Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

30 Agosto 2024 - 2:27PM

Edgar (US Regulatory)

Citigroup Global Markets Holdings Inc. Guaranteed by Citigroup Inc. 1.75 Year Market - Linked Securities Linked to NDXGEN5 Ρ Preliminary Terms This summary of terms is not complete and should be read with the preliminary pricing supplement below Citigroup Global Markets Holdings Inc. Issuer: Citigroup Inc. Guarantor: The Nasdaq Generations 5 Ρ Index (ticker: “NDXGEN5 Ρ ”) Index: September 25, 2024 Pricing date: June 25, 2026 Valuation date: June 30, 2026 Maturity date: 115.00% to 140.00%* Upside participation rate: 17332M3Q5 / US17332M3Q50 CUSIP / ISIN: The closing level of the Index on the pricing date Initial index level: The closing level of the Index on the valuation date Final index level: (Final index level - initial index level) / initial index level Index return: If the final index level is greater than the initial index level: $1,000 п the index return п the upside participation rate If the final index level is less than or equal to the initial index level: $0 All payments on the securities are subject to the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc. Return amount: You will receive at maturity for each security you then hold, the stated principal amount plus the return amount, which will be either zero or positive Payment at maturity: $1,000 per security Stated principal amount: Preliminary Pricing Supplement dated August 29, 20 24 Preliminary pricing supplement: * The actual upside participation rate will be determined on the pricing date. ** The hypotheticals assume that the upside participation rate will be set at the lowest value indicated in this offering summar y. Hypothetical Payment at Maturity per Security** The Securities The Index Hypothetical Payment at Maturity Hypothetical Security Return Hypothetical Index Return on Valuation Date $1 , 575 . 0 0 57.50% 50.00% $1 , 287 . 5 0 28.75% 25.00% B $1 , 057 . 5 0 5.75% 5.00% $1 , 000 . 0 0 0.00% 0.00% $1 , 000 . 0 0 0.00% - 25.00% $1 , 000 . 0 0 0.00% - 50.00% A $1 , 000 . 0 0 0.00% - 100.00% A B

Citigroup Global Markets Holdings Inc. Guaranteed by Citigroup Inc. Key Features of the Index • Sponsored by Nasdaq, Inc. and launched on August 11, 2022. • Tracks the performance of a hypothetical investment portfolio (“ Index Portfolio ”) composed of the Nasdaq - 100® Total Return Index (“ XNDX Ρ ”), the Nasdaq Next Generation 100 Total Return Index® (“ NGXT Ρ ”), a 10 - year US Treasury futures index and/or a 2 - year US Treasury futures index and uninvested cash, where the weights of those constituents within the Index Portfolio are adjusted daily at the market close in an attempt to maintain an overall volatility of the Index at 5%. • The Index Portfolio consists of the following allocations: • Equity Allocation: The Equity Allocation consists of two equity indices, XNDX Ρ and NGXT Ρ , with 70% of the Equity Allocation allocated to XNDX Ρ and 30% of the Equity Allocation allocated to NGXT Ρ . XNDX Ρ is composed of stocks of 100 of the largest non - financial companies listed on the Nasdaq Stock Market, and NGXT Ρ is composed of stocks of the 100 largest non - financial companies listed on the Nasdaq Stock Market that are not included in XNDX Ρ . Both are modified market capitalization - weighted indices, which means that larger companies have greater weights within each index, subject to certain weight caps. • Fixed Income Allocation: The Fixed Income Allocation consists of the Citi 10Y US Treasury Futures Market Tracker Index (the “ 10Y Index ”) and/or the Citi 2Y US Treasury Futures Market Tracker Index (the “ 2Y Index ”). The Fixed Income Allocation will consist solely of the 10Y Index unless the returns of XNDX Ρ and the 10Y Index have become correlated to a relatively high degree compared to the degree of correlation of their returns over the prior year, in which case the Fixed Income Allocation will consist solely of the 2Y Index, subject to averaging between the two during a transition period and subject to a stop - loss mechanic that will reduce the weight of the applicable index to zero if its value has fallen below its 200 - day moving average for 10 consecutive days. Each of the 10Y Index and the 2Y Index tracks the performance of a hypothetical investment, rolled quarterly, in a near - maturity US Treasury note futures contract referencing US Treasury notes with a remaining term to maturity of between 6.5 years and 10 years (in the case of the 10Y Index) or between 1.75 years and 2 years (in the case of the 2Y Index). • Uninvested Allocation: The Index may allocate a portion of the Index Portfolio to hypothetical uninvested cash, which generates no return. The Index will allocate a portion of the Index Portfolio to the Uninvested Allocation when the weights assigned to the Equity Allocation and the Fixed Income Allocation together sum to less than 100%, and the Index is likely to allocate a portion of the Index Portfolio to the Uninvested Allocation when the weight of the constituent(s) then making up the Fixed Income Allocation has been reduced to zero pursuant to the stop - loss mechanic referenced above. • The Index seeks to maintain its volatility target by utilizing a proprietary volatility - targeting methodology developed by Salt Financial LLC. • The Index may employ up to 150% leverage. • The Index is an excess return index, which means that the performance of its constituents will be reduced by an implicit financing cost. • The Index performance is also reduced by an index fee of 0.50% per annum. Selected Risk Considerations • You may not receive any return on your investment in the securities. You will receive a positive return on your investment in the securities only if the Index appreciates from the initial index level to the final index level. If the final index level is less than or equal to the initial index level, you will receive only the stated principal amount for each security you hold at maturity. • The securities do not pay interest. • Your payment at maturity depends on the closing level of the Index on a single day. • The securities are subject to the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc. If Citigroup Global Markets Holdings Inc. defaults on its obligations under the securities and Citigroup Inc. defaults on its guarantee obligations, you may not receive anything owed to you under the securities. • Sale of the securities prior to maturity may result in a loss of principal. • The securities will not be listed on any securities exchange and you may not be able to sell them prior to maturity. • The estimated value of the securities on the pricing date will be less than the issue price . For more information about the estimated value of the securities, see the accompanying preliminary pricing supplement . • The value of the securities prior to maturity will fluctuate based on many unpredictable factors . • The issuer and its affiliates may have conflicts of interest with you . • The Index is likely to significantly underperform equities in rising equity markets. The Index seeks to allocate as much weight to the Equity Allocation as would be consistent with maintaining its volatility target of 5%. In general, however, it is expected that the Index will be required to have a significantly greater allocation to the Fixed Income Allocation than to the Equity Allocation in most circumstances to maintain its volatility target. The Index may also at times have a significant allocation to the Uninvested Allocation, on which no interest or other return will accrue. • The Equity Allocation may underperform the broader equity market. The stocks included in the Equity Allocation may not be representative of the broader equity market, and as a result their performance could be materially worse than that of the broader equity market. • The Equity Allocation and the Fixed Income Allocation may offset each other, dampening Index returns. • The Index is likely to have significant exposure at all times to the Fixed Income Allocation, which has limited return potential and significant downside potential, particularly in times of rising interest rates. • The Index is an “excess return” index, which means that the performance of its underlying constituents will be reduced by an implicit financing cost. The negative impact of the implicit financing cost will increase if market interest rates rise. • The Index may fail to maintain its volatility target. • The performance of the Index will be reduced by an index fee. • The Index was launched on August 11, 2022 and, therefore, has a limited performance history. • The Index follows fixed rules and will not be actively managed. The above summary of selected risks does not describe all of the risks associated with an investment in the securities. You should read the accompanying preliminary pricing supplement and index supplement for a more complete description of risks relating to the securities.

Citigroup Global Markets Holdings Inc. Guaranteed by Citigroup Inc. Additional Information Citigroup Global Markets Holdings Inc. and Citigroup Inc. have filed registration statements (including the accompanying preliminary pricing supplement, index supplement, prospectus supplement and prospectus) with the Securities and Exchange Commission (“SEC”) for the offering to which this communication relates. Before you invest, you should read the accompanying preliminary pricing supplement, index supplement, prospectus supplement and prospectus in those registration statements (File Nos. 333 - 270327 and 333 - 270327 - 01) and the other documents Citigroup Global Markets Holdings Inc. and Citigroup Inc. have filed with the SEC for more complete information about Citigroup Global Markets Holdings Inc., Citigroup Inc. and this offering. You may obtain these documents without cost by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, you can request these documents by calling toll - free 1 - 800 - 831 - 9146. Filed pursuant to Rule 433 This offering summary does not contain all of the material information an investor should consider before investing in the securities. This offering summary is not for distribution in isolation and must be read together with the accompanying preliminary pricing supplement and the other documents referred to therein, which can be accessed via the link on the first page.

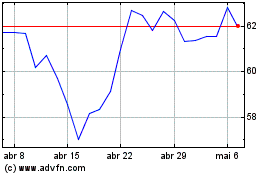

Citigroup (NYSE:C)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

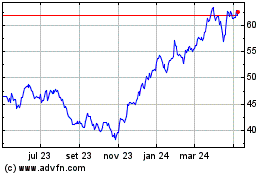

Citigroup (NYSE:C)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024