | The

beneficiaries of the regimen will have a 100% tax credit for the amounts paid for Bank Transactions

Tax to offset the income tax obligations. |

| · | Provinces

and Municipalities cannot establish new taxes affecting the projects, except for service

fees that do not exceed the cost of the service provided to the beneficiary. |

| · | Freedom

to import without quotas or restrictions. |

| · | Exemption

from import duties on capital goods, spare parts, parts, components and consumables. |

| · | Freedom

to export the products produced by the project. |

| · | Exemption

from export duties after three years of registration. The exemption applies for two years

in Strategic Export projects. |

| · | Maximum

Principal gross revenue royalty of 5% (at the discretion of the Province). |

| 6. | Foreign Exchange Regime |

| · | Foreign

proceeds from exports are freely available: 20% of proceeds after two years of the commencement

of production; 40% after three years, and 100% after four years onwards. |

| · | In

the case of a Strategic Export project, the foreign proceeds are freely available as follows:

20% of proceeds after one year of the commencement of production; 40% after two years, and

100% after three years onwards. |

| · | Foreign

proceeds from external financing are freely available. Foreign assets abroad do not generate

foreign exchange restrictions. |

| · | Free

access to the foreign exchange market for the repayment of loans, repatriation of investments,

payment of interests and dividends, conditional on the investment or loan having been entered

through the exchange market. |

Beneficiaries are also granted tax,

customs and foreign exchange stability for 30 years from joining the RIGI. In the case of Strategic Export projects developed in stages,

stability can be extended up to 40 years from the commencement of production of the first stage.

The safeguards offered by the stability

have these main features:

| · | Tax

stability applies by tax and not by total tax burden. It also applies to withholding taxes

on payments to foreign beneficiaries. In the event of an increase in taxes, the beneficiaries

of the regimen may reject the payment of the tax exceeding stability or pay the tax and use

the amount of the tax paid as a tax credit against any other national tax. A breach of stability

is presumed (it is not necessary to prove it) if it comes from a legal or regulatory change.

In the case of tax reduction, the beneficiaries can automatically take advantage of it. |

| · | Customs

stability includes a mechanism that allows the beneficiaries to make a manual self-assessment

applying the stabilized duties instead of the automatic calculation by the customs system. |

| · | Foreign

exchange stability protects against regulations imposing more burdensome or restrictive conditions.

The law allows beneficiaries to reject the application of the new rule. The Central Bank

cannot initiate criminal proceedings without first carrying out a process to determine whether

the exchange stability applies to the case. |

Dispute Resolution

| · | Disputes

can be resolved by administrative proceedings or international arbitration outside Argentina.

Arbitration can be initiated, even if the administrative procedure has not been completed. |

| · | The

arbitration is to be done outside of Argentina, under the rules of the PCA, ICC

or ICSID, with arbitrators who are neither Argentine nor nationals of the investor's country. |

| McEwen Mining Inc. | Page 10 |

Appendix B

- Detailed Data From the 2023-2024 Drilling

Campaign at Los Azules -

Table 1 –

Recent Los Azules Drilling Results

| Hole-ID |

Section |

Predominant

Mineral Zone |

From

(m) |

To

(m) |

Length

(m) |

Cu

(%) |

Au

(g/t) |

Ag

(g/t) |

Comment |

| AZ24316 |

26 |

Total |

111.0 |

315.5 |

204.5 |

0.63 |

0.05 |

1.23 |

|

| |

|

Enriched |

111.0 |

293.0 |

182.0 |

0.64 |

0.05 |

1.22 |

Incl.

123 m of 0.8% Cu |

| |

|

Primary |

293.0 |

315.5 |

22.5 |

0.26 |

0.00 |

1.70 |

|

| AZ24317 |

56 |

Total |

107.0 |

305.0 |

198.0 |

0.18 |

0.03 |

0.61 |

|

| |

|

Enriched |

107.0 |

305.0 |

198.0 |

0.18 |

0.03 |

0.61 |

|

| |

|

Primary |

|

|

|

|

|

|

|

| AZ24318MET |

50 |

Total |

124.0 |

229.5 |

105.5 |

0.70 |

0.05 |

2.53 |

|

| |

|

Enriched |

124.0 |

229.5 |

105.5 |

0.70 |

0.05 |

2.53 |

Incl.

12 m of 1.44% Cu |

| |

|

Primary |

|

|

|

|

|

|

|

| AZ24319 |

35 |

Total |

160.0 |

355.0 |

195.0 |

0.45 |

0.04 |

0.96 |

|

| |

|

Enriched |

160.0 |

332.0 |

172.0 |

0.48 |

0.04 |

1.04 |

Incl.

84 m of 0.51% Cu |

| |

|

Primary |

332.0 |

355.0 |

23.0 |

0.27 |

0.03 |

0.36 |

|

| AZ24320 |

32 |

Total |

58.0 |

204.0 |

146.0 |

0.89 |

0.05 |

1.67 |

|

| |

|

Enriched |

58.0 |

204.0 |

146.0 |

0.89 |

0.05 |

1.67 |

|

| |

|

Primary |

|

|

|

|

|

|

|

| AZ24321 |

30 |

Total |

117.0 |

389.8 |

272.8 |

0.60 |

0.05 |

1.32 |

|

| |

|

Enriched |

117.0 |

389.8 |

272.8 |

0.60 |

0.05 |

1.32 |

Incl.

12 m of 0.85% Cu |

| |

|

Primary |

|

|

|

|

|

|

|

| AZ24322 |

44 |

Total |

144.0 |

491.0 |

347.0 |

0.43 |

0.06 |

1.78 |

|

| |

|

Enriched |

144.0 |

491.0 |

347.0 |

0.43 |

0.06 |

1.78 |

Incl.

130 m of 0.57% Cu |

| |

|

Primary |

|

|

|

|

|

|

|

| AZ24323 |

26 |

Total |

86.0 |

184.6 |

98.6 |

0.19 |

0.01 |

0.64 |

|

| |

|

Enriched |

86.0 |

184.6 |

98.6 |

0.19 |

0.01 |

0.64 |

|

| |

|

Primary |

|

|

|

|

|

|

|

| AZ24324 |

34 |

Total |

108.0 |

343.0 |

235.0 |

0.37 |

0.02 |

0.36 |

|

| |

|

Enriched |

108.0 |

322.0 |

214.0 |

0.40 |

0.02 |

0.37 |

Incl.

12 m of 0.92% Cu |

| |

|

Primary |

322.0 |

343.0 |

21.0 |

0.12 |

0.02 |

0.30 |

|

| AZ24325 |

25 |

Total |

76.0 |

338.0 |

262.0 |

0.19 |

0.02 |

0.65 |

|

| |

|

Enriched |

76.0 |

266.0 |

190.0 |

0.21 |

0.02 |

0.65 |

|

| |

|

Primary |

266.0 |

338.0 |

72.0 |

0.14 |

0.02 |

0.64 |

|

| AZ24326 |

26 |

Total |

108.0 |

331.0 |

223.0 |

0.42 |

0.05 |

1.30 |

|

| |

|

Enriched |

108.0 |

256.0 |

148.0 |

0.52 |

0.07 |

1.47 |

Incl.

57.7 m of 0.59% Cu |

| |

|

Primary |

256.0 |

331.0 |

75.0 |

0.23 |

0.03 |

0.95 |

|

| AZ24327 |

31 |

Total |

78.0 |

316.0 |

238.0 |

0.38 |

0.03 |

1.10 |

|

| |

|

Enriched |

78.0 |

316.0 |

238.0 |

0.38 |

0.03 |

1.10 |

|

| |

|

Primary |

|

|

|

|

|

|

|

| AZ24328 |

48 |

Total |

126.0 |

231.0 |

105.0 |

0.08 |

0.02 |

1.13 |

|

| |

|

Enriched |

126.0 |

231.0 |

105.0 |

0.08 |

0.02 |

1.13 |

|

| |

|

Primary |

|

|

|

|

|

|

|

| AZ24329 |

29 |

Total |

90.0 |

332.0 |

242.0 |

0.24 |

0.03 |

0.89 |

|

| |

|

Enriched |

90.0 |

290.0 |

200.0 |

0.25 |

0.03 |

0.96 |

|

| |

|

Primary |

290.0 |

332.0 |

42.0 |

0.17 |

0.02 |

0.56 |

|

| AZ24330 |

56 |

Total |

164.0 |

185.0 |

21.0 |

0.70 |

0.03 |

1.26 |

|

| |

|

Enriched |

164.0 |

185.0 |

21.0 |

0.70 |

0.03 |

1.26 |

|

| |

|

Primary |

|

|

|

|

|

|

|

| McEwen Mining Inc. | Page 11 |

| Hole-ID |

Section |

Predominant

Mineral Zone |

From

(m) |

To

(m) |

Length

(m) |

Cu

(%) |

Au

(g/t) |

Ag

(g/t) |

Comment |

| AZ24332 |

28 |

Total |

136.0 |

255.6 |

119.6 |

0.72 |

0.06 |

1.72 |

|

| |

|

Enriched |

136.0 |

255.6 |

119.6 |

0.72 |

0.06 |

1.72 |

|

| |

|

Primary |

|

|

|

|

|

|

|

| AZ24334 |

48 |

Total |

104.0 |

657.0 |

553.0 |

0.42 |

0.07 |

2.94 |

|

| |

|

Enriched |

104.0 |

412.0 |

308.0 |

0.50 |

0.08 |

3.53 |

Incl.

60 m of 0.71% Cu |

| |

|

Primary |

412.0 |

657.0 |

245.0 |

0.32 |

0.06 |

2.21 |

|

| AZ24335 |

31 |

Total |

69.5 |

227.5 |

158.0 |

0.84 |

0.10 |

0.98 |

|

| |

|

Enriched |

69.5 |

227.5 |

158.0 |

0.84 |

0.10 |

0.98 |

Incl.

78.5 m of 1.10% Cu |

| |

|

Primary |

|

|

|

|

|

|

|

| AZ24336CC |

8a |

Total |

218.0 |

501.0 |

283.0 |

0.20 |

0.08 |

1.93 |

|

| |

|

Enriched |

218.0 |

370.0 |

152.0 |

0.25 |

0.14 |

2.76 |

|

| |

|

Primary |

370.0 |

501.0 |

131.0 |

0.14 |

0.02 |

0.91 |

|

| AZ24338 |

5a |

Total |

252.0 |

729.5 |

477.5 |

0.19 |

0.02 |

0.88 |

|

| |

|

Enriched |

252.0 |

490.0 |

238.0 |

0.23 |

0.04 |

0.97 |

|

| |

|

Primary |

490.0 |

729.5 |

239.5 |

0.14 |

0.01 |

0.78 |

|

| AZ24339CC |

12a |

Total |

140.0 |

517.5 |

377.5 |

0.16 |

0.02 |

0.68 |

|

| |

|

Enriched |

140.0 |

470.0 |

330.0 |

0.17 |

0.02 |

0.67 |

|

| |

|

Primary |

470.0 |

517.5 |

47.5 |

0.11 |

0.01 |

0.74 |

|

| AZ24340 |

26 |

Total |

66.0 |

300.5 |

234.5 |

0.50 |

0.04 |

1.04 |

|

| |

|

Enriched |

66.0 |

300.5 |

234.5 |

0.50 |

0.04 |

1.04 |

Incl.

72 m of 0.78% Cu |

| |

|

Primary |

|

|

|

|

|

|

|

| AZ24341 |

48 |

Total |

87.0 |

261.5 |

174.5 |

0.57 |

0.07 |

1.09 |

|

| |

|

Enriched |

87.0 |

261.5 |

174.5 |

0.57 |

0.07 |

1.09 |

|

| |

|

Primary |

|

|

|

|

|

|

|

| AZ24342 |

28 |

Total |

81.0 |

235.5 |

154.5 |

0.39 |

0.05 |

2.82 |

|

| |

|

Enriched |

81.0 |

235.5 |

154.5 |

0.39 |

0.05 |

2.82 |

|

| |

|

Primary |

|

|

|

|

|

|

|

| AZ24343 |

58 |

Total |

71.0 |

365.6 |

294.6 |

0.17 |

0.01 |

0.67 |

|

| |

|

Enriched |

71.0 |

344.0 |

273.0 |

0.18 |

0.01 |

0.70 |

|

| |

|

Primary |

344.0 |

365.6 |

21.6 |

0.07 |

0.00 |

0.30 |

|

| AZ24344 |

43 |

Total |

140.0 |

312.0 |

172.0 |

0.43 |

0.05 |

1.50 |

|

| |

|

Enriched |

140.0 |

312.0 |

172.0 |

0.43 |

0.05 |

1.50 |

Incl.

52 m of 0.62% Cu |

| |

|

Primary |

|

|

|

|

|

|

|

| AZ24345 |

44 |

Total |

80.7 |

291.2 |

210.5 |

0.37 |

0.02 |

1.98 |

|

| |

|

Enriched |

80.7 |

190.0 |

109.3 |

0.55 |

0.02 |

1.68 |

Incl.

66 m of 0.66% Cu |

| |

|

Primary |

190.0 |

291.2 |

101.2 |

0.17 |

0.02 |

2.31 |

|

| AZ24346 |

40 |

Total |

44.0 |

196.6 |

152.6 |

0.06 |

0.00 |

0.64 |

|

| |

|

Enriched |

44.0 |

100.0 |

56.0 |

0.07 |

0.00 |

0.33 |

|

| |

|

Primary |

100.0 |

196.6 |

96.6 |

0.06 |

0.00 |

0.83 |

|

| AZ24347 |

14 |

Total |

88.0 |

295.8 |

207.8 |

0.30 |

0.05 |

0.90 |

|

| |

|

Enriched |

88.0 |

286.0 |

198.0 |

0.30 |

0.05 |

0.94 |

|

| |

|

Primary |

286.0 |

295.8 |

9.8 |

0.15 |

0.06 |

0.30 |

|

| McEwen Mining Inc. | Page 12 |

| Hole-ID |

Section |

Predominant

Mineral Zone |

From

(m) |

To

(m) |

Length

(m) |

Cu

(%) |

Au

(g/t) |

Ag

(g/t) |

Comment |

| AZ24348 |

40 |

Total |

168.0 |

373.7 |

205.7 |

0.20 |

0.01 |

0.56 |

|

| |

|

Enriched |

168.0 |

373.7 |

205.7 |

0.20 |

0.01 |

0.56 |

|

| |

|

Primary |

|

|

|

|

|

|

|

| AZ24349 |

22 |

Total |

98.0 |

356.0 |

258.0 |

0.44 |

0.04 |

1.27 |

|

| |

|

Enriched |

98.0 |

339.4 |

241.4 |

0.46 |

0.04 |

1.31 |

Incl.

84 m of 0.78% Cu |

| |

|

Primary |

339.4 |

356.0 |

16.6 |

0.20 |

0.03 |

0.63 |

|

| AZ24350 |

30 |

Total |

96.0 |

224.0 |

128.0 |

0.10 |

0.02 |

1.01 |

|

| |

|

Enriched |

96.0 |

154.0 |

58.0 |

0.12 |

0.03 |

1.21 |

|

| |

|

Primary |

154.0 |

224.0 |

70.0 |

0.08 |

0.02 |

0.85 |

|

| AZ24351A |

29 |

Total |

110.0 |

449.4 |

339.4 |

0.29 |

0.03 |

1.52 |

|

| |

|

Enriched |

110.0 |

400.0 |

290.0 |

0.31 |

0.03 |

1.69 |

|

| |

|

Primary |

400.0 |

449.4 |

49.4 |

0.12 |

0.01 |

0.51 |

|

| AZ24352 |

12 |

Total |

168.3 |

379.3 |

211.0 |

0.34 |

0.05 |

0.67 |

|

| |

|

Enriched |

168.3 |

358.0 |

189.7 |

0.36 |

0.05 |

0.56 |

|

| |

|

Primary |

358.0 |

379.3 |

21.3 |

0.13 |

0.03 |

1.62 |

|

| AZ24353 |

46 |

Total |

90.0 |

338.5 |

248.5 |

0.35 |

0.04 |

1.85 |

|

| |

|

Enriched |

90.0 |

320.0 |

230.0 |

0.37 |

0.04 |

1.96 |

|

| |

|

Primary |

320.0 |

338.5 |

18.5 |

0.12 |

0.00 |

0.52 |

|

| AZ24354 |

42 |

Total |

194.0 |

331.0 |

137.0 |

0.14 |

0.01 |

0.71 |

|

| |

|

Enriched |

194.0 |

331.0 |

137.0 |

0.14 |

0.01 |

0.71 |

|

| |

|

Primary |

|

|

|

|

|

|

|

| AZ24355 |

56 |

Total |

84.5 |

288.5 |

204.0 |

0.23 |

0.01 |

0.87 |

|

| |

|

Enriched |

84.5 |

288.5 |

204.0 |

0.23 |

0.01 |

0.87 |

|

| |

|

Primary |

|

|

|

|

|

|

|

| AZ24356 |

56 |

Total |

51.0 |

205.5 |

154.5 |

0.70 |

0.15 |

3.79 |

|

| |

|

Enriched |

51.0 |

108.0 |

57.0 |

0.17 |

0.04 |

1.43 |

|

| |

|

Primary |

108.0 |

205.5 |

97.5 |

1.01 |

0.21 |

5.14 |

Incl.

30 m of 2.84% Cu |

| AZ24357 |

22 |

Total |

152.0 |

386.0 |

234.0 |

0.21 |

0.02 |

2.51 |

|

| |

|

Enriched |

152.0 |

302.0 |

150.0 |

0.24 |

0.02 |

0.45 |

|

| |

|

Primary |

302.0 |

386.0 |

84.0 |

0.17 |

0.02 |

6.18 |

|

| AZ24358 |

36 |

Total |

70.2 |

264.5 |

194.3 |

0.23 |

0.01 |

0.57 |

|

| |

|

Enriched |

70.2 |

188.0 |

117.8 |

0.18 |

0.01 |

0.53 |

|

| |

|

Primary |

188.0 |

264.5 |

76.5 |

0.31 |

0.00 |

0.62 |

|

| AZ24360 |

24 |

Total |

84.0 |

335.5 |

251.5 |

0.21 |

0.02 |

0.89 |

|

| |

|

Enriched |

84.0 |

258.0 |

174.0 |

0.25 |

0.02 |

0.87 |

|

| |

|

Primary |

258.0 |

335.5 |

77.5 |

0.12 |

0.02 |

0.93 |

|

| AZ24361 |

12 |

Total |

220.0 |

335.2 |

115.2 |

0.42 |

0.06 |

1.37 |

|

| |

|

Enriched |

220.0 |

308.0 |

88.0 |

0.49 |

0.07 |

1.35 |

Incl.

28 m of 0.68% Cu |

| |

|

Primary |

308.0 |

335.2 |

27.2 |

0.17 |

0.03 |

1.45 |

|

| AZ24362 |

34 |

Total |

76.0 |

309.0 |

233.0 |

0.34 |

0.01 |

1.01 |

|

| |

|

Enriched |

76.0 |

309.0 |

233.0 |

0.34 |

0.01 |

1.01 |

|

| |

|

Primary |

|

|

|

|

|

|

|

| McEwen Mining Inc. | Page 13 |

| Hole-ID |

Section |

Predominant

Mineral Zone |

From

(m) |

To

(m) |

Length

(m) |

Cu

(%) |

Au

(g/t) |

Ag

(g/t) |

Comment |

| AZ24363 |

48 |

Total |

96.0 |

335.6 |

239.6 |

0.18 |

0.01 |

0.71 |

|

| |

|

Enriched |

96.0 |

250.0 |

154.0 |

0.20 |

0.00 |

0.57 |

|

| |

|

Primary |

250.0 |

335.6 |

85.6 |

0.14 |

0.01 |

0.96 |

|

| AZ24364 |

51 |

Total |

92.0 |

215.4 |

123.4 |

0.21 |

0.03 |

0.82 |

|

| |

|

Enriched |

92.0 |

215.4 |

123.4 |

0.21 |

0.03 |

0.82 |

|

| |

|

Primary |

|

|

|

|

|

|

|

| AZ24365 |

55 |

Total |

118.0 |

291.5 |

173.5 |

0.40 |

0.01 |

1.32 |

|

| |

|

Enriched |

118.0 |

291.5 |

173.5 |

0.40 |

0.01 |

1.32 |

Incl.

10 m of 0.89% Cu |

| |

|

Primary |

|

|

|

|

|

|

|

| AZ24366 |

22 |

Total |

182.0 |

328.2 |

146.2 |

0.17 |

0.02 |

0.78 |

|

| |

|

Enriched |

182.0 |

298.0 |

116.0 |

0.19 |

0.02 |

0.91 |

|

| |

|

Primary |

298.0 |

328.2 |

30.2 |

0.10 |

0.01 |

0.25 |

|

| AZ24367 |

50 |

Total |

94.0 |

433.5 |

339.5 |

0.32 |

0.05 |

1.30 |

|

| |

|

Enriched |

94.0 |

400.0 |

306.0 |

0.32 |

0.06 |

1.30 |

|

| |

|

Primary |

400.0 |

433.5 |

33.5 |

0.26 |

0.04 |

1.34 |

|

| AZ24368 |

4 |

Total |

138.0 |

220.5 |

82.5 |

0.21 |

0.03 |

0.52 |

|

| |

|

Enriched |

138.0 |

220.5 |

82.5 |

0.21 |

0.03 |

0.52 |

|

| |

|

Primary |

|

|

|

|

|

|

|

| AZ24369A |

48 |

Total |

122.0 |

248.0 |

126.0 |

0.61 |

0.05 |

1.14 |

|

| |

|

Enriched |

122.0 |

248.0 |

126.0 |

0.61 |

0.05 |

1.14 |

Incl.

58 m of 1.01% Cu |

| |

|

Primary |

|

|

|

|

|

|

|

| AZ24370 |

8 |

Total |

156.0 |

290.0 |

134.0 |

0.39 |

0.04 |

0.53 |

|

| |

|

Enriched |

156.0 |

262.0 |

106.0 |

0.44 |

0.05 |

0.60 |

Incl.

20 m of 0.81% Cu |

| |

|

Primary |

262.0 |

290.0 |

28.0 |

0.22 |

0.04 |

0.25 |

|

| AZ24371 |

36 |

Total |

98.0 |

302.1 |

204.1 |

0.31 |

0.03 |

0.74 |

|

| |

|

Enriched |

98.0 |

290.0 |

192.0 |

0.32 |

0.03 |

0.77 |

|

| |

|

Primary |

290.0 |

302.1 |

12.1 |

0.16 |

0.00 |

0.25 |

|

| AZ24372 |

10 |

Total |

155.7 |

298.2 |

142.5 |

0.38 |

0.06 |

0.99 |

|

| |

|

Enriched |

155.7 |

298.2 |

142.5 |

0.38 |

0.06 |

0.99 |

|

| |

|

Primary |

|

|

|

|

|

|

|

| AZ24373 |

54 |

Total |

120.0 |

291.5 |

171.5 |

0.22 |

0.00 |